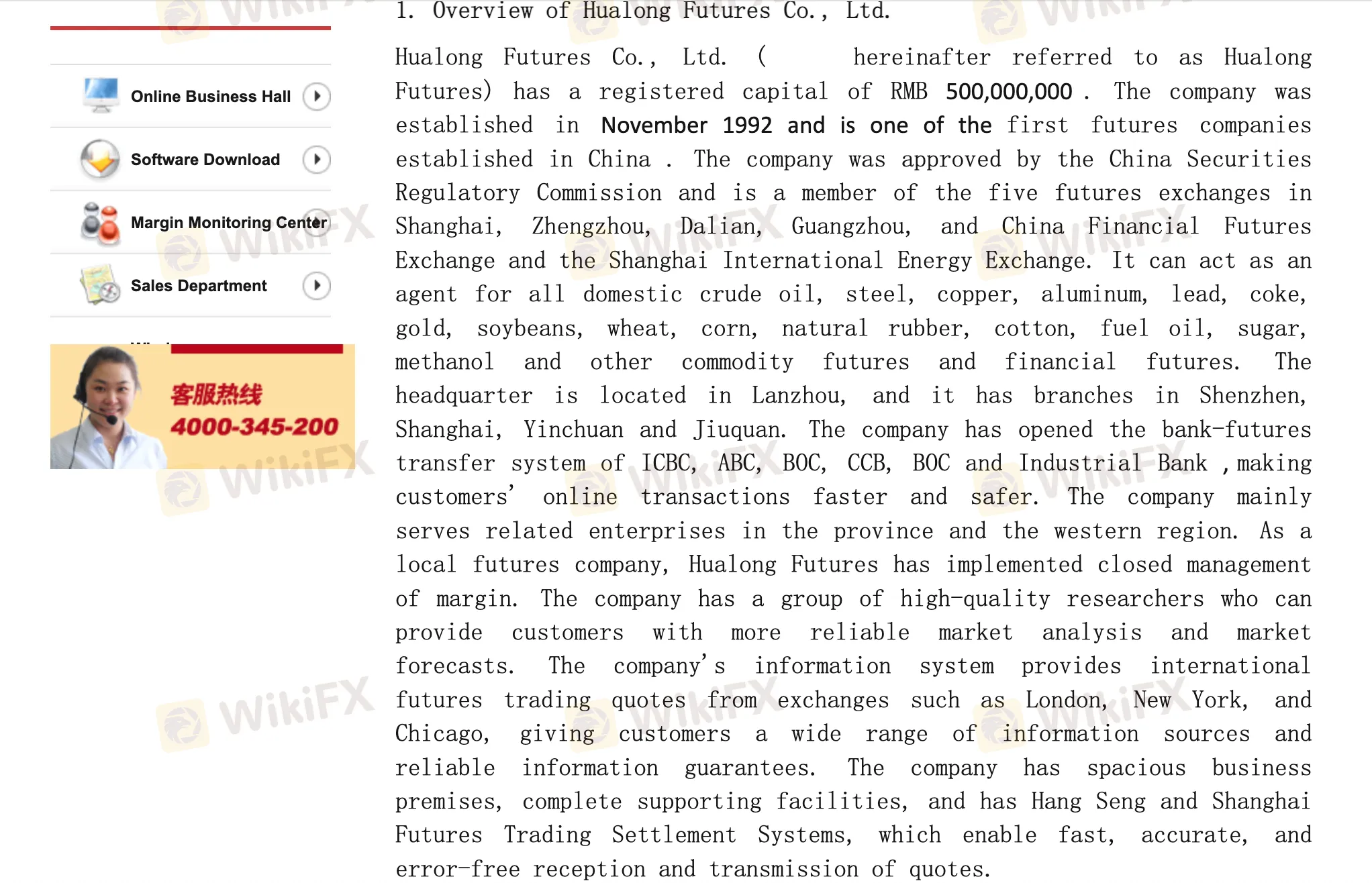

Profil perusahaan

| CHINA DRAGON Ringkasan Ulasan | |

| Dibentuk | 2019 |

| Negara/Daerah Terdaftar | China |

| Regulasi | CFFE (Teregulasi) |

| Instrumen Pasar | Futures |

| Akun Demo | ✅ |

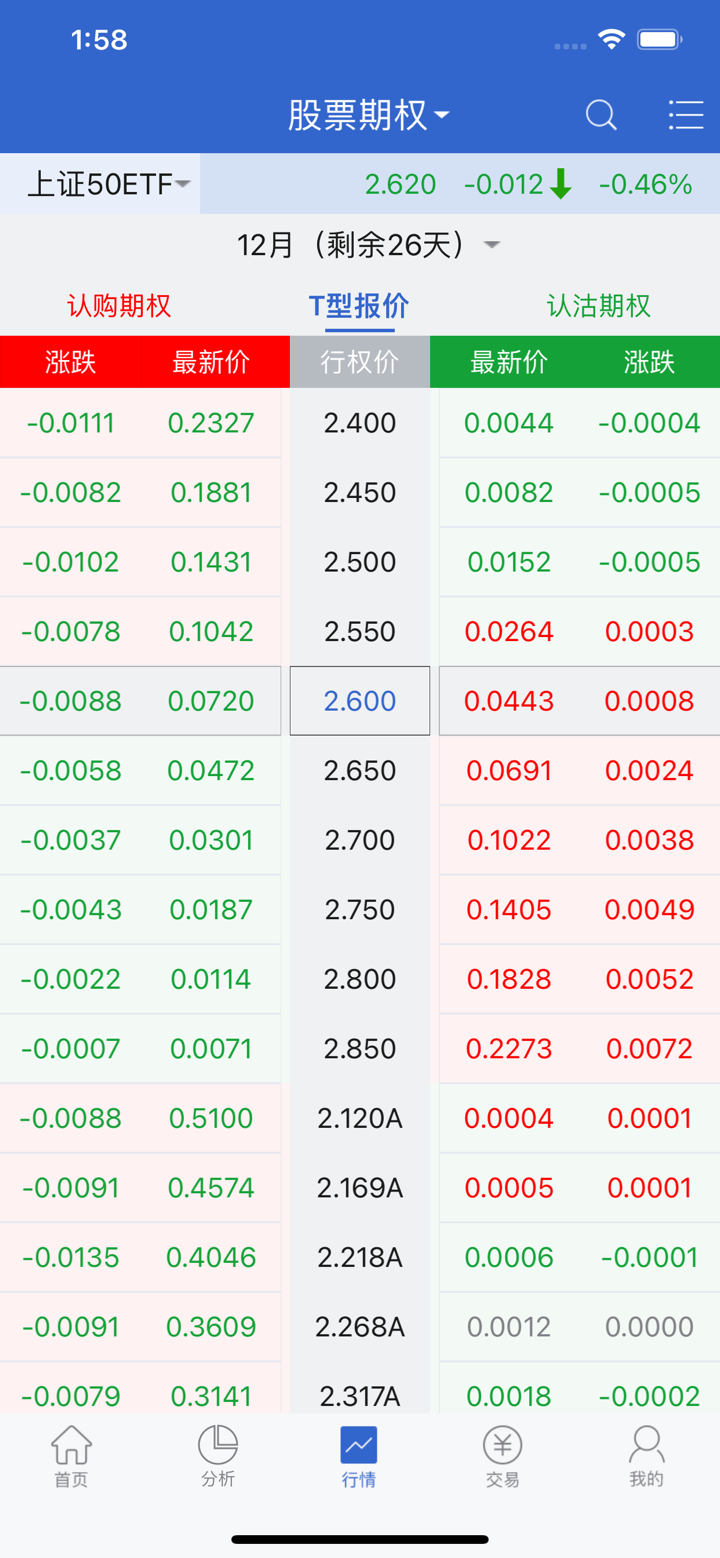

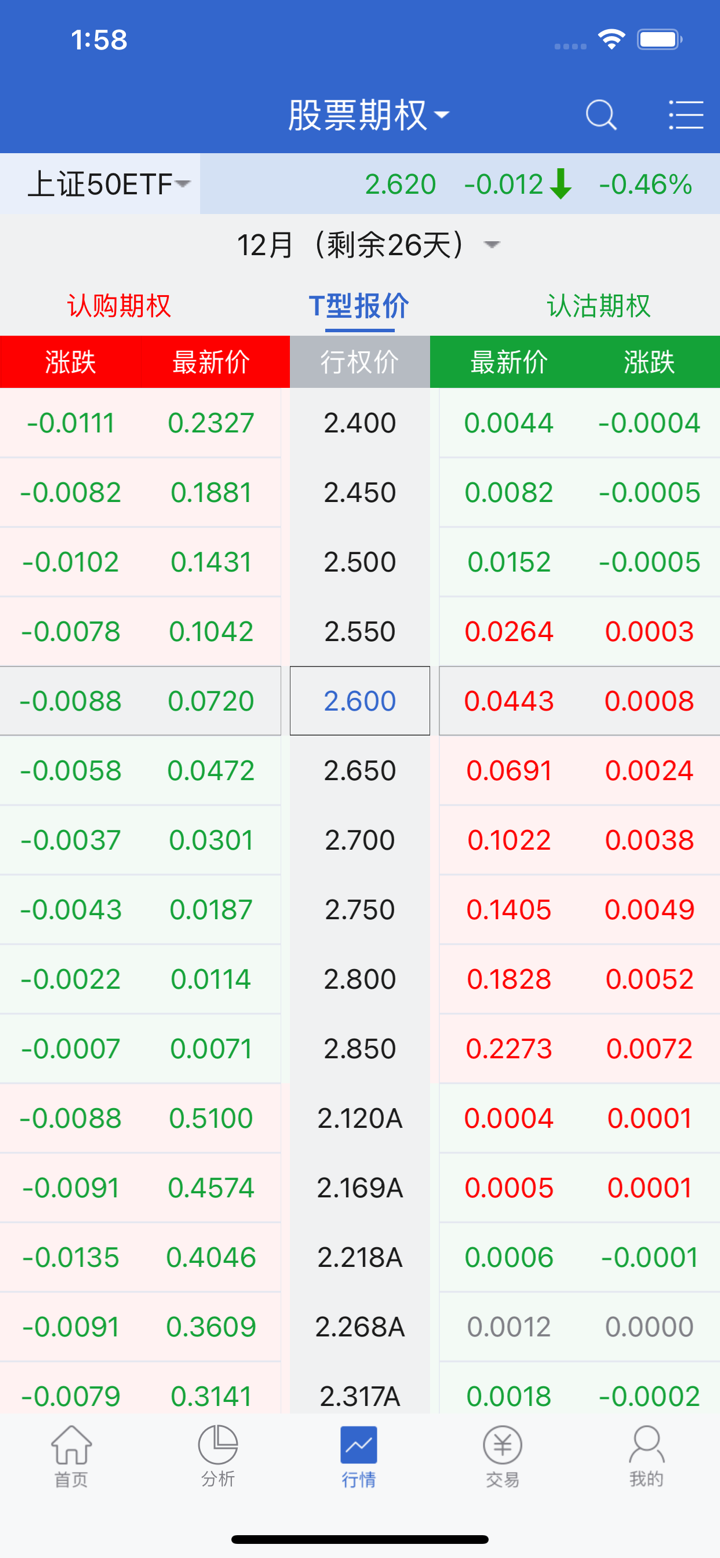

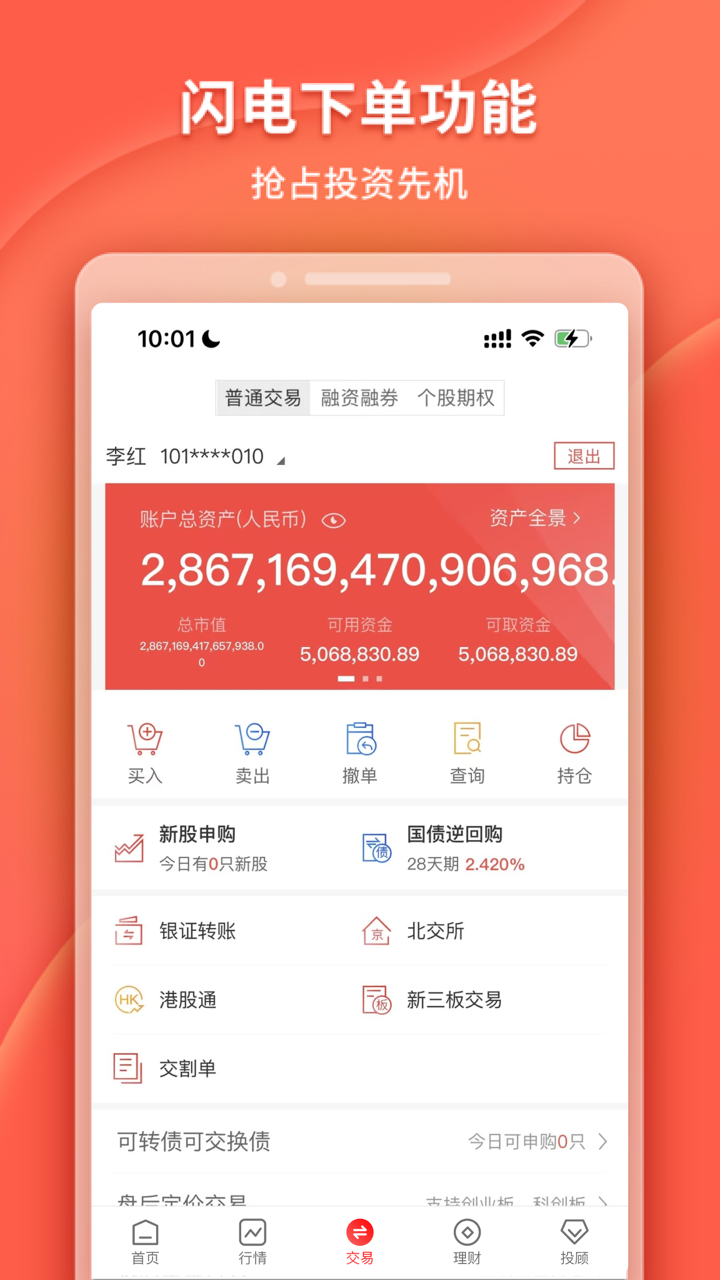

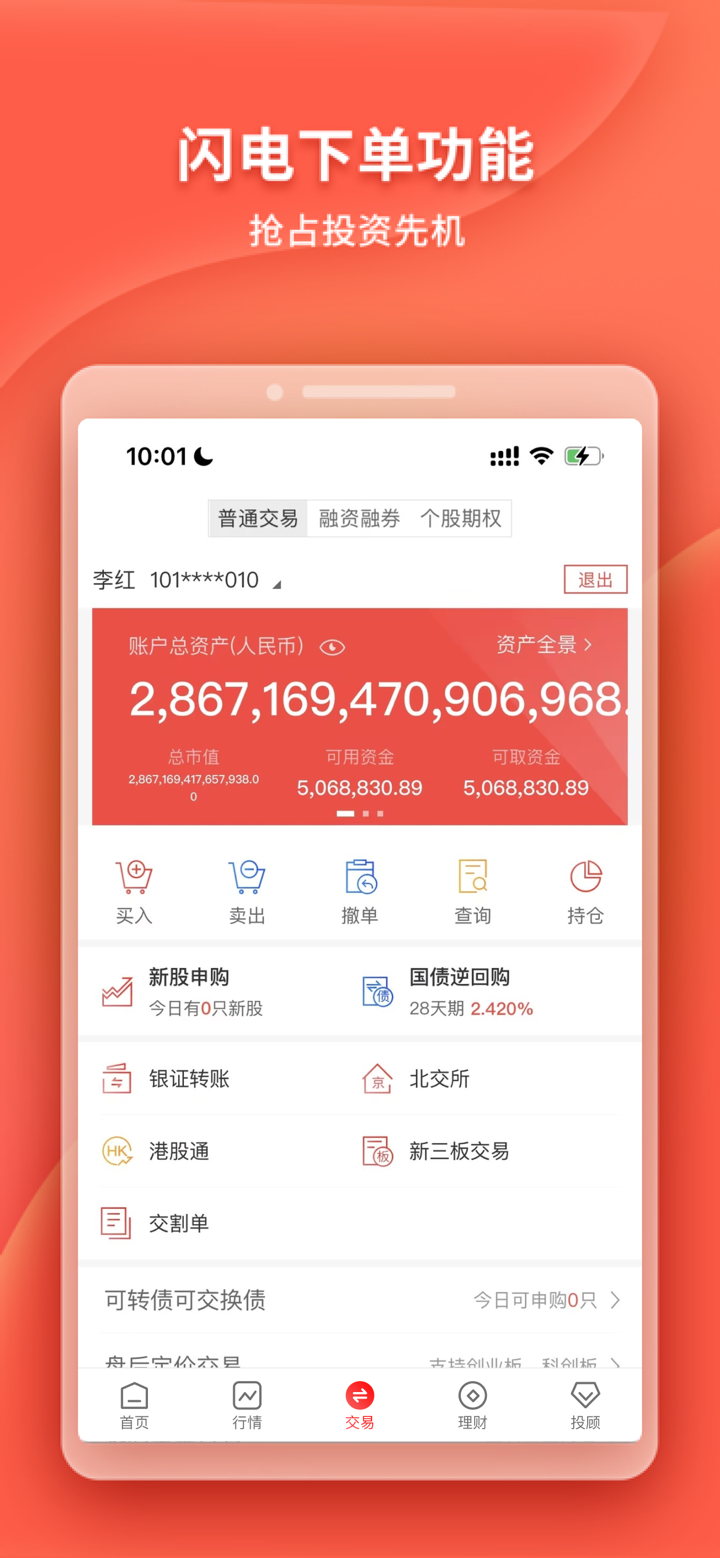

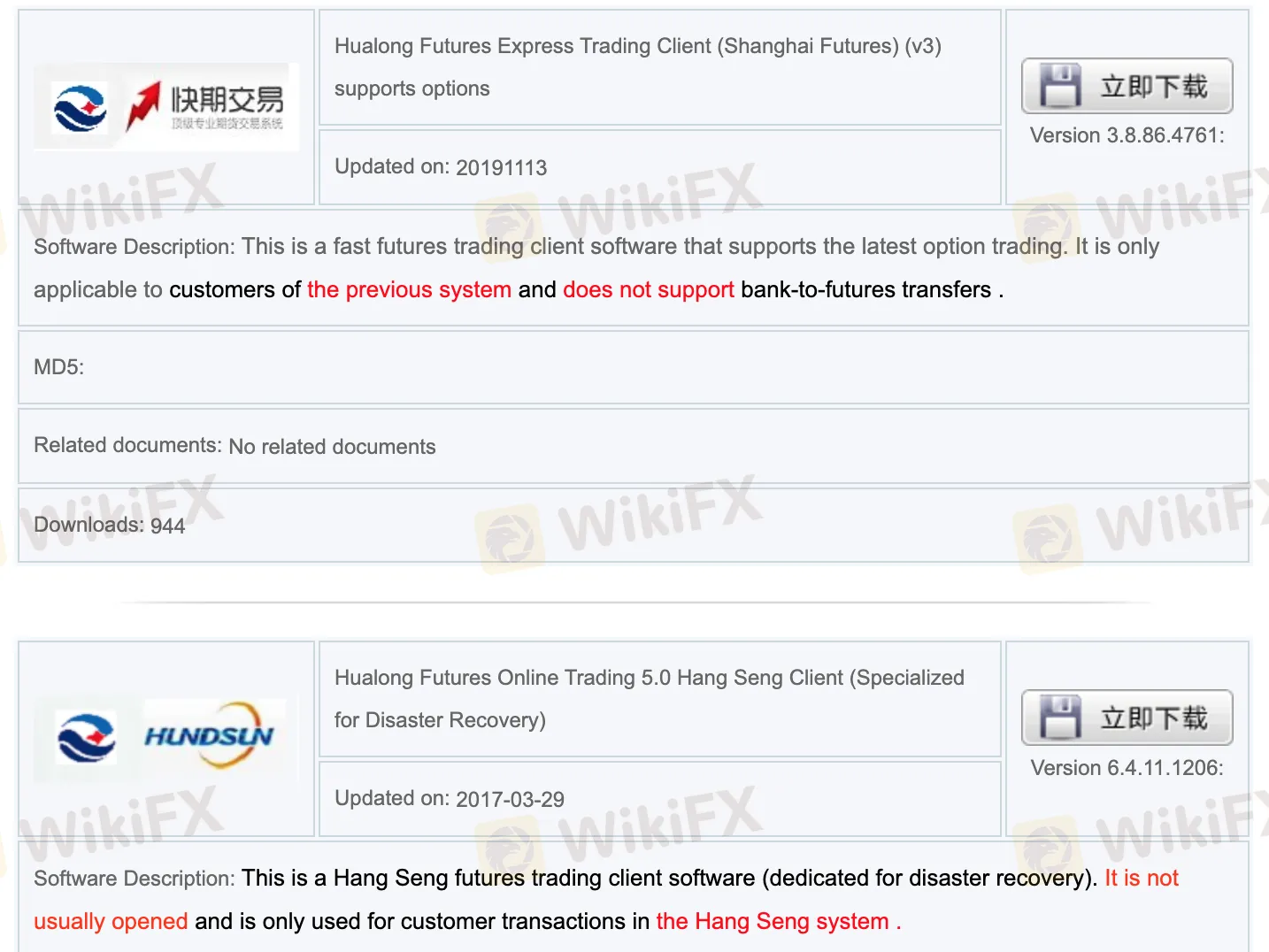

| Platform Perdagangan | Perangkat Lunak Perdagangan Pasar Awan Hualong Futures-Boyi, Versi HD Perangkat Lunak Perdagangan Pasar Awan Hualong Futures-Yingshun (wh6), Perdagangan Online UF2.0 Hang Seng Client Hualong Futures, Edisi Hang Seng Hualong Zhixin, Edisi Boyi Hualong Futures, Klien Perdagangan Ekspres Hualong Futures (Periode Terakhir), Klien Perdagangan Ekspres Hualong Futures (Shanghai Futures) (v3) mendukung opsi, Perdagangan Online Hualong Futures 5.0 Hang Seng Client (Khusus untuk Pemulihan Bencana), Perangkat Lunak Perdagangan Pasar Awan Hualong Futures-Yingshun Versi IPV6, Versi Android Hualong Futures Boyi (Versi Android), Versi IOS Hualong Futures Boyi (Versi IOS), Versi Android Hualong Zhixin Hang Seng (Versi Android), Versi IOS Hualong Zhixin Hang Seng (Versi IOS), Aplikasi Seluler Keuangan Wenhua, dll. |

| Dukungan Pelanggan | Tel: 0931-8894644; 0931-8894283 |

| FAX:0931-8894198 | |

| Email: hlqh@hlqhgs.com | |

Informasi CHINA DRAGON

CHINA DRAGON adalah broker yang teregulasi, menawarkan perdagangan futures di berbagai platform perdagangan.

Pro dan Kontra

| Pro | Kontra |

| Berbagai platform perdagangan | Jenis produk perdagangan terbatas |

| Akun demo | Biaya margin dibebankan |

| Teregulasi dengan baik | Opsi pembayaran terbatas |

| Berbagai saluran dukungan pelanggan |

Apakah CHINA DRAGON Legal?

Ya. CHINA DRAGON memiliki lisensi dari CFFEX untuk menawarkan layanan.

| Negara yang Diatur | Regulator | Status Saat Ini | Entitas yang Diatur | Jenis Lisensi | No. Lisensi |

| Bursa Futures Keuangan China | Teregulasi | 华龙期货股份有限公司 | Lisensi Futures | 0279 |

Apa yang Bisa Saya Perdagangkan di CHINA DRAGON?

CHINA DRAGON menawarkan perdagangan futures.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Futures | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Saham | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

| ETF | ❌ |

Jenis Akun

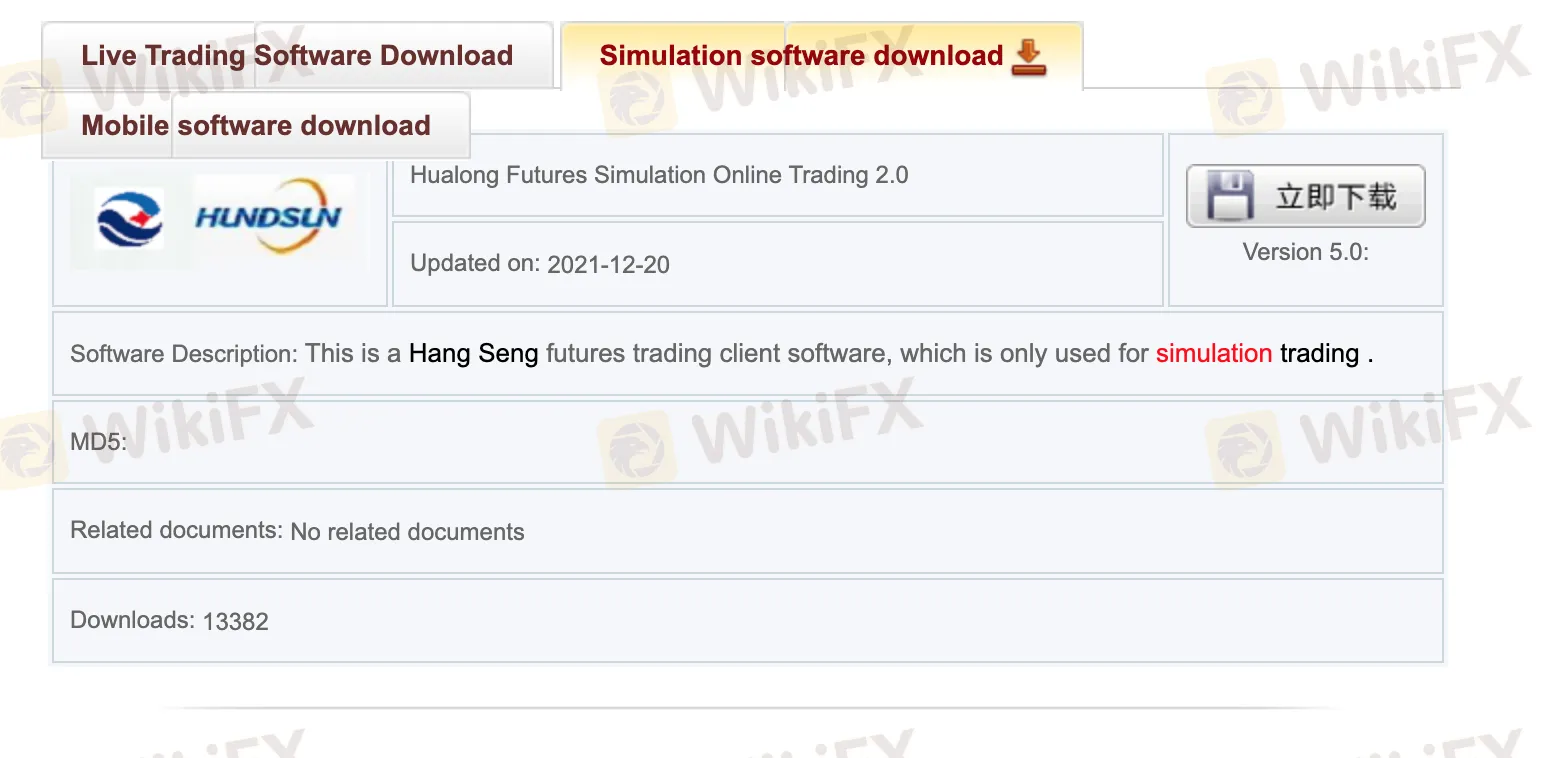

Broker tidak secara jelas menyediakan jenis akun yang ditawarkan. Klien dapat mengunduh perangkat lunak simulasi untuk membuka akun demo.

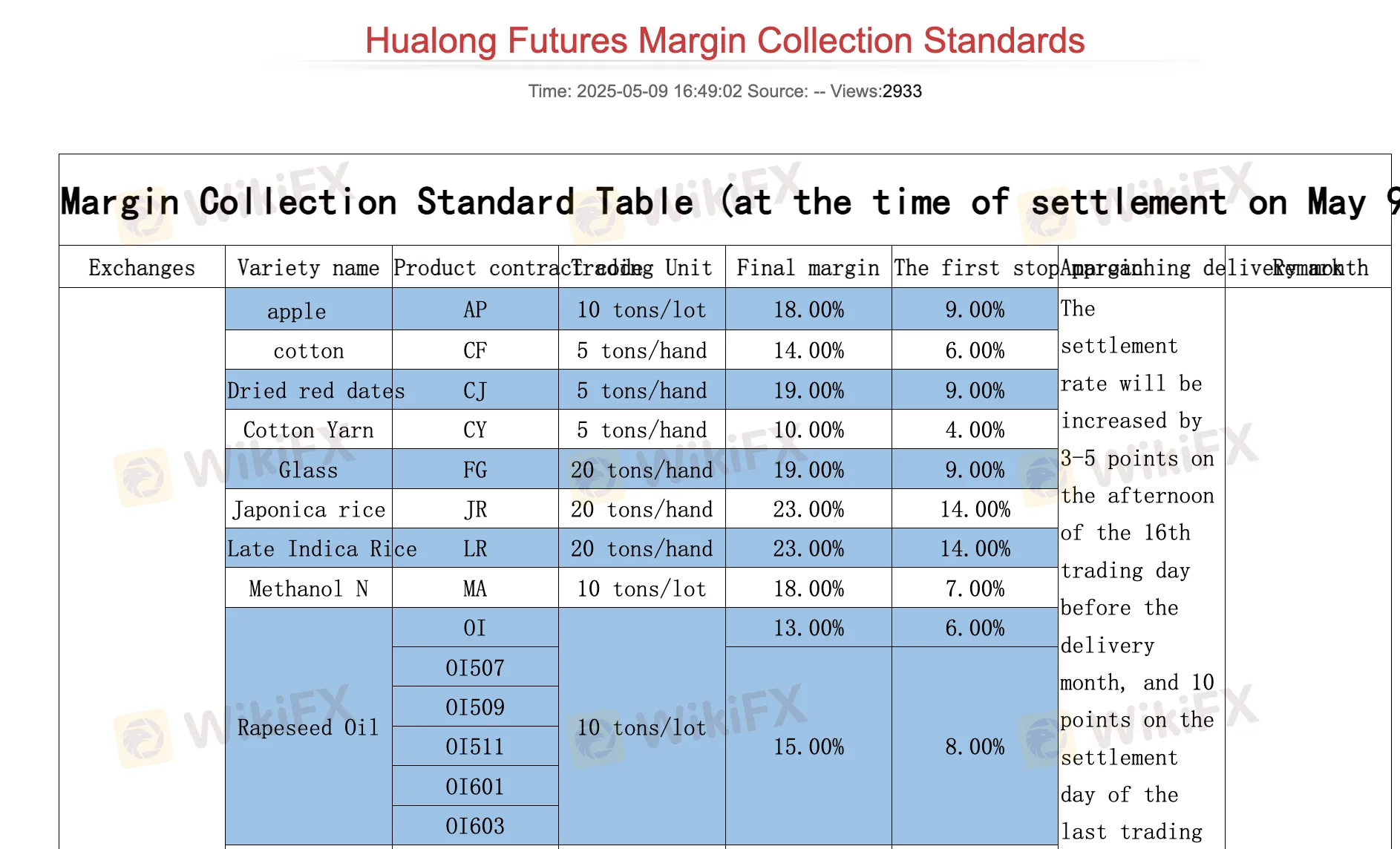

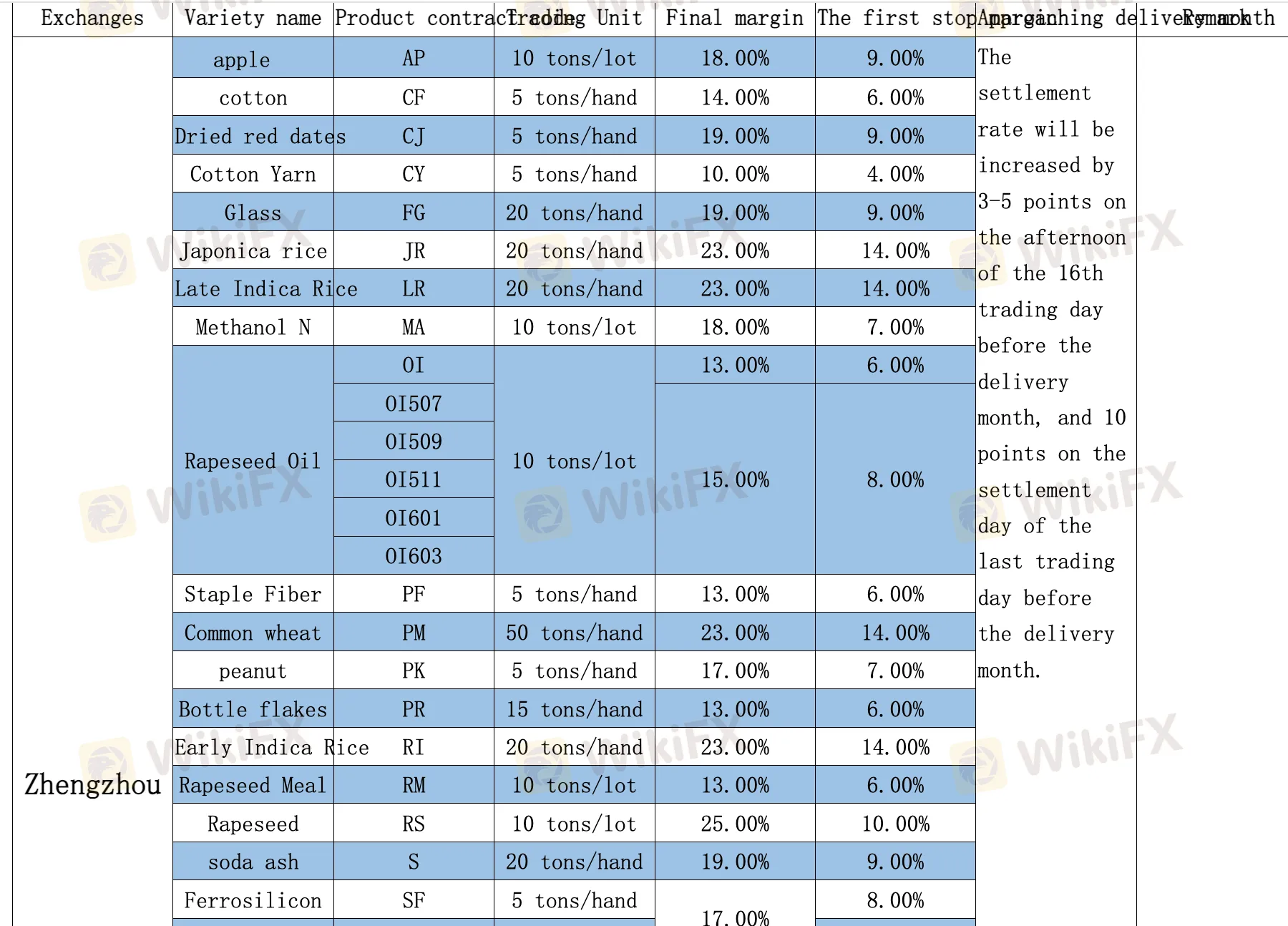

Biaya CHINA DRAGON

Broker memerlukan biaya margin untuk instrumen perdagangan yang berbeda.

Platform Perdagangan

Broker menyediakan berbagai platform perdagangan, termasuk Perangkat Lunak Perdagangan Pasar Awan Boyi Hualong Futures, Versi HD Perangkat Lunak Perdagangan Pasar Awan Yingshun Hualong Futures (wh6), Hualong Futures Online Trading UF2.0 Hang Seng Client, Edisi Hang Seng Hualong Zhixin, Edisi Boyi Hualong Futures, Klien Perdagangan Ekspres Hualong Futures (Periode Terakhir), Klien Perdagangan Ekspres Hualong Futures (Shanghai Futures) (v3) mendukung opsi, Hualong Futures Online Trading 5.0 Hang Seng Client (Khusus untuk Pemulihan Bencana), Perangkat Lunak Perdagangan Pasar Awan Yingshun Hualong Futures-Versi IPV6, Versi Boyi Hualong Futures (Versi Android), Versi Boyi Hualong Futures (Versi IOS), versi Android Hualong Zhixin Hang Seng, versi IOS Hualong Zhixin Hang Seng, dan Aplikasi Seluler Keuangan Wenhua.

Perangkat yang Tersedia: desktop dan seluler (IOS, Android).

Deposit dan Penarikan

Broker menerima pembayaran melalui transfer bank. Tidak ada jumlah deposit atau penarikan minimum yang ditentukan dan tidak ada biaya atau biaya yang spesifik.

Ketika menarik dana melalui transfer silver-futures, jika klien tidak memiliki posisi, mereka dapat menarik seluruh jumlah, tetapi keuntungan hari itu tidak dapat ditarik. Jika klien memiliki transaksi atau posisi pada hari yang sama, mereka dapat mentransfer 70% dari dana yang tersedia setiap kali, dan dapat menarik 5 kali berturut-turut.