Perfil de la compañía

| Alfa Capital Resumen de la revisión | |

| Establecido | / |

| País/Región Registrada | Chipre |

| Regulación | CYSEC/FCA (Revocado) |

| Instrumentos de Mercado | Divisas, metales, opciones, futuros |

| Cuenta Demo | / |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | / |

| Depósito Mínimo | / |

| Soporte al Cliente | Tel: +357 22 470900 |

| Fax: +357 22 681505 | |

| Email: info@alfacapital.com.cy | |

| Dirección: 3, Calle Themistocles Dervis, Edificio Julia, 4to Piso, 1066 Nicosia, Chipre | |

| Restricción Regional | EE. UU. |

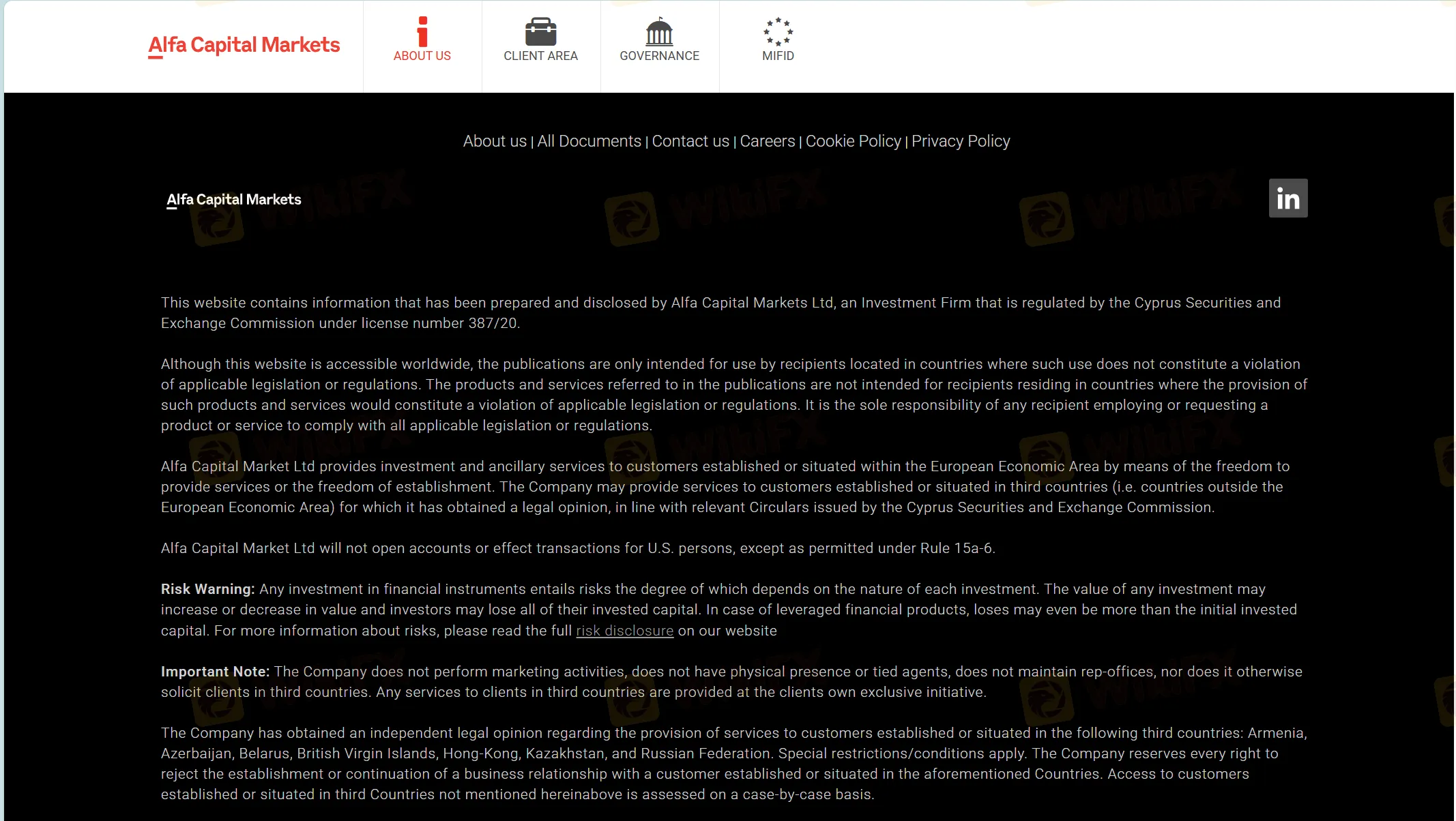

Alfa Capital es una empresa registrada en Chipre. Ofrece varios instrumentos de mercado para operar junto con servicios de inversión y auxiliares. Sin embargo, sus licencias han sido revocadas. También existen restricciones regionales, con los servicios restringidos para los EE. UU., y tiene un sitio web inválido, lo que lo convierte en un bróker arriesgado.

Aquí está la página de inicio del sitio oficial de este bróker:

Pros y Contras

| Pros | Contras |

| / | Licencias CYSEC/FCA revocadas |

| Clientes de EE. UU. no son aceptados | |

| Información limitada sobre las condiciones de trading |

¿Es Alfa Capital Legítimo?

Las licencias de Alfa Capital de la Comisión de Valores y Bolsa de Chipre (CySEC) y de la Autoridad de Conducta Financiera (FCA) han sido revocadas.

| País Regulado | Autoridad Reguladora | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| Chipre | Comisión de Valores y Bolsa de Chipre (CySEC) | Revocada | Alfa Capital Holdings (Chipre) Ltd | Creador de Mercado (MM) | 025/04 |

| Estados Unidos | Autoridad de Conducta Financiera (FCA) | Revocada | Alfa Capital Holdings (Chipre) Ltd | Representante Autorizado Europeo (EEA) | 416251 |

¿Qué Puedo Operar en Alfa Capital?

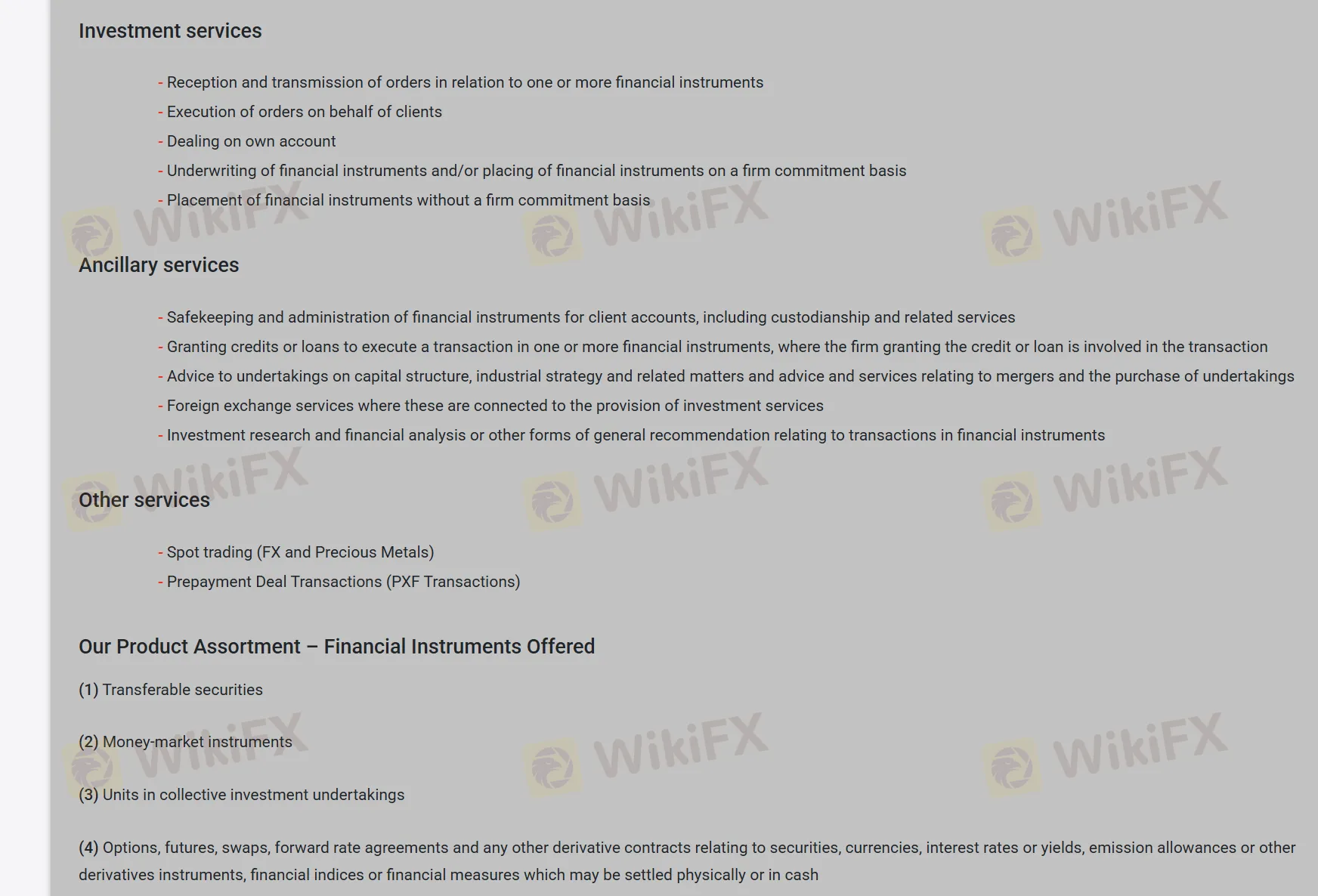

Alfa Capital ofrece servicios de inversión y auxiliares. También ofrece trading al contado de FX, metales, opciones y futuros.

| Instrumentos de Trading | Soportados |

| FX | ✔ |

| Metales | ✔ |

| Opciones | ✔ |

| Futuros | ✔ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| ETFs | ❌ |