مقدمة عن الشركة

| Alfa Capital ملخص المراجعة | |

| تأسست | / |

| البلد/المنطقة المسجلة | قبرص |

| التنظيم | CYSEC/FCA (مُلغاة) |

| أدوات السوق | العملات الأجنبية، المعادن، الخيارات، العقود الآجلة |

| حساب تجريبي | / |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | / |

| الحد الأدنى للإيداع | / |

| دعم العملاء | هاتف: +357 22 470900 |

| فاكس: +357 22 681505 | |

| البريد الإلكتروني: info@alfacapital.com.cy | |

| العنوان: 3، شارع تيميستوكليس درفيس، جوليا هاوس، الطابق 4، 1066 نيقوسيا، قبرص | |

| قيود إقليمية | الولايات المتحدة |

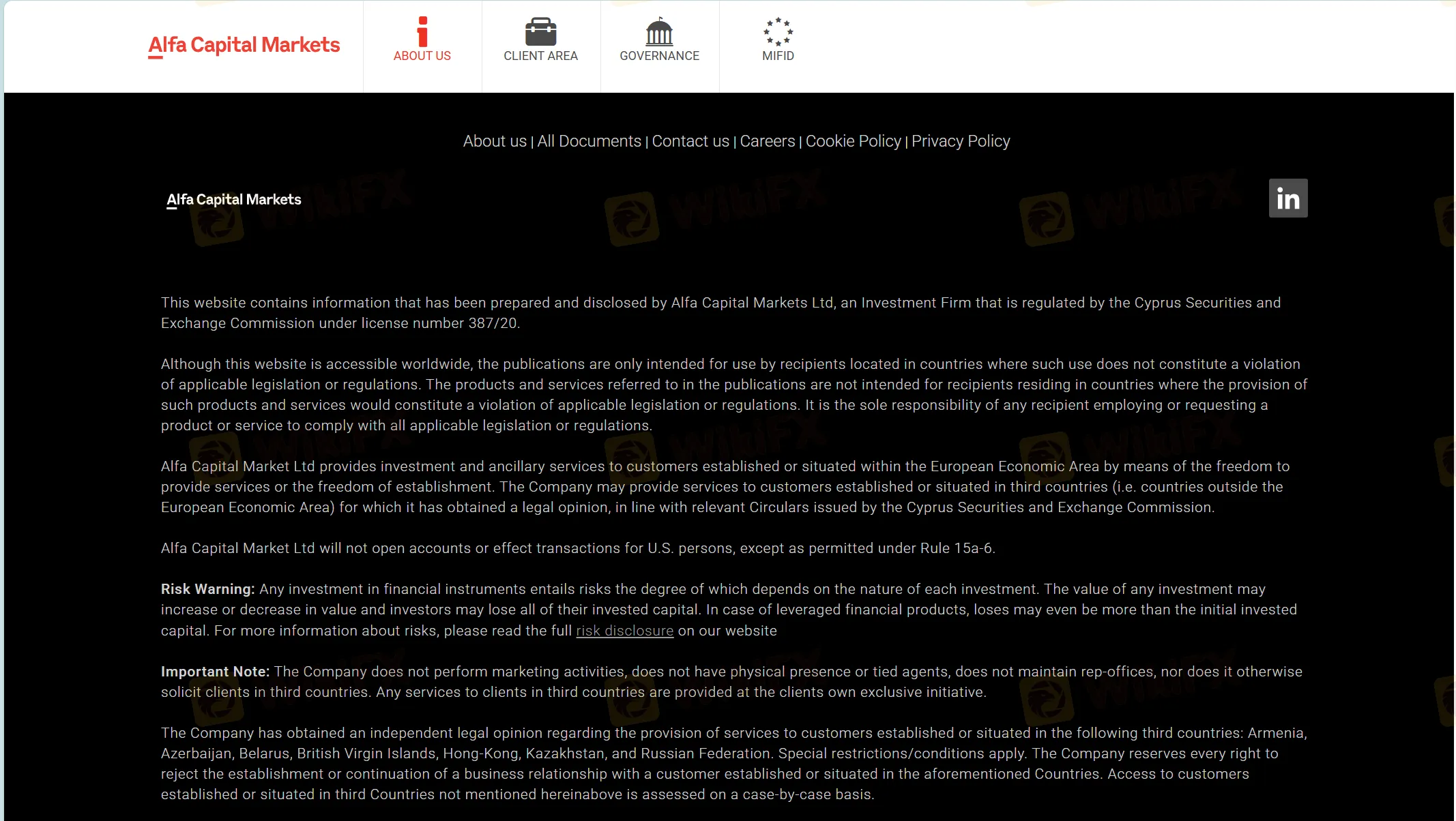

Alfa Capital هي شركة مسجلة في قبرص. تقدم مجموعة متنوعة من الأدوات السوقية للتداول بالإضافة إلى خدمات الاستثمار والخدمات الإضافية. ومع ذلك، تم إلغاء تراخيصها. كما توجد قيود إقليمية، حيث يتم منع الولايات المتحدة من خدماتها، ولديها موقع ويب غير صالح، مما يجعلها وسيطًا محفوفًا بالمخاطر.

إليك صفحة البداية لموقع هذا الوسيط الرسمي:

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| / | تراخيص CYSEC/FCA مُلغاة |

| عدم قبول عملاء من الولايات المتحدة | |

| معلومات محدودة حول شروط التداول |

هل Alfa Capital شرعية؟

تم إلغاء تراخيص Alfa Capital من هيئة قبرص للأوراق المالية والبورصة (CySEC) وهيئة السلوك المالي (FCA).

| البلد المنظم | السلطة المنظمة | الحالة الحالية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| قبرص | هيئة قبرص للأوراق المالية والبورصة (CySEC) | مُلغاة | Alfa Capital Holdings (Cyprus) Ltd | صانع سوق (MM) | 025/04 |

| الولايات المتحدة | هيئة السلوك المالي (FCA) | مُلغاة | Alfa Capital Holdings (Cyprus) Ltd | الممثل المعتمد الأوروبي (EEA) | 416251 |

ما الذي يمكنني التداول به على Alfa Capital؟

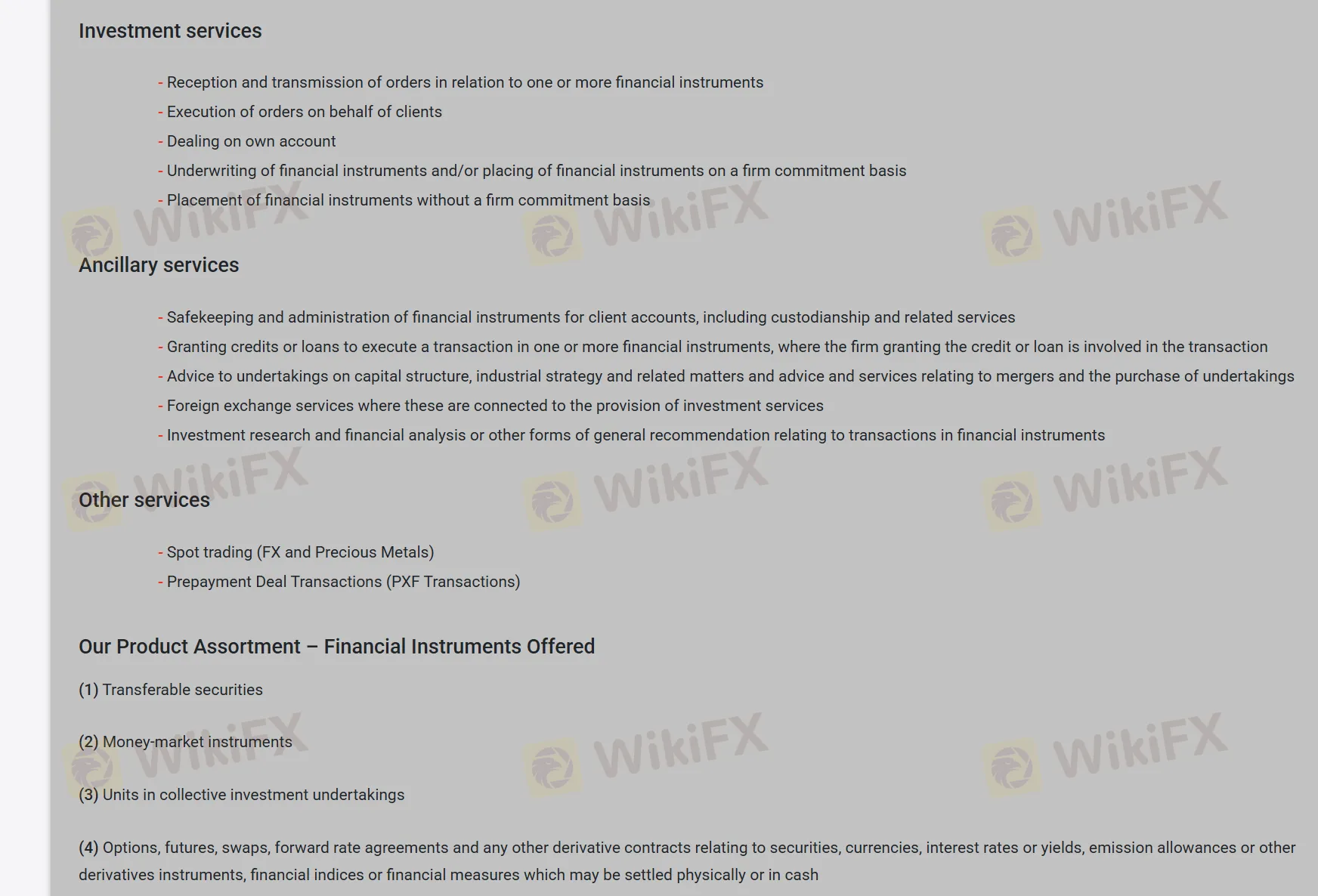

Alfa Capital تقدم خدمات الاستثمار والخدمات الإضافية. كما تقدم تداول فوري لـ العملات الأجنبية، المعادن، الخيارات، والعقود الآجلة.

| أدوات التداول | مدعوم |

| العملات الأجنبية | ✔ |

| المعادن | ✔ |

| الخيارات | ✔ |

| العقود الآجلة | ✔ |

| السلع | ❌ |

| المؤشرات | ❌ |

| الأسهم | ❌ |

| العملات الرقمية | ❌ |

| السندات | ❌ |

| صناديق الاستثمار المتداولة | ❌ |