Présentation de l'entreprise

| S Broker Résumé de l'examen | |

| Fondé | 1999 |

| Pays/Région d'enregistrement | Allemagne |

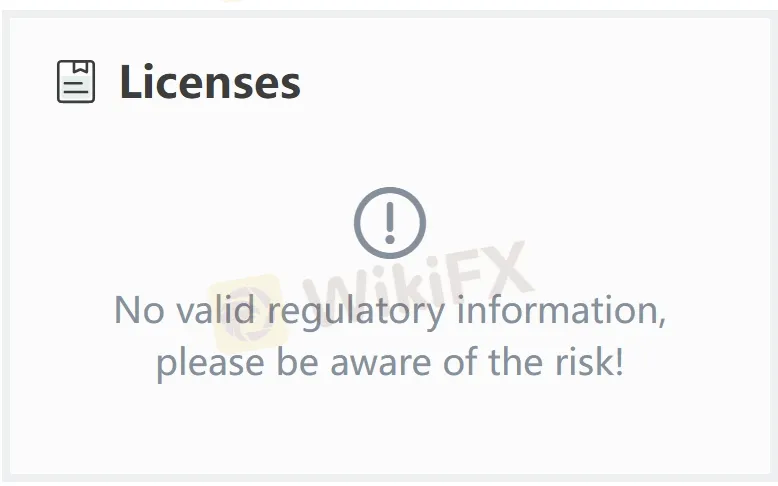

| Régulation | Pas de régulation |

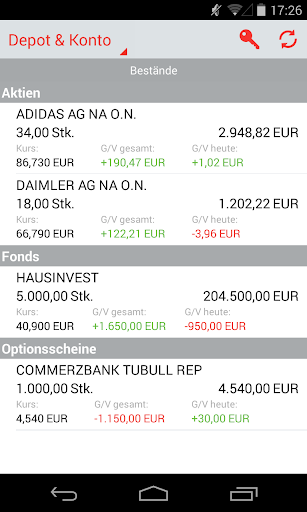

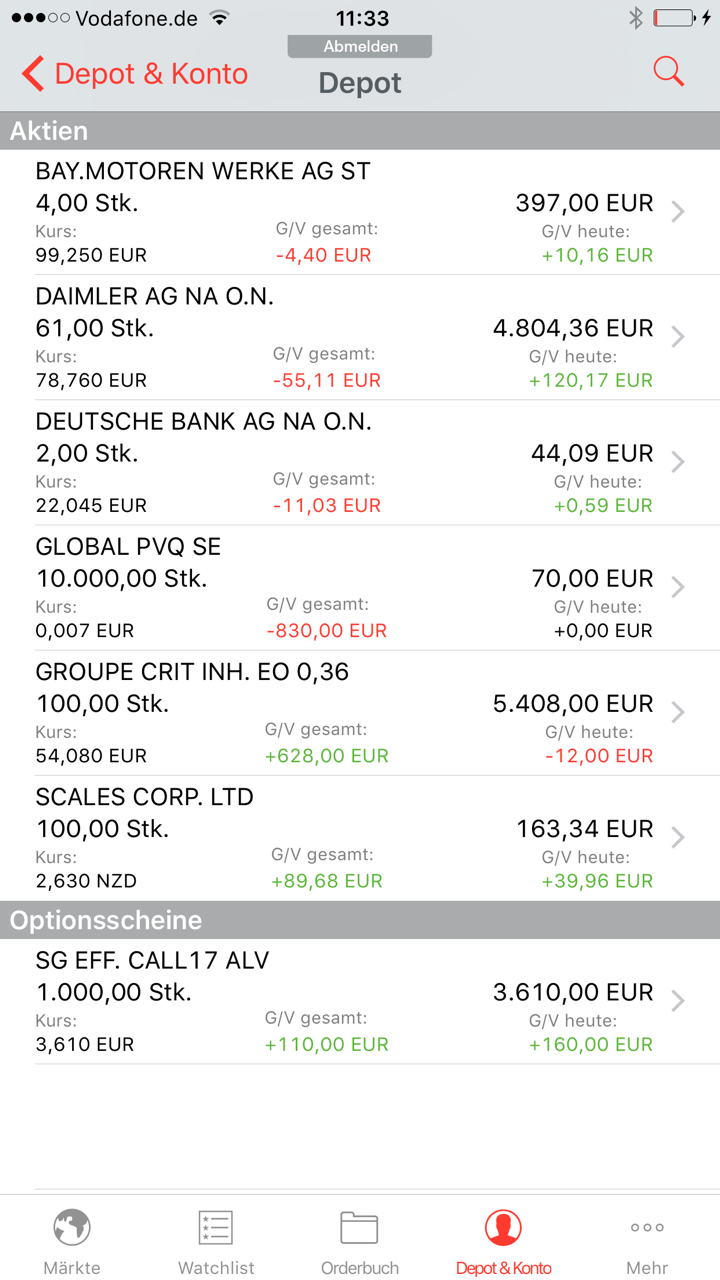

| Instruments de marché | Actions, fonds, ETF, CFD, obligations, indices, etc. |

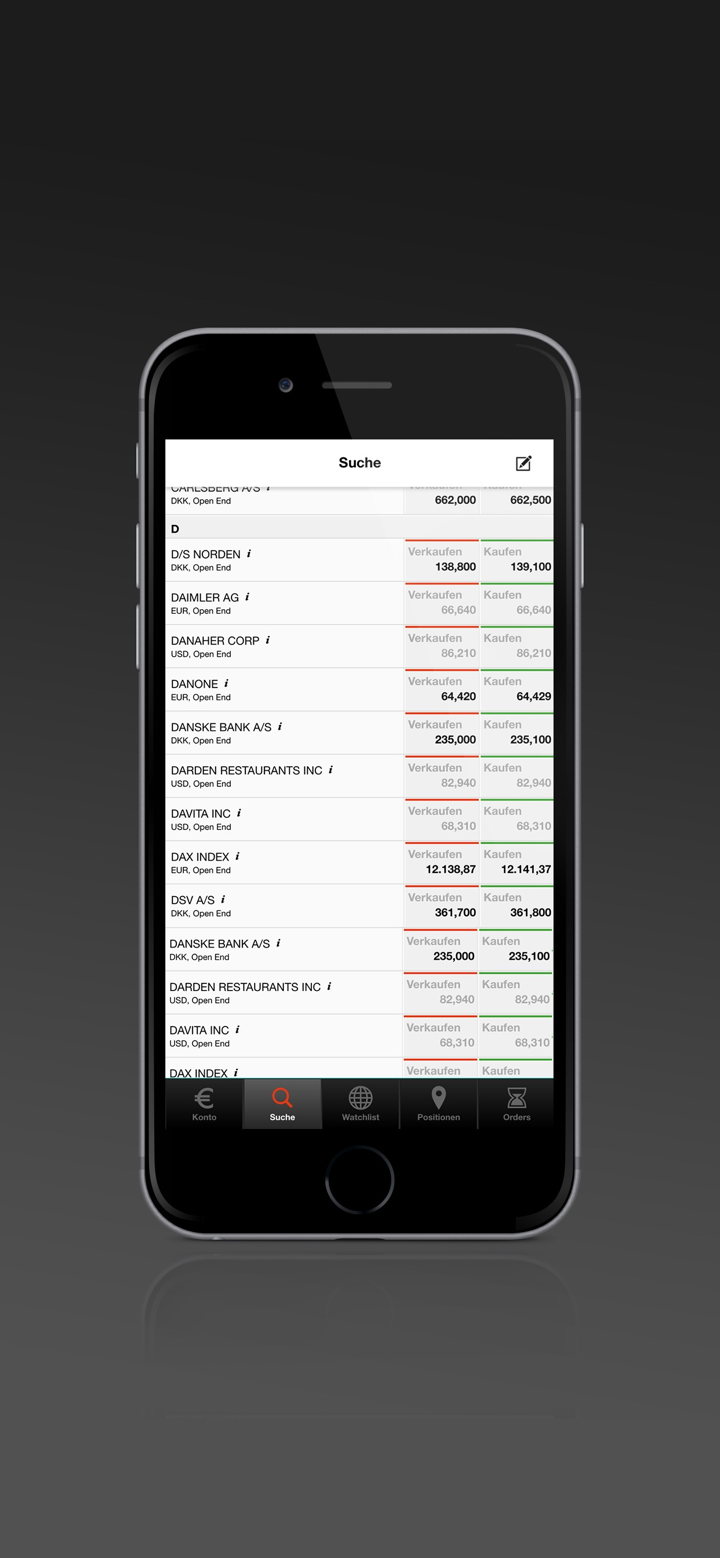

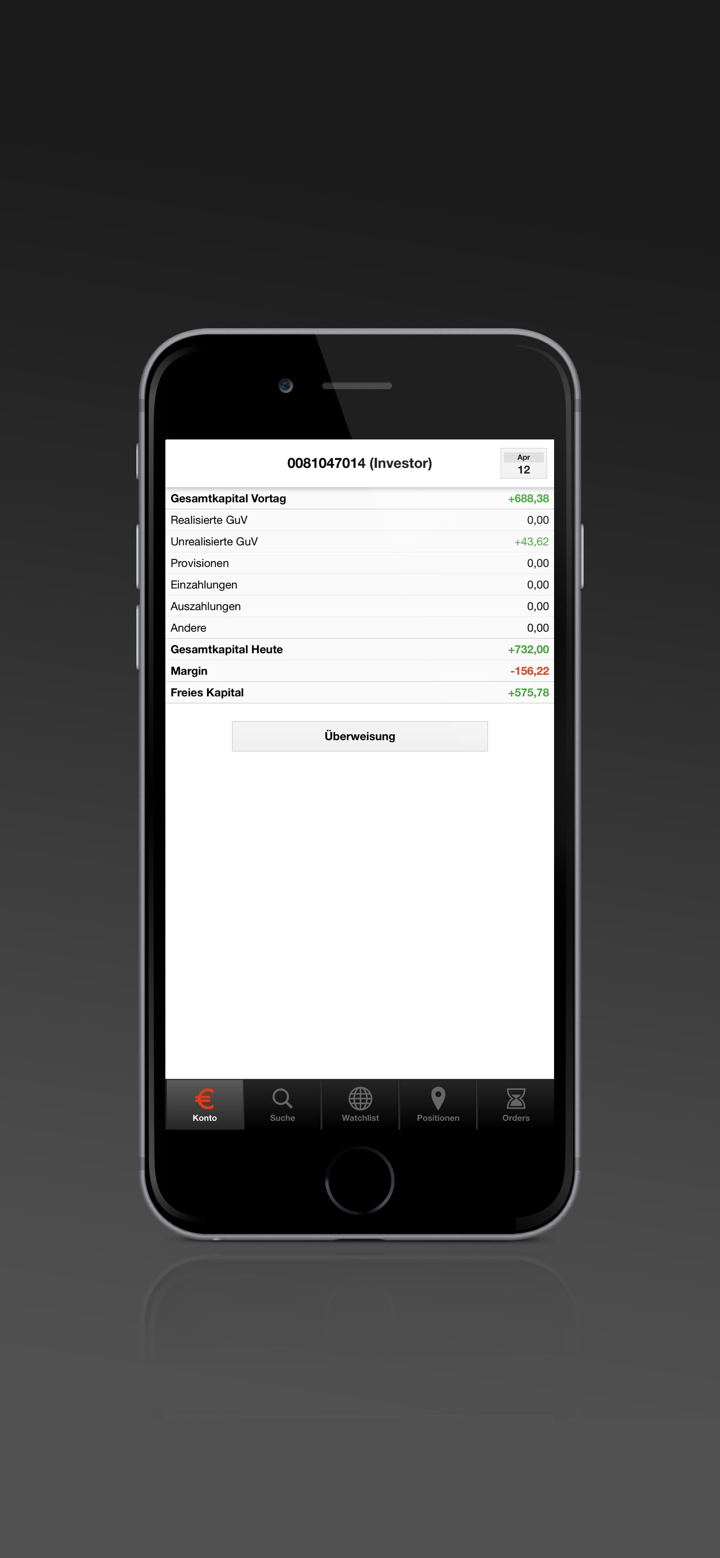

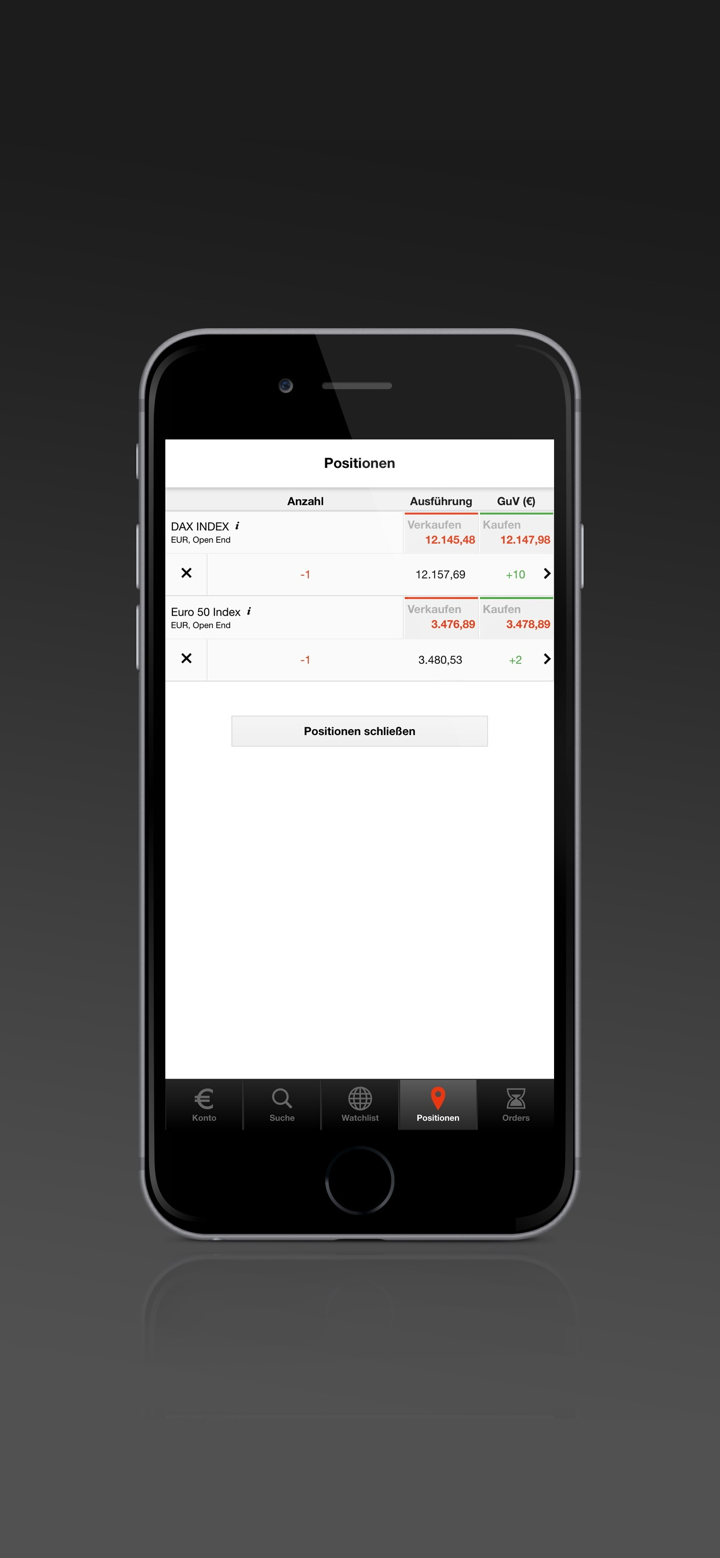

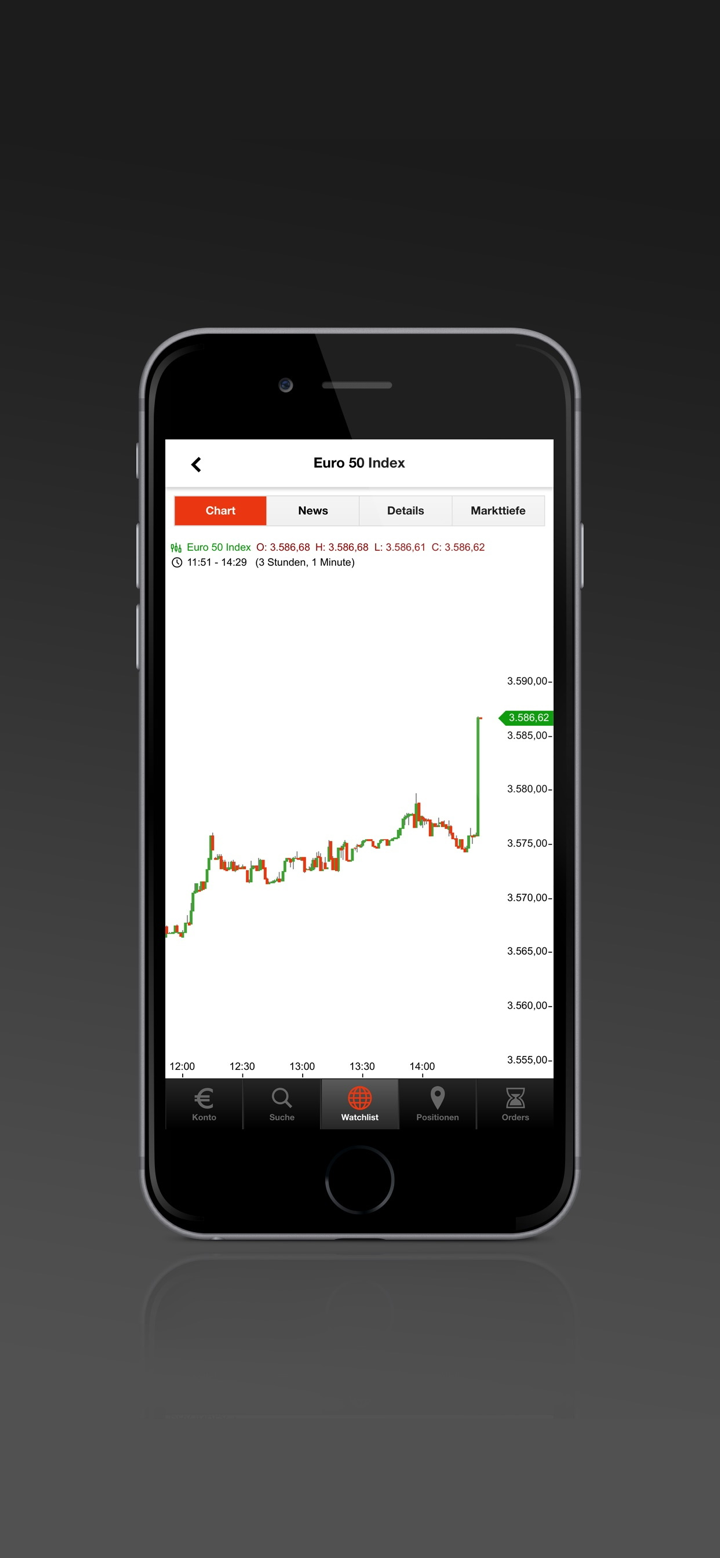

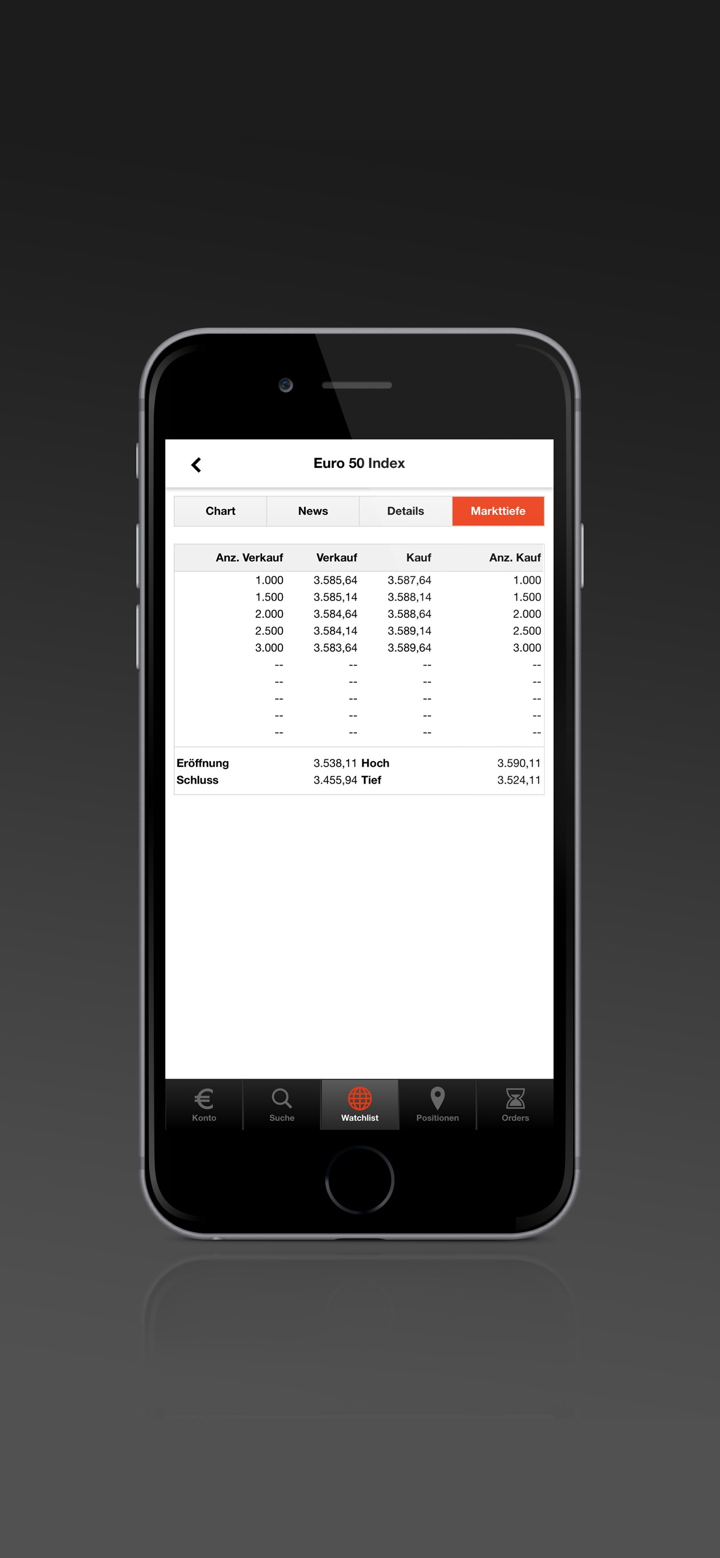

| Plateforme de trading | S Broker Application Mobile |

| Dépôt minimum | 0 |

| Support Client | Chat en direct |

| Tél : 0611 2044-1912; 0611 2044-1911; 0611 2044-1944 | |

| Email : service@sbroker.de | |

| FAQ, Instagram, YouTube, LinkedIn, Facebook, etc. | |

| Adresse : S Broker AG & Co. KG, Service Client, Boîte Postale 90 01 50, 39133 Magdeburg | |

Informations sur S Broker

S Broker est une société de trading de titres qui a été initialement créée en 1999 en Allemagne. La société propose désormais des produits de trading comprenant, entre autres, des actions, des fonds, des ETF, des CFD, des obligations, des produits à effet de levier comme les indices, etc. Elle propose deux comptes de trading sans exigence de dépôt minimum.

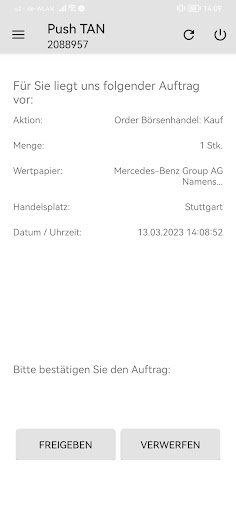

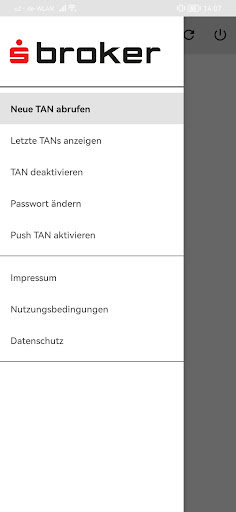

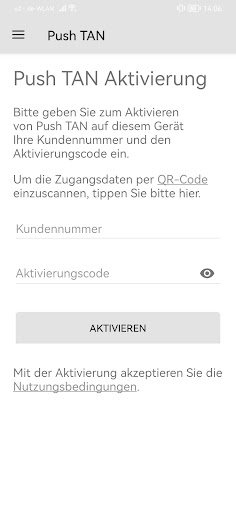

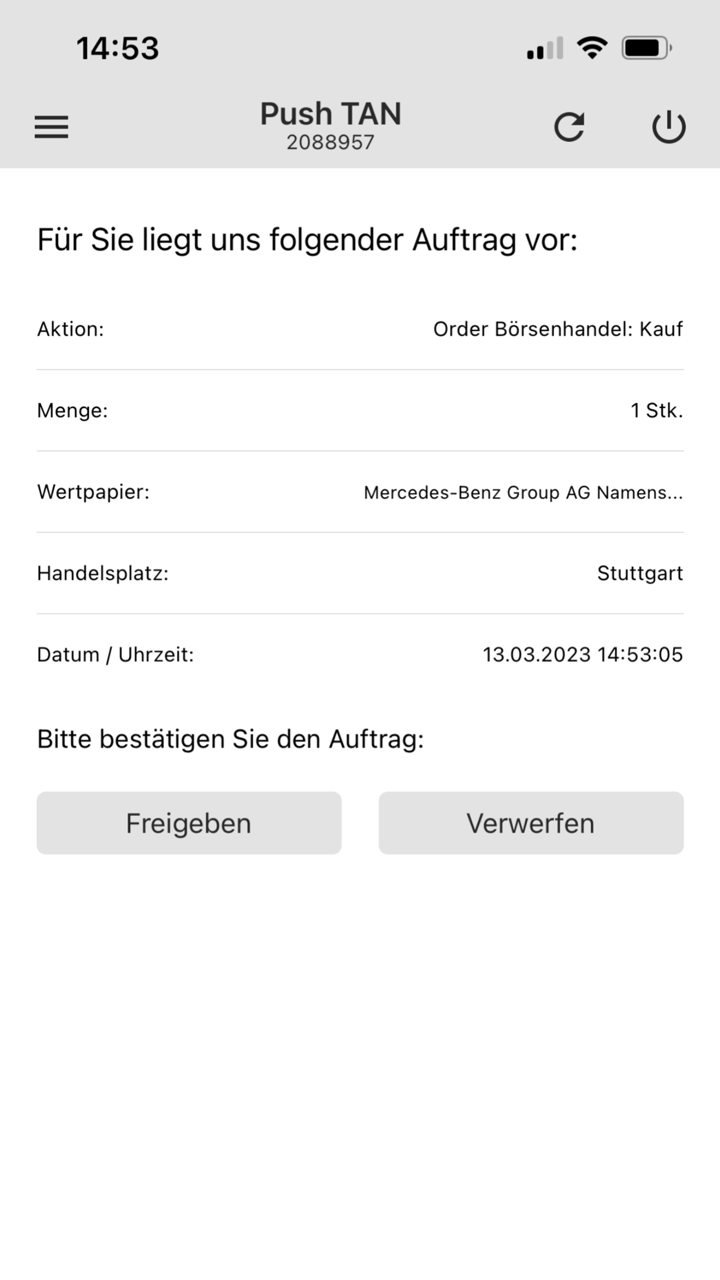

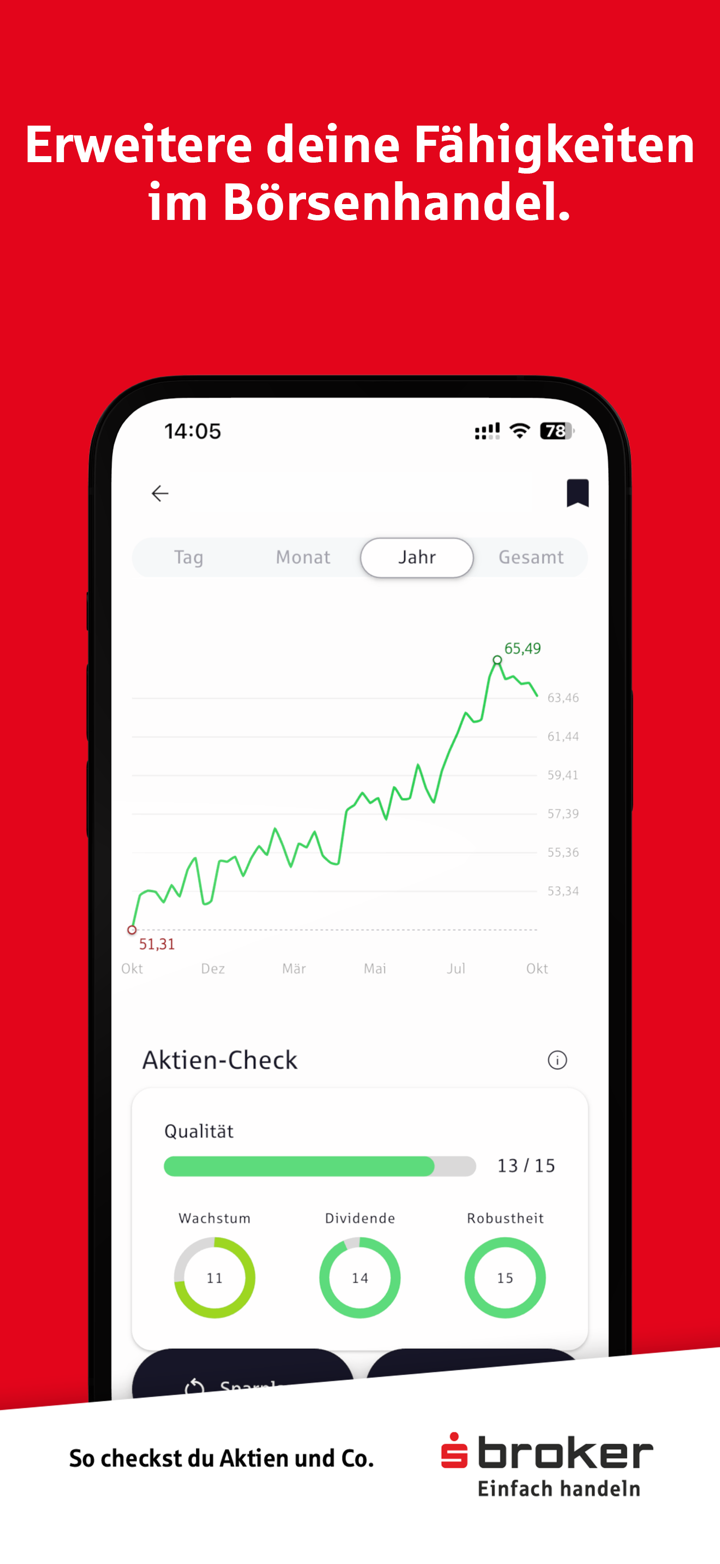

Pour exécuter des transactions, la société a développé sa propre Application Mobile S Broker, spécialement conçue pour ses utilisateurs.

Cependant, le courtier n'est actuellement pas bien réglementé par les autorités officielles, ce qui nuit à sa crédibilité et à sa fiabilité.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Expérience de l'industrie de nombreuses années | Pas de régulation |

| Divers produits de trading | |

| Pas de dépôt minimum |

S Broker est-il légitime ?

Le facteur le plus important pour mesurer la sécurité d'une plateforme de courtage est sa réglementation formelle. S Broker est un courtier non réglementé, ce qui signifie que la sécurité des fonds des utilisateurs et de leurs activités de trading n'est pas efficacement protégée. Les investisseurs doivent choisir S Broker avec prudence.

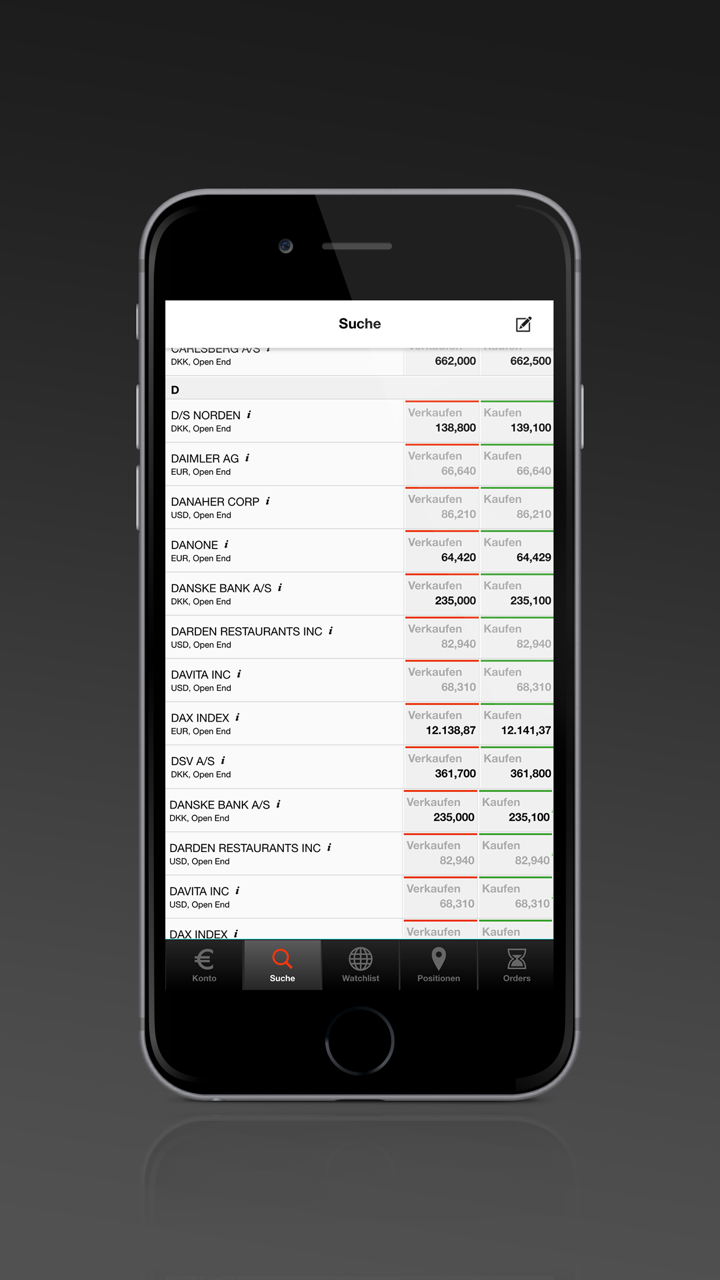

Que puis-je trader sur S Broker ?

| Instruments de Trading | Pris en charge |

| Actions | ✔ |

| Fonds | ✔ |

| ETF | ✔ |

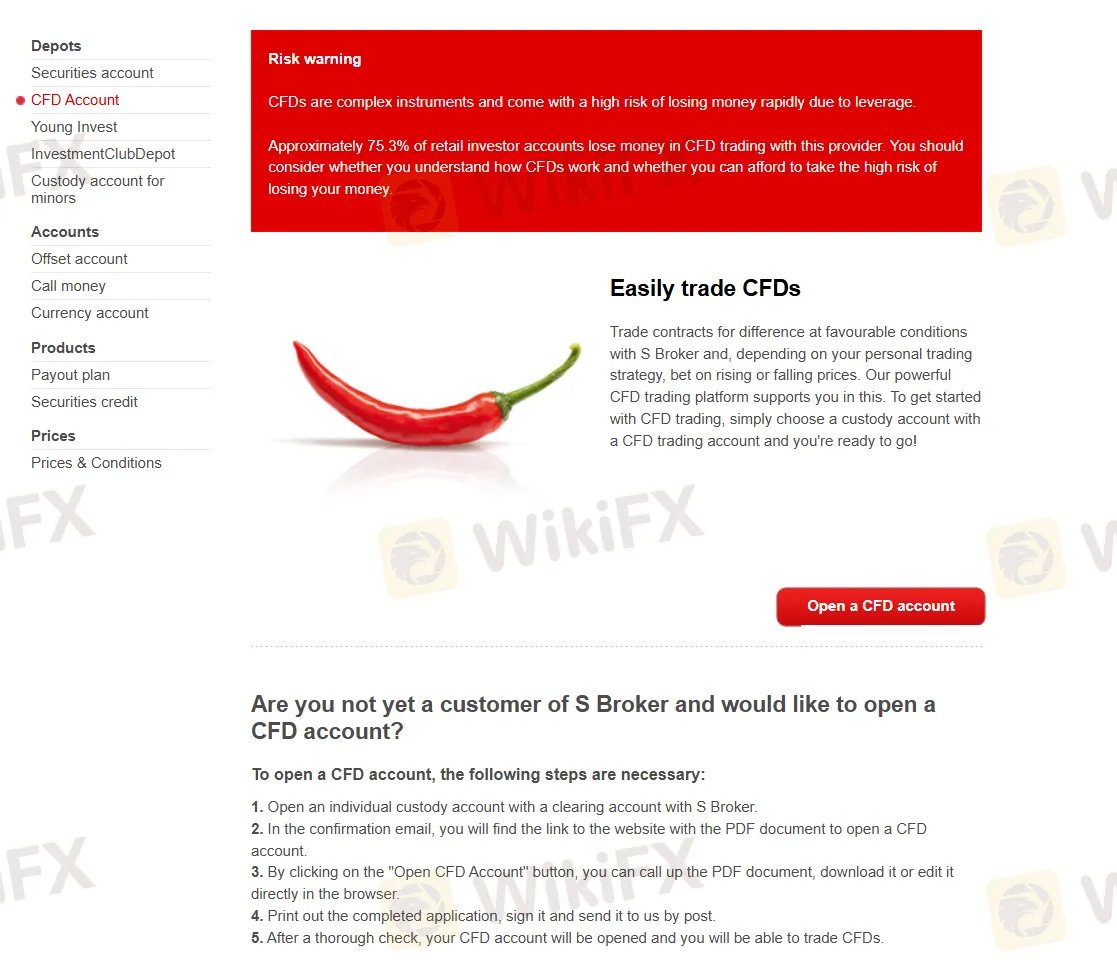

| CFD | ✔ |

| Obligations | ✔ |

| Indices | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Cryptomonnaies | ❌ |

| Options | ❌ |

Type de Compte

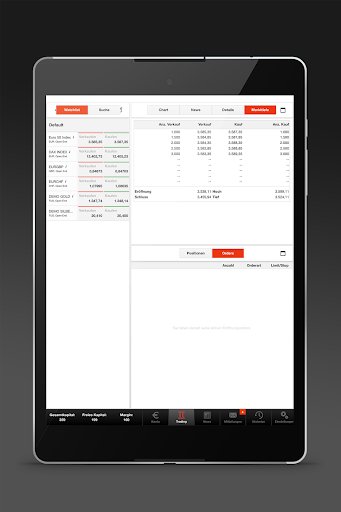

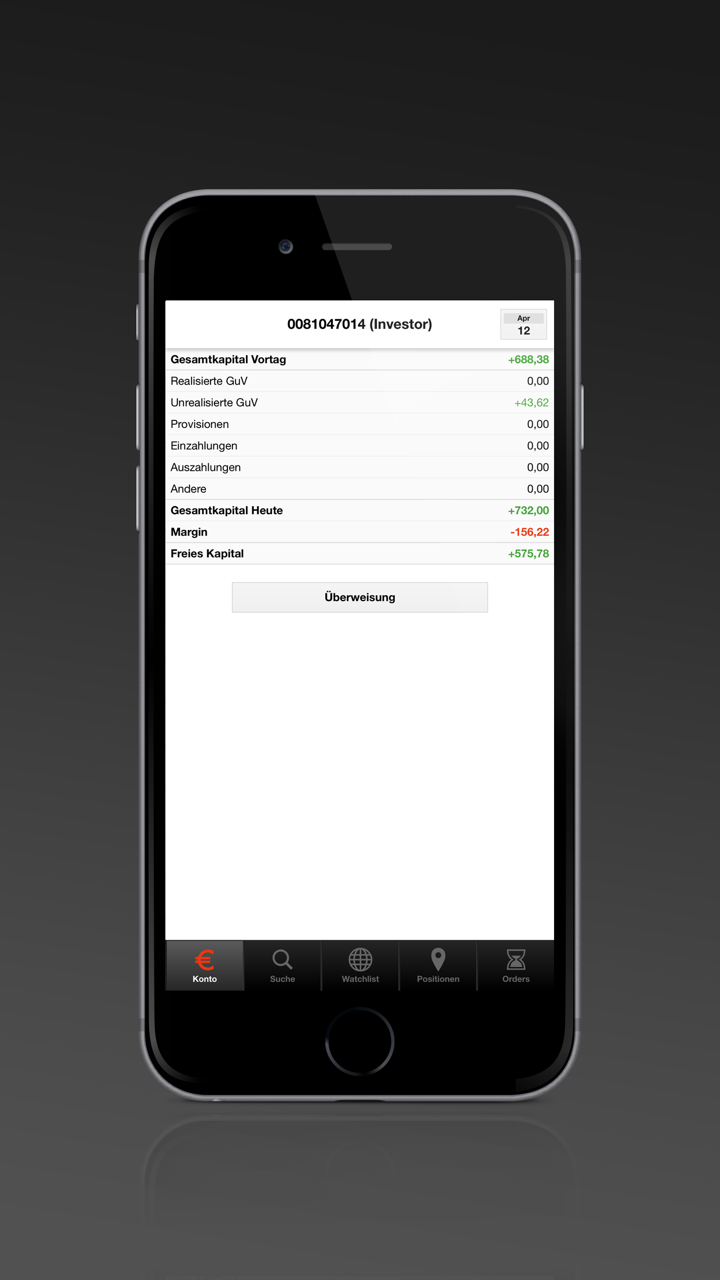

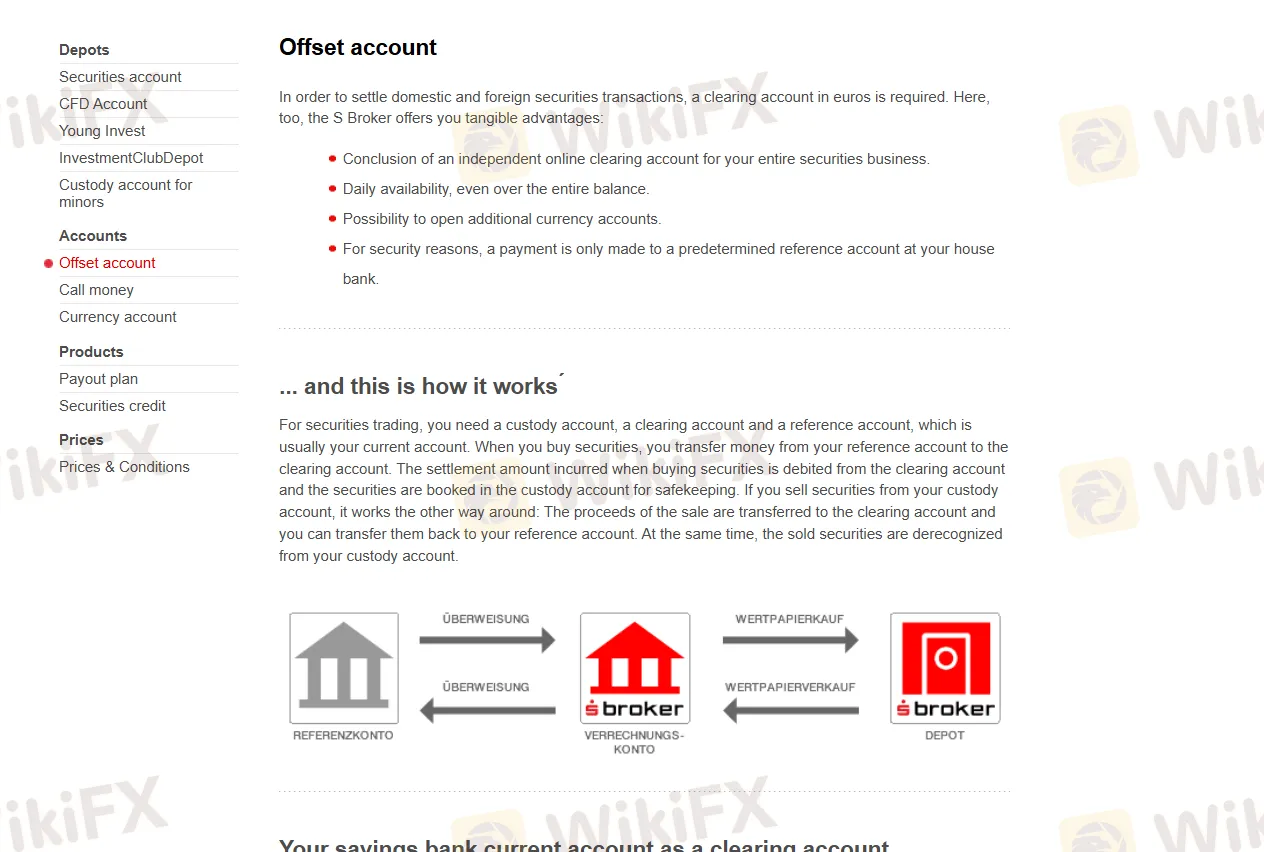

S Broker propose trois types de comptes pour différents produits : compte CFD, compte titres, compte de compensation et compte de devises.

Il n'y a aucune exigence de dépôt minimum pour ouvrir un compte avec la société.

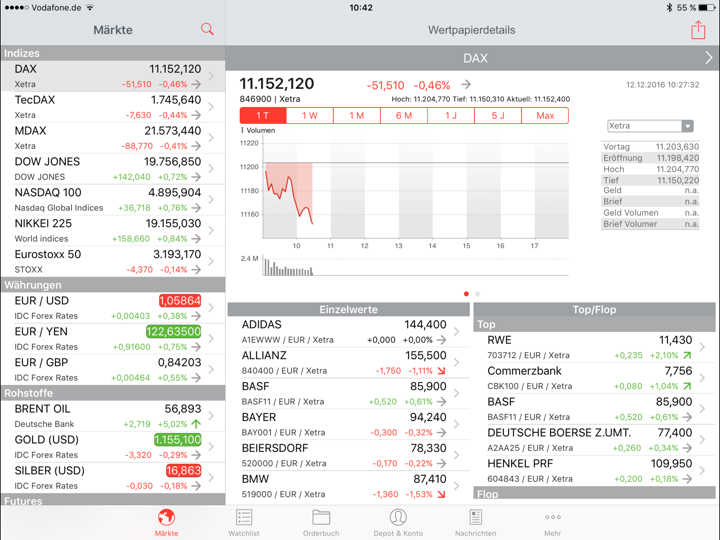

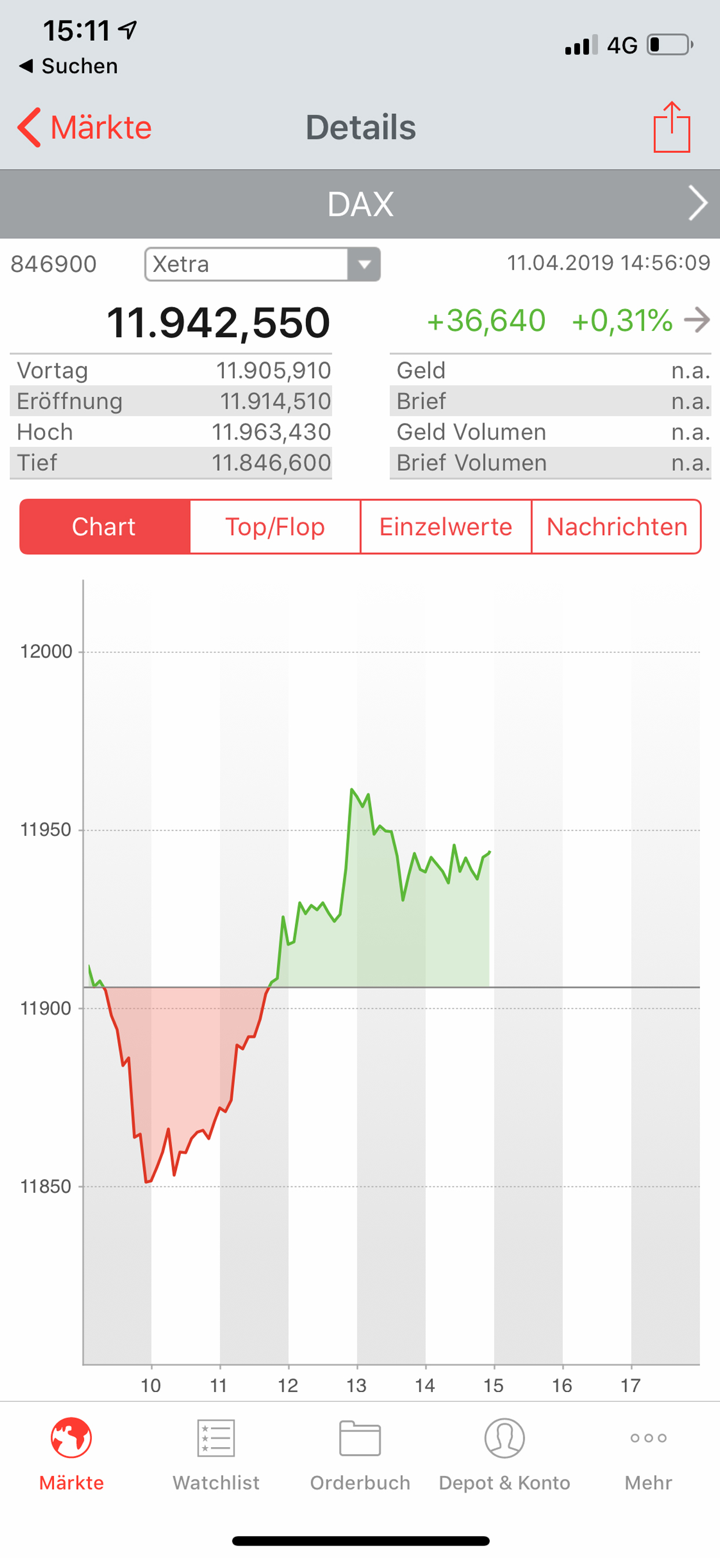

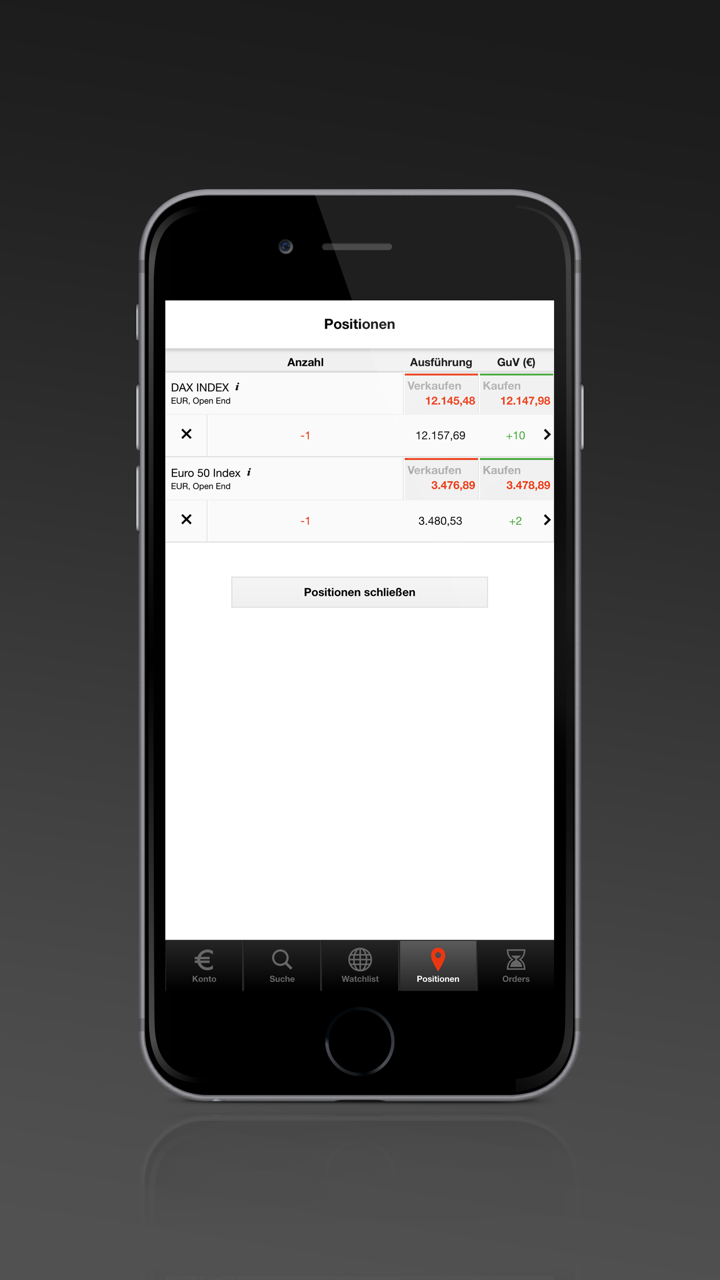

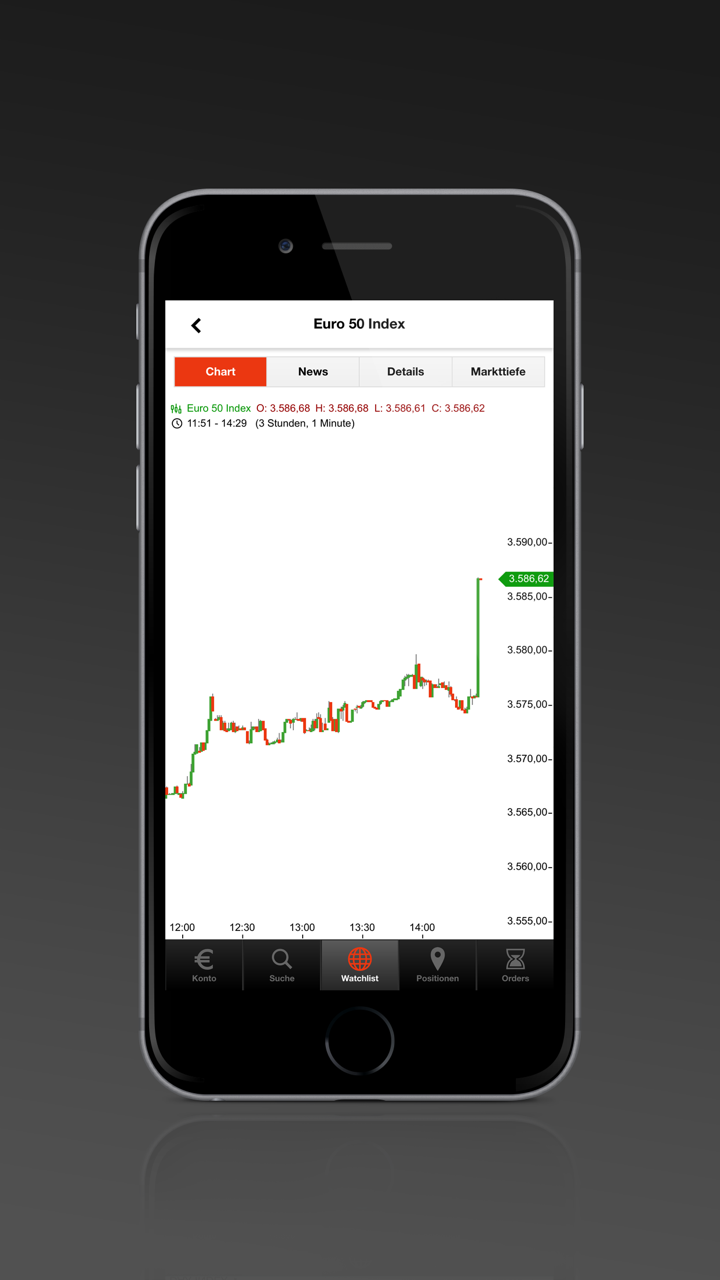

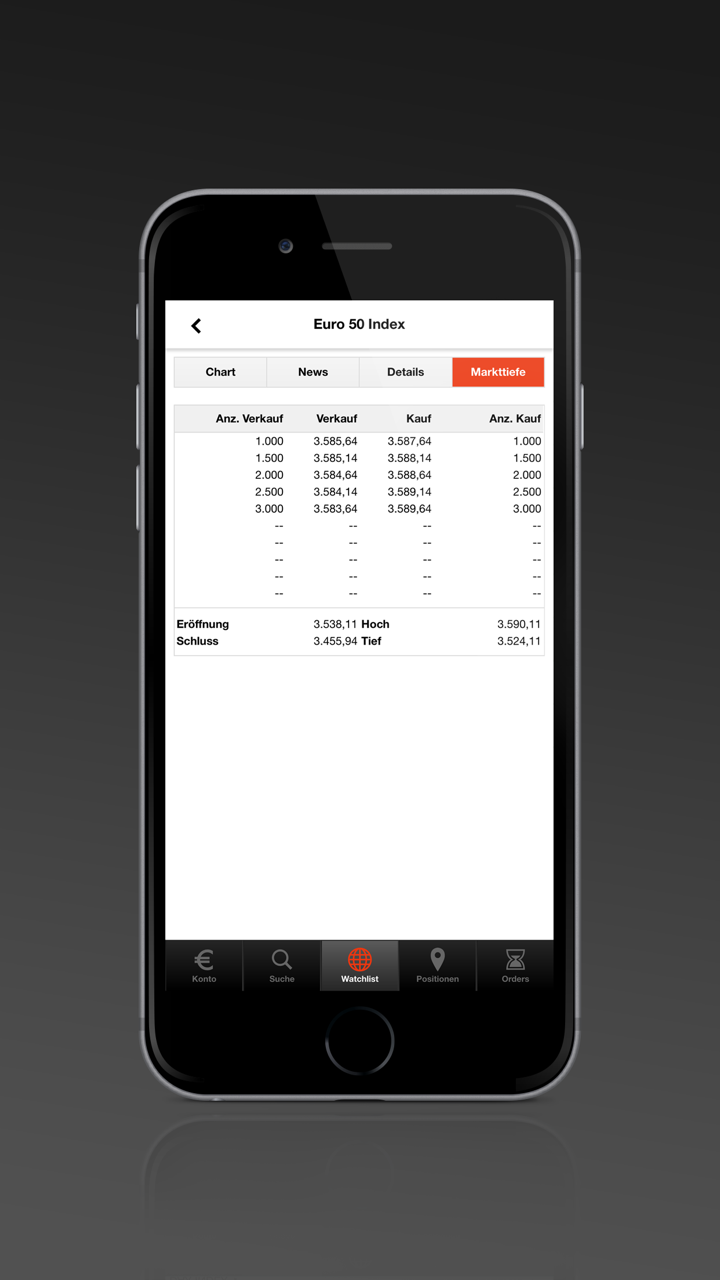

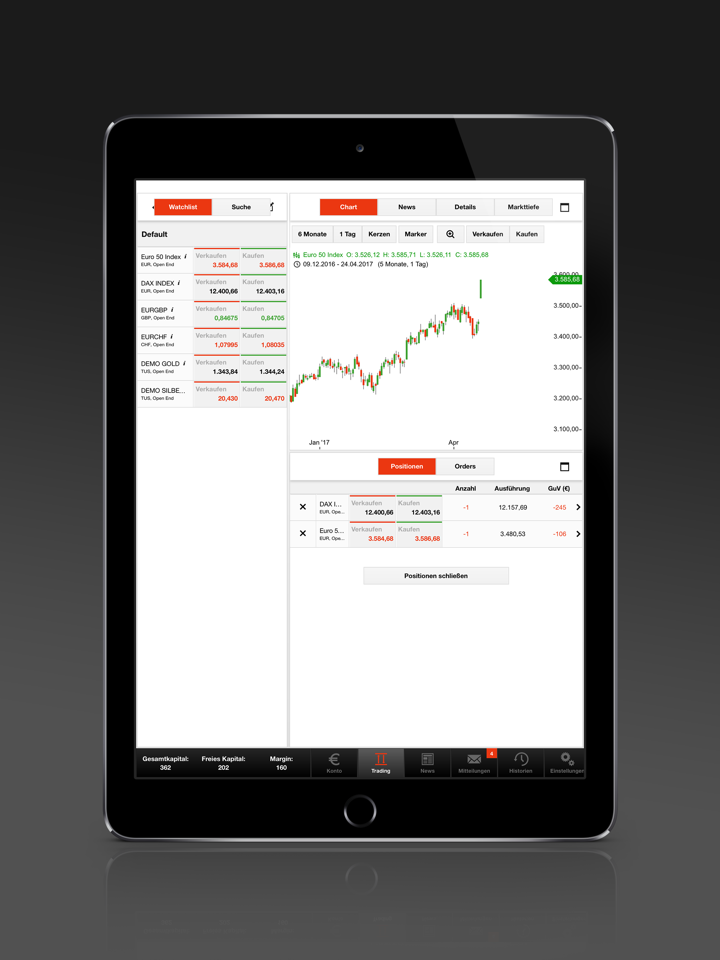

Plateforme de trading

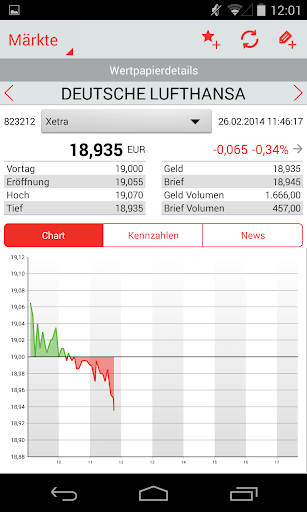

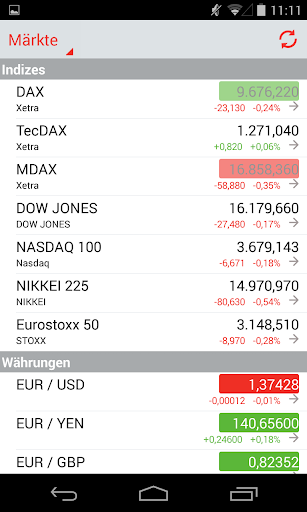

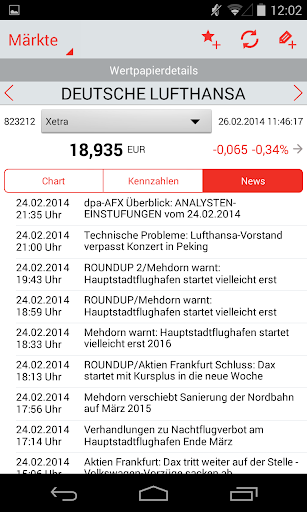

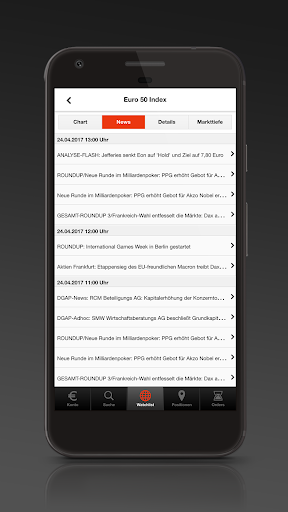

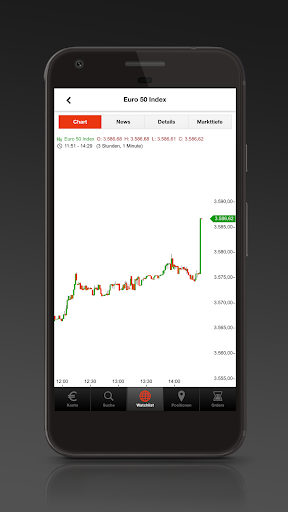

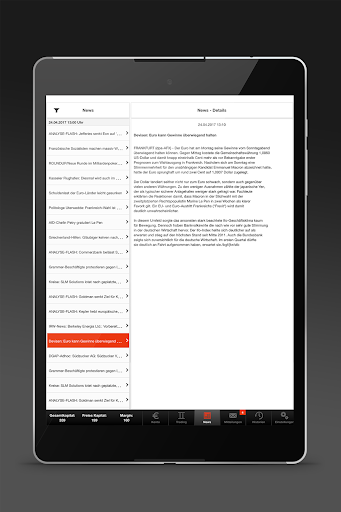

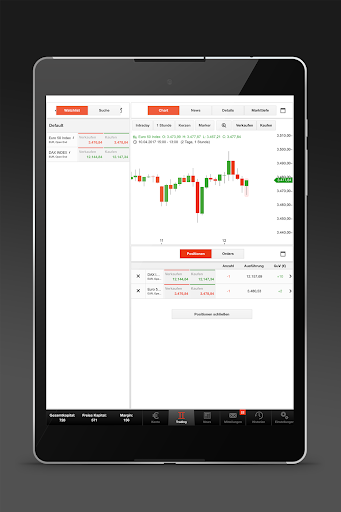

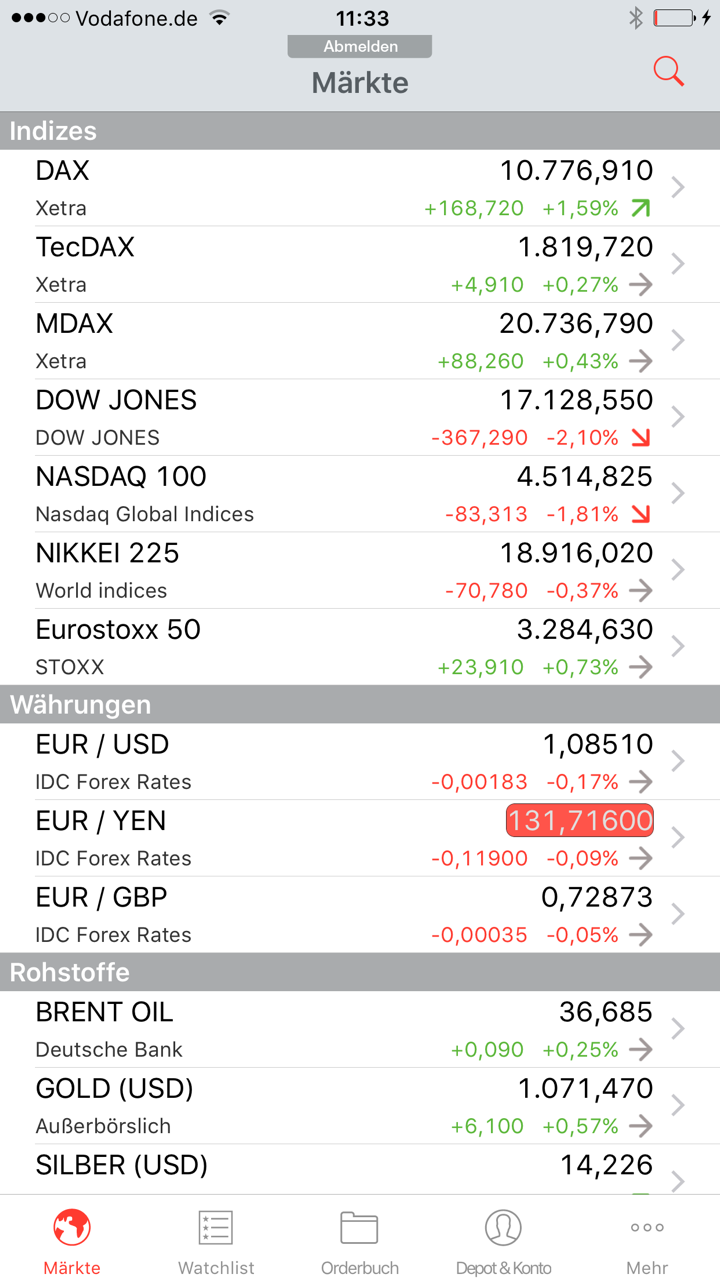

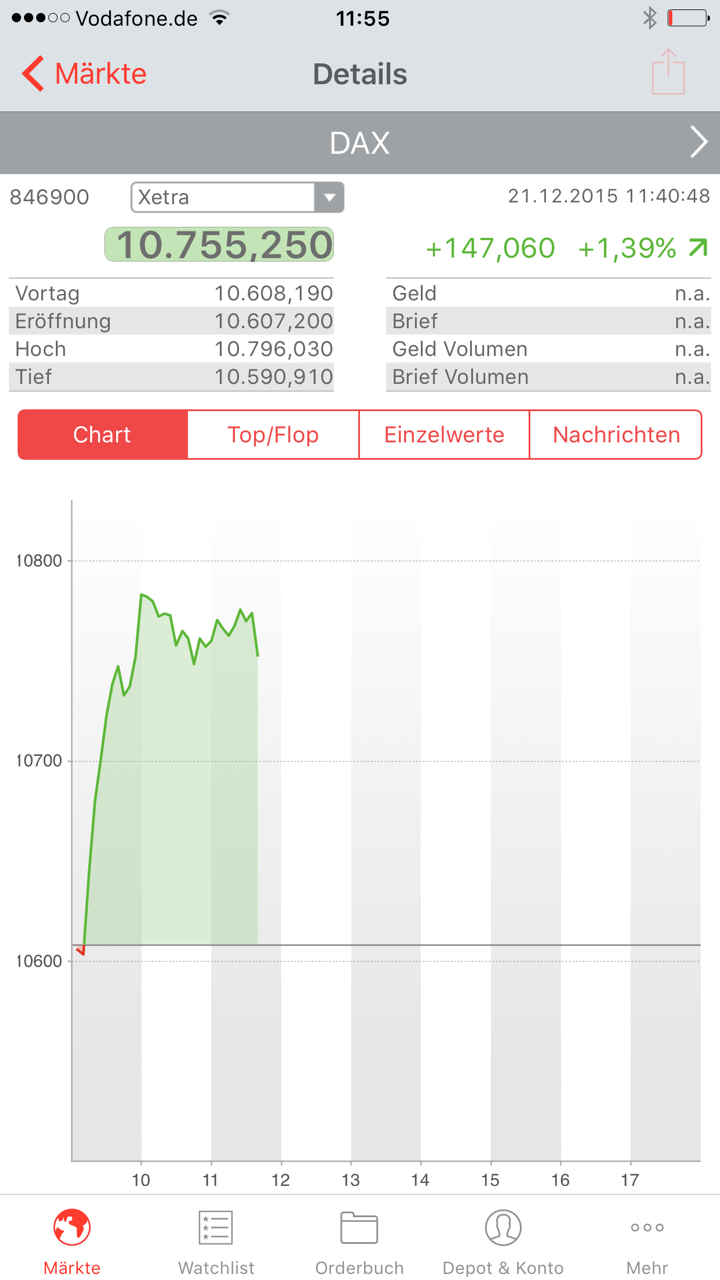

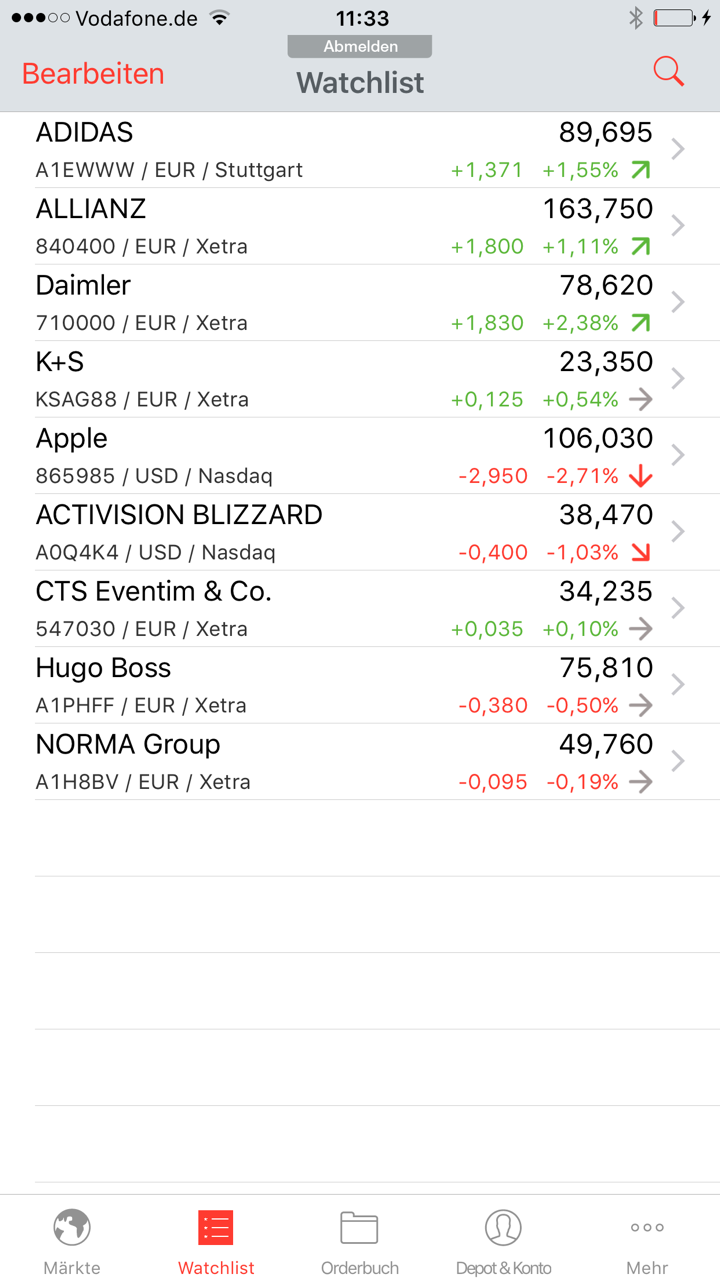

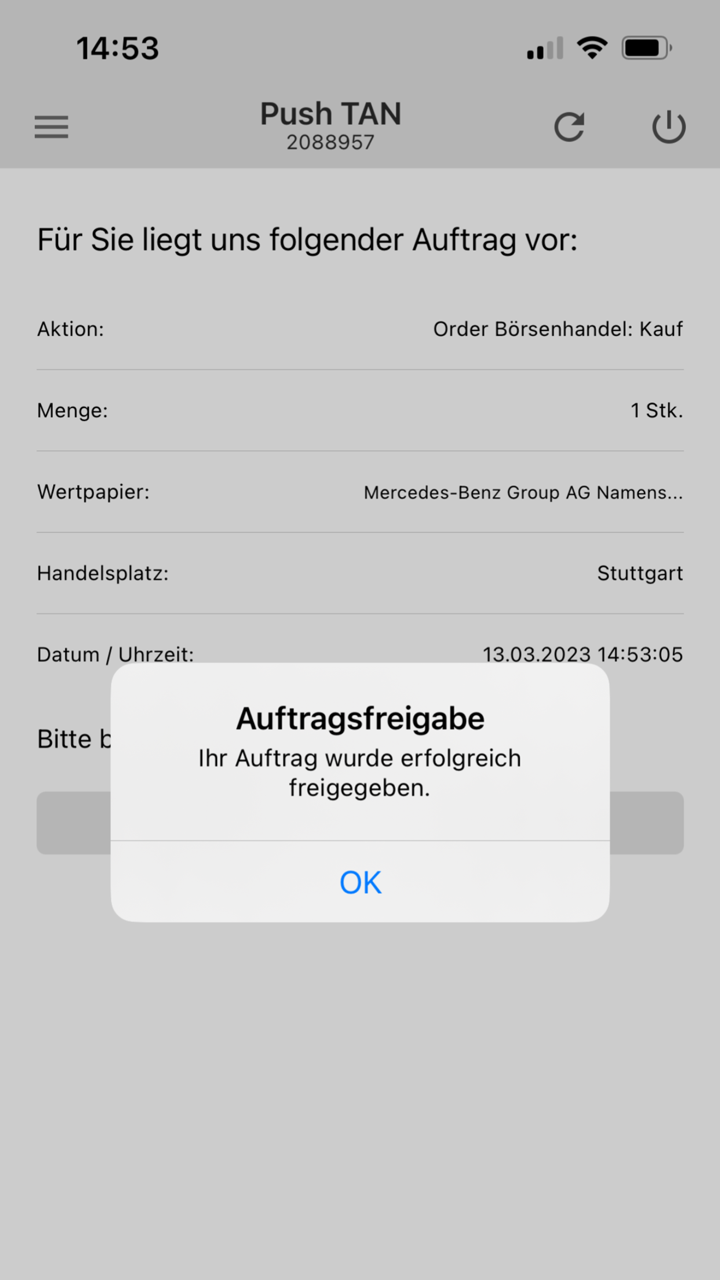

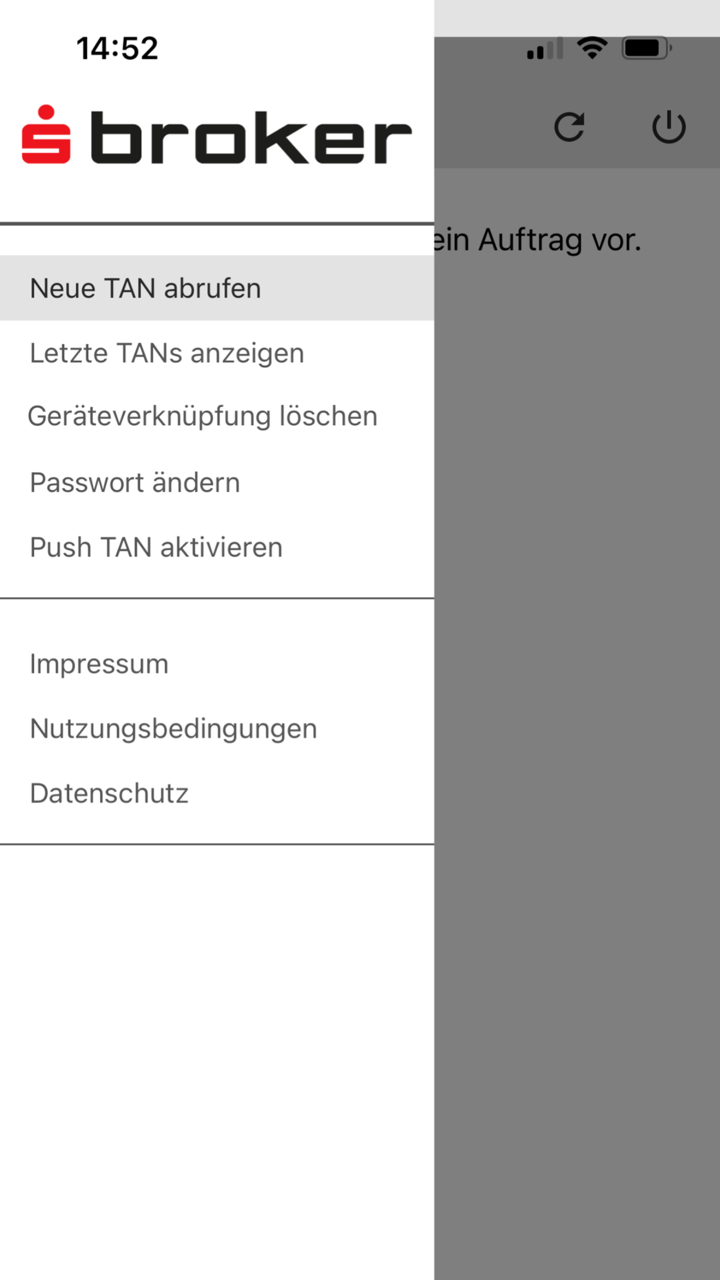

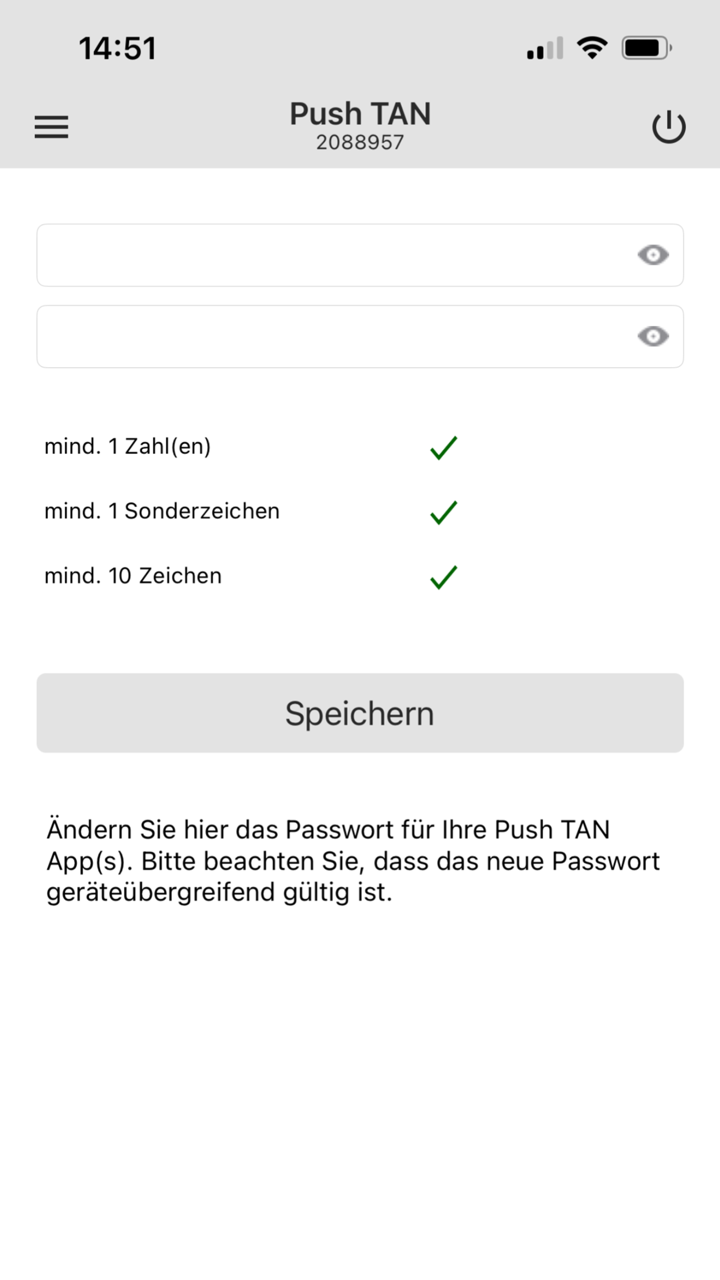

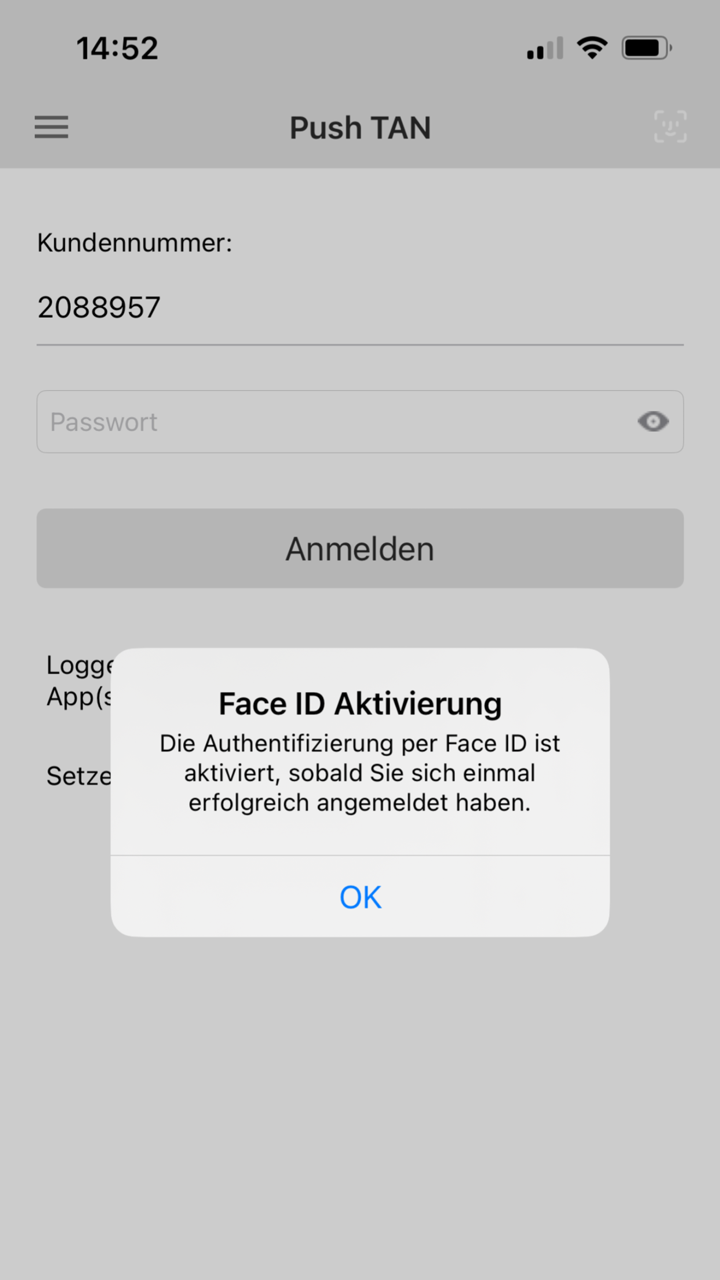

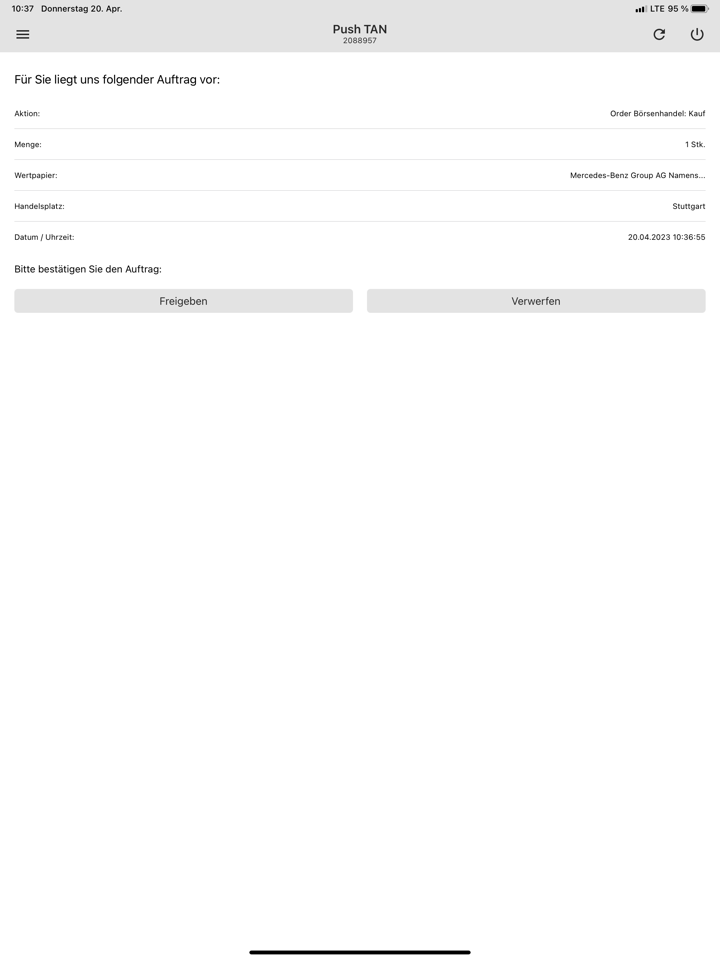

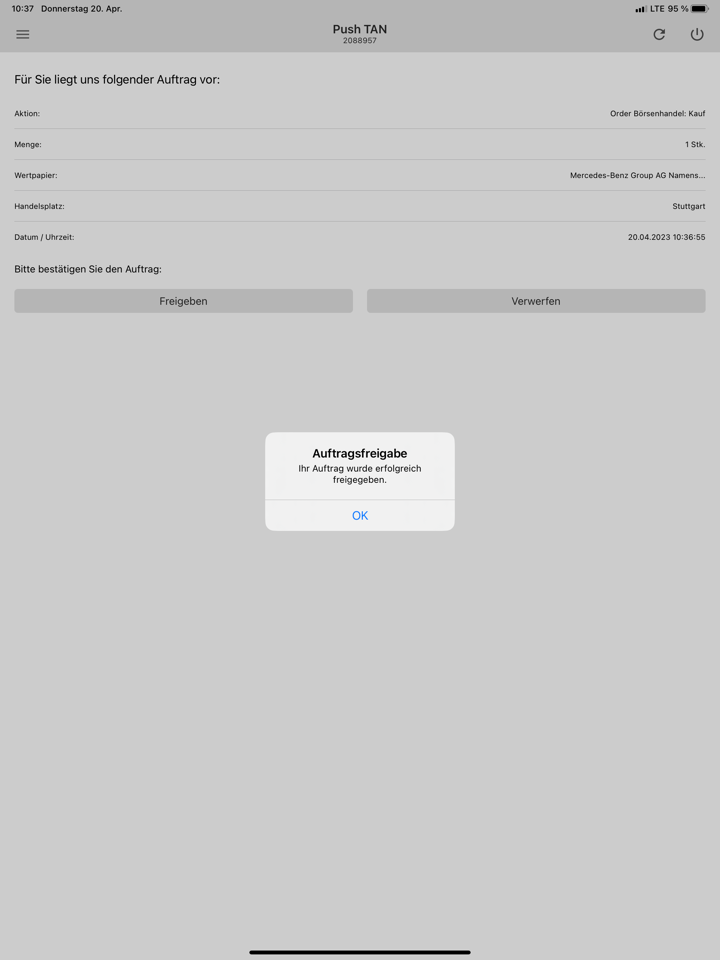

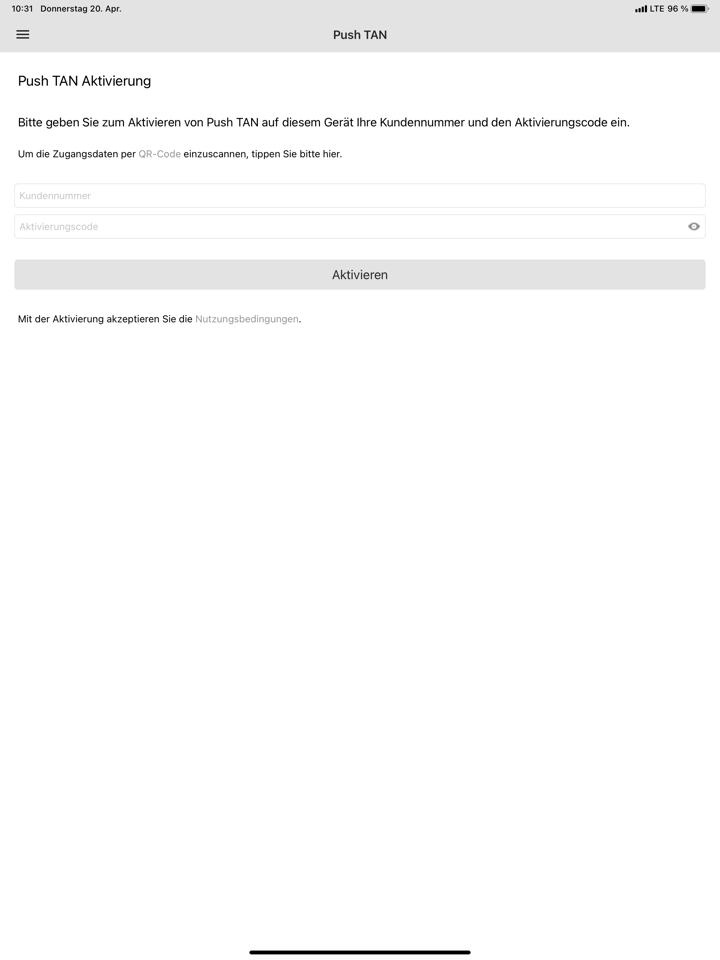

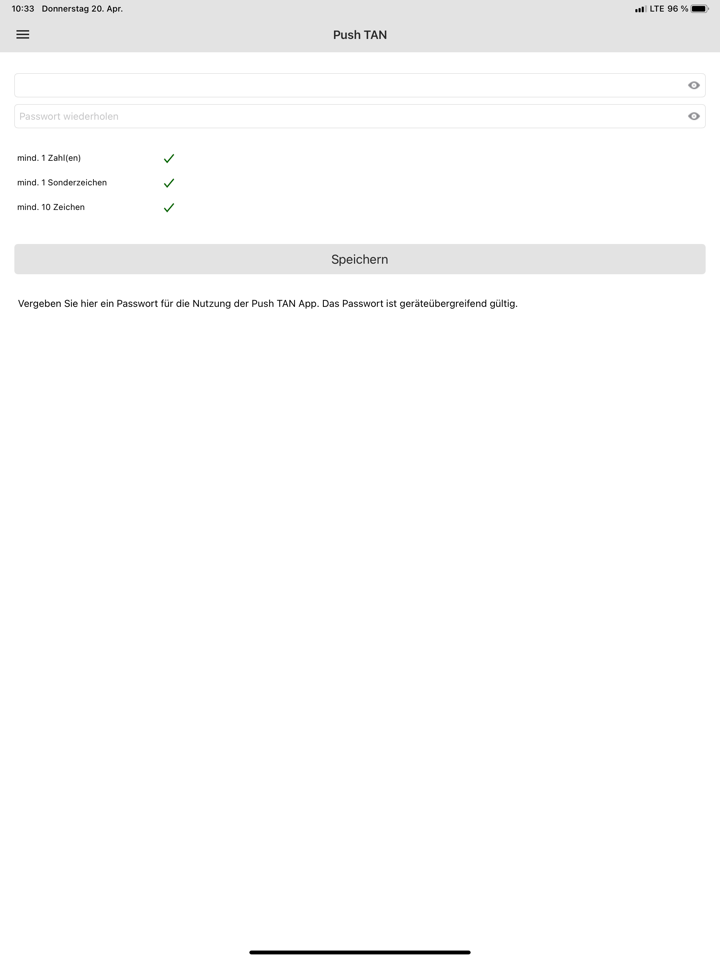

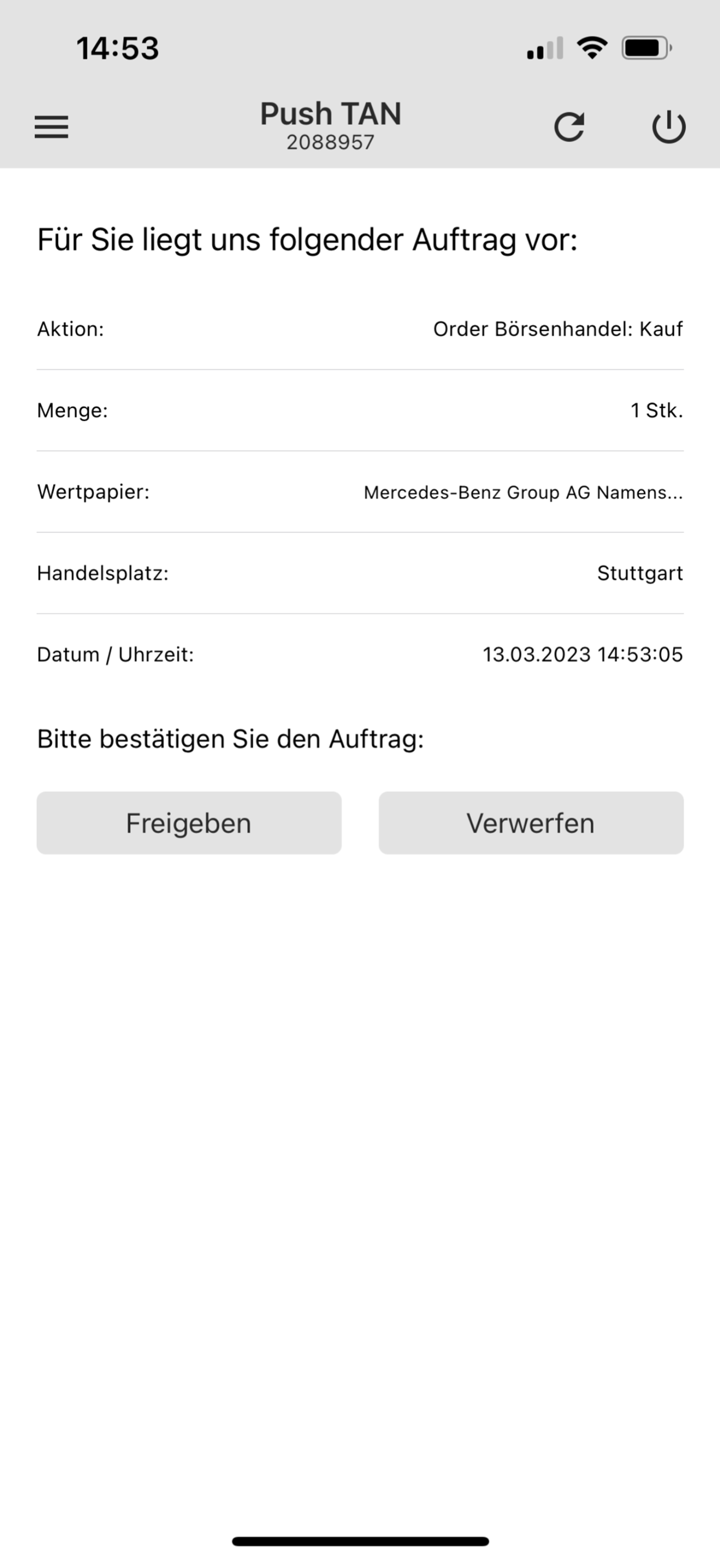

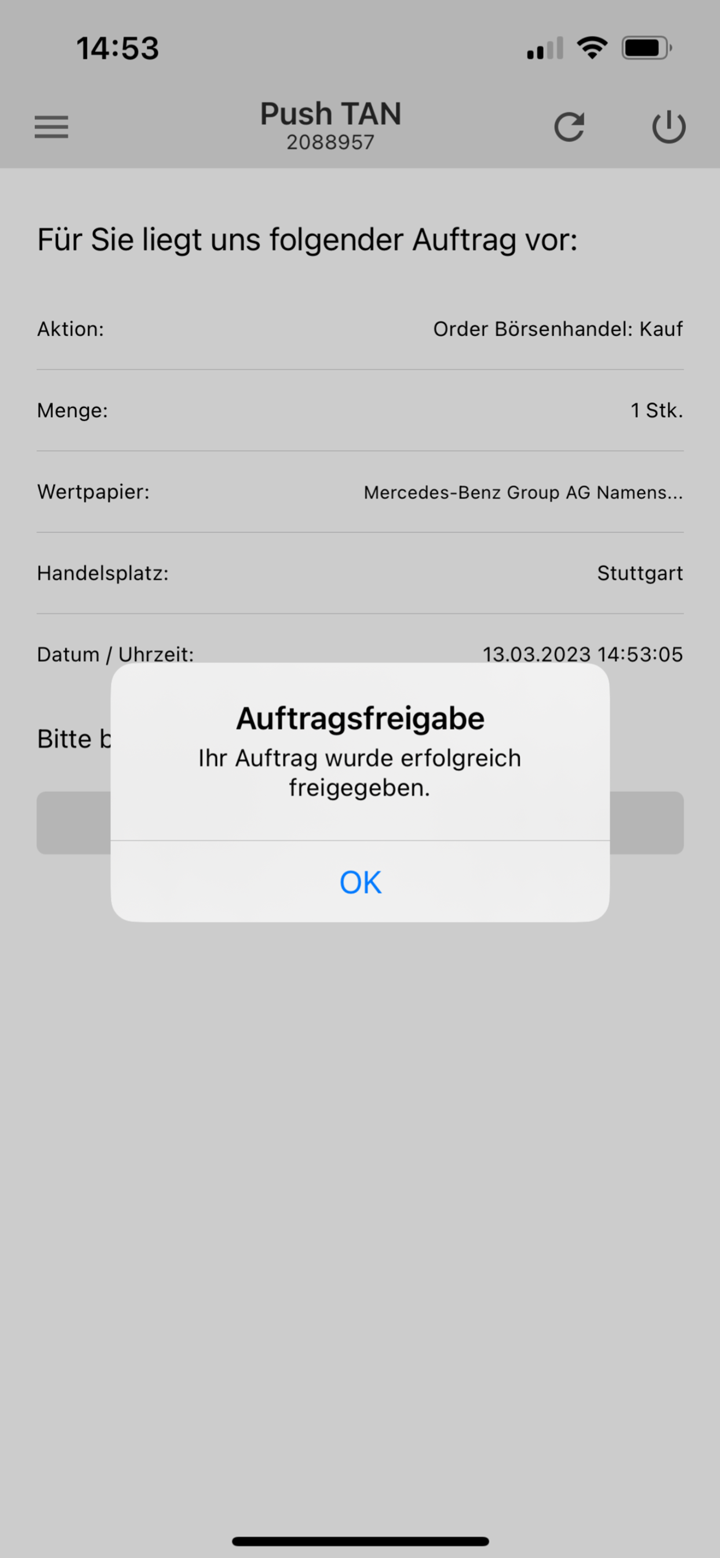

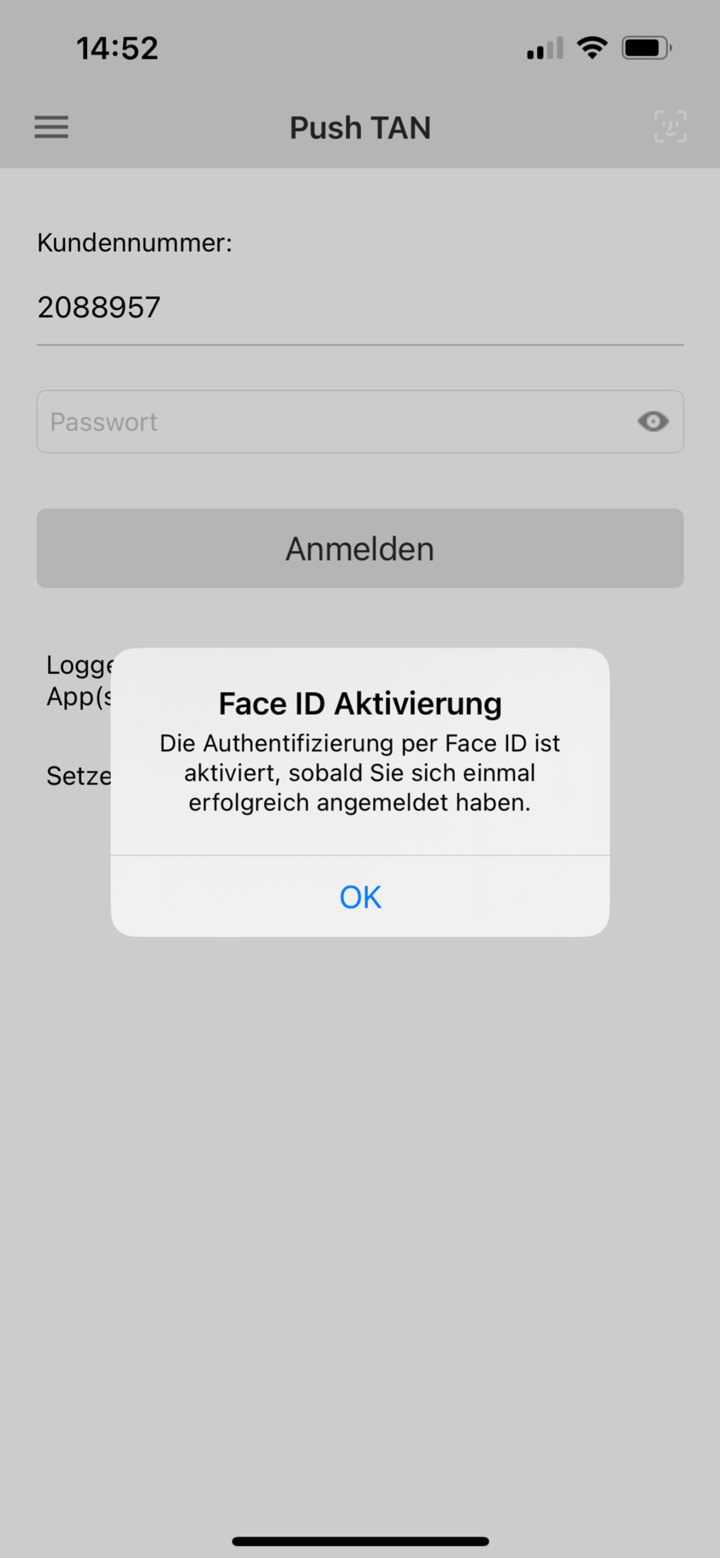

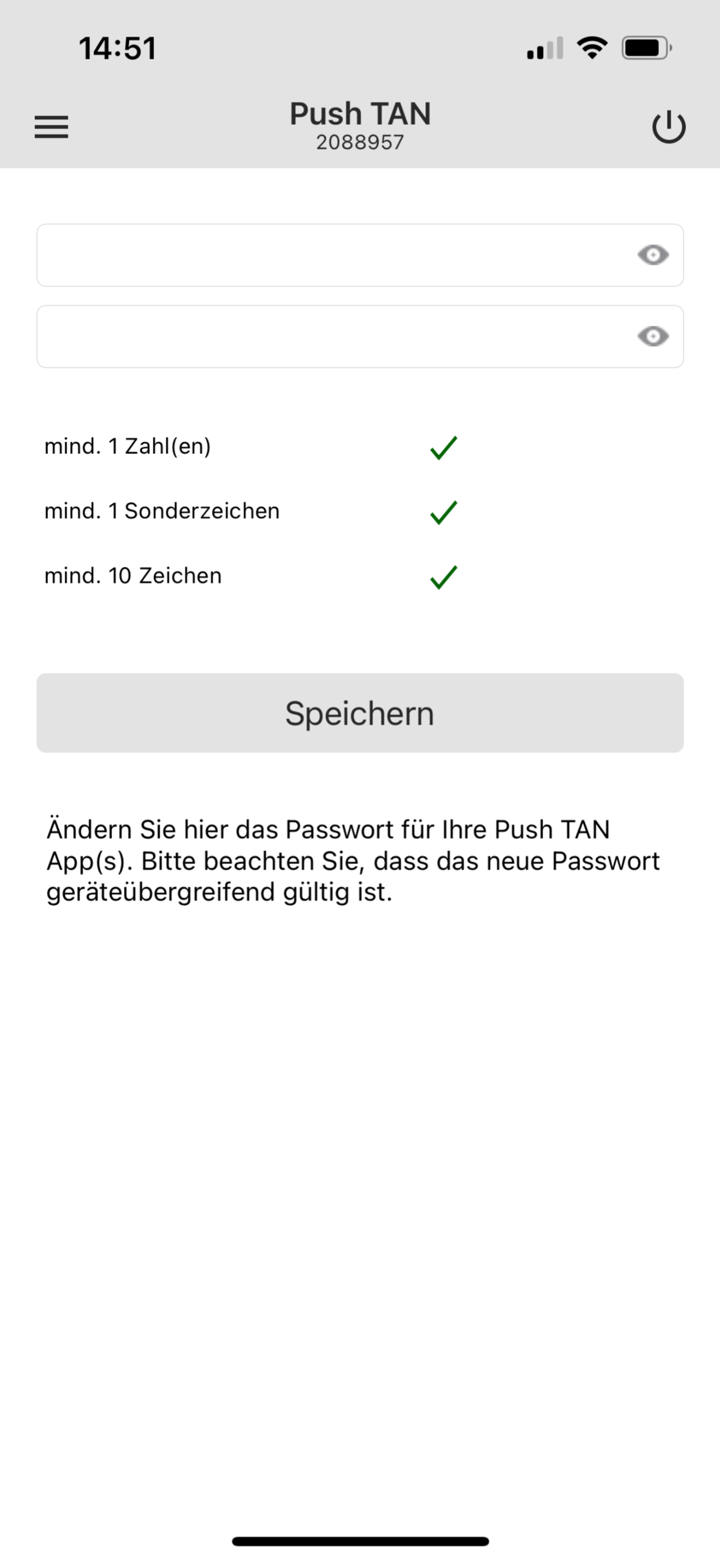

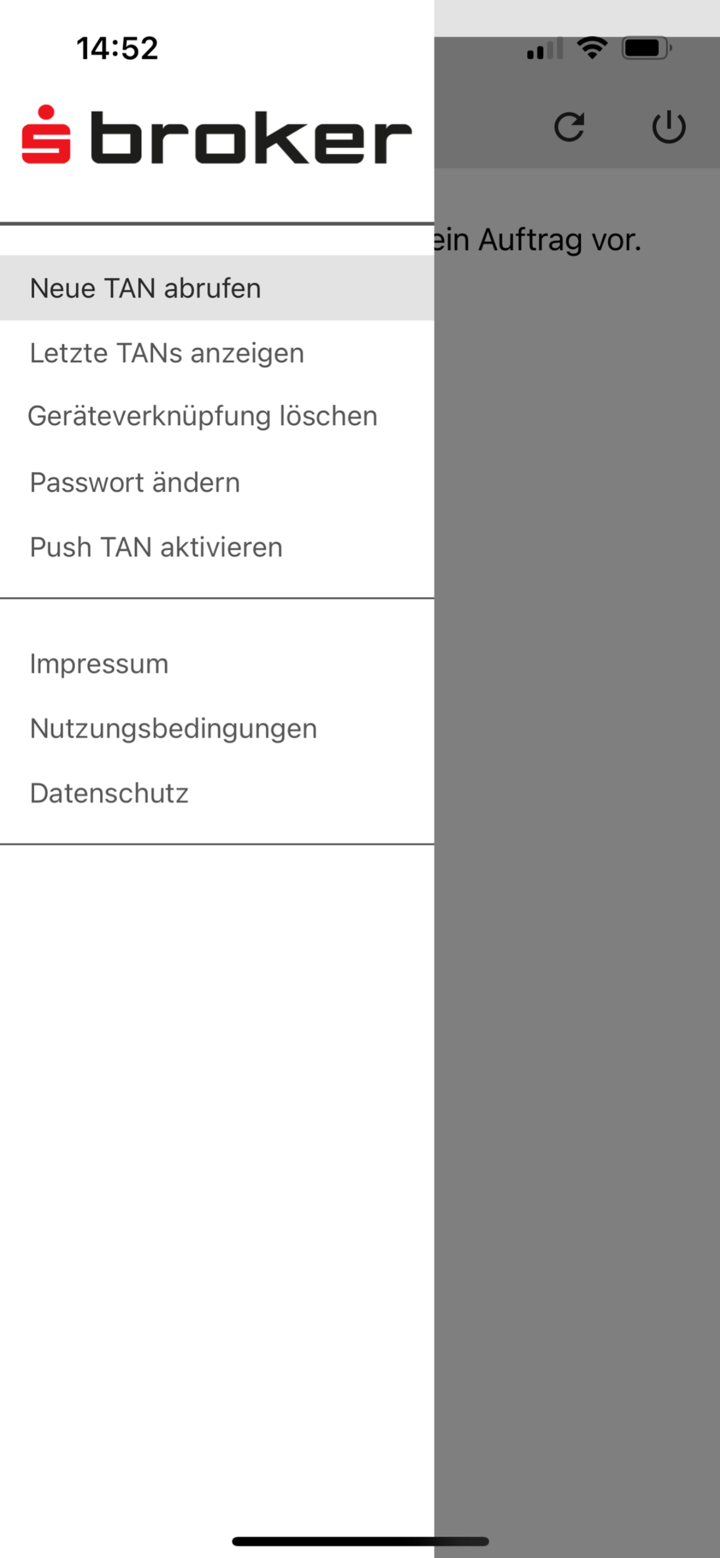

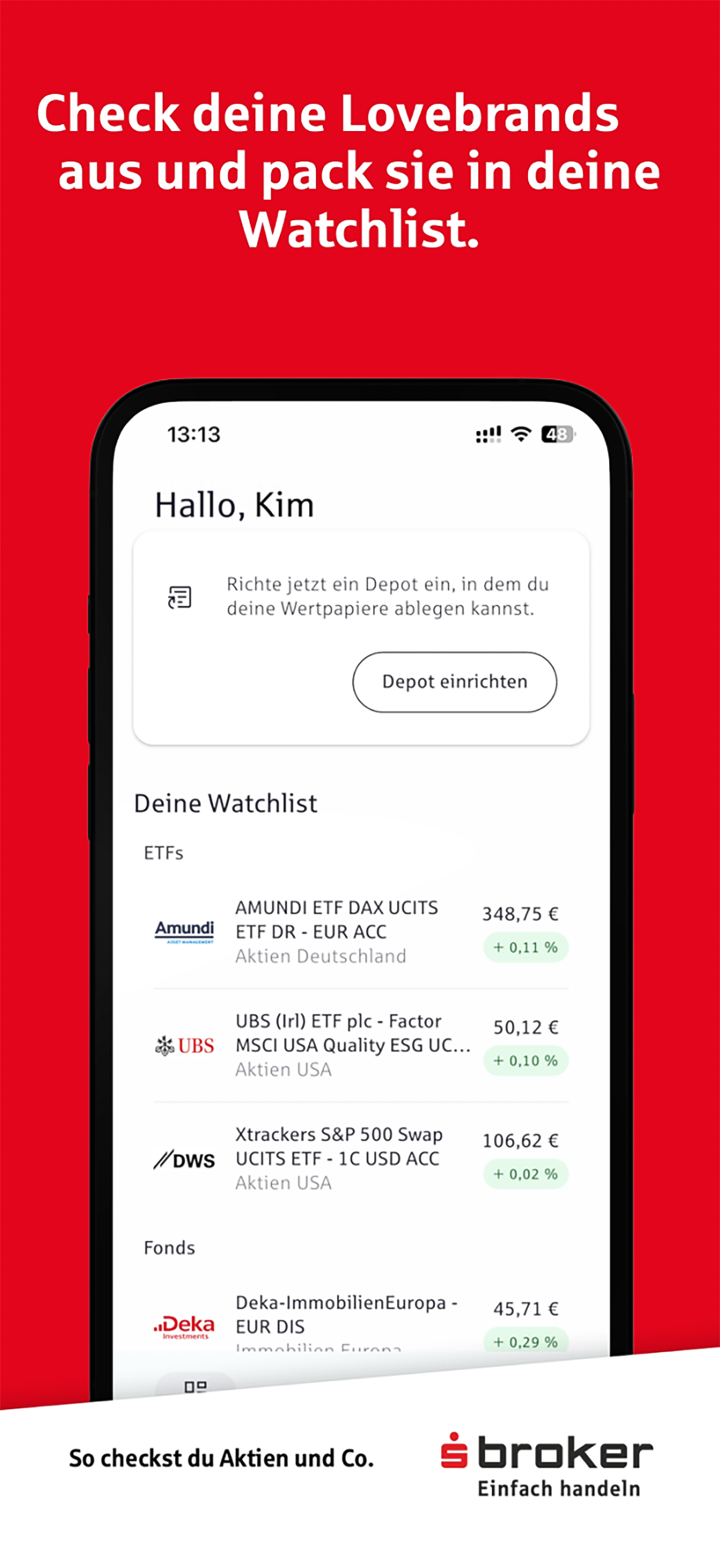

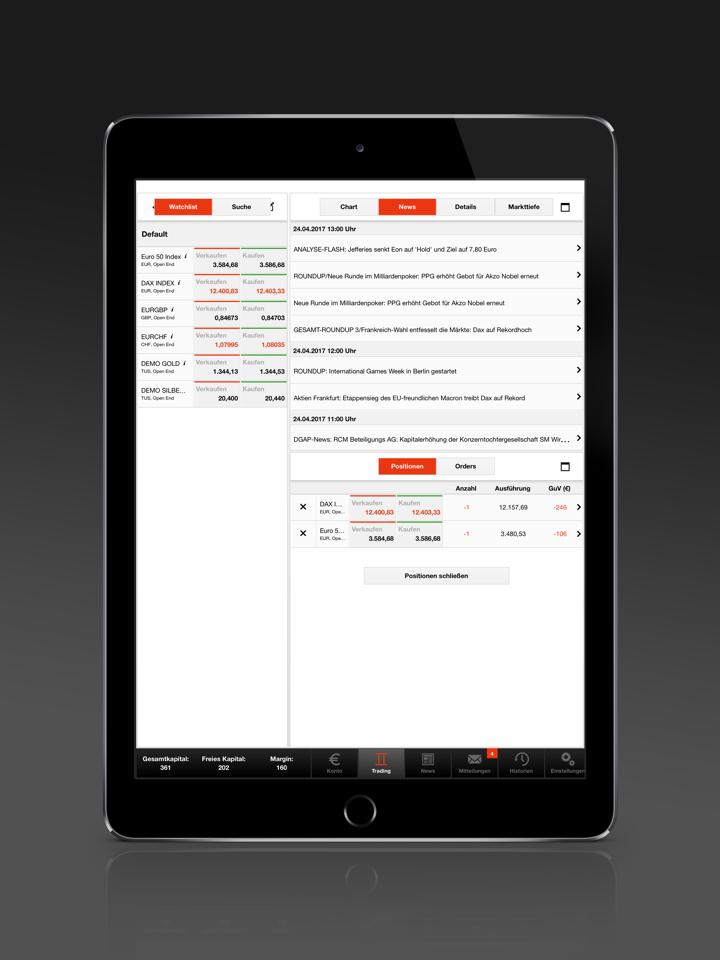

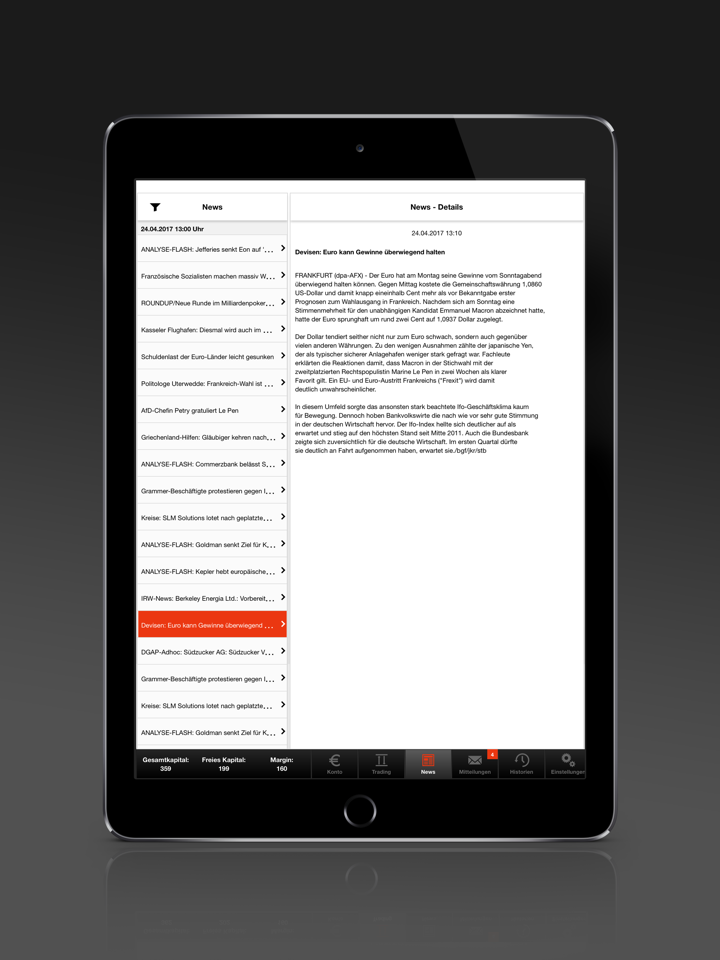

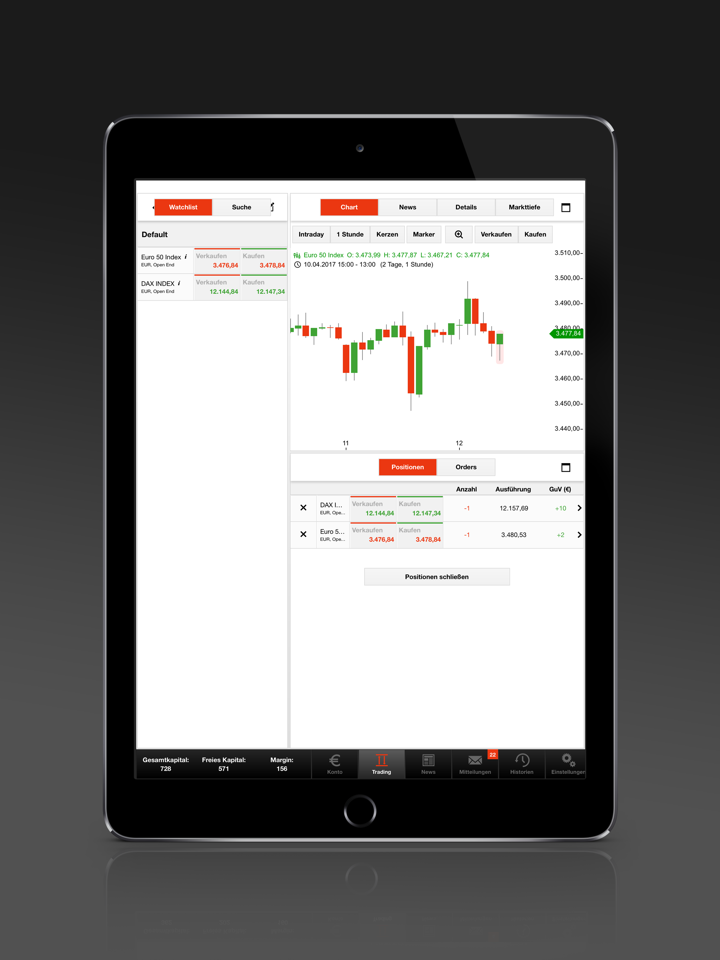

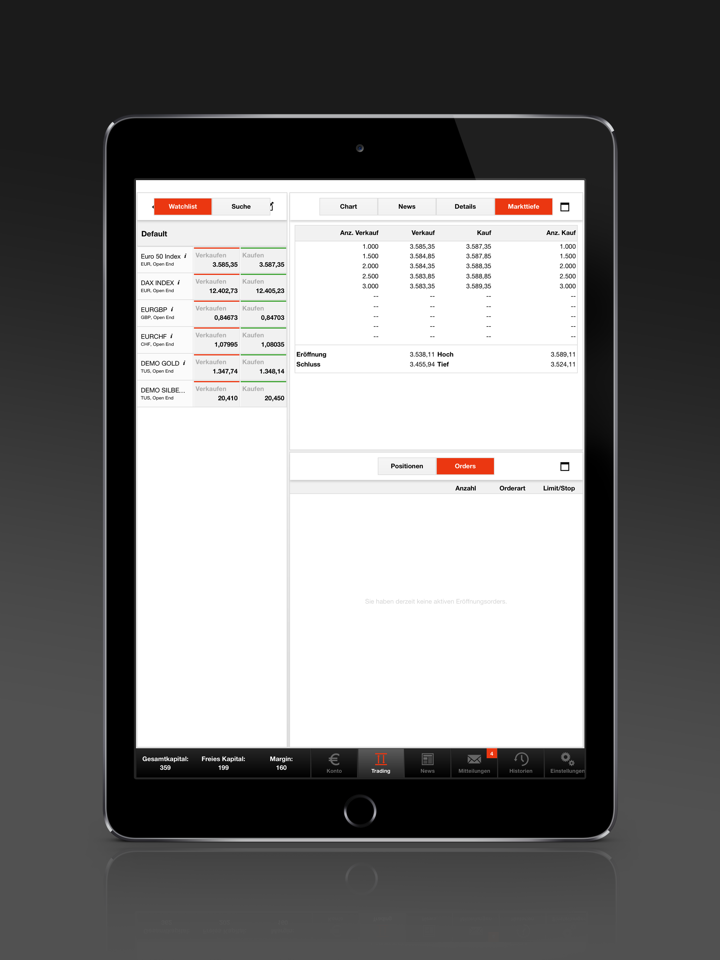

S Broker propose une plateforme de trading propriétaire appelée “S Broker App”, disponible sur les plateformes iOS et Android. Elle est personnalisée pour ses propres utilisateurs, avec accès aux données de marché les plus récentes, aux actualités, indices et citations, liste de suivi, etc.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient à |

| Application mobile S Broker | ✔ | iOS/Android | Utilisateurs de S Broker |

| MT4 | ❌ | / | Débutants |

| MT5 | ❌ | / | Traders expérimentés |