Unternehmensprofil

| S Broker Überprüfungszusammenfassung | |

| Gegründet | 1999 |

| Registriertes Land/Region | Deutschland |

| Regulierung | Keine Regulierung |

| Handelsinstrumente | Aktien, Fonds, ETFs, CFDs, Anleihen, Indizes, usw. |

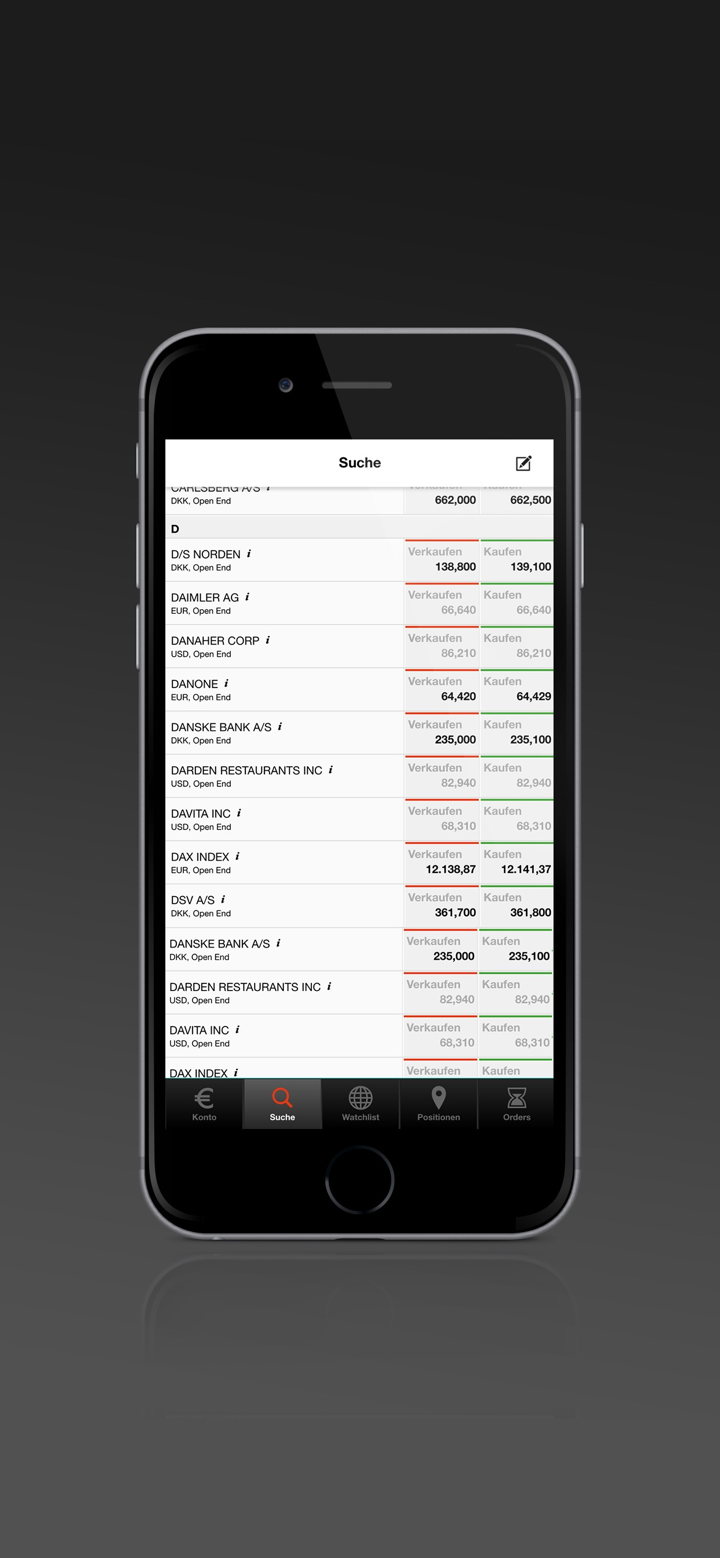

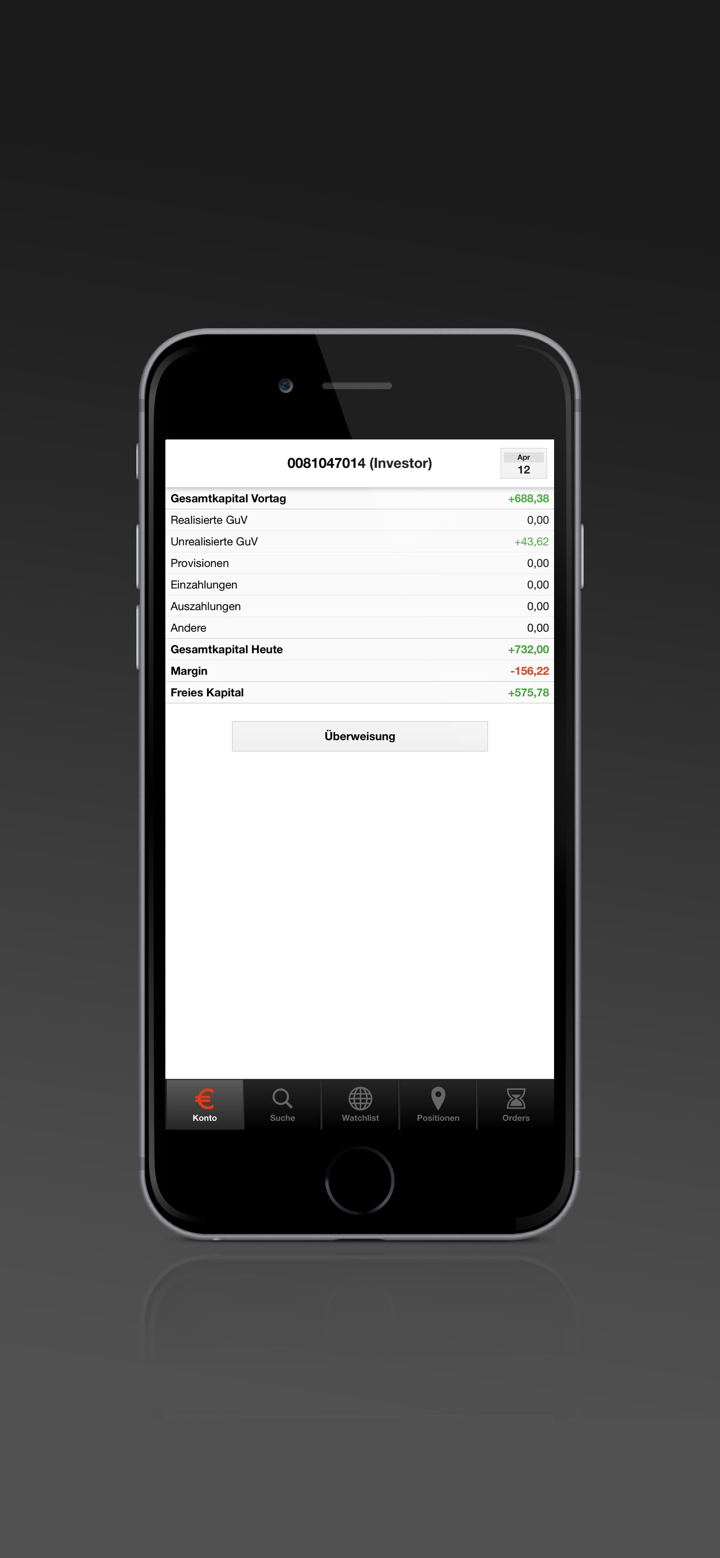

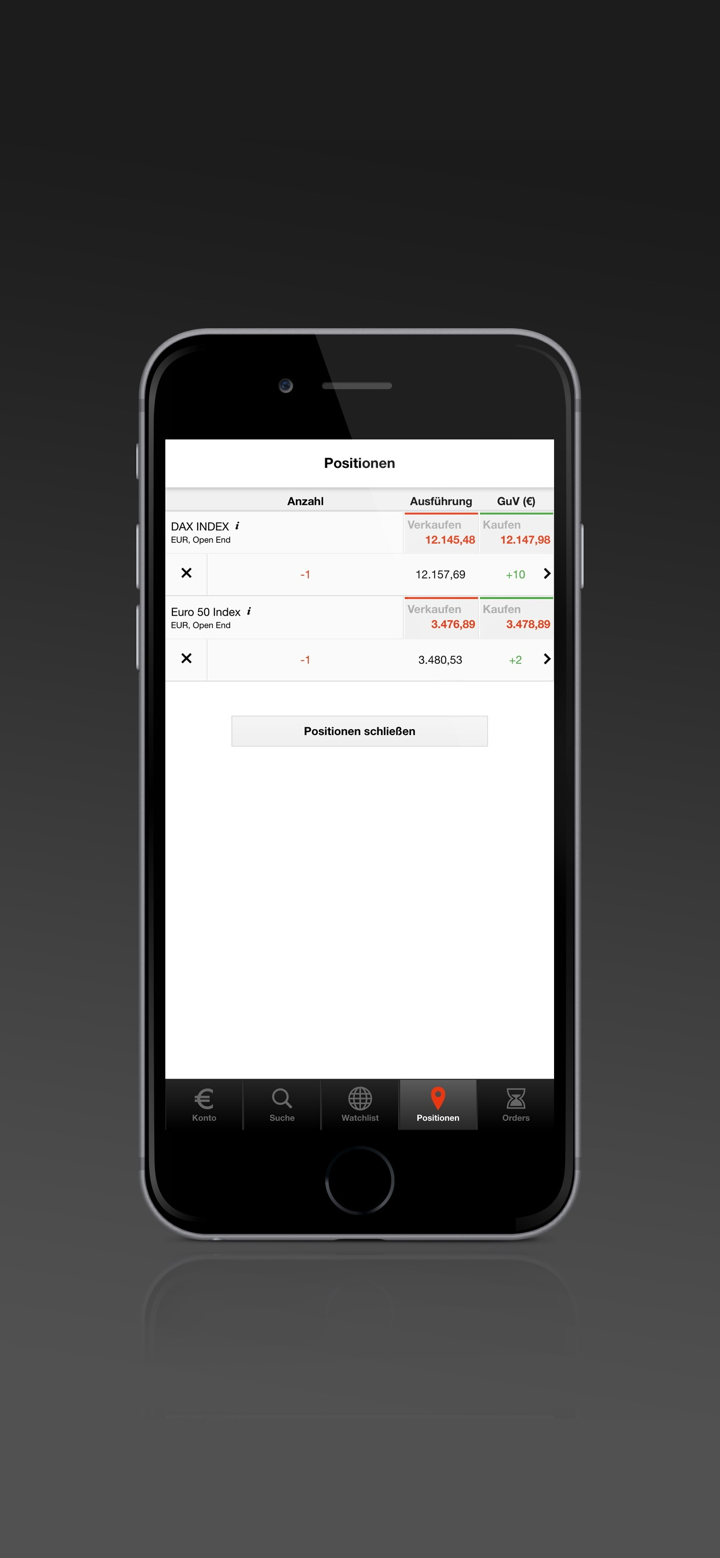

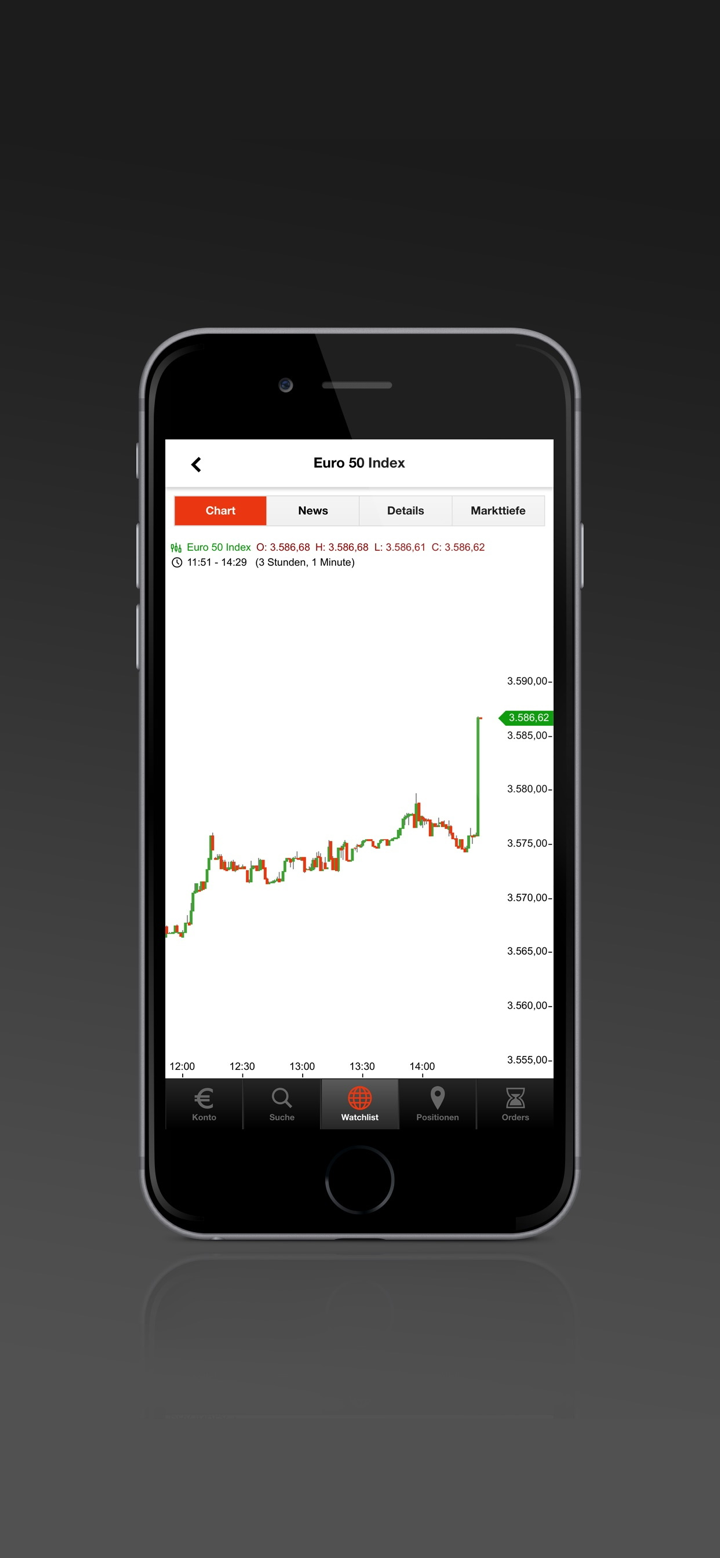

| Handelsplattform | S Broker Mobile App |

| Mindesteinzahlung | 0 |

| Kundensupport | Live-Chat |

| Tel: 0611 2044-1912; 0611 2044-1911; 0611 2044-1944 | |

| E-Mail: service@sbroker.de | |

| FAQ, Instagram, YouTube, LinkedIn, Facebook, usw. | |

| Adresse: S Broker AG & Co. KG, Kundenservice, Postfach 90 01 50, 39133 Magdeburg | |

S Broker Informationen

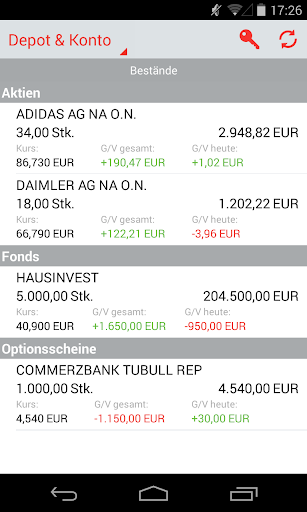

S Broker ist ein Wertpapierhandelsunternehmen, das 1999 in Deutschland gegründet wurde. Das Unternehmen bietet jetzt Handelsprodukte einschließlich, aber nicht beschränkt auf Aktien, Fonds, ETFs, CFDs, Anleihen, gehebelte Produkte wie Indizes, usw. Es bietet zwei Handelskonten ohne Mindesteinzahlungsanforderungen an.

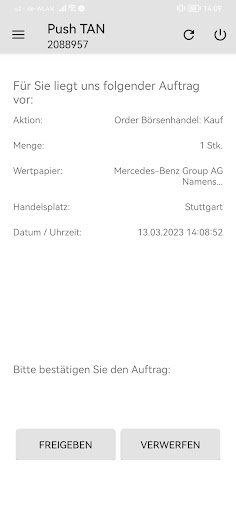

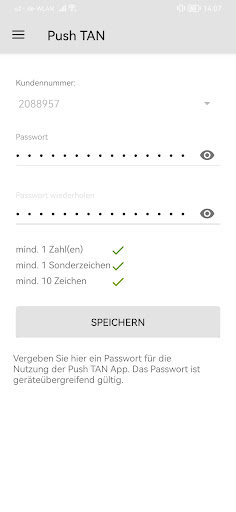

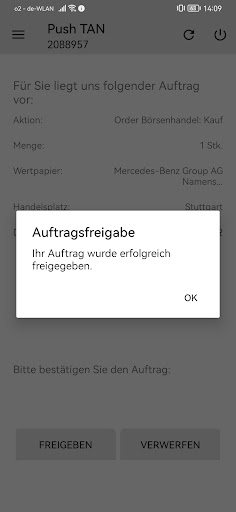

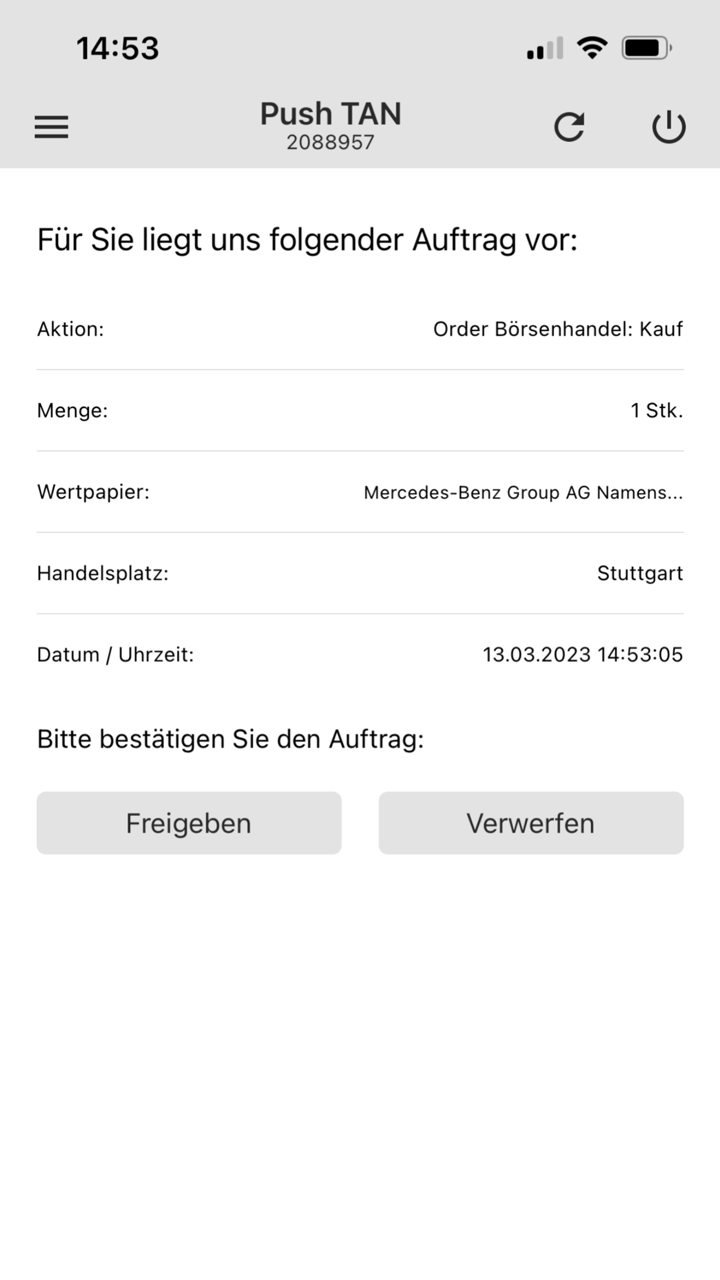

Um Trades auszuführen, hat das Unternehmen seine eigene S Broker Mobile App entwickelt, maßgeschneidert für seine eigenen Benutzer.

Allerdings wird der Broker derzeit nicht von offiziellen Behörden gut reguliert, was seine Glaubwürdigkeit und Vertrauenswürdigkeit beeinträchtigt.

Vor- und Nachteile

| Vorteile | Nachteile |

| Viele Jahre Branchenerfahrung | Keine Regulierung |

| Verschiedene Handelsprodukte | |

| Keine Mindesteinzahlung |

Ist S Broker Seriös?

Der wichtigste Faktor zur Messung der Sicherheit einer Brokerplattform ist, ob sie formell reguliert ist. S Broker ist ein unregulierter Broker, was bedeutet, dass die Sicherheit der Gelder der Benutzer und ihrer Handelsaktivitäten nicht effektiv geschützt sind. Anleger sollten S Broker mit Vorsicht wählen.

Was kann ich auf S Broker handeln?

| Handelsinstrumente | Unterstützt |

| Aktien | ✔ |

| Fonds | ✔ |

| ETFs | ✔ |

| CFDs | ✔ |

| Anleihen | ✔ |

| Indizes | ✔ |

| Forex | ❌ |

| Waren | ❌ |

| Kryptowährungen | ❌ |

| Optionen | ❌ |

Kontotyp

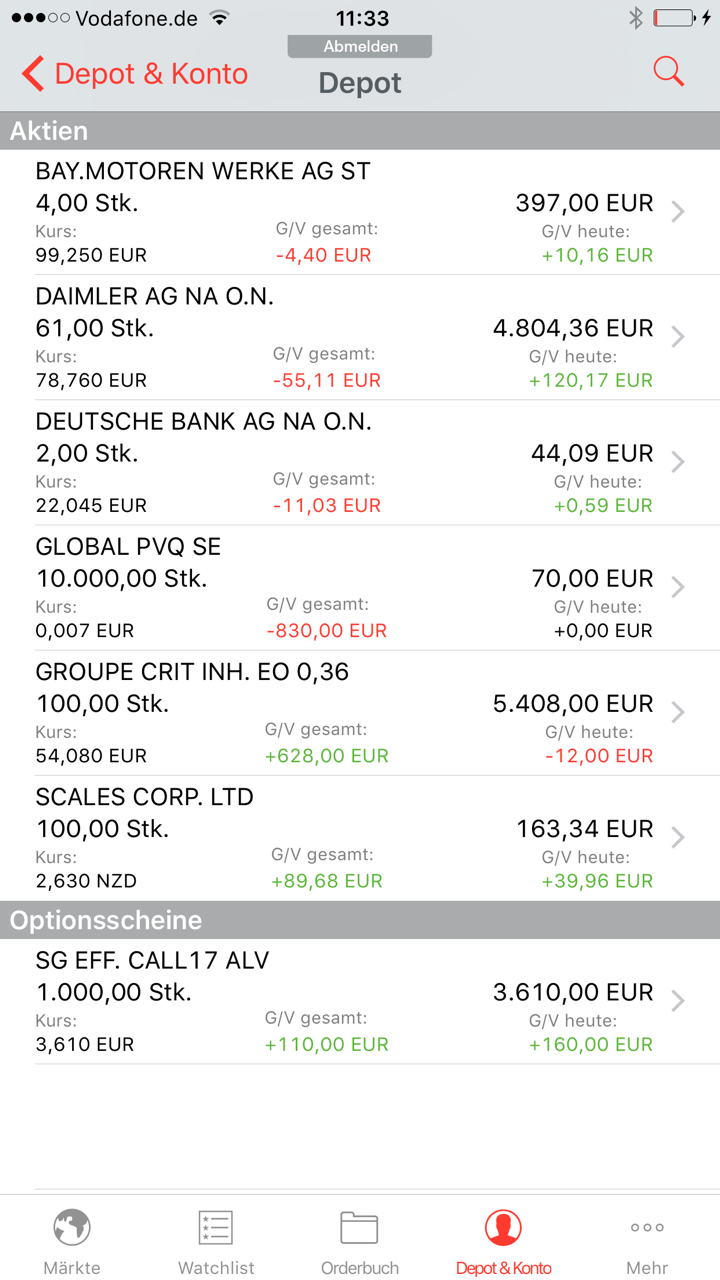

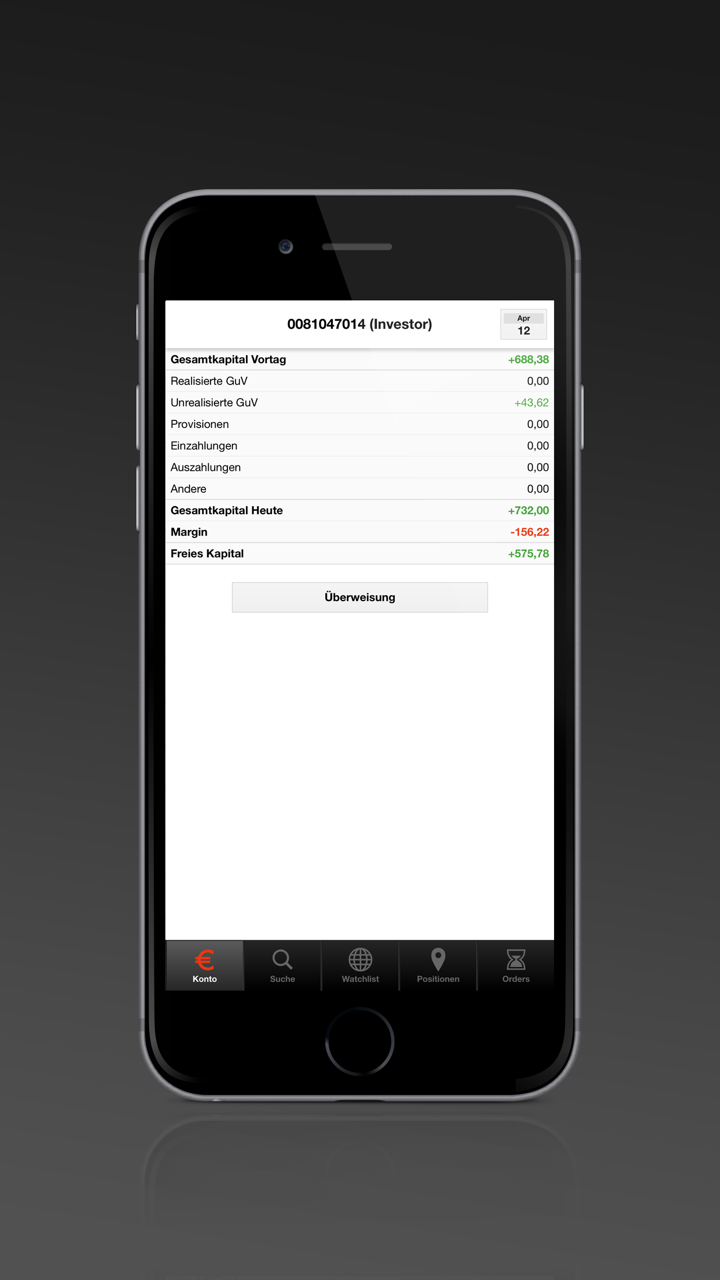

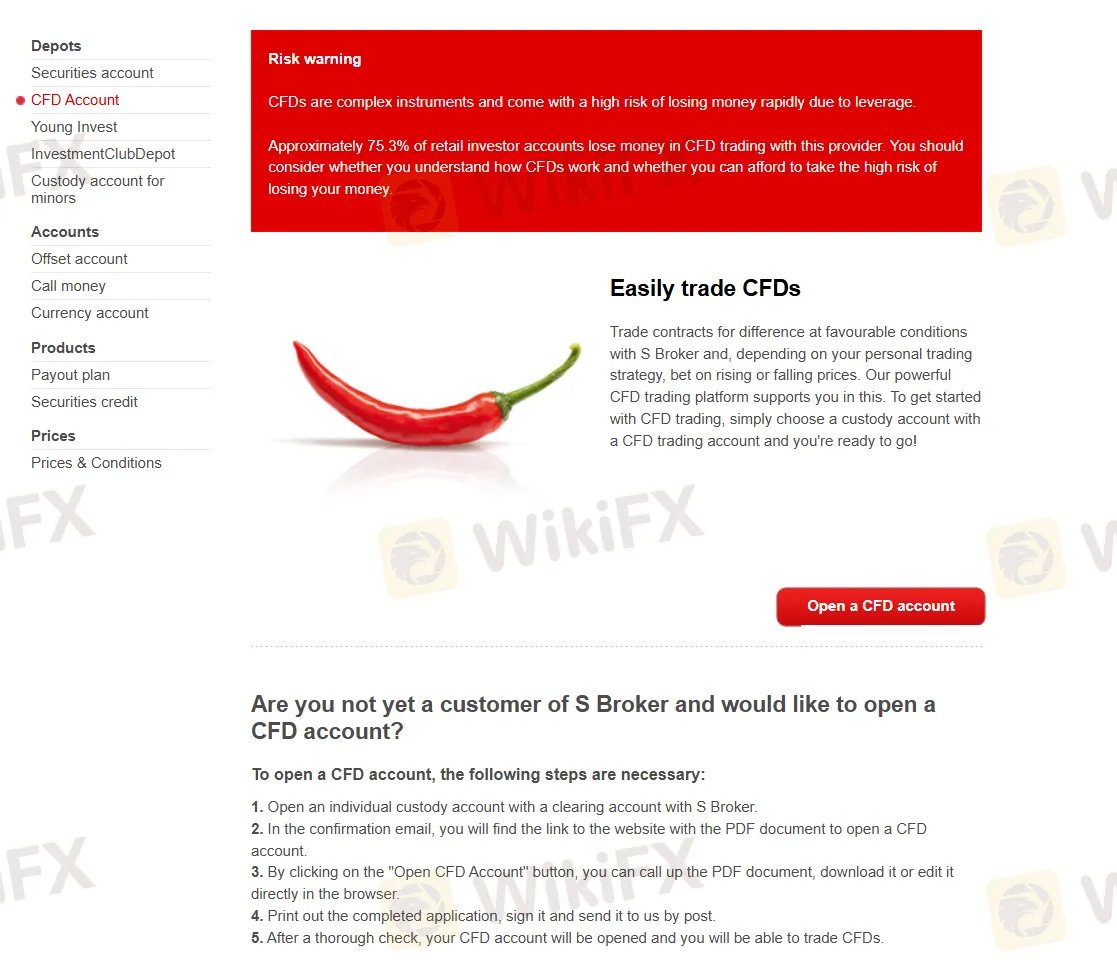

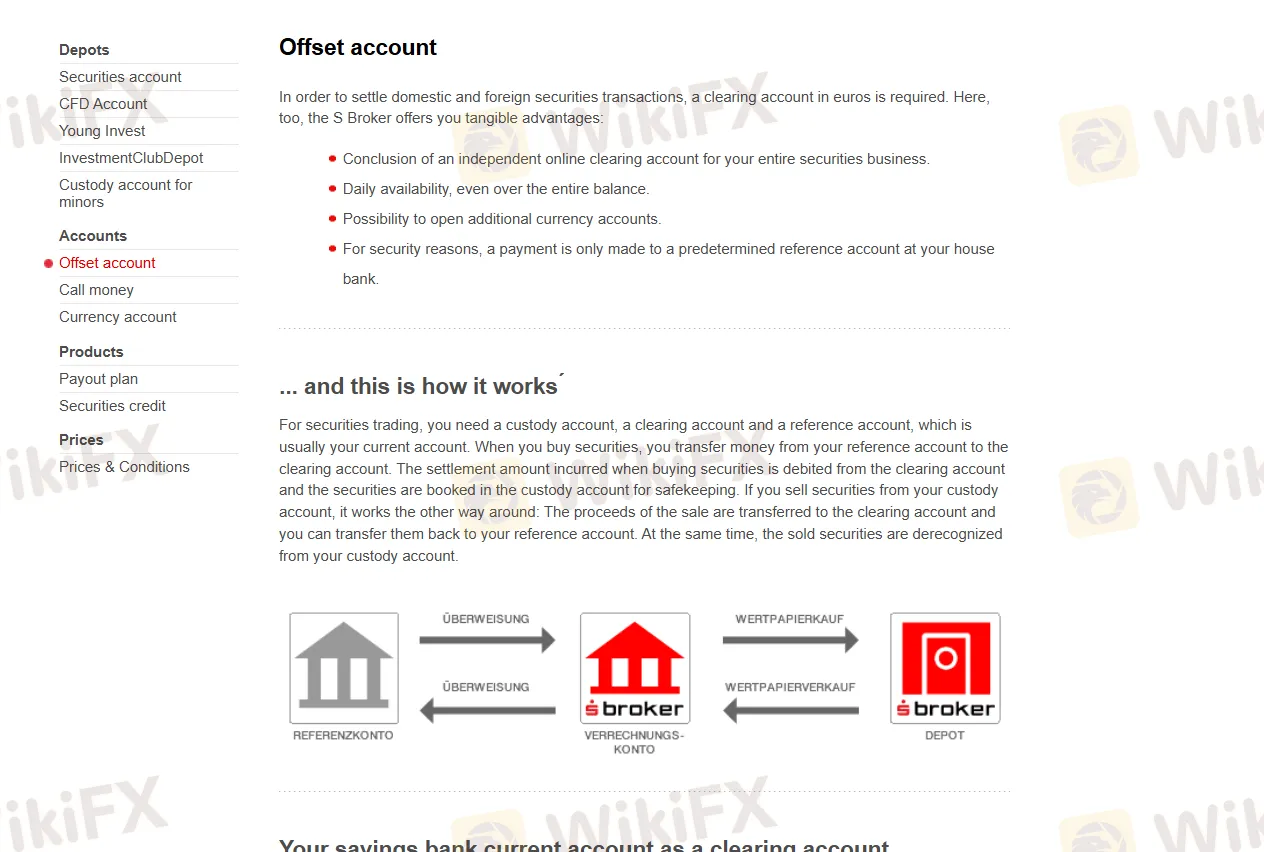

S Broker bietet drei Kontotypen für verschiedene Produkte an: CFD-Konto, Wertpapierkonto, Ausgleichskonto und Währungskonto.

Es gibt keine Mindesteinzahlungsanforderungen, um ein Konto bei dem Unternehmen zu eröffnen.

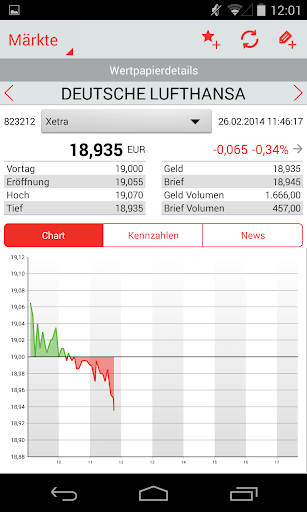

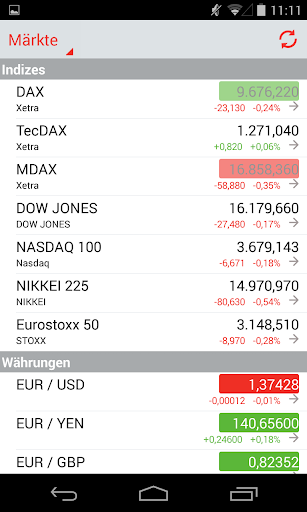

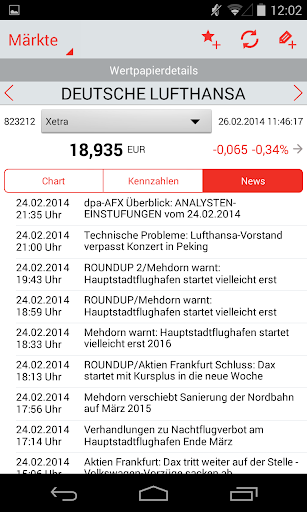

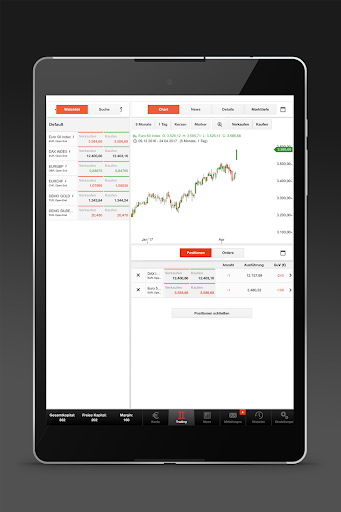

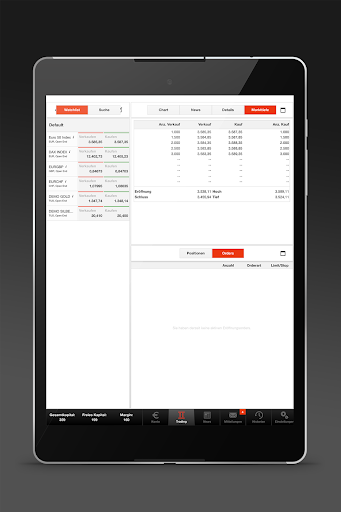

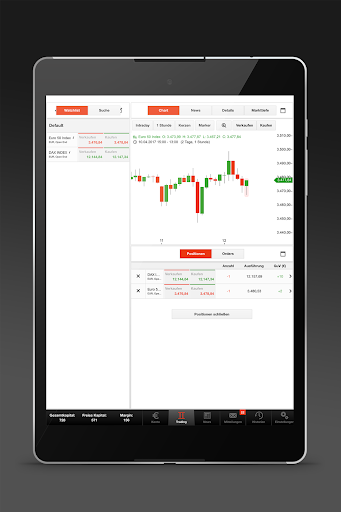

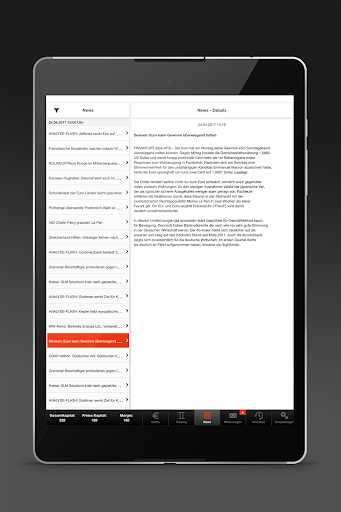

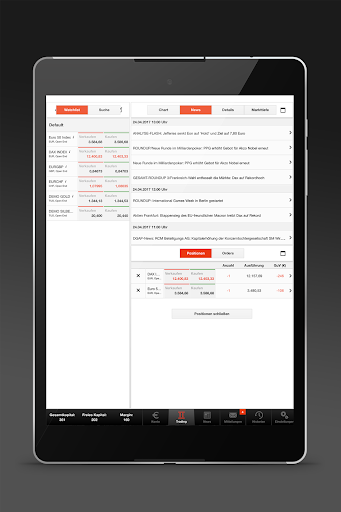

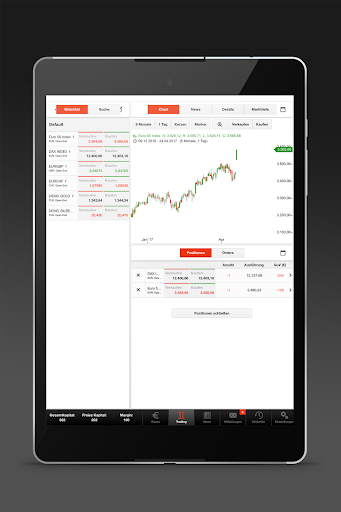

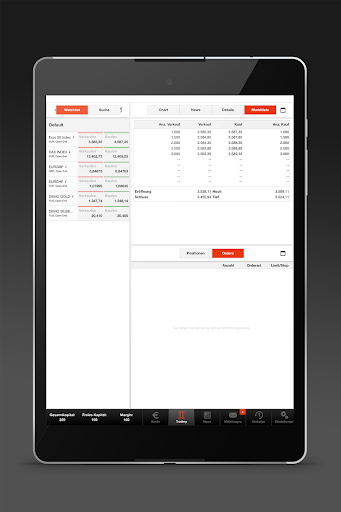

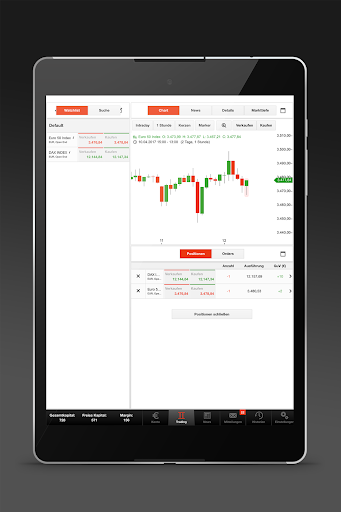

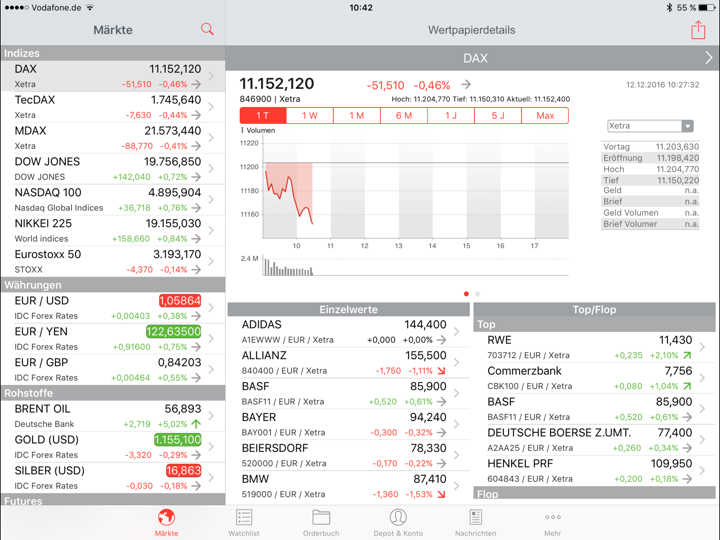

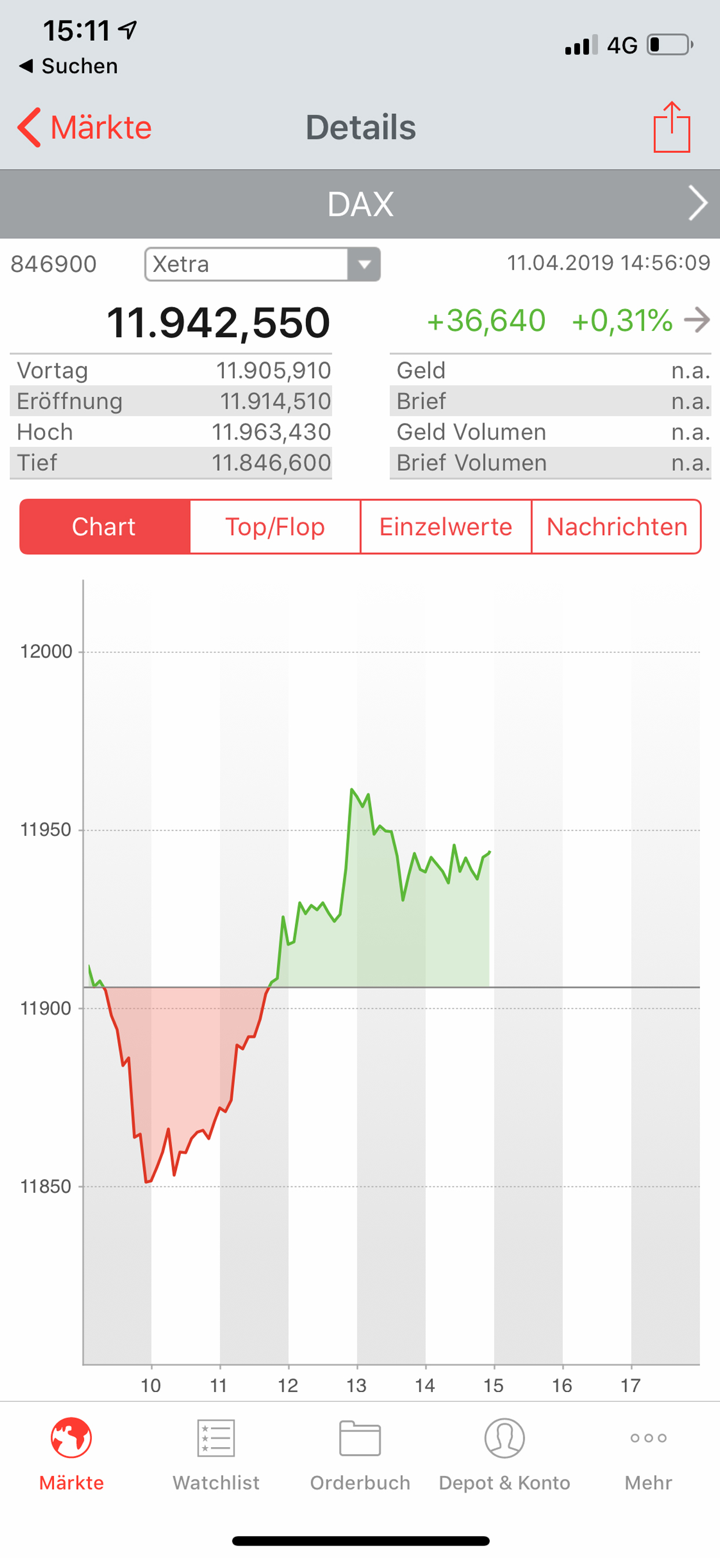

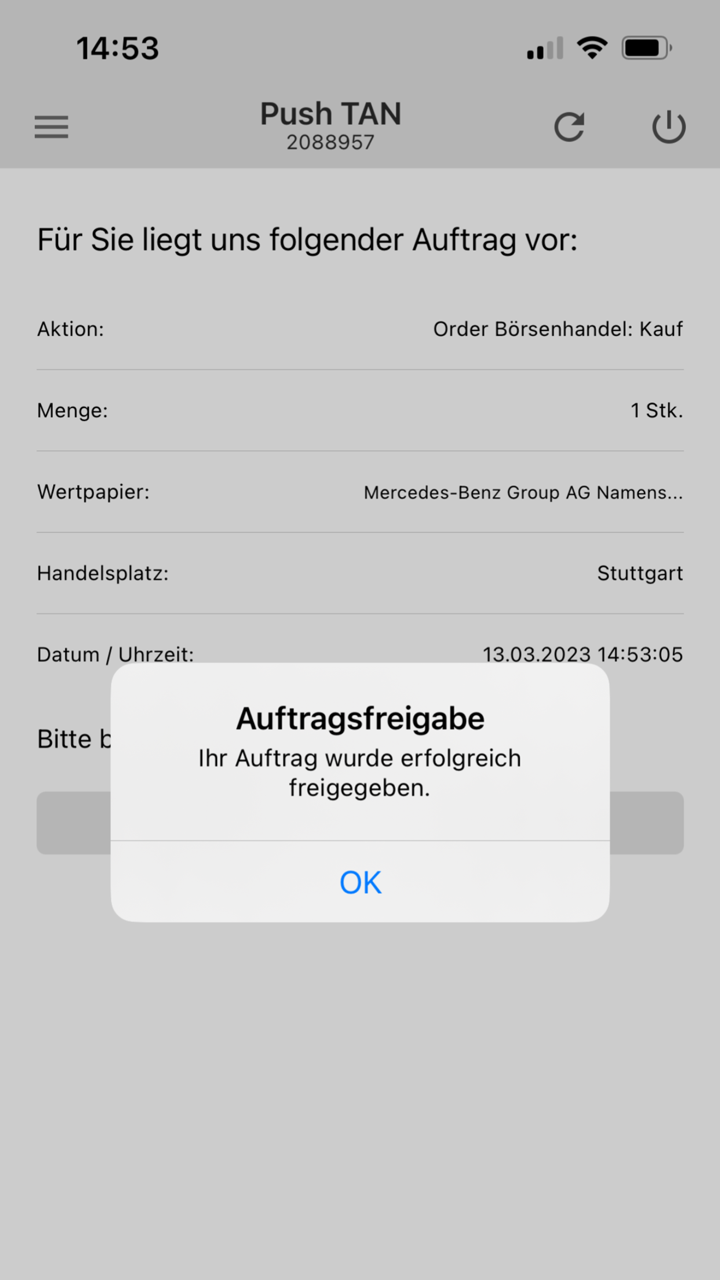

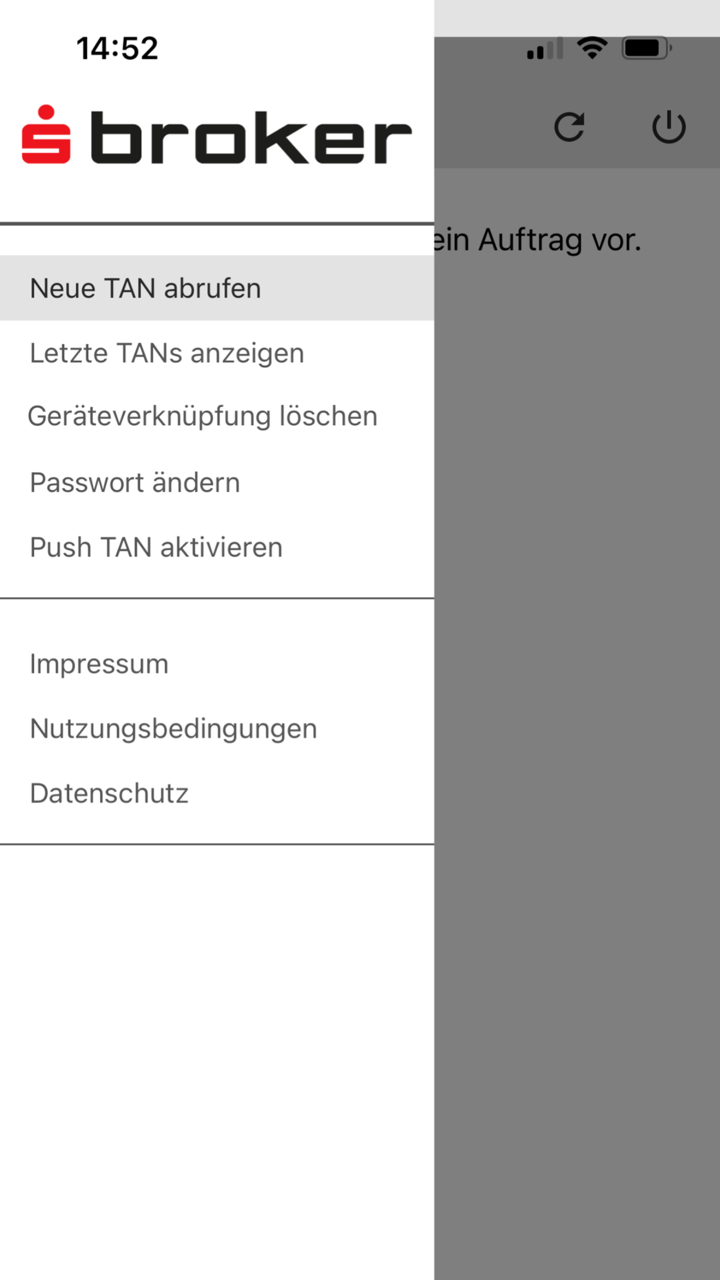

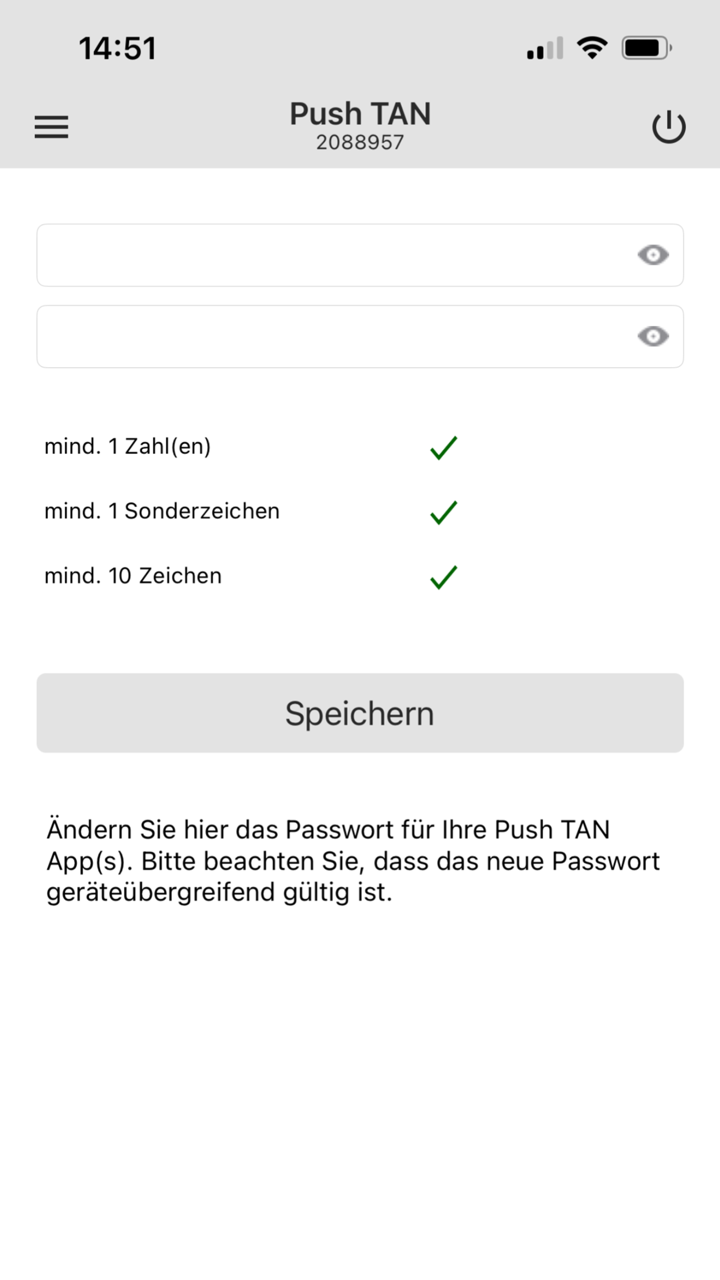

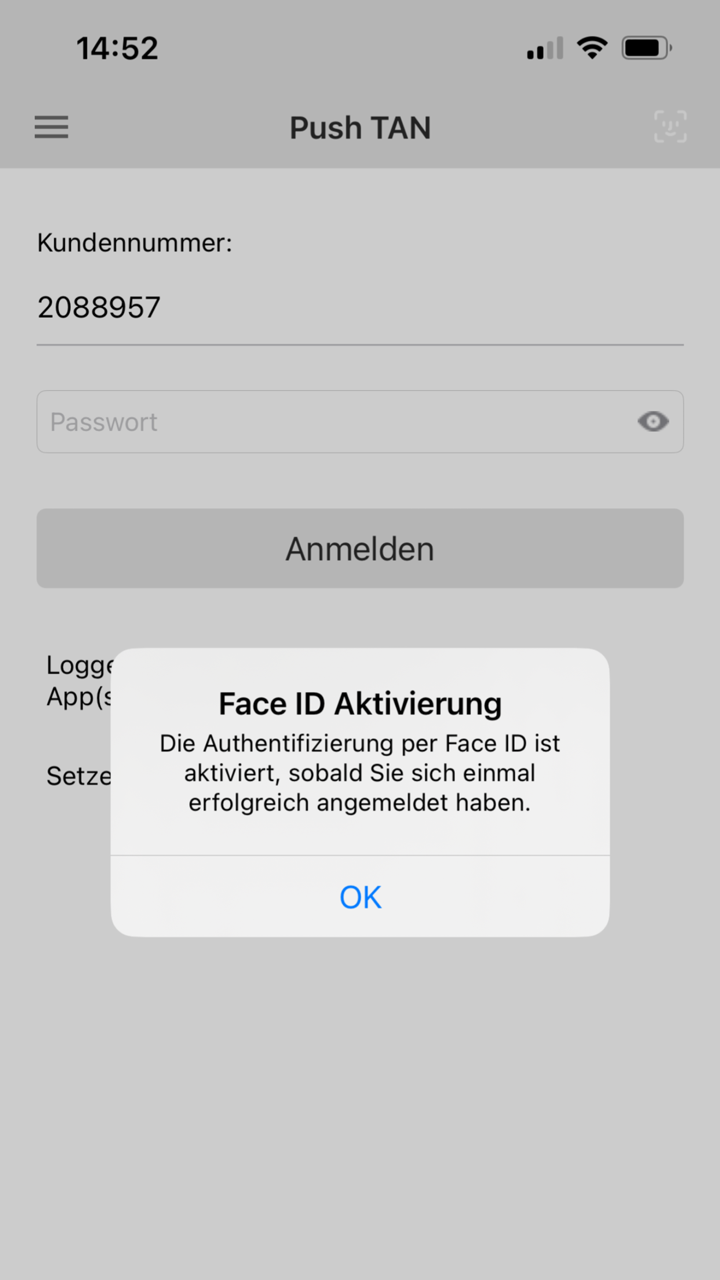

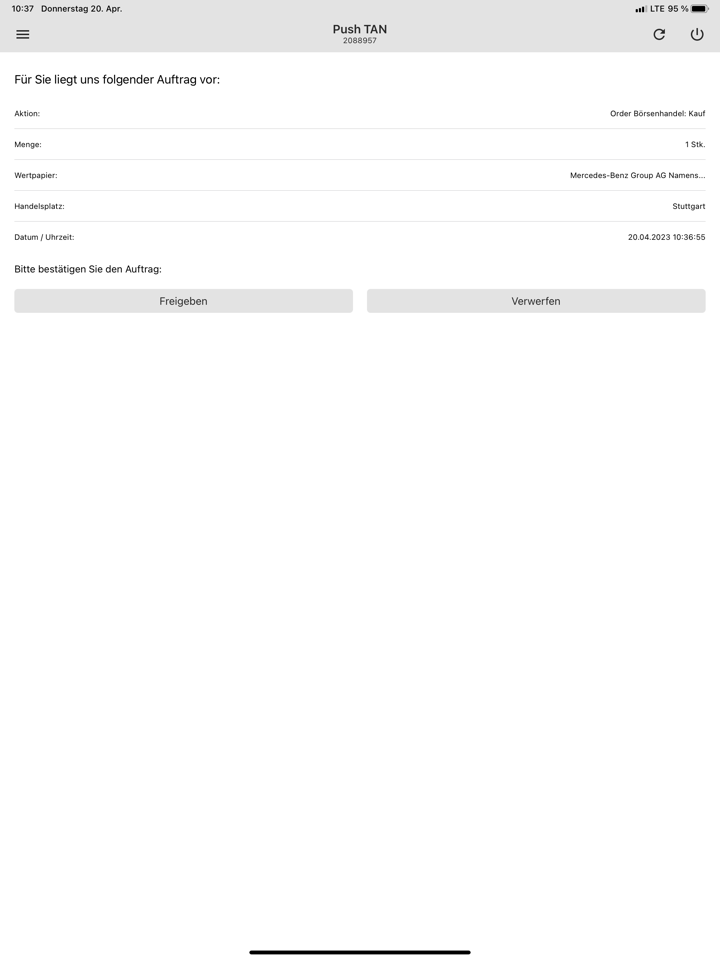

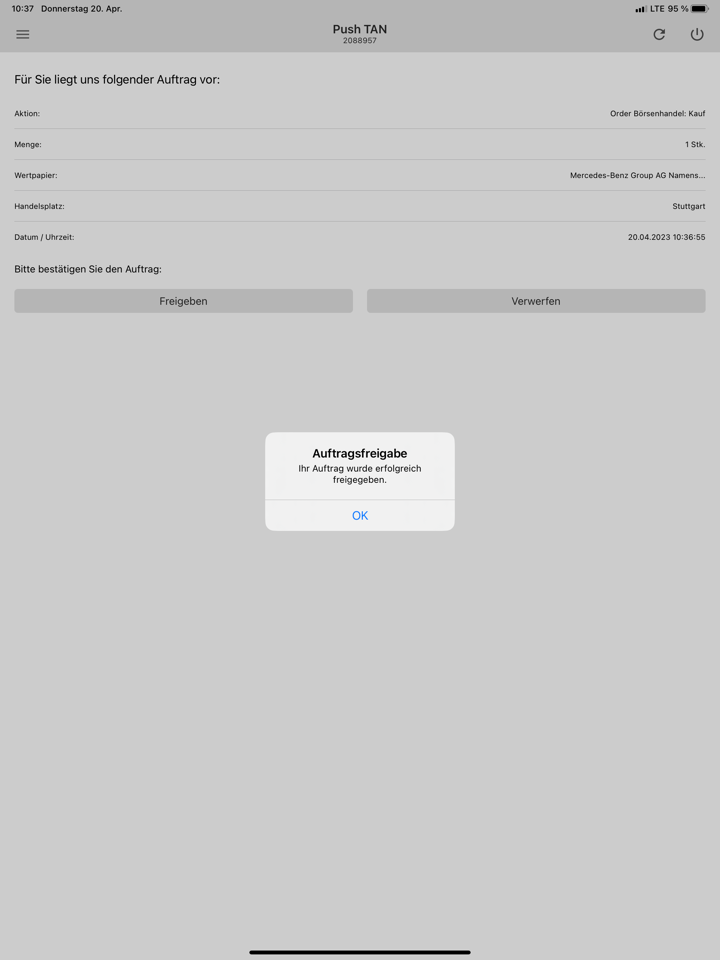

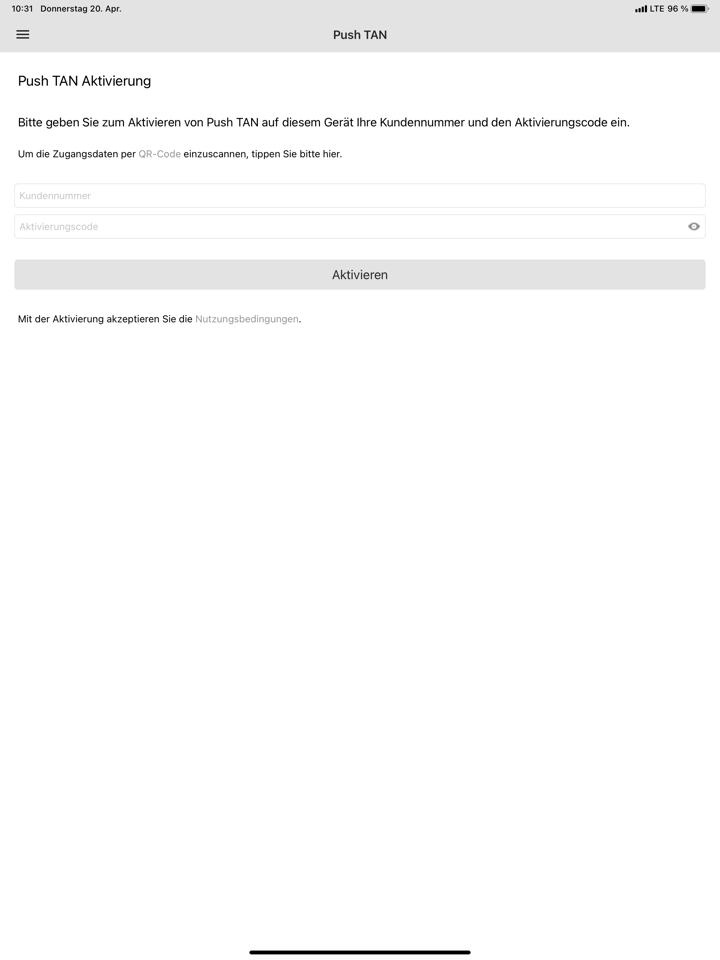

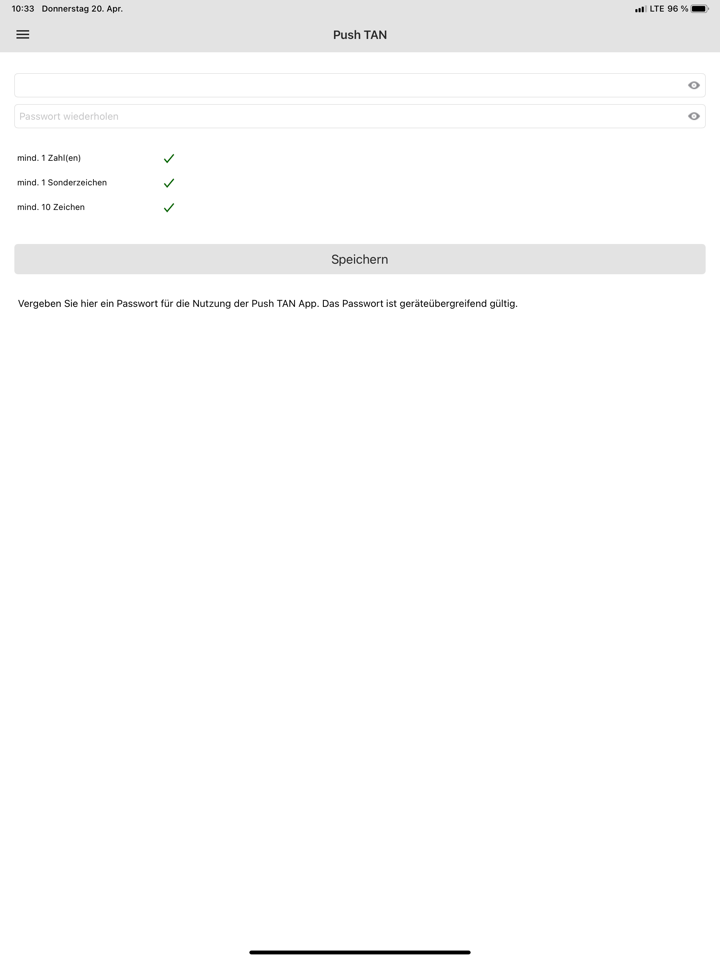

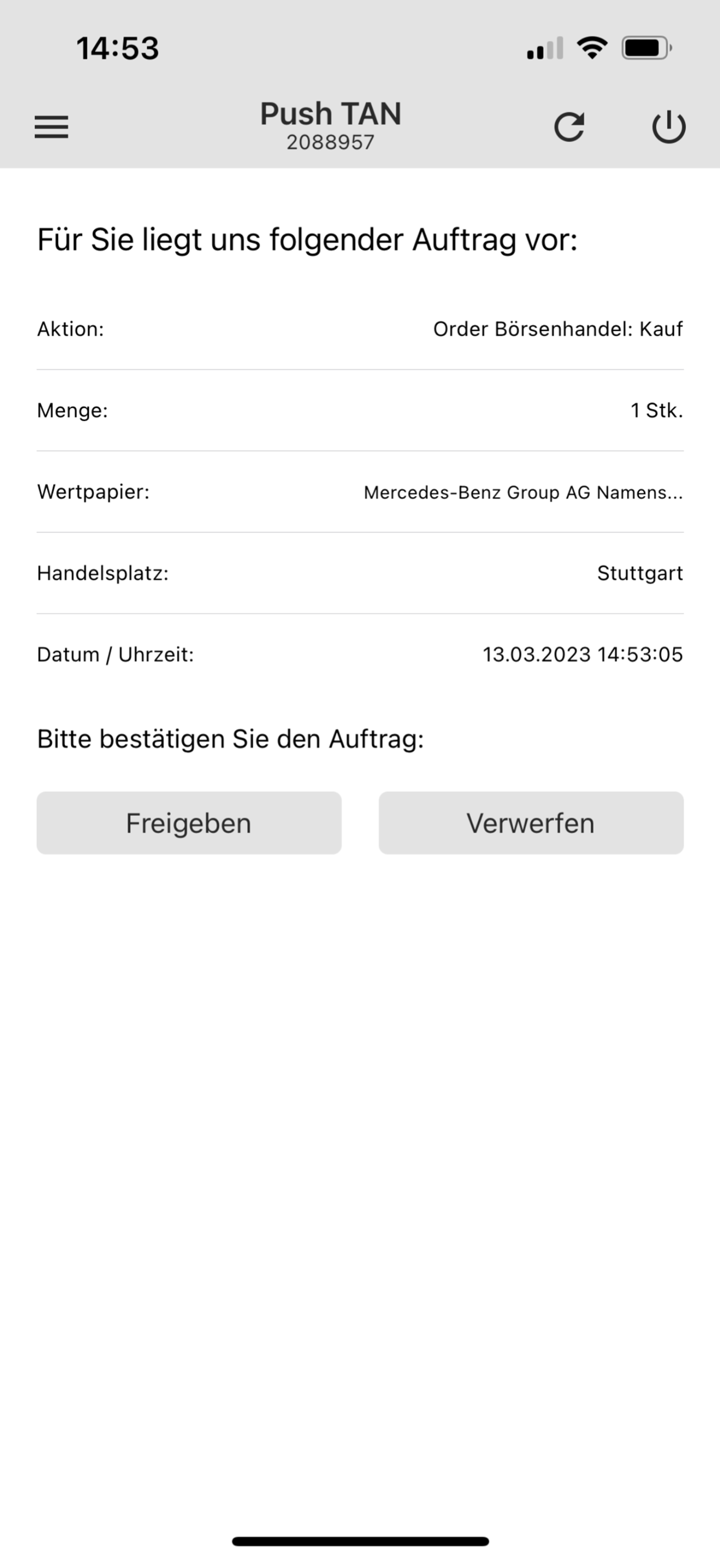

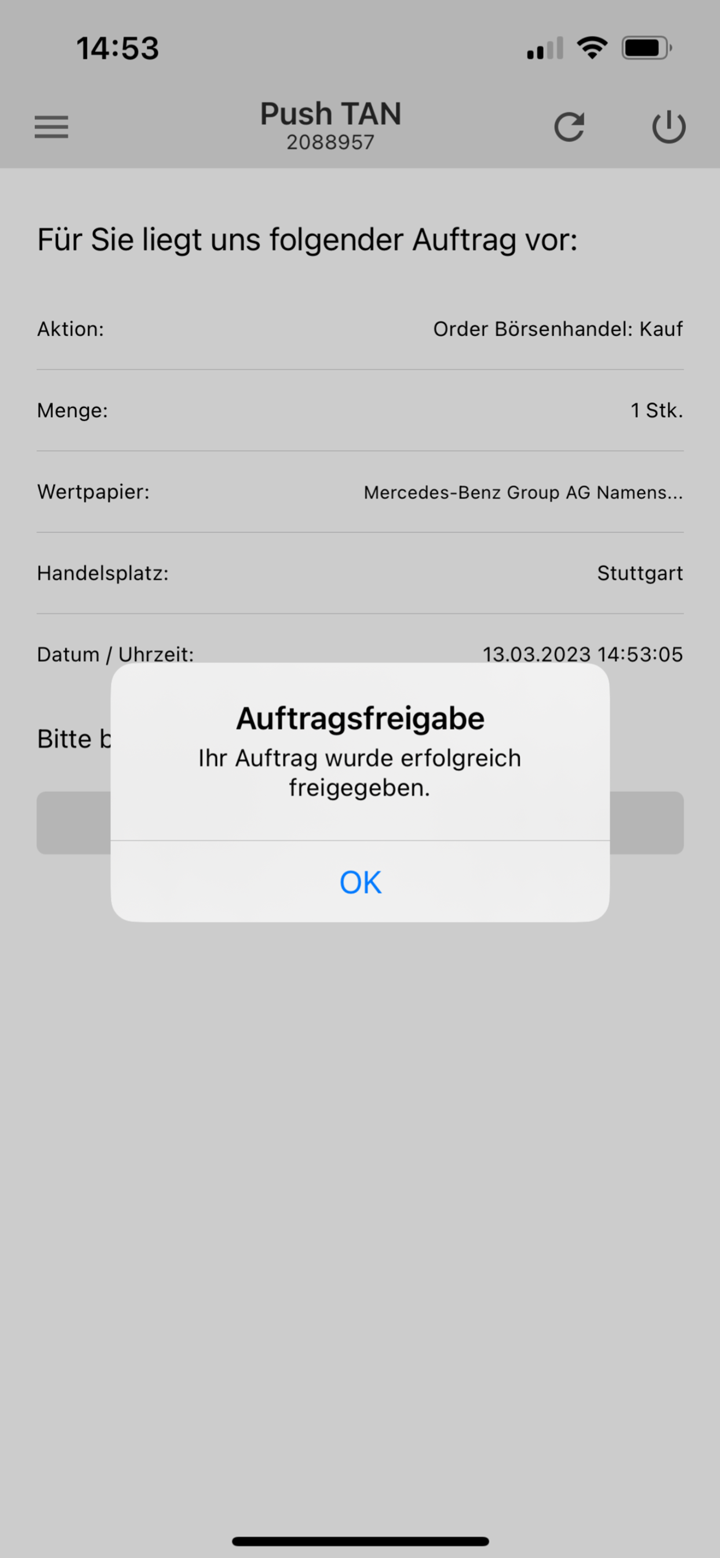

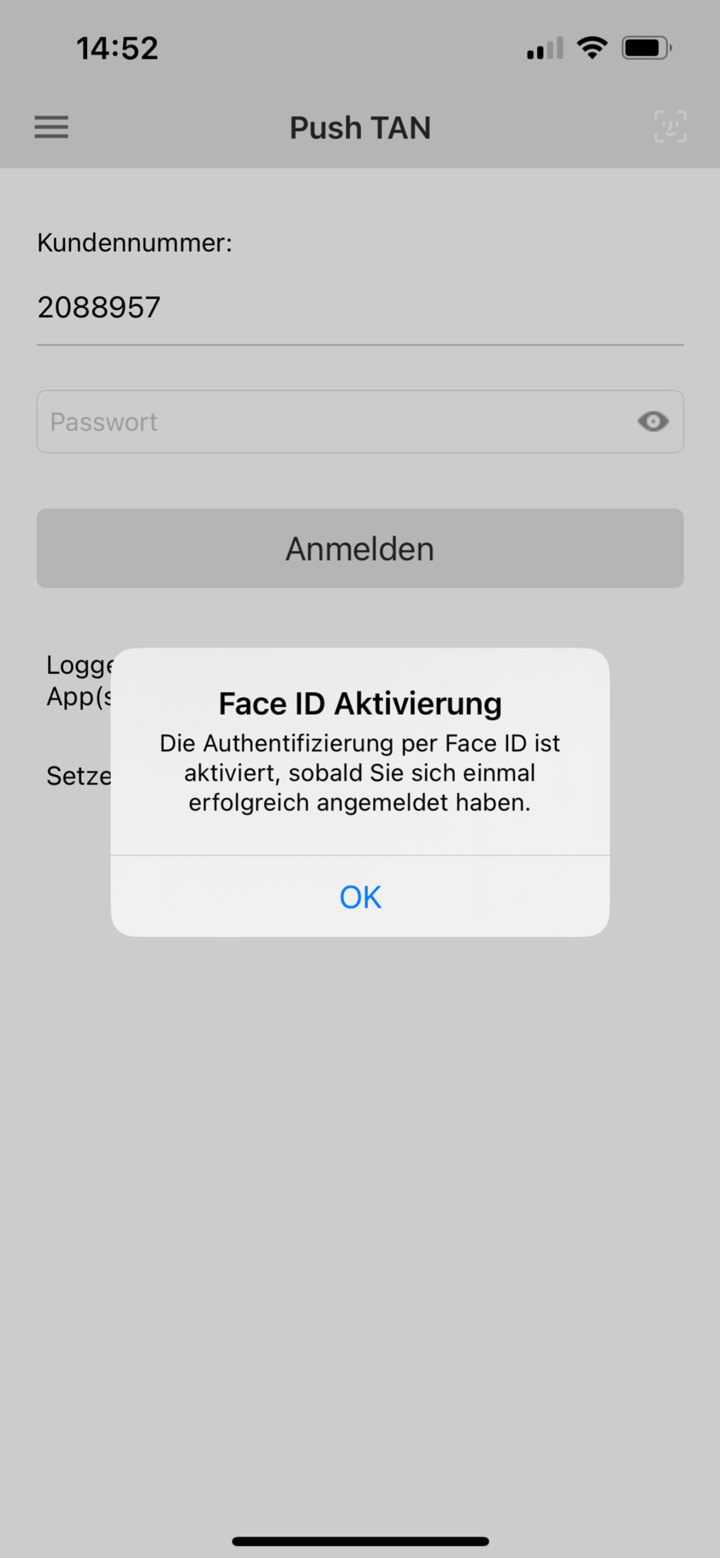

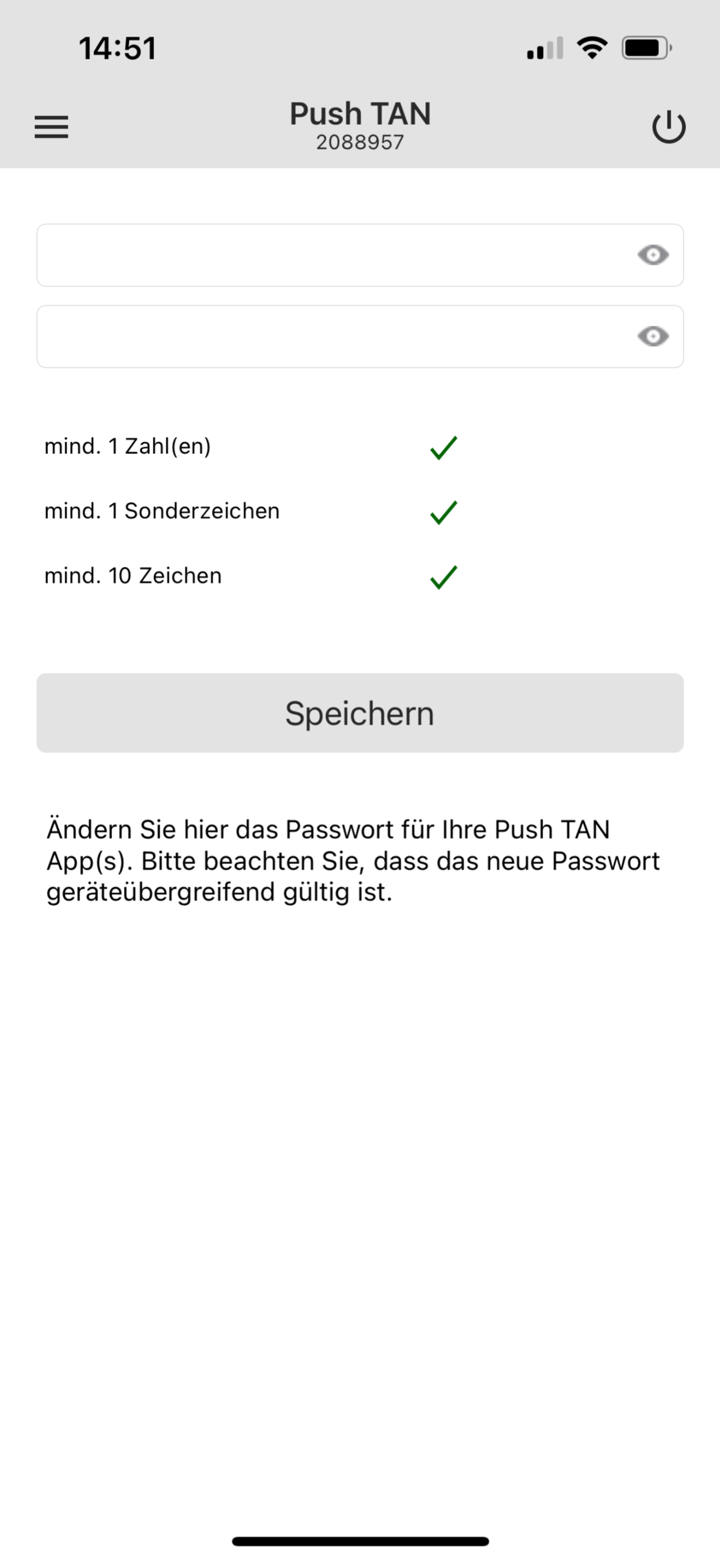

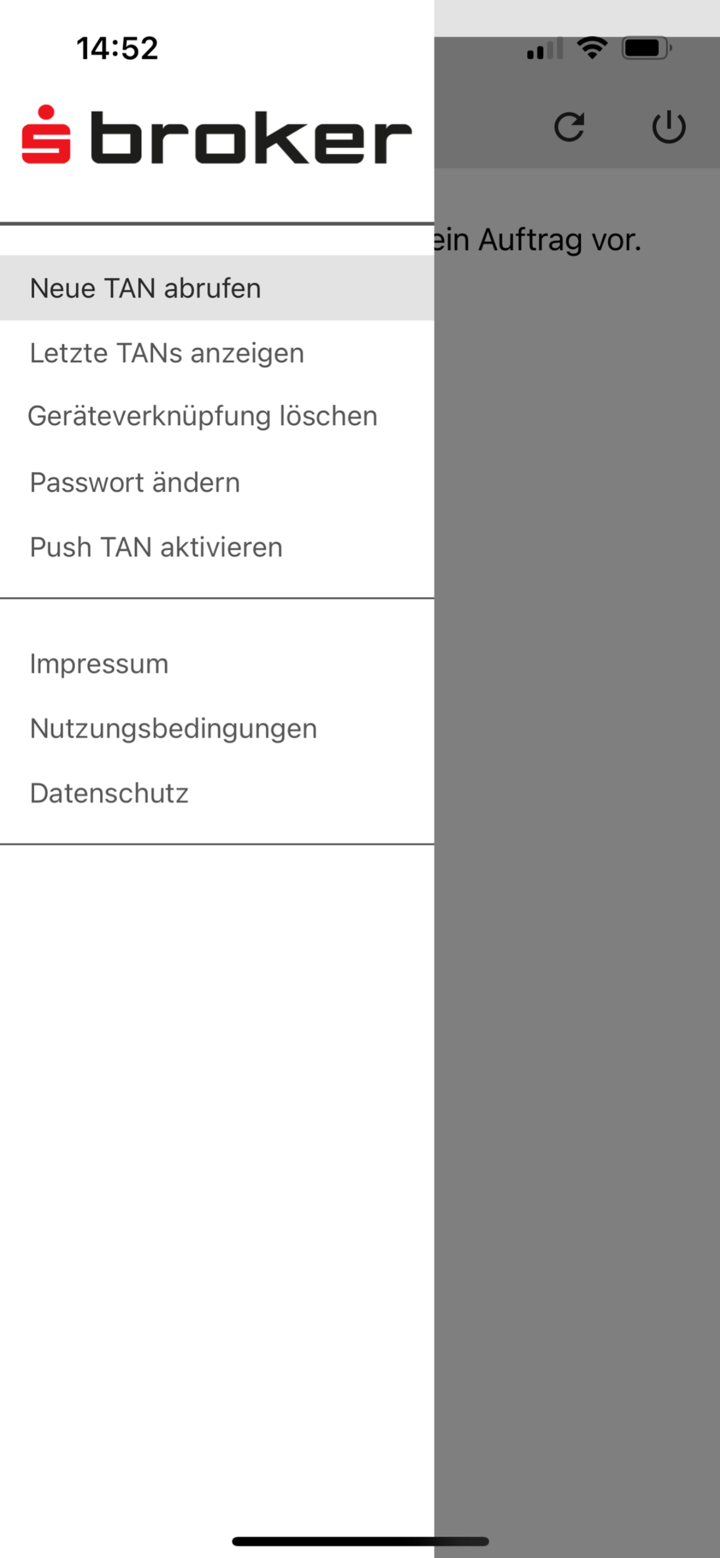

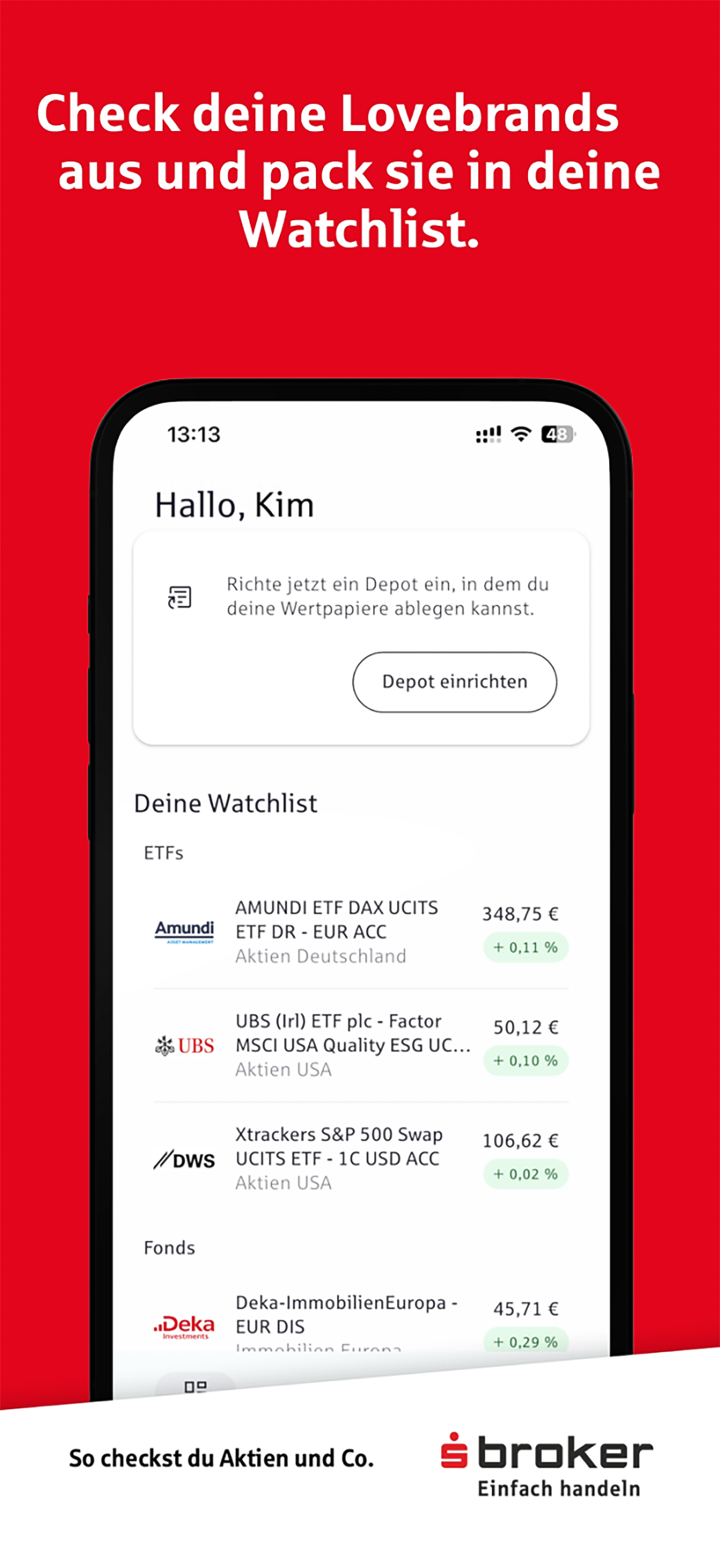

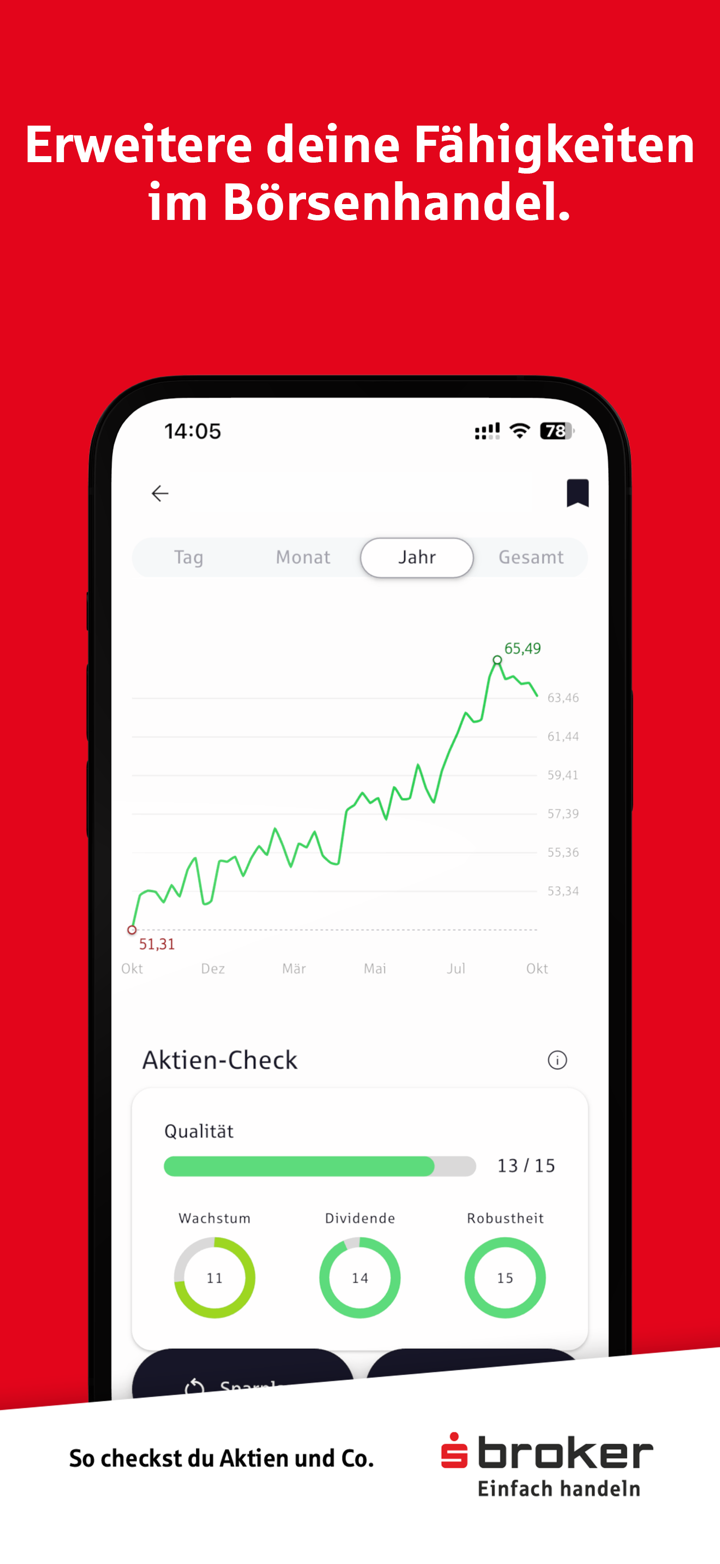

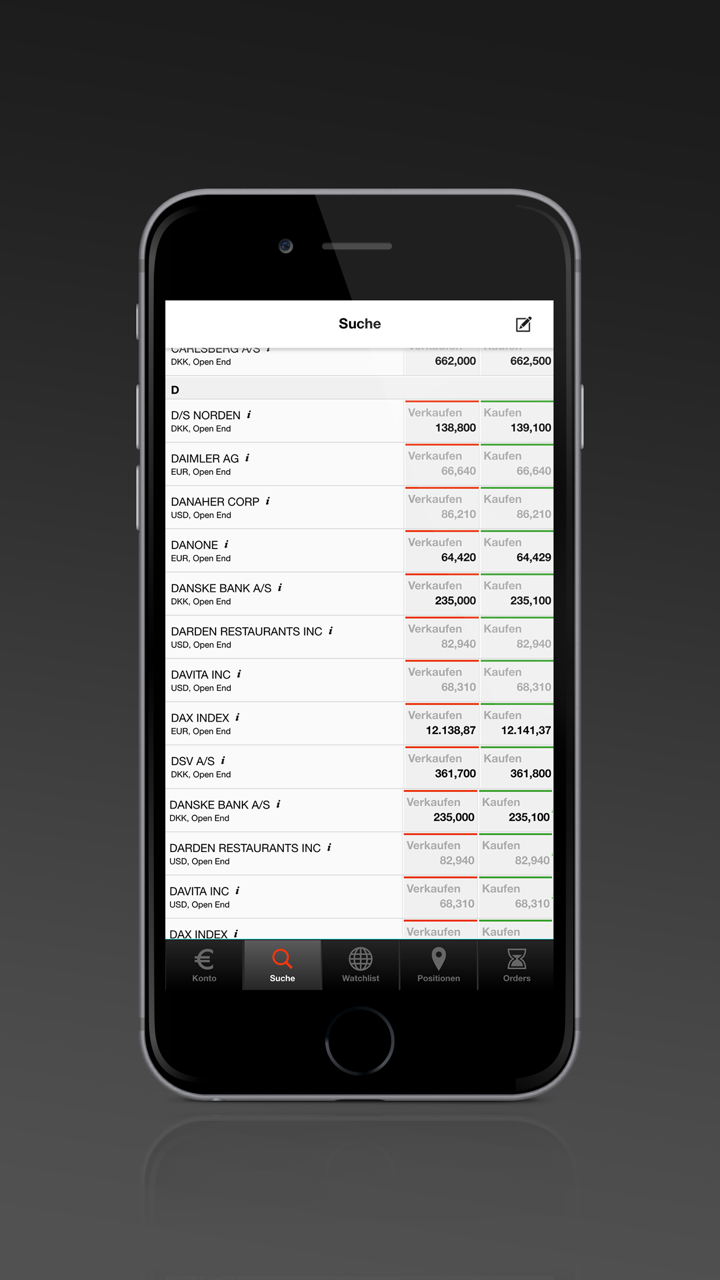

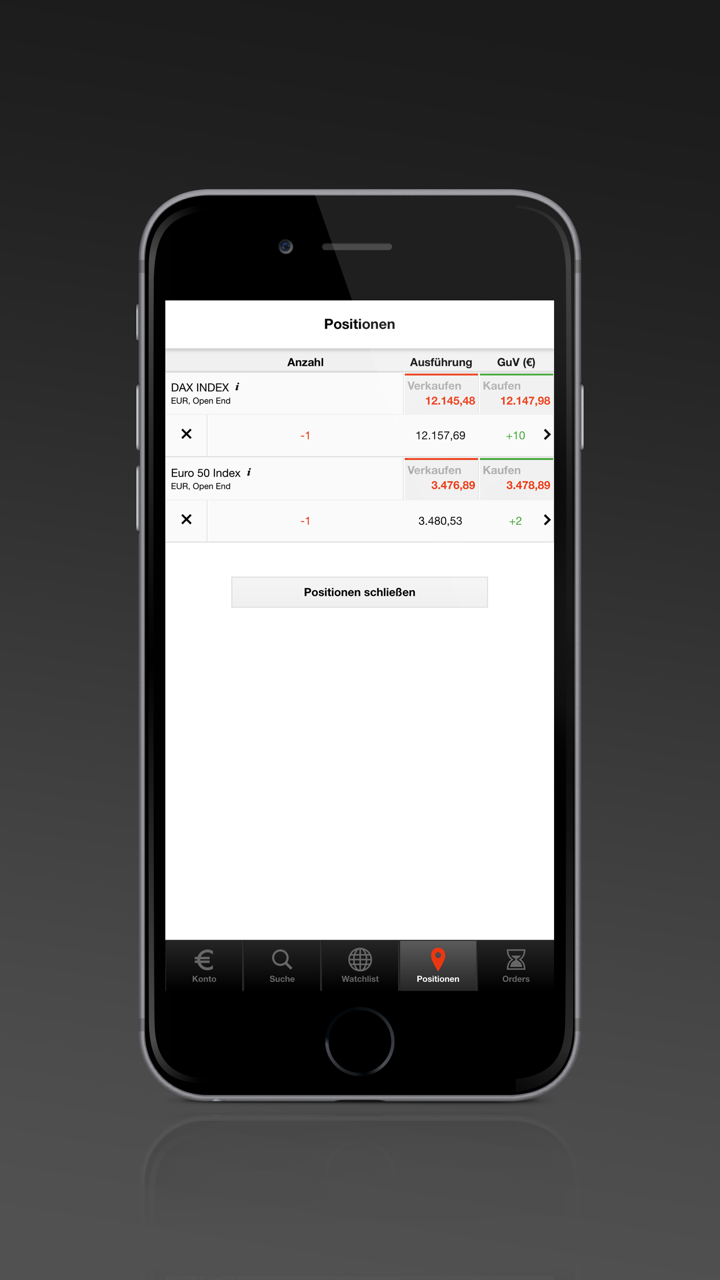

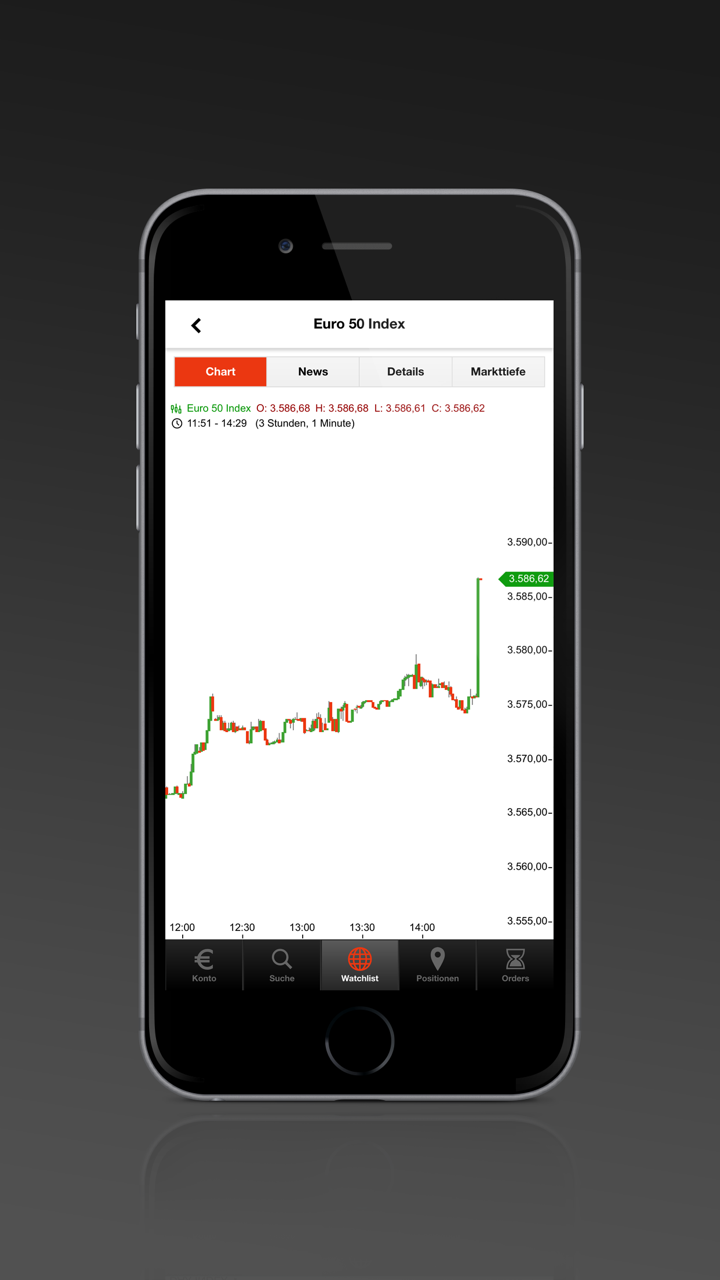

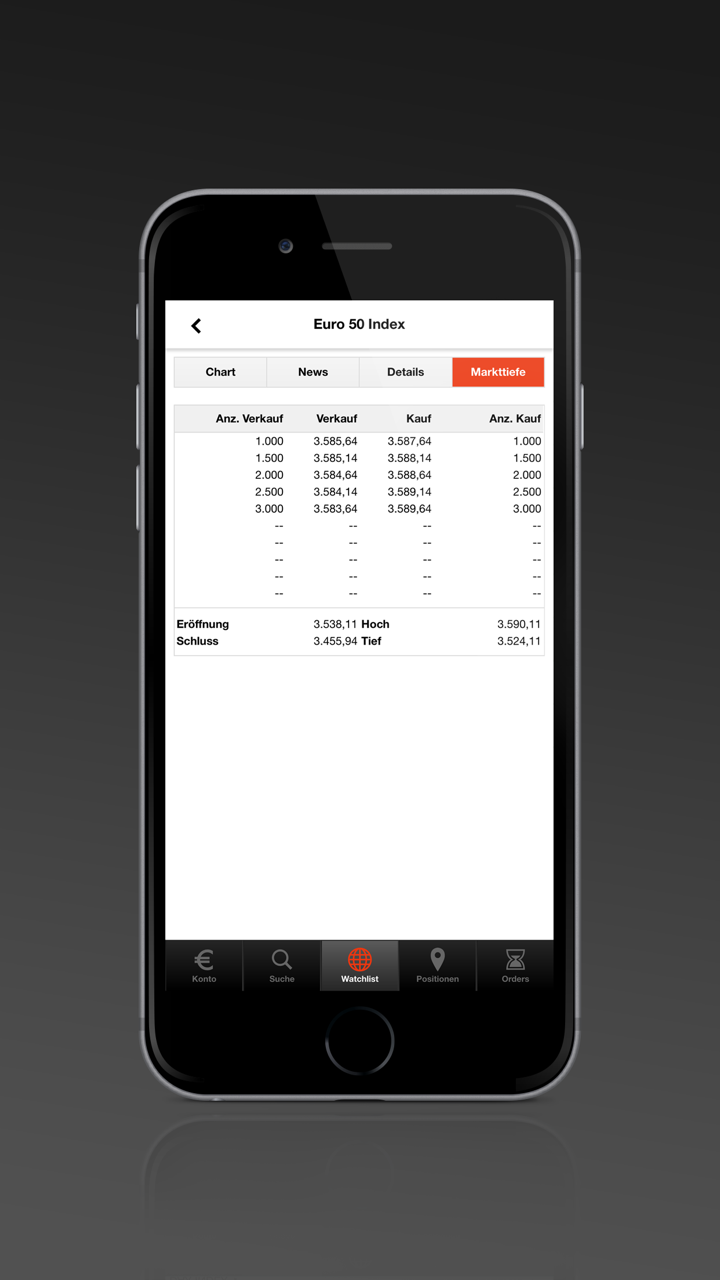

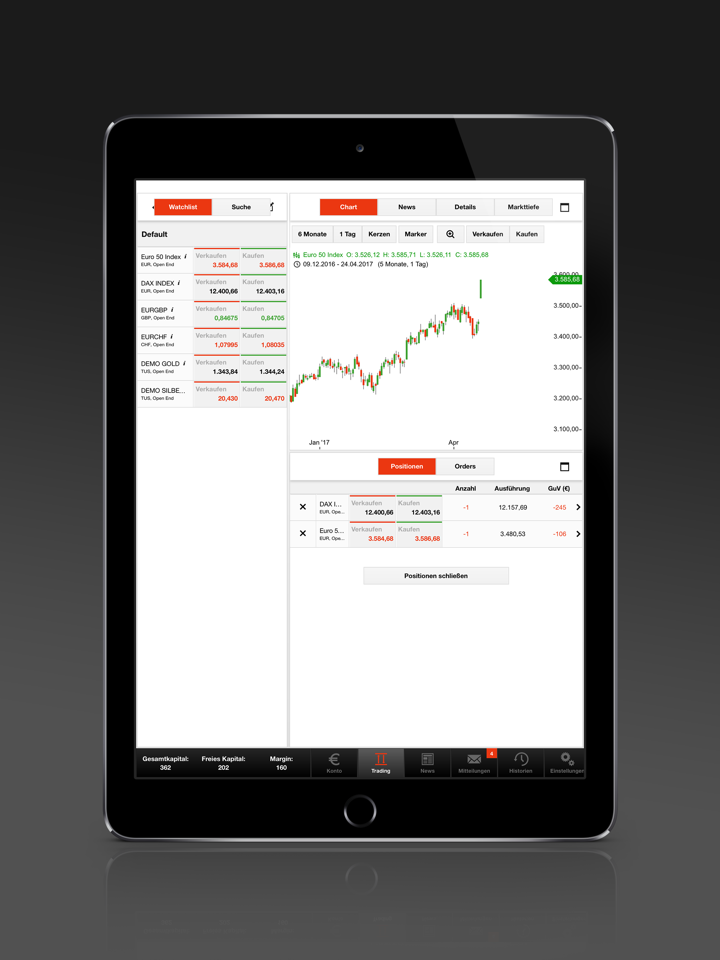

Handelsplattform

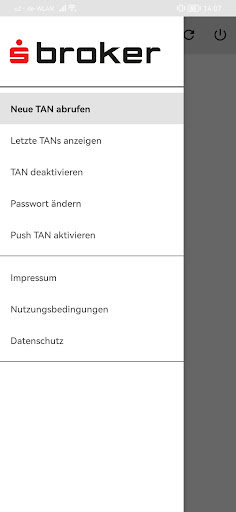

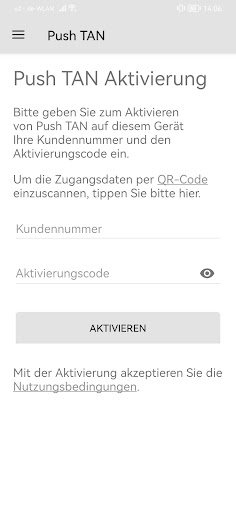

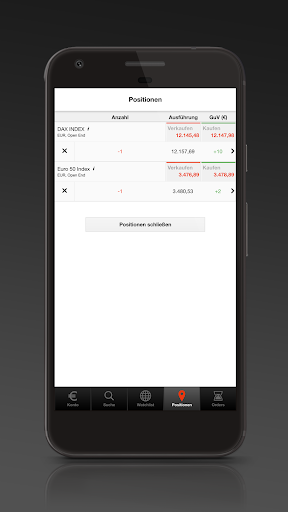

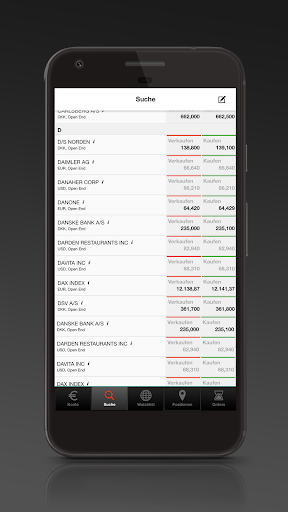

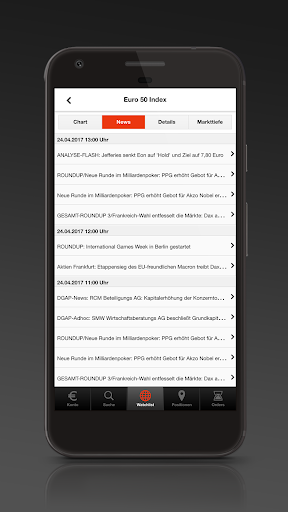

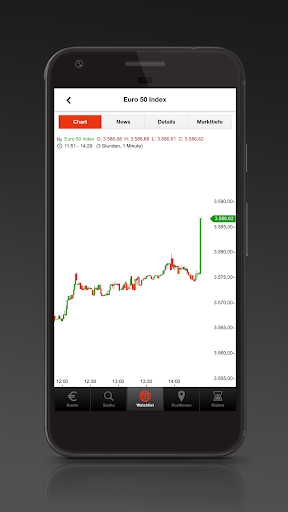

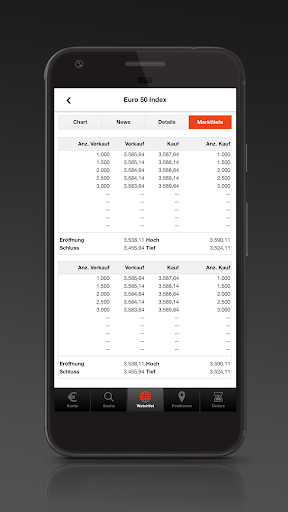

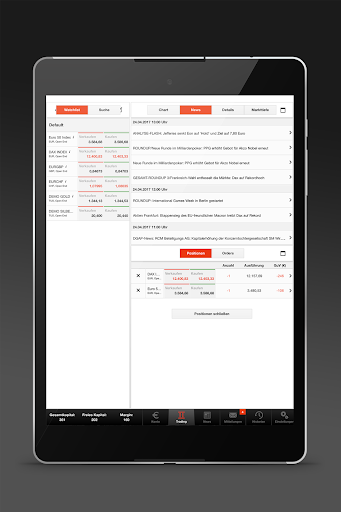

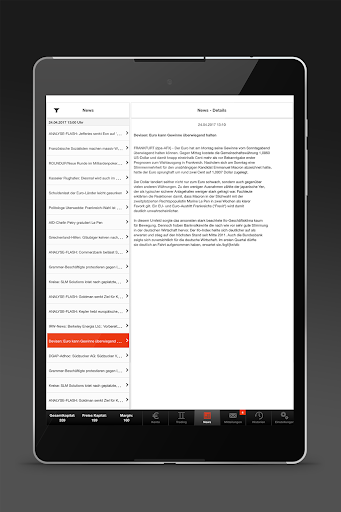

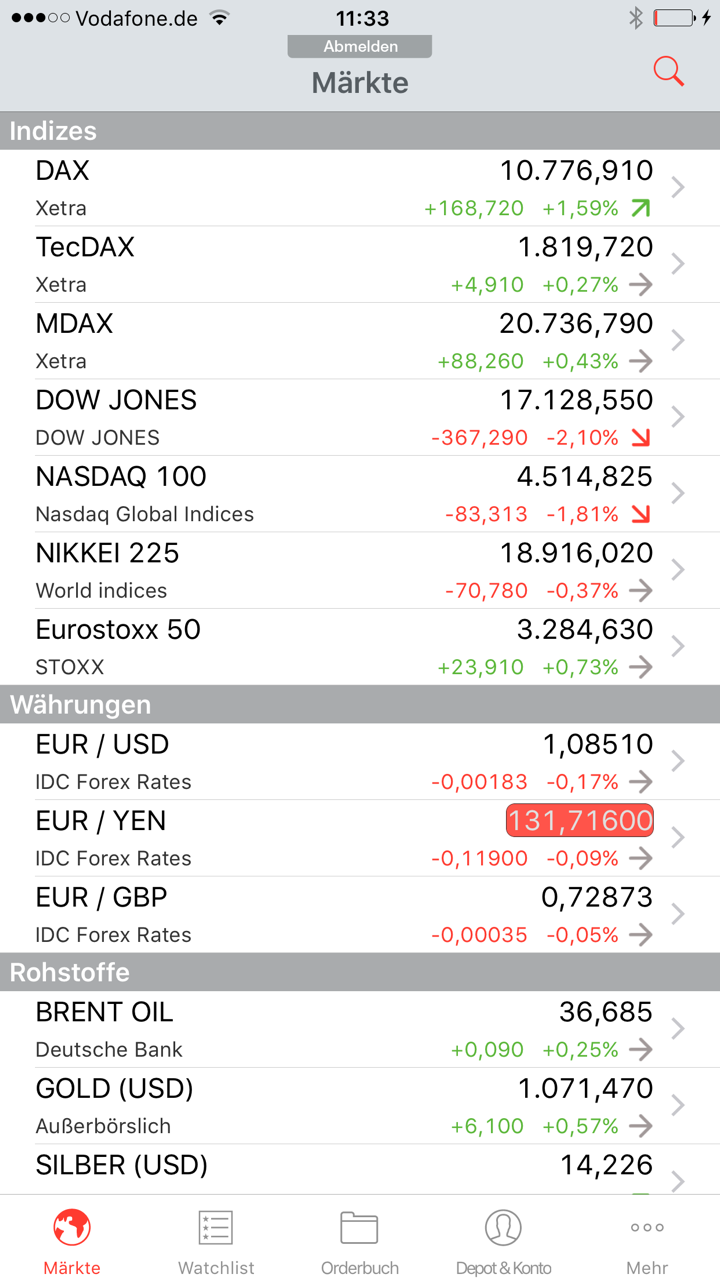

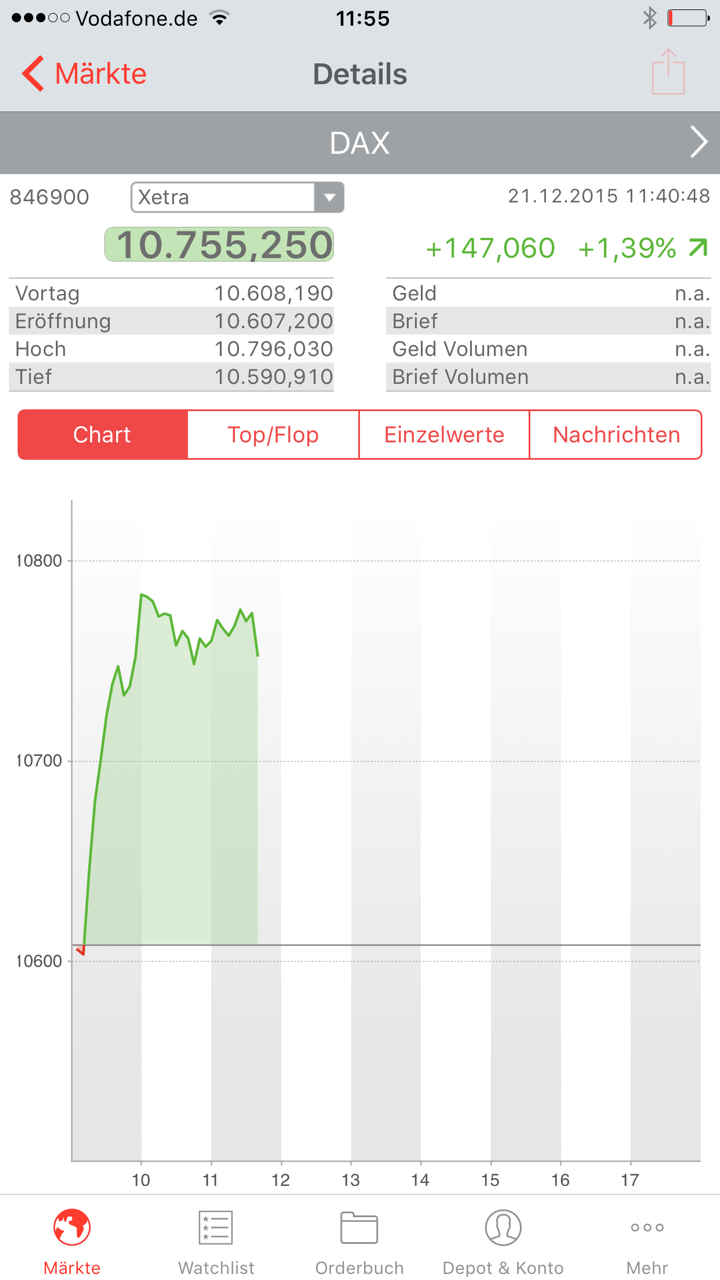

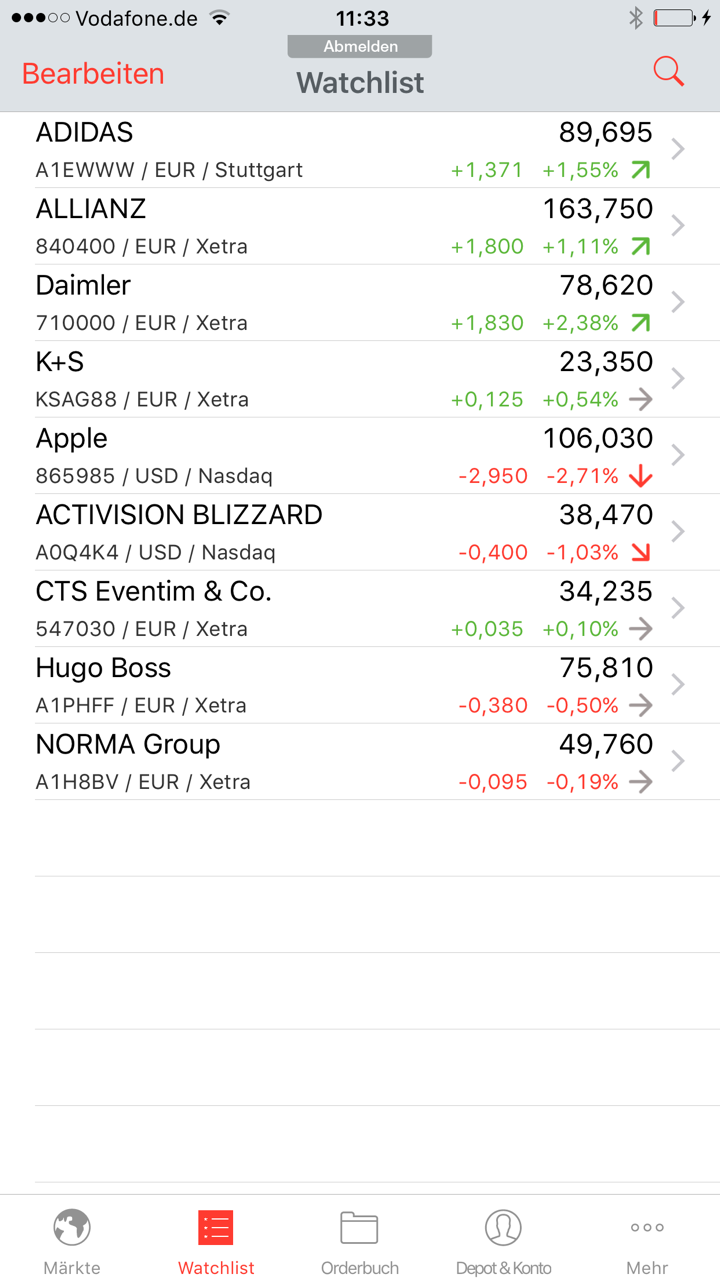

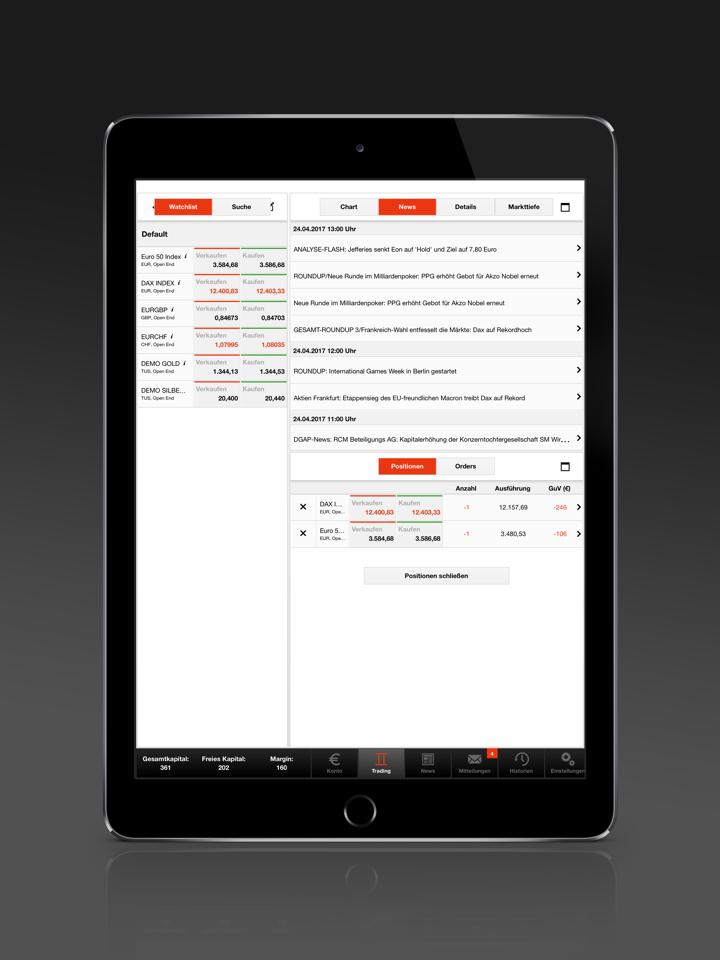

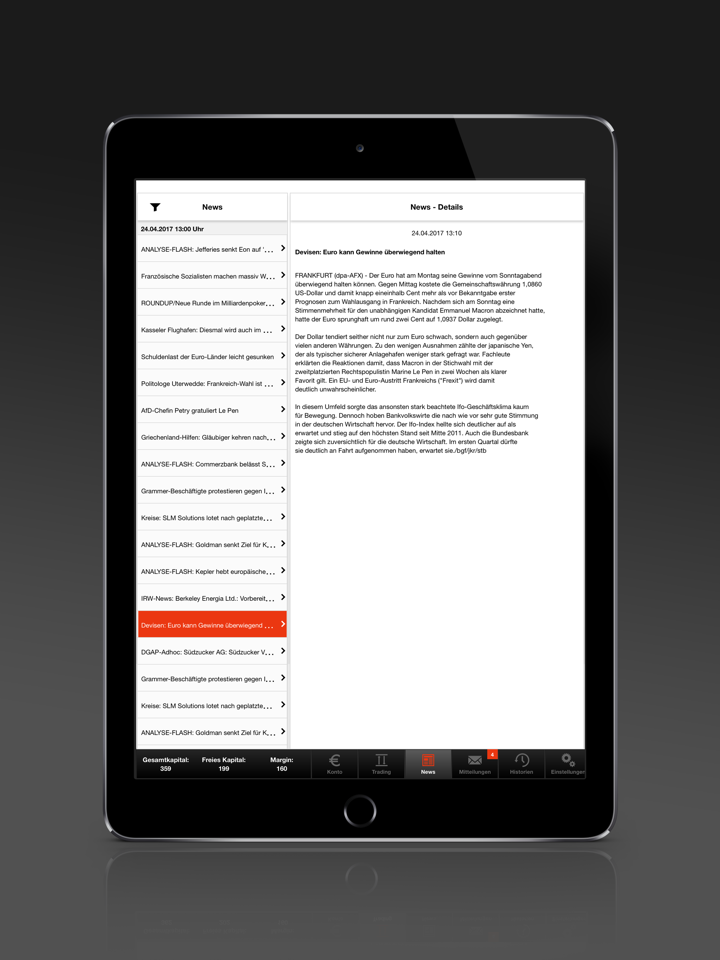

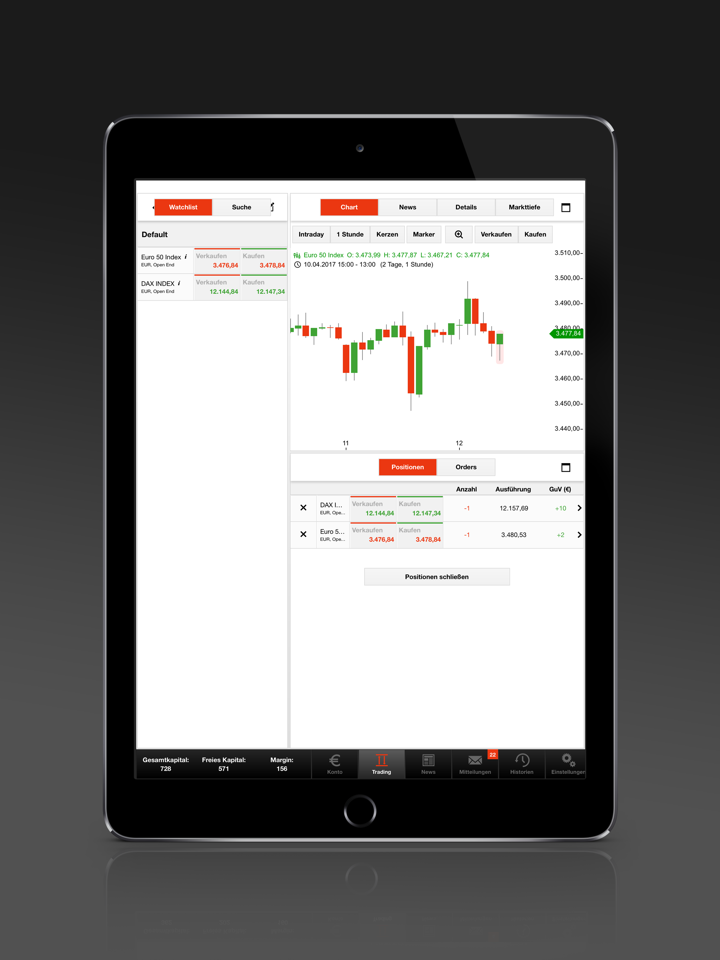

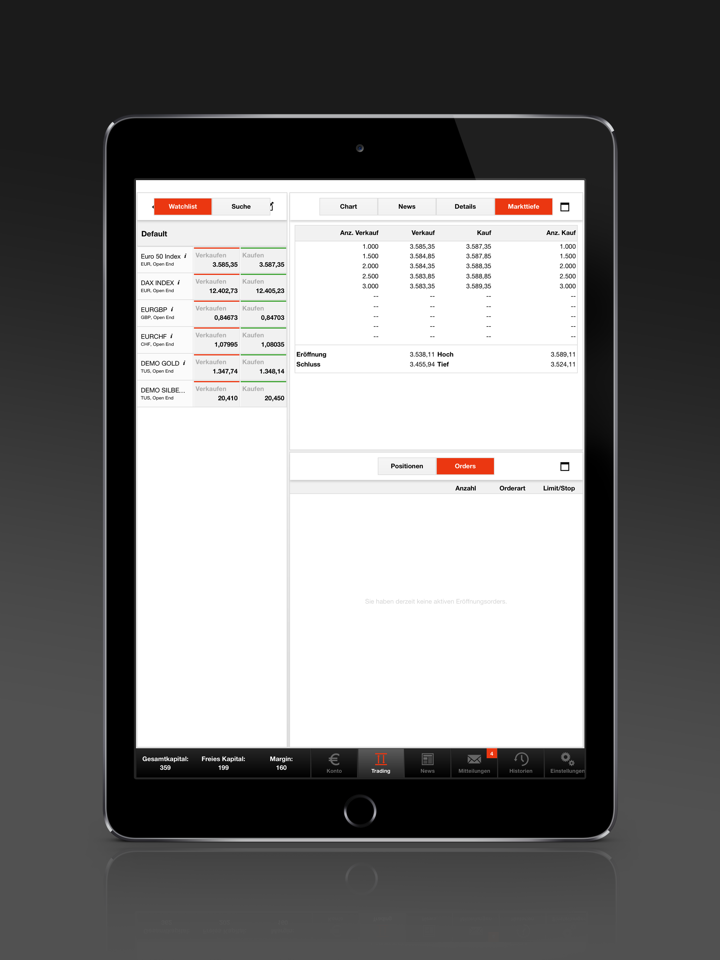

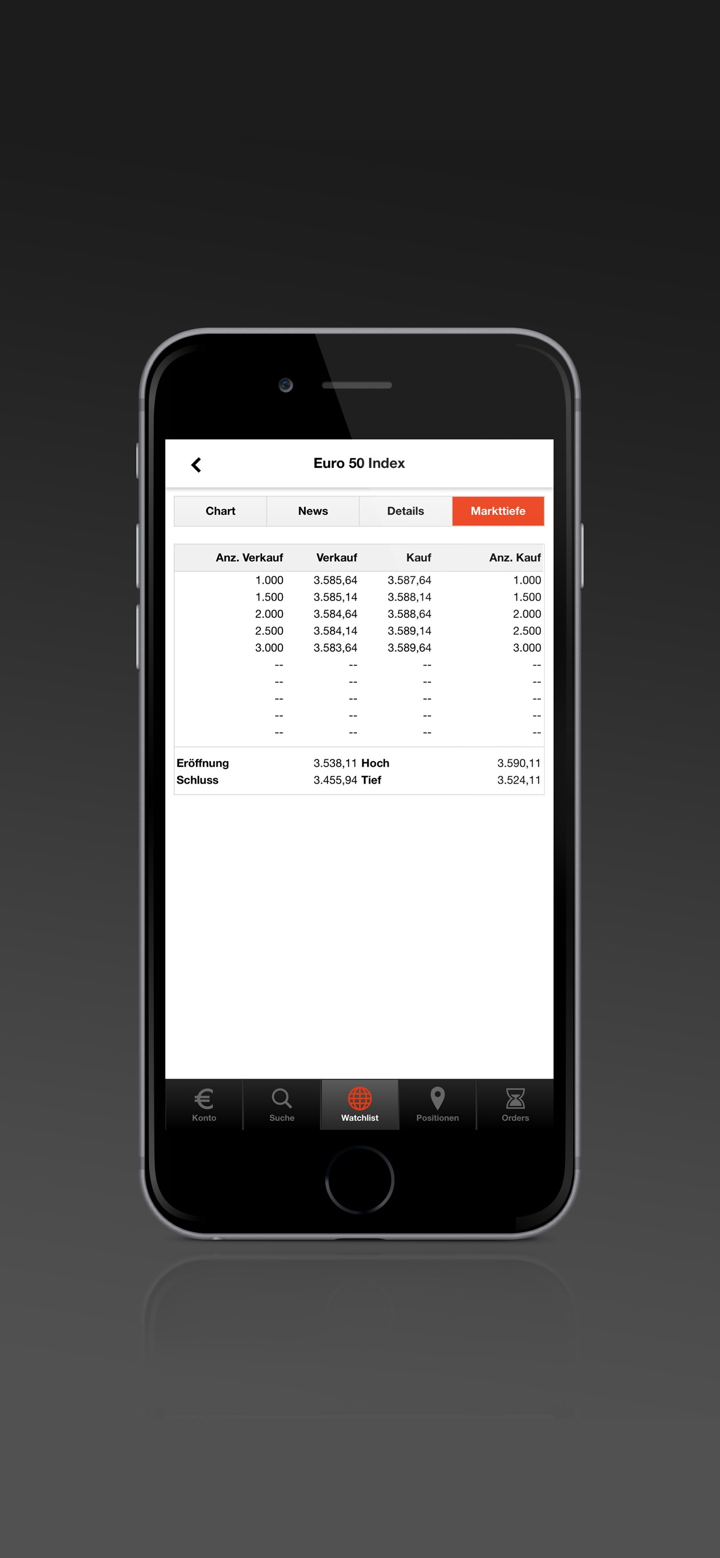

S Broker bietet eine eigene Handelsplattform namens “S Broker App”, verfügbar auf beiden iOS und Android-Plattformen. Es ist an die eigenen Benutzer angepasst, mit Zugriff auf aktuellste Marktdaten, Nachrichten, Indizes & Kurse, Watchlist, usw.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| S Broker Mobile App | ✔ | iOS/Android | S Broker-Benutzer |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Händler |