Описание компании

| S Broker Обзор | |

| Основано | 1999 |

| Страна/Регион регистрации | Германия |

| Регулирование | Отсутствует |

| Торговые инструменты | Акции, фонды, ETF, CFD, облигации, индексы и т. д. |

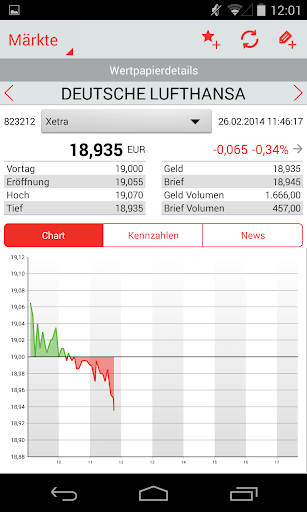

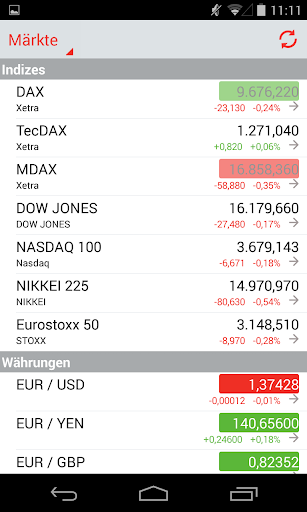

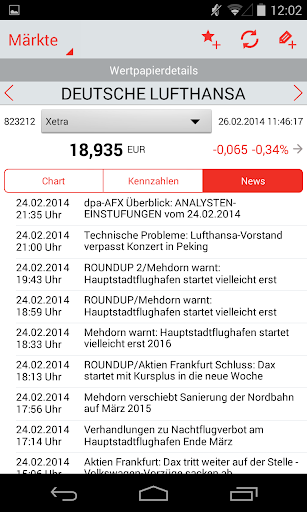

| Торговая платформа | S Broker Мобильное приложение |

| Минимальный депозит | 0 |

| Поддержка клиентов | Онлайн-чат |

| Тел: 0611 2044-1912; 0611 2044-1911; 0611 2044-1944 | |

| Эл. почта: service@sbroker.de | |

| FAQ, Instagram, YouTube, LinkedIn, Facebook и т. д. | |

| Адрес: S Broker AG & Co. KG, Служба поддержки, Почтовый ящик 90 01 50, 39133 Магдебург | |

Информация о S Broker

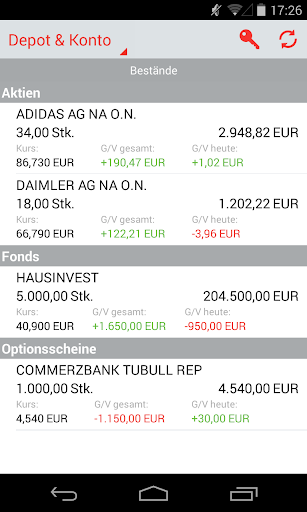

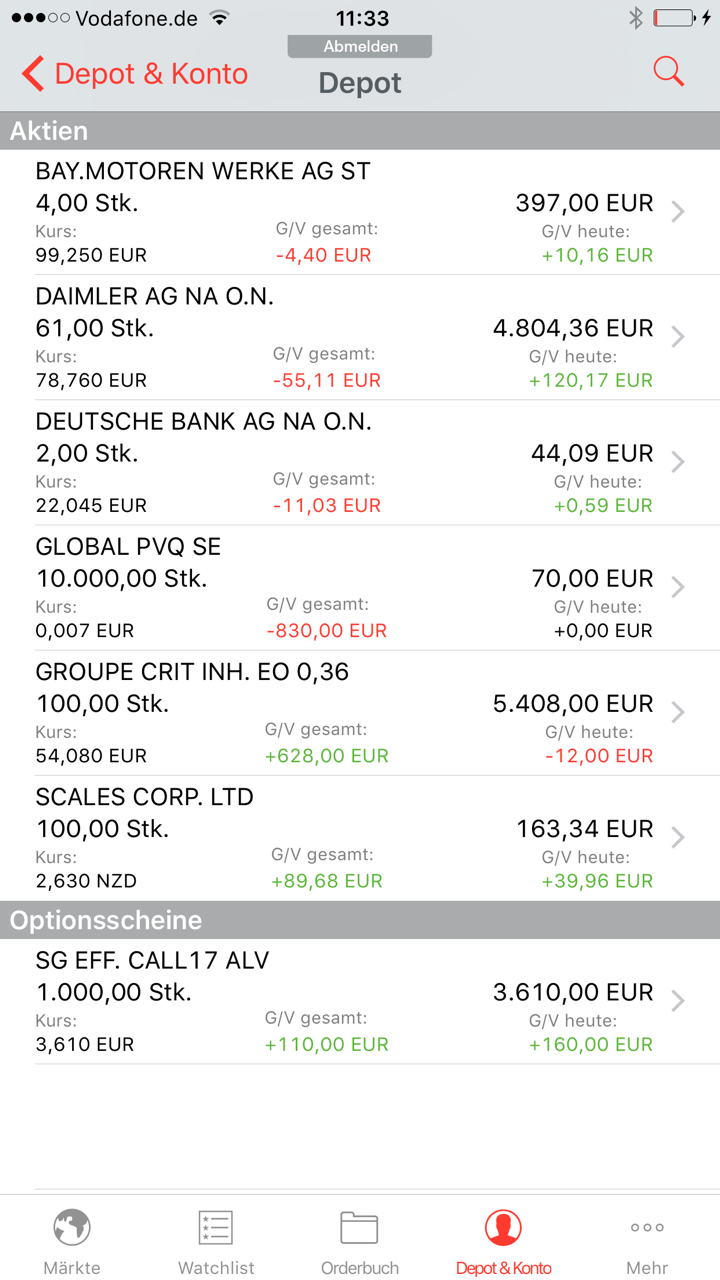

S Broker - это компания по торговле ценными бумагами, которая была основана в 1999 году в Германии. Компания в настоящее время предлагает торговые продукты, включая, но не ограничиваясь, акциями, фондами, ETF, CFD, облигациями, продуктами с плечом, такими как индексы и т. д. Она предлагает два торговых счета без требований к минимальному депозиту.

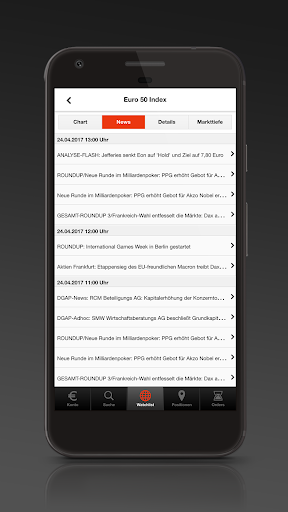

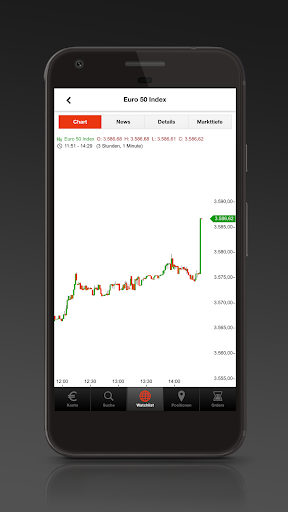

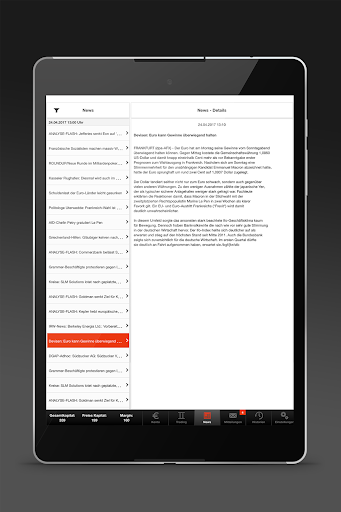

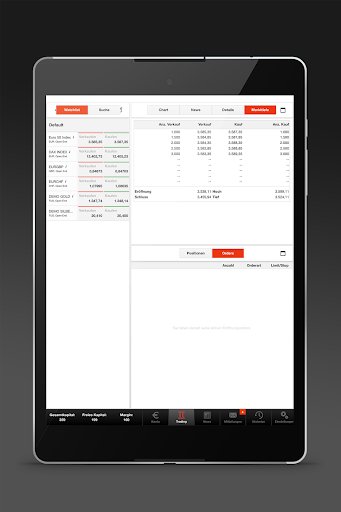

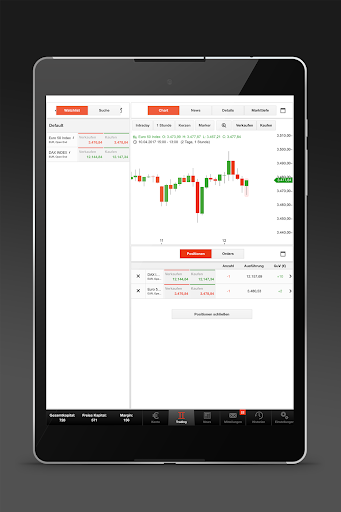

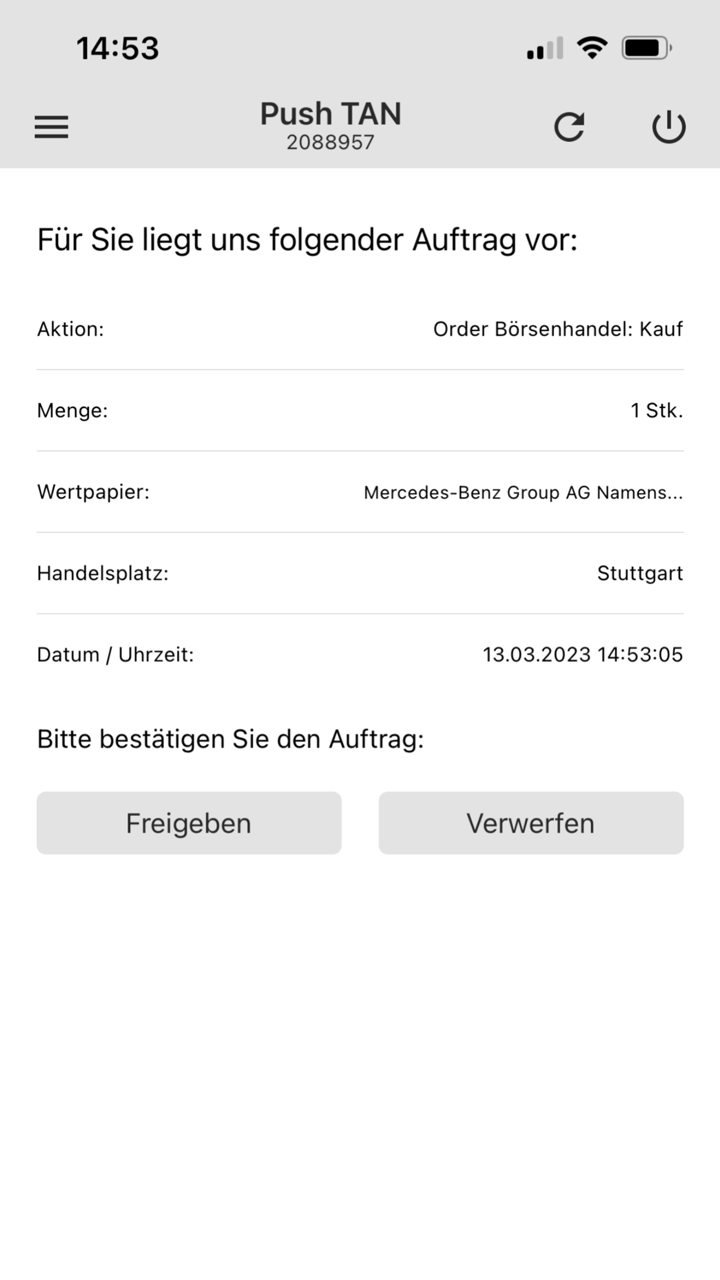

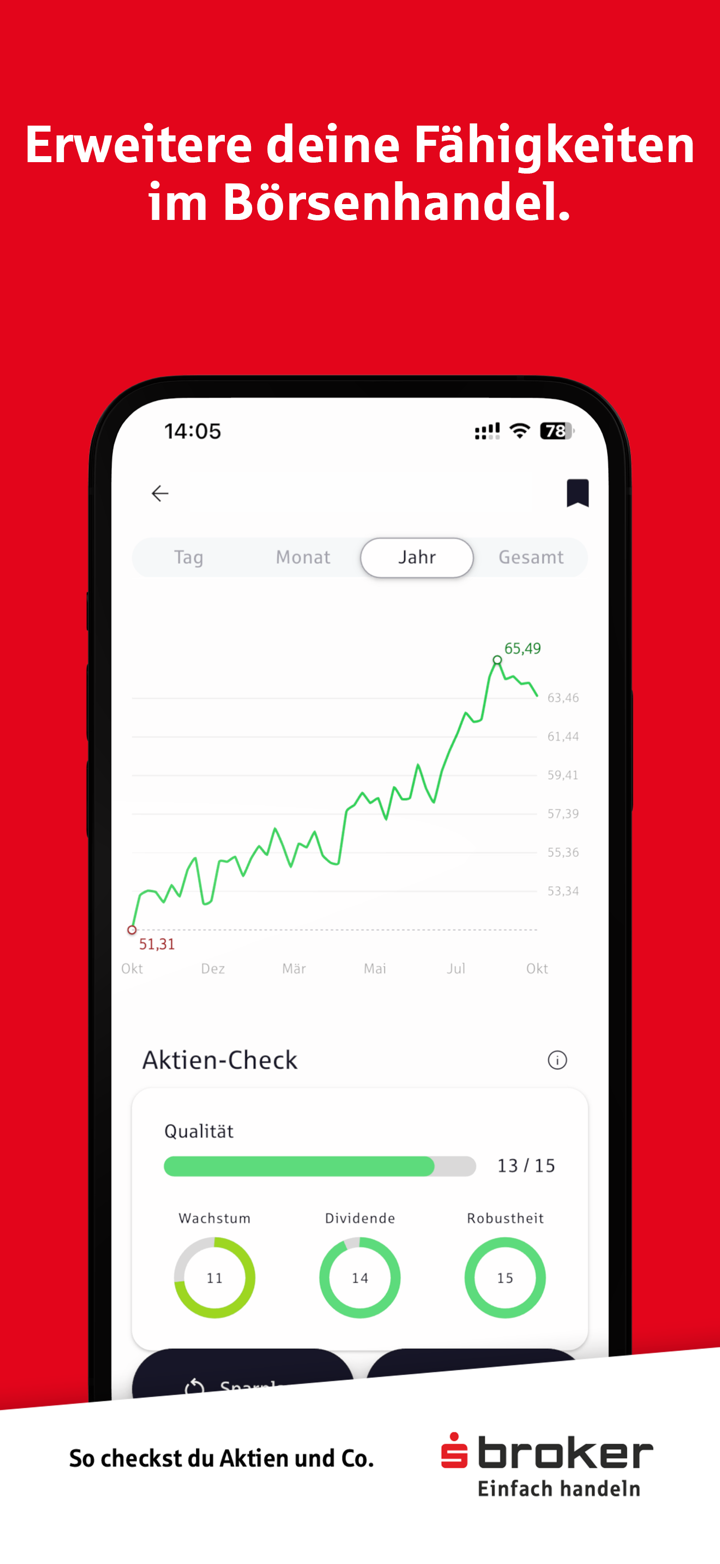

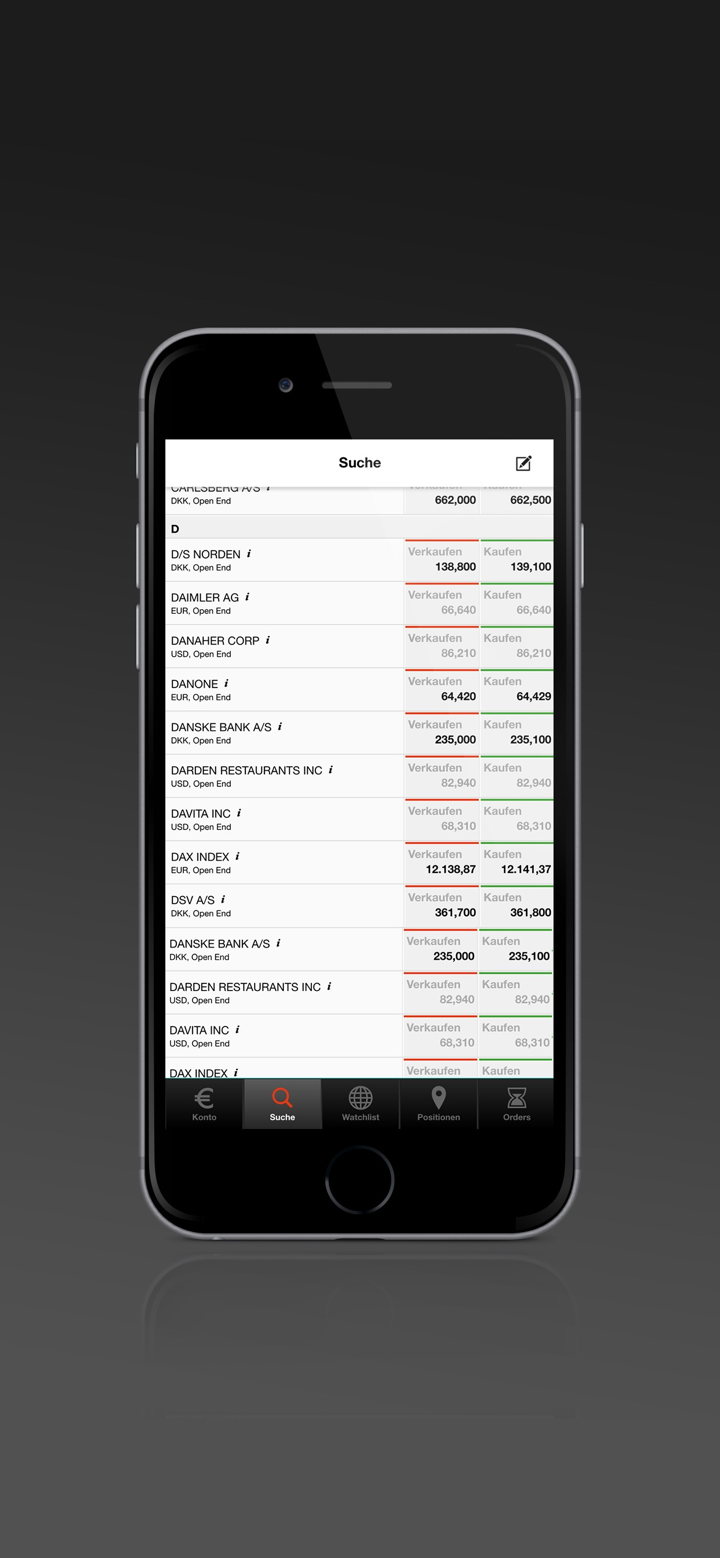

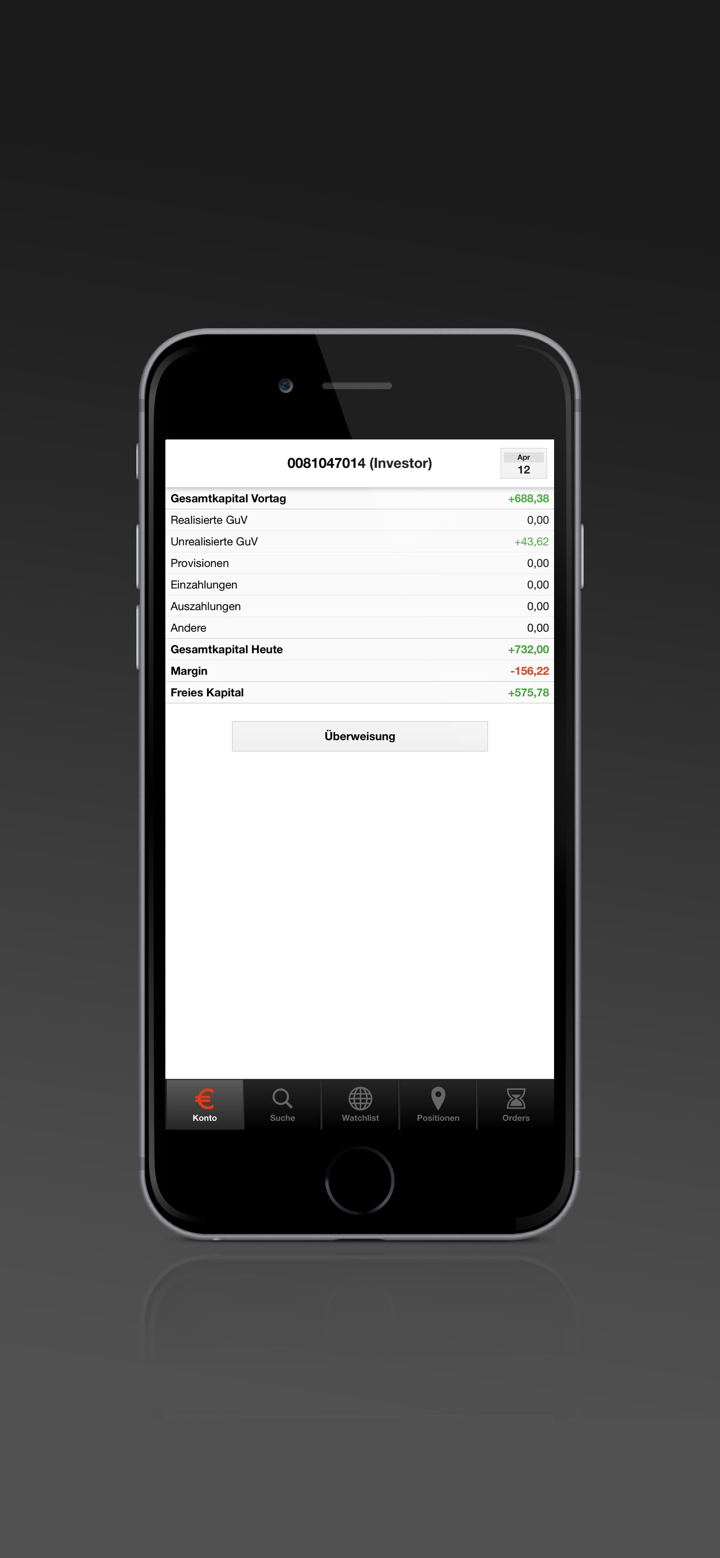

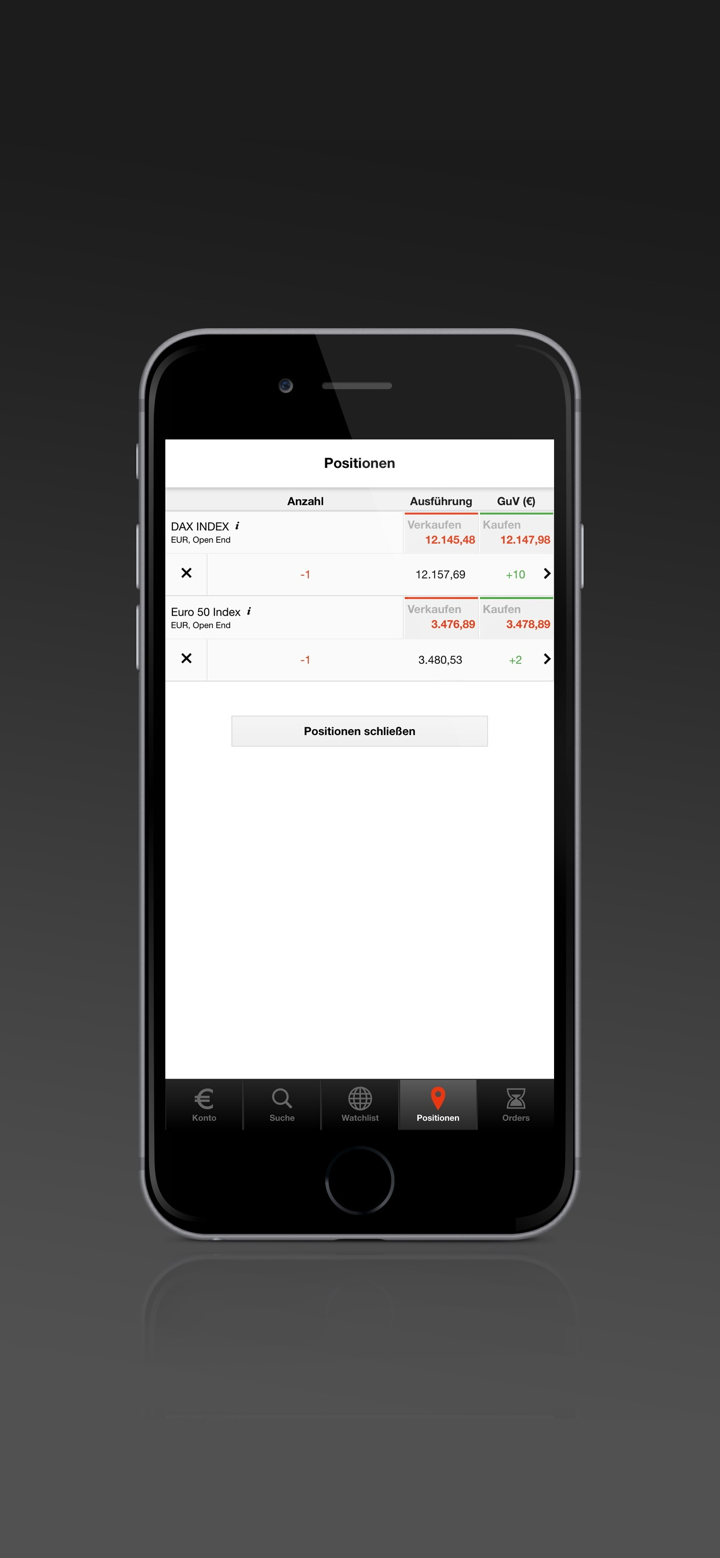

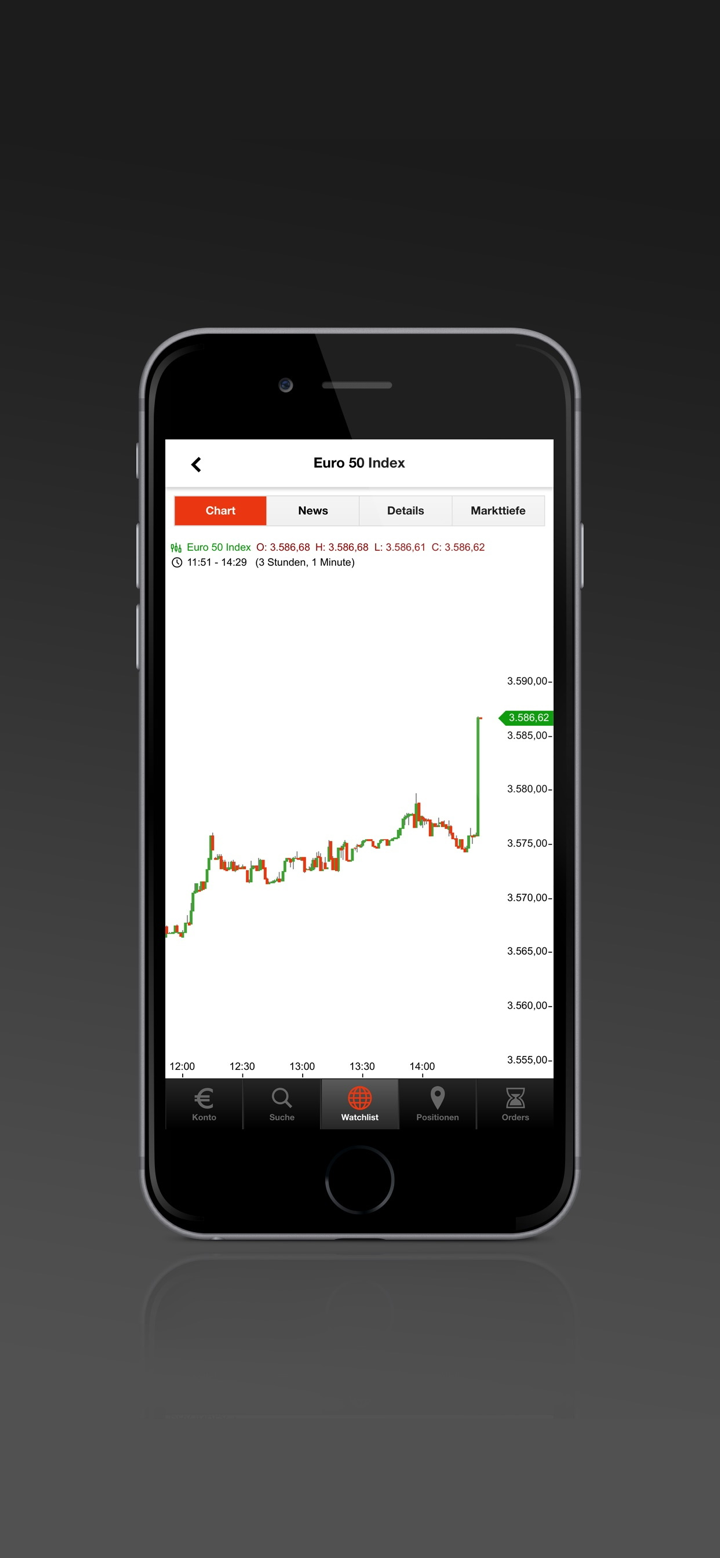

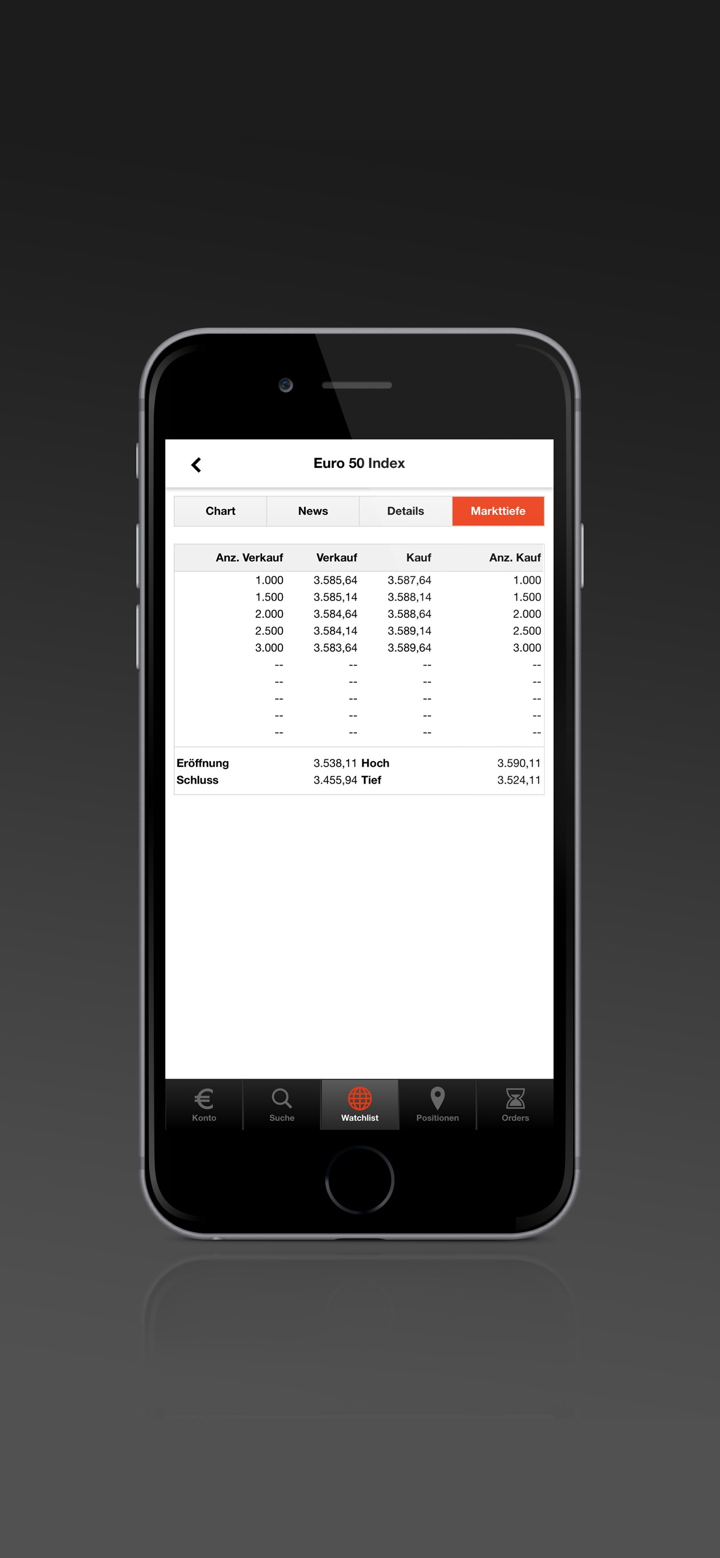

Для совершения сделок компания разработала собственное мобильное приложение S Broker, специально для своих пользователей.

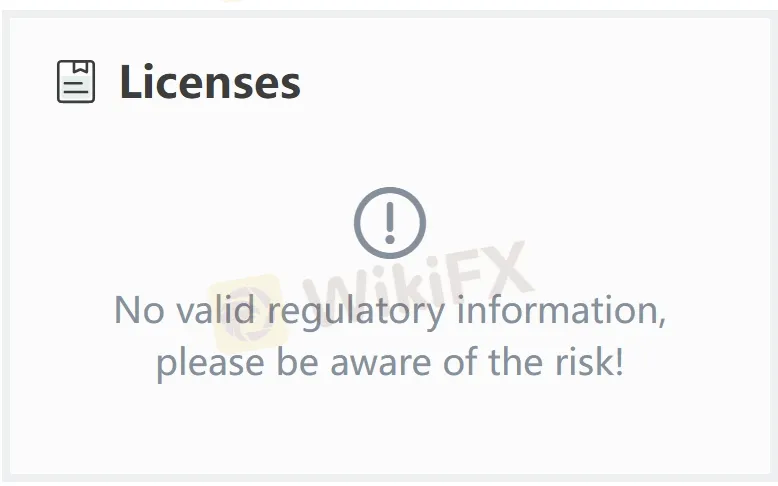

Однако в настоящее время брокер не имеет хорошего регулирования со стороны официальных органов, что снижает его доверие и надежность.

Плюсы и минусы

| Плюсы | Минусы |

| Многолетний опыт в индустрии | Отсутствие регулирования |

| Разнообразие торговых продуктов | |

| Отсутствие минимального депозита |

Является ли S Broker Легальным?

Самым важным фактором при оценке безопасности брокерской платформы является ее официальное регулирование. S Broker - это нерегулируемый брокер, что означает, что безопасность средств пользователей и их торговых операций не защищена эффективно. Инвесторам следует выбирать S Broker осторожно.

На что я могу торговать на S Broker?

| Торговые Инструменты | Поддерживается |

| Акции | ✔ |

| Фонды | ✔ |

| ETF | ✔ |

| CFD | ✔ |

| Облигации | ✔ |

| Индексы | ✔ |

| Форекс | ❌ |

| Товары | ❌ |

| Криптовалюты | ❌ |

| Опционы | ❌ |

Тип счета

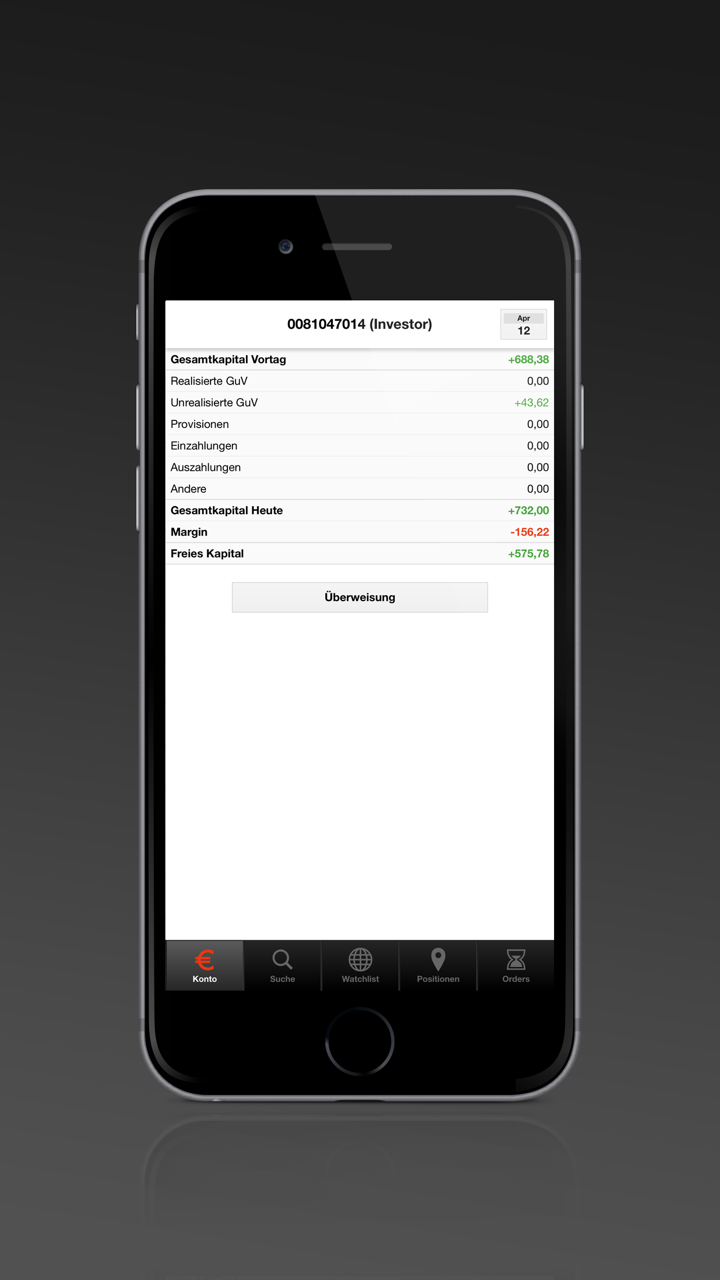

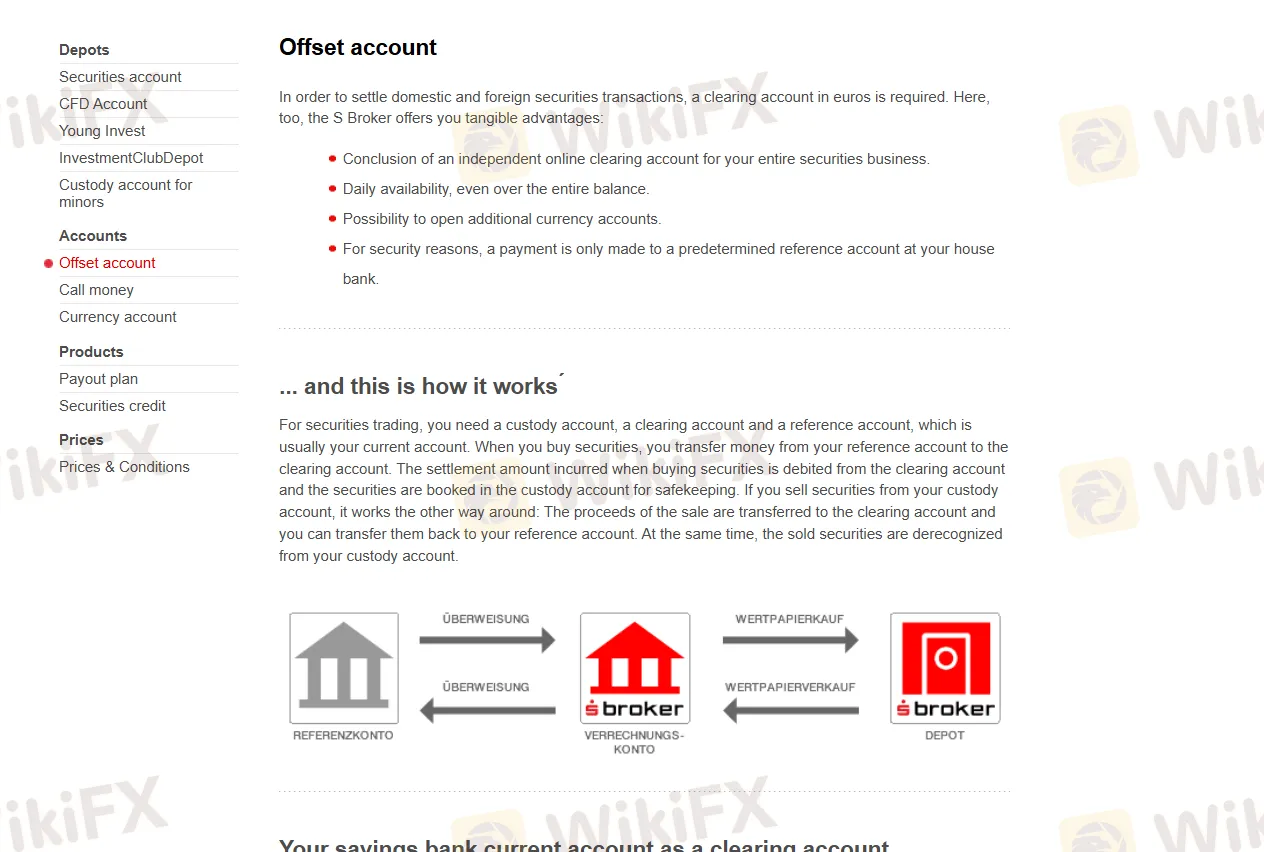

S Broker предлагает три типа счетов для различных продуктов: CFD счет, ценные бумаги, счет смещения и валютный счет.

Для открытия счета в компании нет минимальных требований к депозиту.

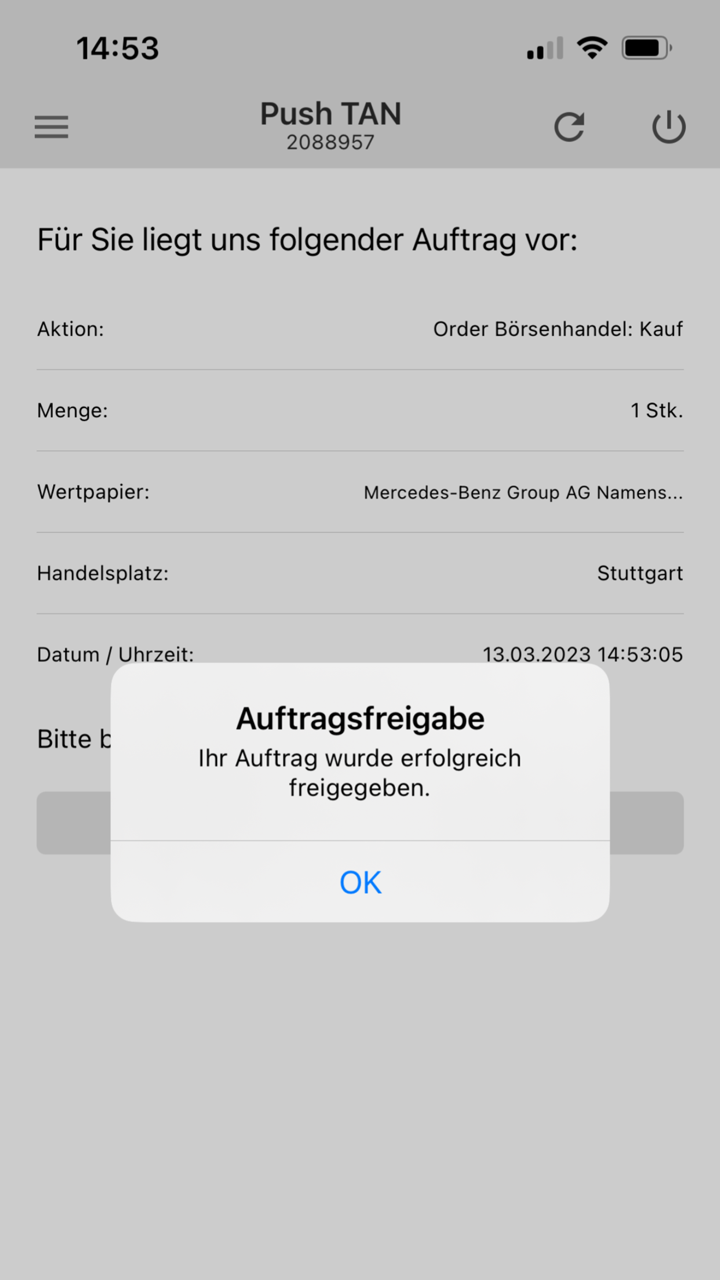

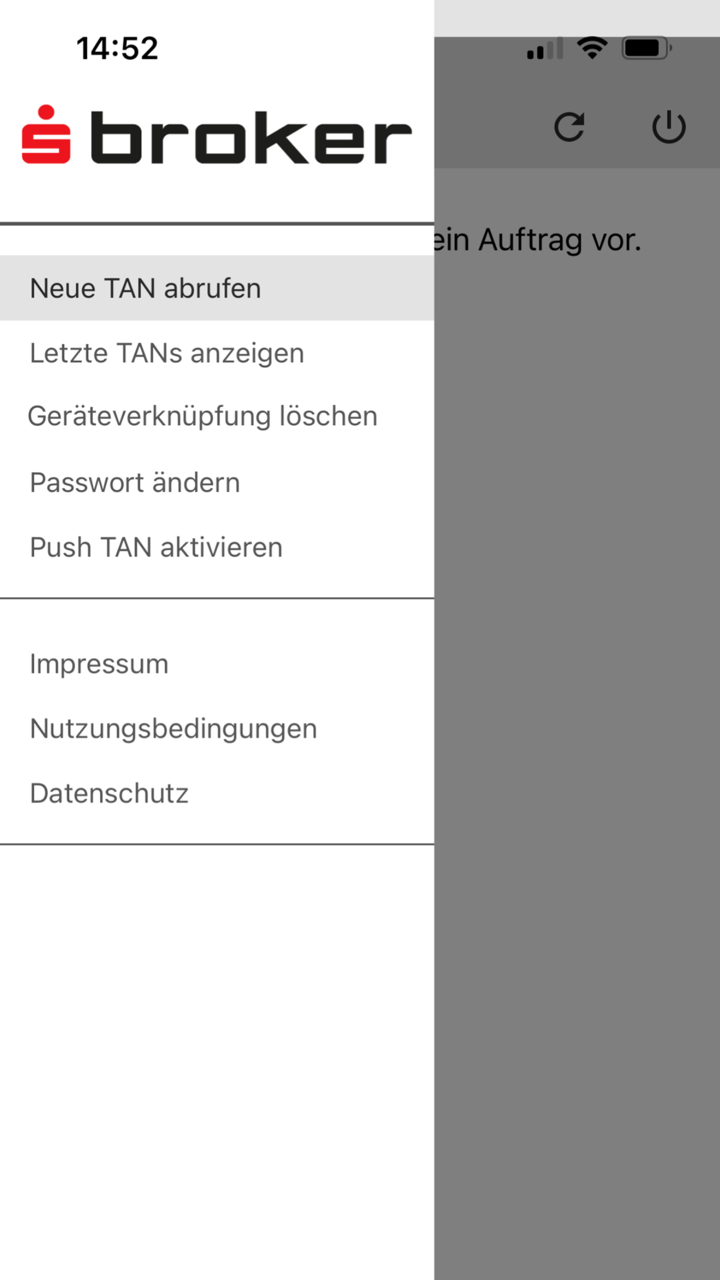

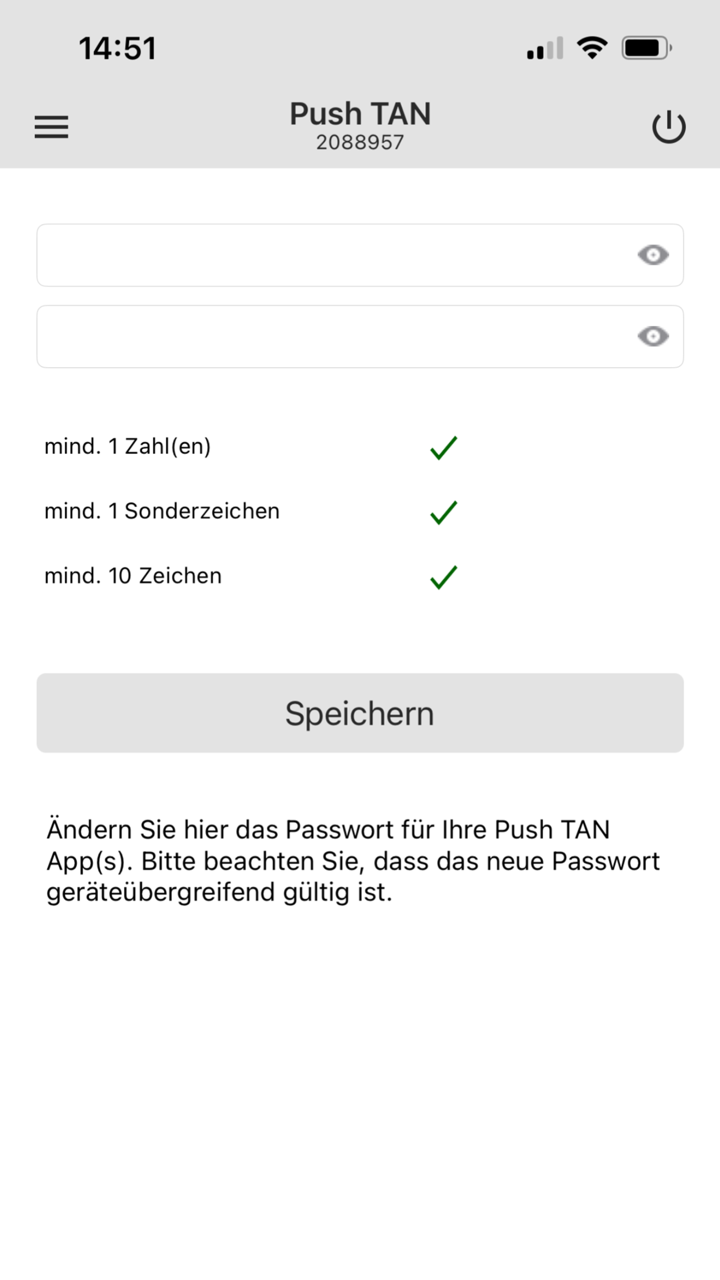

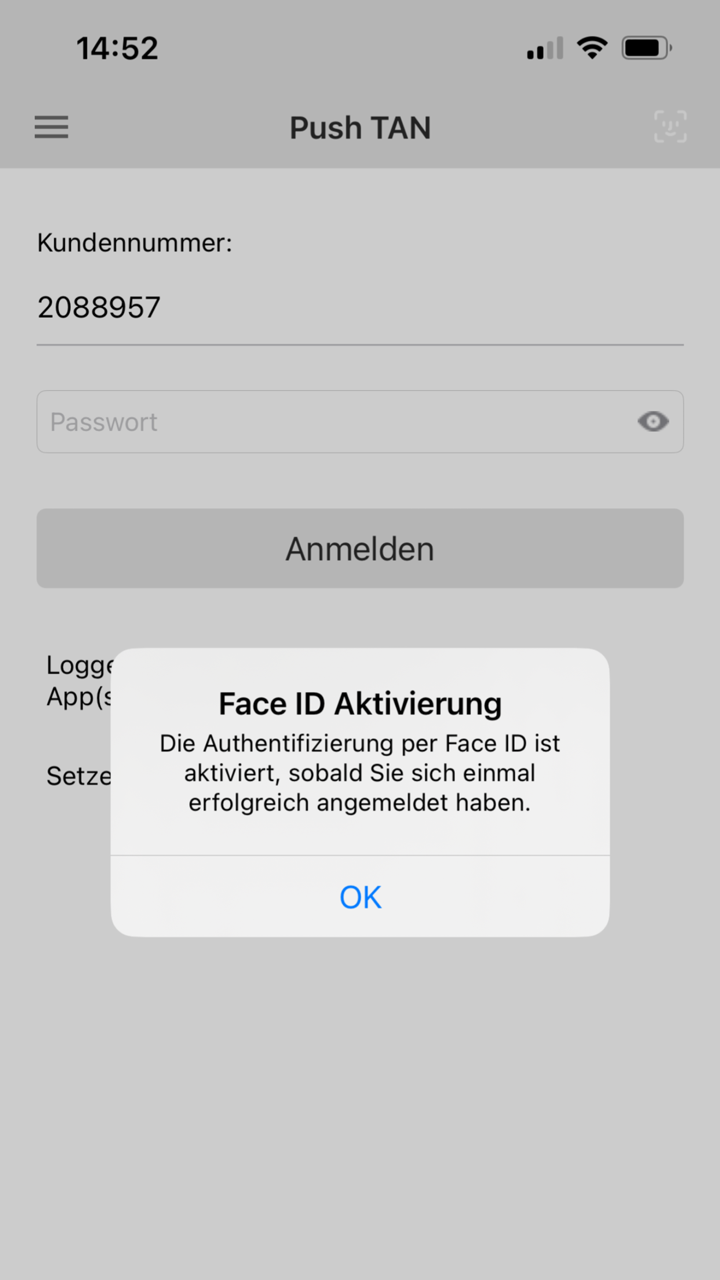

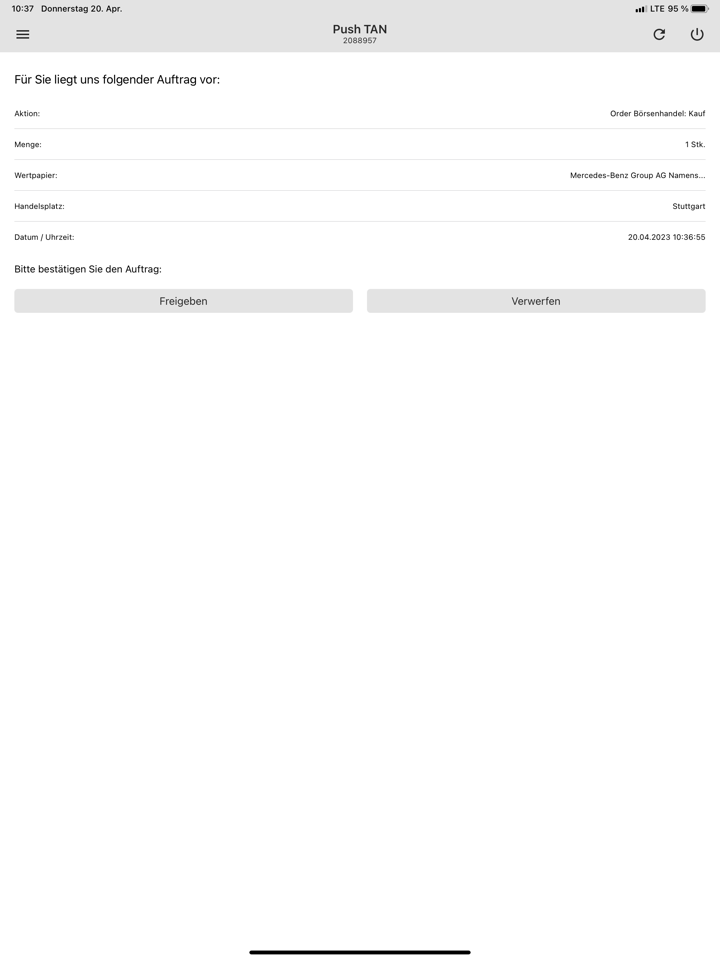

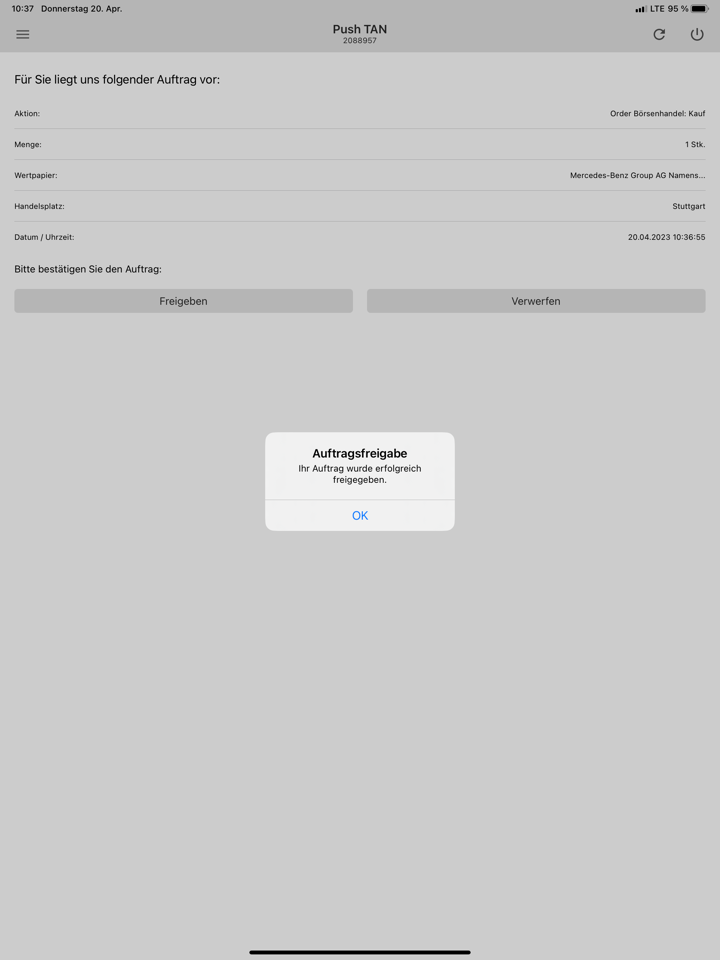

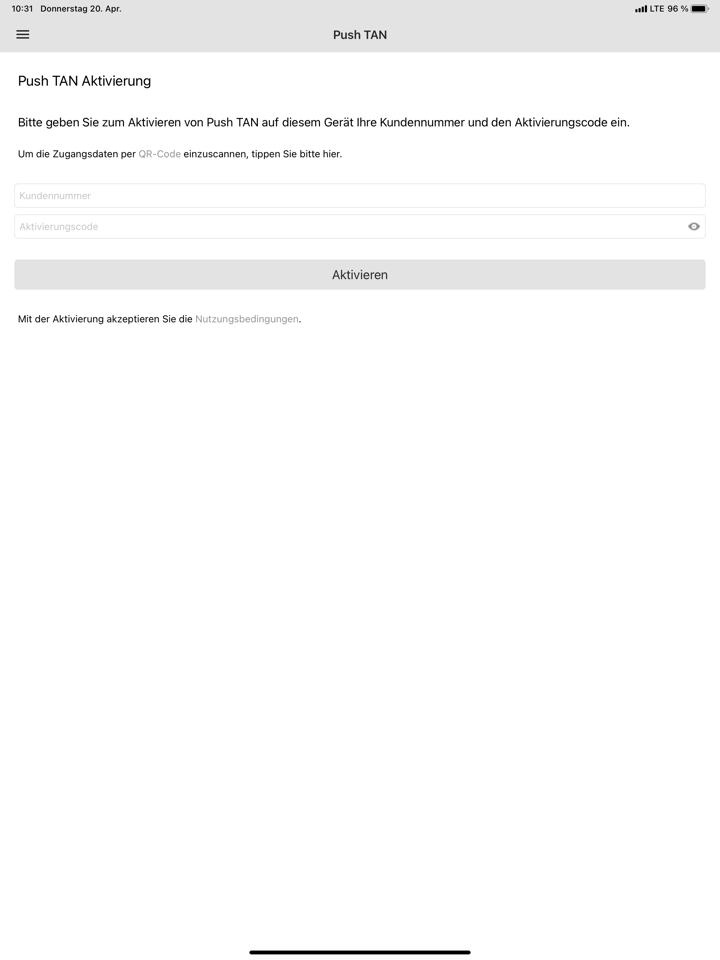

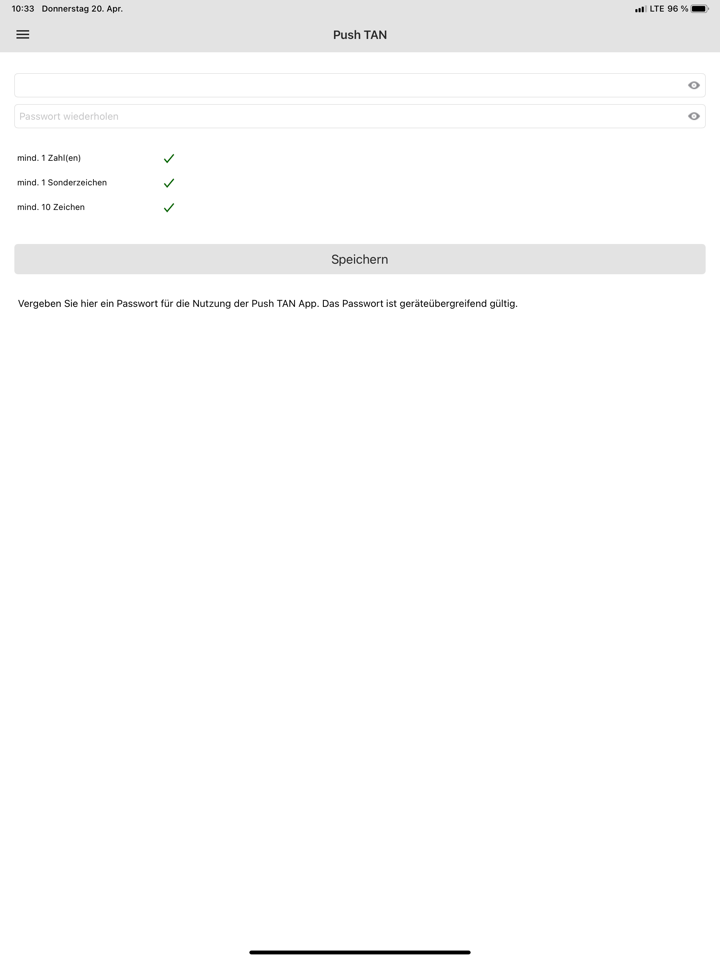

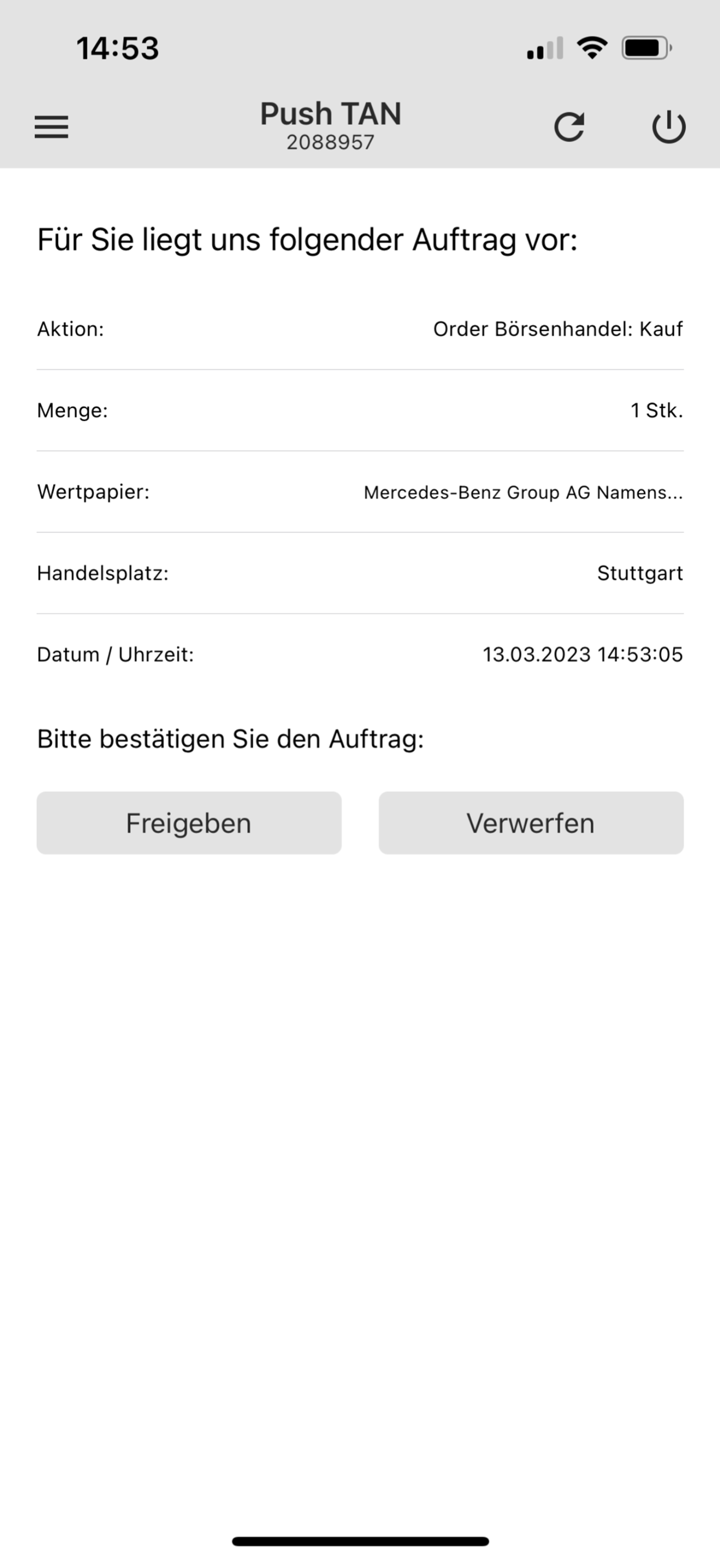

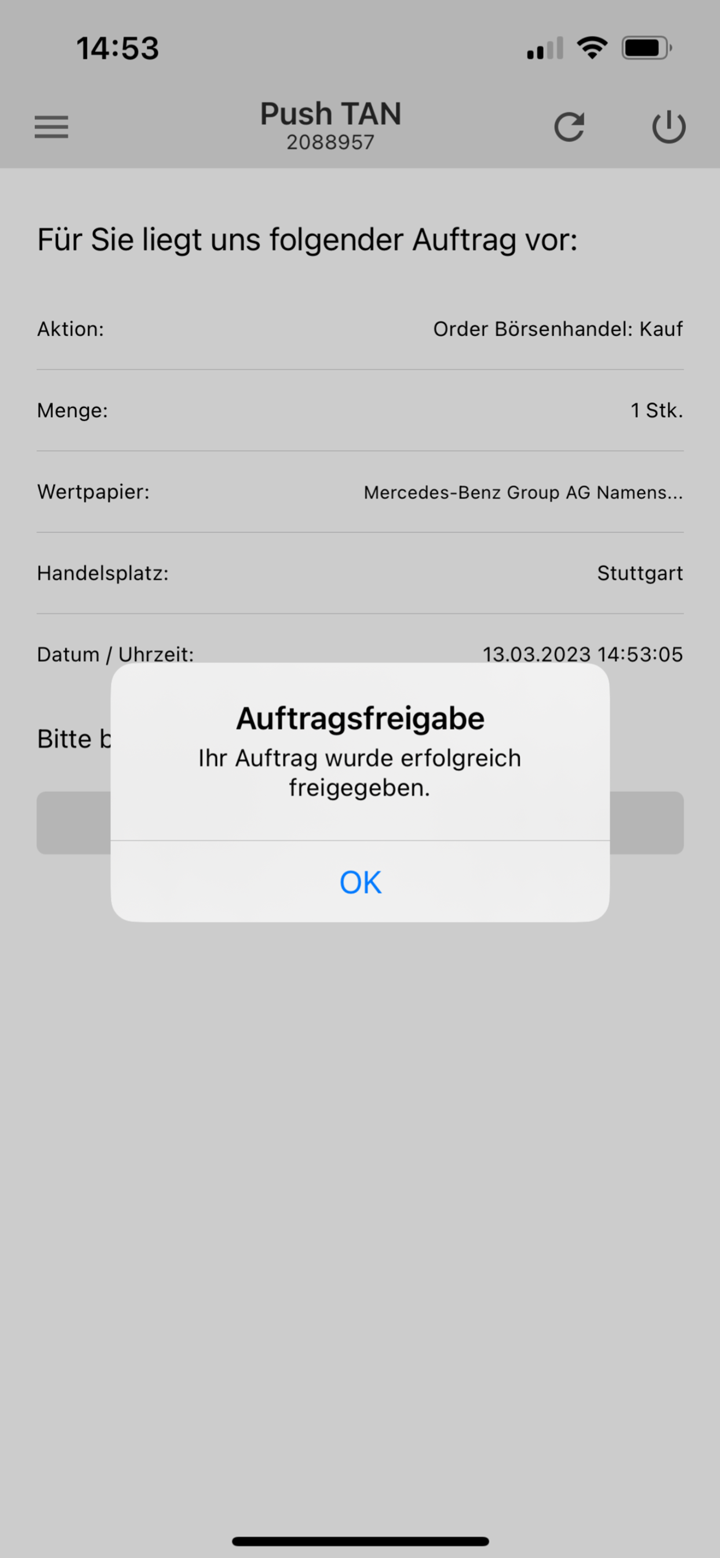

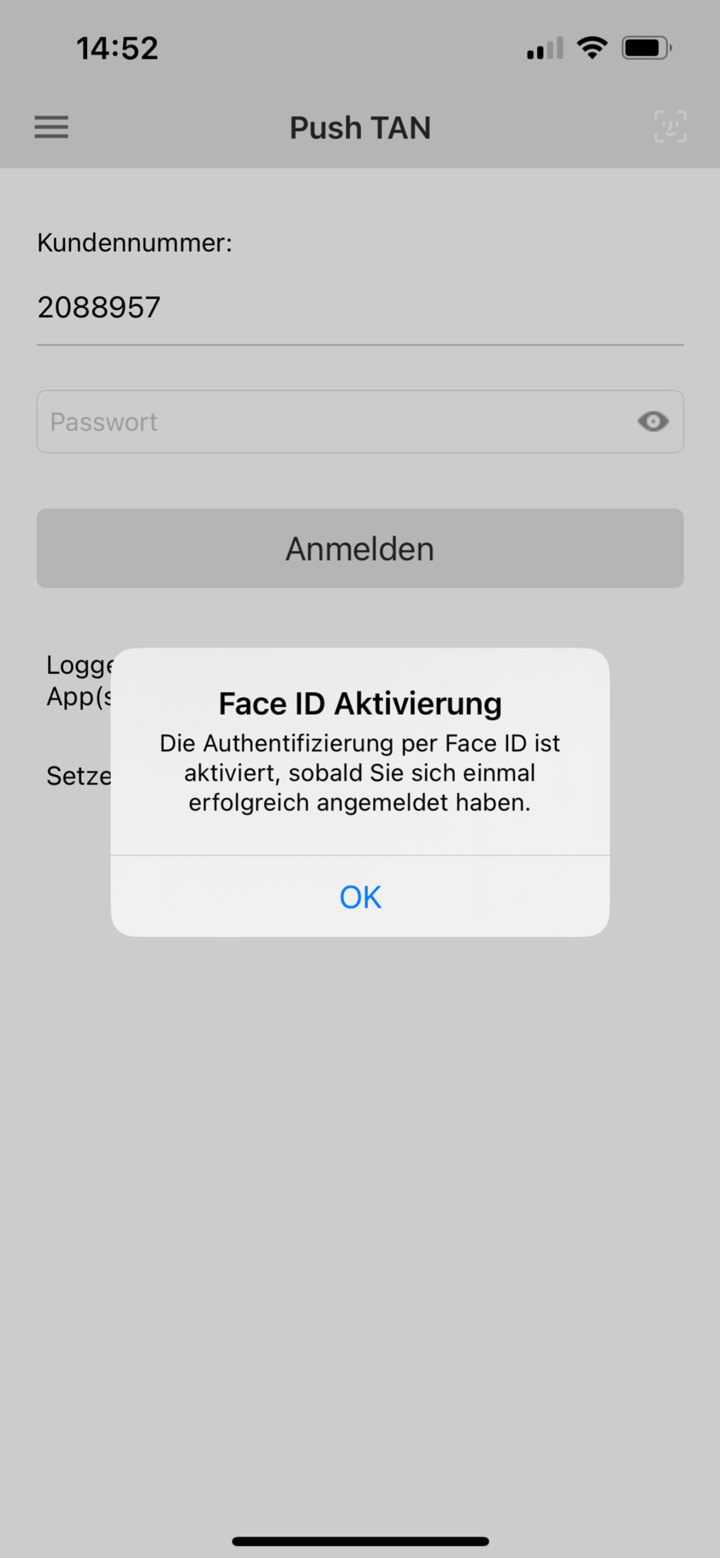

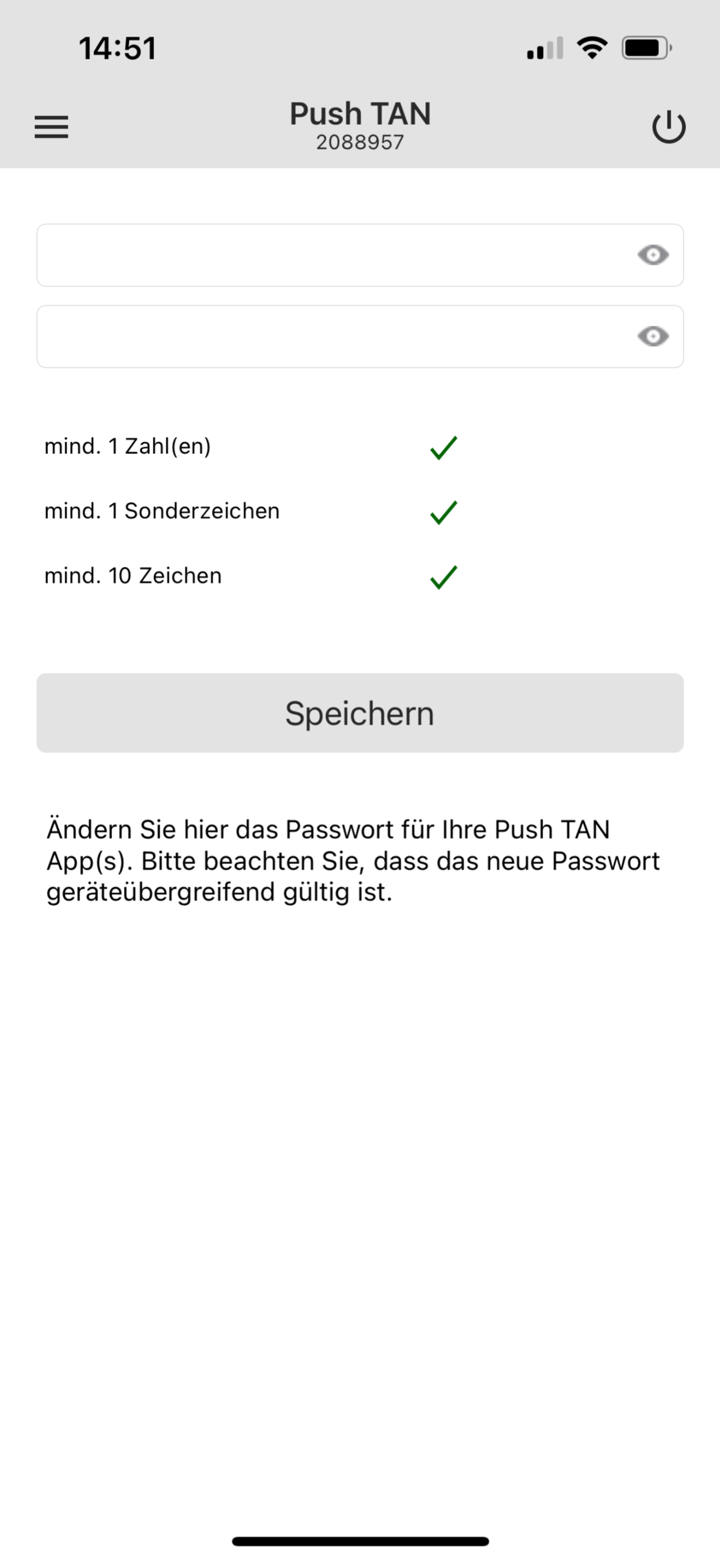

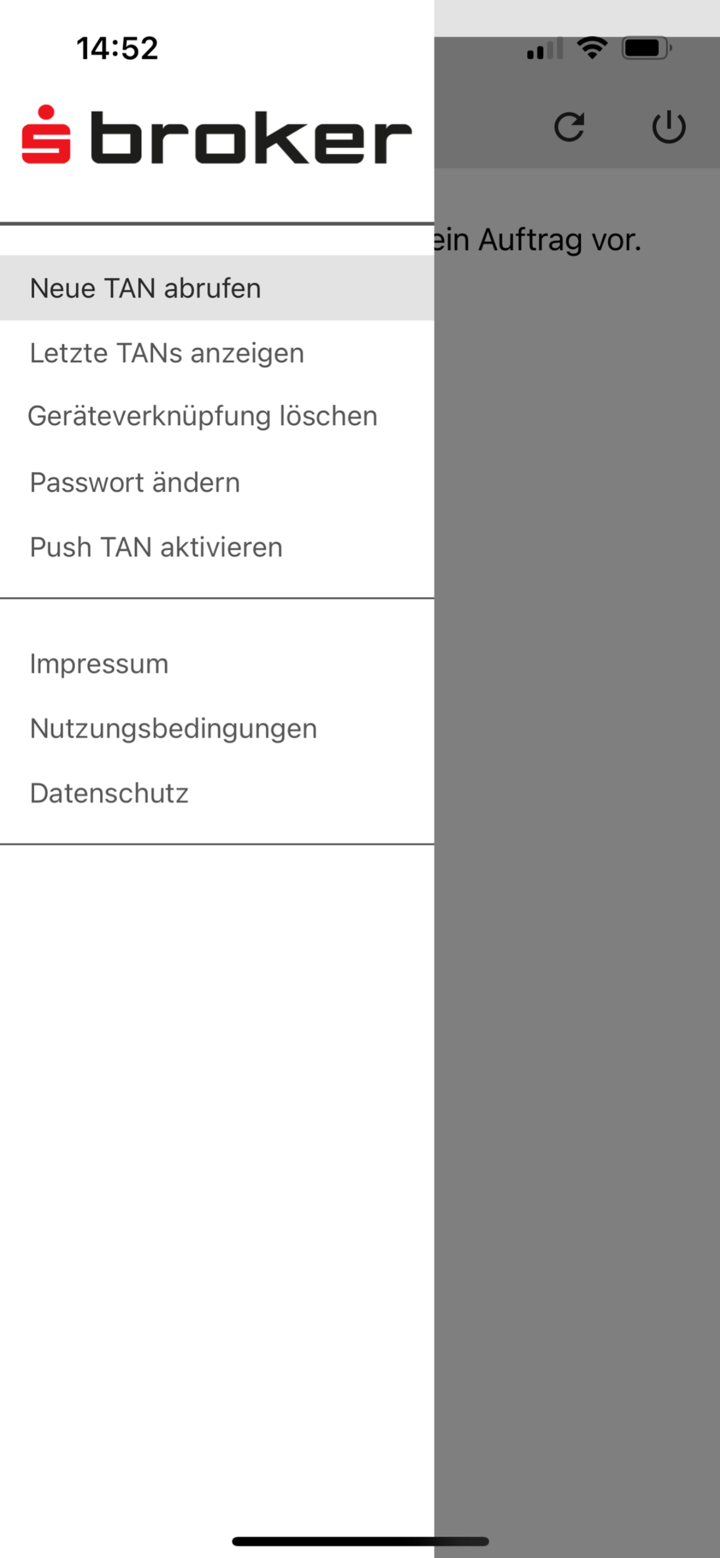

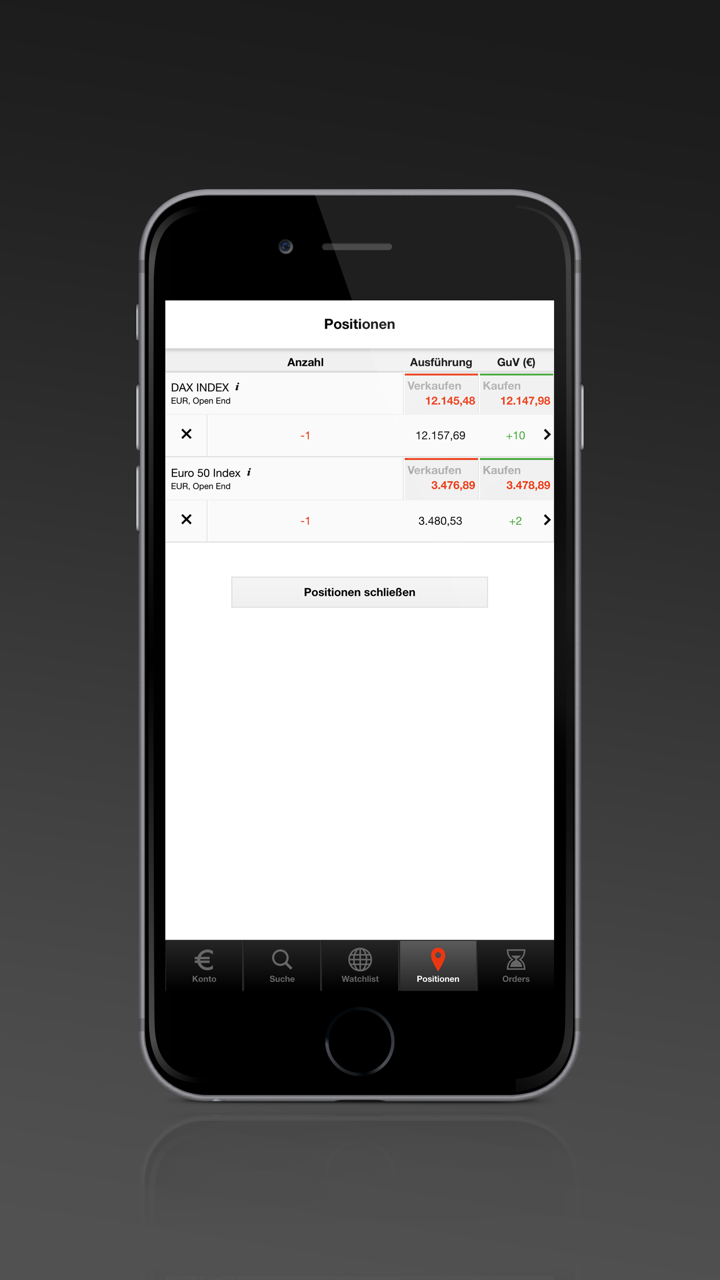

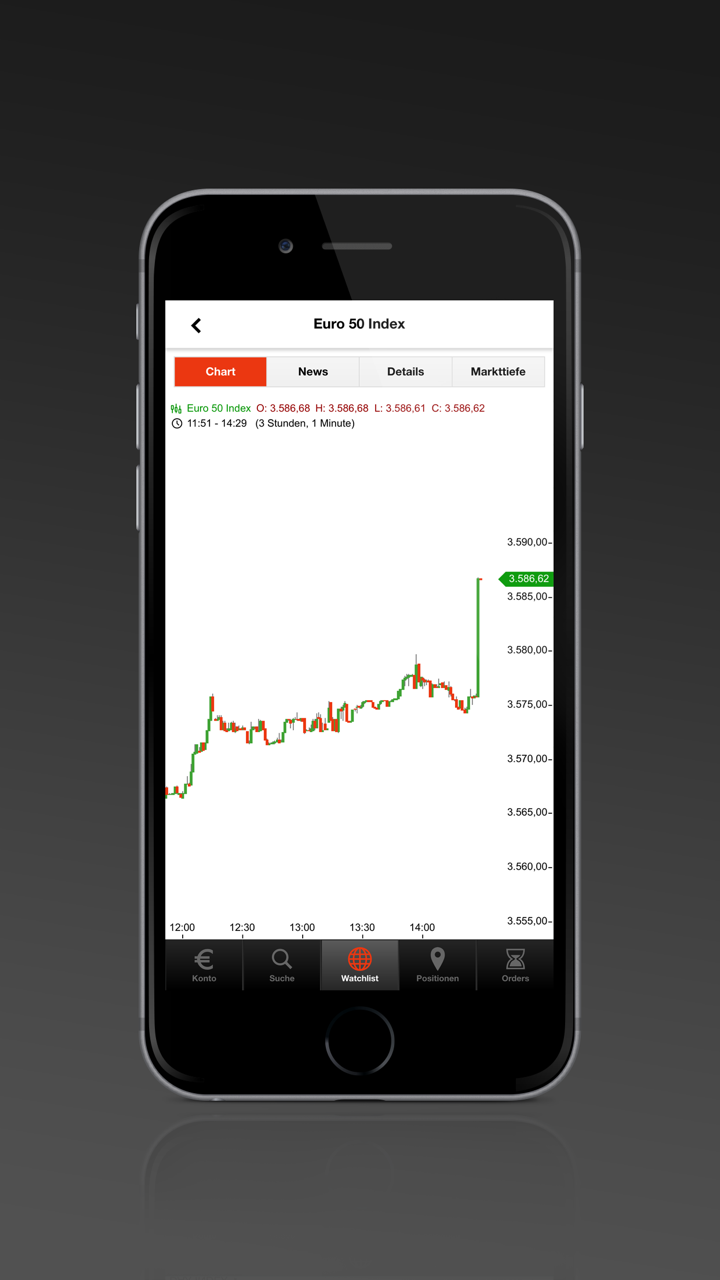

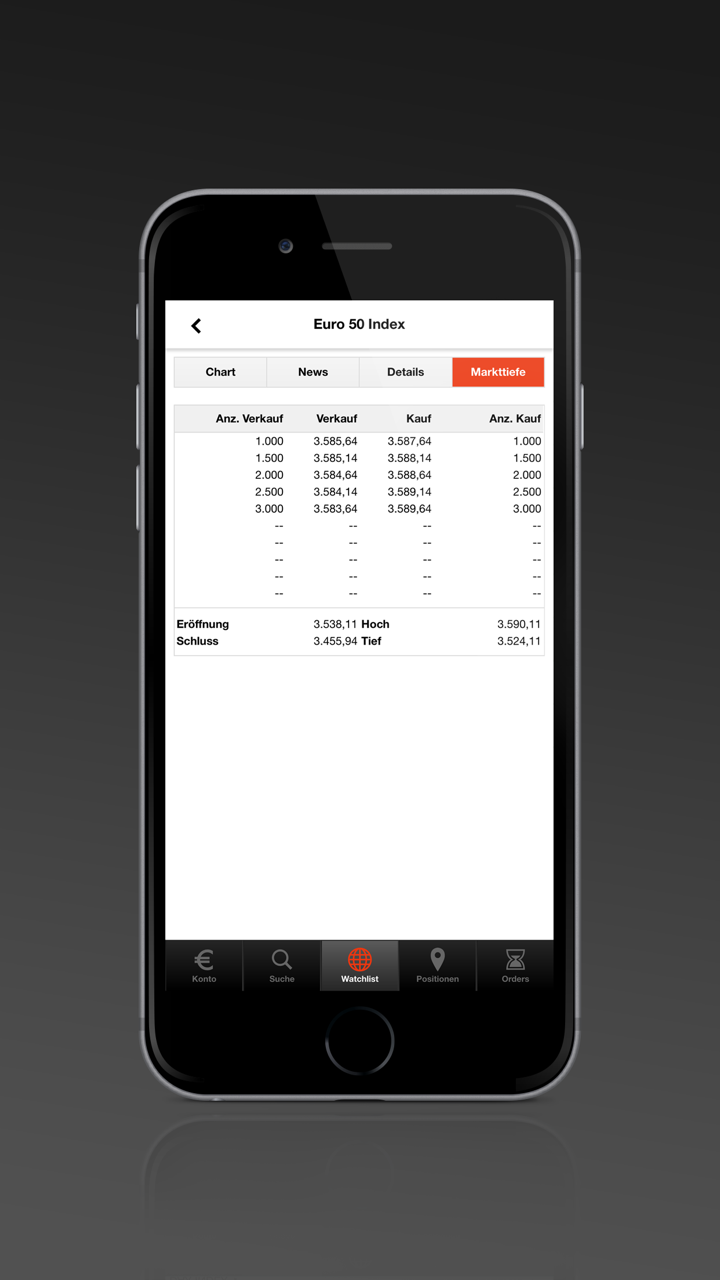

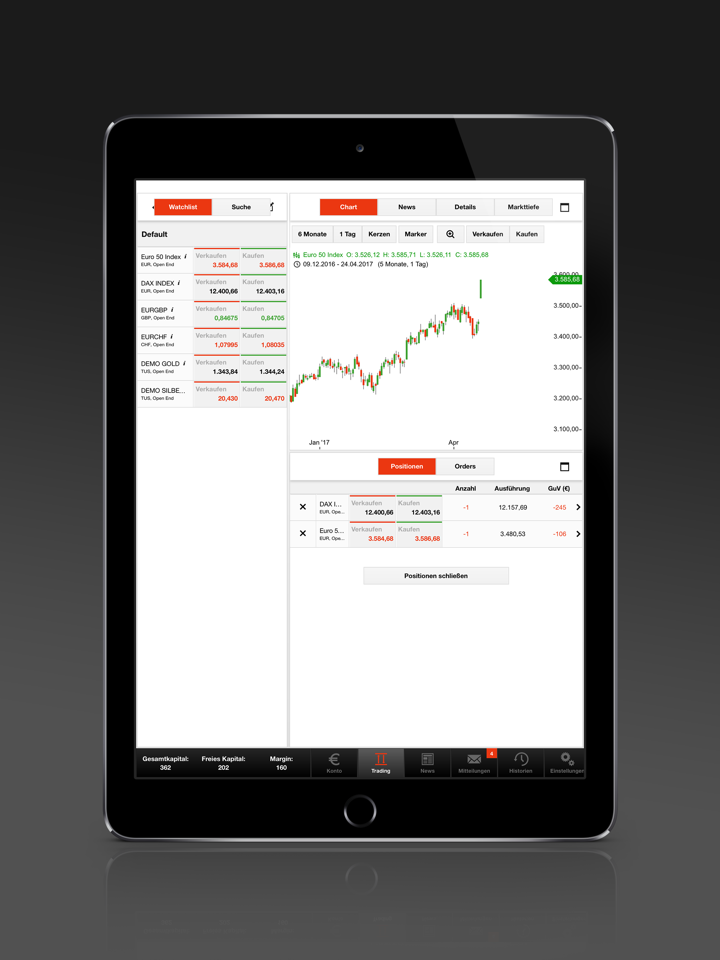

Торговая платформа

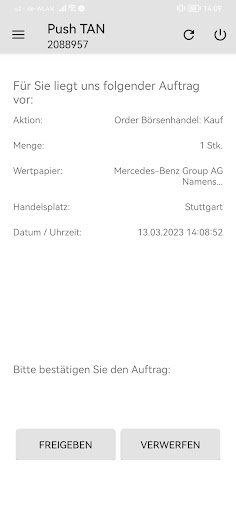

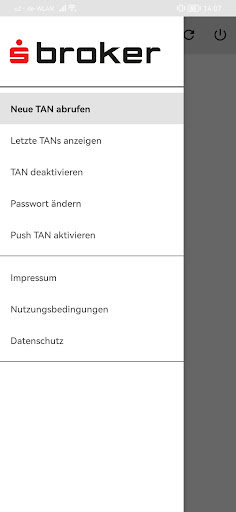

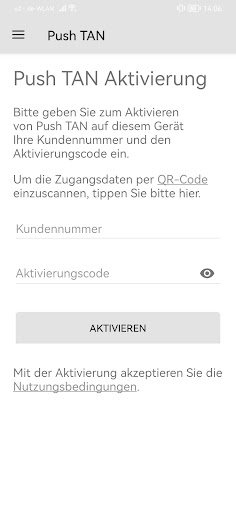

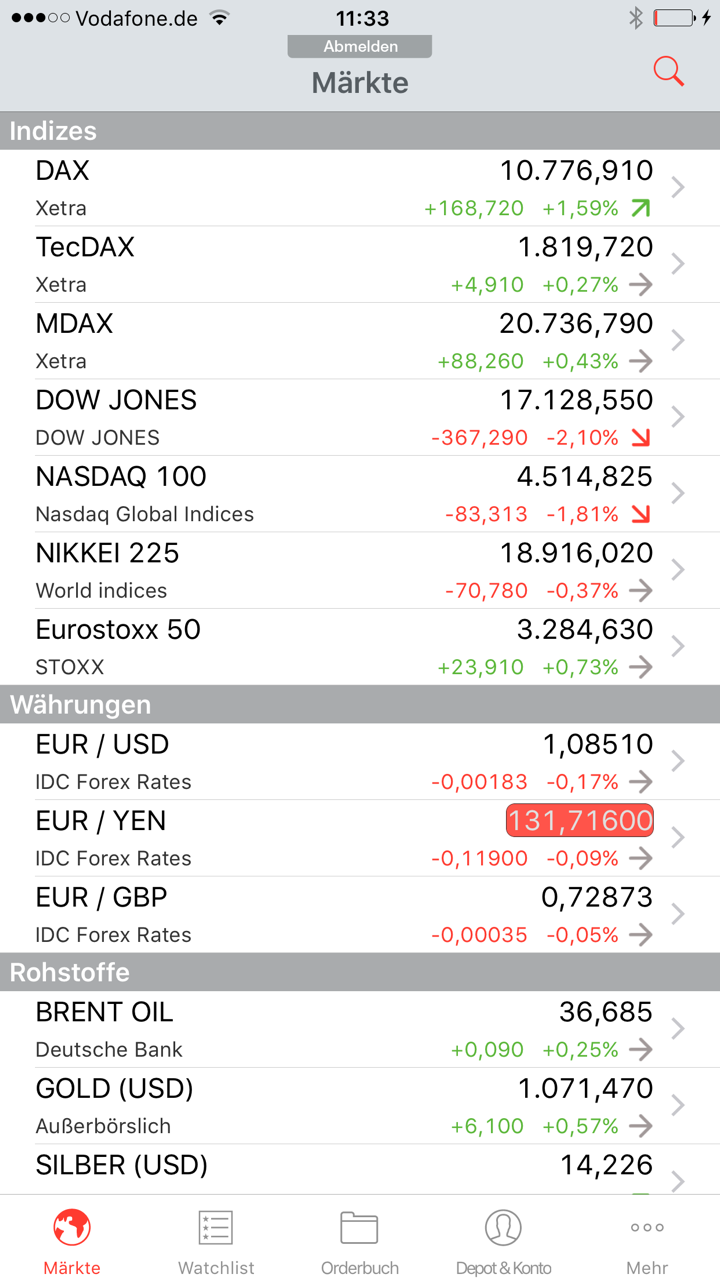

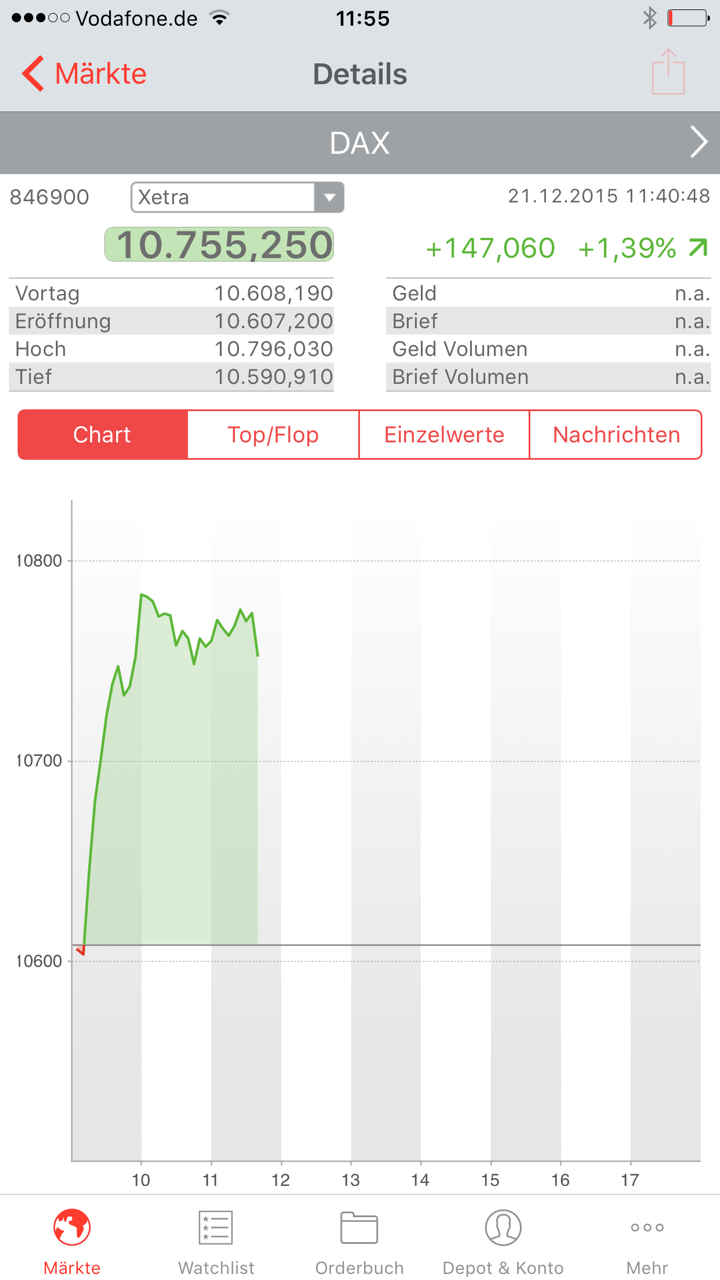

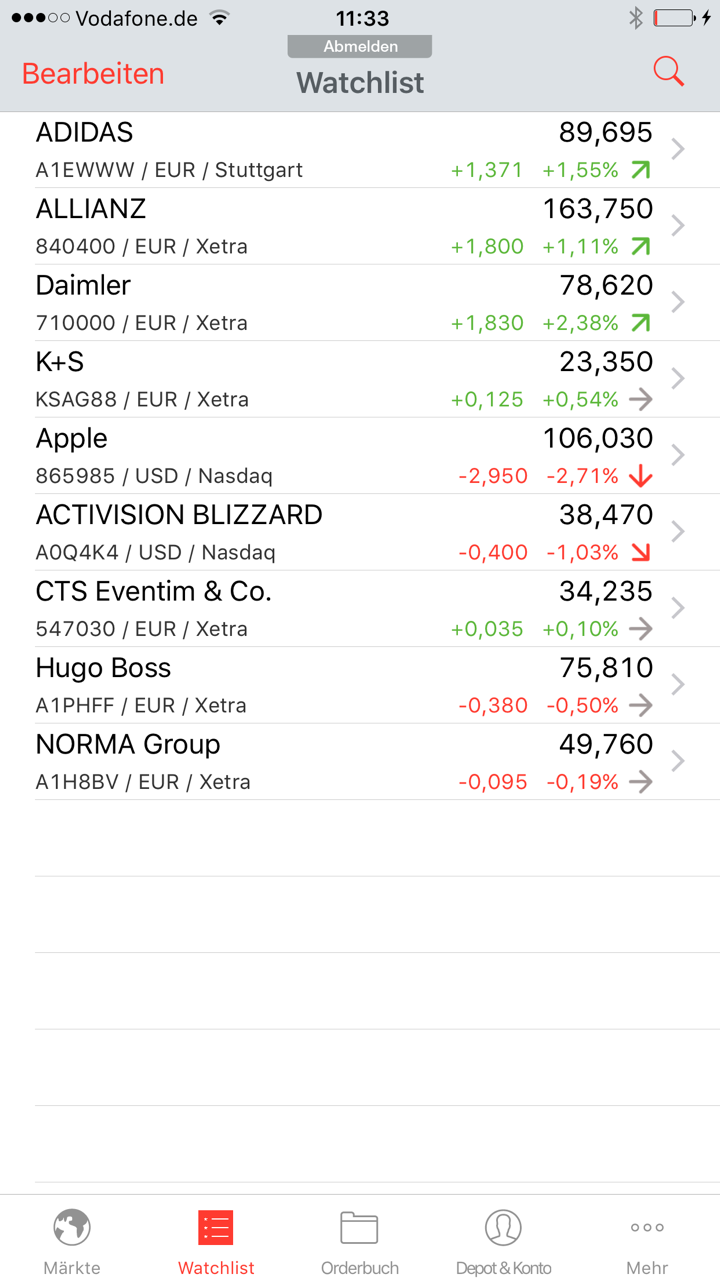

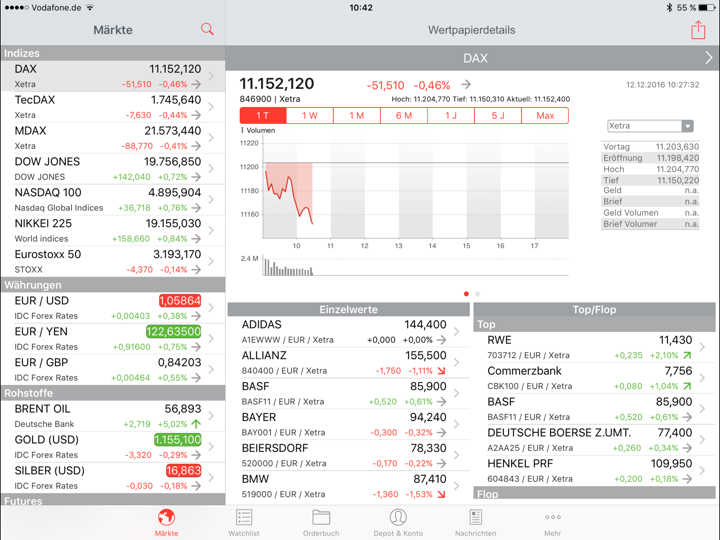

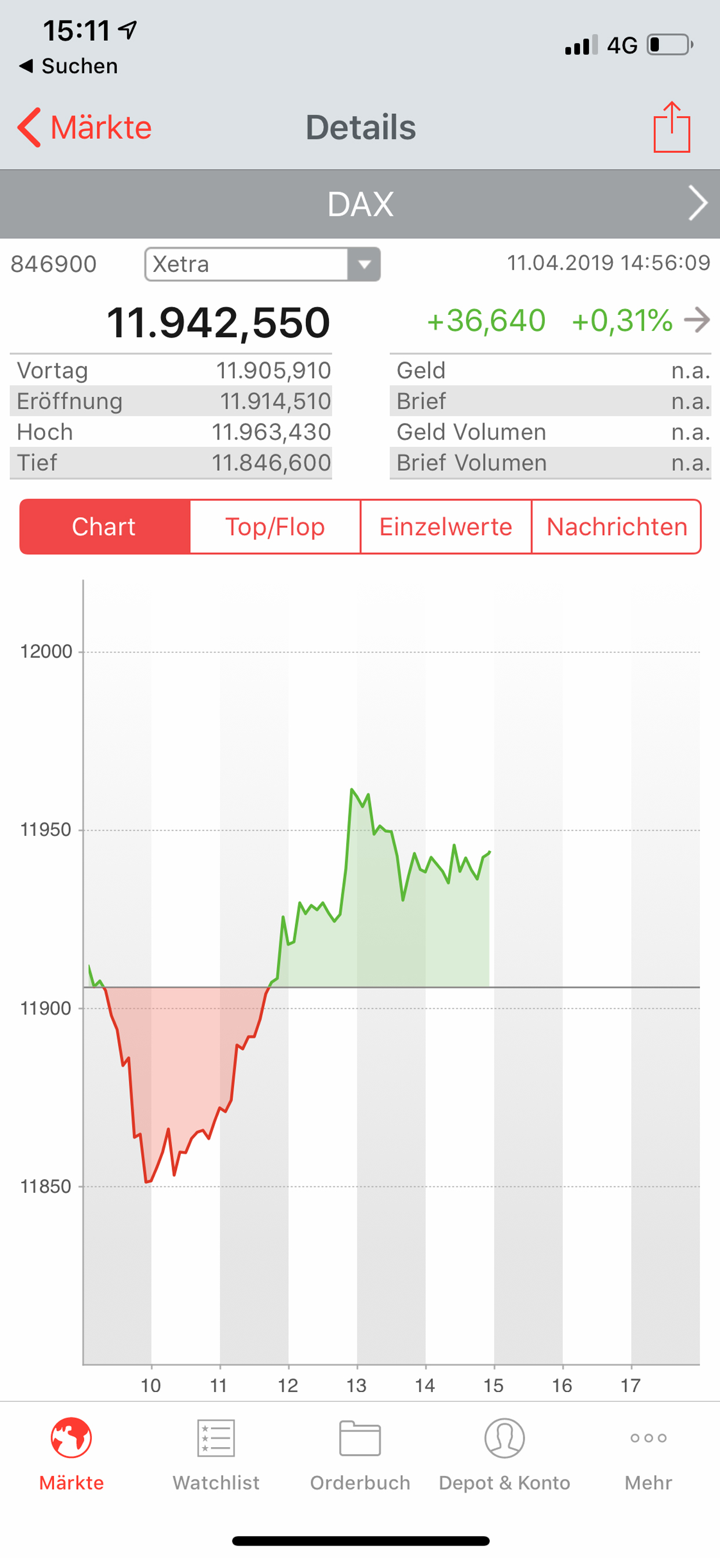

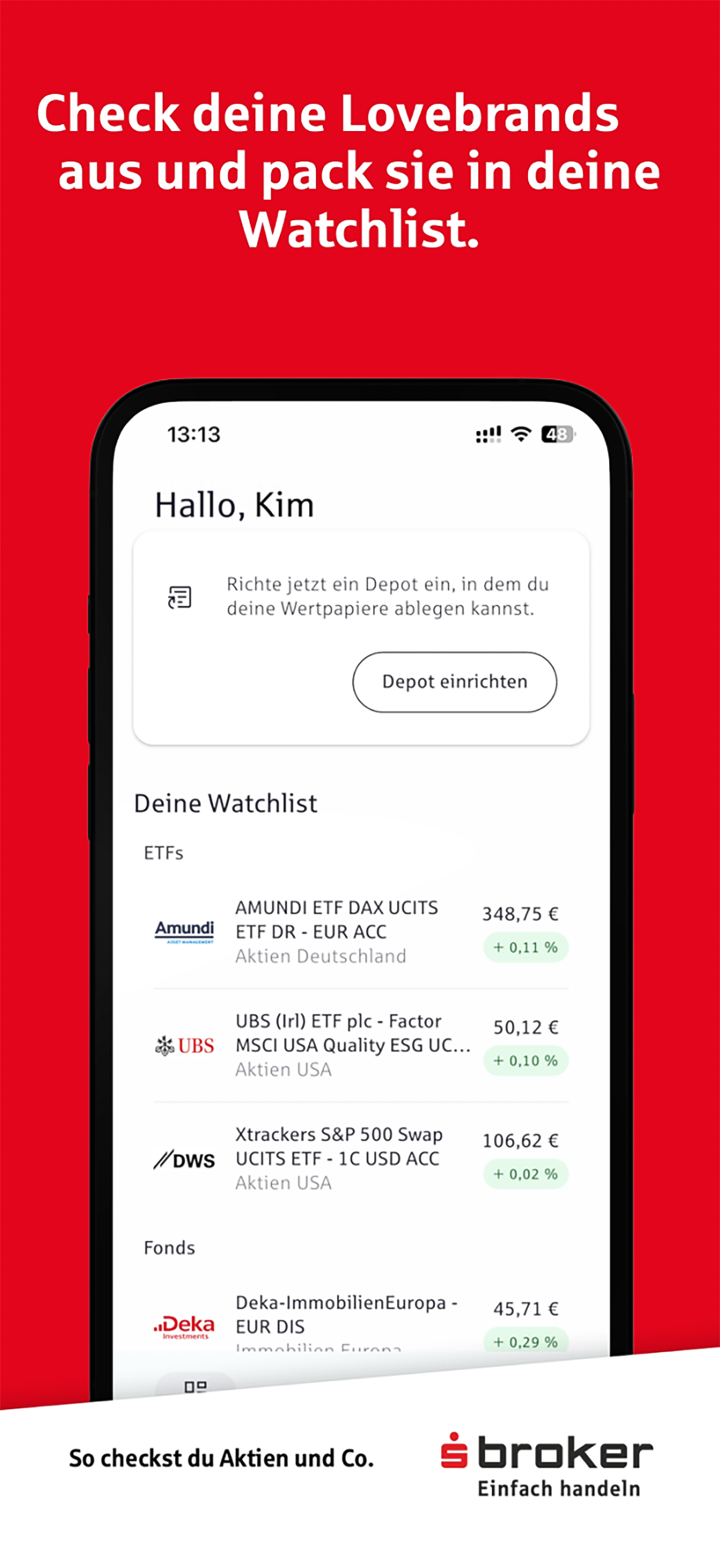

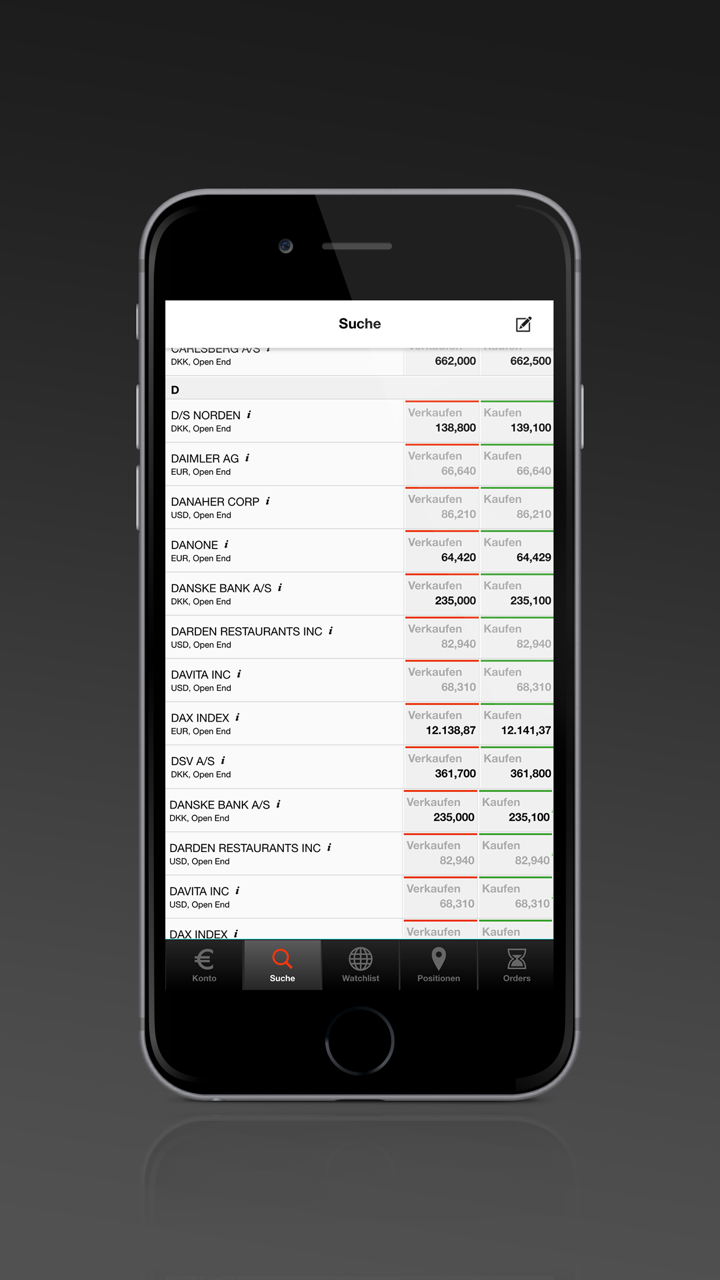

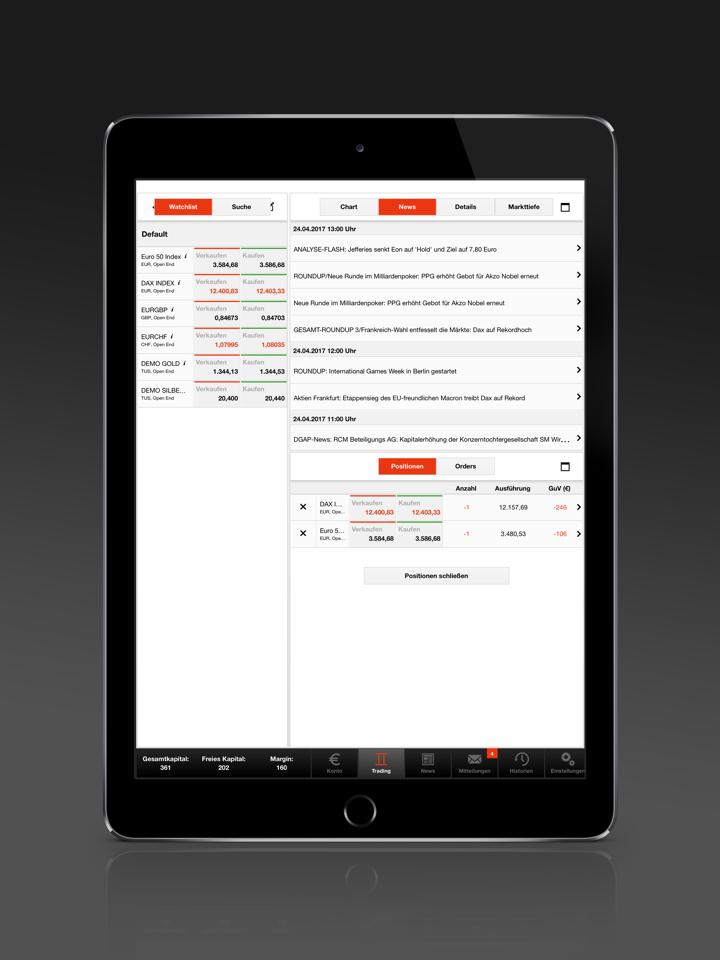

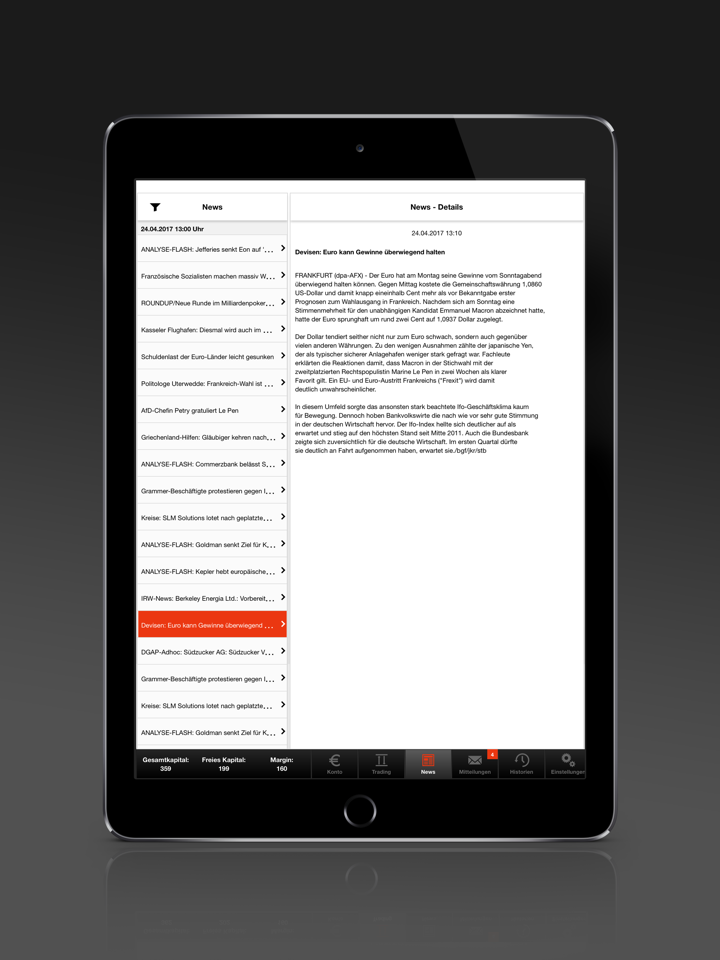

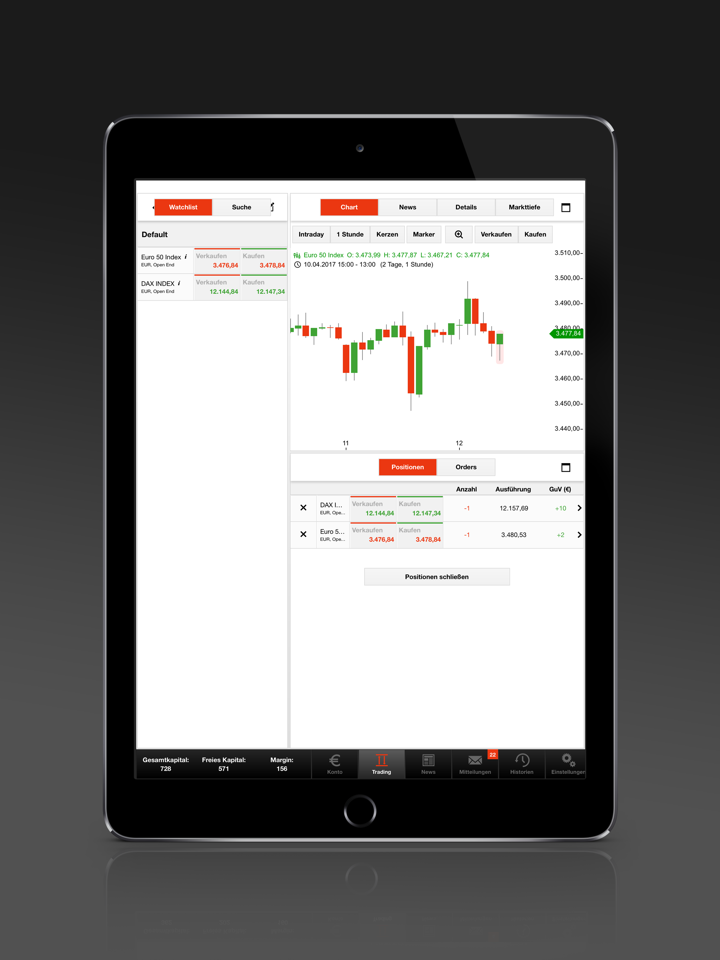

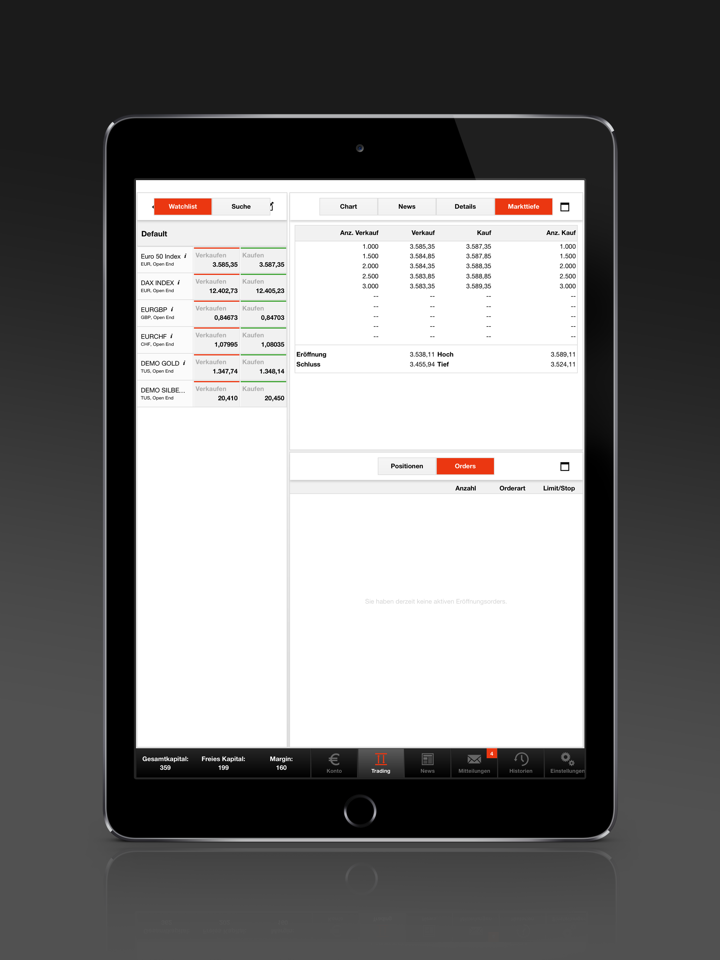

S Broker предлагает собственную торговую платформу под названием “S Broker App”, доступную как на iOS, так и на Android платформах. Она настроена специально для своих пользователей, с доступом к самой актуальной рыночной информации, новостям, индексам и котировкам, списку отслеживаемых активов и т. д.

| Торговая платформа | Поддерживается | Доступные устройства | Подходит для |

| S Broker Мобильное приложение | ✔ | iOS/Android | Пользователей S Broker |

| MT4 | ❌ | / | Начинающих трейдеров |

| MT5 | ❌ | / | Опытных трейдеров |