Şirket özeti

| S Broker İnceleme Özeti | |

| Kuruluş Yılı | 1999 |

| Kayıtlı Ülke/Bölge | Almanya |

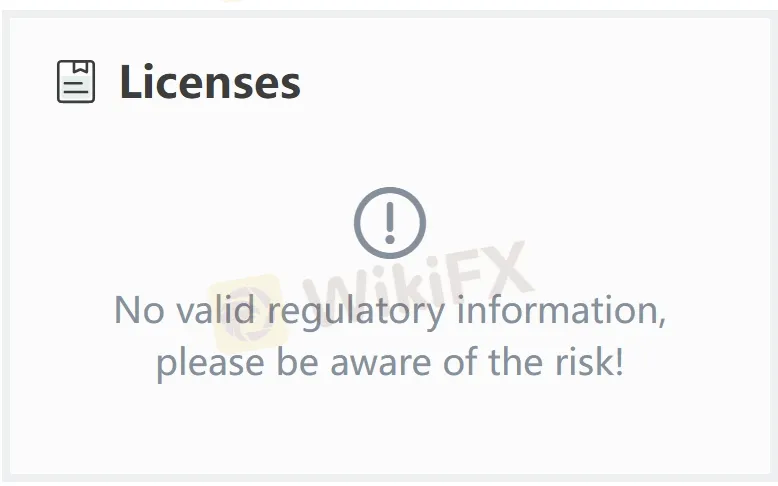

| Düzenleme | Düzenleme yok |

| Piyasa Araçları | Hisse senetleri, fonlar, ETF'ler, CFD'ler, tahviller, endeksler, vb. |

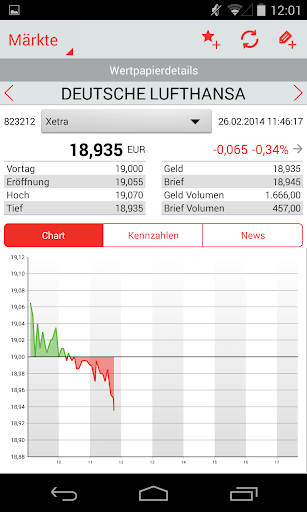

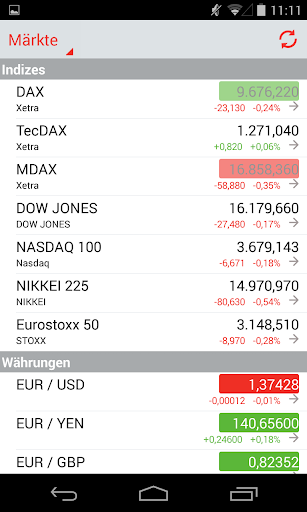

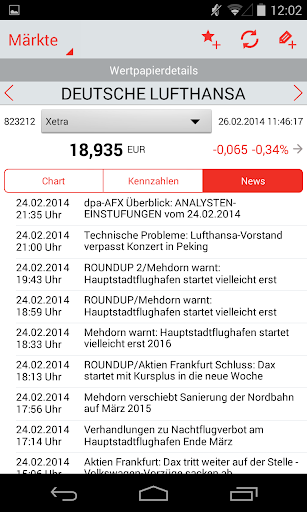

| İşlem Platformu | S Broker Mobil Uygulaması |

| Minimum Yatırım | 0 |

| Müşteri Desteği | Canlı destek |

| Tel: 0611 2044-1912; 0611 2044-1911; 0611 2044-1944 | |

| E-posta: service@sbroker.de | |

| SSS, Instagram, YouTube, LinkedIn, Facebook, vb. | |

| Adres: S Broker AG & Co. KG, Müşteri Hizmetleri, Posta Kutusu 90 01 50, 39133 Magdeburg | |

S Broker Bilgileri

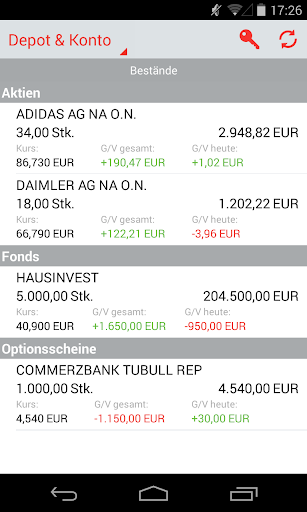

S Broker, başlangıçta 1999 yılında Almanya'da kurulan bir sermaye piyasası işlem şirketidir. Şirket şu anda hisse senetleri, fonlar, ETF'ler, CFD'ler, tahviller, endeksler gibi ürünler de dahil olmak üzere ticari ürünler sunmaktadır. Minimum depozito gereksinimi olmadan iki ticaret hesabı sunmaktadır.

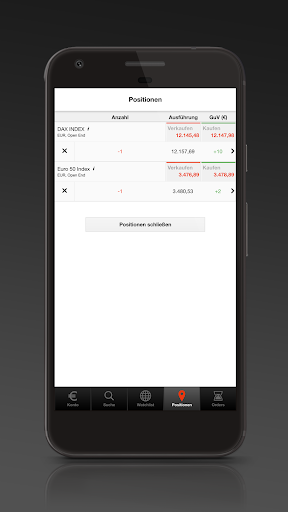

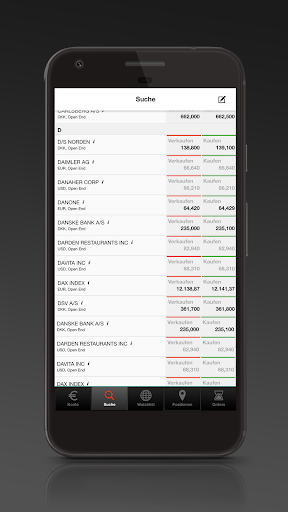

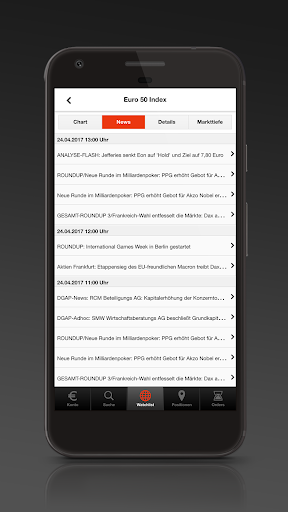

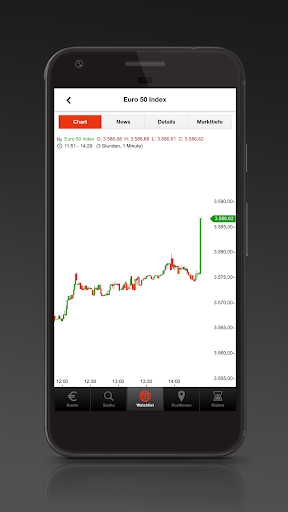

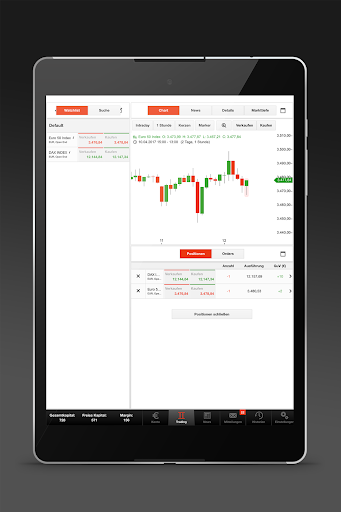

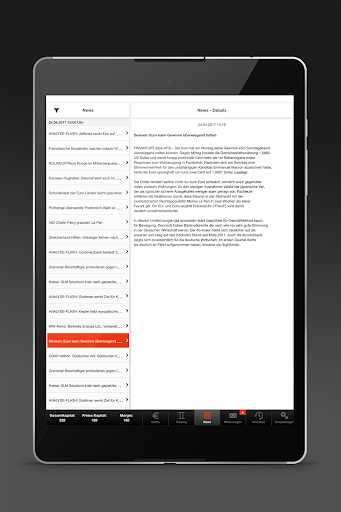

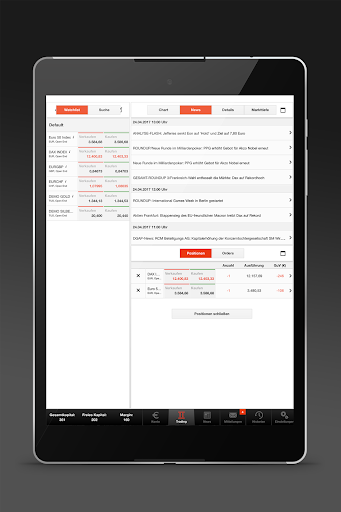

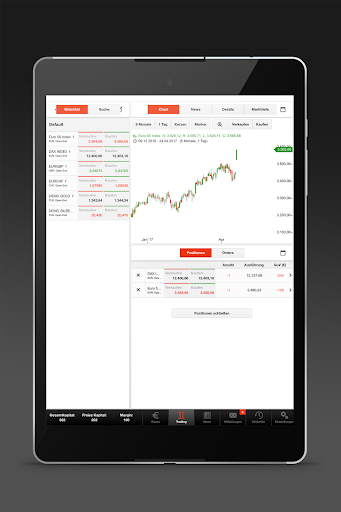

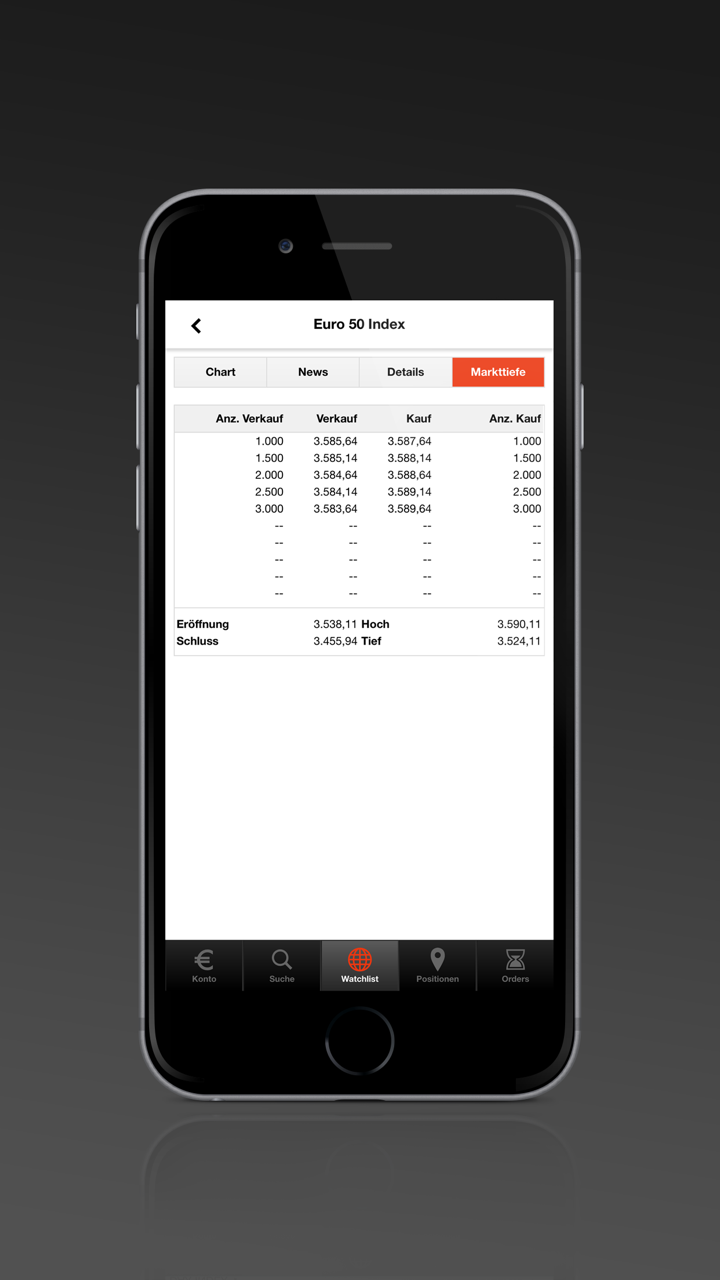

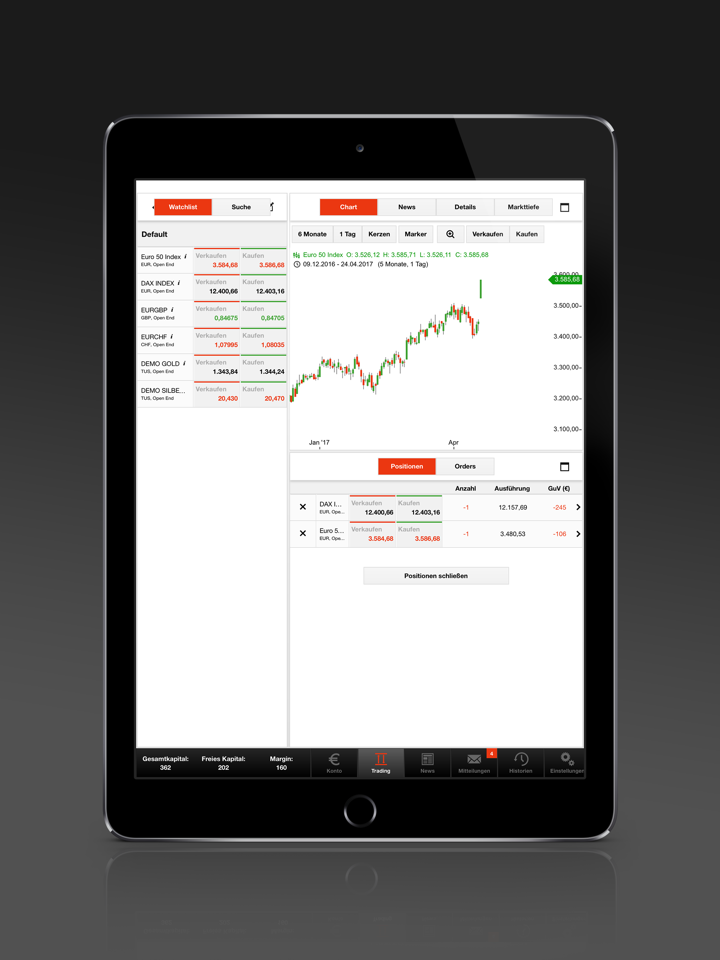

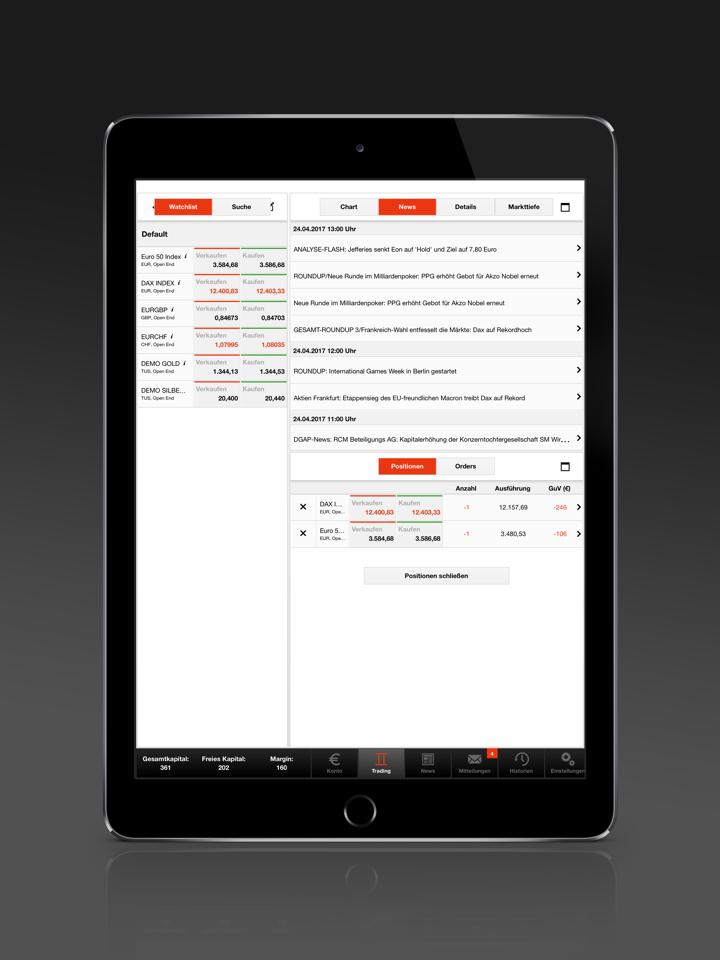

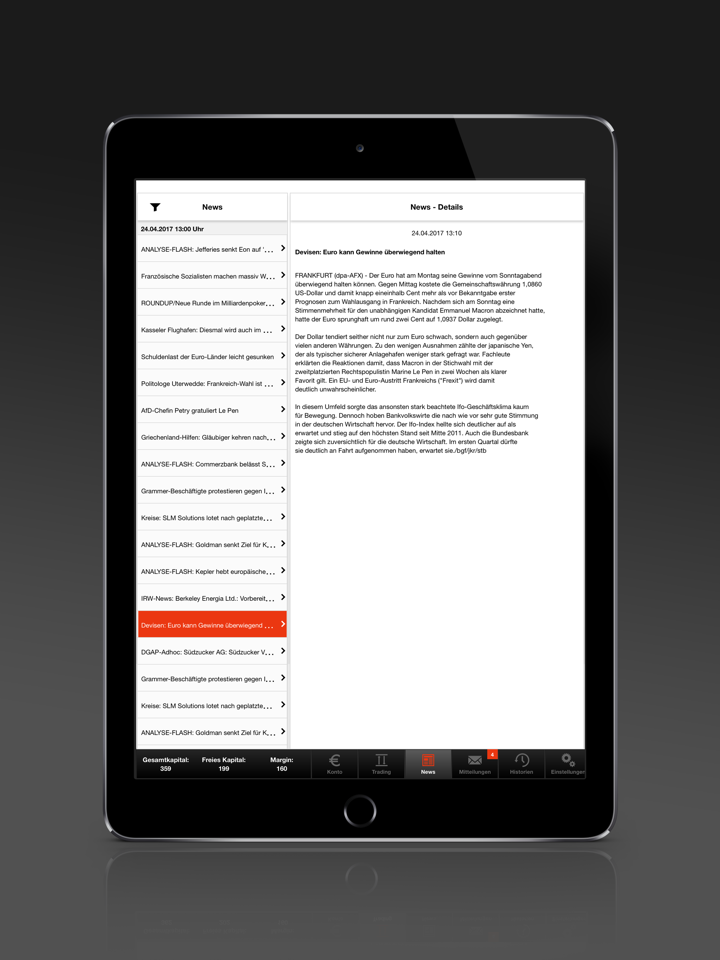

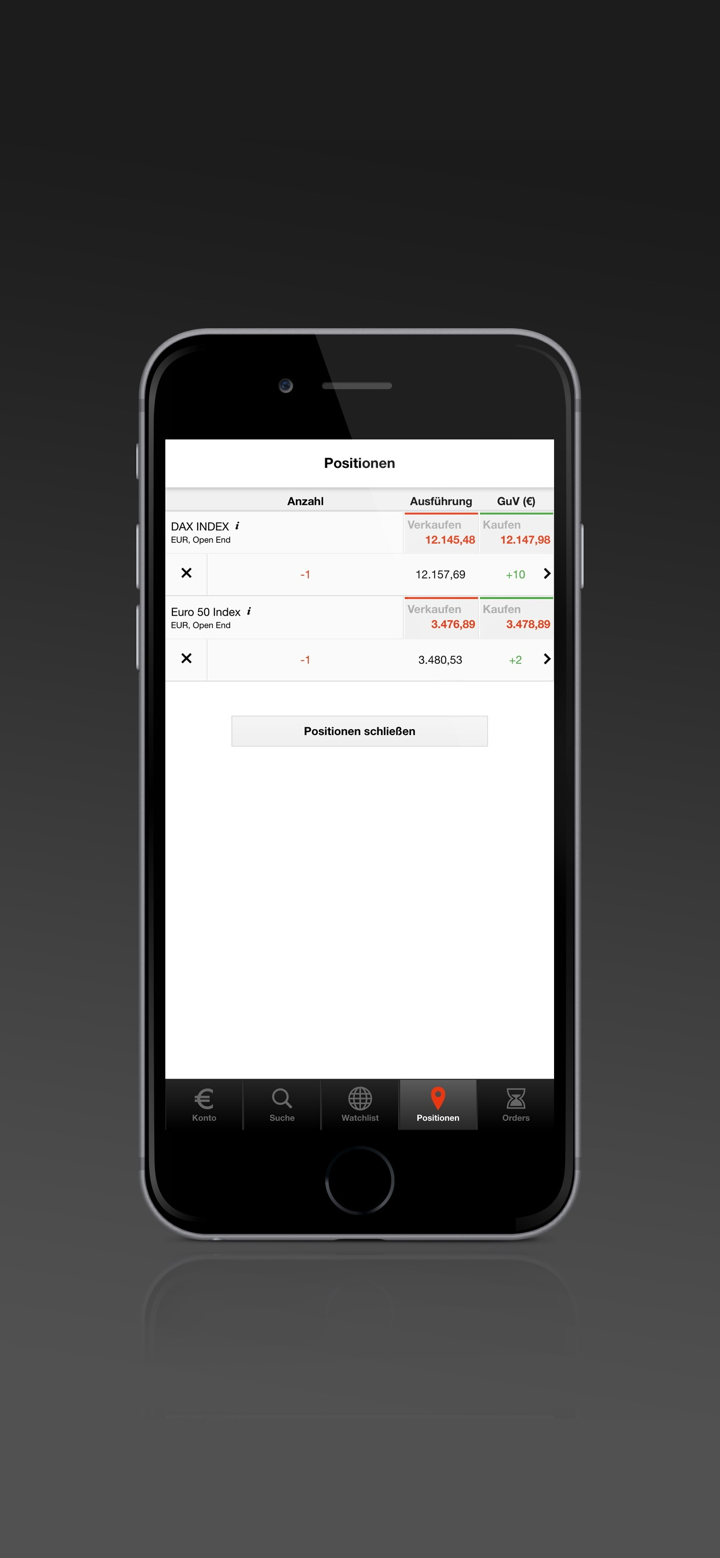

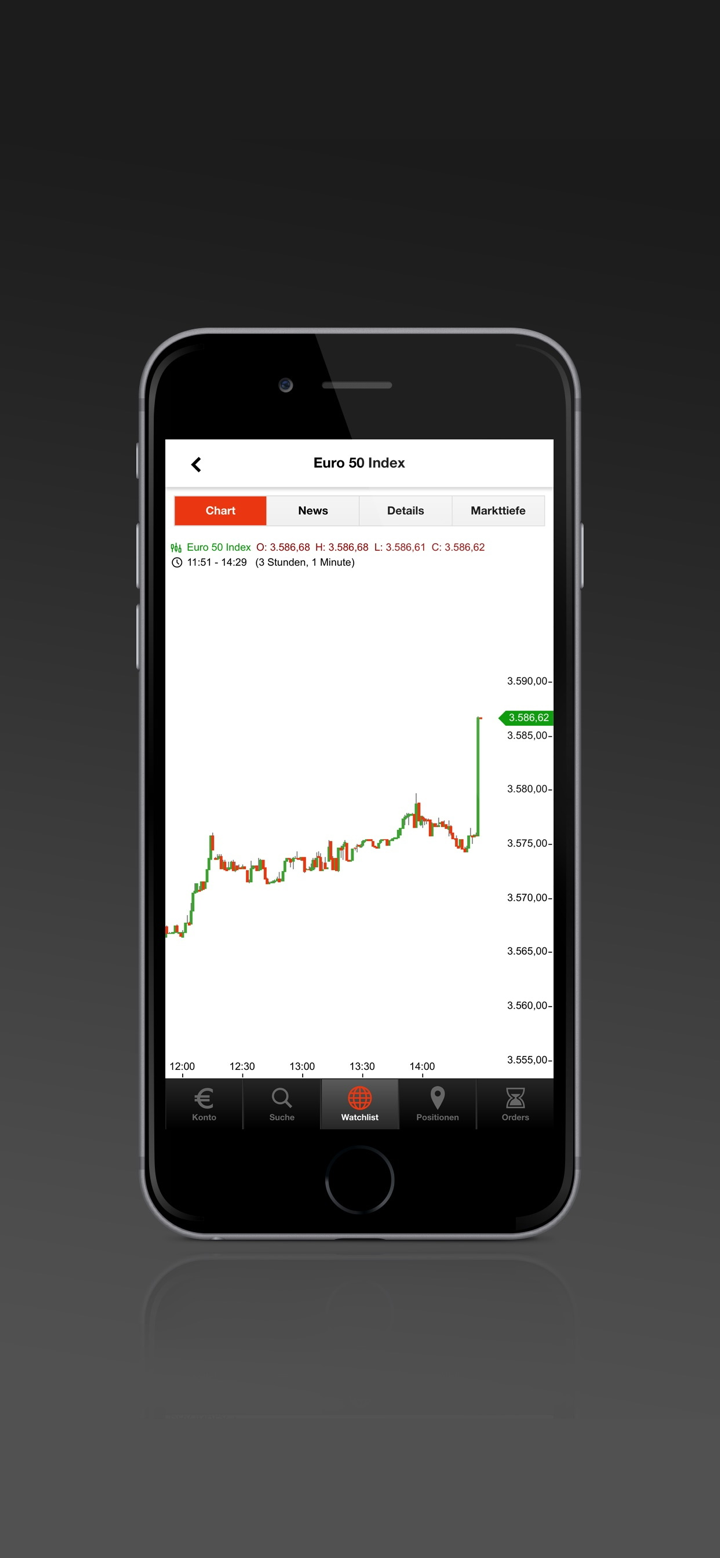

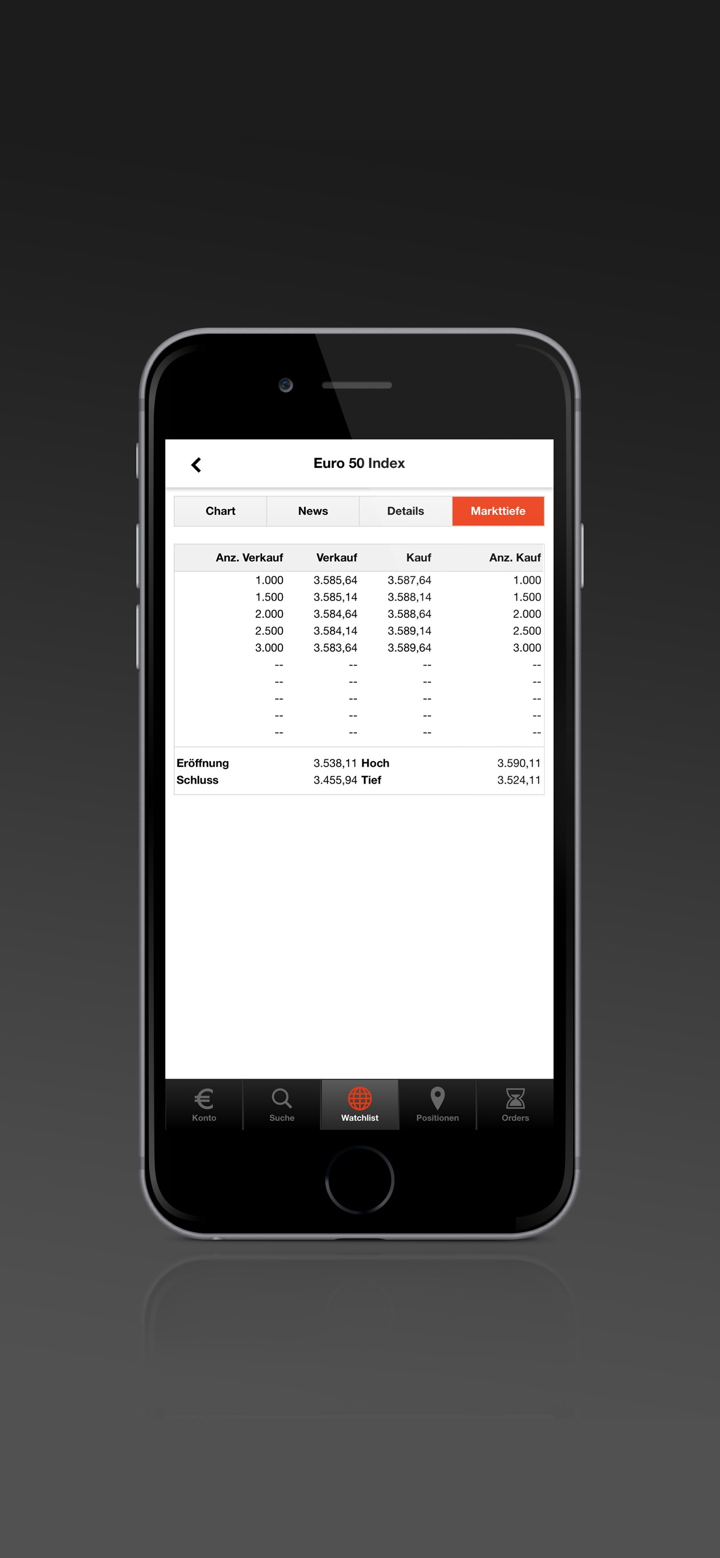

İşlemleri gerçekleştirmek için şirket, kendi kullanıcıları için özel olarak geliştirdiği S Broker Mobil Uygulamasını kullanmaktadır.

Ancak, şu anda broker herhangi bir resmi otorite tarafından iyi düzenlenmemektedir, bu da güvenilirliğini ve güvenilirliğini azaltmaktadır.

Artıları ve Eksileri

| Artılar | Eksiler |

| Yıllara dayanan endüstri deneyimi | Düzenleme yok |

| Çeşitli ticaret ürünleri | |

| Minimum depozito yok |

S Broker Güvenilir mi?

Bir aracı platformunun güvenliğini ölçmenin en önemli faktörü resmi olarak düzenlenip düzenlenmediğidir. S Broker düzenlenmemiş bir brokerdir, bu da kullanıcıların fonlarının ve ticari faaliyetlerinin etkili bir şekilde korunmadığı anlamına gelir. Yatırımcılar S Broker seçerken dikkatli olmalıdır.

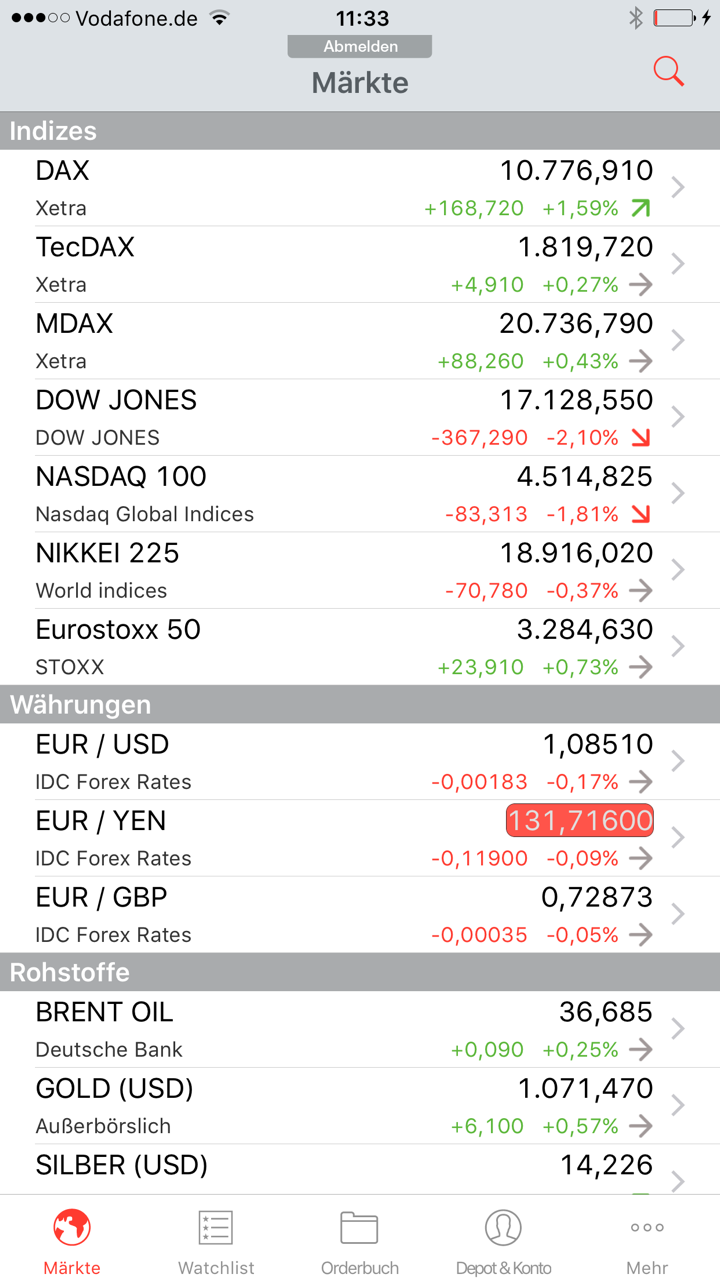

S Broker Üzerinde Ne Alım Satım Yapabilirim?

| Alım Satım Araçları | Desteklenen |

| Hisse Senetleri | ✔ |

| Fonlar | ✔ |

| ETF'ler | ✔ |

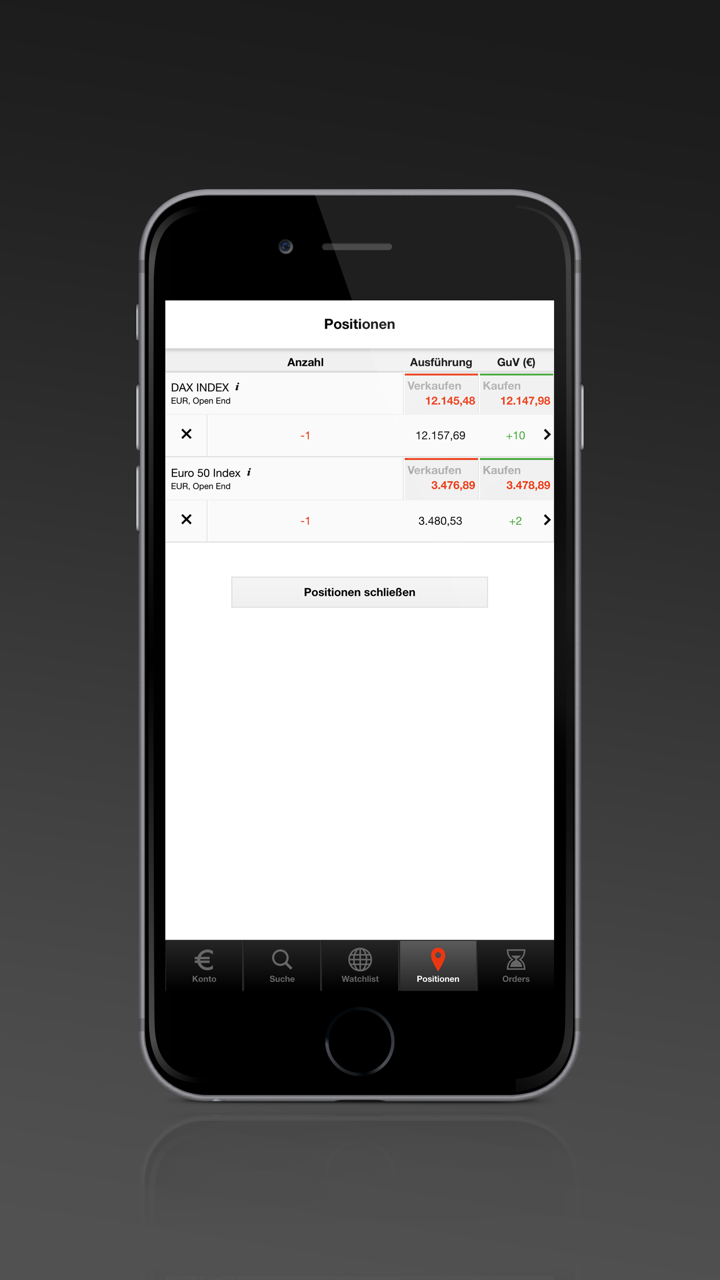

| CFD'ler | ✔ |

| Tahviller | ✔ |

| Endeksler | ✔ |

| Forex | ❌ |

| Emtialar | ❌ |

| Kripto Paralar | ❌ |

| Opsiyonlar | ❌ |

Hesap Türü

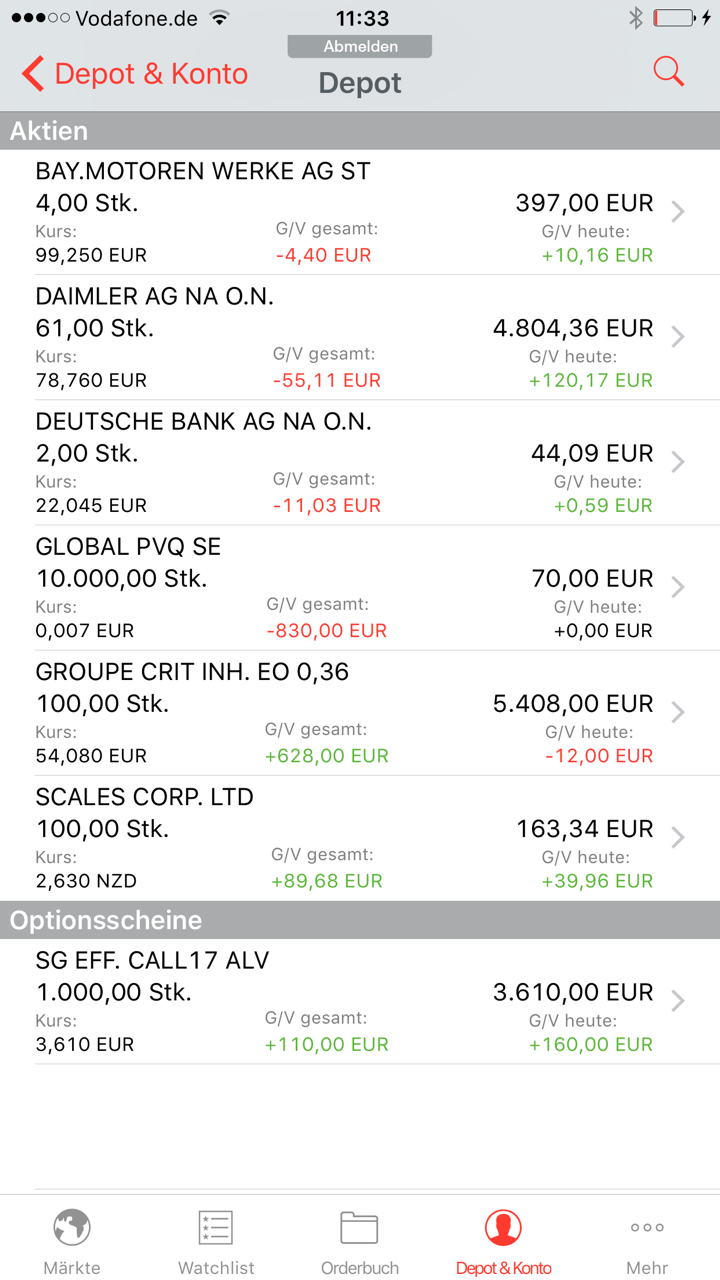

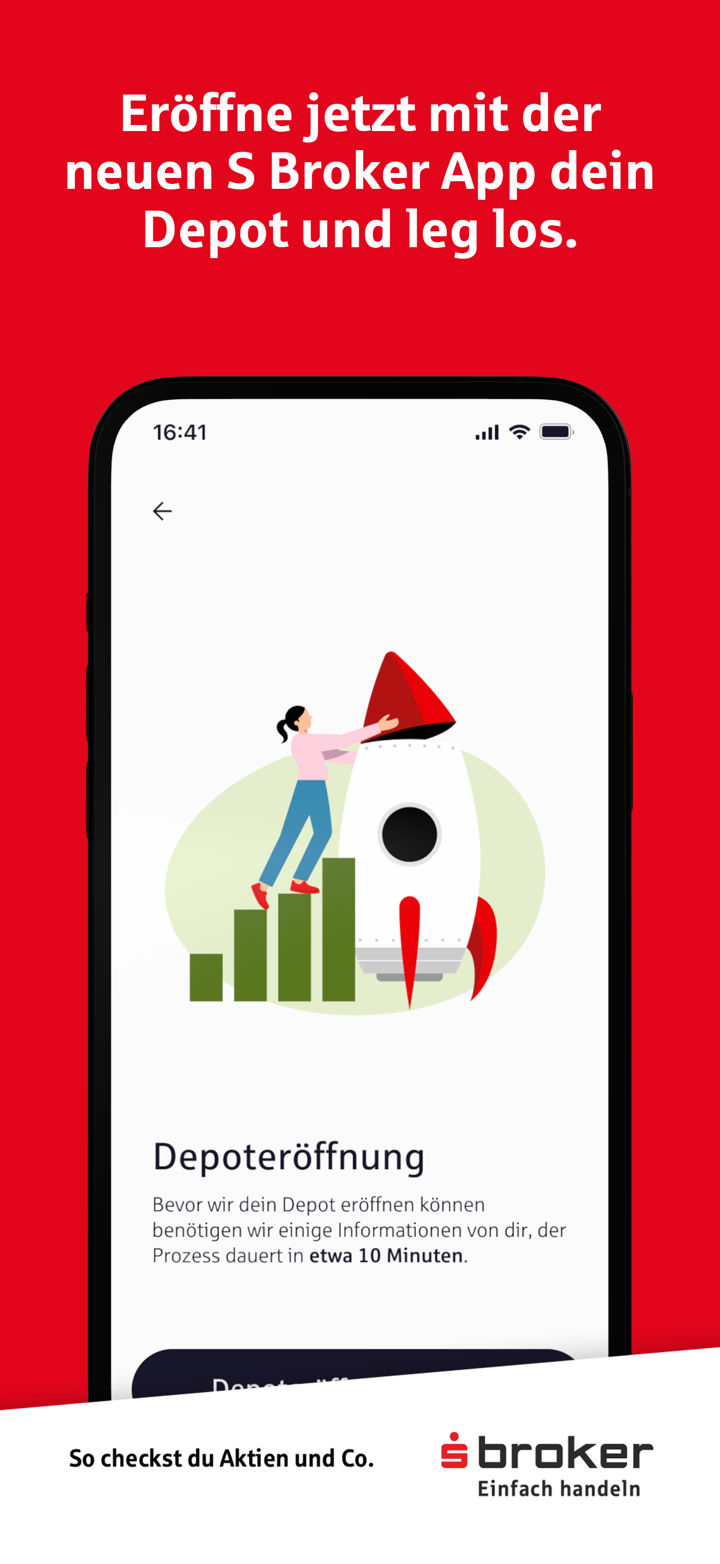

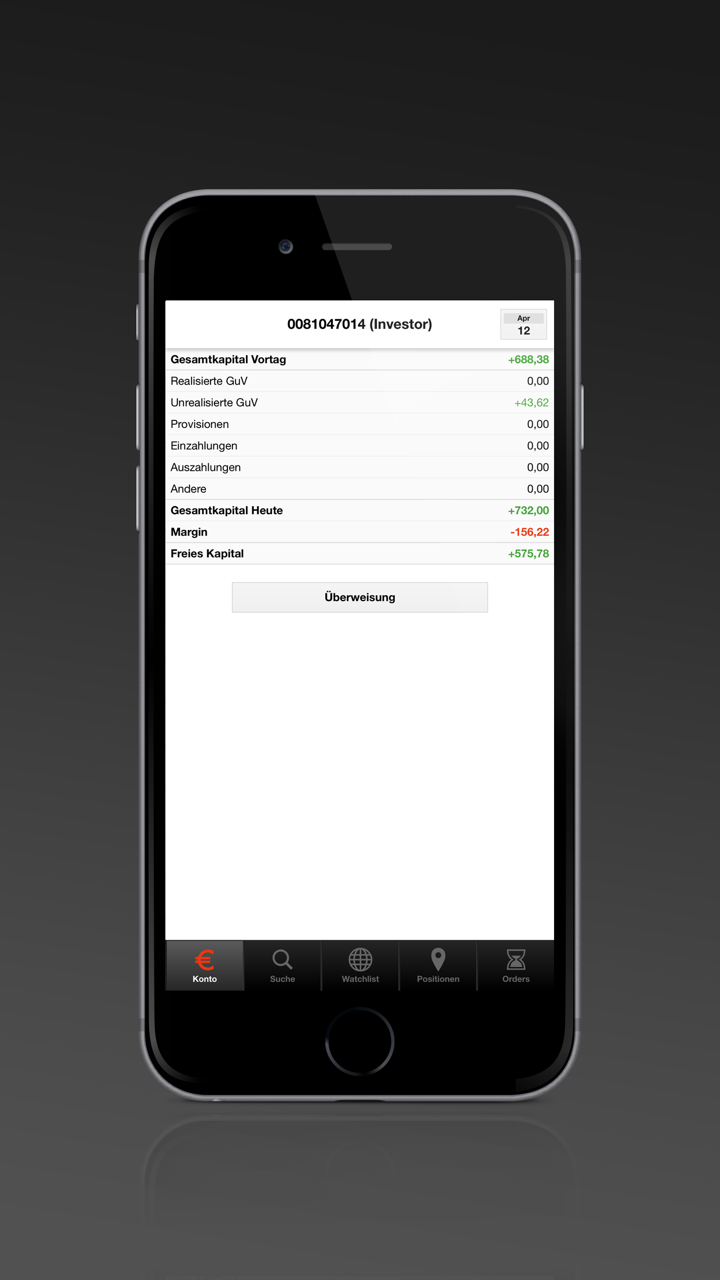

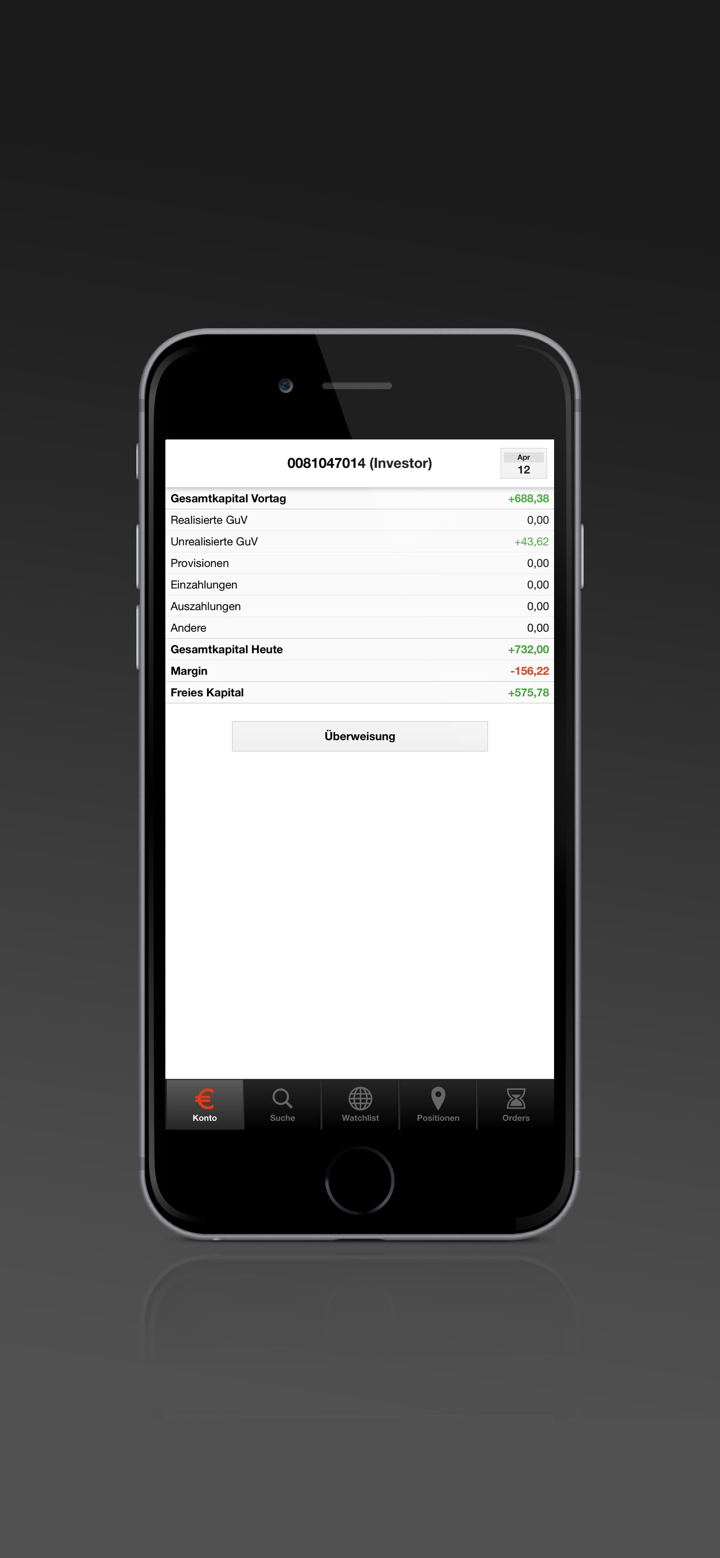

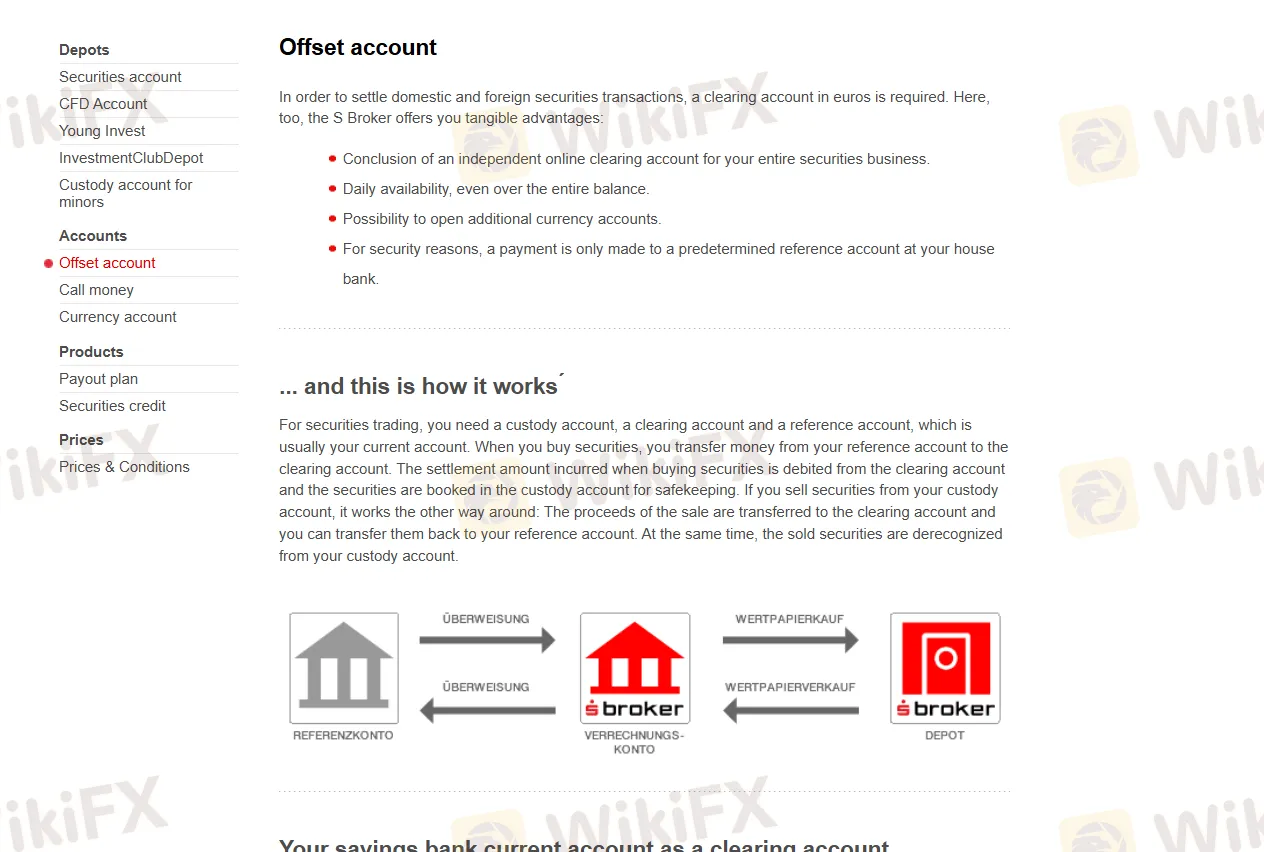

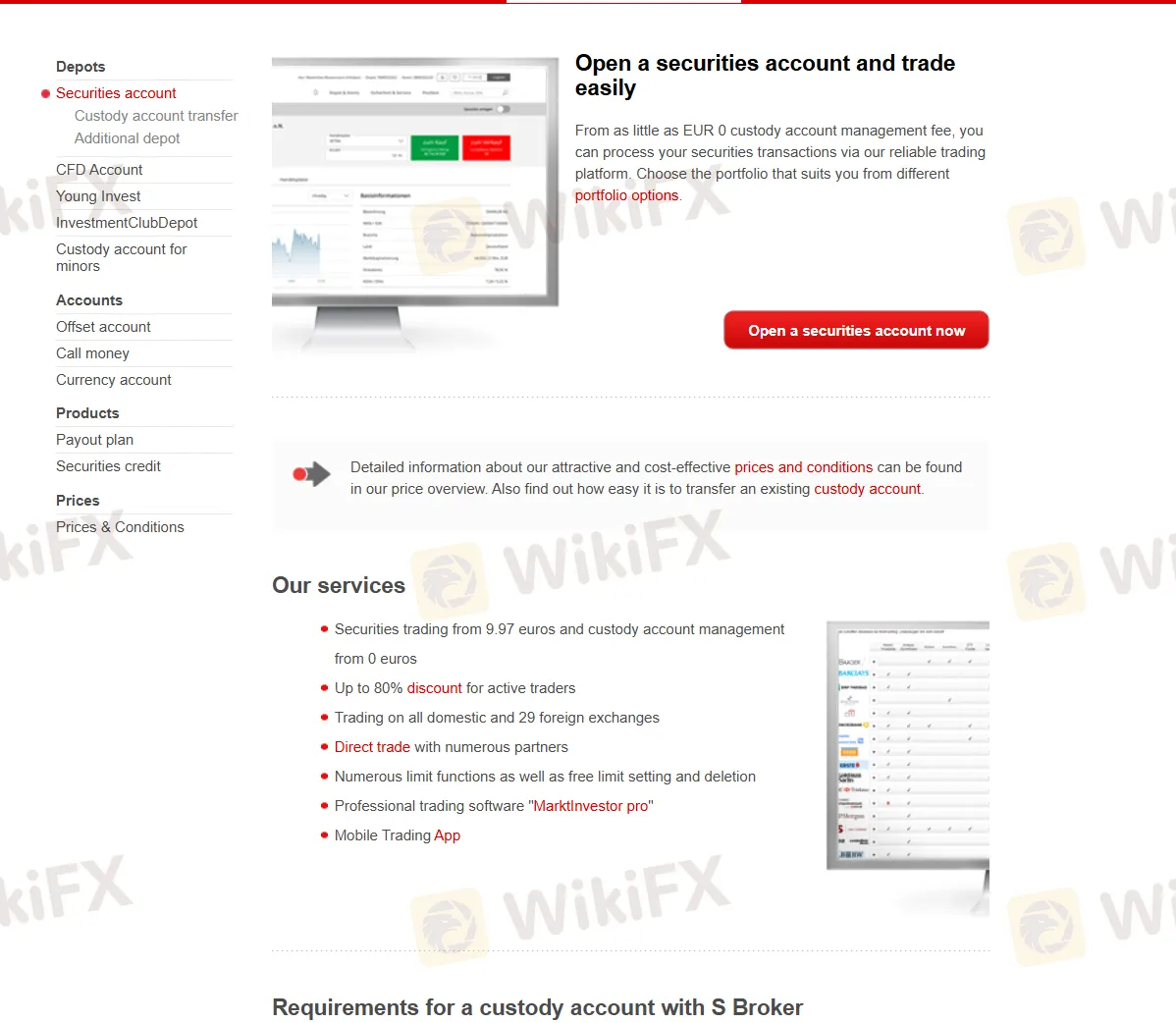

S Broker farklı ürünler için üç hesap türü sunar: CFD hesabı, menkul kıymetler hesabı, dengeleme hesabı ve para hesabı.

Şirketle bir hesap açmak için minimum depozito gereksinimleri yoktur.

İşlem Platformu

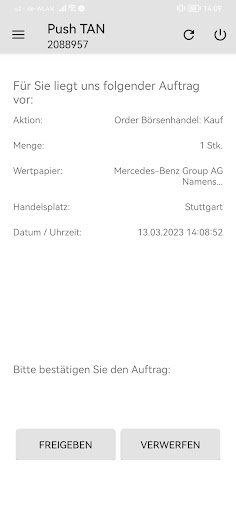

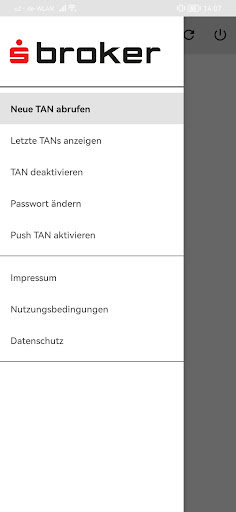

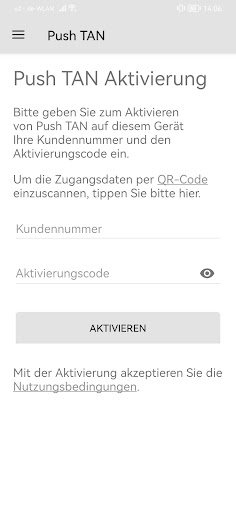

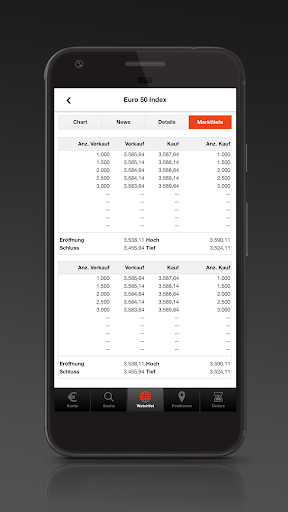

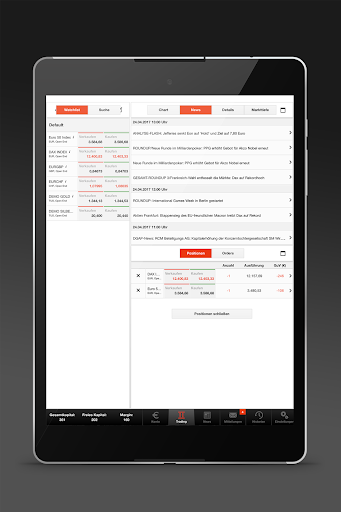

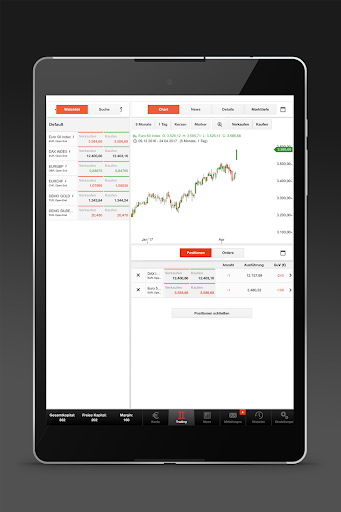

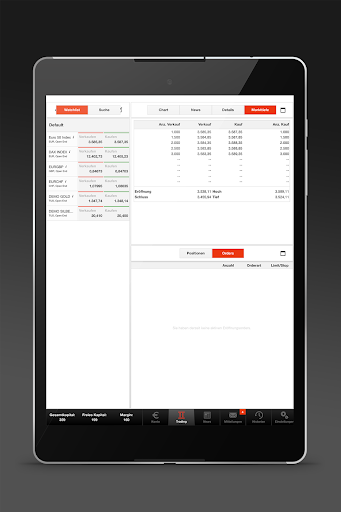

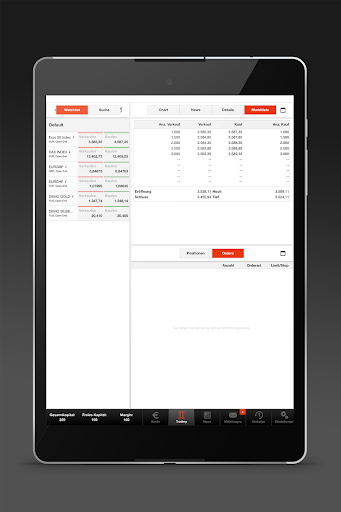

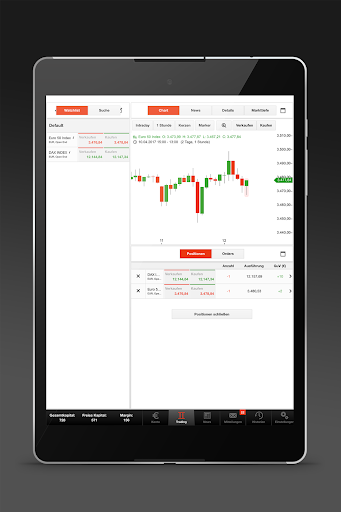

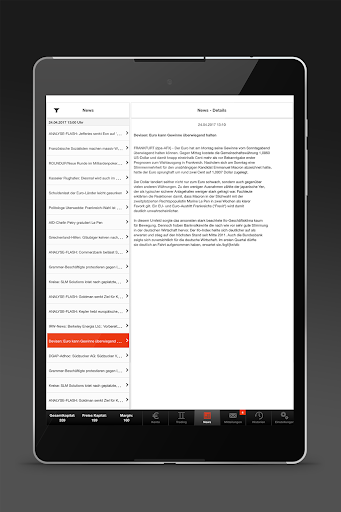

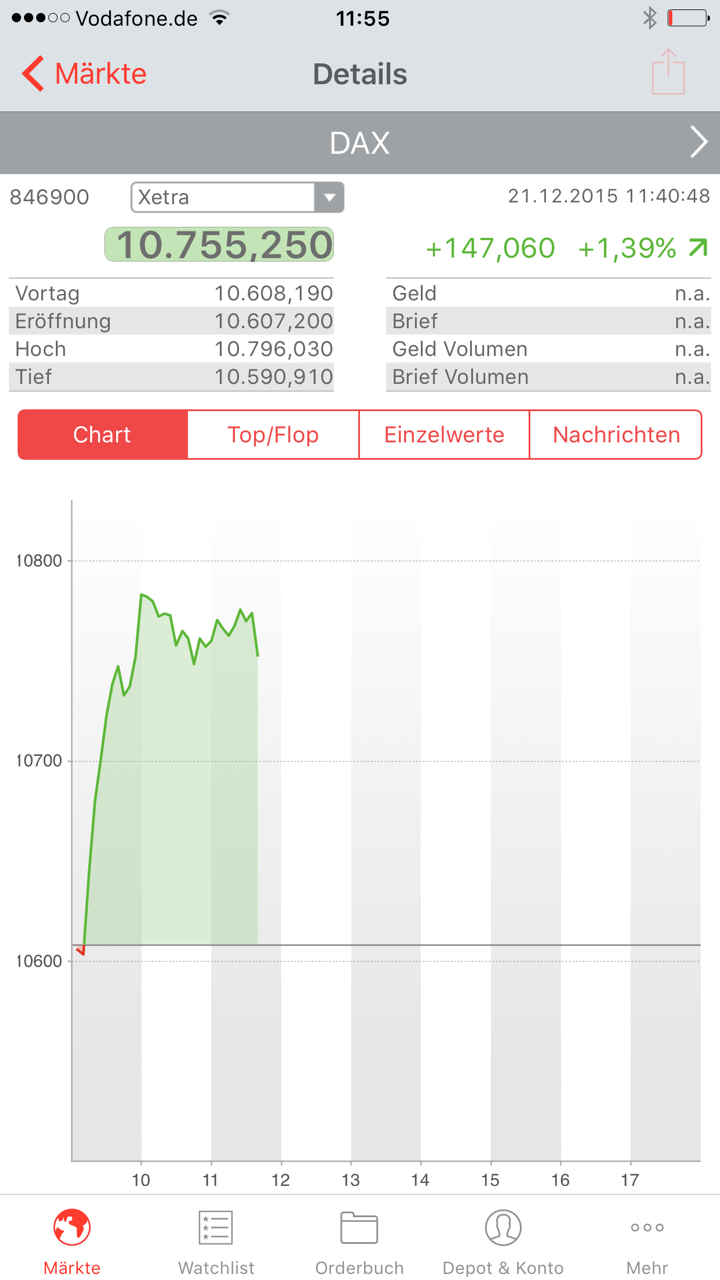

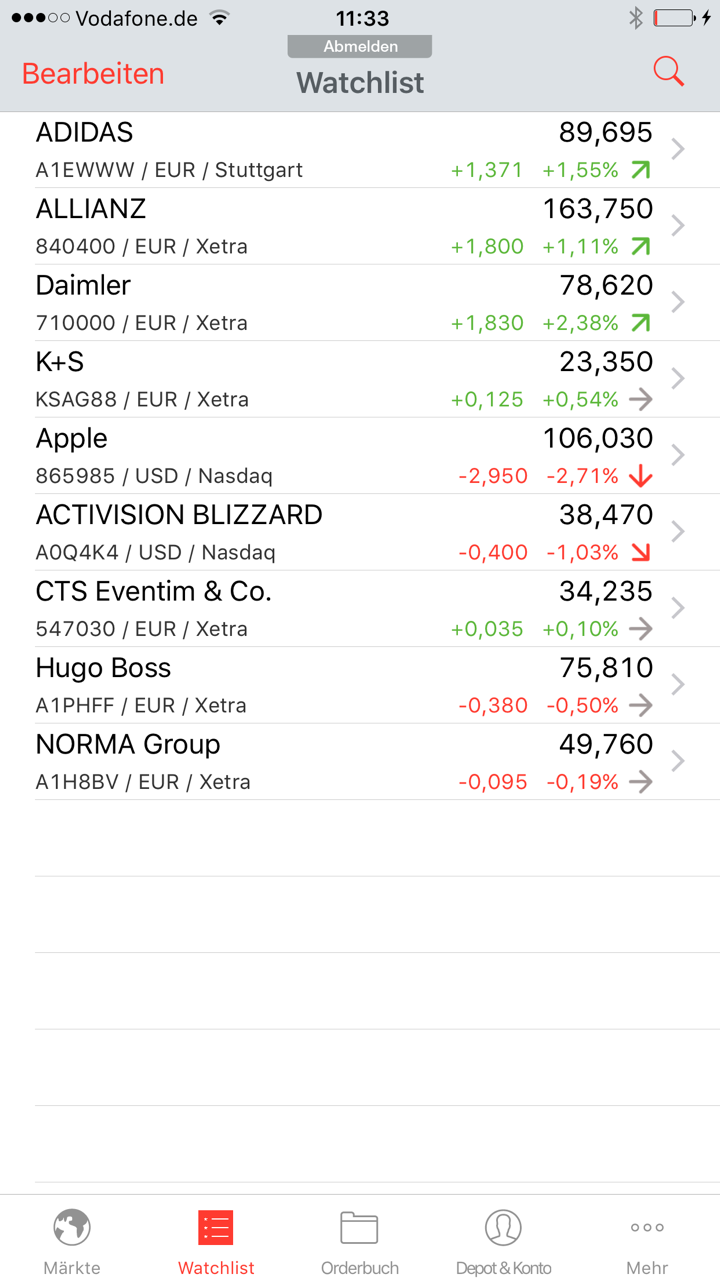

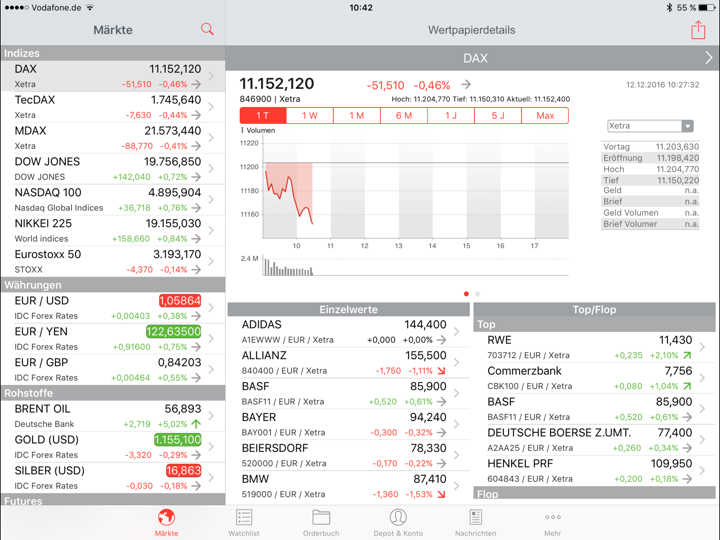

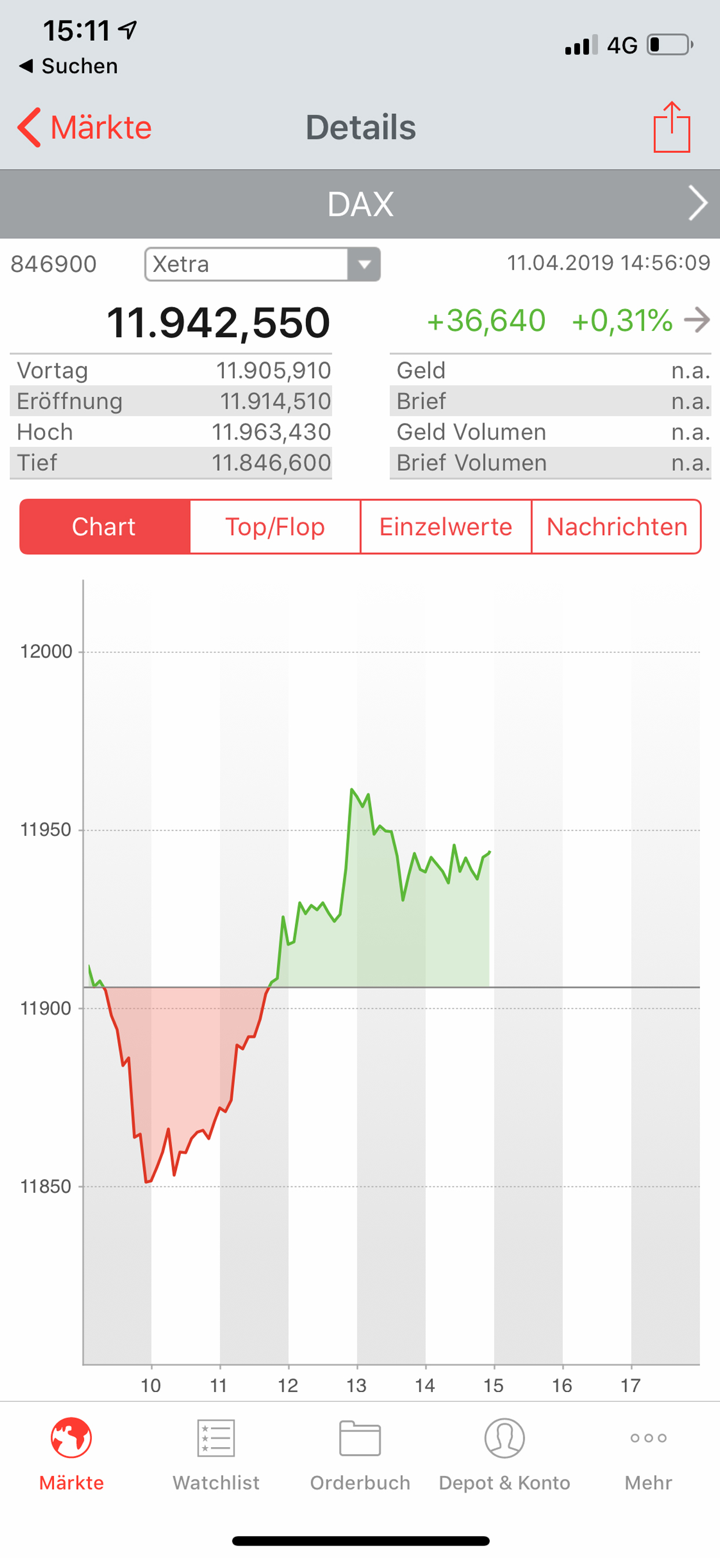

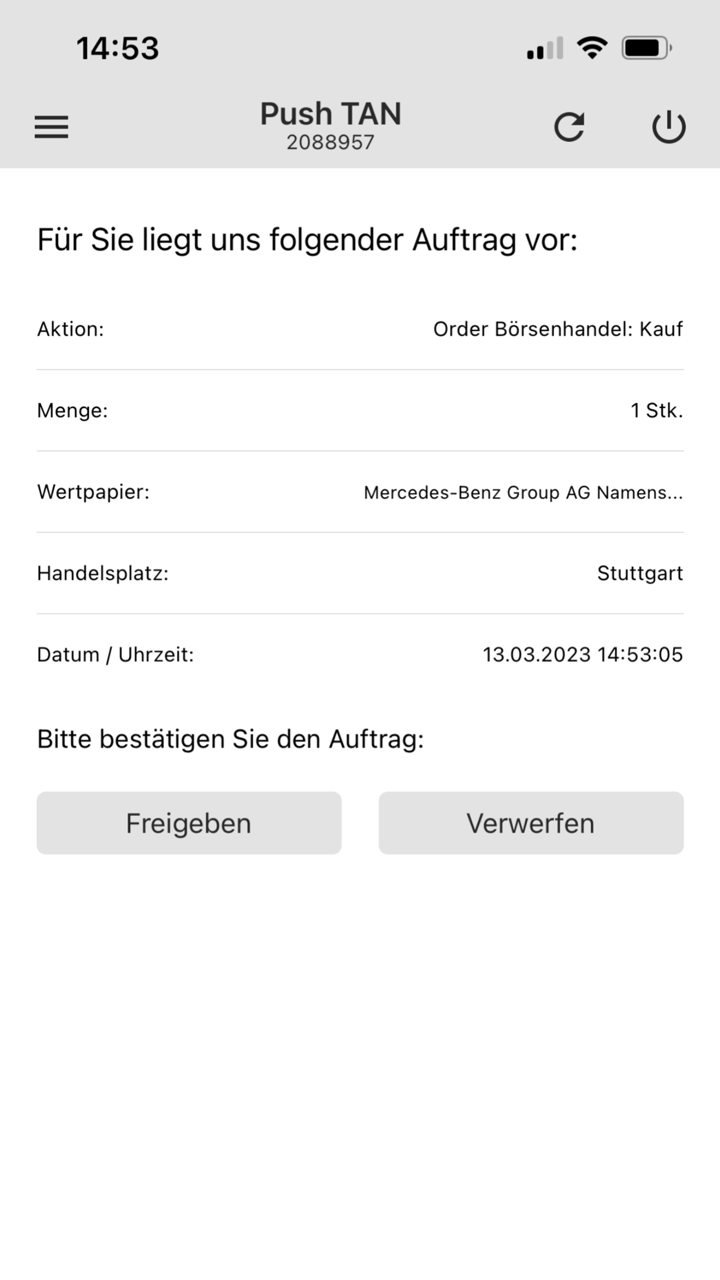

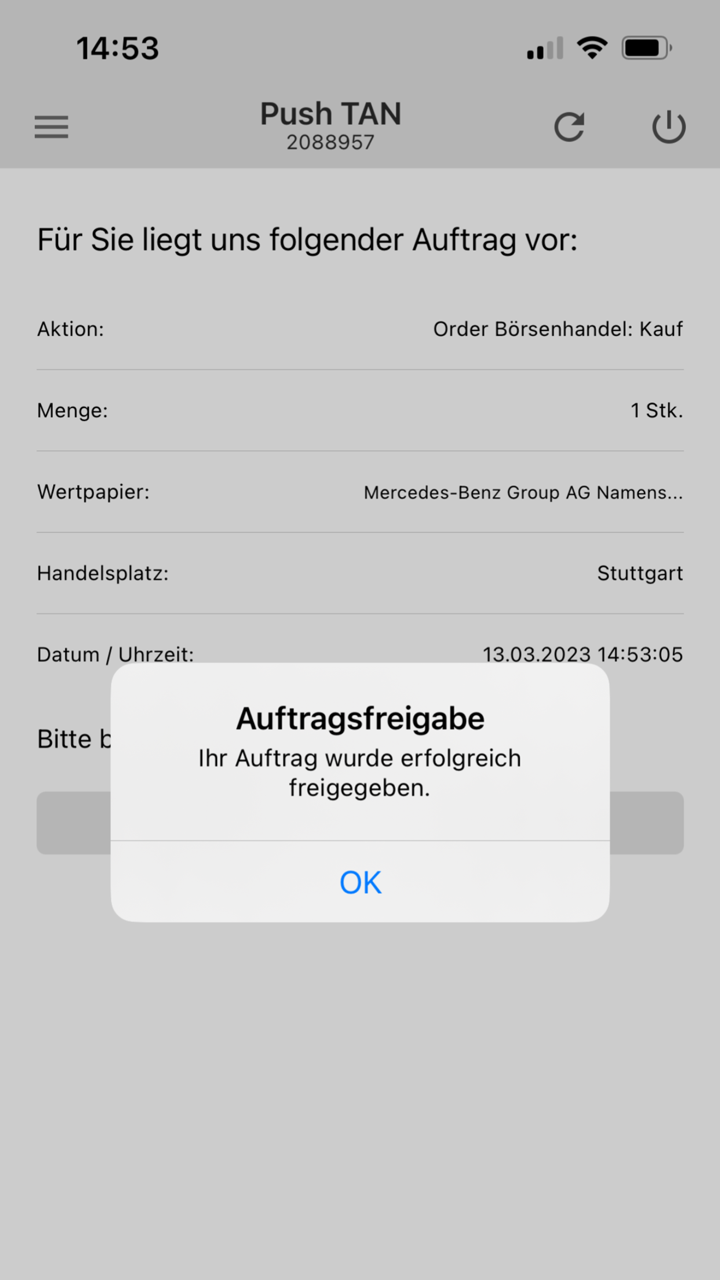

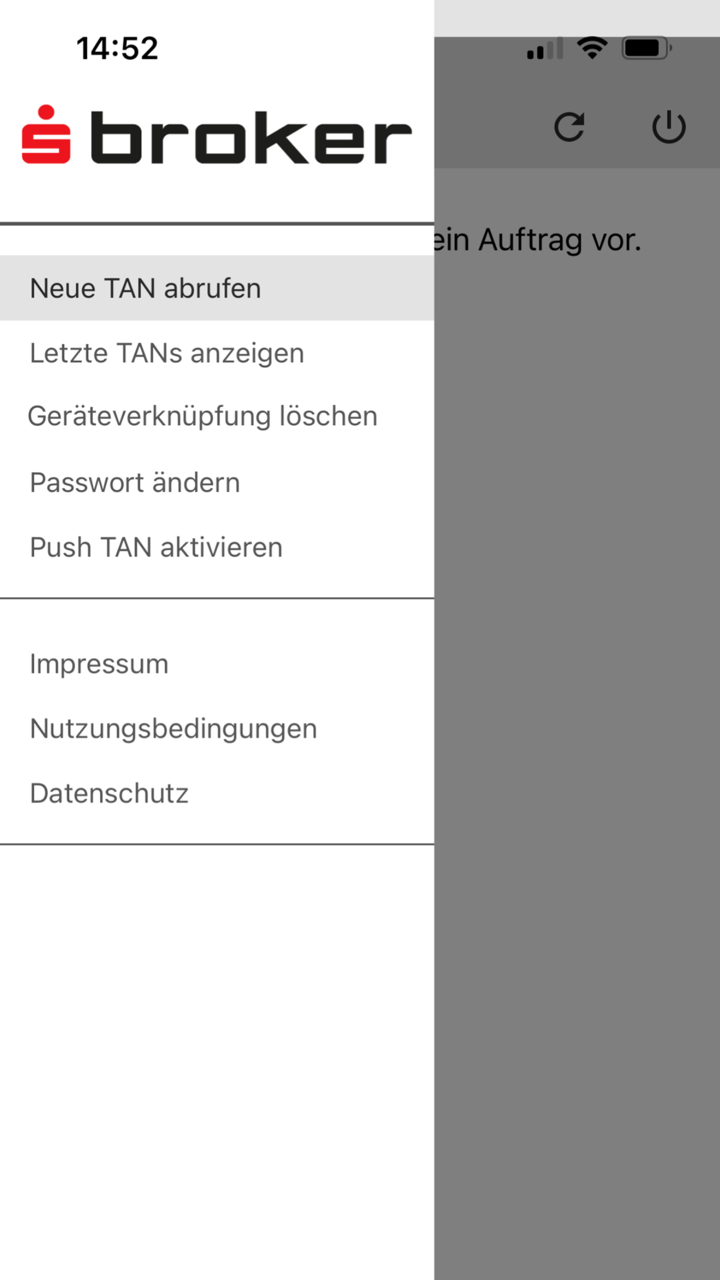

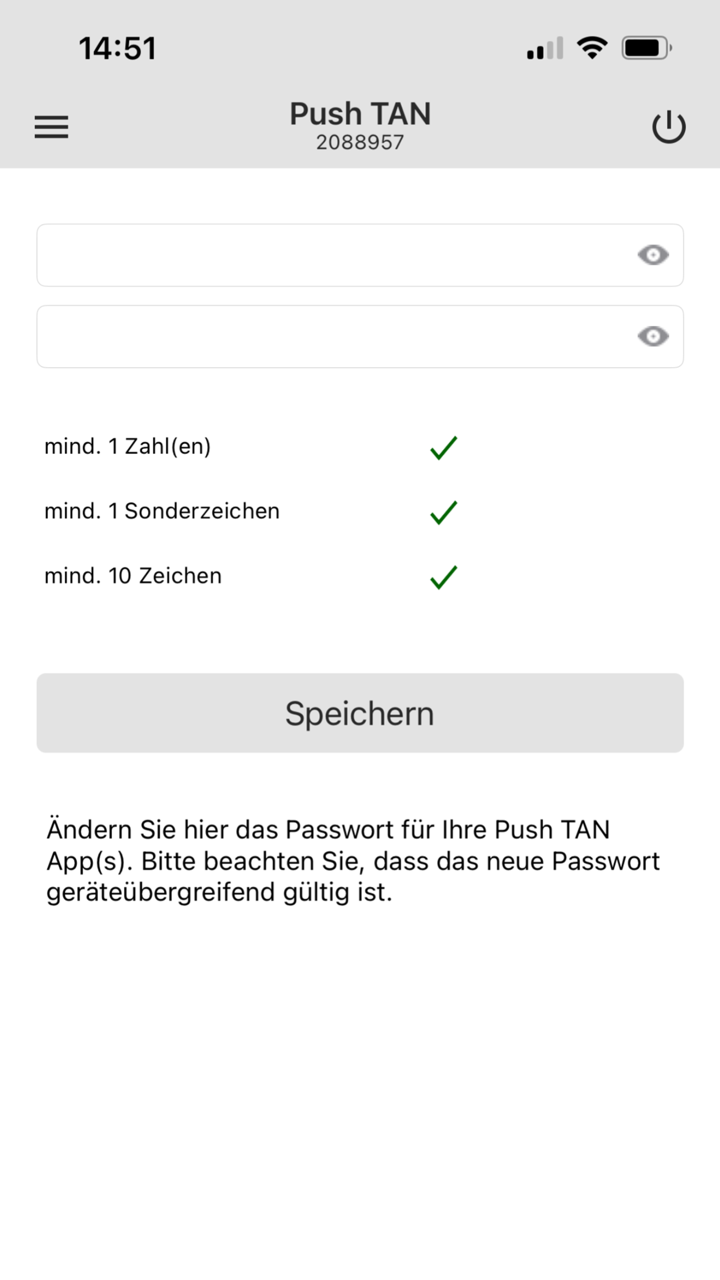

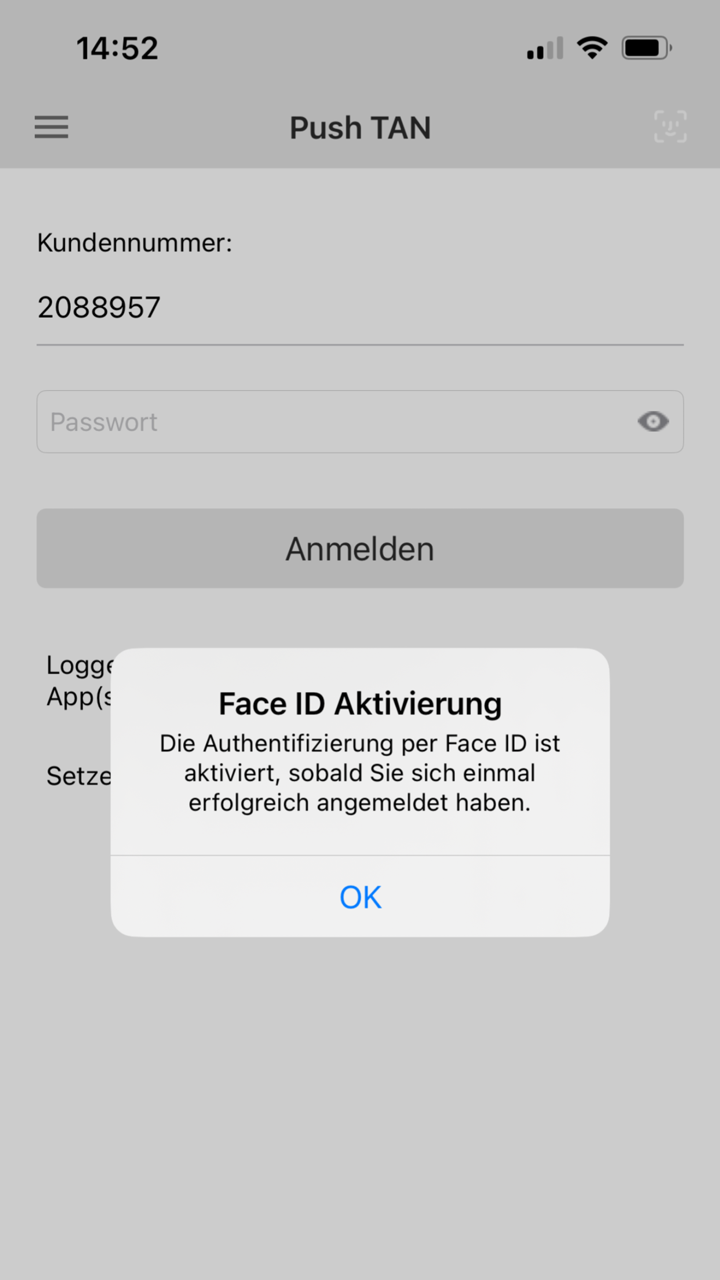

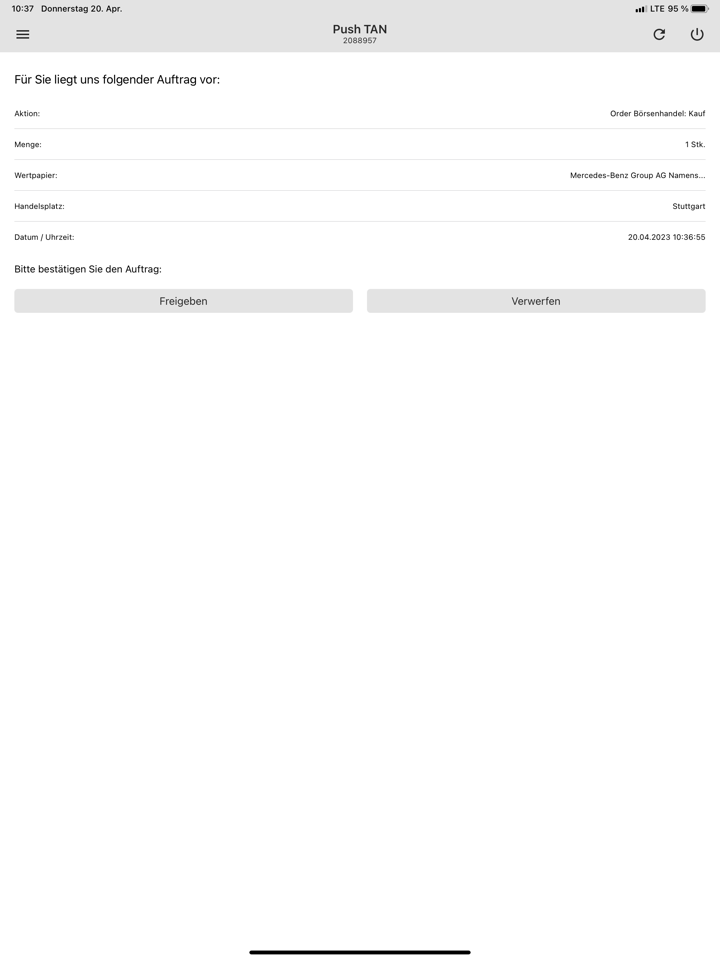

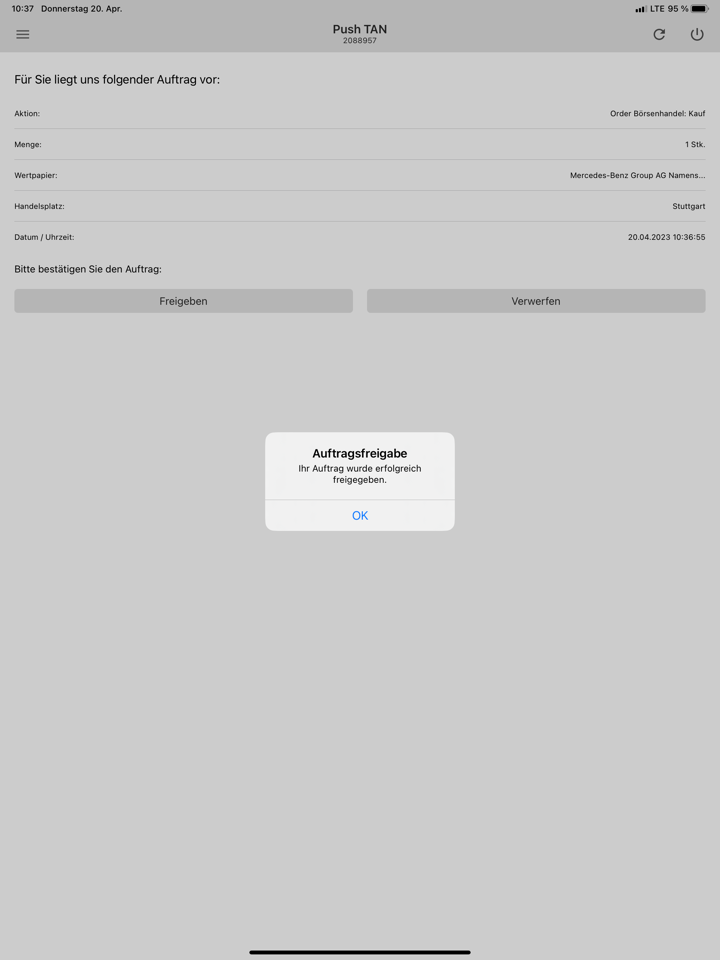

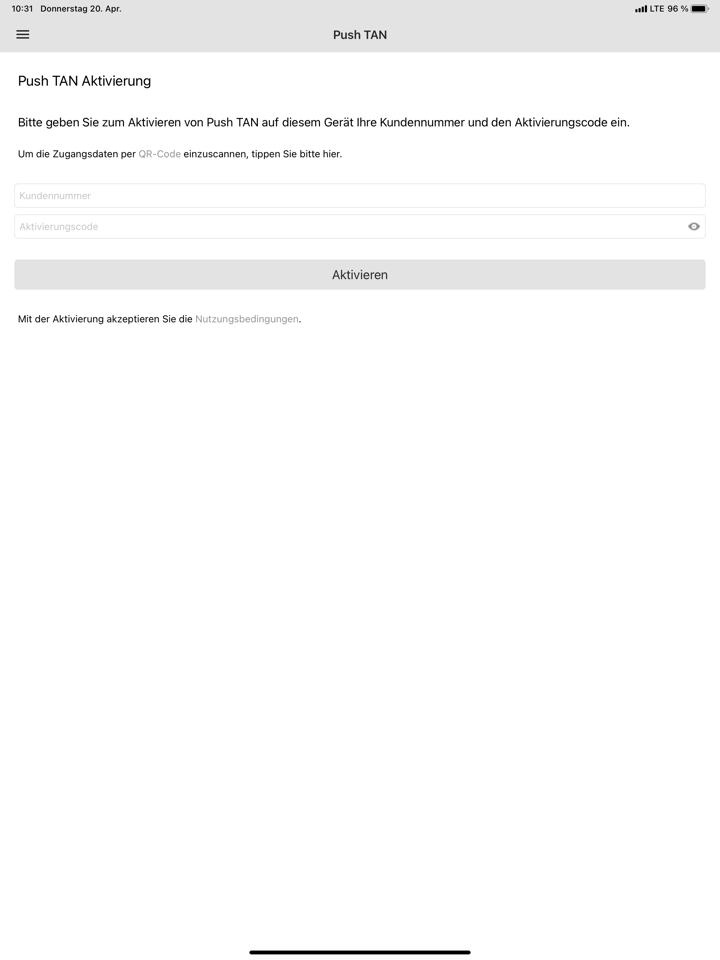

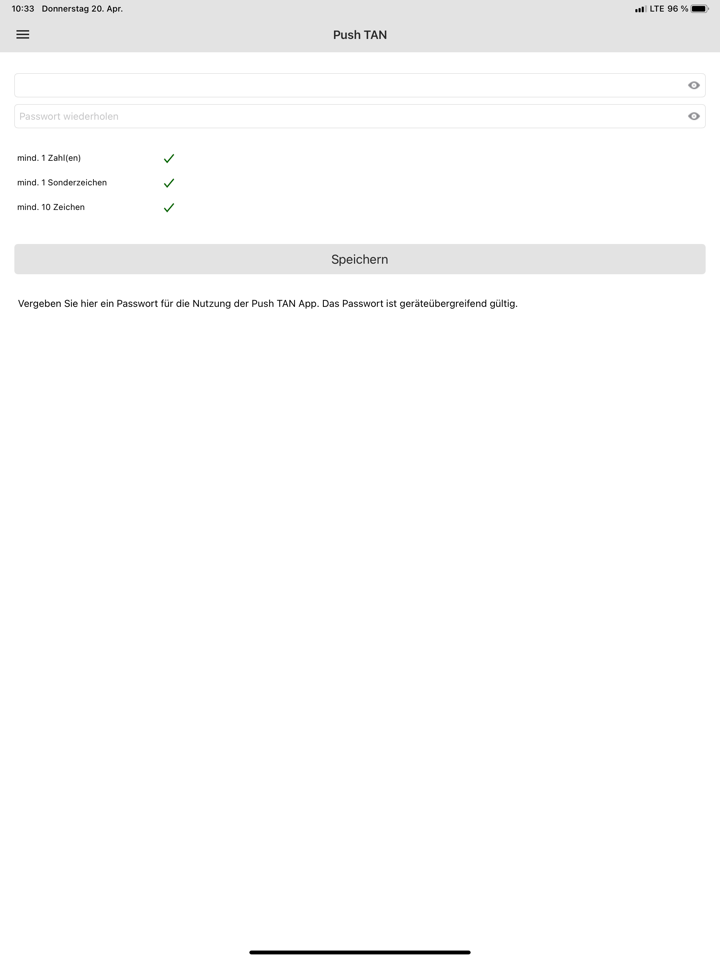

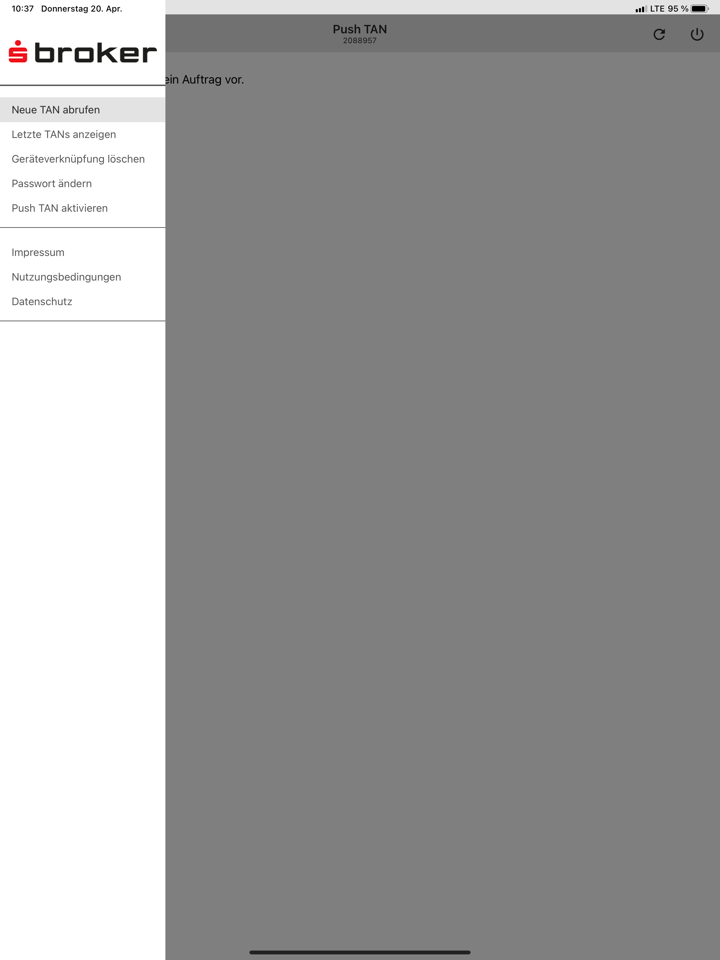

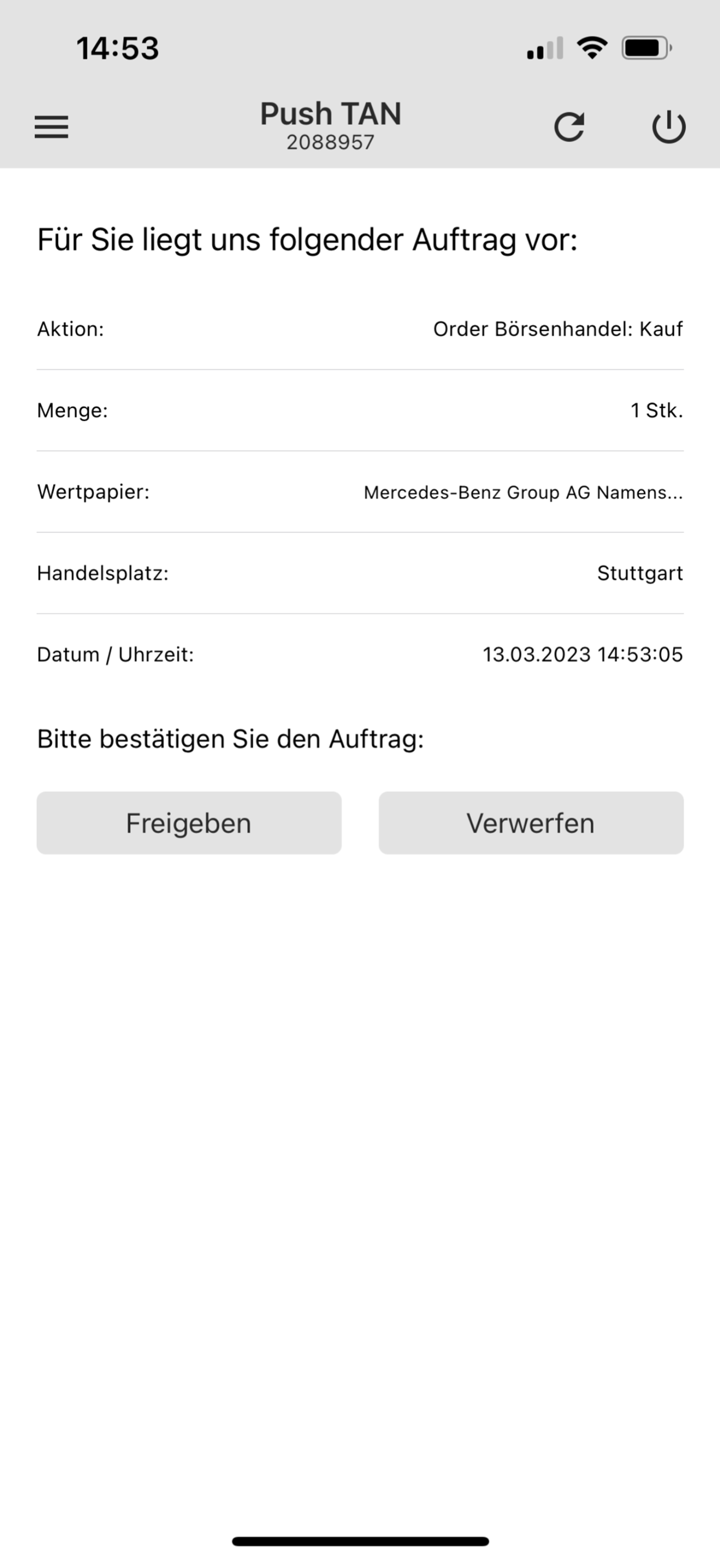

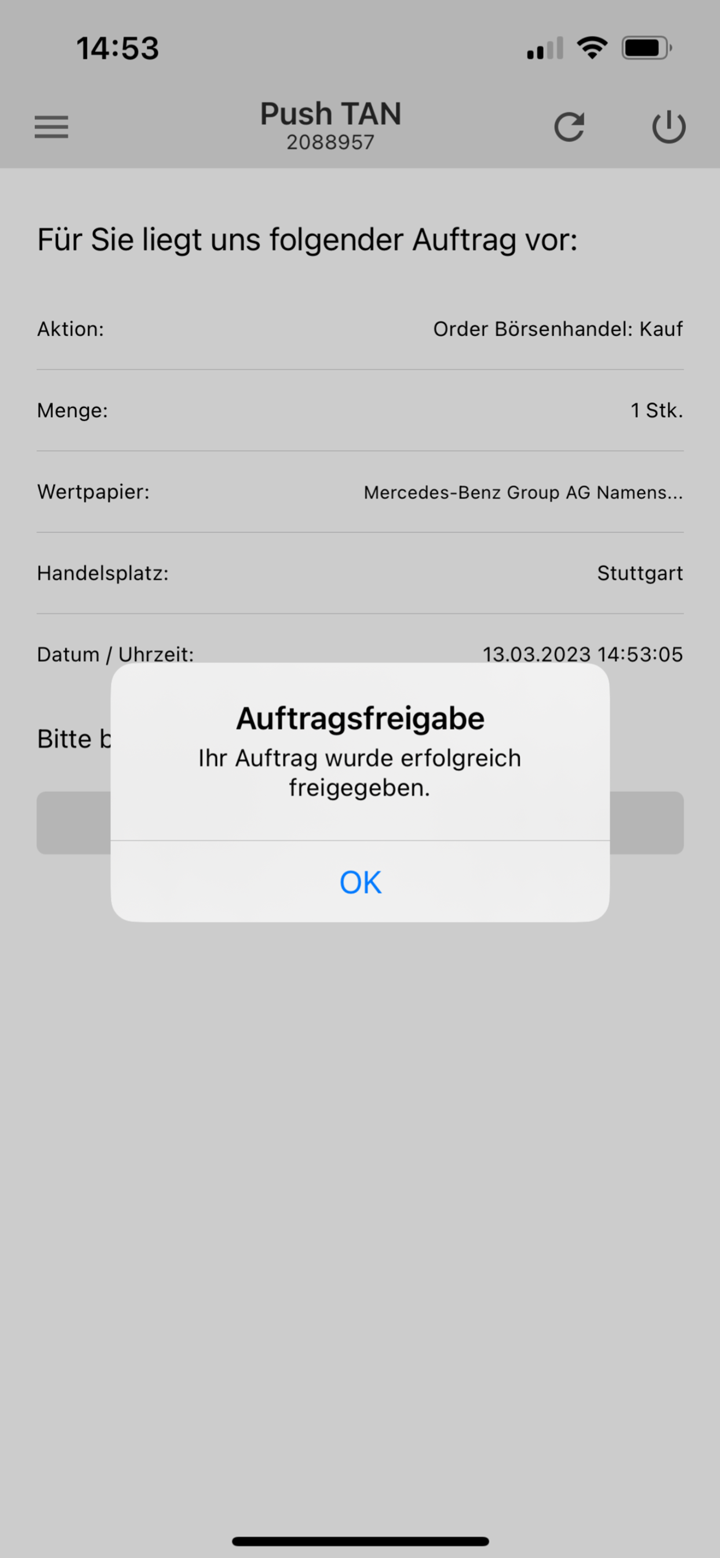

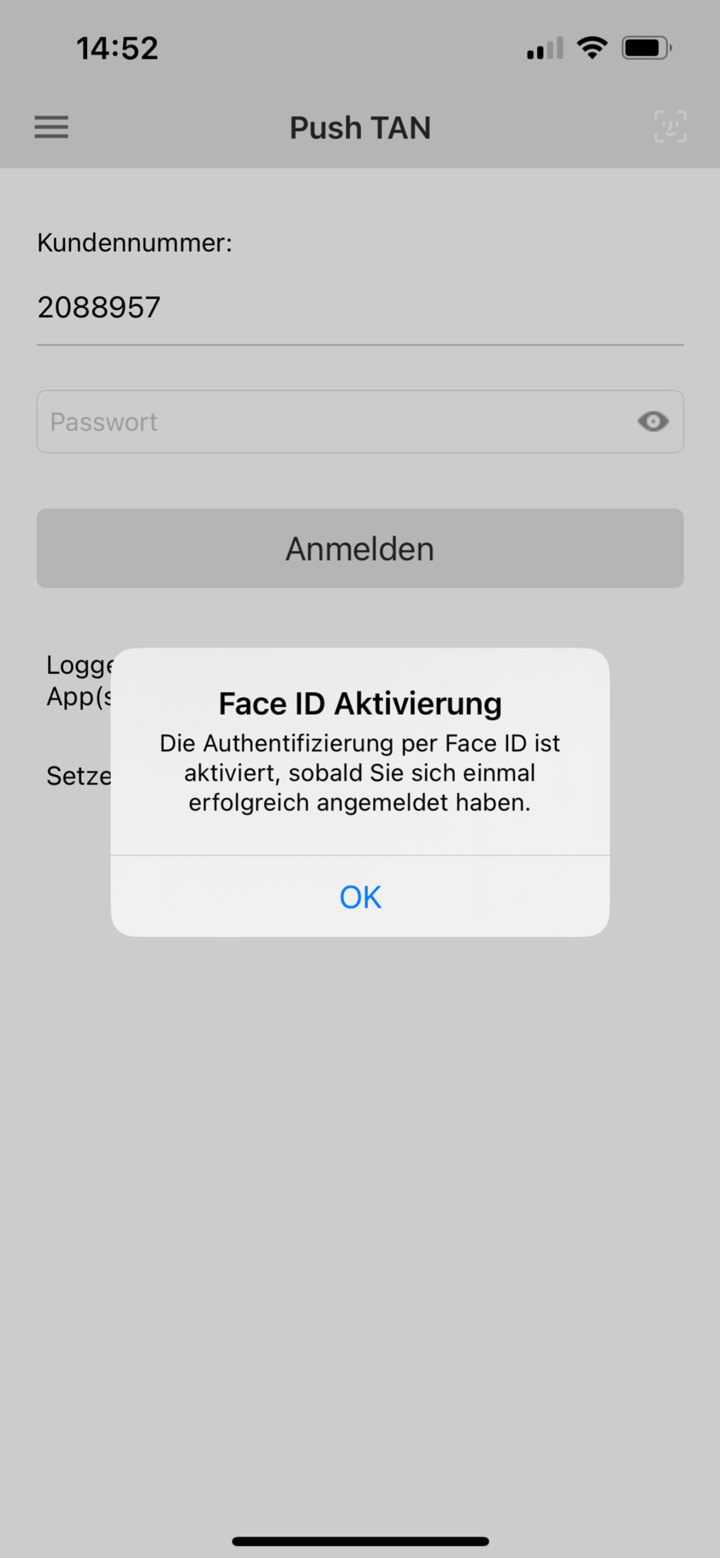

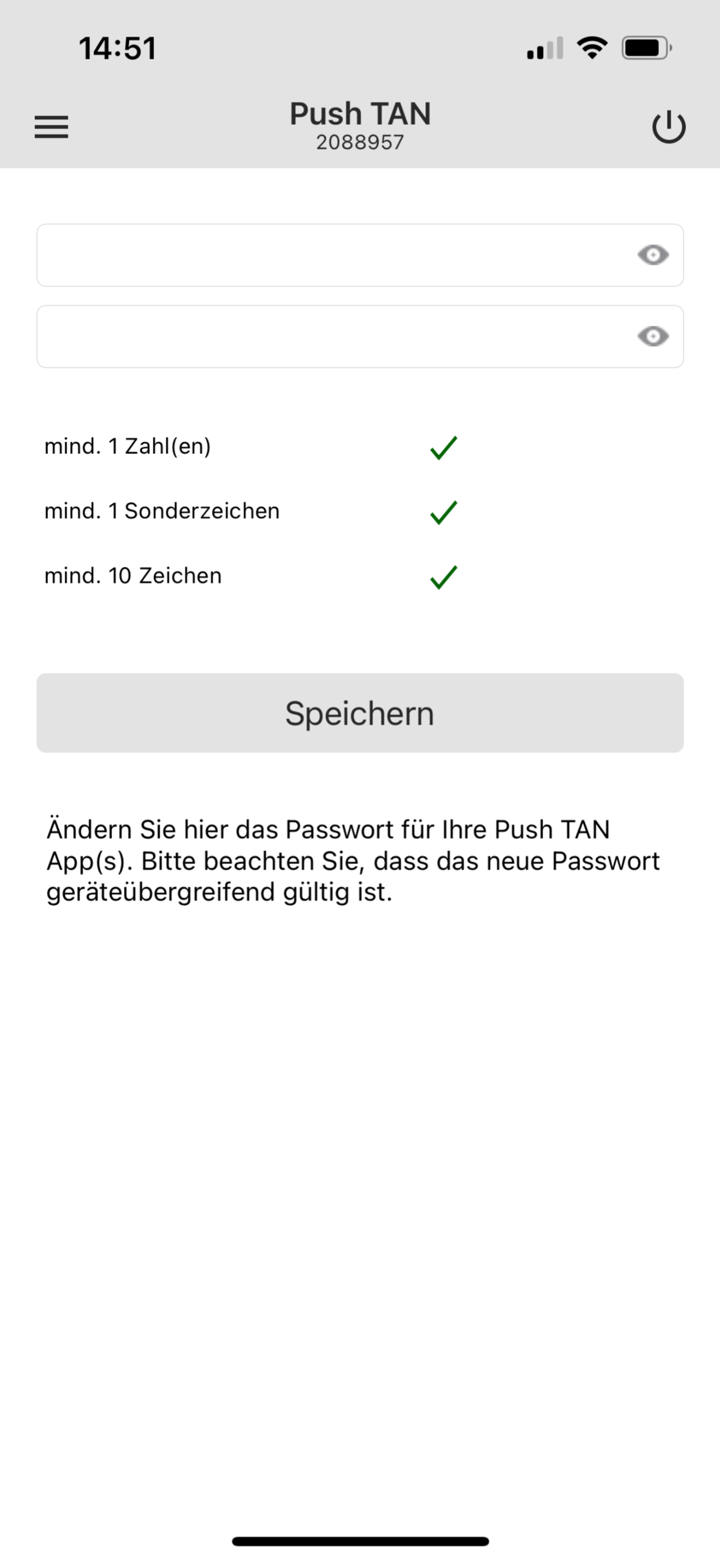

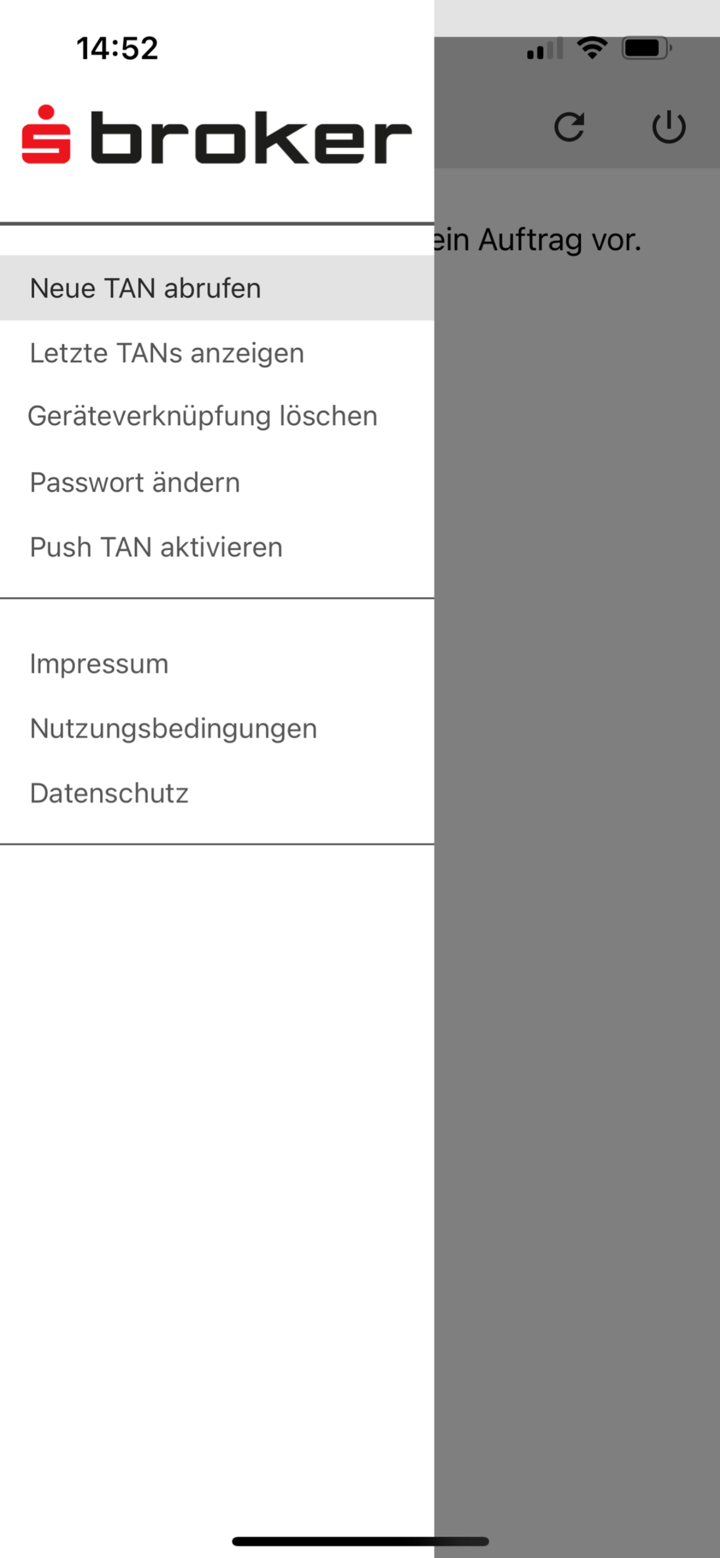

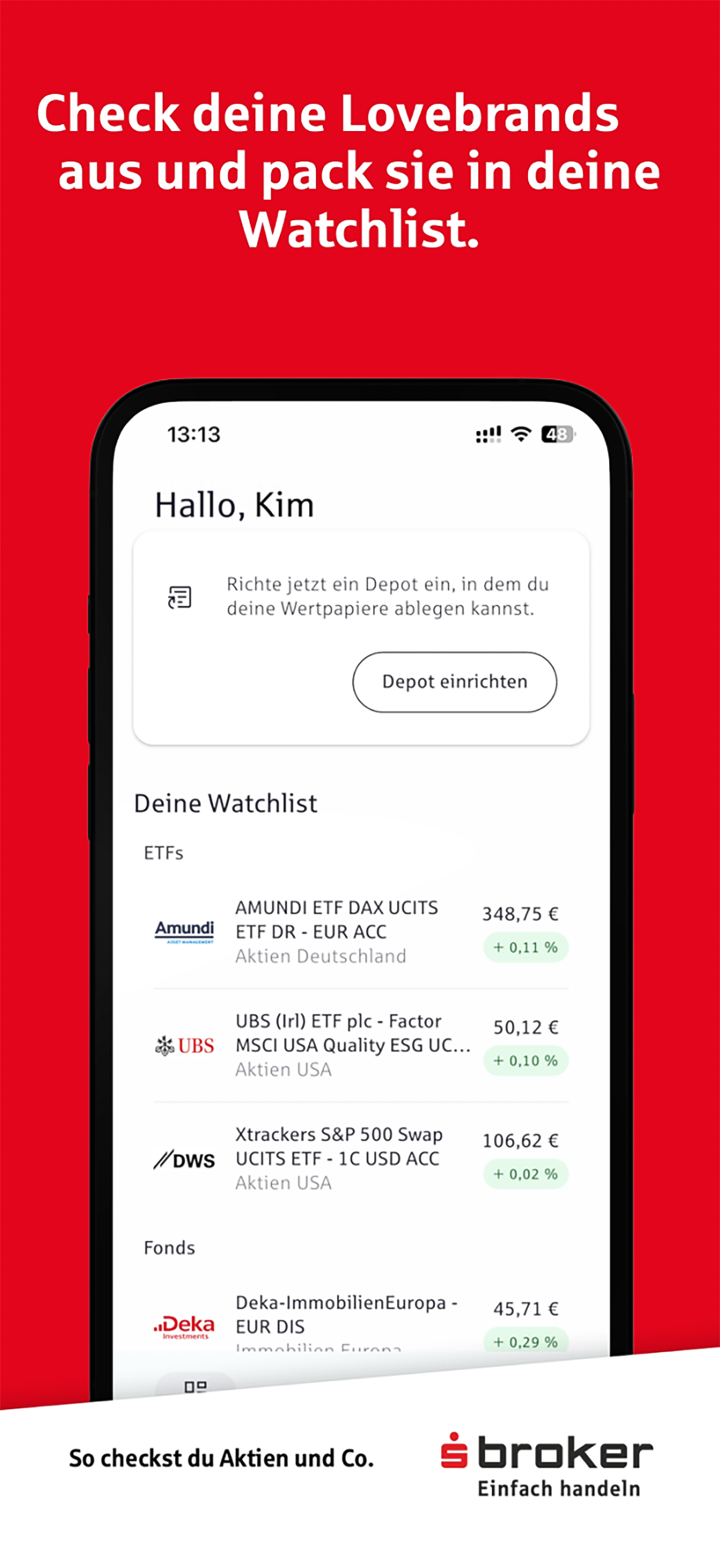

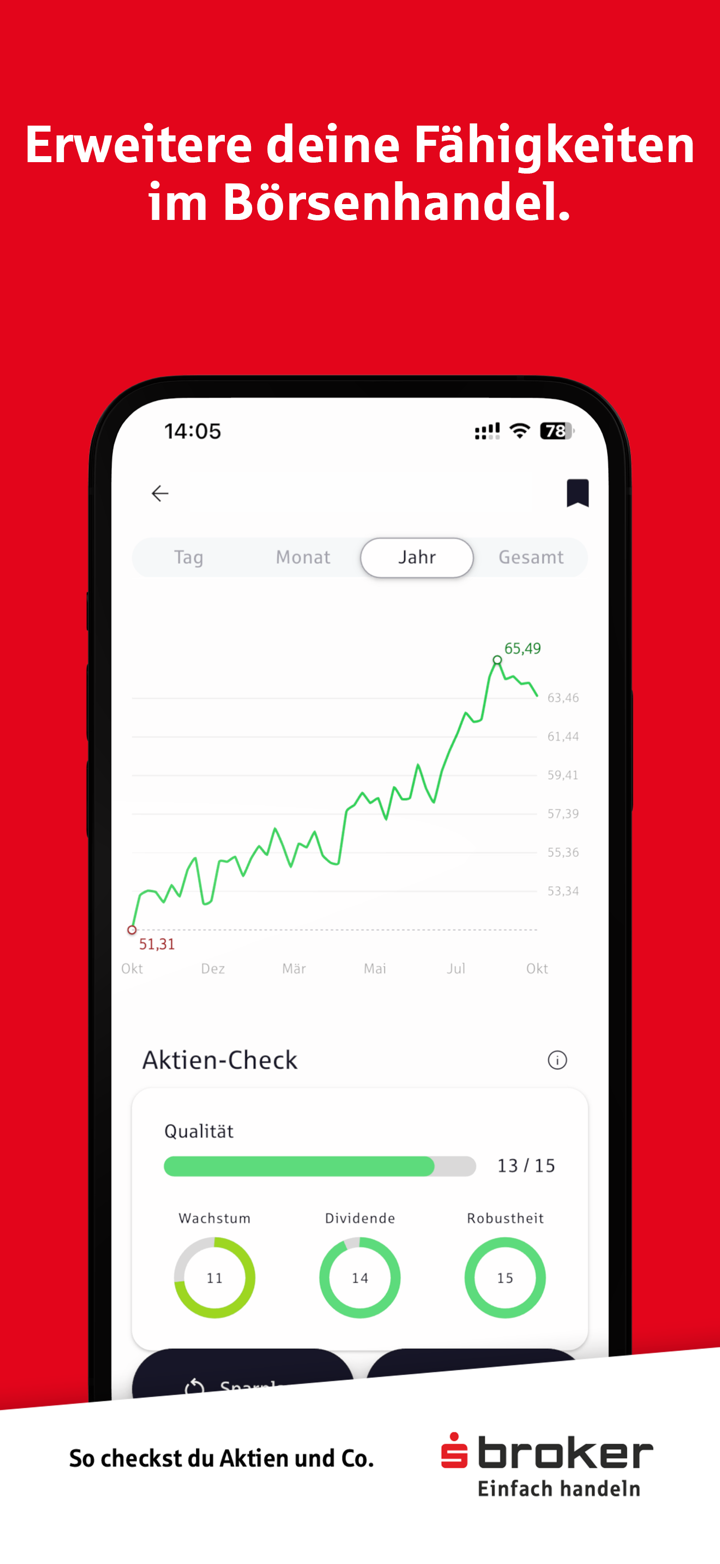

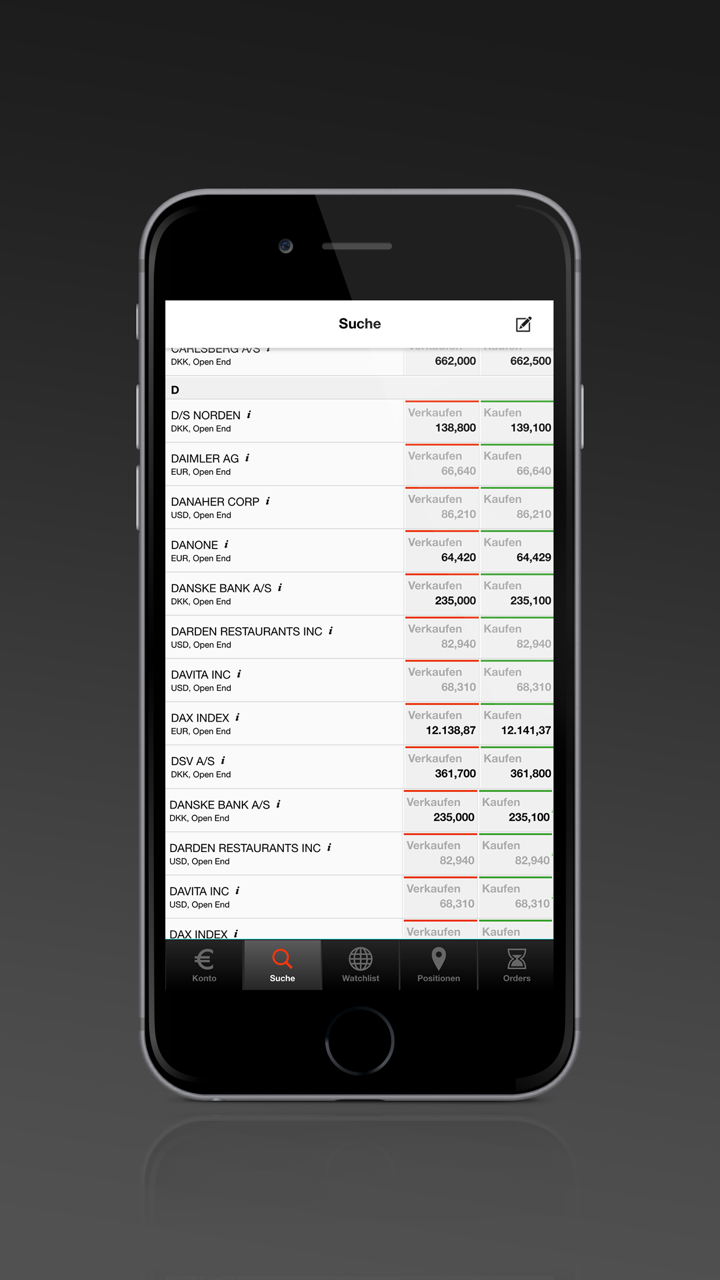

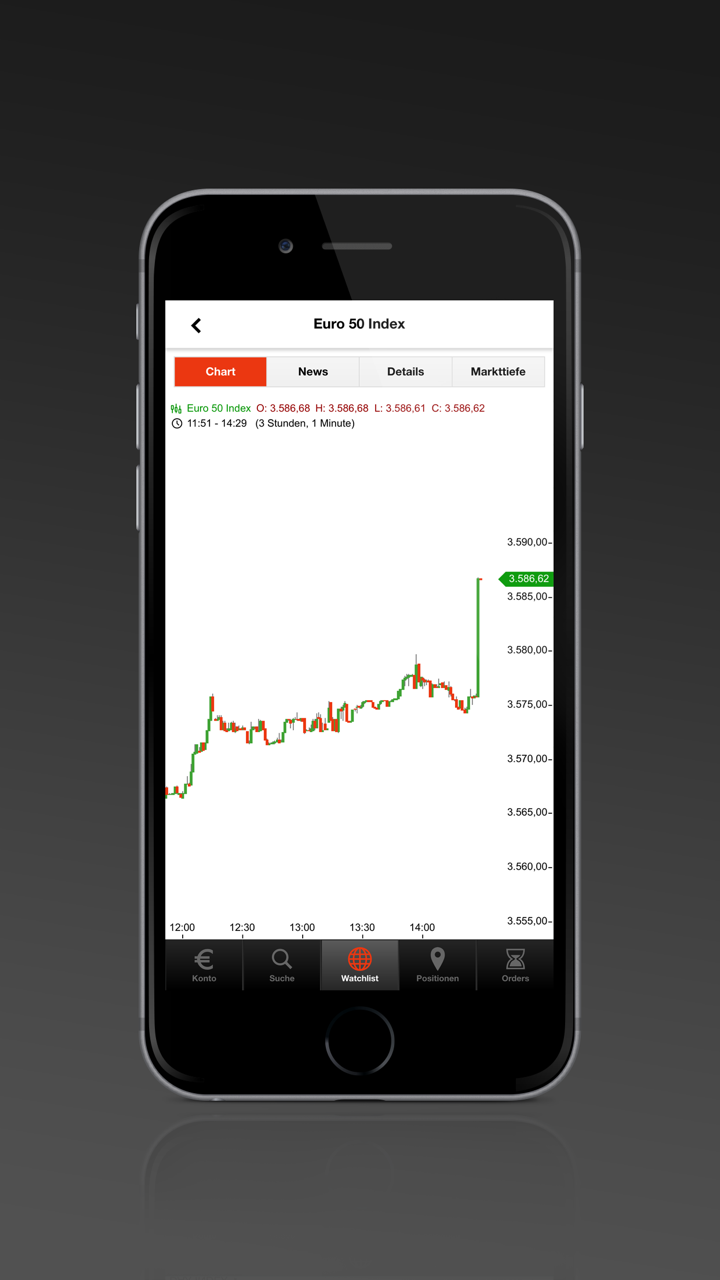

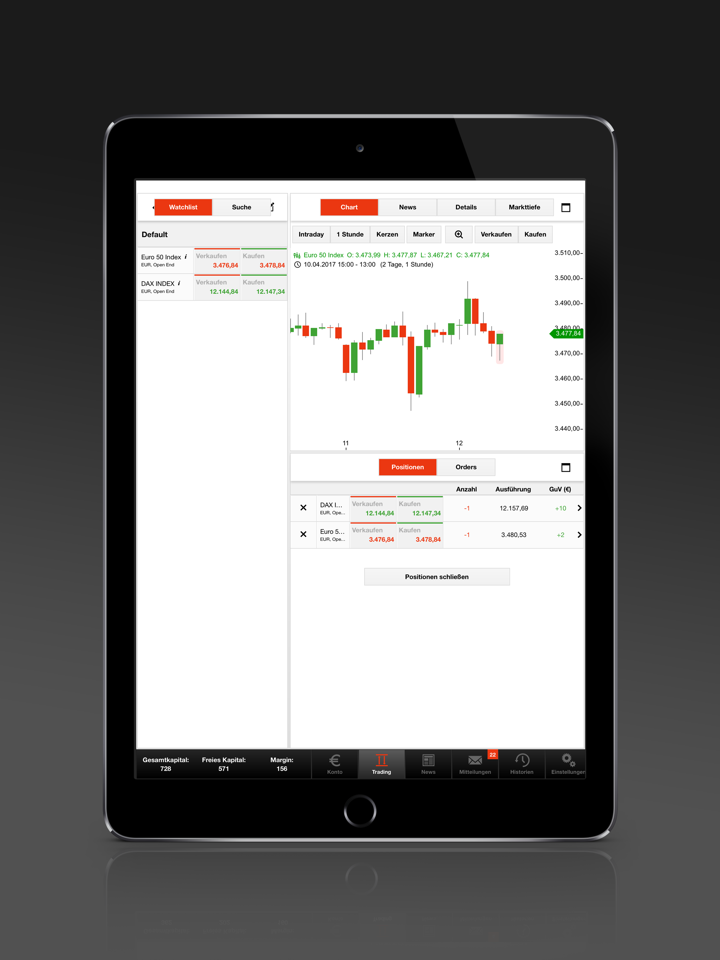

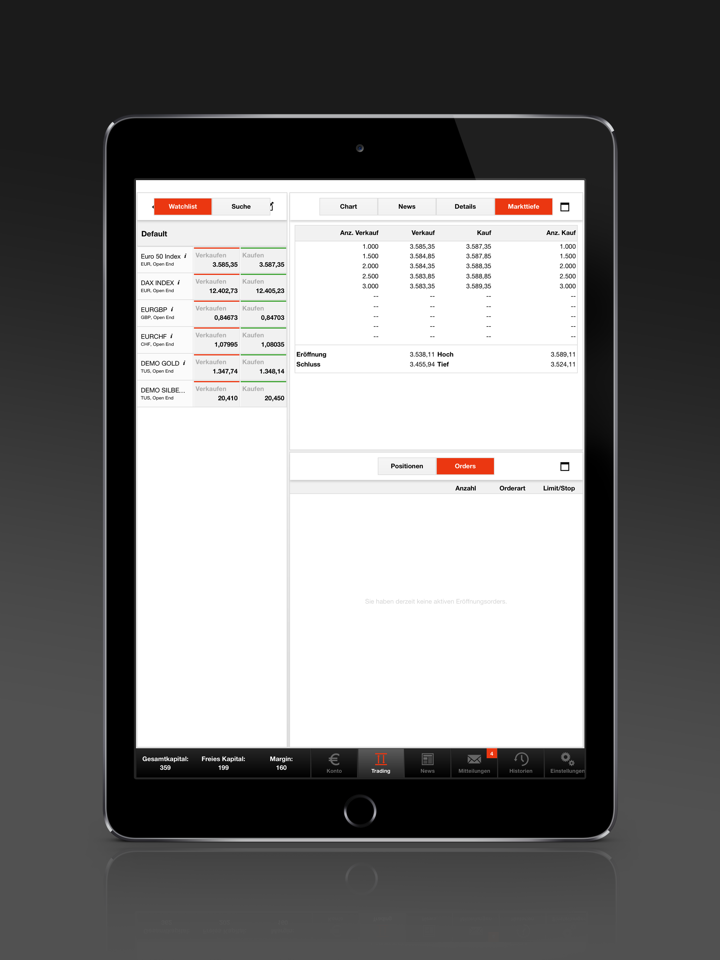

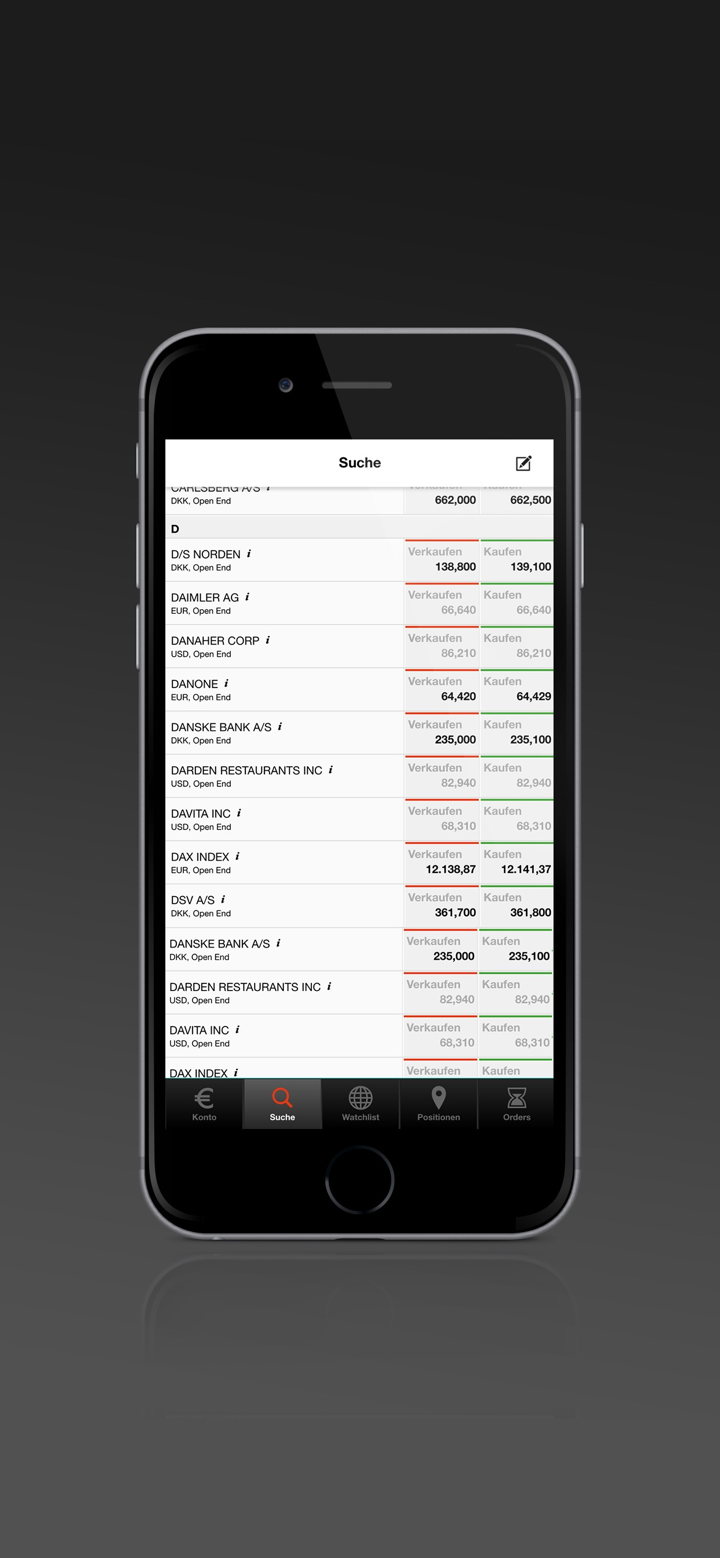

S Broker, “S Broker Uygulaması” adlı özel bir işlem platformu sunar, hem iOS hem de Android platformlarında mevcuttur. Kendi kullanıcıları için özelleştirilmiş olup, en güncel piyasa verilerine, haberlere, endekslere ve kotalara, izleme listesine vb. erişim sağlar.

| İşlem Platformu | Desteklenen | Mevcut Cihazlar | Uygun |

| S Broker Mobil Uygulaması | ✔ | iOS/Android | S Broker kullanıcıları |

| MT4 | ❌ | / | Yeni başlayanlar |

| MT5 | ❌ | / | Deneyimli işlemciler |