Présentation de l'entreprise

| TIANFU FUTURES Résumé de l'examen | |

| Fondé | 2003 |

| Pays/Région Enregistré | Chine |

| Régulation | CFFE |

| Instrument de Marché | Contrats à terme de matières premières |

| Compte de Démo | ❌ |

| Plateforme de Trading | Terminal de Trading du Marché Cloud Boyi de Tianfu Futures, Terminal de Trading du Marché Cloud Wenhua Yingshun de Tianfu Futures, Édition True Winner du Maître Boyi de Tianfu Futures, etc. |

| Support Client | Tél : 0431-88993790/400-700-5136 |

| Email : tfqh@tfqh.com | |

| Adresse : 4ème étage, Bâtiment B, Résidence Greentown Milan, intersection de la rue Jinchuan et de la route Pudong, Zone de Développement Économique et Technologique de Changchun | |

Informations sur TIANFU FUTURES

TIANFU FUTURES est un fournisseur de services réglementé de courtage et de services financiers de premier plan, fondé en Chine en 2003. Il est spécialisé dans le trading de contrats à terme de matières premières.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Temps d'opération long | Produits de trading limités |

| Bien réglementé | Manque de transparence |

| Pas de comptes de démonstration | |

| Frais de traitement facturés |

TIANFU FUTURES Est-il Légitime ?

Oui. TIANFU FUTURES est agréé par la China Financial Futures Exchange (CFFEX) pour offrir des services. Son numéro de licence est le 0169. La CFFEX, créée avec l'approbation du Conseil d'État de la République populaire de Chine et de la Commission de régulation des valeurs mobilières de Chine (CSRC), est une bourse incorporée spécialisée dans la fourniture de services de trading et de compensation pour les contrats à terme financiers, les options et autres dérivés.

| Pays Réglementé | Régulateur | Statut Actuel | Entité Réglementée | Type de Licence | Numéro de Licence |

| China Financial Futures Exchange | Réglementé | 天富期货有限公司 | Licence de Contrats à Terme | 0169 |

Que Puis-je Trader sur TIANFU FUTURES ?

| Instruments de Trading | Pris en Charge |

| Contrats à terme de matières premières | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptos | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

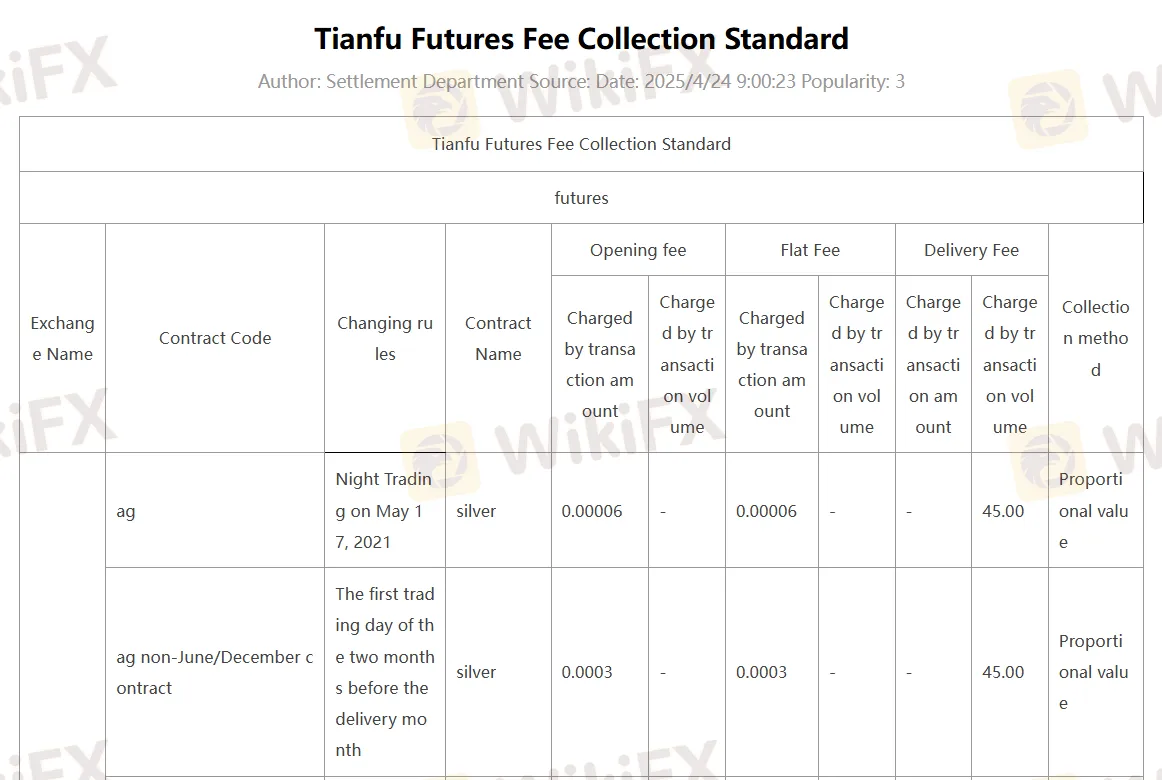

Frais TIANFU FUTURES

Pour le trading de contrats à terme, des frais d'ouverture, des frais fixes et des frais de livraison sont facturés. Les informations détaillées sur les frais peuvent être trouvées dans la capture d'écran ci-dessous :

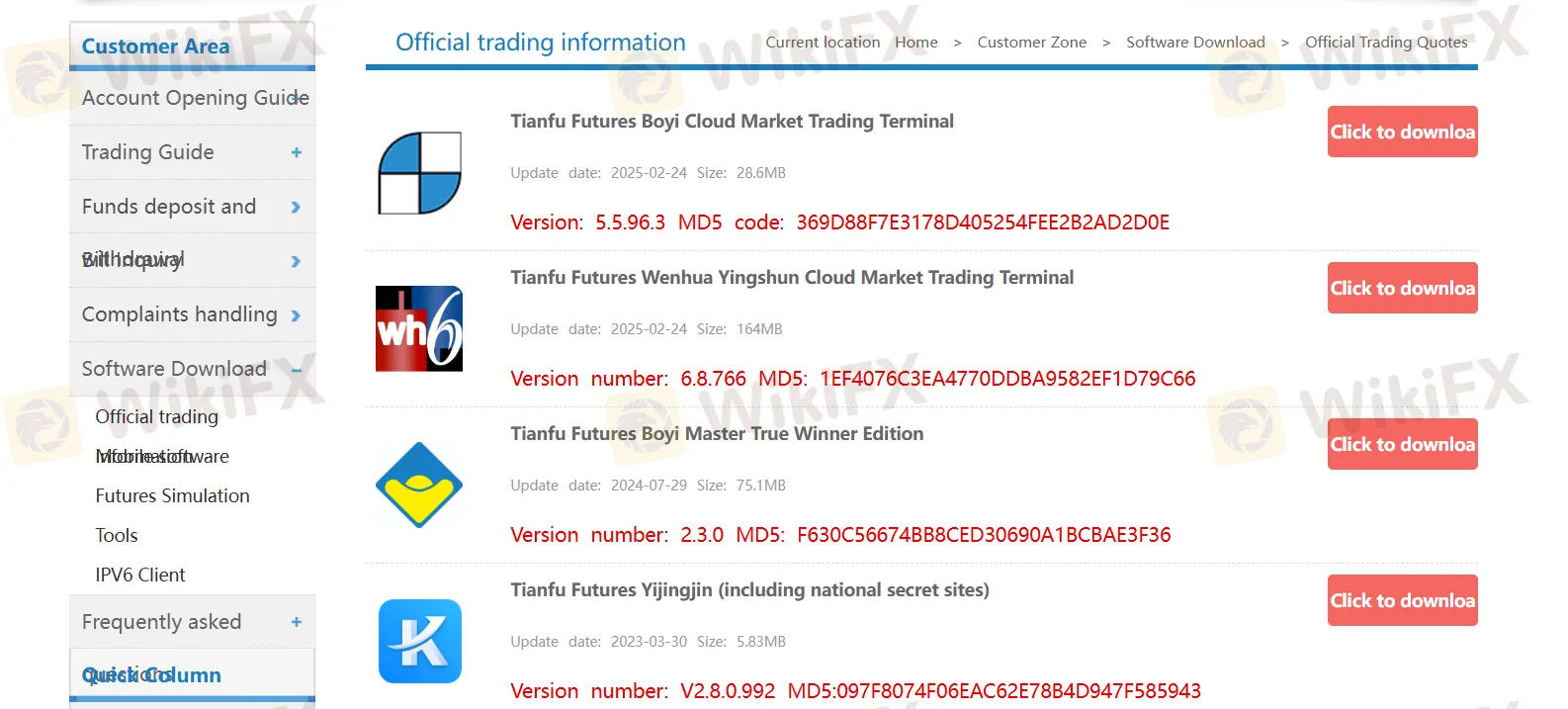

Plateforme de Trading

| Plateforme de Trading | Pris en charge | Appareils Disponibles |

| Terminal de Trading du Marché Cloud Boyi de Tianfu Futures | ✔ | PC, ordinateur portable, tablette |

| Terminal de Trading du Marché Cloud Wenhua Yingshun de Tianfu Futures | ✔ | PC, ordinateur portable, tablette |

| Édition True Winner du Maître Boyi de Tianfu Futures | ✔ | PC, ordinateur portable, tablette |

| Yijingjin de Tianfu Futures (y compris les sites secrets nationaux) | ✔ | PC, ordinateur portable, tablette |

| Terminal de Trading Express V2 de Tianfu Futures (Deuxième Siège) | ✔ | PC, ordinateur portable, tablette |

| Terminal de Trading Express V3 de Tianfu Futures (Deuxième Siège) | ✔ | PC, ordinateur portable, tablette |

| Plateforme d'Investissement Quilter | ✔ | PC, ordinateur portable, tablette |

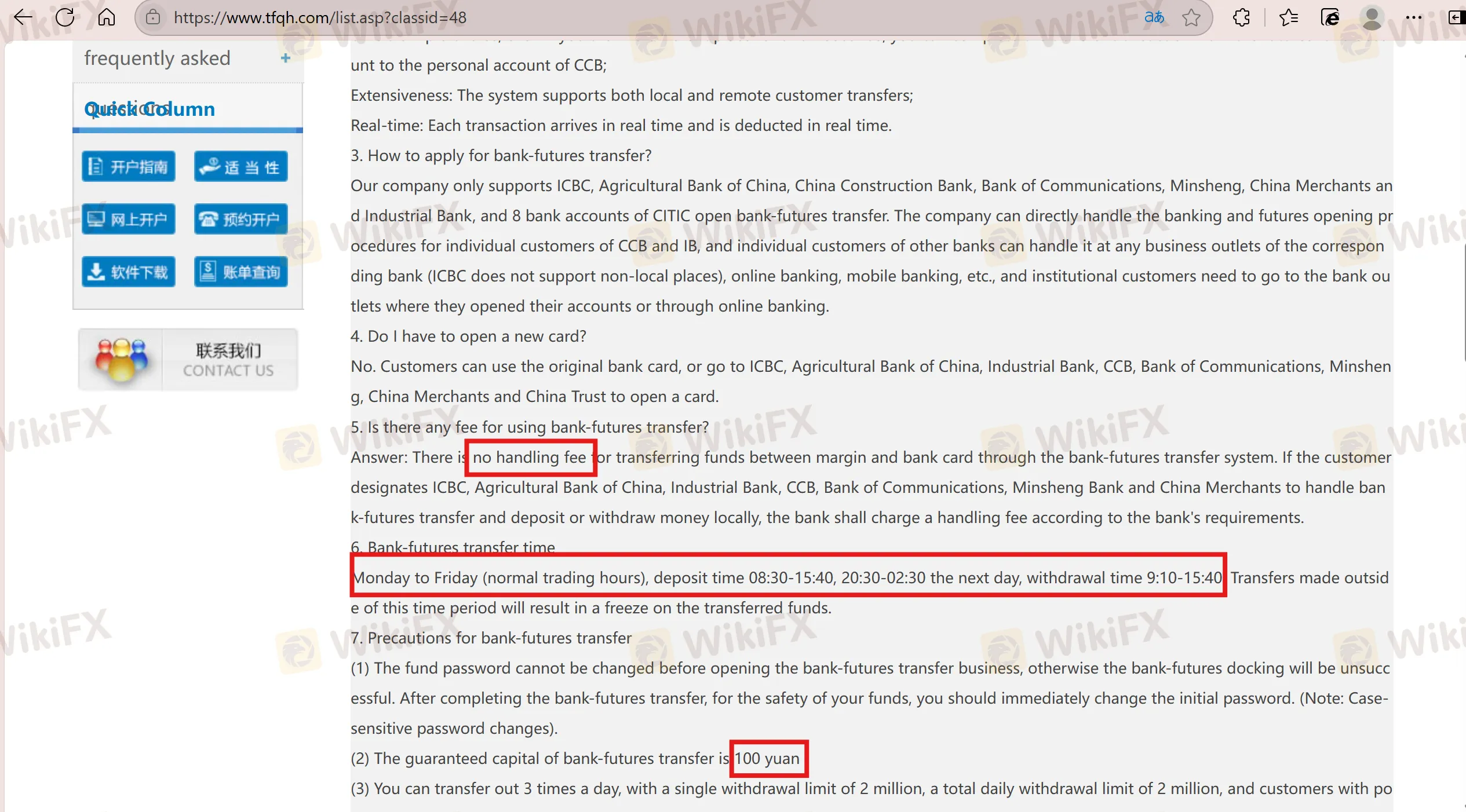

Dépôt et Retrait

Il n'y a pas de frais de traitement pour le transfert de fonds entre la marge et la carte bancaire via le système de transfert bancaire-futures. Si le client désigne la ICBC, la Banque Agricole de Chine, la Banque Industrielle, la CCB, la Banque de Communications, la Banque Minsheng et la China Merchants pour gérer le transfert bancaire-futures et déposer ou retirer de l'argent localement, la banque facturera des frais de traitement selon les exigences de la banque. Du lundi au vendredi, horaires de dépôt de 08h30 à 15h40, de 20h30 à 02h30 le lendemain, horaires de retrait de 9h10 à 15h40. Les transferts effectués en dehors de cette période entraîneront un gel des fonds transférés.