Présentation de l'entreprise

| China-Derivatives FuturesRésumé de l'examen | |

| Fondé | 1996 |

| Pays/Région Enregistré | Chine |

| Régulation | CFFEX |

| Produits & Services | Futures, Courtage, Investissement, Conseil, Gestion d'actifs, Fonds |

| Compte de Démo | ✅ |

| Effet de Levier | / |

| Spread | / |

| Plateforme de Trading | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star, et TradeBlazer |

| Dépôt Minimum | / |

| Support Client | Chat en Direct |

| Email: office@cdfco.com.cn | |

| Téléphone: 400-688-1117 | |

| Adresse: Zhongyan Futures Co., Ltd., 7th Floor, Building B, Jinchang'an Building, No. 82 Dongsi Fourth Ring Road, Chaoyang District, Beijing | |

China-Derivatives Futures Informations

Fondée en 1996, China-Derivatives Futures Co., Ltd. est une entité réglementée sous la supervision de la China Financial Futures Exchange (CFFEX). Cependant, elle ne sert que les clients en Chine et est un acteur important sur le marché intérieur des dérivés. C'est une société financière complète approuvée par la China Securities Regulatory Commission (CSRC) spécialisée dans le courtage de contrats à terme sur marchandises domestiques, le courtage de contrats à terme financiers, le conseil en trading de contrats à terme, la gestion d'actifs et la vente publique de fonds d'investissement en titres.

Avantages & Inconvénients

| Avantages | Inconvénients |

| Régulé par CFFEX | Manque de transparence |

| Spécialisé dans le trading de contrats à terme | |

| Support du trading de démonstration | |

| Diverses plateformes de trading | |

| Longue histoire d'opération |

China-Derivatives Futures Est-il Légitime?

China-Derivatives Futures est régulé par CFFEX sous les numéros de licence 0197.

| Pays Réglementé | Autorité de Régulation | Statut Réglementaire | Entité Réglementée | Type de Licence | Numéro de Licence |

| Chine | China Financial Futures Exchange (CFFEX) | Régulé | China Commodity Futures Co., Ltd. | Licence de Contrats à Terme | 0197 |

Produits & Services

China-Derivatives Futures se concentre principalement sur le trading de contrats à terme et propose également une gamme complète de services d'investissement, tels que courtage, investissement, conseil, gestion d'actifs et fonds.

| Produits & Services | Pris en charge |

| Contrats à terme | ✔ |

| Fonds | ✔ |

| Courtage | ✔ |

| Investissement | ✔ |

| Conseil | ✔ |

| Gestion d'actifs | ✔ |

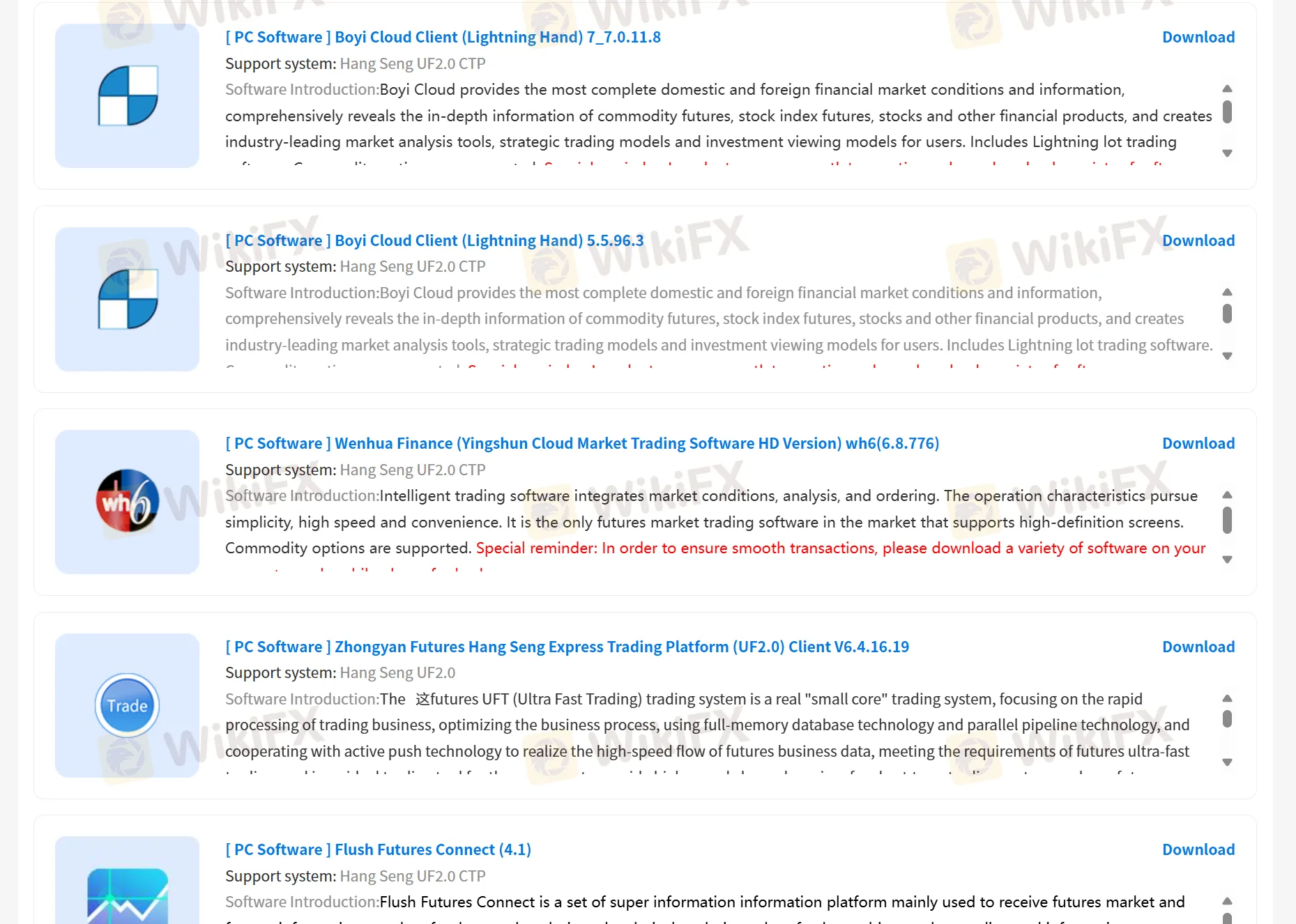

Plateforme de trading

China Derivatives Futures prend en charge le trading via des plateformes propriétaires, l'application China-Derivatives Futures , Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star et TradeBlazer. De plus, il offre également des opportunités aux clients de simuler des transactions.

| Plateforme de trading | Pris en charge | Appareils disponibles | Convient pour |

| Application China-Derivatives Futures | ✔ | PC, Mobile | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

扶众法援

Hong Kong

En ce mois de mars, j'ai reçu une demande d'ami, que je pensais que ce pourrait être un ami de stock. Ensuite, j'ai été entraîné dans un groupe de préparation, dans lequel les membres ont montré des captures d'écran des bénéfices. J'ai été ému et observé pendant un moment. Plus tard, je me suis également inscrit et j'ai suivi les instructions du professeur. L'enseignant m'a demandé de porter la caution à 500 000 comme seuil, affirmant que des enseignants professionnels pouvaient opérer pour moi. Il y a eu des gains et des pertes. Quand il ne restait plus que 100 000, j'ai essayé de demander le retrait. Mais le canal de financement n'était pas disponible en raison de l'existence d'un risque. Le professeur a continué à se défendre et m'a remarqué que le dépôt / retrait pouvait être différé. Le retrait est indisponible pendant une semaine.

Divulgation

Cris Men

L'Équateur

je n'ai jamais eu de problèmes avec les retraits ni rien de ce genre

Positifs

Maximilian 111

Le Nigeria

Je commerce des matières premières ici tout le temps. Il propose des frais transparents et un excellent service client, ce qui est toujours mon choix solide.

Positifs

Vegas

La colombie

China-Derivatives Futures co,.LTD. Fournit une variété d'applications de trading, en cas d'erreurs de trading, très intime. Et la société dispose d'un organisme de réglementation formel, les informations de trading sont ouvertes et transparentes, je suis très rassuré.

Positifs