회사 소개

| TIANFU FUTURES 리뷰 요약 | |

| 설립 연도 | 2003 |

| 등록 국가/지역 | 중국 |

| 규제 | CFFE |

| 시장 상품 | 상품 선물 |

| 데모 계정 | ❌ |

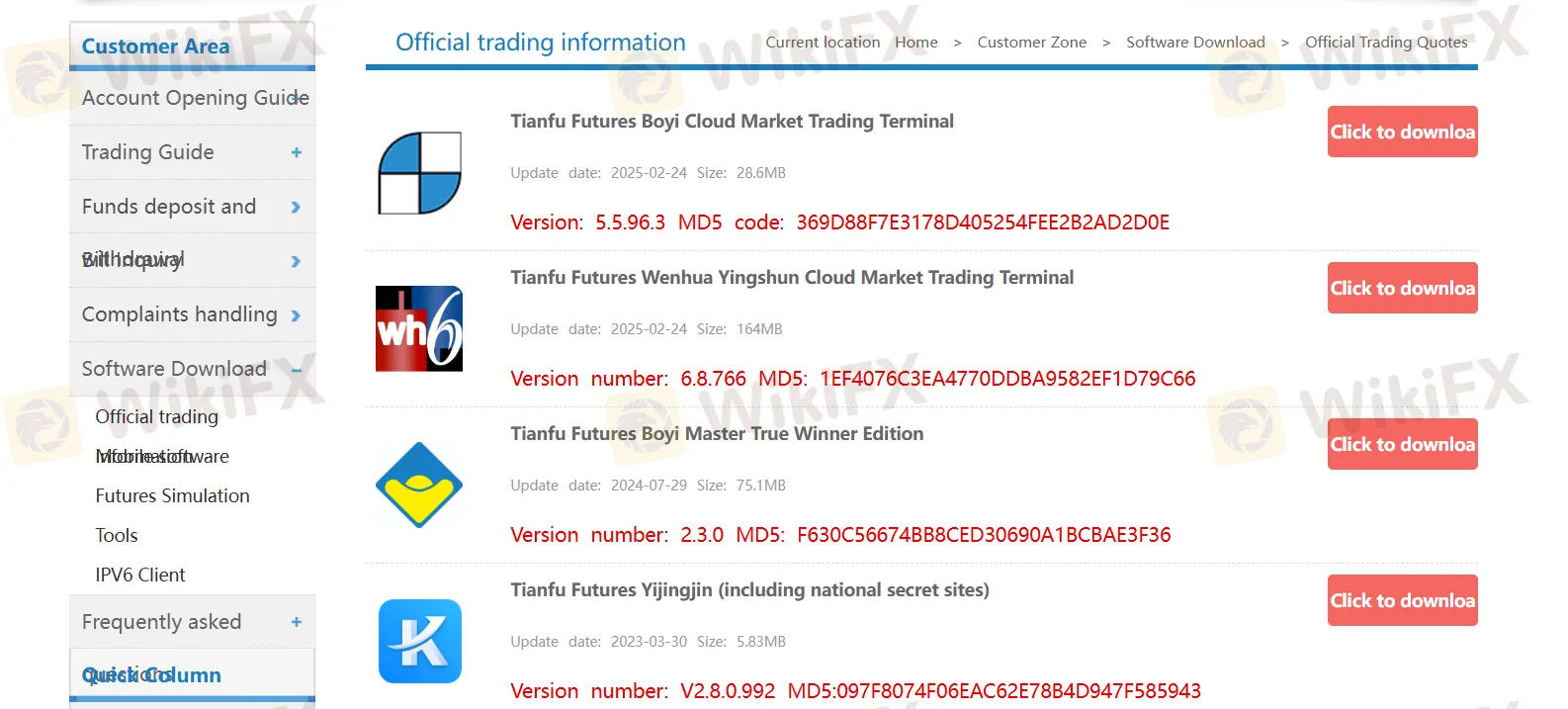

| 거래 플랫폼 | Tianfu Futures Boyi Cloud Market Trading Terminal, Tianfu Futures Wenhua Yingshun Cloud Market Trading Terminal, Tianfu Futures Boyi Master True Winner Edition 등 |

| 고객 지원 | 전화: 0431-88993790/400-700-5136 |

| 이메일: tfqh@tfqh.com | |

| 주소: 중국 창춘 경제 기술 개발 구역 진춘 거리와 푸동로 교차로에 위치한 그린타운 밀란 레지던스 B동 4층 | |

TIANFU FUTURES 정보

TIANFU FUTURES은 2003년 중국에서 설립된 프리미어 중개 및 금융 서비스의 규제된 공급 업체로, 상품 선물 거래에 특화되어 있습니다.

장단점

| 장점 | 단점 |

| 운영 시간이 길다 | 거래 제품이 제한적 |

| 잘 규제됨 | 투명성 부족 |

| 데모 계정 없음 | |

| 수수료 부과 |

TIANFU FUTURES 합법적인가요?

네. TIANFU FUTURES은(는) 중국금융선물거래소(CFFEX)의 라이센스를 받아 서비스를 제공합니다. 라이센스 번호는 0169입니다. 중국금융선물거래소(CFFEX)는 중화인민공화국 국무원과 중국증권감독위원회(CSRC)의 승인을 받아 설립된 주식회사로, 금융 선물, 옵션 및 기타 파생상품에 대한 거래 및 청산 서비스를 전문으로 제공합니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이센스 유형 | 라이센스 번호 |

| 중국금융선물거래소 | 규제됨 | 天富期货有限公司 | 선물 라이센스 | 0169 |

TIANFU FUTURES에서 무엇을 거래할 수 있나요?

| 거래 상품 | 지원됨 |

| 상품 선물 | ✔ |

| 외환 | ❌ |

| 지수 | ❌ |

| 주식 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETFs | ❌ |

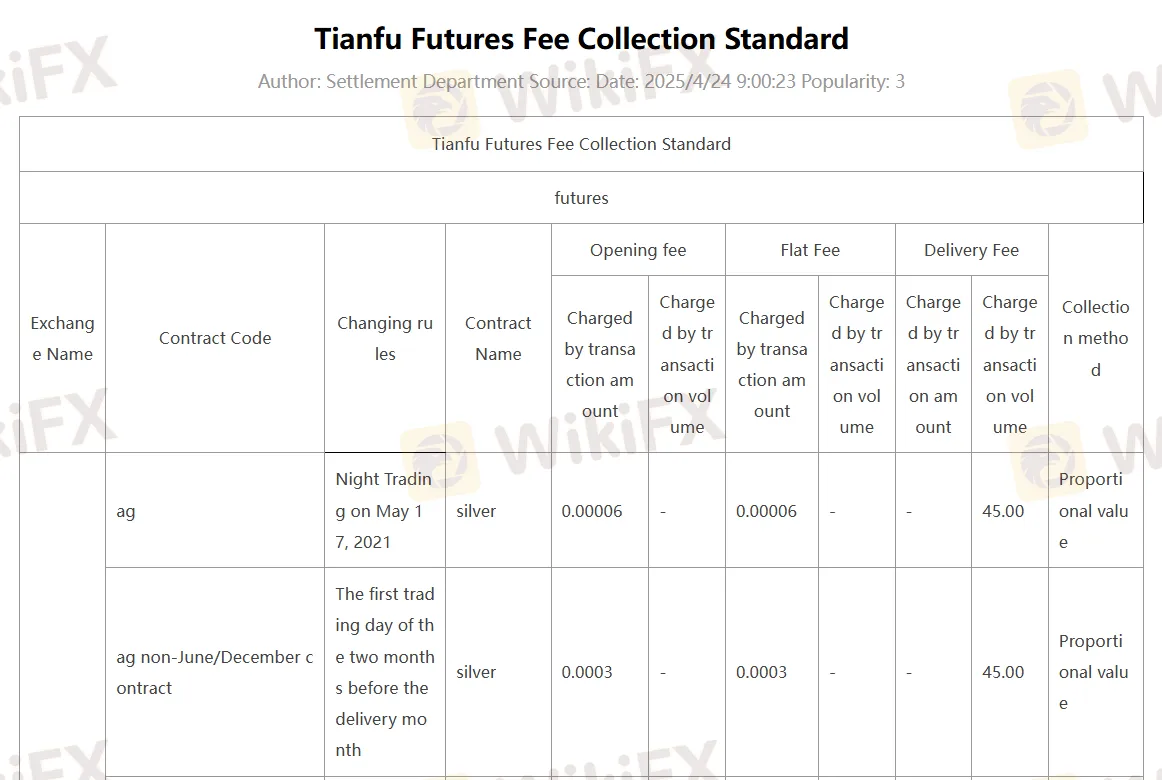

TIANFU FUTURES 수수료

선물 거래에는 개설 수수료, 고정 수수료 및 배송 수수료가 부과됩니다. 자세한 수수료 정보는 아래 스크린샷에서 확인할 수 있습니다:

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 |

| Tianfu Futures Boyi Cloud Market Trading Terminal | ✔ | PC, 노트북, 태블릿 |

| Tianfu Futures Wenhua Yingshun Cloud Market Trading Terminal | ✔ | PC, 노트북, 태블릿 |

| Tianfu Futures Boyi Master True Winner Edition | ✔ | PC, 노트북, 태블릿 |

| Tianfu Futures Yijingjin (including national secret sites) | ✔ | PC, 노트북, 태블릿 |

| Tianfu Futures Express Trading Terminal V2 (Second Seat) | ✔ | PC, 노트북, 태블릿 |

| Tianfu Futures Express Trading Terminal V3 (Second Seat) | ✔ | PC, 노트북, 태블릿 |

| Quilter 투자 플랫폼 | ✔ | PC, 노트북, 태블릿 |

입출금

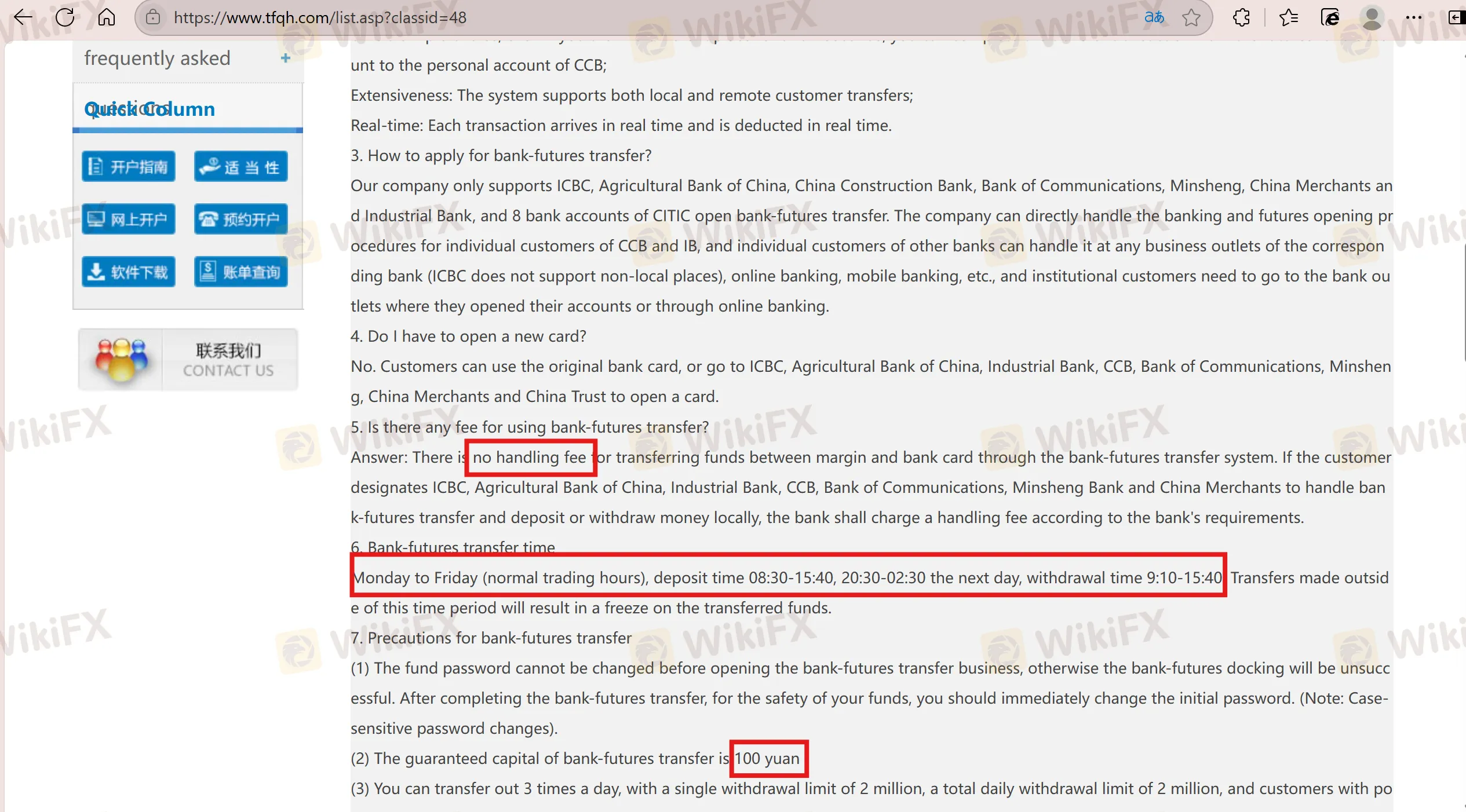

은행-선물 이체 시 마진과 은행 카드 간 자금 이체에 대한 수수료는 없습니다. 고객이 ICBC, 중국농업은행, 중국공상은행, CCB, 중국통신은행, 민생은행 및 중국무역 은행을 현지에서 은행-선물 이체 및 입출금을 처리하도록 지정하는 경우, 은행은 은행의 요구에 따라 수수료를 부과합니다. 월요일부터 금요일까지 입금 시간은 08:30-15:40, 20:30-다음 날 02:30이며, 출금 시간은 9:10-15:40입니다. 이 시간 이외에 이체를 하면 이체된 자금이 동결됩니다.