Resumo da empresa

| TIANFU FUTURES Resumo da Revisão | |

| Fundação | 2003 |

| País/Região Registrada | China |

| Regulação | CFFE |

| Instrumento de Mercado | Futuros de commodities |

| Conta Demonstrativa | ❌ |

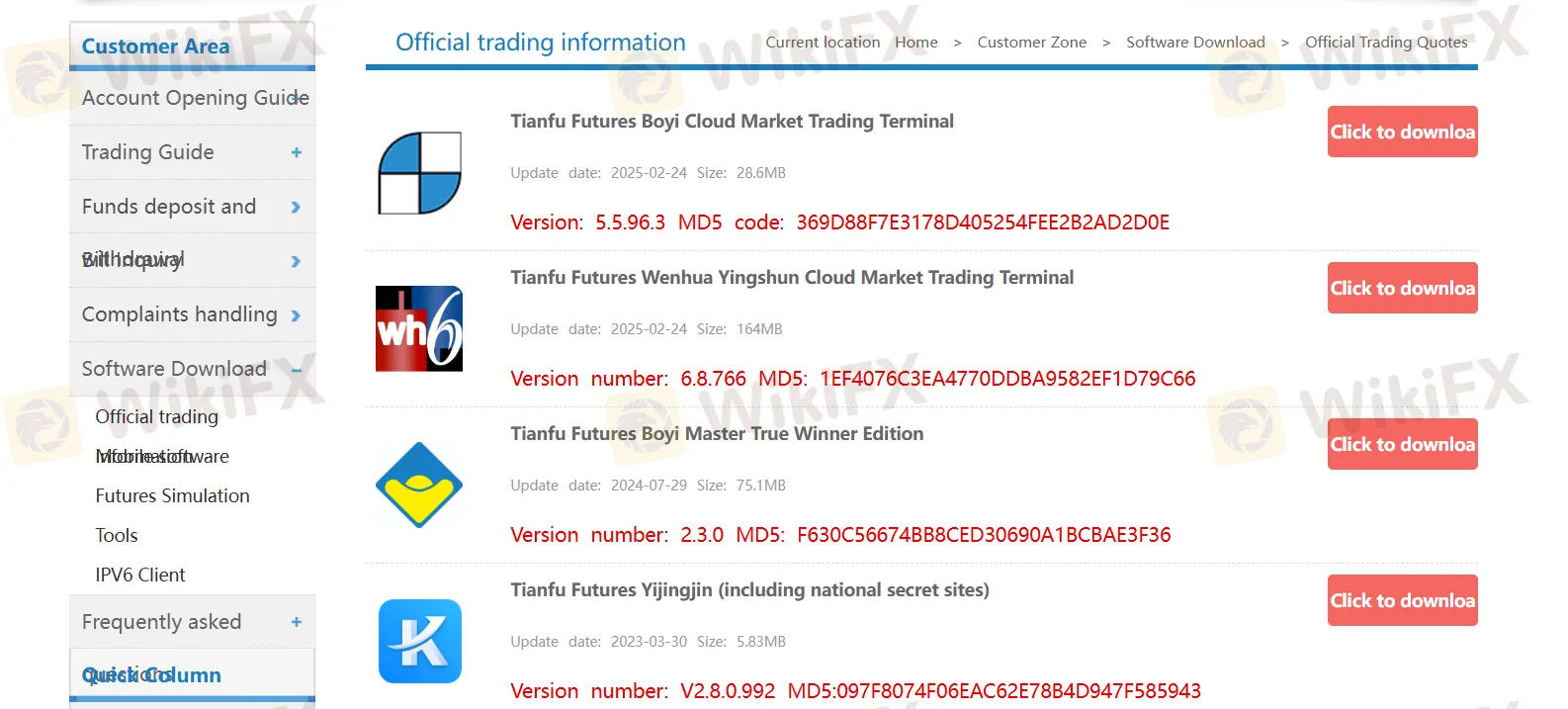

| Plataforma de Negociação | Terminal de Negociação de Mercado em Nuvem Tianfu Futures Boyi, Terminal de Negociação de Mercado em Nuvem Tianfu Futures Wenhua Yingshun, Edição Vencedora Verdadeira Mestre Boyi Tianfu Futures, etc. |

| Suporte ao Cliente | Tel: 0431-88993790/400-700-5136 |

| Email: tfqh@tfqh.com | |

| Endereço: 4º Andar, Edifício B, Residência Greentown Milan, interseção da Rua Jinchuan e Estrada Pudong, Zona de Desenvolvimento Econômico e Tecnológico de Changchun | |

Informações sobre TIANFU FUTURES

TIANFU FUTURES é um provedor de serviços regulamentado de corretagem e serviços financeiros de primeira linha, fundado na China em 2003. Especializa-se em negociação de futuros de commodities.

Prós e Contras

| Prós | Contras |

| Tempo de operação longo | Produtos de negociação limitados |

| Regulado adequadamente | Falta de transparência |

| Sem contas de demonstração | |

| Taxas de manuseio cobradas |

TIANFU FUTURES é Legítimo?

Sim. TIANFU FUTURES é licenciado pela China Financial Futures Exchange (CFFEX) para oferecer serviços. Seu número de licença é 0169. A CFFEX, estabelecida com a aprovação do Conselho de Estado da República Popular da China e da Comissão Reguladora de Valores Mobiliários da China (CSRC), é uma bolsa incorporada especializada em fornecer serviços de negociação e compensação para futuros financeiros, opções e outros derivativos.

| País Regulamentado | Regulador | Status Atual | Entidade Regulamentada | Tipo de Licença | Nº de Licença |

| China Financial Futures Exchange | Regulamentado | 天富期货有限公司 | Licença de Futuros | 0169 |

O que posso negociar na TIANFU FUTURES?

| Instrumentos de Negociação | Suportado |

| Futuros de commodities | ✔ |

| Forex | ❌ |

| Índices | ❌ |

| Ações | ❌ |

| Criptomoedas | ❌ |

| Obrigações | ❌ |

| Opções | ❌ |

| ETFs | ❌ |

Taxas TIANFU FUTURES

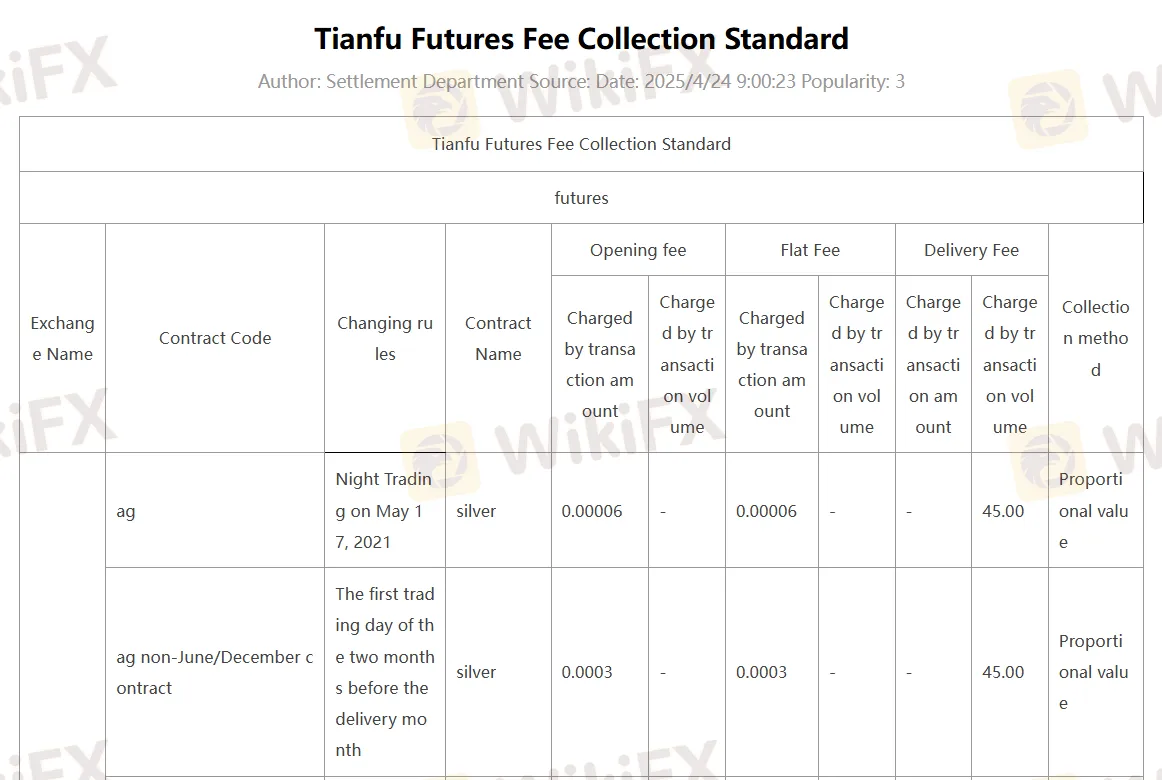

Para a negociação de futuros, são cobradas taxas de abertura, taxas fixas e taxas de entrega. As informações detalhadas sobre as taxas podem ser encontradas na captura de tela abaixo:

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| Terminal de Negociação de Mercado em Nuvem Boyi da Tianfu Futures | ✔ | PC, laptop, tablet |

| Terminal de Negociação de Mercado em Nuvem Wenhua Yingshun da Tianfu Futures | ✔ | PC, laptop, tablet |

| Edição True Winner Master Boyi da Tianfu Futures | ✔ | PC, laptop, tablet |

| Yijingjin da Tianfu Futures (incluindo sites secretos nacionais) | ✔ | PC, laptop, tablet |

| Terminal de Negociação Express V2 da Tianfu Futures (Segundo Assento) | ✔ | PC, laptop, tablet |

| Terminal de Negociação Express V3 da Tianfu Futures (Segundo Assento) | ✔ | PC, laptop, tablet |

| Plataforma de Investimento Quilter | ✔ | PC, laptop, tablet |

Depósito e Saque

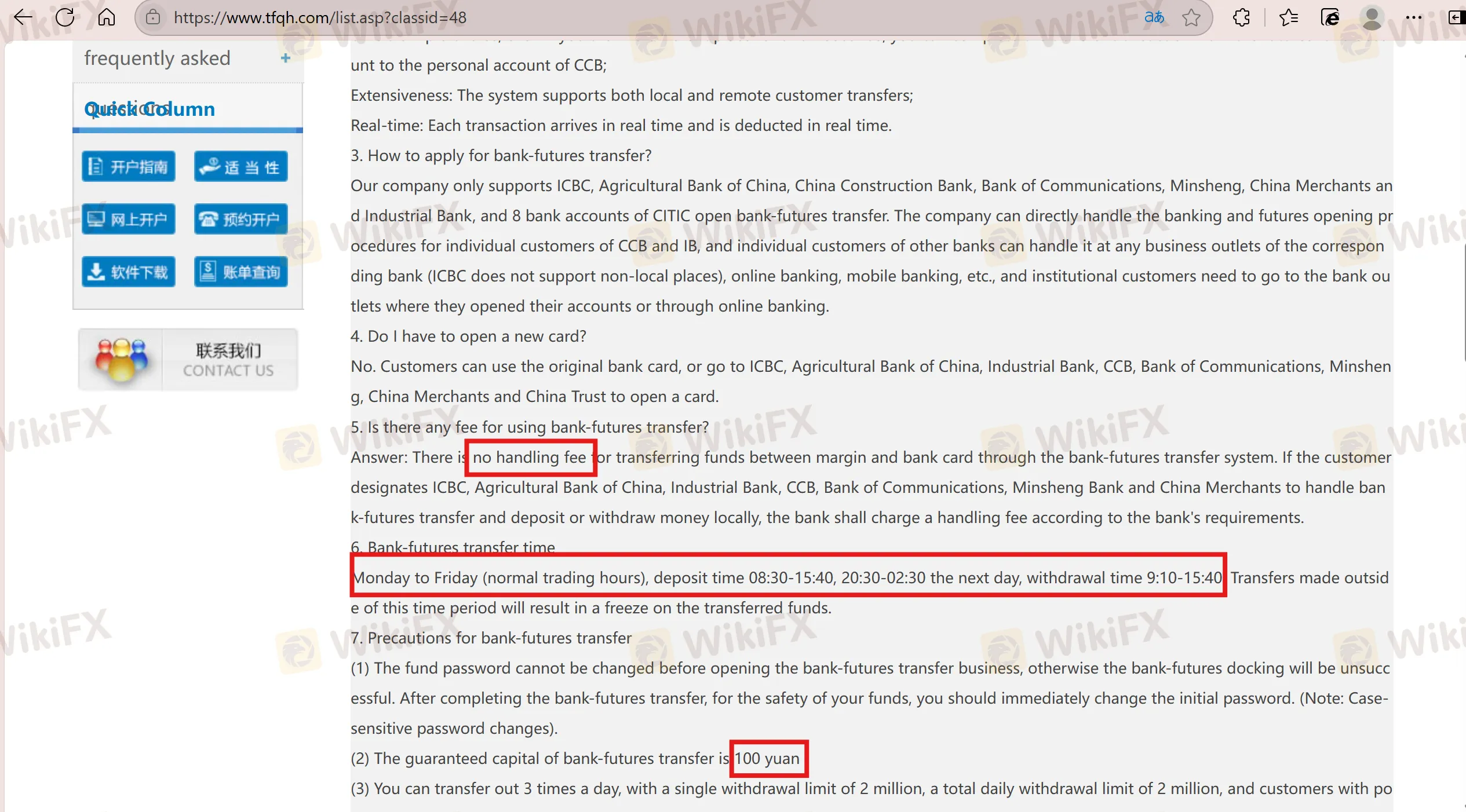

Não há taxa de manuseio para transferência de fundos entre margem e cartão bancário através do sistema de transferência banco-futuros. Se o cliente designar ICBC, Banco Agrícola da China, Banco Industrial, CCB, Banco de Comunicações, Banco Minsheng e China Merchants para lidar com a transferência banco-futuros e depositar ou sacar dinheiro localmente, o banco cobrará uma taxa de manuseio de acordo com os requisitos do banco. De segunda a sexta-feira, horário de depósito 08:30-15:40, 20:30-02:30 do dia seguinte, horário de saque 9:10-15:40. Transferências feitas fora deste período resultarão em congelamento dos fundos transferidos.