Perfil de la compañía

| TIANFU FUTURES Resumen de la reseña | |

| Fundación | 2003 |

| País/Región Registrada | China |

| Regulación | CFFE |

| Instrumento de Mercado | Futuros de productos básicos |

| Cuenta Demo | ❌ |

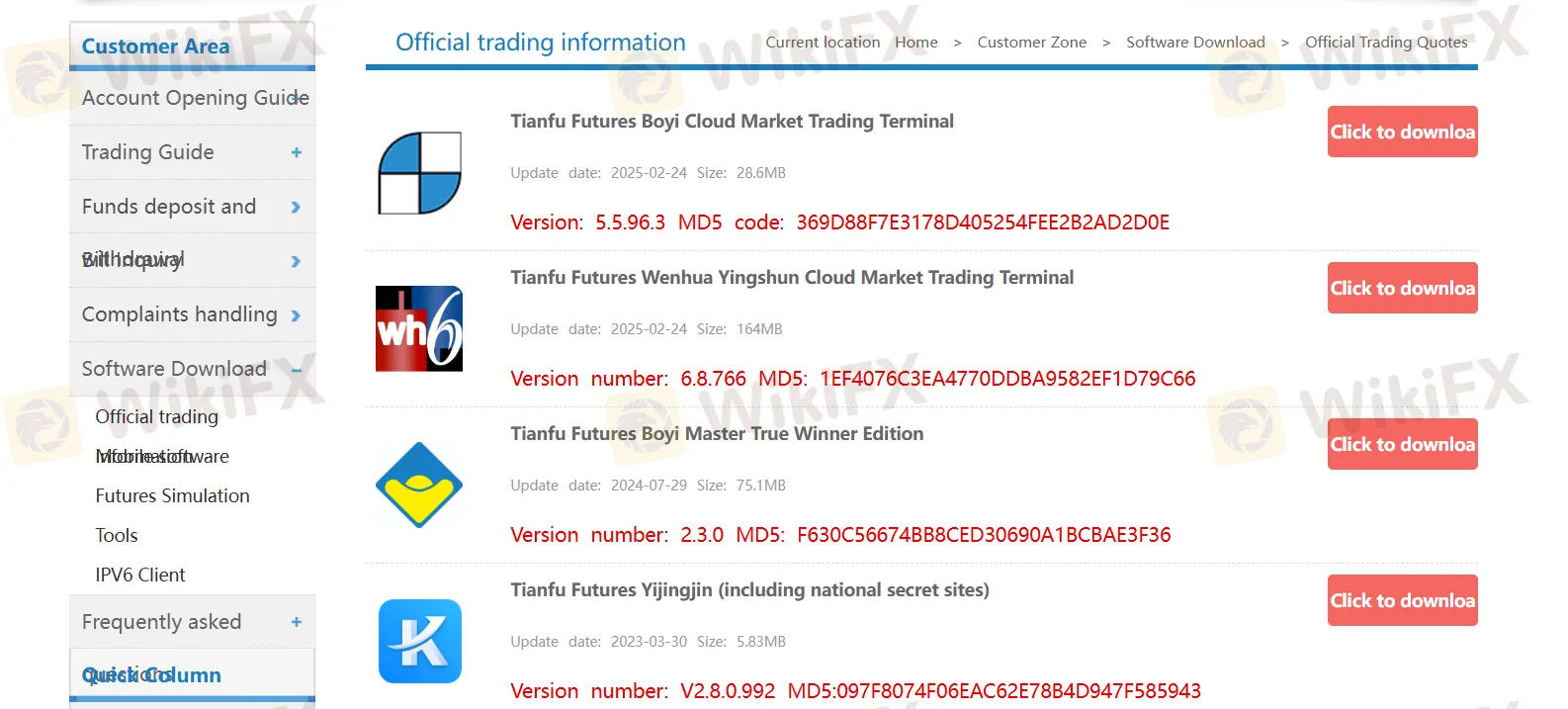

| Plataforma de Trading | Terminal de Trading del Mercado en la Nube Boyi de Tianfu Futures, Terminal de Trading del Mercado en la Nube Wenhua Yingshun de Tianfu Futures, Edición Maestra Verdadero Ganador de Boyi de Tianfu Futures, etc. |

| Soporte al Cliente | Tel: 0431-88993790/400-700-5136 |

| Email: tfqh@tfqh.com | |

| Dirección: 4th Floor, Edificio B, Residencia Greentown Milan, intersección de la Calle Jinchuan y la Calle Pudong, Zona de Desarrollo Económico y Tecnológico de Changchun | |

Información de TIANFU FUTURES

TIANFU FUTURES es un proveedor de servicios regulado de corretaje y servicios financieros de primera categoría, fundado en China en 2003. Se especializa en el trading de futuros de productos básicos.

Pros y Contras

| Pros | Contras |

| Tiempo de operación prolongado | Productos de trading limitados |

| Bien regulado | Falta de transparencia |

| Sin cuentas demo | |

| Se cobran comisiones de manejo |

¿Es TIANFU FUTURES Legítimo?

Sí. TIANFU FUTURES está licenciado por China Financial Futures Exchange (CFFEX) para ofrecer servicios. Su número de licencia es 0169. CFFEX, establecido con la aprobación del Consejo de Estado de la República Popular China y la Comisión Reguladora de Valores de China (CSRC), es un intercambio incorporado especializado en proporcionar servicios de negociación y compensación para futuros financieros, opciones y otros derivados.

| País Regulado | Regulador | Estado Actual | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| China Financial Futures Exchange | Regulado | 天富期货有限公司 | Licencia de Futuros | 0169 |

¿Qué puedo negociar en TIANFU FUTURES?

| Instrumentos de Negociación | Soportado |

| Futuros de productos básicos | ✔ |

| Forex | ❌ |

| Índices | ❌ |

| Acciones | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| Opciones | ❌ |

| ETFs | ❌ |

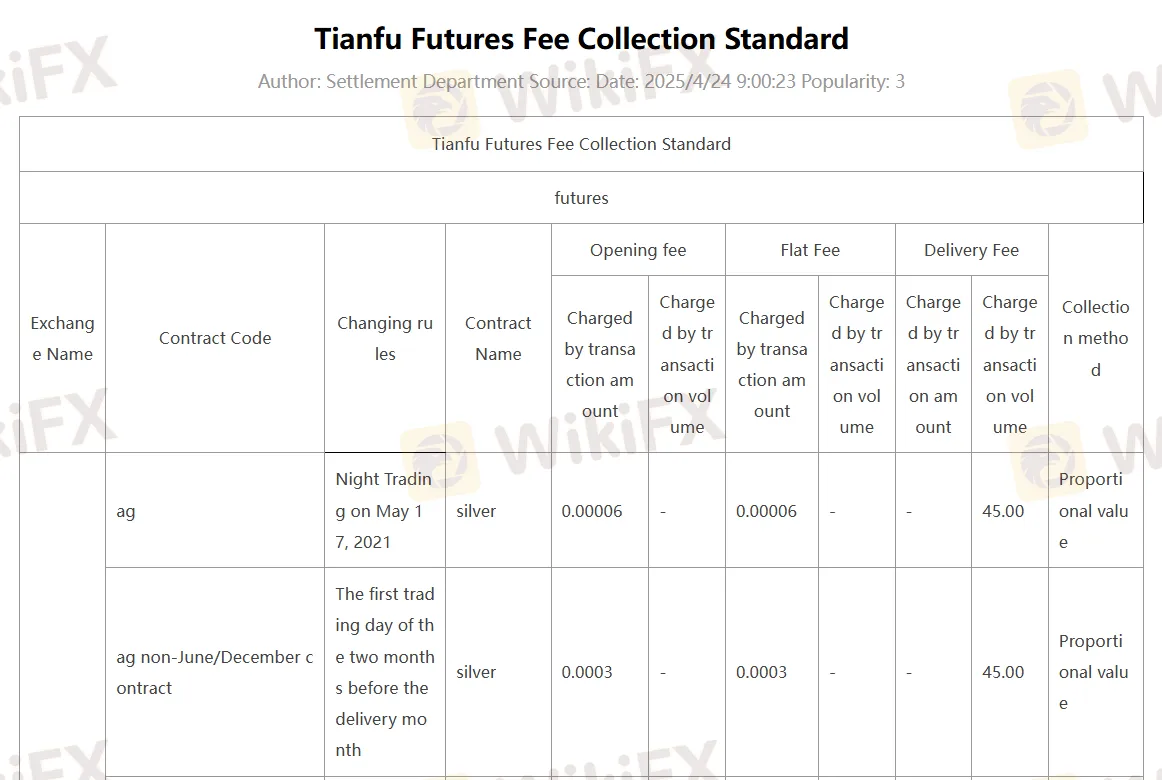

Tarifas de TIANFU FUTURES

Para el trading de futuros, se cobran comisiones de apertura, comisiones fijas y comisiones de entrega. Puede encontrar información detallada sobre las tarifas en la captura de pantalla a continuación:

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| Terminal de Trading del Mercado en la Nube Boyi de Tianfu Futures | ✔ | PC, portátil, tablet |

| Terminal de Trading del Mercado en la Nube Wenhua Yingshun de Tianfu Futures | ✔ | PC, portátil, tablet |

| Edición Maestra Verdadero Ganador Boyi de Tianfu Futures | ✔ | PC, portátil, tablet |

| Yijingjin de Tianfu Futures (incluidos sitios secretos nacionales) | ✔ | PC, portátil, tablet |

| Terminal de Trading Express V2 de Tianfu Futures (Segundo Asiento) | ✔ | PC, portátil, tablet |

| Terminal de Trading Express V3 de Tianfu Futures (Segundo Asiento) | ✔ | PC, portátil, tablet |

| Plataforma de Inversión Quilter | ✔ | PC, portátil, tablet |

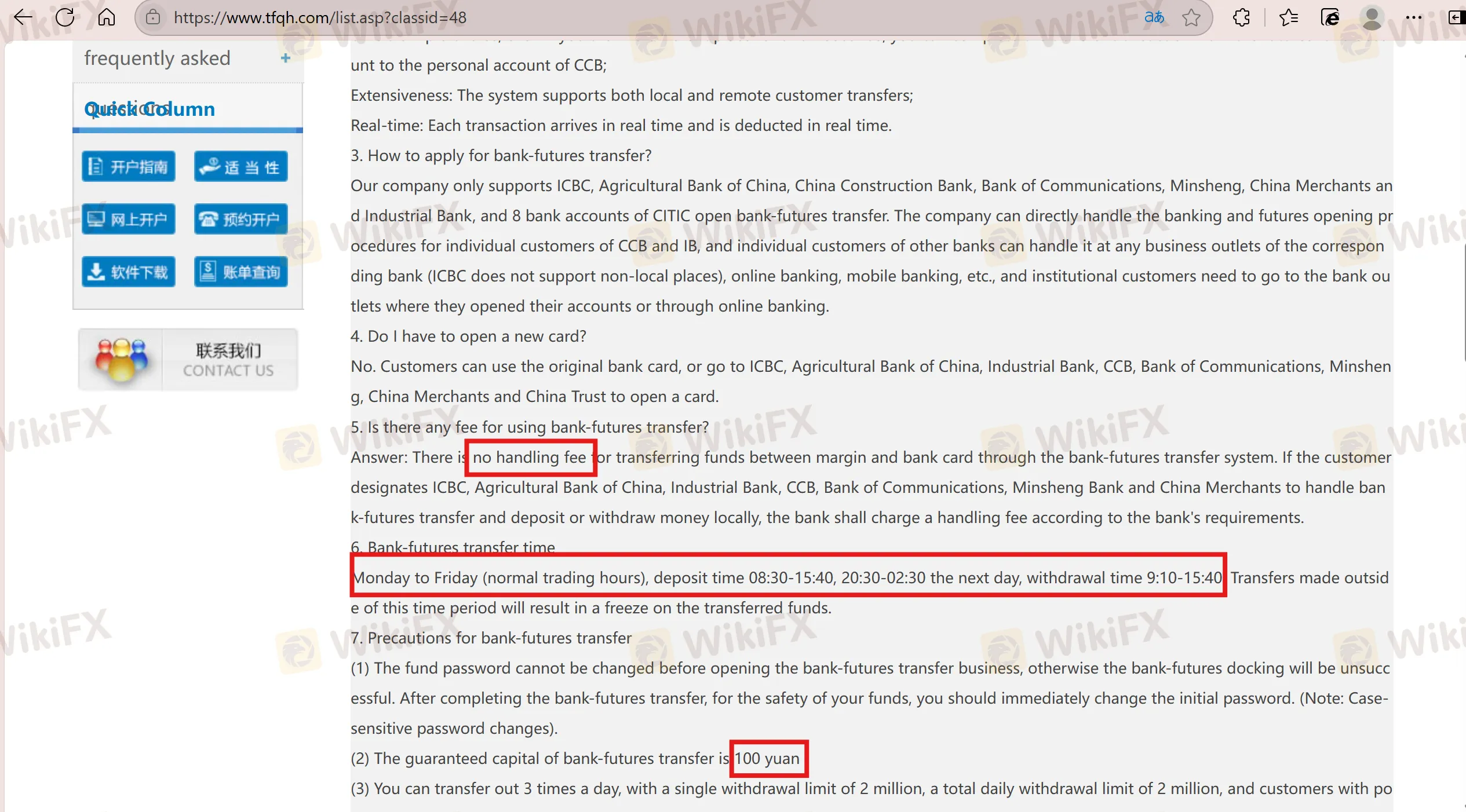

Depósito y Retiro

No hay tarifa de manejo por transferir fondos entre el margen y la tarjeta bancaria a través del sistema de transferencia banco-futuros. Si el cliente designa a ICBC, Agricultural Bank of China, Industrial Bank, CCB, Bank of Communications, Minsheng Bank y China Merchants para manejar la transferencia banco-futuros y depositar o retirar dinero localmente, el banco cobrará una tarifa de manejo de acuerdo con los requisitos del banco. De lunes a viernes, horario de depósito de 08:30 a 15:40, de 20:30 a 02:30 del día siguiente, horario de retiro de 9:10 a 15:40. Las transferencias realizadas fuera de este período de tiempo resultarán en una congelación de los fondos transferidos.