公司簡介

| TD道明道明 評論摘要 | |

| 成立年份 | 1998 |

| 註冊國家/地區 | 加拿大 |

| 監管 | 無監管 |

| 產品與服務 | 支票和儲蓄帳戶、信用卡、抵押貸款選擇、個人投資、借貸、網上投資和交易、個人財富建議 |

| 平台/App | TD道明道明 App |

| 客戶支援 | 英語:1-800-983-8472,法語:1-800-983-8472,普通話:1-877-233-5844 |

TD道明道明 資訊

TD道明道明 是一家線上交易公司,提供全面的個人銀行服務,包括信用卡、抵押貸款和各種投資選擇,可通過其用戶友好的 TD道明道明 App 輕鬆訪問。然而,目前並未受到任何金融監管機構的監管。

優點與缺點

| 優點 | 缺點 |

| 多元的個人銀行服務 | 未受監管的平台 |

| 費用結構不清晰 |

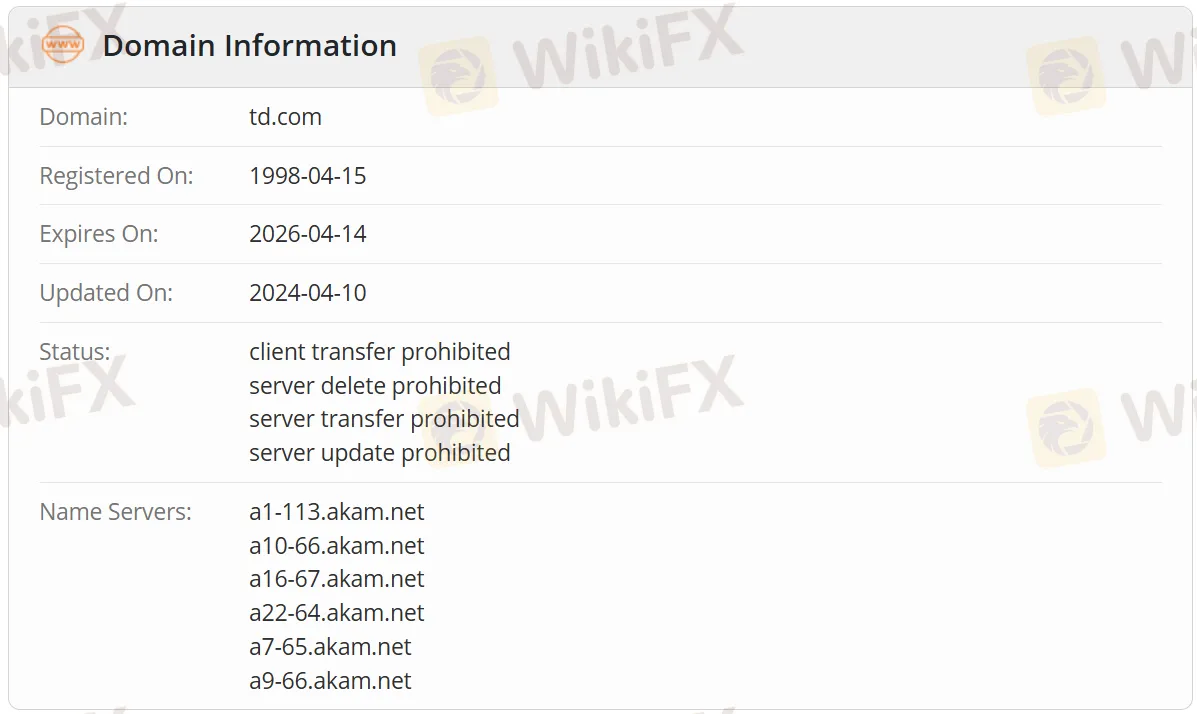

TD道明道明 是否合法?

否。TD道明道明 是一個未受監管的平台。域名 td.com 在1998年4月15日在WHOIS上註冊,並於2026年4月14日到期。目前狀態為“客戶轉移禁止,服務器刪除/轉移/更新禁止”。

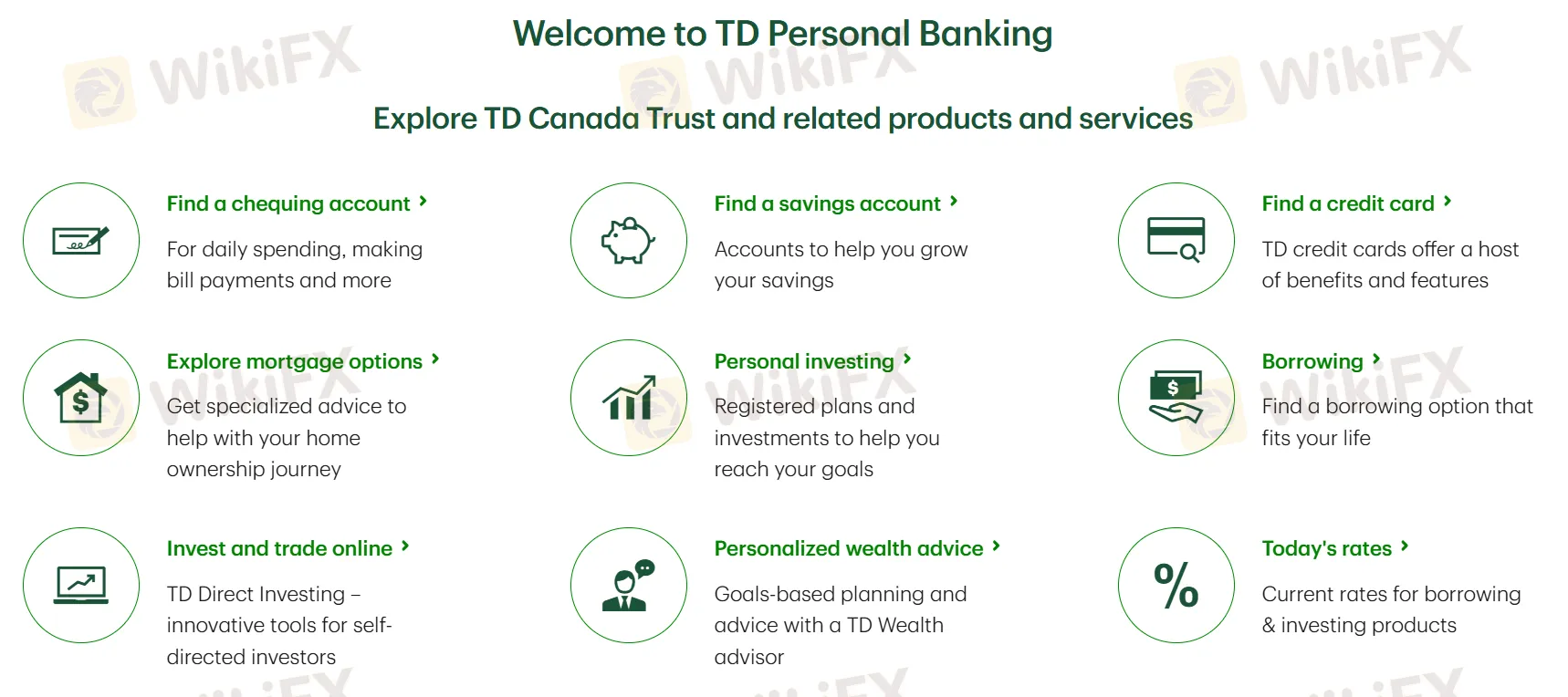

產品與服務

TD道明道明 提供的產品和服務包括支票和儲蓄帳戶、信用卡、抵押貸款選擇、個人投資、借貸、網上投資和交易、個人財富建議等。

平台/App

| 平台/App | 支援 | 可用設備 |

| TD道明道明 App | ✔ | 蘋果,安卓 |