Buod ng kumpanya

| TD Buod ng Pagsusuri | ||

| Itinatag | 1998 | |

| Nakarehistrong Bansa/Rehiyon | Canada | |

| Regulasyon | Walang Regulasyon | |

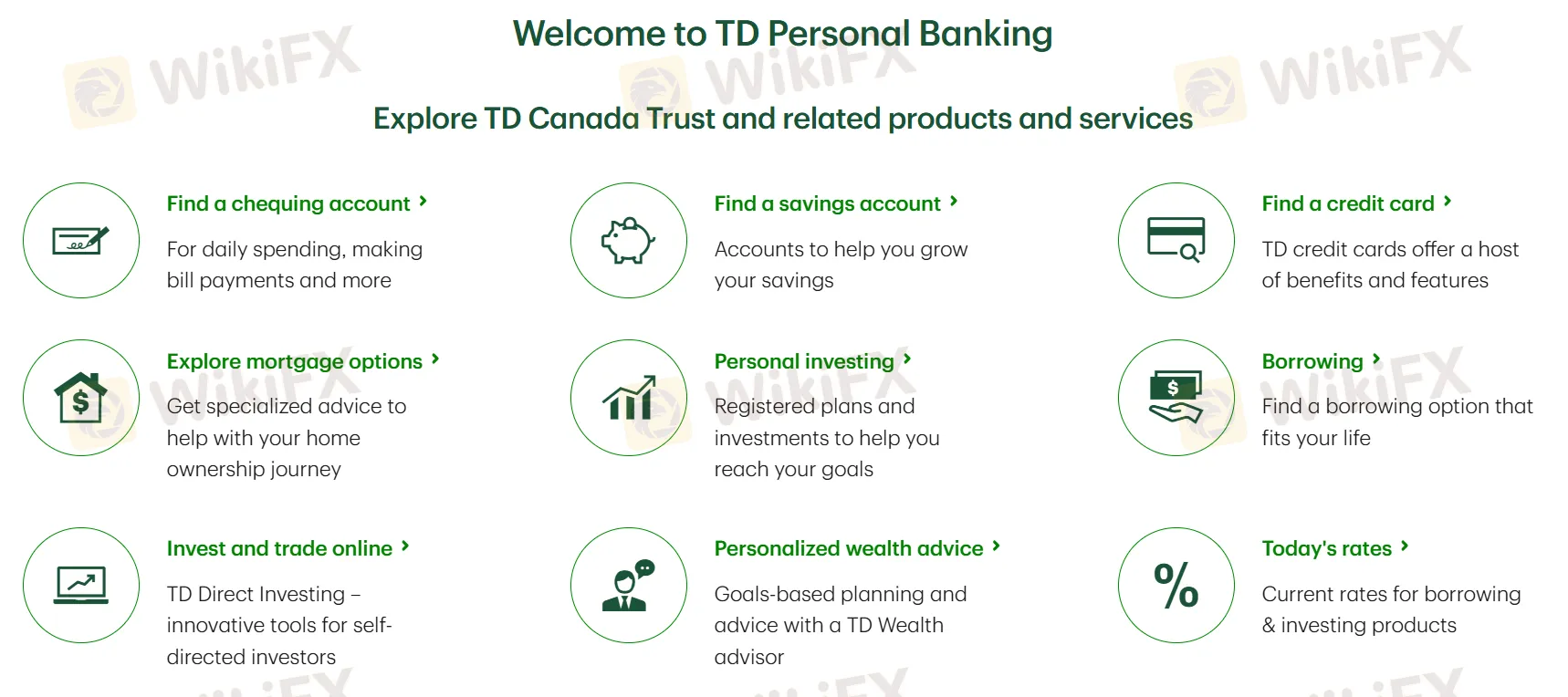

| Mga Produkto at Serbisyo | Mga account sa chequing at savings, credit cards, mga pagpipilian sa mortgage, personal na investing, pagnenegosyo, online investing at trading, personal na payo sa yaman | |

| Platform/App | Suporta sa Customer | Ingles: 1-800-983-8472, Pranses: 1-800-983-8472, Mandarin: 1-877-233-5844 |

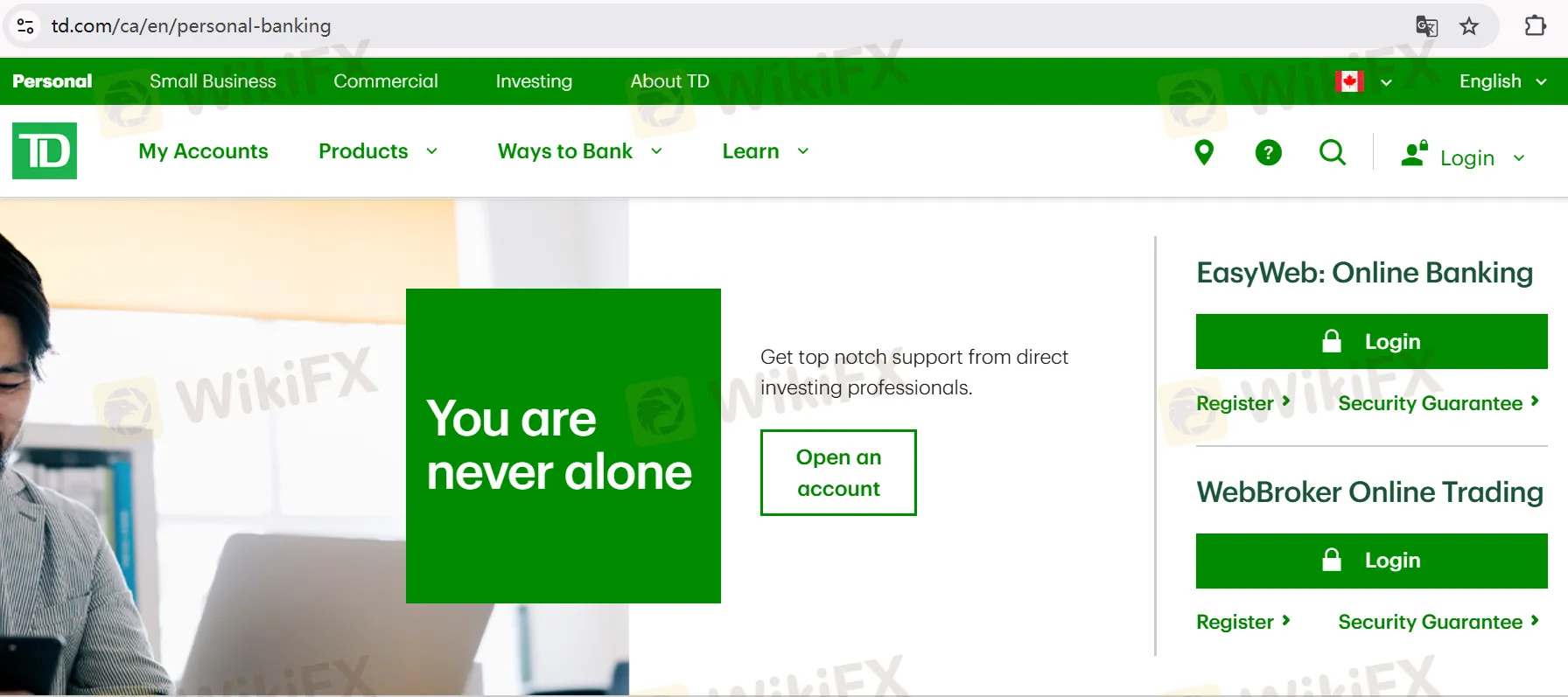

Impormasyon Tungkol sa TD

Ang TD ay isang online trading firm na nag-aalok ng komprehensibong personal na mga serbisyong bangko, kabilang ang credit cards, mortgages, at iba't ibang mga pagpipilian sa investing na madaling gamitin sa pamamagitan ng kanilang user-friendly na TD App. Gayunpaman, ito ay hindi regulado ng anumang mga awtoridad sa pinansya sa kasalukuyan.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Iba't ibang personal na mga serbisyong bangko | Hindi reguladong platform |

| Di-malinaw na istraktura ng bayad |

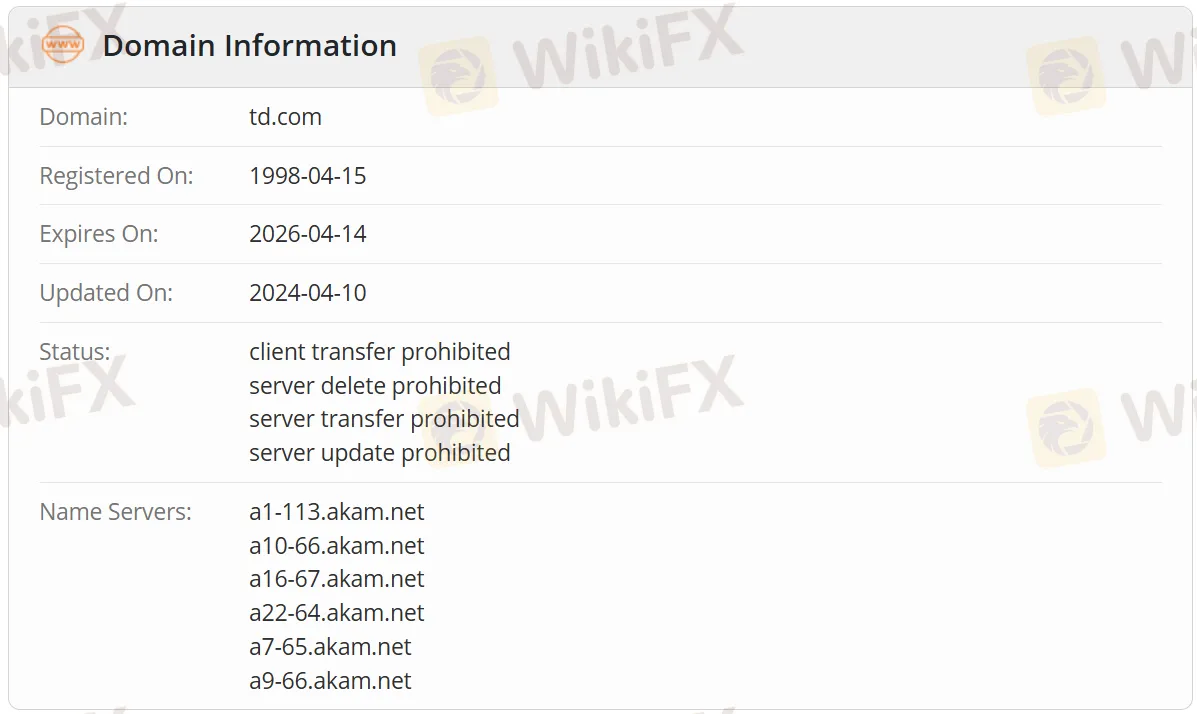

Totoo ba ang TD?

Hindi. Ang TD ay isang hindi reguladong platform. Ang pangalan ng domain td.com ay narehistro sa WHOIS noong Abril 15, 1998, at mag-eexpire sa Abril 14, 2026. Ang kasalukuyang status nito ay "client transfer prohibited, server delete/transfer/update prohibited."

Mga Produkto at Serbisyo

Ang TD ay nag-aalok ng mga produkto at serbisyo kabilang ang mga account sa chequing at savings, credit cards, mga pagpipilian sa mortgage, personal na investing, pagnenegosyo, online investing at trading, personal na payo sa yaman, atbp.

Platform/App

| Platform/App | Supported | Available Devices |

| TD App | ✔ | Apple, Android |