Présentation de l'entreprise

| CTBC SECURITIES Résumé de l'examen | |

| Fondé | 1989 |

| Pays/Région Enregistré | Taïwan |

| Régulation | Bourse de Taipei |

| Instruments de Marché | Offre Publique Secondaire, Obligations Convertibles, Obligations Échangeables, BCE, GDR, Offre Publique, Actions Émergentes |

| Compte de Démonstration | Non Mentionné |

| Support Client | TEL:(02)6639-2345 |

| FAX:(02)6639-2339 | |

CTBC SECURITIES Informations

CTBC Securities, établi à Taïwan en 1989 et réglementé par la Bourse de Taipei, propose plusieurs instruments de marché, y compris des OPS, diverses obligations, et gère des offres liées aux IPO. Les informations telles que les frais de transaction, les types de comptes et la plateforme de trading ne sont pas mentionnées sur le site web.

Avantages et Inconvénients

| Avantages | Inconvénients |

|

|

|

|

Est-ce que CTBC SECURITIES est Légitime ?

CTBC SECURITIES détient une licence de "Négociation de valeurs mobilières" réglementée par la Bourse de Taipei à Taïwan.

Que Puis-je Trader sur CTBC SECURITIES ?

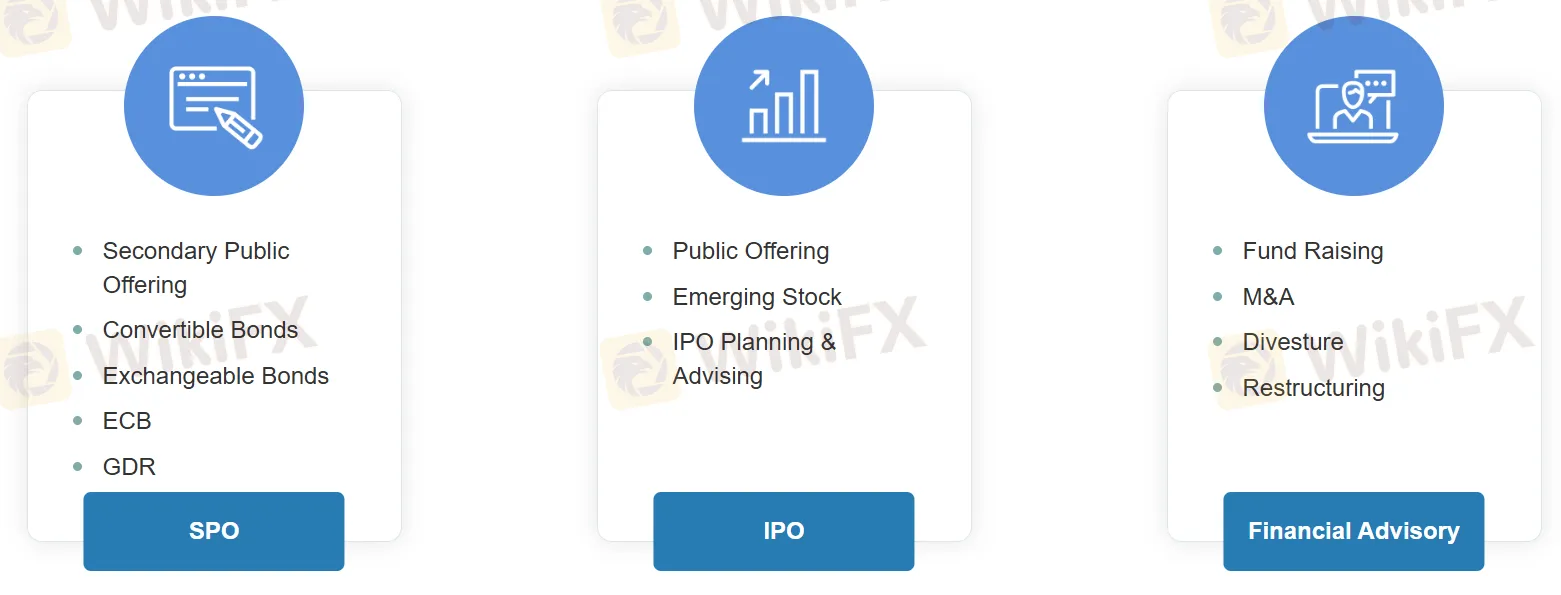

CTBC SECURITIES facilite le trading lié aux Offres Publiques Secondaires (OPS), Obligations Convertibles, Obligations Échangeables, BCE et GDR. Ils gèrent également des Offres Publiques et des Actions Émergentes associées aux Offres Publiques Initiales (IPO), tout en fournissant des services de Conseil Financier pour la collecte de fonds, les fusions et acquisitions, les cessions et les restructurations.

| Catégorie | Instruments Offerts |

| OPS | Offre Publique Secondaire |

| Obligations Convertibles | |

| Obligations Échangeables | |

| BCE | |

| GDR | |

| IPO | Offre Publique |

| Actions Émergentes | |

| Planification et Conseil en IPO | |

| Conseil Financier | Collecte de Fonds |

| Fusions et Acquisitions | |

| Cessions | |

| Restructurations |

Processus d'IPO

Chemin 1: Nécessite l'enregistrement des actions sur l'ESB pendant au moins 6 mois après la pré-déclaration et une offre publique, suivi de 3 à 6 mois de souscription et de cotation, puis une période d'émission post-cotation de 2 ans.

Chemin 2: Implique qu'une société de valeurs mobilières recommandée par le chef mène un conseil en cotation pendant au moins 6 mois après la pré-déclaration et le dépôt/révision. Cela est suivi de 3 à 6 mois d'offre publique, de souscription et de cotation, et d'une période d'émission post-cotation de 2 ans.

Sécurité en Ligne

CTBC Securities met l'accent sur la sécurité en ligne en conseillant aux utilisateurs de toujours se connecter via leur site officiel, d'effectuer des transactions sur des appareils de confiance et de ne jamais partager leurs informations personnelles via téléphone ou messages instantanés.