Buod ng kumpanya

| CTBC SECURITIES Buod ng Pagsusuri | |

| Itinatag | 1989 |

| Rehistradong Bansa/Rehiyon | Taiwan |

| Regulasyon | Taipei Exchange |

| Mga Instrumento sa Merkado | Secondary Public Offering, Convertible Bonds, Exchangeable Bonds, ECB, GDR, Public Offering, Emerging Stock |

| Demo Account | Hindi Nabanggit |

| Suporta sa Customer | TEL:(02)6639-2345 |

| FAX:(02)6639-2339 | |

CTBC SECURITIES Impormasyon

Ang CTBC Securities, itinatag sa Taiwan noong 1989 at niregula ng Taipei Exchange, ay nag-aalok ng iba't ibang mga instrumento sa merkado, kabilang ang SPOs, iba't ibang bonds, at namamahala sa mga alokasyon kaugnay ng IPO. Ang impormasyon, kabilang ang mga bayad sa kalakalan, uri ng account, at plataporma ng kalakalan, ay hindi nabanggit sa website.

Mga Benepisyo at Kons

| Mga Benepisyo | Kons |

|

|

|

|

Tunay ba ang CTBC SECURITIES?

Ang CTBC SECURITIES ay may lisensiyang "Dealing in securities" na nireregula ng Taipei Exchange sa Taiwan.

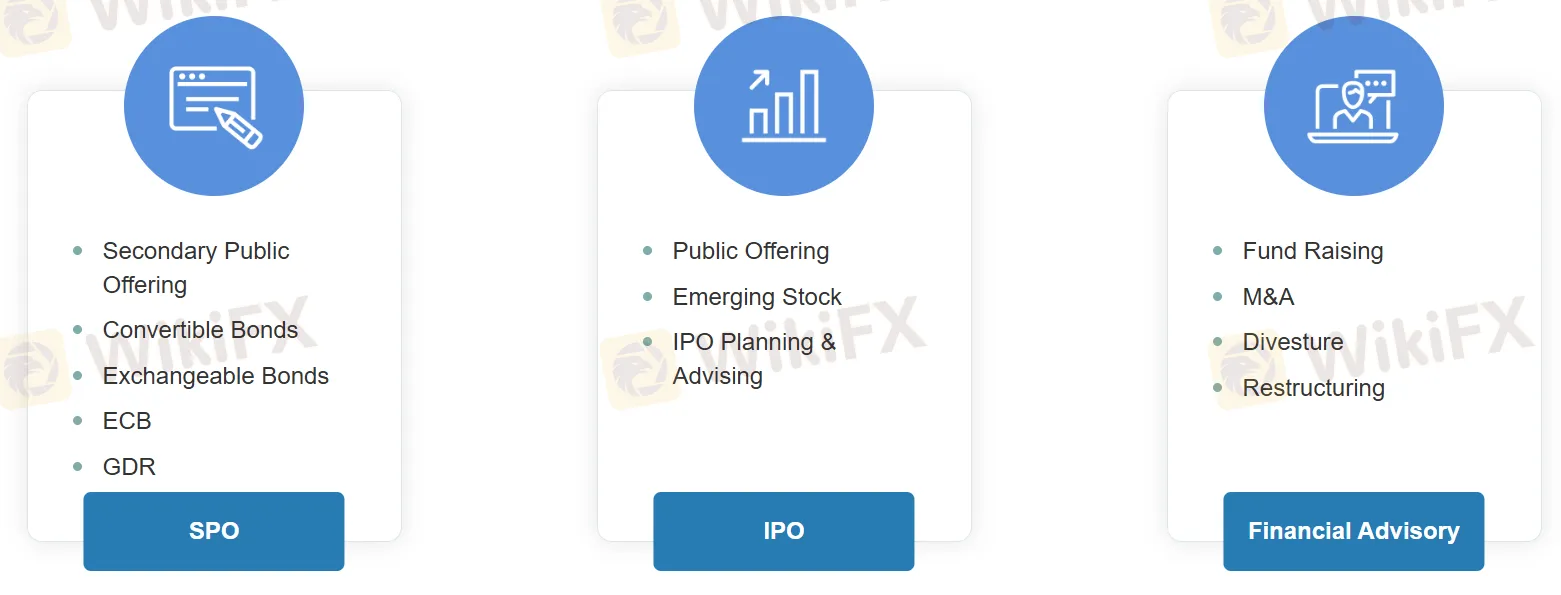

Ano ang Maaari Kong I-trade sa CTBC SECURITIES?

Ang CTBC SECURITIES ay nagpapadali ng kalakalang kaugnay ng Secondary Public Offerings (SPO), Convertible Bonds, Exchangeable Bonds, ECB, at GDR. Sila rin ang namamahala sa Public Offerings at Emerging Stocks kaugnay ng Initial Public Offerings (IPO), kasama ang pagbibigay ng Financial Advisory services para sa fundraising, M&A, divestiture, at restructuring.

| Kategorya | Mga Alokasyon |

| SPO | Secondary Public Offering |

| Convertible Bonds | |

| Exchangeable Bonds | |

| ECB | |

| GDR | |

| IPO | Public Offering |

| Emerging Stock | |

| IPO Planning & Advising | |

| Financial Advisory | Fund Raising |

| M&A | |

| Divestiture | |

| Restructuring |

Proseso ng IPO

Layunin 1: Nangangailangan ng pagpaparehistro ng mga stocks sa ESB nang hindi kukulangin sa 6 na buwan pagkatapos ng pre-filing at public offering, sinundan ng 3-6 na buwan ng underwriting at listing, at pagkatapos ay 2 taon ng post-listing issuance period.

Layunin 2: Kinapapalooban ng pagpapagawa ng Lead Recommending Securities Firm ng listing advisory nang hindi kukulangin sa 6 na buwan pagkatapos ng pre-filing at filing/review. Sinundan ito ng 3-6 na buwan ng public offering, underwriting, at listing, at 2 taon ng post-listing issuance period.

Seguridad sa Online

Pinapalakas ng CTBC Securities ang seguridad sa online sa pamamagitan ng pagsasabing laging mag-login sa kanilang opisyal na website, gawin ang mga transaksyon sa mga pinagkakatiwalaang aparato, at huwag ibahagi ang personal na detalye sa pamamagitan ng telepono o instant messages.