Profil perusahaan

| CTBC SECURITIES Ringkasan Ulasan | |

| Didirikan | 1989 |

| Negara/Daerah Terdaftar | Taiwan |

| Regulasi | Bursa Taipei |

| Instrumen Pasar | Penawaran Umum Sekunder, Obligasi Konversi, Obligasi Tukar, ECB, GDR, Penawaran Umum, Saham Perusahaan yang Baru Go Public |

| Akun Demo | Tidak Disebutkan |

| Dukungan Pelanggan | TEL:(02)6639-2345 |

| FAX:(02)6639-2339 | |

Informasi CTBC SECURITIES

CTBC Securities, didirikan di Taiwan pada tahun 1989 dan diatur oleh Bursa Taipei, menawarkan berbagai instrumen pasar, termasuk SPO, berbagai obligasi, dan menangani penawaran IPO terkait. Informasi, termasuk biaya perdagangan, jenis akun, dan platform perdagangan, tidak disebutkan di situs web.

Pro dan Kontra

| Pro | Kontra |

|

|

|

|

Apakah CTBC SECURITIES Legal?

CTBC SECURITIES memiliki lisensi "Bertransaksi dalam sekuritas" yang diatur oleh Bursa Taipei di Taiwan.

Apa yang Dapat Diperdagangkan di CTBC SECURITIES?

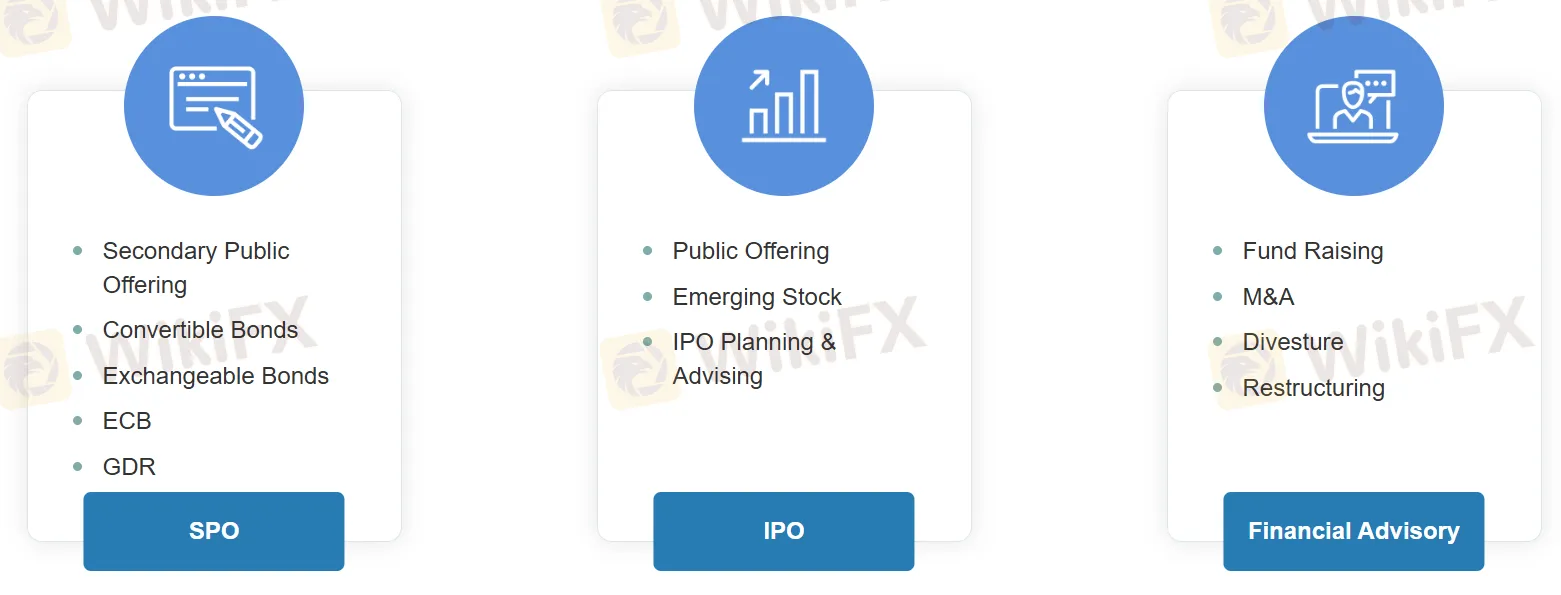

CTBC SECURITIES memfasilitasi perdagangan terkait Penawaran Umum Sekunder (SPO), Obligasi Konversi, Obligasi Tukar, ECB, dan GDR. Mereka juga menangani Penawaran Umum dan Saham Perusahaan yang Baru Go Public terkait Penawaran Saham Perdana (IPO), serta menyediakan layanan Konsultasi Keuangan untuk penggalangan dana, M&A, pelepasan aset, dan restrukturisasi.

| Kategori | Instrumen yang Ditawarkan |

| SPO | Penawaran Umum Sekunder |

| Obligasi Konversi | |

| Obligasi Tukar | |

| ECB | |

| GDR | |

| IPO | Penawaran Umum |

| Saham Perusahaan yang Baru Go Public | |

| Perencanaan & Penasehatan IPO | |

| Konsultasi Keuangan | Penggalangan Dana |

| M&A | |

| Pelepasan Aset | |

| Restrukturisasi |

Proses IPO

Jalur 1: Memerlukan pendaftaran saham di ESB selama setidaknya 6 bulan setelah pra-pengajuan dan penawaran umum, diikuti oleh 3-6 bulan penjaminan dan pencatatan, dan kemudian periode penerbitan pasca-pencatatan selama 2 tahun.

Jalur 2: Melibatkan Lead Recommending Securities Firm melakukan penasehatan pencatatan selama setidaknya 6 bulan setelah pra-pengajuan dan pengajuan/peninjauan. Ini diikuti oleh 3-6 bulan penawaran umum, penjaminan, dan pencatatan, serta periode penerbitan pasca-pencatatan selama 2 tahun.

Keamanan Online

CTBC Securities menekankan keamanan online dengan menyarankan pengguna untuk selalu masuk melalui situs web resmi mereka, melakukan transaksi pada perangkat yang terpercaya, dan tidak pernah membagikan detail pribadi melalui telepon atau pesan instan.