Buod ng kumpanya

| NCC Bank Buod ng Pagsusuri | |

| Itinatag | 1985 |

| Rehistradong Bansa | Bangladesh |

| Regulasyon | Walang regulasyon |

| Mga Produkto at Serbisyo | Retail banking, SME banking, corporate banking, digital financial services, NRB banking, cards, offshore banking |

| Platform | NCC Always (Internet & Mobile Banking), NCC ICON (Corporate Internet Banking), NCC Green PIN, NCC Sanchayee (Digital Onboarding), Customer Self Service (CSS), Statement Portal |

| Minimum Deposit | Tk. 500 |

| Suporta sa Customer | Telepono: 09666700008 |

| PABX: 8802-223381903-4, 8802-223383981-3 | |

| Fax: 8802-223386290 | |

| Email: info@nccbank.com.bd | |

| SWIFT: NCCLBDDH | |

Impormasyon Tungkol sa NCC Bank

Ang NCC Bank ay isang Bangladeshi commercial bank na itinatag noong 1985. Nag-aalok ito ng malawak na hanay ng mga serbisyong bangko sa mga indibidwal, maliit at gitnang negosyo, kumpanya, at mga customer mula sa iba't ibang bansa. Nag-aalok ito ng mahusay na serbisyong pang-retail at pang-korporasyon, ngunit hindi pinapayagan na mag-alok ng forex o investment brokerage services.

Mga Kalamangan at Disadvantages

| Kalamangan | Kahinaan |

| Matagal nang itinatag na bangko | Walang regulasyon |

| Malawak na hanay ng serbisyong pang-retail at pang-korporasyon | Komplikadong istraktura ng bayad |

| Matatag na digital at mobile banking platforms |

Tunay ba ang NCC Bank?

Hindi, ang NCC Bank ay hindi isang reguladong forex o investment broker. Hindi nagbibigay ng lisensya ang Bangladesh Securities and Exchange Commission (BSEC) at ang Bangladesh Bank sa kumpanya upang mag-alok ng forex o investment services, kahit na ito ay nakabase sa Bangladesh.

Mga Produkto at Serbisyo

NCC Bank ay nakatuon sa mga indibidwal, negosyo, at kliyente mula sa iba't ibang bansa. Nag-aalok ito ng malawak na hanay ng mga serbisyong bangko, tulad ng retail banking, corporate banking, SME banking, digital financial services, NRB (non-resident Bangladeshi) banking, at card services.

| Mga Produkto at Serbisyo | Supported |

| Retail Banking | ✔ |

| SME Banking | ✔ |

| Corporate Banking | ✔ |

| Digital Financial Services | ✔ |

| NRB Banking (Overseas Clients) | ✔ |

| Cards | ✔ |

| Impormasyon sa Indikatibong Rate | ✔ |

| Offshore Banking Unit (OBU) | ✔ |

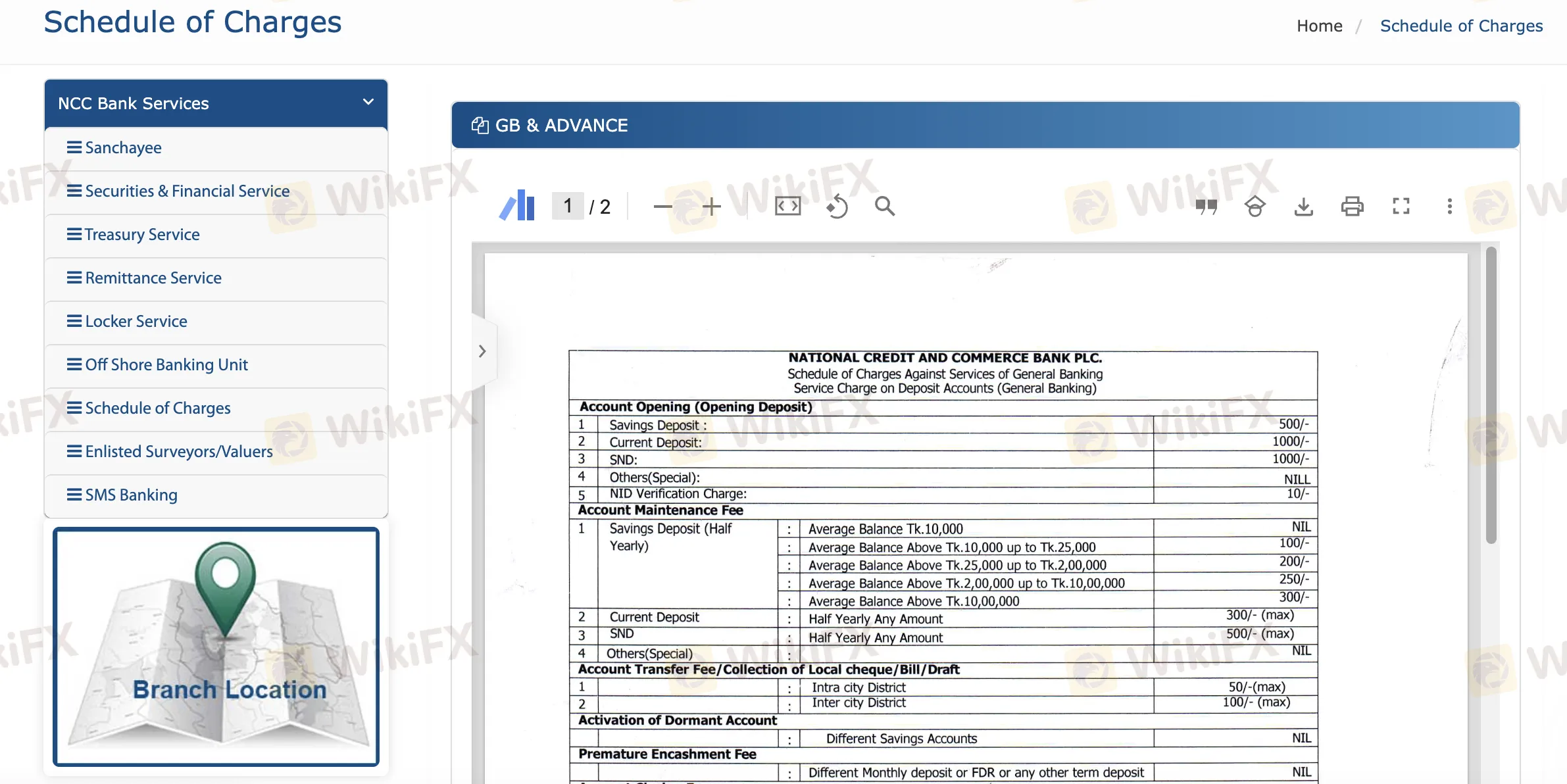

Mga Bayad sa NCC Bank

Ang mga presyo ng NCC Bank ay karaniwang makatarungan kumpara sa singil ng iba pang mga bangko sa lugar. Ang ilang mga serbisyo, tulad ng pagpapanatili ng iyong account na up-to-date at paggawa ng simpleng transaksyon, ay libre o mababa ang halaga. Gayunpaman, ang mga mas espesyalisadong serbisyo, tulad ng mga pautang, garantiya, o malalaking transaksyon, ay mas mahal.

| Uri ng Bayad | Halaga / Saklaw |

| Pagbubukas ng Account (Savings) | Tk. 500 |

| Pagbubukas ng Account (Current) | Tk. 1,000 |

| Bayad sa Pagpapanatili ng Account (Savings) | NIL hanggang Tk. 300 (kalahating taon, batay sa balance tier) |

| Bayad sa Pagpapanatili ng Account (Current) | Hanggang Tk. 300 (kalahating taon) |

| Bayad sa Paglipat ng Account (Intra-city) | Max Tk. 50 |

| Bayad sa Paglipat ng Account (Inter-city) | Max Tk. 100 |

| Aktibasyon ng Dormant Account | Libre |

| Bayad sa Pagpapaclose ng Account (Savings) | Tk. 200 |

| Pagpapalabas ng Cheque Book (Nawawala) | Tk. 7 bawat dahon |

| Kumpirmasyon ng Balance / Statement | Tk. 100–200 (bawat kaso, mga record ng nakaraang taon) |

| Stop Payment Instruction | Tk. 100 bawat tagubilin |

| Payment Order (PO) | Tk. 20–100 (batay sa halaga) |

| DD, TT, MT | Tk. 20–300 (batay sa halaga) |

| Bayad sa Paggawa ng Pautang | Max 0.50% hanggang sa Tk. 50 lakh (max Tk. 15,000); 0.30% sa itaas ng Tk. 50 lakh (max Tk. 20,000) |

| Bayad sa Pagreschedule / Pagrestructure ng Pautang | Hanggang sa 0.25%, max Tk. 10,000 (non-CMSME) |

| Bayad sa Maagang Pagtutuos | NIL (CMSME); Max 0.50% (ibang mga pautang) |

| Bayad sa Multa | 2% |

| Komisyon sa Bank Guarantee | 0.30–0.50% bawat quarter, min Tk. 1,000 |

| Mga Bayad Online (Intra-city) | Libre (mga maliit na halaga), Tk. 50 (mas malaki) |

| Mga Bayad Online (Inter-city) | Libre (maliit), Tk. 100 (mas malaki) |

Platform

| Platform | Supported | Available Devices |

| NCC Always (Internet & Mobile Banking) | ✔ | PC, Mobile |

| NCC ICON (Corporate Internet Banking) | ✔ | PC, Web |

| NCC Green PIN (Card Activation & PIN) | ✔ | ATM, Internet Banking, Mobile Banking |

| NCC Sanchayee (Digital Onboarding) | ✔ | Web, Mobile |

| Customer Self Service (CSS) | ✔ | Web, Mobile |

| Statement Portal | ✔ | Web |