Buod ng kumpanya

| BRAC EPL Buod ng Pagsusuri | |

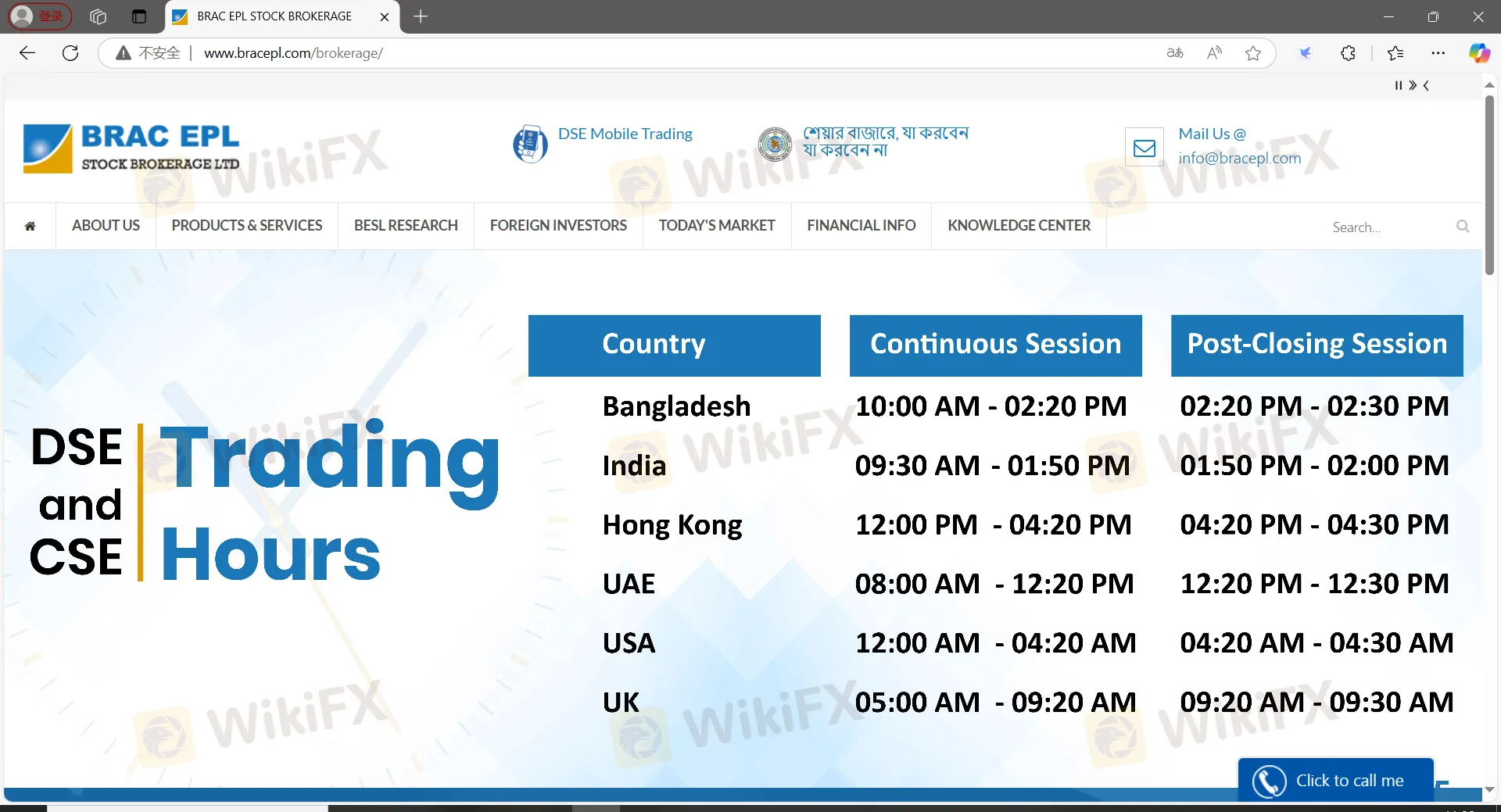

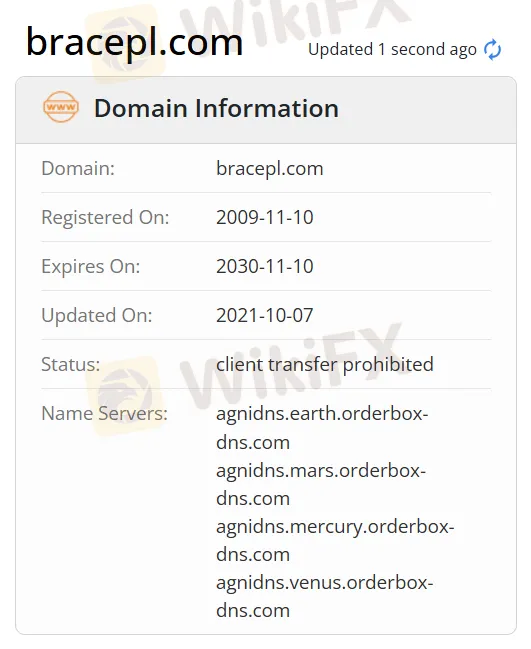

| Itinatag | 2009 |

| Rehistradong Bansa/Rehiyon | Bangladesh |

| Regulasyon | Walang regulasyon |

| Instrumento sa Merkado | Equity |

| Demo Account | ❌ |

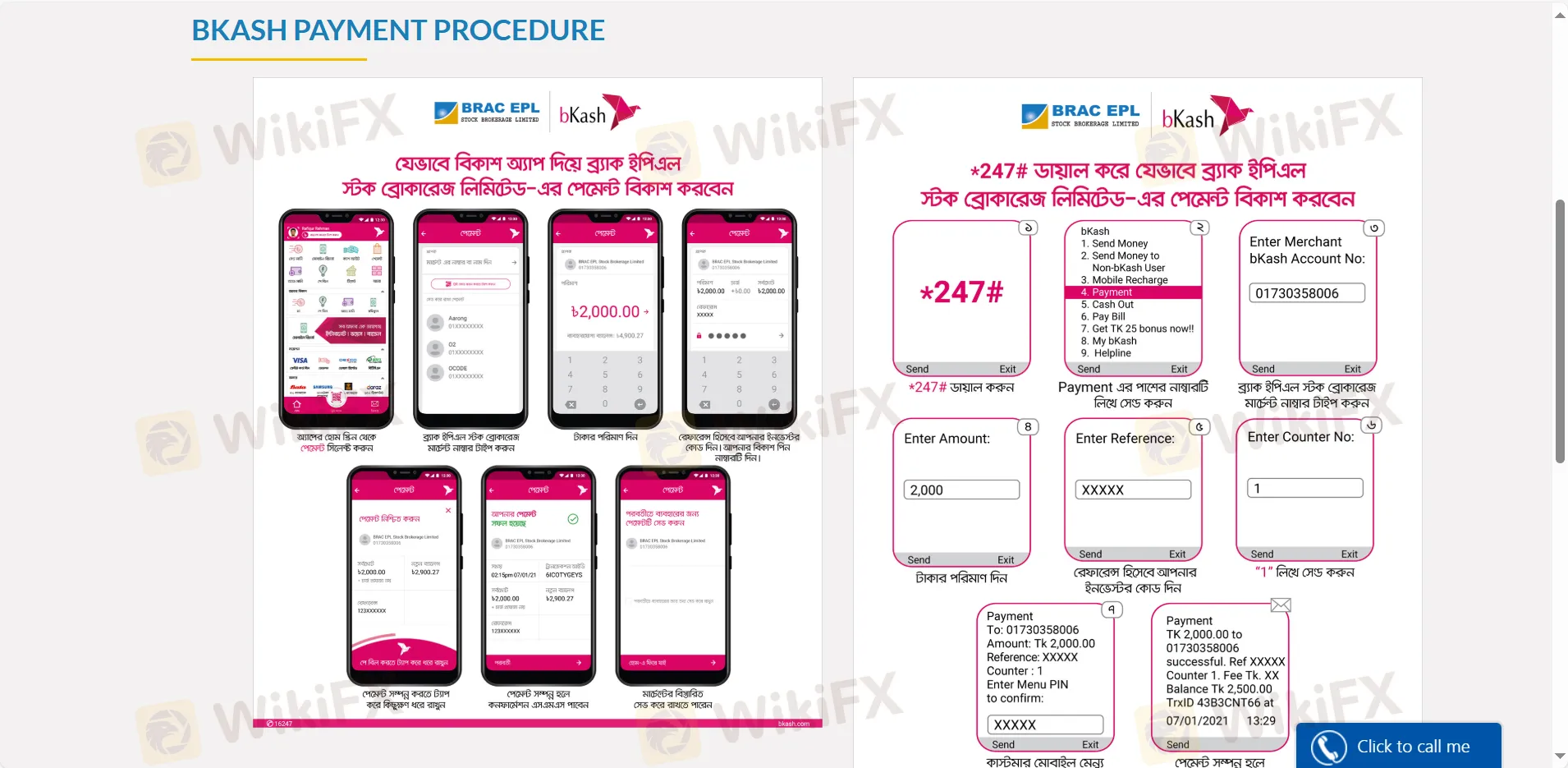

| Platform ng Paggawa ng Kalakalan | bKash |

| Suporta sa Customer | Form ng Pakikipag-ugnayan |

| Tel: +88 02-9514-729-30; +88 02-222282446-48 | |

| Email: info@bracepl.com | |

| Address: Symphony (3rd Floor) SE (F)-9, Road No-142, Gulshan Avenue, Dhaka- Bangladesh. | |

| Social media: Facebook, LinkedIn | |

Impormasyon Tungkol sa BRAC EPL

Ang BRAC EPL ay isang hindi naaayon sa regulasyon na tagapagbigay ng pangunahing brokerage at serbisyong pinansyal, na itinatag sa Bangladesh noong 2009. Nag-aalok ito ng mga produkto at serbisyo sa Equity, BESL PROBASHI BINIYOG, Full DP Service, EFT/BFTN/RTGS, IPO, Retail Brokerage Service, NRB Brokerage Service, SMS Service, Online BO Application, BRAC EPL iDesk, at bKash Payment Procedure.

Mga Kalamangan at Disadvantages

| Kalamangan | Kahinaan |

| Mahabang oras ng operasyon | Kawalan ng regulasyon |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Walang demo accounts |

| Mga bayad sa komisyon | |

| Kawalan ng transparensya |

Tunay ba ang BRAC EPL?

Walang kasalukuyang valid regulations ang No. BRAC EPL. Mangyaring maging maingat sa panganib!

Ano ang Maaari Kong I-trade sa BRAC EPL?

| Mga Asset sa Trading | Supported |

| Equity | ✔ |

| Forex | ❌ |

| Commodity | ❌ |

| Indice | ❌ |

| Stock | ❌ |

| Crypto | ❌ |

| Bond | ❌ |

| Option | ❌ |

| ETF | ❌ |

Mga Bayad sa BRAC EPL

Ang bayad sa komisyon ay itinakda sa maximum na 1% ng kabuuang halaga ng kalakalan.

Plataporma ng Kalakalan

| Plataporma ng Kalakalan | Supported | Available Devices |

| App ng bKash | ✔ | Mobile |