Perfil de la compañía

| Fidelity Resumen de la revisión | |

| Establecido | 1969 |

| País/Región Registrada | EE. UU. |

| Regulación | SFC |

| Productos y Servicios | Fondos mutuos globales, planes de jubilación MPF y ORSO, soluciones de inversión temáticas y multiactivos |

| Cuenta Demo | ❌ |

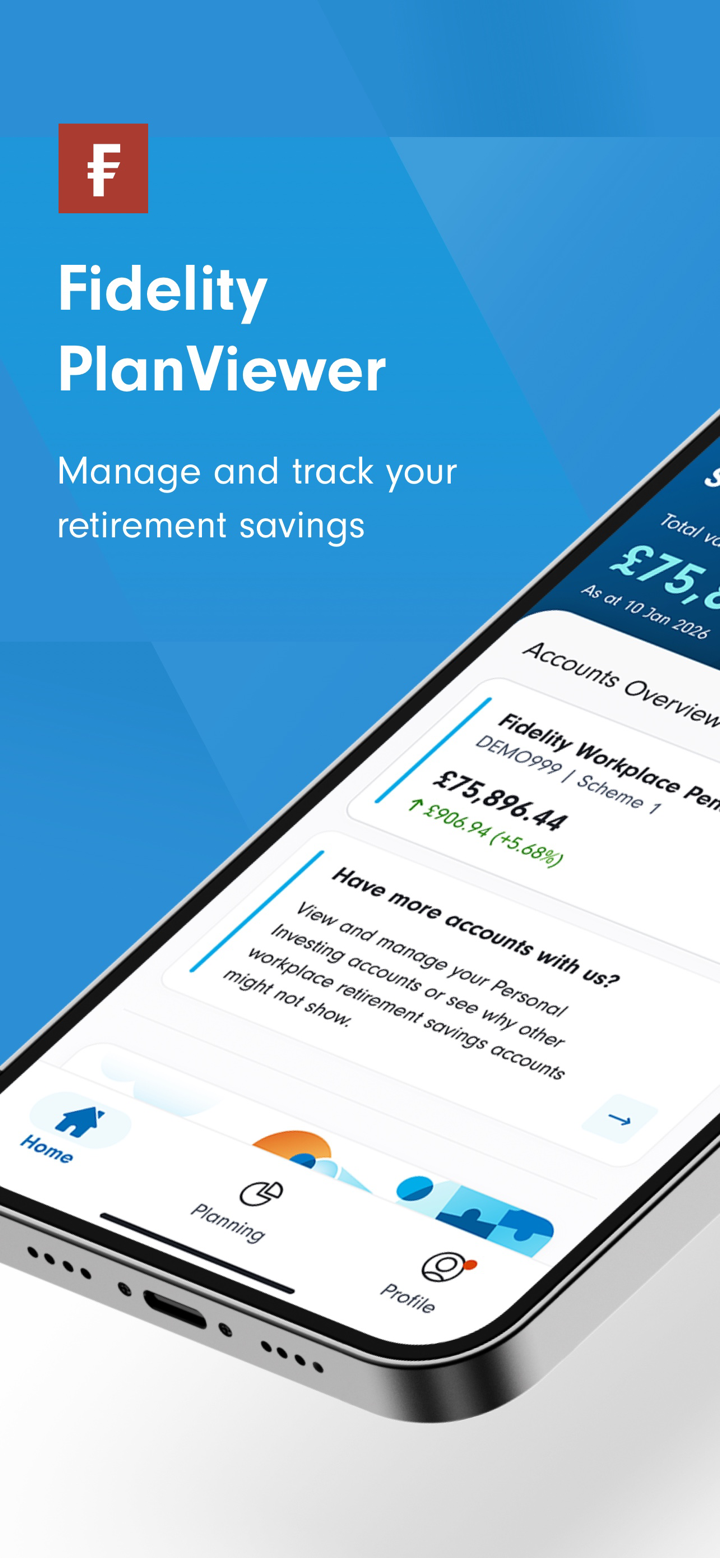

| Plataforma de Trading | Fidelity en línea, Fidelity Aplicación Móvil |

| Depósito Mínimo | HK$1,000/mes (Plan de Inversión Mensual) |

| Soporte al Cliente | Teléfono: (852) 2629 2629 |

| Correo Electrónico: hkenquiry@fil.com | |

Información de Fidelity

Establecida en 1969, Fidelity es una empresa financiera regulada por la SFC que ofrece soluciones de inversión internacionales. No proporciona FX o CFDs, sino que se centra en fondos mutuos, planes de jubilación (MPF/ORSO) y estrategias temáticas.

Pros y Contras

| Pros | Contras |

| Regulado por la SFC | Sin cuenta demo o cuenta islámica (libre de swaps) |

| Amplia selección de fondos mutuos y soluciones de jubilación | Comisiones relativamente altas |

| Estructura de comisiones escalonadas beneficia a inversores con saldos altos | |

| Largo tiempo de operación | |

| Varios tipos de cuentas |

¿Es Fidelity Legítimo?

Sí, Fidelity está regulado. Está autorizado por la Comisión de Valores y Futuros (SFC) de Hong Kong con una licencia de Operaciones en contratos de futuros. El número de licencia es AAG408.

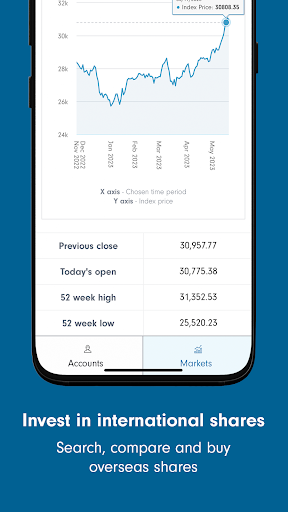

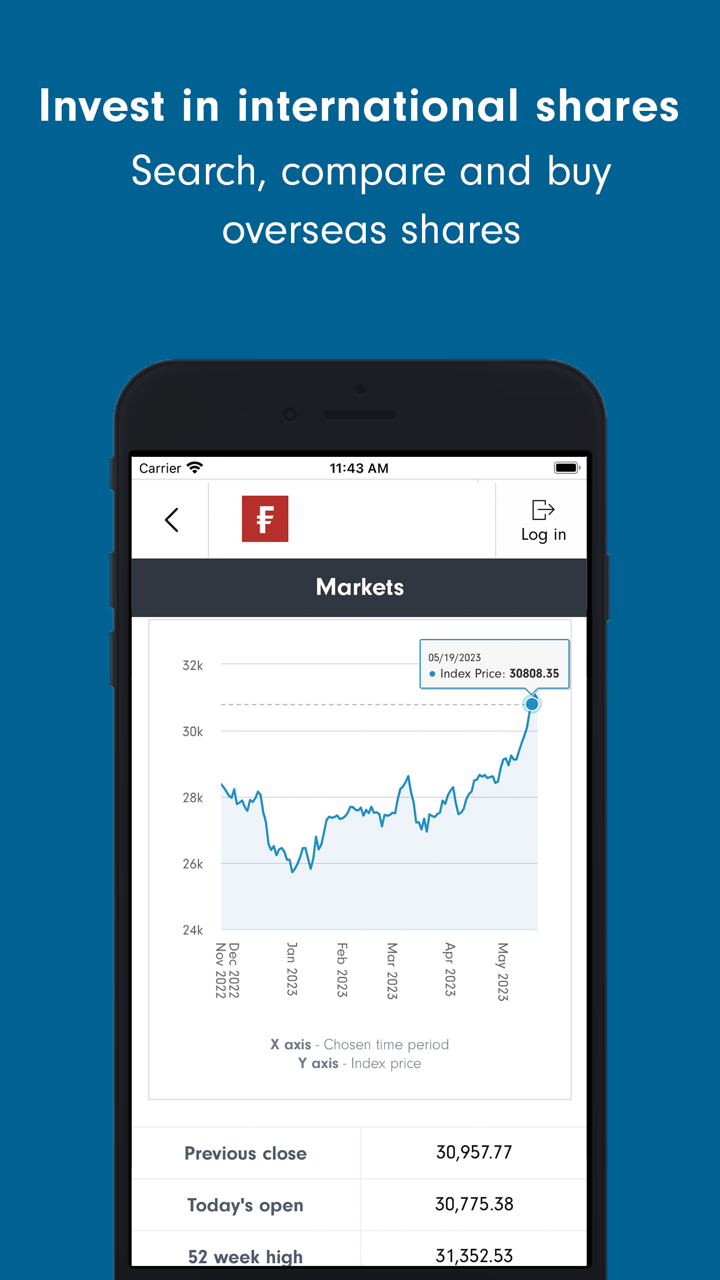

Productos y Servicios

Fidelity ofrece fondos mutuos globales, planes de jubilación (MPF & ORSO) e inversiones temáticas para cumplir con los objetivos financieros de los inversores. Ofrecen creación de ingresos, inversión sostenible y estrategias multiactivos.

| Productos & Servicios | Característica |

| Fondos Mutuos | Fondos globales en diversas monedas y clases de activos |

| Inversión Temática | Inversiones a largo plazo basadas en tendencias globales y temas de innovación |

| Soluciones Multiactivos | Portafolios diversificados que combinan diferentes tipos de activos |

| Inversión Sostenible | Enfocada en estrategias de inversión ESG y responsables |

| MPF (Fondo de Previsión Obligatorio) | Fondos de jubilación adaptados a diferentes perfiles de riesgo e ingresos |

| ORSO (Ordenanza de Esquemas de Jubilación Ocupacional) | Planes de inversión de jubilación patrocinados por el empleador |

| Estrategias de Ingresos | Opciones de inversión globales centradas en ingresos |

| Inversiones en Asia | Fondos que apuntan a oportunidades de crecimiento en los mercados asiáticos |

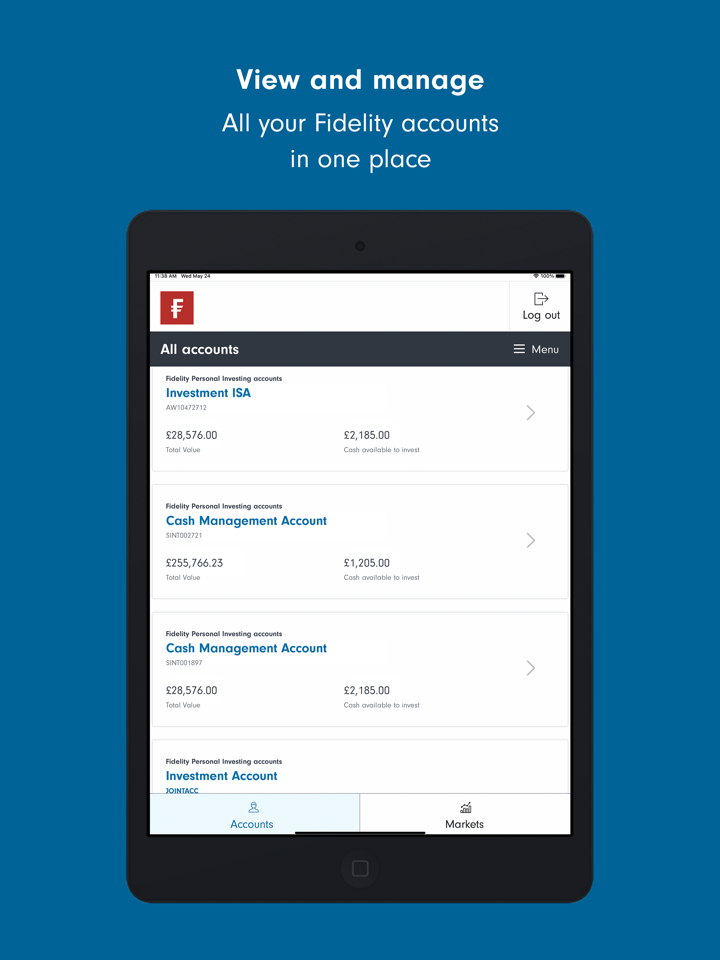

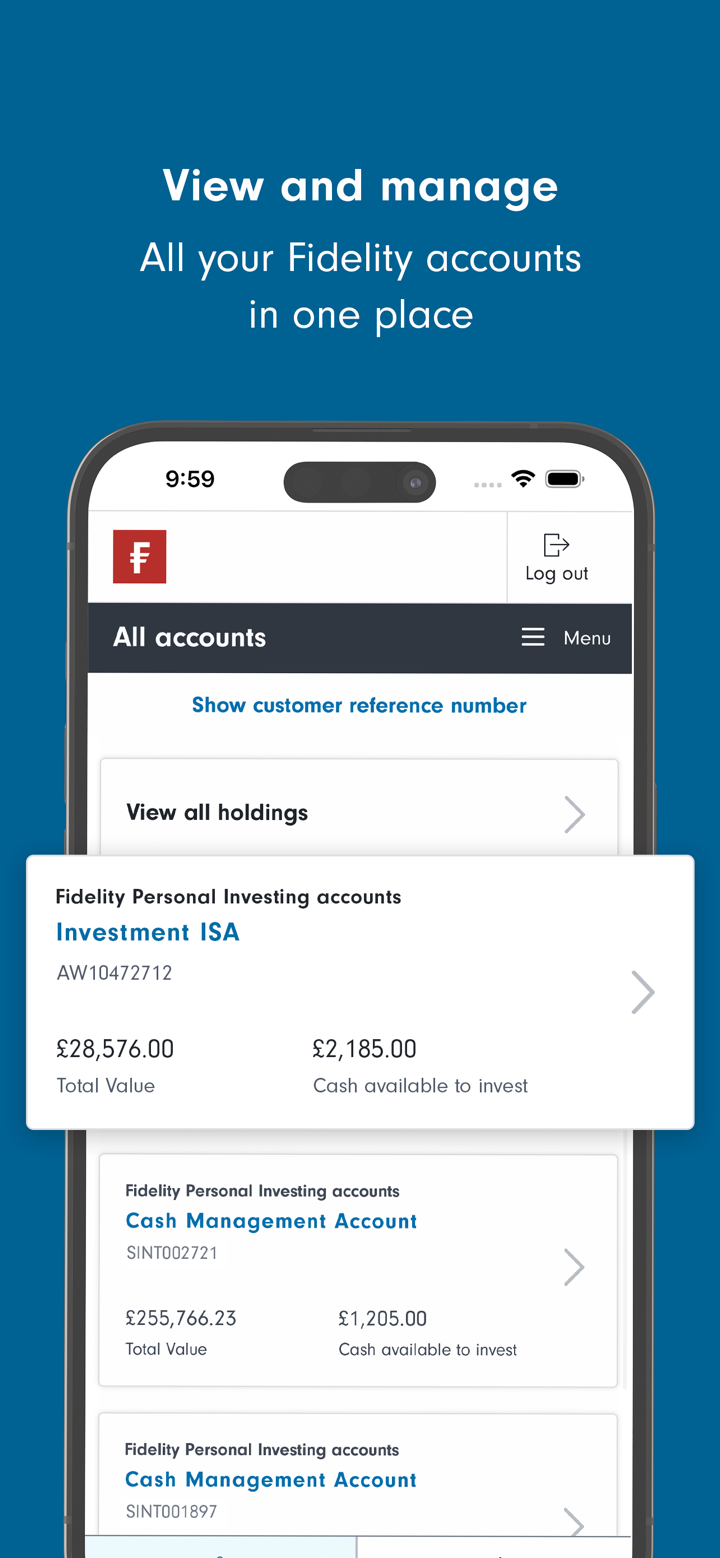

Tipo de Cuenta

Fidelity ofrece cuatro tipos de cuentas en vivo: Inversores Personales, miembros de MPF/ORSO, Intermediarios e Inversores Institucionales. No hay cuentas demo ni cuentas islámicas (sin swap) disponibles.

| Tipo de Cuenta | Adecuado para |

| Inversores Personales | Individuos que gestionan sus propias inversiones |

| Cuentas MPF / ORSO | Empleados y empleadores bajo esquemas de jubilación de Hong Kong |

| Intermediarios | Asesores, gestores de patrimonio, consultores financieros |

| Inversores Institucionales | Instituciones como fondos de pensiones, corporativos y family offices |

Tarifas de Fidelity

Las tarifas de Fidelity siguen una estructura escalonada: las cantidades de inversión más grandes disfrutan de cargos más bajos, mientras que las inversiones más pequeñas enfrentan tarifas más altas. En general, su estructura de costos es moderada a alta según los estándares de la industria.

| Método de Inversión | Tipo de Tarifa | Saldo de Inversión (USD) | Fondos en Efectivo | Fondos de Bonos | Fondos de Acciones y Otros |

| Inversión de una sola vez | Cobro de Venta | ≥ 1,000,000 | 0.00% | 0.30% | 0.60% |

| 500,000 – <1,000,000 | 0.45% | 0.90% | |||

| 250,000 – <500,000 | 0.60% | 1.20% | |||

| 100,000 – <250,000 | 0.75% | 1.50% | |||

| 50,000 – <100,000 | 1.05% | 2.10% | |||

| <50,000 | 1.50% | 3.00% | |||

| Tarifa de Cambio | ≥ 1,000,000 | 0.10% | - | ||

| 500,000 – <1,000,000 | 0.15% | - | |||

| 250,000 – <500,000 | 0.20% | - | |||

| 100,000 – <250,000 | 0.25% | - | |||

| 50,000 – <100,000 | 0.35% | - | |||

| <50,000 | 0.50% | - | |||

| Plan de Inversión Mensual | Cobro de Venta | <HK$20,000/mes | 1.00% | - | - |

| ≥HK$20,000/mes | 0.00% | - | - |

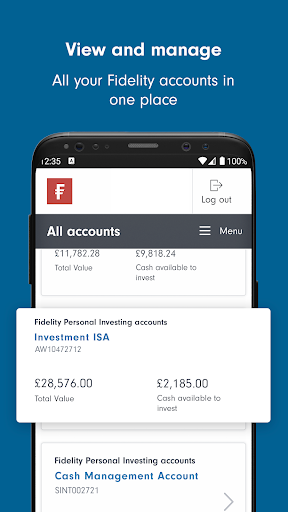

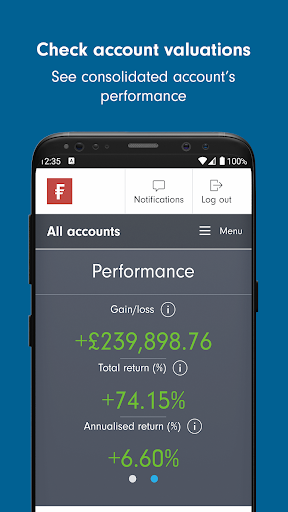

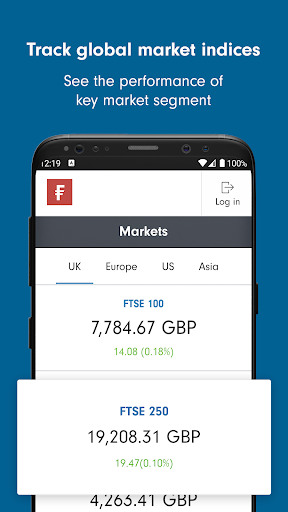

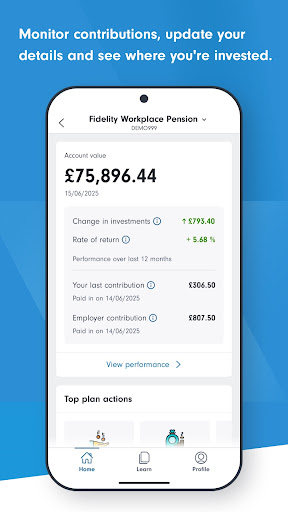

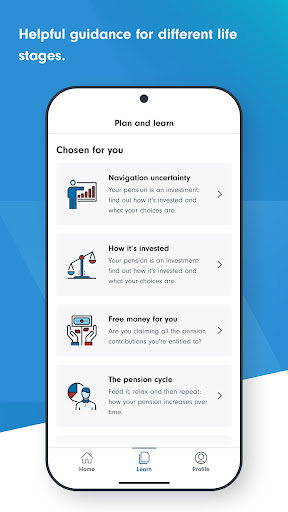

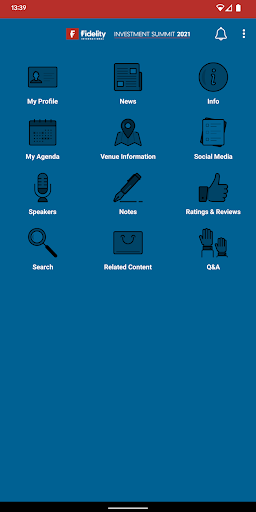

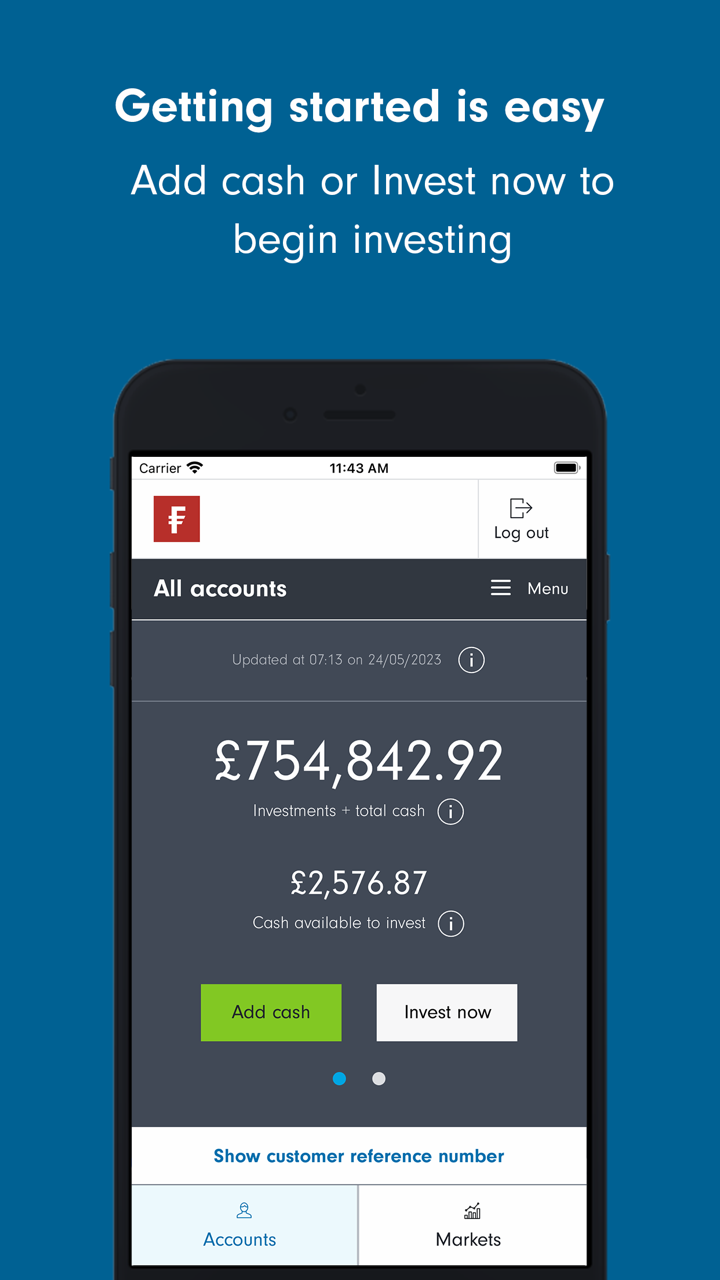

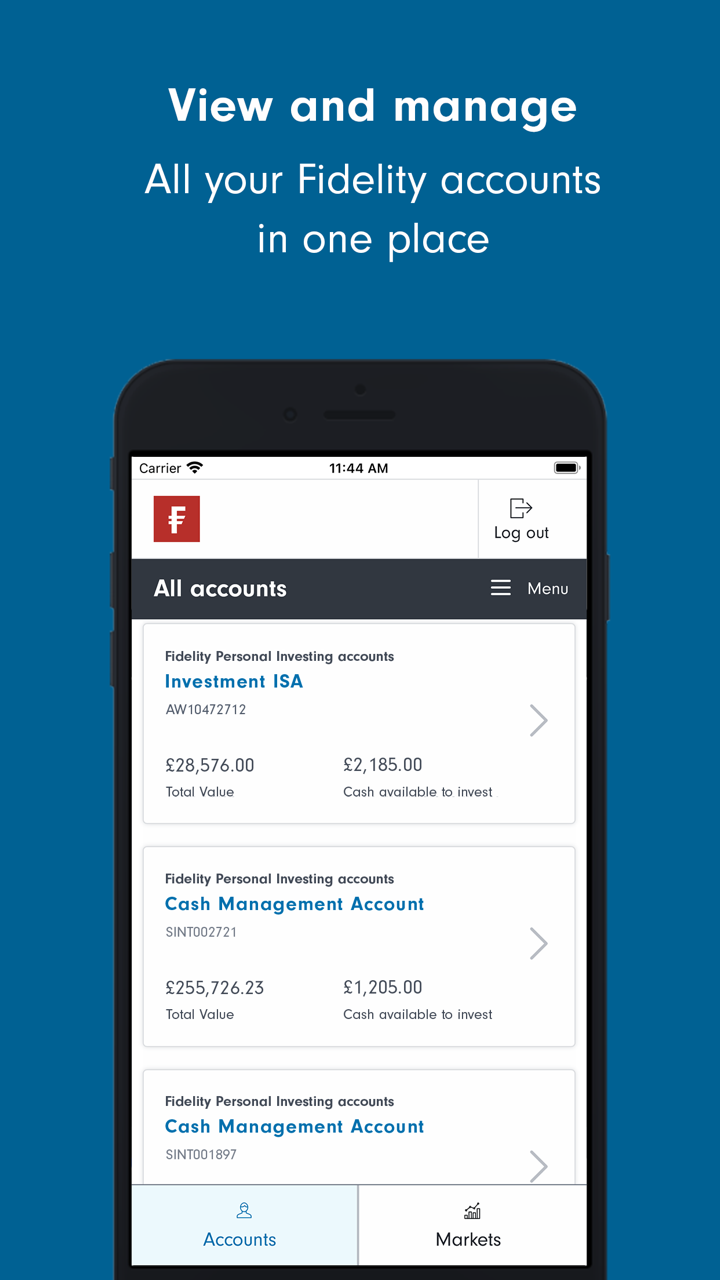

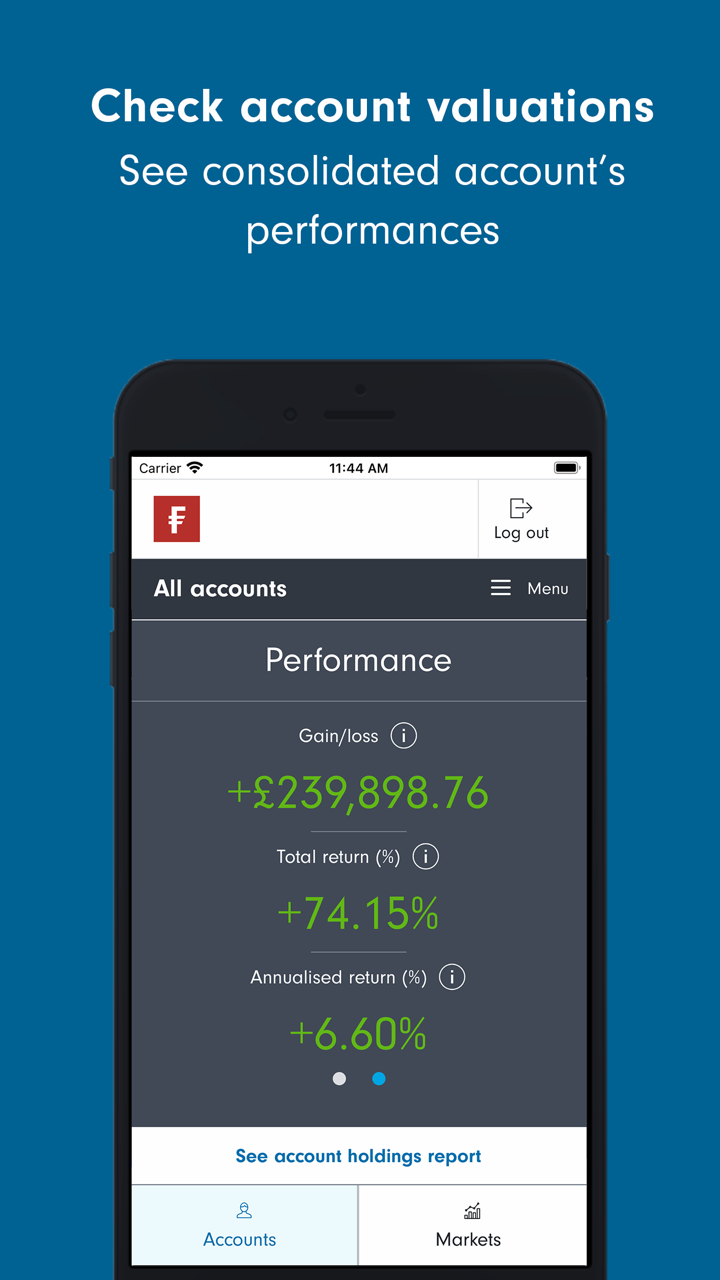

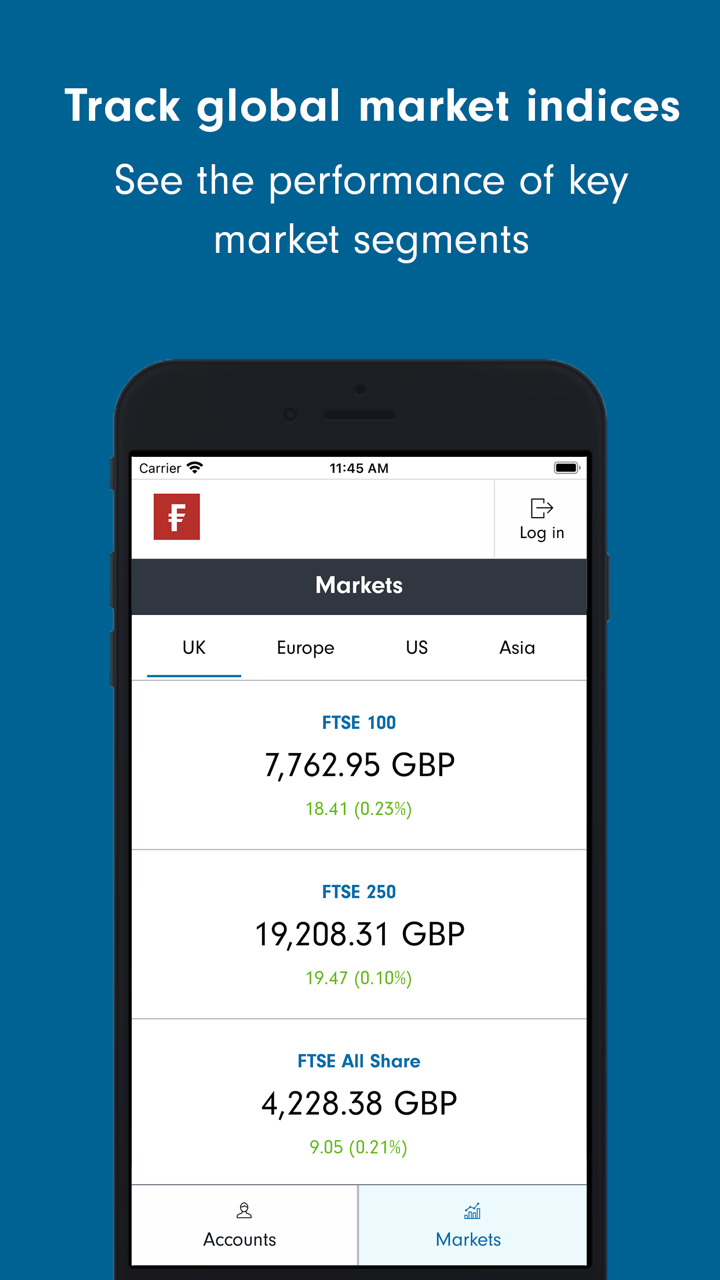

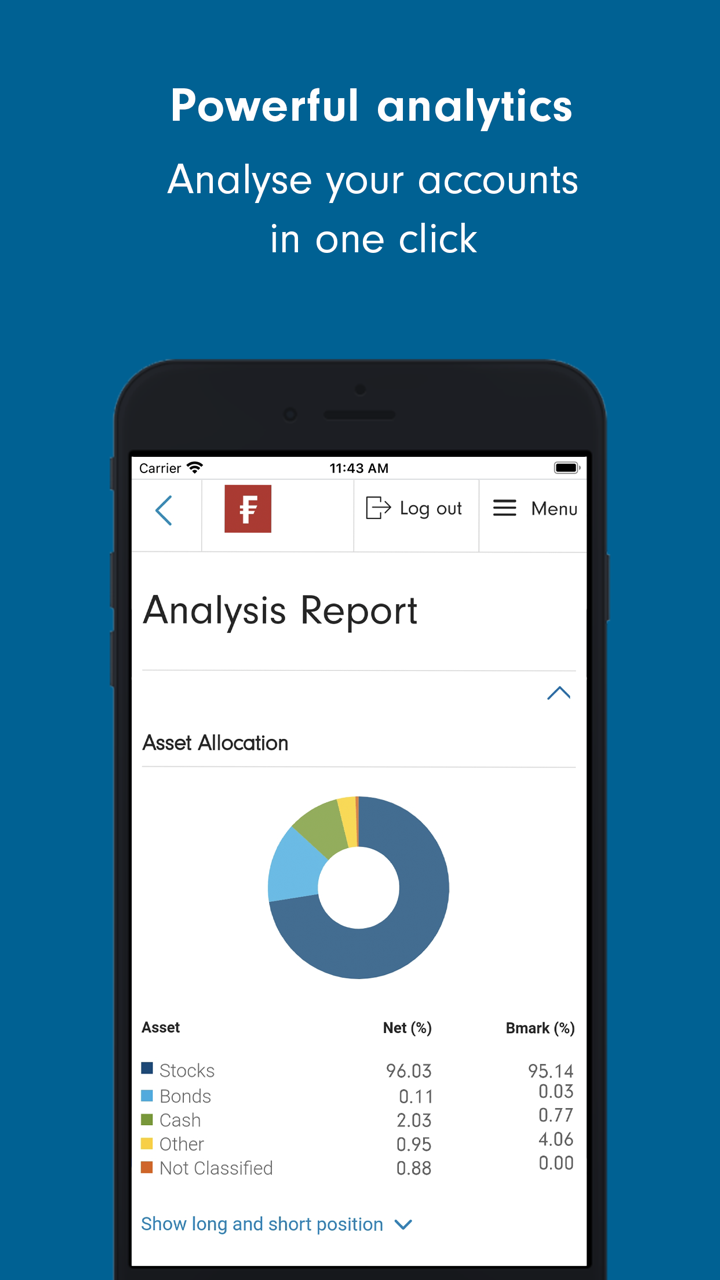

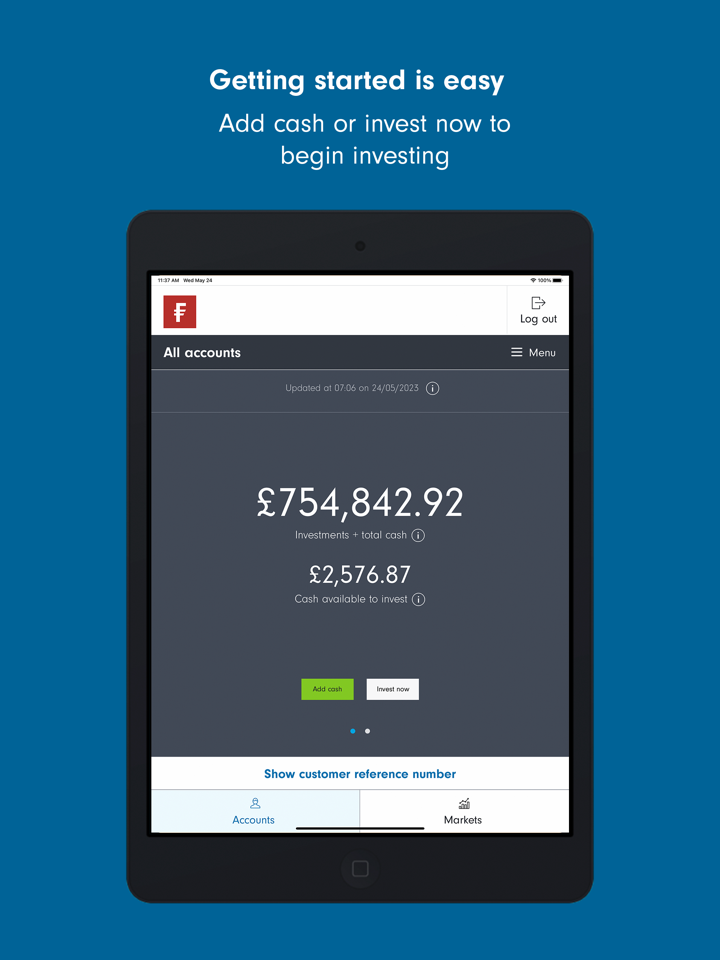

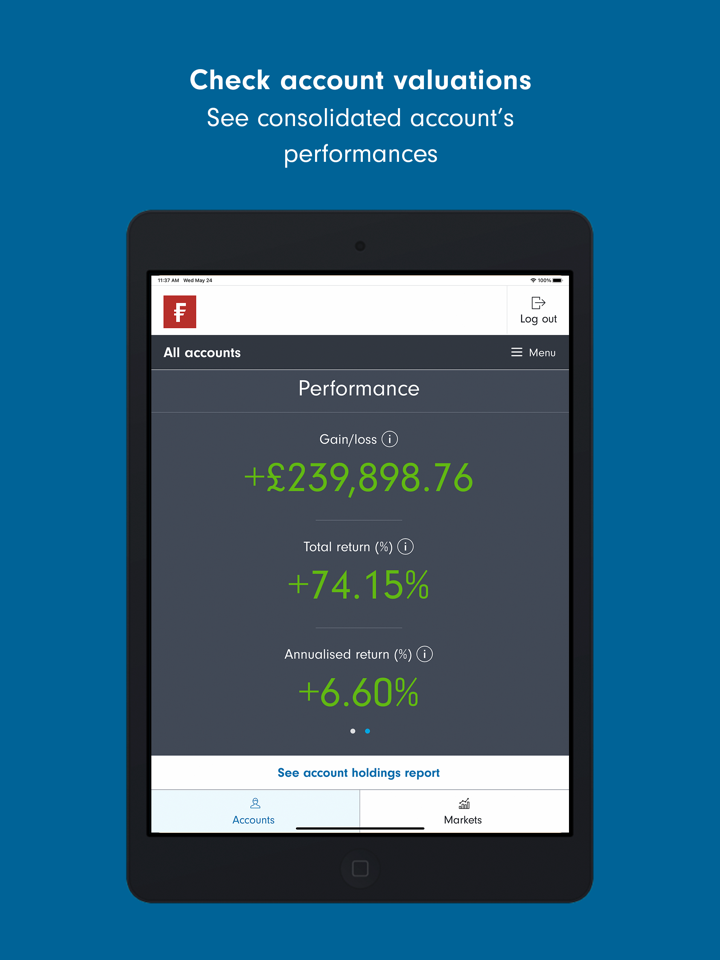

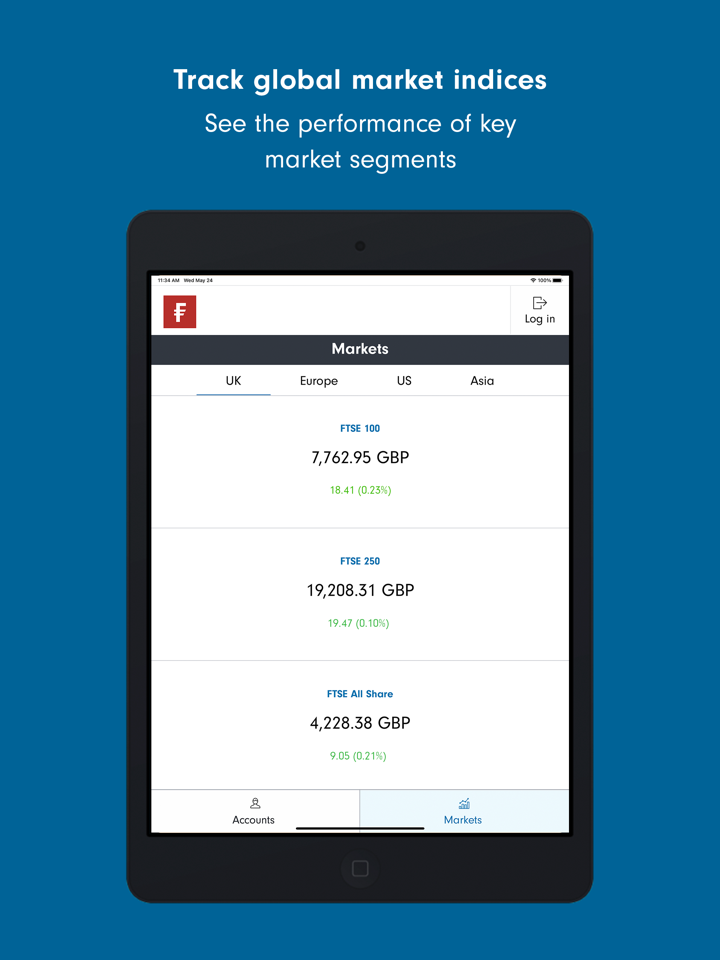

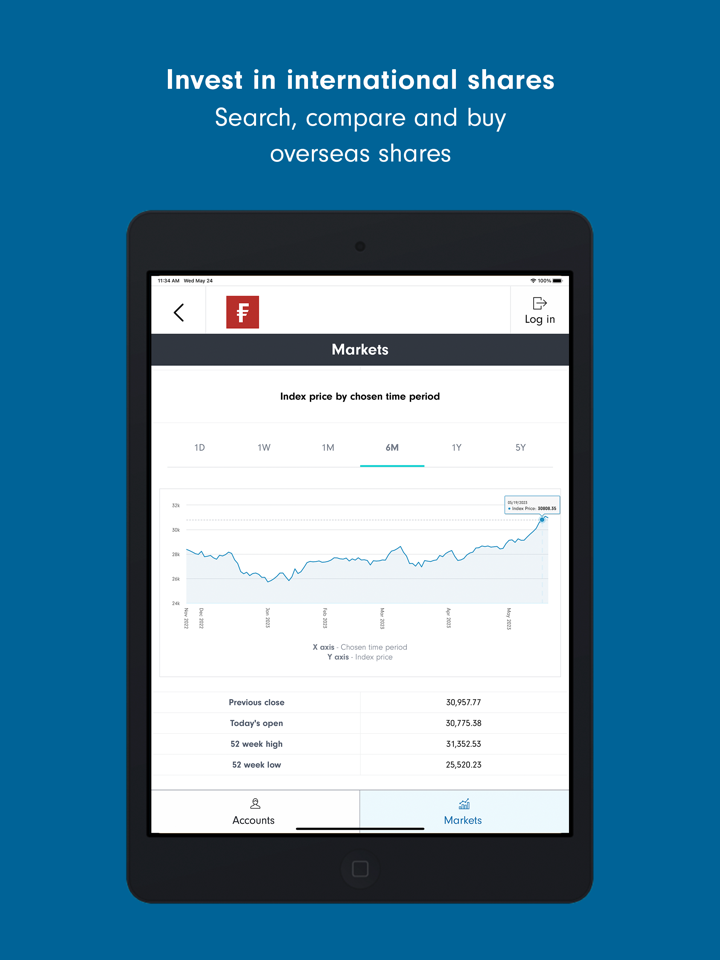

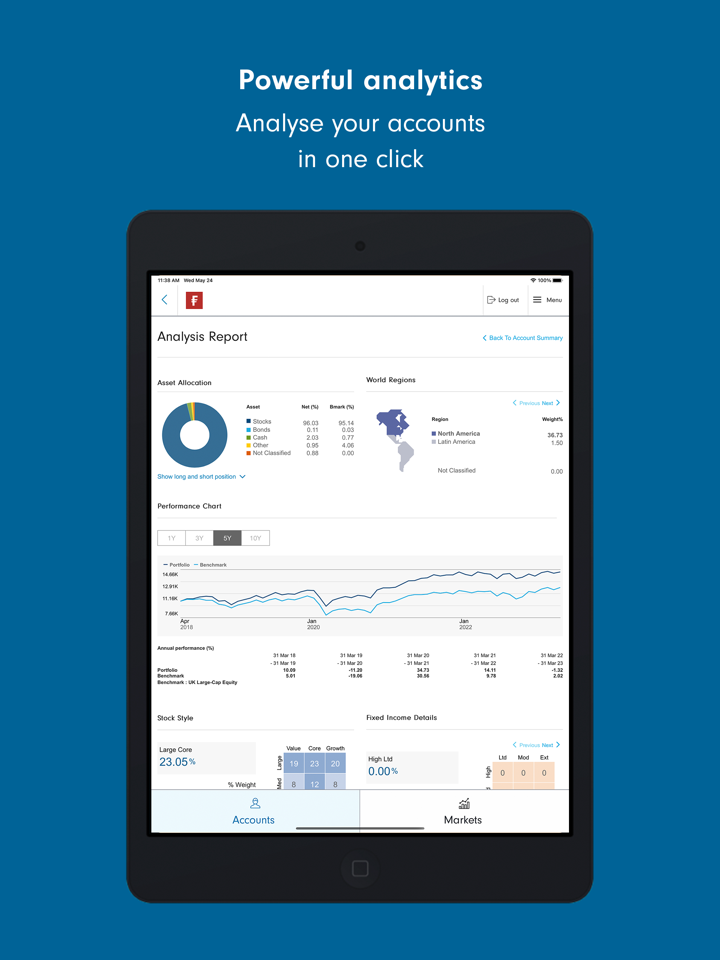

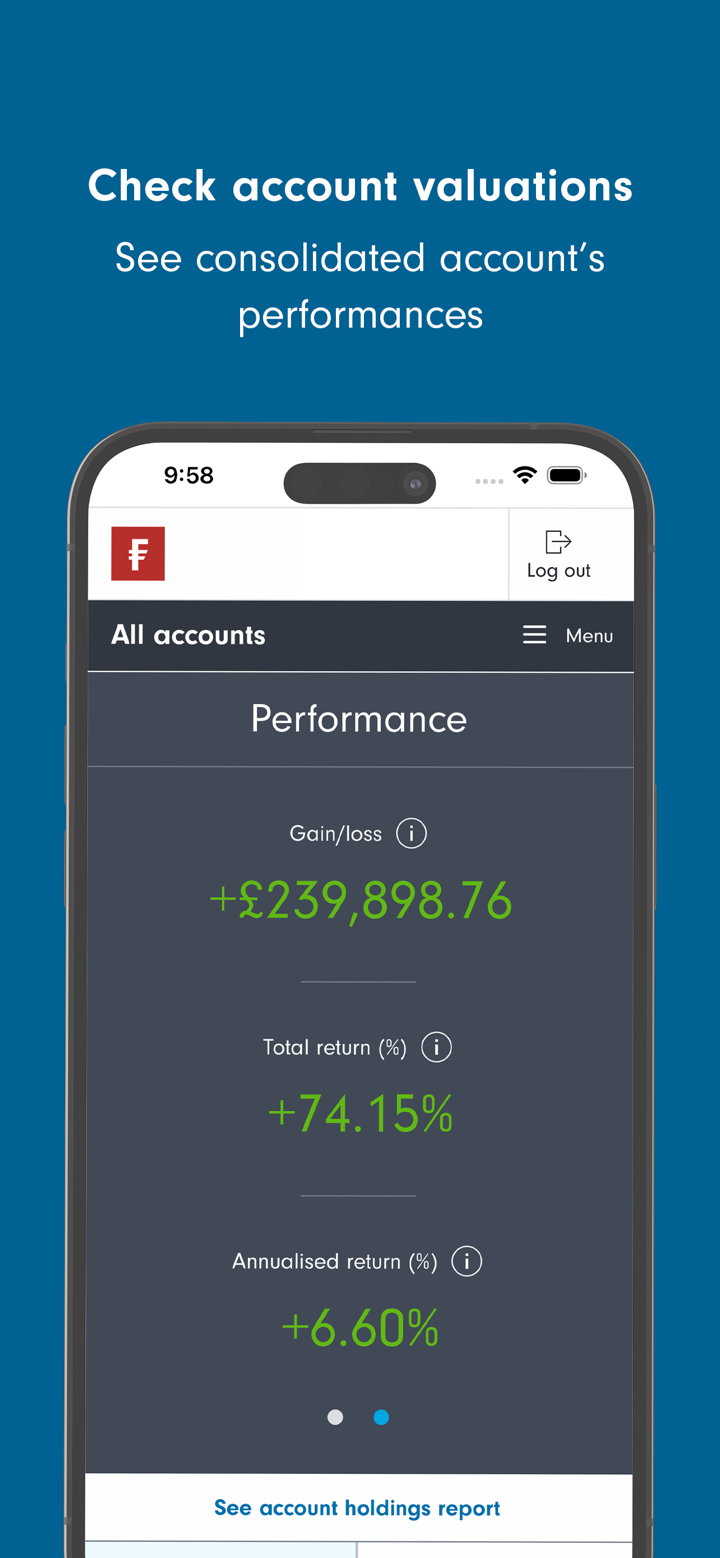

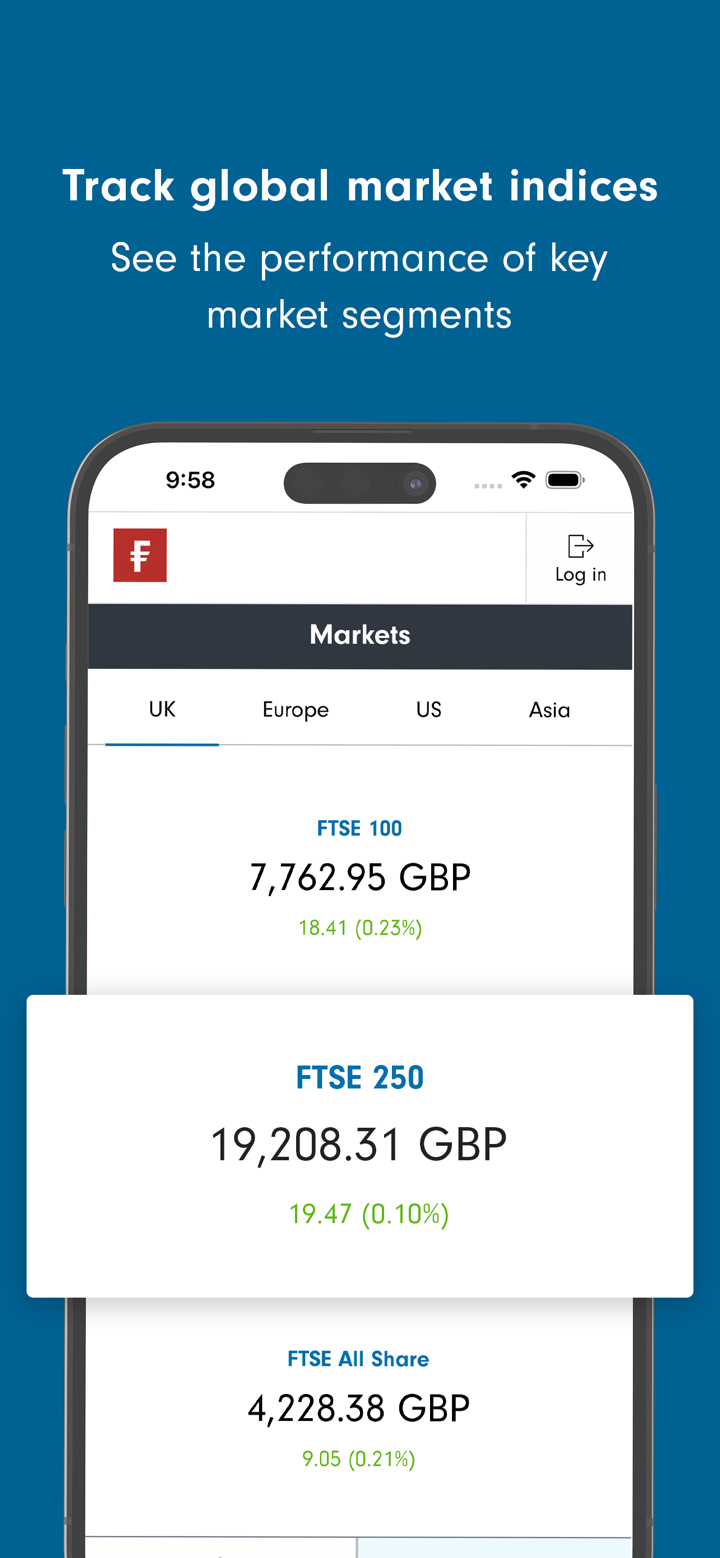

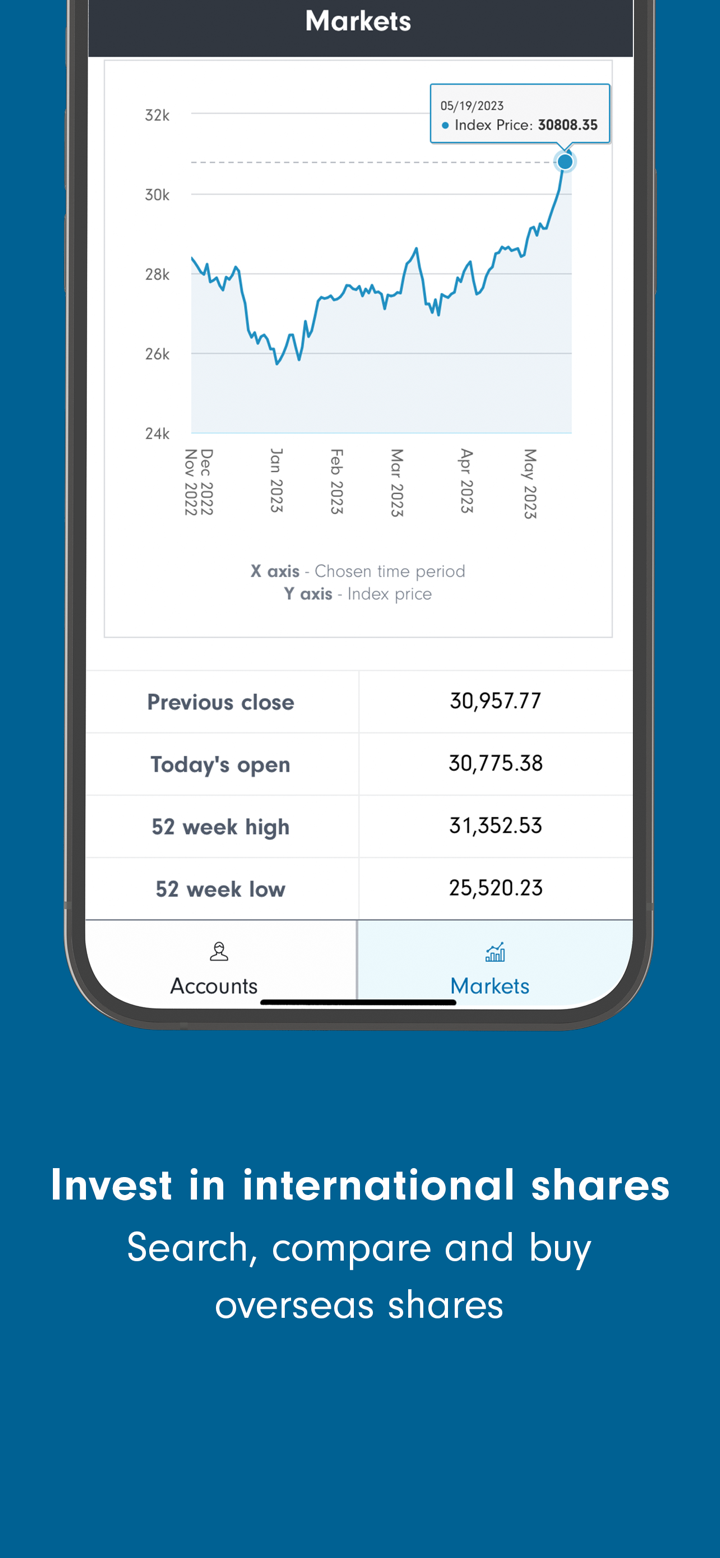

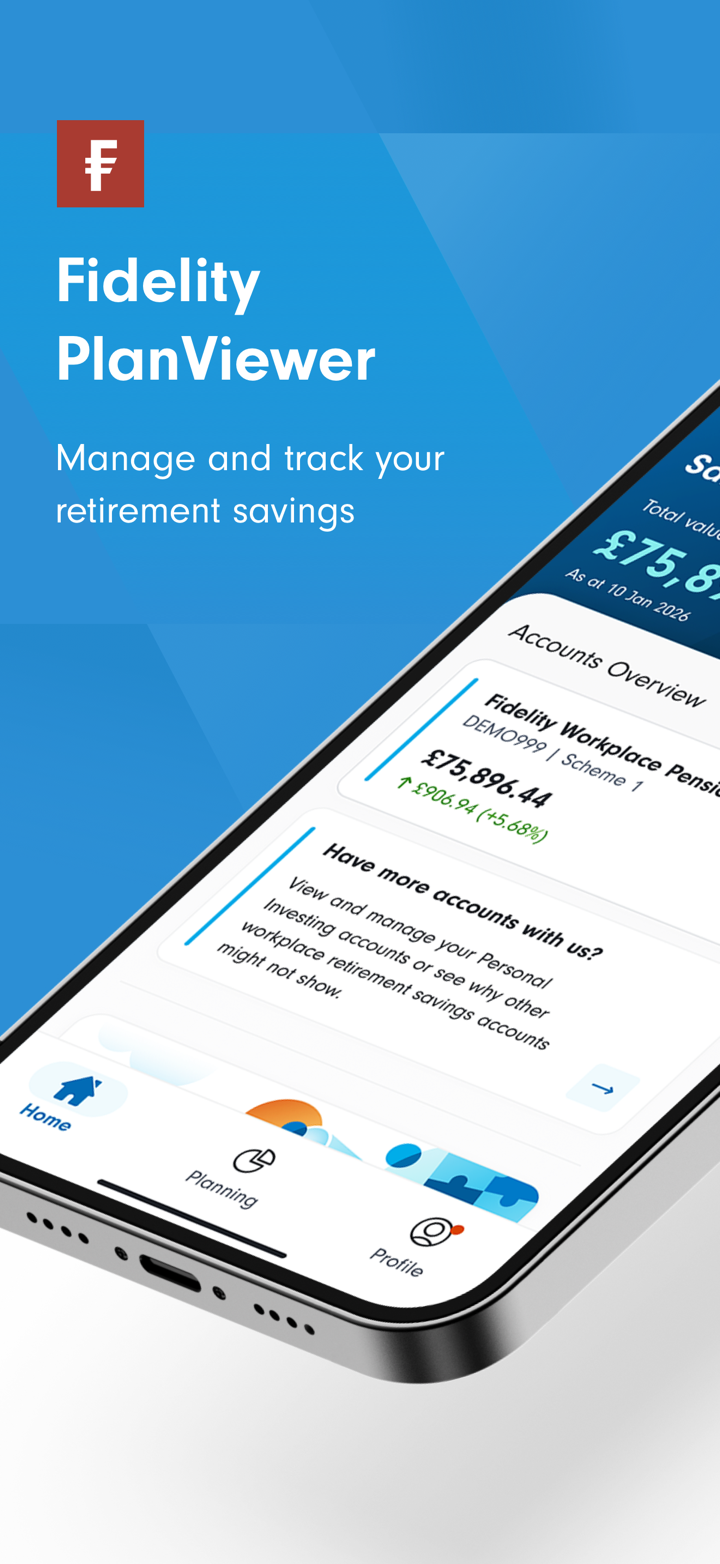

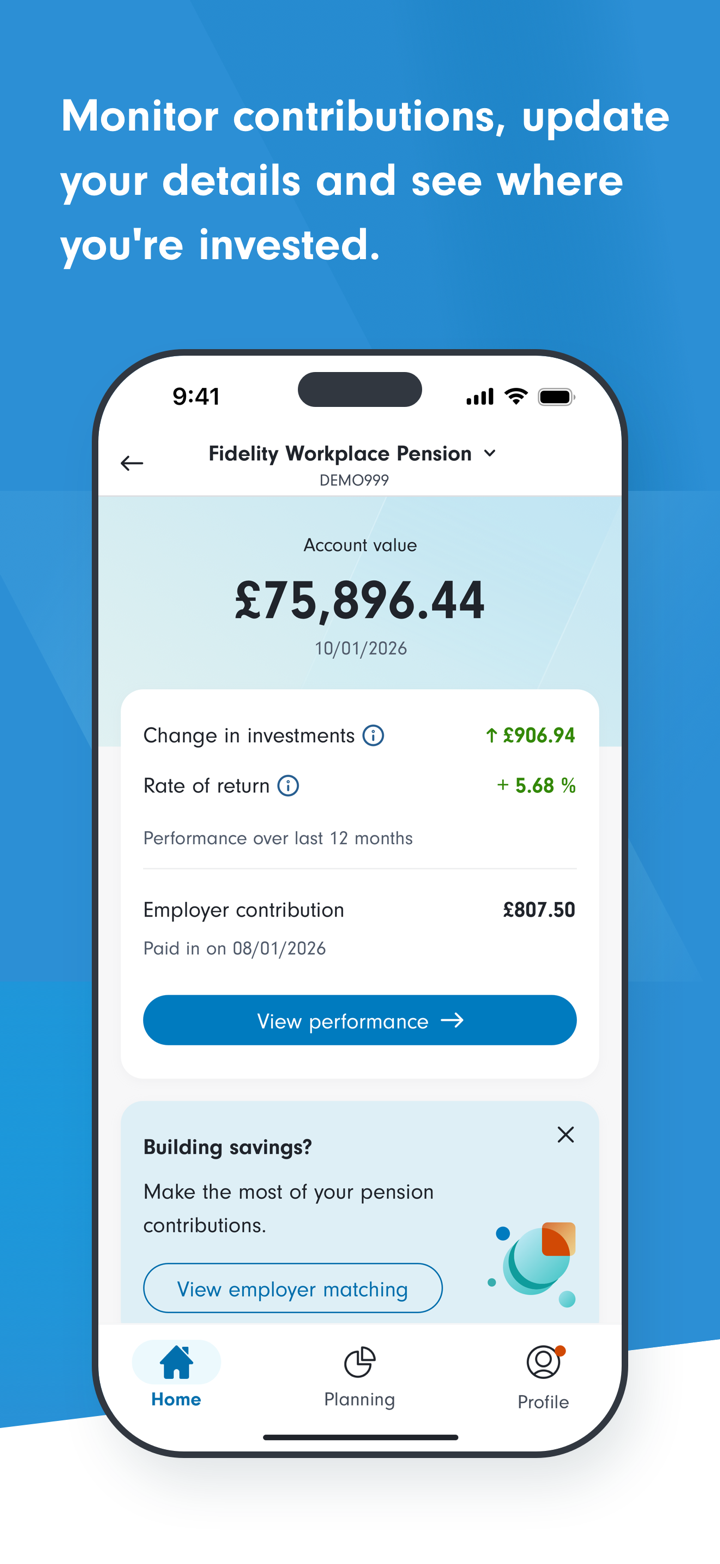

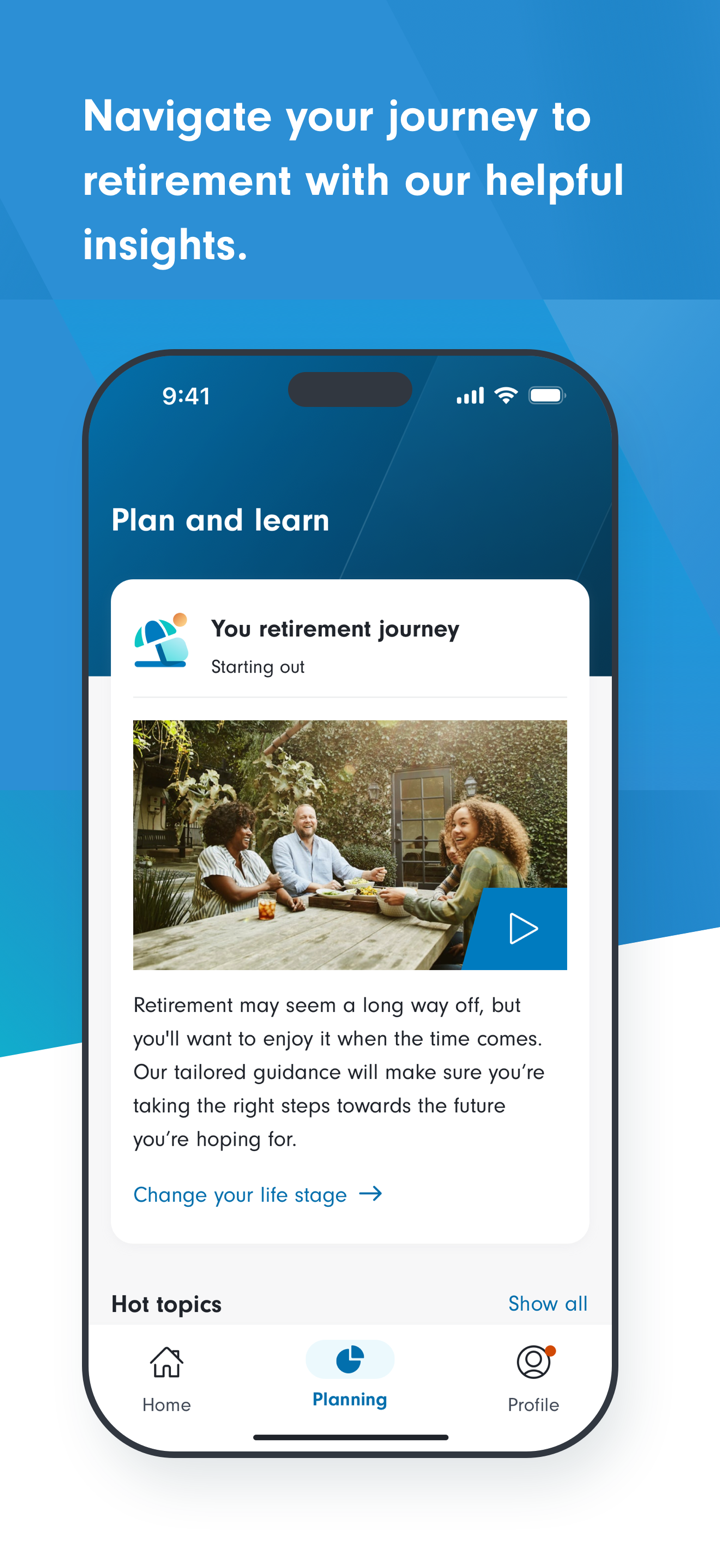

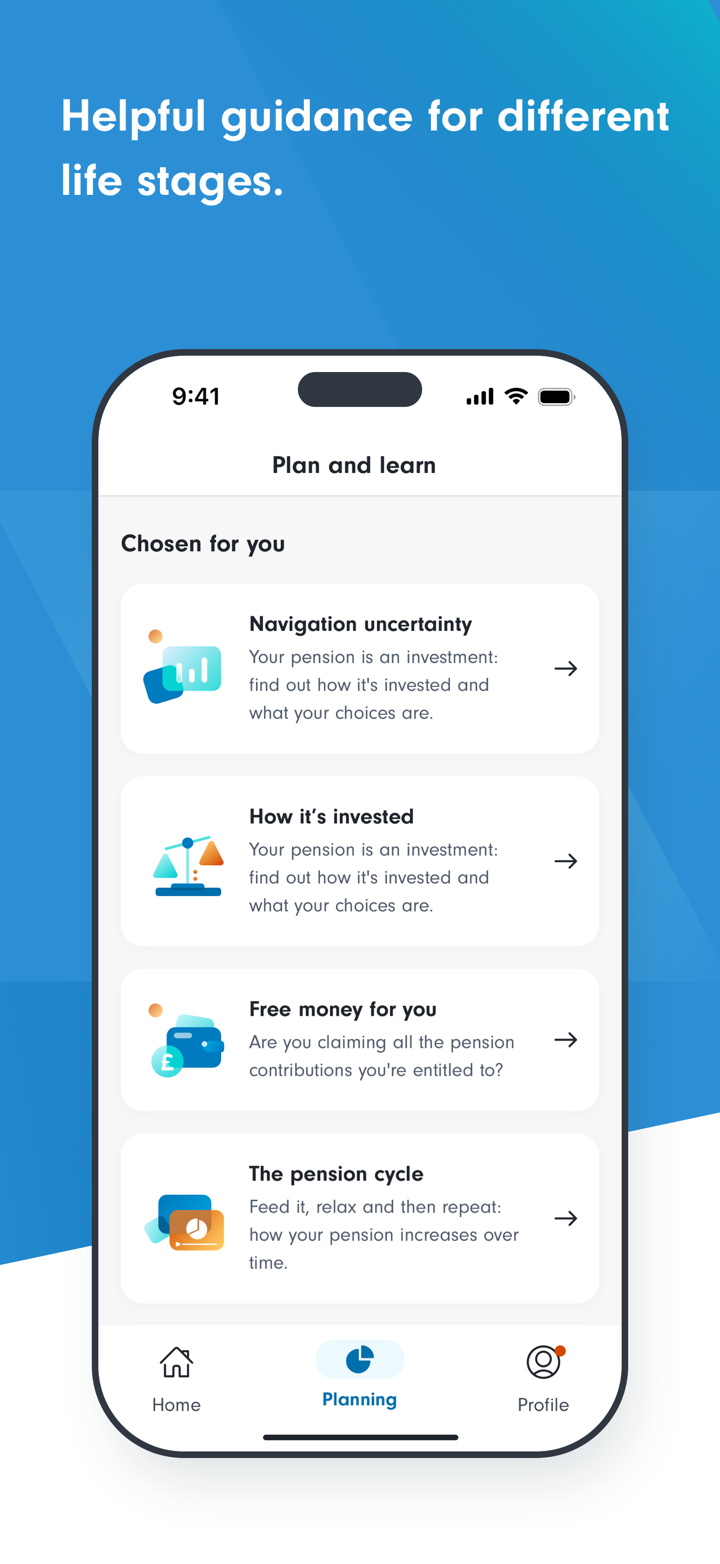

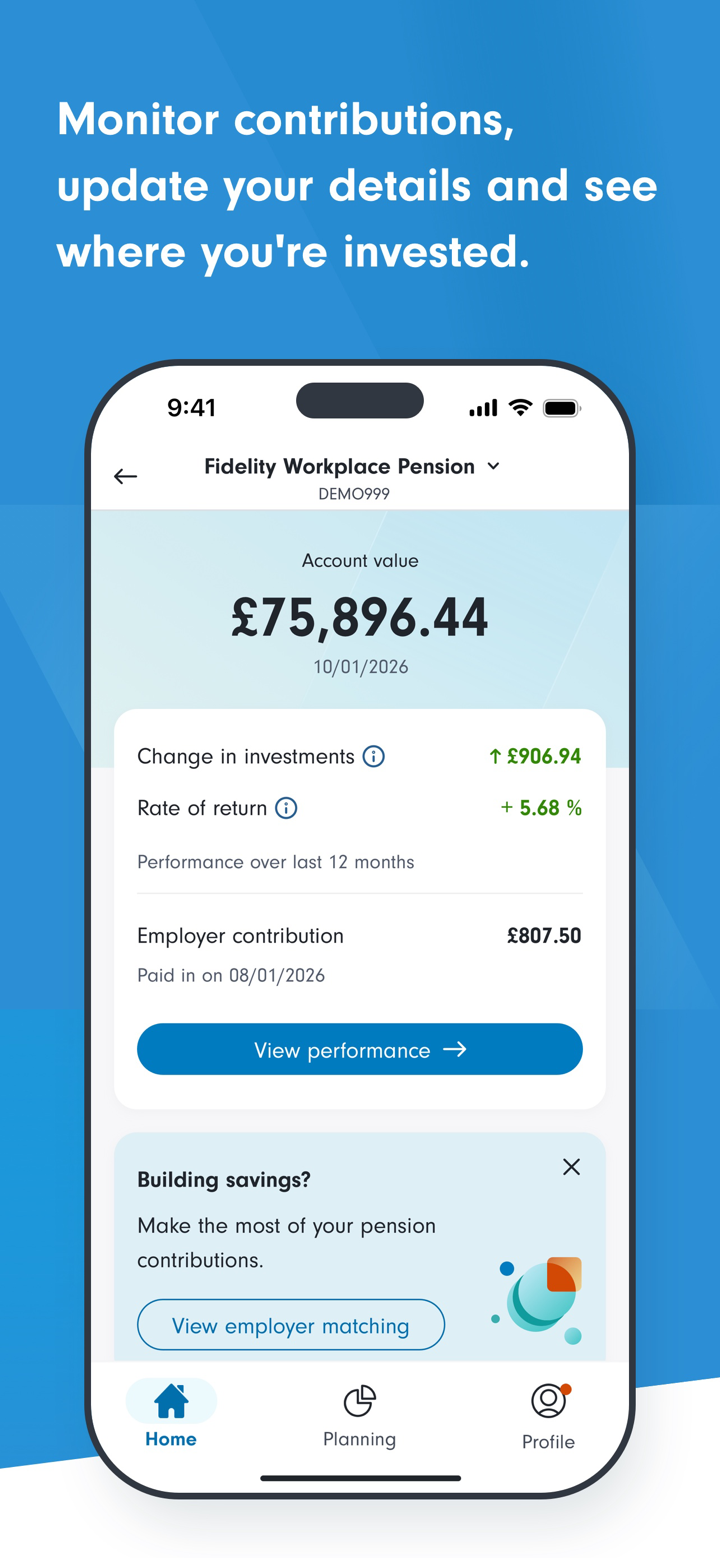

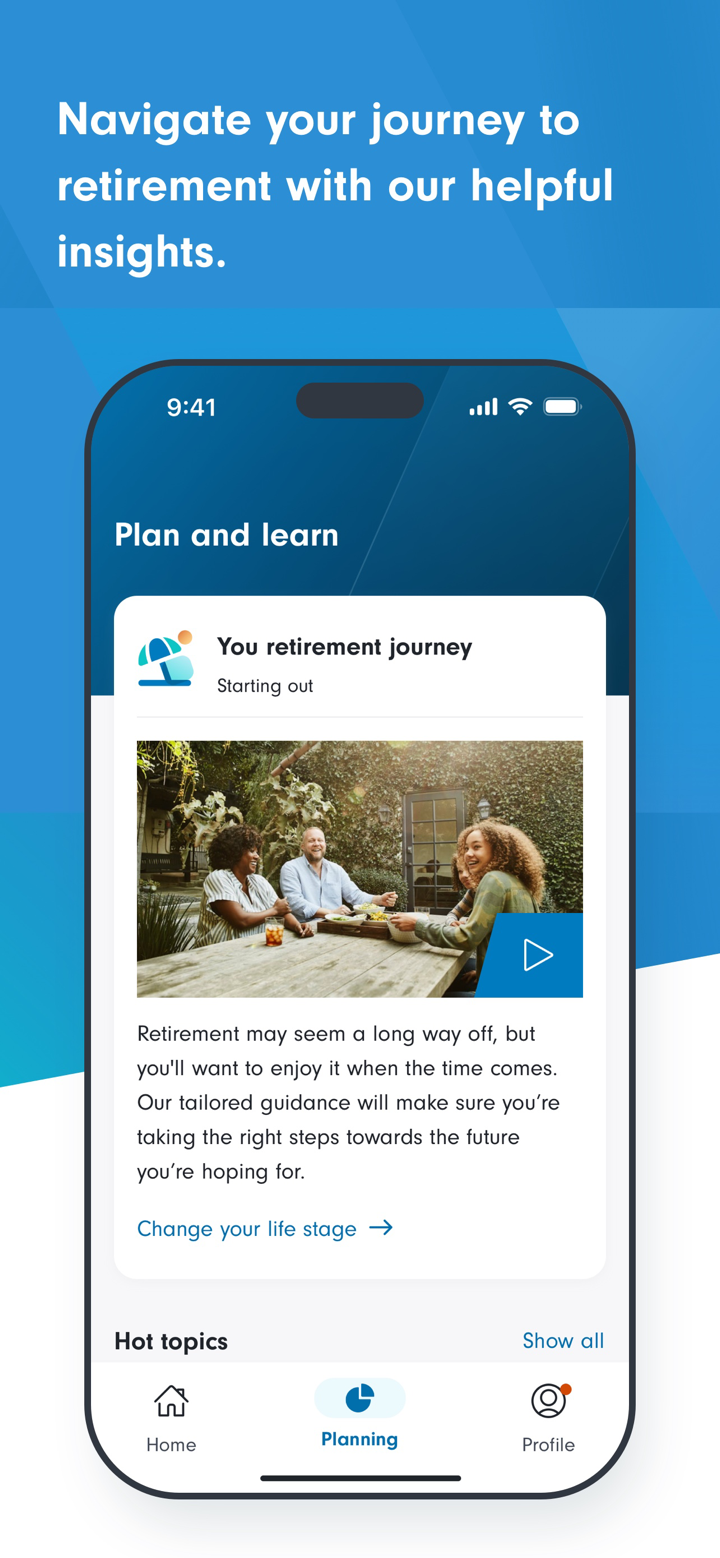

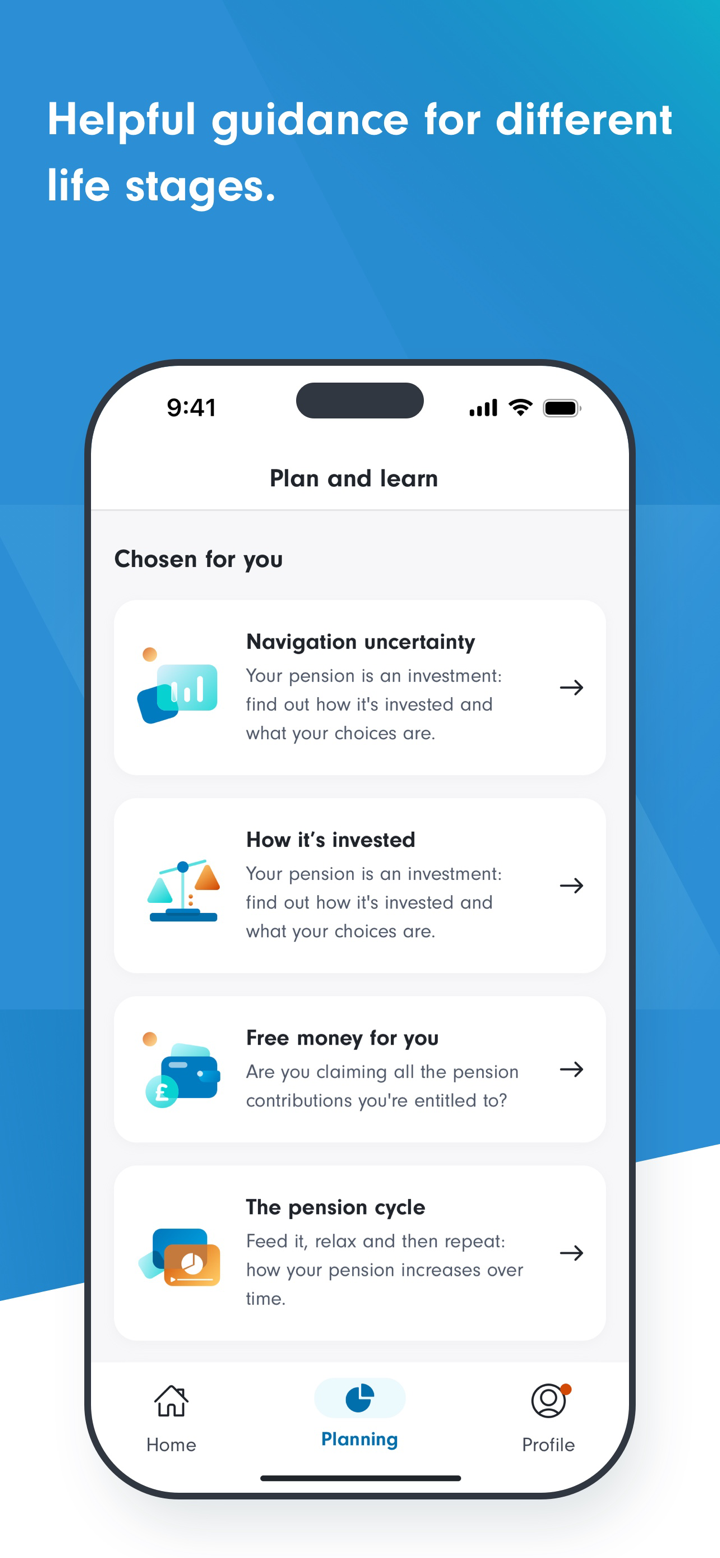

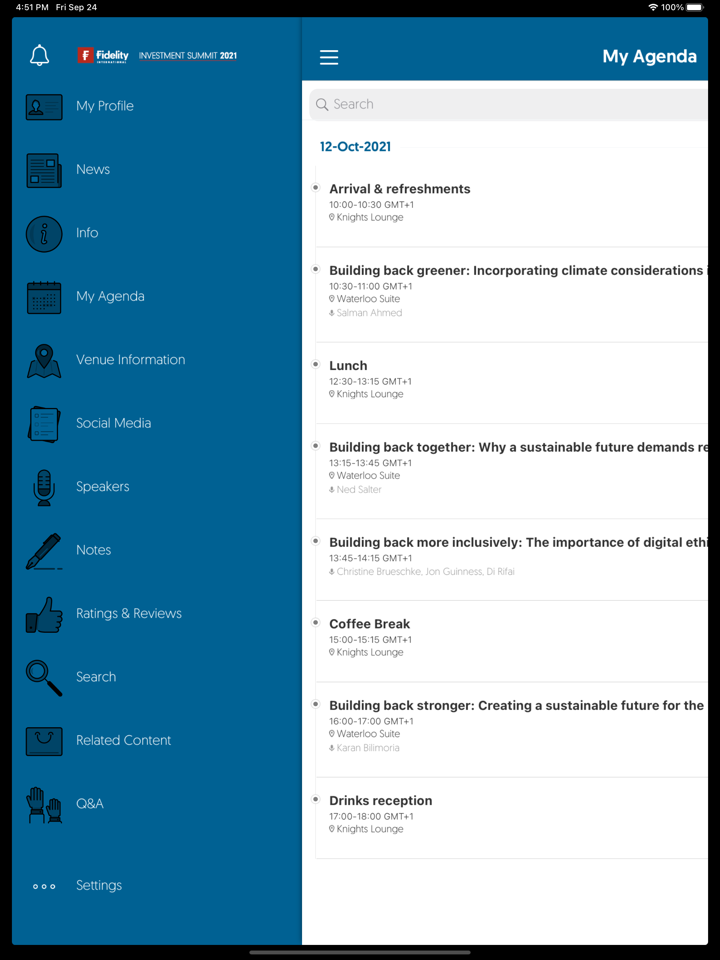

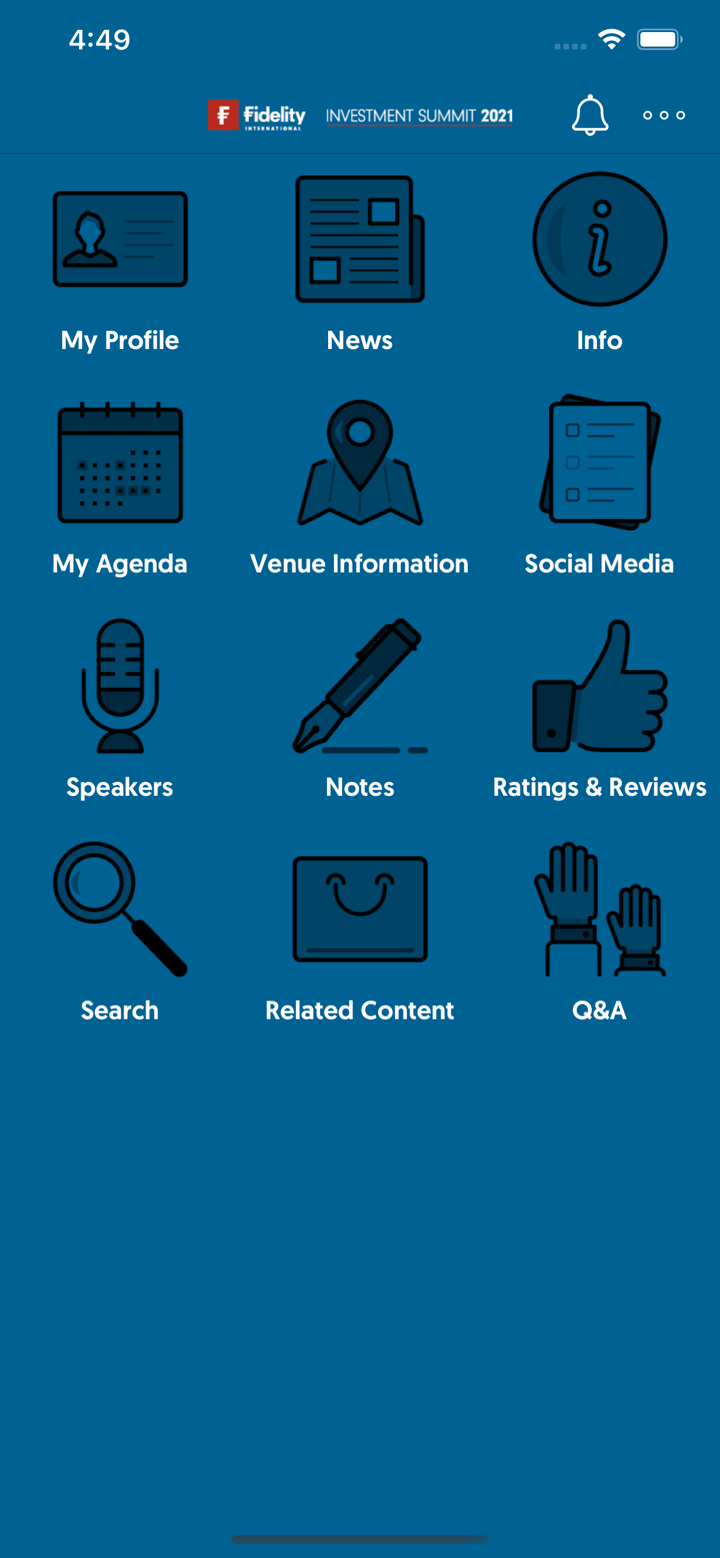

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles | Adecuado para |

| Fidelity Online | ✔ | Web (PC, Mac) | Inversores a largo plazo que gestionan carteras en línea |

| Fidelity Mobile App | ✔ | iOS, Android | Inversores que necesitan acceso a la cartera sobre la marcha |

Depósito y Retiro

Fidelity no cobra tarifas adicionales por métodos estándar de depósito o retiro. Sin embargo, pueden aplicarse cargos bancarios o de intermediarios según el método utilizado. El depósito mínimo es de HK$1,000 por fondo por mes para los Planes de Inversión Mensual; no se especifica un mínimo específico para inversiones únicas.

| Método de Pago | Cantidad Mínima | Tarifas | Tiempo de Procesamiento |

| Transferencia Telegráfica | / | Cargos bancarios/intermediarios | Al recibir los fondos compensados |

| Pago de Facturas HSBC (Banca por Internet) | / | ❌ (excepto tarifas de agente) | Inmediato |

| Giro Bancario / Giro de Caja | / | Cargos bancarios de agente | |

| Débito Directo el Mismo Día de HSBC / Hang Seng | / | ❌ (fondos insuficientes pueden incurrir en cargos bancarios) | |

| Cheque Personal (HK compensado) | HK$1,000,000 o menos | ❌ | |

| Cheque Personal (no compensado en HK) | / | Pueden aplicarse cargos de cobro | Después de la compensación |