Información básica

China

ChinaCalificación

China

|

De 5 a 10 años

|

China

|

De 5 a 10 años

| http://www.cdfco.com.cn

Sitio web

Índice de calificación

influencia

D

índice de influencia NO.1

Taiwán 2.37

Taiwán 2.37 Licencias

LicenciasInstitución autorizada:中衍期货有限公司

Número de regulación:0197

China

China cdfco.com.cn

cdfco.com.cn China

China

| China-Derivatives FuturesResumen de la reseña | |

| Establecido | 1996 |

| País/Región Registrada | China |

| Regulación | CFFEX |

| Productos y Servicios | Futuros, Corretaje, Inversión, Consultoría, Gestión de Activos, Fondos |

| Cuenta Demo | ✅ |

| Apalancamiento | / |

| Spread | / |

| Plataforma de Trading | China-Derivatives Futures App, Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star y TradeBlazer |

| Depósito Mínimo | / |

| Soporte al Cliente | Chat en Vivo |

| Email: office@cdfco.com.cn | |

| Teléfono: 400-688-1117 | |

| Dirección: Zhongyan Futures Co., Ltd., 7th Floor, Building B, Jinchang'an Building, No. 82 Dongsi Fourth Ring Road, Distrito de Chaoyang, Beijing | |

Fundada en 1996, China-Derivatives Futures Co., Ltd. es una entidad regulada bajo la supervisión de la Bolsa de Futuros Financieros de China (CFFEX). Sin embargo, solo atiende a clientes dentro de China y es un actor destacado en el mercado de derivados nacional. Es una empresa financiera integral aprobada por la Comisión Reguladora de Valores de China (CSRC) que se especializa en corretaje de futuros de productos básicos nacionales, corretaje de futuros financieros, consultoría en operaciones de futuros, gestión de activos y oferta pública de ventas de fondos de inversión en valores.

| Pros | Contras |

| Regulado por CFFEX | Falta de transparencia |

| Especializado en trading de futuros | |

| Soporte para trading de demostración | |

| Diversas plataformas de trading | |

| Larga historia de operación |

China-Derivatives Futures está regulado por CFFEX bajo el número de licencia 0197.

| País Regulado | Autoridad Reguladora | Estado Regulatorio | Entidad Regulada | Tipo de Licencia | Número de Licencia |

| China | Bolsa de Futuros Financieros de China (CFFEX) | Regulado | China Commodity Futures Co., Ltd. | Licencia de Futuros | 0197 |

China-Derivatives Futures se enfoca principalmente en el comercio de futuros, y también ofrece una amplia gama de servicios de inversión, como corretaje, inversión, consultoría, gestión de activos y fondos.

| Productos y Servicios | Soportado |

| Futuros | ✔ |

| Fondos | ✔ |

| Corretaje | ✔ |

| Inversión | ✔ |

| Consultoría | ✔ |

| Gestión de Activos | ✔ |

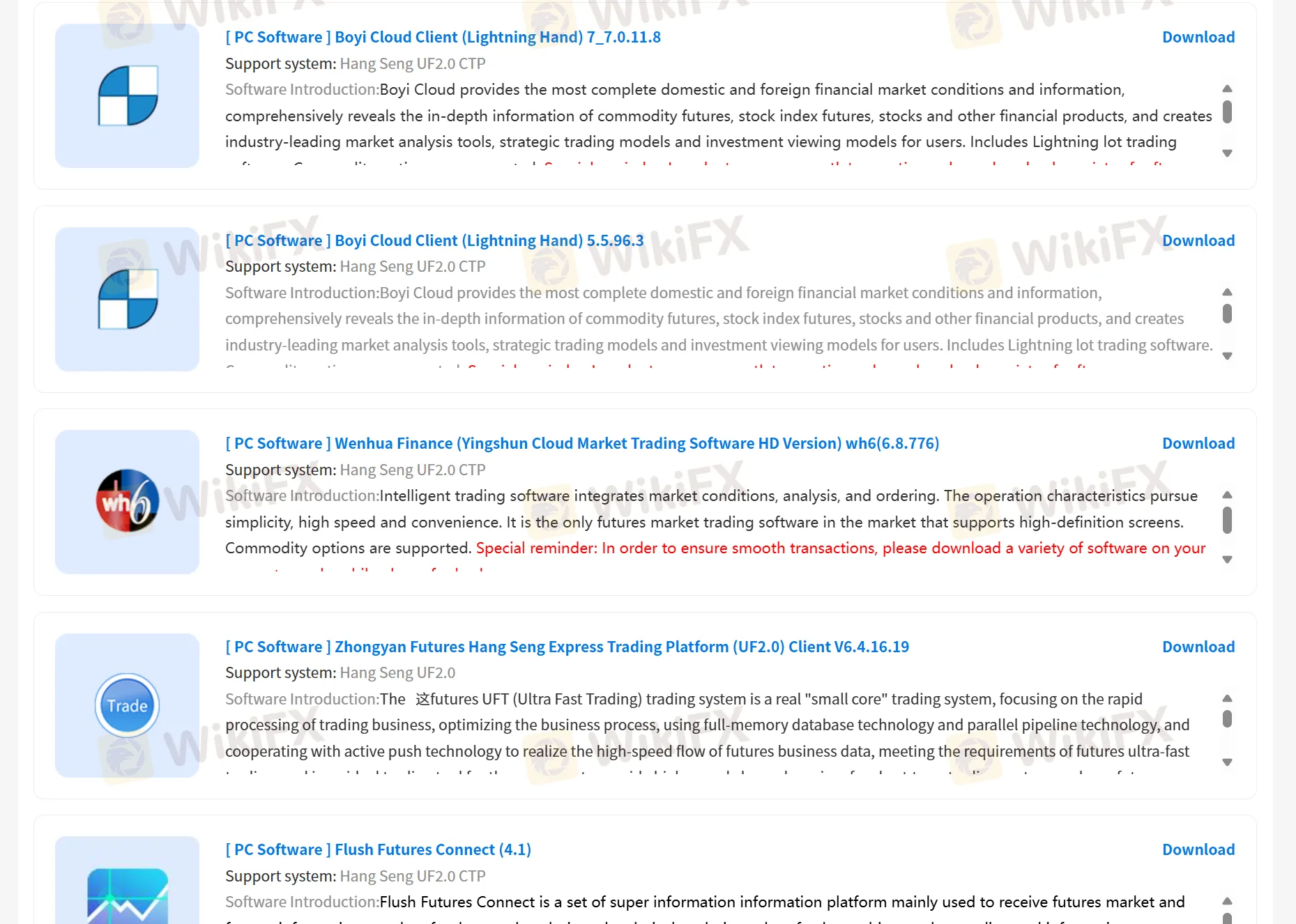

China Derivatives Futures admite el comercio a través de plataformas propias, China-Derivatives Futures App, y Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star y TradeBlazer. Además, también brinda oportunidades a los clientes para simular operaciones.

| Plataforma de Trading | Soportado | Dispositivos Disponibles | Adecuado para |

| China-Derivatives Futures App | ✔ | PC, Móvil | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

Based on my experience as a trader and after reviewing the details about China-Derivatives Futures, I believe it's essential to approach this broker with a cautious mindset. While it is regulated in China by the CFFEX and has a long business history, I noticed some important factors that warrant attention. First, there is mention of a "suspicious scope of business," which, for me, raises concerns about full regulatory coverage and the broker’s activities outside its core offerings. Clarity about exactly what is regulated versus what is not is vital, as unregulated operations may expose clients to unexpected risks. Additionally, customer experiences appear mixed, with one significant exposure highlighting issues such as withdrawal delays and vague explanations from support staff. While some clients report positive experiences and transparent fees, the negative report regarding withdrawal difficulty cannot be disregarded. In my view, consistently reliable fund withdrawals are non-negotiable for trust in any broker. Another point I weigh heavily is that China-Derivatives Futures predominantly serves domestic Chinese clients. For non-residents, access to customer support, regulatory recourse, and platform familiarity could be limited or challenging. Furthermore, as the platforms offered are proprietary or locally focused, traders who are used to international standards like MT4/MT5 may find adaptation difficult. Ultimately, while regulation and long operational history are positives, I only proceed with brokers after thorough due diligence, an understanding of all withdrawal policies, and confirmation that all activities are properly licensed. Personal vigilance is key in safeguarding my capital.

As an independent trader with a strong focus on due diligence, I always prioritize transparency when evaluating brokers. In my detailed review of China-Derivatives Futures, I found that while the company has a long operating history and is officially regulated in China under CFFEX, specific trading conditions for standard forex pairs like EUR/USD, such as spreads, are not explicitly disclosed in available materials. My experience tells me that any reputable broker should clearly publish critical metrics like average spreads, especially since these costs significantly impact trading outcomes. For China-Derivatives Futures, the emphasis is primarily on futures trading and related financial instruments rather than traditional spot forex products. Their product range and platforms appear tailored for domestic futures markets, not global forex, with no direct mention of specific spreads or leverage on major currency pairs. Whenever I encounter this kind of information gap, particularly for something as fundamental as the EUR/USD spread, I prefer a cautious approach and recommend that potential clients contact the broker directly for precise trading details. This lack of transparency makes it difficult for me to properly assess trading costs and risk, which, from a risk management perspective, is essential before committing any funds. If transparency on standard spreads is lacking, I always consider it a significant limitation.

In my experience with China-Derivatives Futures, I found that their primary focus is on futures trading rather than the broad array of instruments commonly offered by offshore forex brokers. As someone always seeking transparency and regulatory clarity, I note that China-Derivatives Futures operates under a CFFEX futures license and is supervised by Chinese authorities, strictly serving mainland clients. Their specialty lies in domestic commodity futures and financial futures, so for traders like me aiming for exposure to global spot forex, international stocks, or cryptocurrencies, this broker does not meet those needs. Through their proprietary platforms, including their own app and several desktop solutions such as Boyi Client Cloud and Wenhua Finance, I was able to access instruments tied to China’s futures markets. Besides futures, they advertise additional services like investment consulting, asset management, and brokerage for funds, but I did not see access to individual stocks, spot forex pairs, indices, or digital assets. For me, the appeal of China-Derivatives Futures is their established presence and their clear regulatory status in China, but I have to stress this broker’s product offering is highly specialized. Anyone considering them should be seeking exposure to mainland China’s futures and perhaps fund products, not broader global markets. As always, I view specialization as a double-edged sword; it brings depth in one area, but also limits diversification opportunities for a trader’s portfolio.

As someone who values the ability to evaluate a broker before committing real funds, the availability of a demo account is a significant factor in my decision-making process. With China-Derivatives Futures, I found that they do indeed offer demo trading—an important resource for both beginners and experienced traders seeking to familiarize themselves with the broker’s proprietary platforms and functionalities, such as the China-Derivatives Futures App and several desktop solutions. This demo access allowed me to simulate trades and understand the user interface, which I believe helps minimize initial trading errors and builds confidence before moving to live markets. However, while the context confirms that demo trading is supported, I was unable to find any specific mention regarding restrictions like a time limit or capped virtual funds. In my experience, prudent traders should always clarify such terms directly with the broker, as some platforms may introduce limitations on demo accounts that can affect the learning experience. For me, this cautious approach is essential, especially when dealing with derivatives trading, where risk management and platform familiarity are critical. Overall, having demo access influenced my perception positively, allowing for safer skill development, but I would advise anyone to verify any potential demo account restrictions through official channels before relying on this feature extensively.

Ingrese...

TOP

TOP

Chrome

Extensión de Chrome

Consulta regulatoria de bróker de Forex global

Navegue por los sitios web de los brokers de divisas e identifique con precisión los brokers legítimos y los fraudulentos.

Instalar ahora

扶众法援

China

En este mes de marzo, recibí una solicitud de amistad, que pensé que podría ser un amigo común. Luego fui llevado a un grupo de preparación, en el que los miembros mostraron capturas de pantalla de ganancias. Me conmovieron y observaron por un tiempo. Más tarde, también me registré y seguí las instrucciones del maestro. El maestro me pidió que trajera el depósito a 500 mil como umbral, alegando que los maestros profesionales podrían operar para mí. Hubo ganancias y pérdidas. Cuando solo quedaban 100 mil, traté de solicitar el retiro. Pero el canal de financiación no estaba disponible debido a la existencia de riesgo. La maestra se defendió y notó que el depósito / retiro podría ser diferido. El retiro no está disponible por una semana.

Exposición

Cris Men

Ecuador

nunca he tenido problemas con retiros ni nada por el estilo

Positivo

Maximilian 111

Nigeria

Compro materias primas aquí todo el tiempo. Ofrece tarifas transparentes y un excelente servicio al cliente, que siempre es mi elección sólida.

Positivo

Vegas

Colombia

China-Derivatives Futures co,.LTD. proporciona una variedad de aplicaciones de trading, en caso de errores de trading, muy íntimas. Y la empresa tiene un organismo regulador formal, la información de trading es abierta y transparente, estoy muy tranquilo/a.

Positivo