Company Summary

| IQM CAPITALReview Summary | |

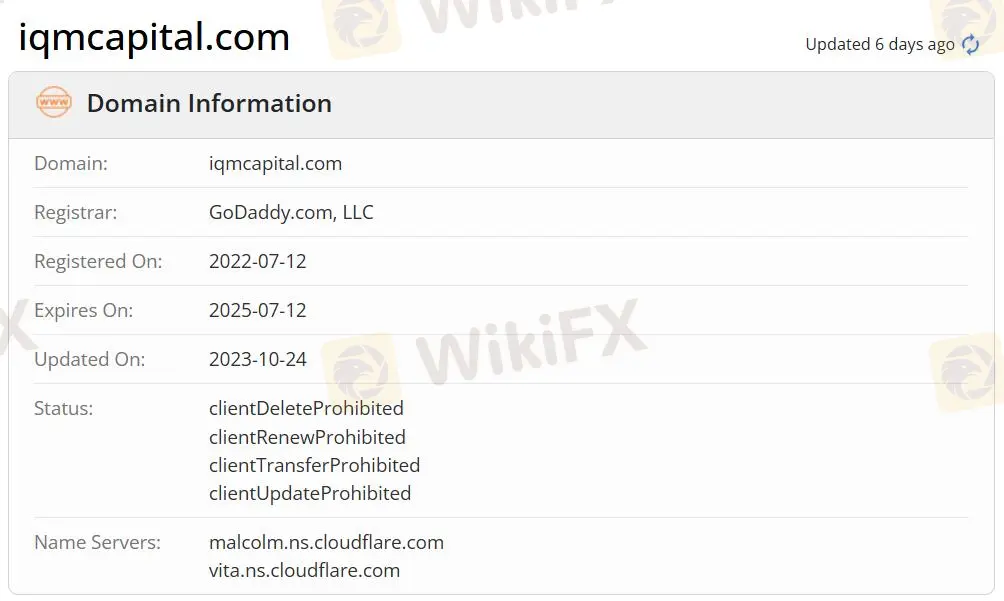

| Founded | 2022-07-12 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex/Precious metals/Indices/CFDs/Stocks/Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 0.0 pips |

| Trading Platform | CTrader(Desktop(Windows)/Mobile(iOS/Android)/Web) |

| Min Deposit | $100 |

| Customer Support | Phone: +971 4 5823377 |

| Email: support@iqmcapital.com | |

| Email: info@iqmcapital.com | |

| Live chat | |

| Facebook/YouTube/Instagram/LinkedIn/TikTok/Telegram/WhatsApp | |

IQM CAPITAL Information

IQM CAPITAL is an ECN (Forex) brokerage company that provides individual and corporate clients with various trading methods, 24/7 support, and advisory services. The tradable instruments include 40 currency pairs, 7 precious metals, 37 indices, 25 CFDs, 250 stocks, and 28 cryptocurrencies. The broker also provides three accounts with a maximum leverage of 1:500. The minimum spread is from 0.0 pips and the minimum deposit is $100. IQM CAPITAL is still risky due to its unregulated status, and bad reviews about difficulty withdrawing money.

Pros and Cons

| Pros | Cons |

| Leverage up to 1:500 | Unregulated |

| 24/7 customer support | MT4/MT5 unavailable |

| Various tradable instruments | Negative comments about difficulty in withdrawal |

| Spread from 0.0 pips | No withdrawal processing information |

| Demo account available |

Is IQM CAPITAL Legit?

IQM CAPITAL is not regulated, even though it claims to be regulated by Saint LUCIA. However, an unregulated broker is not as safe as a regulated one.

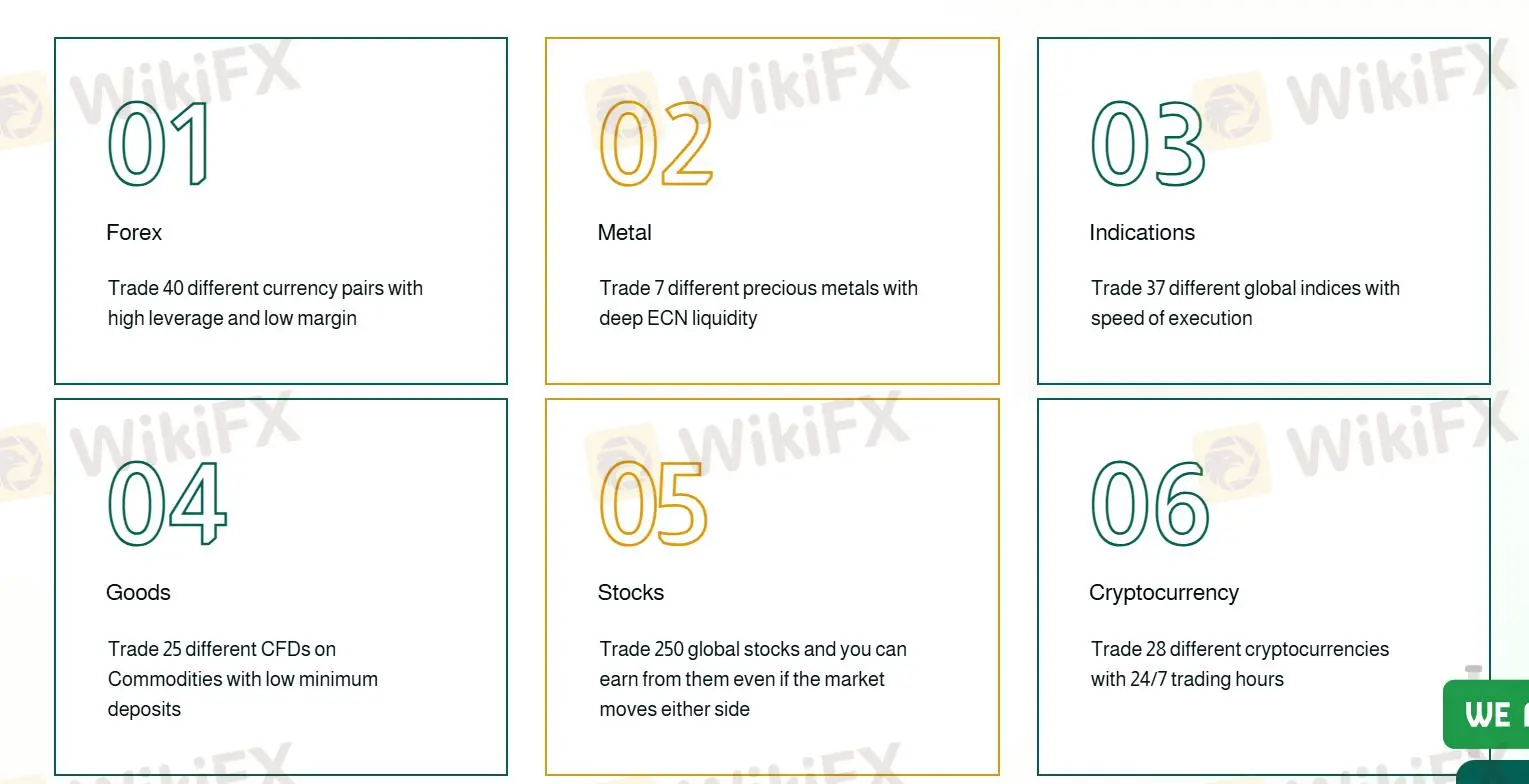

What Can I Trade on IQM CAPITAL?

IQM CAPITAL offers various market instruments, including 40 currency pairs, 7 precious metals, 37 indices, 25 CFDs, 250 stocks, and 28 cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| CFDs | ✔ |

| Precious Metals | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ❌ |

| Commodities | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

IQM CAPITAL has three account types: VIP, standard, and ZERO. Traders who want low leverage can choose a VIP account, while those with a small budget can open a standard account. In addition, the demo account is predominantly used to familiarize traders with the trading platform and for educational purposes only. Everyone can also earn money by copying the success of top traders. Muslims are allowed to open Islamic accounts without swaps.

| Account Type | VIP | Standard | ZERO |

| Leverage | Up to 1:200 | Up to 1:400 | Up to 1:500 |

| Minimum Deposit | $20000 | $100 | $500 |

| Commission | Free | Free | $8 |

| Islamic Account | Yes | Yes | Yes |

IQM CAPITAL Fees

The spread is from 0.0 pips, the commission is from 0. The lower the spread, the faster the liquidity.

Leverage

The maximum leverage is 1:500 meaning that profits and losses are magnified 500 times.

Trading Platform

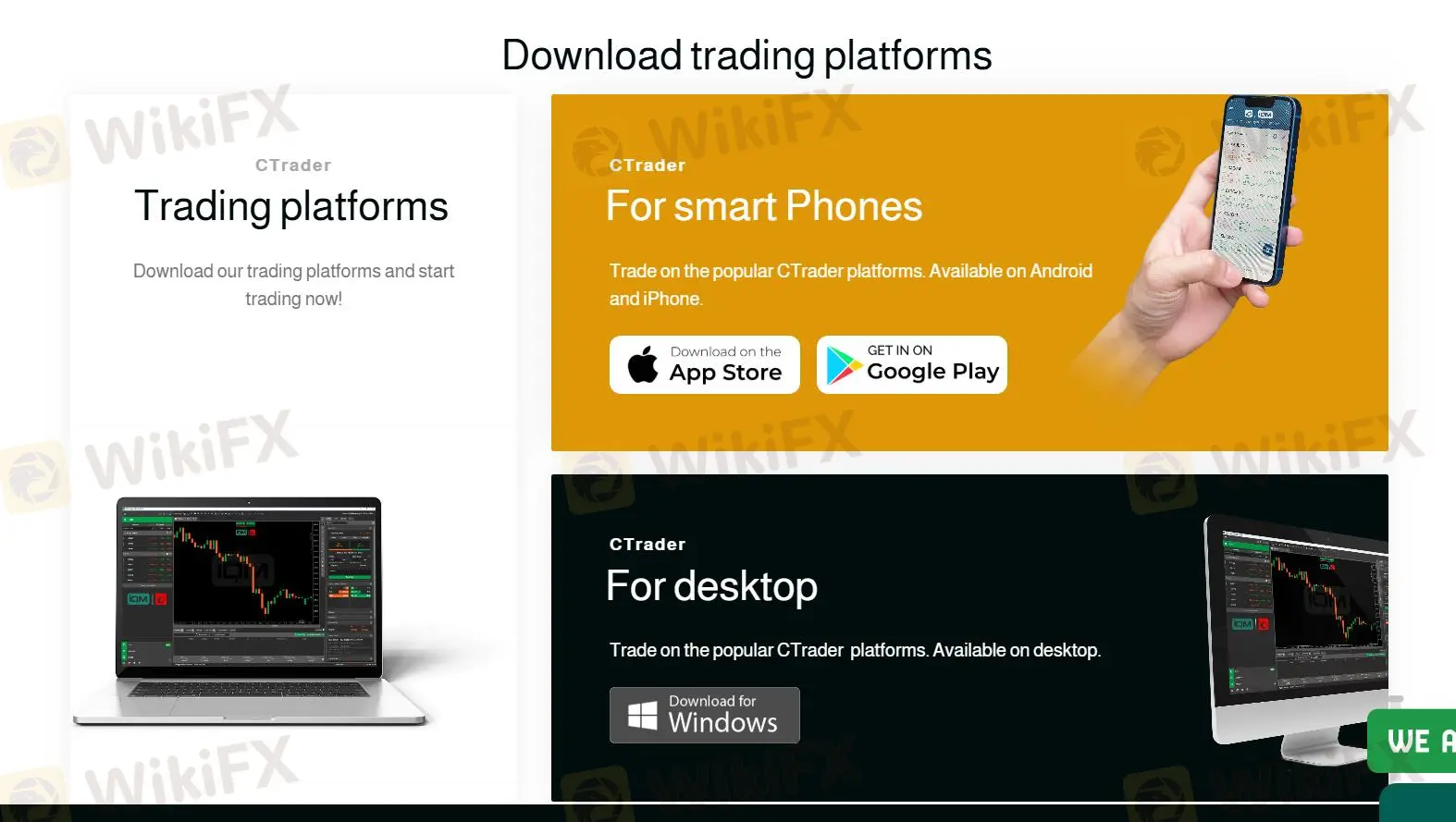

IQM CAPITAL provides a propriety CTrader trading platform available on desktop(Windows) and mobile(iOS and Android) instead of the authoritative MT4/MT5 with mature analysis tools and EA intelligent systems.

| Trading Platform | Supported | Available Devices |

| CTrader | ✔ | Desktop(Windows)/Mobile(iOS/Android)/Web |

Deposit and Withdrawal

The first deposit amount must be $100 or above. IQM CAPITAL accepts local transfers, tethers, visas, Perfect Money, Skrill, and Neteller for deposit and withdrawal. However, transfer processing times and associated fees are unknown.