Buod ng kumpanya

| IQM CAPITAL Buod ng Pagsusuri | |

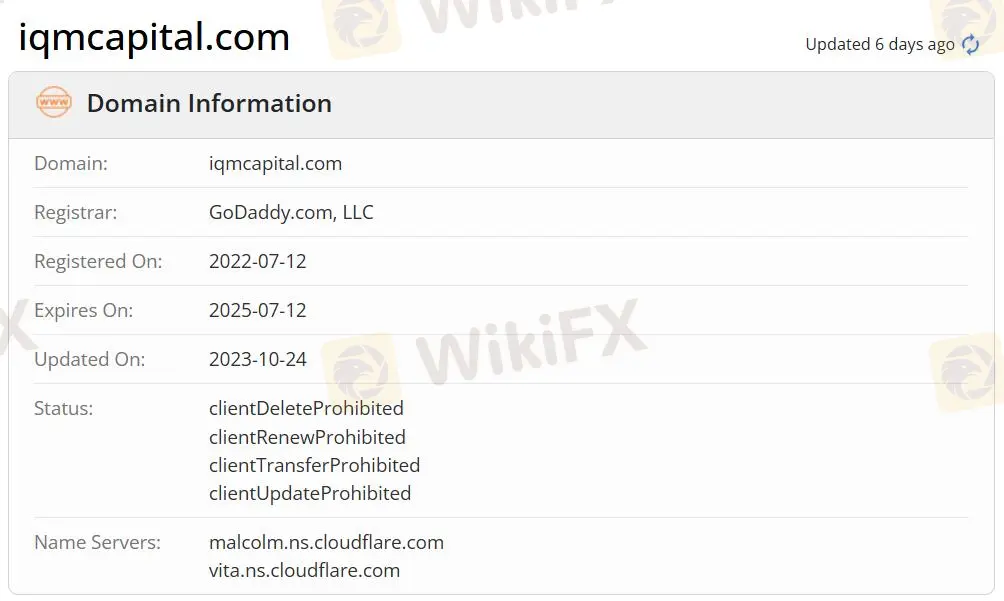

| Itinatag | 2022-07-12 |

| Rehistradong Bansa/Rehiyon | Saint Vincent and the Grenadines |

| Regulasyon | Hindi Regulado |

| Mga Instrumento sa Merkado | Forex/Precious metals/Indices/CFDs/Stocks/Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Hanggang 1:500 |

| Spread | Mula sa 0.0 pips |

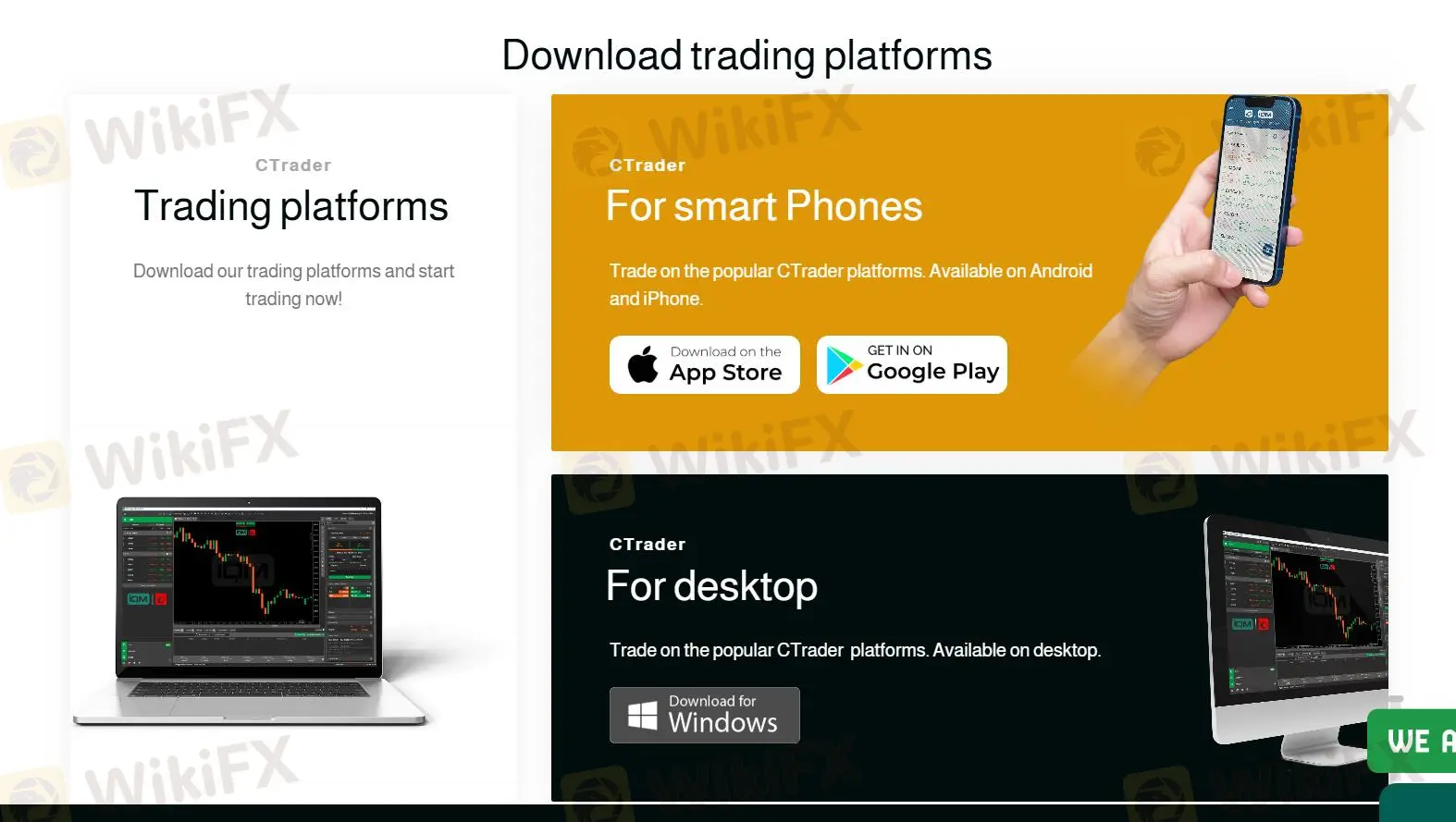

| Plataporma ng Pagkalakalan | CTrader(Desktop(Windows)/Mobile(iOS/Android)/Web) |

| Min Deposit | $100 |

| Tulong sa Customer | Telepono: +971 4 5823377 |

| Email: support@iqmcapital.com | |

| Email: info@iqmcapital.com | |

| Live chat | |

| Facebook/YouTube/Instagram/LinkedIn/TikTok/Telegram/WhatsApp | |

Impormasyon ng IQM CAPITAL

Ang IQM CAPITAL ay isang ECN (Forex) brokerage company na nagbibigay ng iba't ibang paraan ng pagkalakalan sa mga indibidwal at korporasyon, 24/7 na suporta, at serbisyong pangpayo. Kasama sa mga maaaring i-trade ang 40 currency pairs, 7 precious metals, 37 indices, 25 CFDs, 250 stocks, at 28 cryptocurrencies. Nagbibigay din ang broker ng tatlong account na may maximum leverage na 1:500. Ang minimum spread ay mula sa 0.0 pips at ang minimum deposit ay $100. Ang IQM CAPITAL ay patuloy pa ring mapanganib dahil sa hindi reguladong kalagayan nito, at sa mga negatibong review tungkol sa kahirapan sa pag-withdraw ng pera.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Leverage hanggang 1:500 | Hindi Regulado |

| 24/7 na suporta sa customer | MT4/MT5 hindi available |

| Iba't ibang mga instrumento na maaaring i-trade | Negatibong mga komento tungkol sa kahirapan sa pag-withdraw |

| Spread mula sa 0.0 pips | Walang impormasyon sa proseso ng pag-withdraw |

| Available ang demo account |

Totoo ba ang IQM CAPITAL?

Ang IQM CAPITAL ay hindi regulado, kahit na ito ay nagpapahayag na regulado ito ng Saint LUCIA. Gayunpaman, ang isang hindi reguladong broker ay hindi kasing ligtas ng isang reguladong broker.

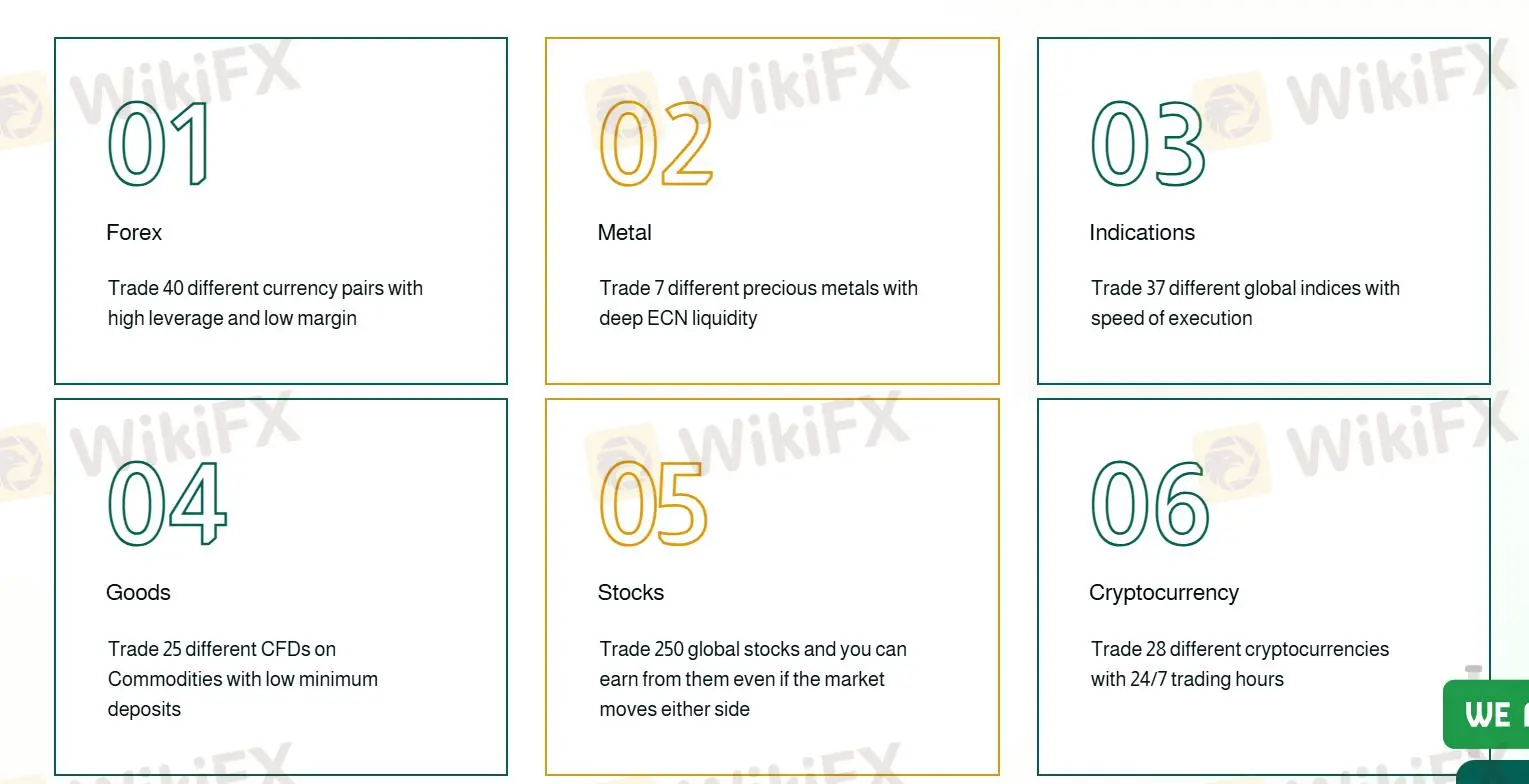

Ano ang Maaari Kong I-trade sa IQM CAPITAL?

IQM CAPITAL ay nag-aalok ng iba't ibang mga instrumento sa merkado, kasama ang 40 currency pairs, 7 precious metals, 37 indices, 25 CFDs, 250 stocks, at 28 cryptocurrencies.

| Mga Tradable na Instrumento | Supported |

| Forex | ✔ |

| Indices | ✔ |

| CFDs | ✔ |

| Precious Metals | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Shares | ❌ |

| Commodities | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Uri ng Account

Ang IQM CAPITAL ay may tatlong uri ng account: VIP, standard, at ZERO. Ang mga trader na nais ng mababang leverage ay maaaring pumili ng VIP account, samantalang ang mga may maliit na budget ay maaaring magbukas ng standard account. Bukod dito, ang demo account ay pangunahin na ginagamit upang pamilyarisin ang mga trader sa platform ng pag-trade at para sa layuning pang-edukasyon lamang. Lahat ay maaari ring kumita ng pera sa pamamagitan ng pagkopya sa tagumpay ng mga top trader. Pinapayagan ang mga Muslim na magbukas ng mga Islamic account na walang swaps.

| Uri ng Account | VIP | Standard | ZERO |

| Leverage | Hanggang 1:200 | Hanggang 1:400 | Hanggang 1:500 |

| Minimum Deposit | $20000 | $100 | $500 |

| Commission | Libre | Libre | $8 |

| Islamic Account | Oo | Oo | Oo |

Mga Bayarin sa IQM CAPITAL

Ang spread ay mula sa 0.0 pips, ang komisyon ay mula sa 0. Mas mababa ang spread, mas mabilis ang liquidity.

Leverage

Ang maximum na leverage ay 1:500 ibig sabihin, ang mga kita at pagkawala ay pinalalaki ng 500 beses.

Platform ng Pag-trade

Nagbibigay ang IQM CAPITAL ng sariling CTrader na platform ng pag-trade na available sa desktop(Windows) at mobile(iOS at Android) sa halip ng awtoridad na MT4/MT5 na may matatag na mga tool sa pagsusuri at mga EA intelligent system.

| Platform ng Pag-trade | Supported | Available Devices |

| CTrader | ✔ | Desktop(Windows)/Mobile(iOS/Android)/Web |

Pagdeposito at Pag-withdraw

Ang unang halaga ng deposito ay dapat na $100 o higit pa. Tinatanggap ng IQM CAPITAL ang mga lokal na paglipat, tethers, visas, Perfect Money, Skrill, at Neteller para sa deposito at pag-withdraw. Gayunpaman, ang mga oras ng pagproseso ng paglipat at ang mga kaakibat na bayad ay hindi alam.