Basic Information

Saint Lucia

Saint Lucia

Score

Saint Lucia

|

2-5 years

|

Saint Lucia

|

2-5 years

| https://carltonfx.com/

Website

Rating Index

MT4/5

Full License

CarltonFinancial-Server

Influence

D

Influence index NO.1

India 2.39

India 2.39

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

D

Influence index NO.1

India 2.39

India 2.39 Licenses

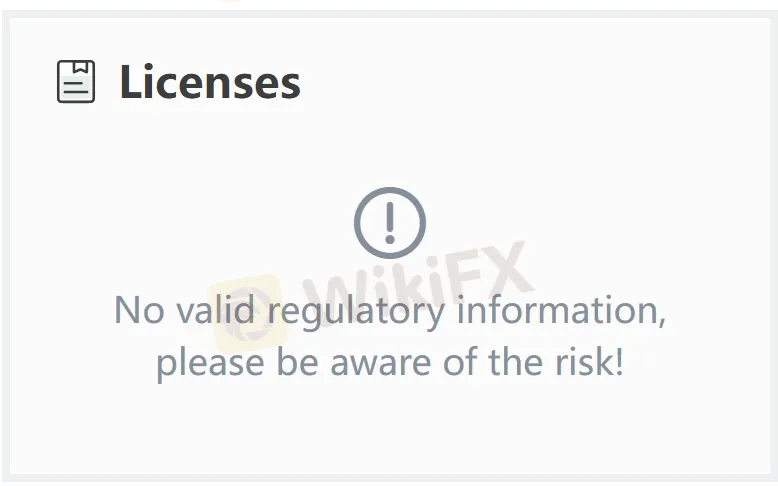

LicensesNo valid regulatory information, please be aware of the risk!

Saint Lucia

Saint Lucia

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

carltonfx.com

carltonfx.com India

India| CARLTON Review Summary | |

| Founded | 2022 |

| Registered Country/Region | Saint Lucia |

| Regulation | No regulation |

| Market Instruments | CFDs on forex, stocks, commodities, indices, cryptocurrencies, ETFs, etc. |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | 40-50 points for forex (Standard account) |

| Trading Platform | MT5 |

| Minimum Deposit | $10 |

| Customer Support | Contact form, WhatsApp |

| Tel: +971 4 832 2845 | |

| Email: support@carltonfx.com | |

| Facebook, Twitter, Instagram, LinkedIn | |

| Registered Address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia | |

| Physical Address: #1404, 14th Floor, Zone A, Aspect Tower, Executive Tower-D, Business Bay, Dubai, UAE | |

| Restricted Areas | United States of America, Canada, Israel and the Islamic Republic of Iran |

Registered in Saint Lucia while physically operating in Dubai, UAE, CARLTON is a brokerage company who offers more than 1,200 trading instruments to both retail and institutional traders. Their business mainly fall into categories like CFDs on forex, stocks, commodities, indices, cryptocurrencies, ETFs, etc.

It provides a demo account for practicing before actual trading and 5 tiered accounts, with a minimum deposit of $10 only, which is affordable to most traders. Trades are excuted on the most popular and advance MetaTrader 5 platform.

However, one of the facts that cannot be neglected is that the broker is not being well-regulated by any official authorities so far, which degrades its credibility and trustworthiness.

| Pros | Cons |

| Demo accounts available | No regulation |

| MT5 platform | |

| Tiered accounts | |

| Low minimum deposit |

The most important factor in measuring the safety of a brokerage platform is whether it is formally regulated. CARLTON is an unregulated broker, which means that the safety of users' funds and trading activities are not effectively protected. Investors should choose CARLTON with caution.

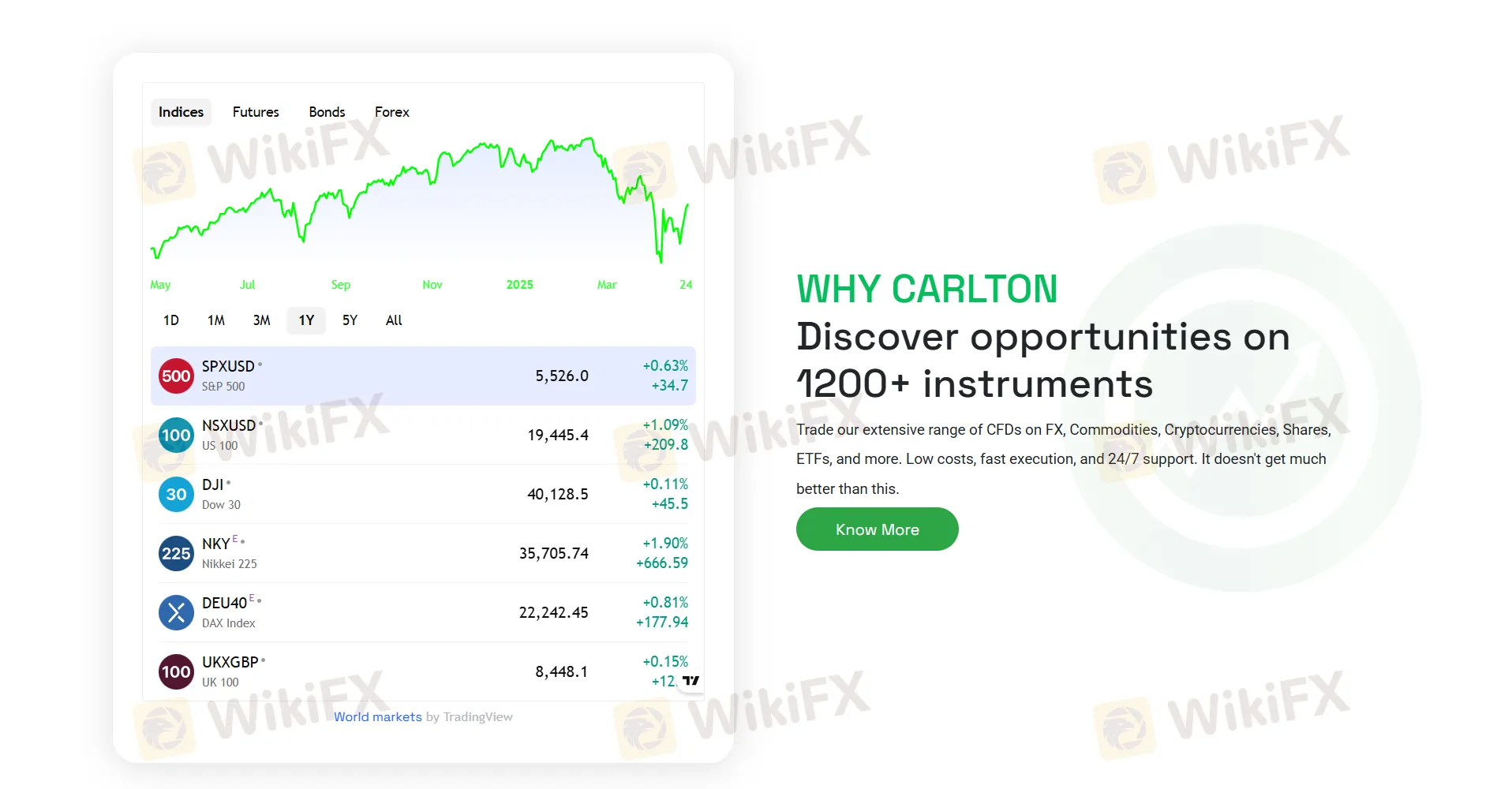

CARLTON offers 1,200+ trading instruments 24 hours a day, 7 days a week. These mainly include:

| Tradable Instruments | Supported |

| CFDs | ✔ |

| Forex | ✔ |

| Stocks | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Cryptocurrencies | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

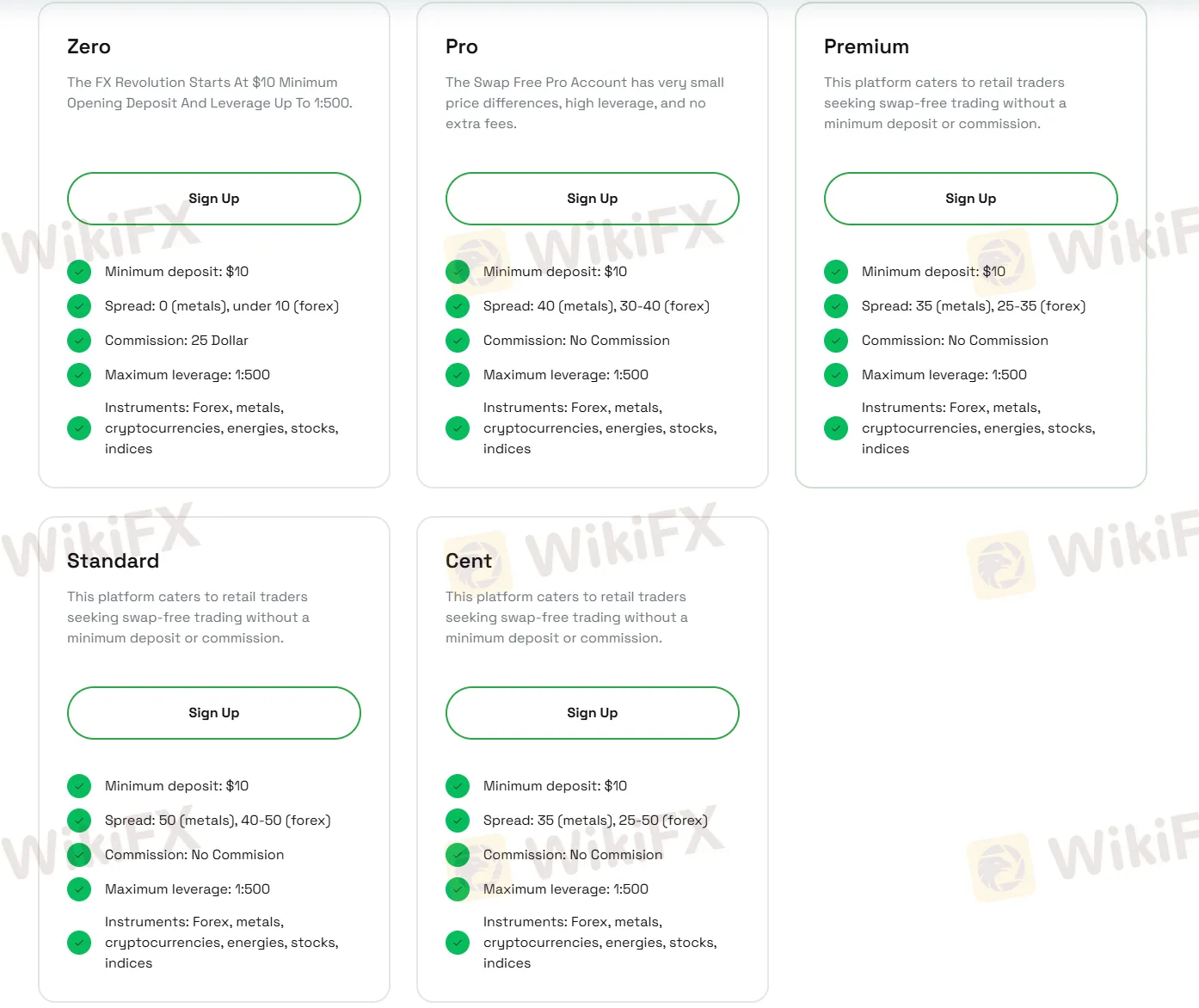

Except for a demo account with virtual money to practice before commiting real money, CARLTON offers a 5 tiered live accounts for clients to choose from.

Minimum deposit is only $10, affordable to most traders, even beginners.

While for spreads, the higher level the account is, the wider the spread will be for metals and forex.

No trading commissions will be charged except for the Zero account with the tightest spread. The commission will be 25 dollars per trade.

| Account Type | Minimum Deposit | Spread (Forex) | Spread (Metals) | Commission |

| Zero | $10 | Under 10 points | 0 points | 25 dollars |

| Pro | 30-40 points | 40 points | ❌ | |

| Premium | 25-35 points | 35 points | ❌ | |

| Standard | 40-50 points | 50 points | ❌ | |

| Cent | 25-50 points | 35 points | ❌ |

Leverage will be up to 1:500 for all account types for this broker, which means your profits can be maximized to 500 times of your initial deposit. However, be cautious with leverage since it amplifies your losses at the same time.

Clients of CARLTON can enjoy the industry recognized MetaTrader 5 platform with robust functions and friendly user interface.

You can access the platform on both mobile and Windows devices.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Mobile/Windows | Experienced traders |

| MT4 | ❌ | / | Beginners |

The broker claims to accept all payment methods, including MasterCard, Razorpay, Skrill, Neteller, Ethereum, Tether, Tron, and Wire Transfer.

GatesFX is an unregulated broker with no valid forex license. Read our review on its platforms, account types, and potential risks before trading.

Carlton exposed reveals unregulated status, blocked withdrawals, support delays, and why traders worldwide are warning others about this FX broker.

CARLTON is not regulated, which raises concerns for me as a trader. Without regulation, there’s no formal oversight to protect my funds or ensure the broker adheres to industry standards. For me, regulation is a critical factor when choosing a broker.

CARLTON offers tiered account types, with different fees for each. For example, the Zero account charges a $25 commission per trade, while other accounts like Pro, Premium, and Standard don’t have commission fees but have higher spreads. Personally, I’d need to calculate how these fees affect my trades, especially on the Zero account.

CARLTON offers the MetaTrader 5 (MT5) platform, which is my preferred platform due to its advanced features. However, they don’t support MT4, which is a bit of a downside for beginners like me.

Spreads vary depending on the account type. The Zero account has spreads under 10 pips for forex, while the Standard account’s spreads are 40-50 pips. Personally, I’d go for a Zero account to benefit from tighter spreads, but I’d still have to account for the commission fees.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Zara Akhtar

Pakistan

my account was verified and I have been trading well and good but today I just logged into my account and see that my account is showing unverified I don’t understand how this things works how can a fully verified account be unverified all of a sudden seems the don’t want to give my withdrawals

Exposure

FX2002900347

Sri Lanka

I had a sell position on XAUUSD for 8.00 Lots at the price of 2682.80 I have waited for this trade like 40-45 minutes till the Asian markets opened and the price started to drop and as soon as it crossed my entry price I put a SL at 2682.69 to protect my position. Once I have closed the trade modification the position was already closed even when the candle kept dropping and it reached my desired TP at 2674.5. I have contacted their support for almost a month till I got an answer on this matter yet they claim that when the SL was placed the price came back up to 2682.69 then it dropped again, recently I had a free time to check this out on MT5 strategy tester to check specifically how the candles formed, yet the candle never retraced to my SL and the price it stayed at for a few milliseconds was around 2682.61-2682.63 then it continued dropping. I checked this time stamp with multiple brokers that I trade with yet the price never came back to my SL during that duration.

Exposure

FX2151755231

Sri Lanka

I opened a buy stop order at price 42870 for US30. It was triggered at 42991, a massive 121 points difference! Even more ridiculous is that my order then TP at 42964.1! This is the first time I've seen such a ridiculous trade execution and I've tried numerous brokers. When I bring this up for them to check, their compliance provided the standard reply of slippage due to high market volatility or news release and won't compensate me.

Exposure

FX1963543270

Pakistan

Earlier today, my trade was stopped out at a price that NEVER even existed on the chart. I checked different timeframes, and there was no candle or wick that reached my stop-loss level, yet somehow, my trade got closed. This is a clear sign of artificial price movements, which is unacceptable for a broker claiming to offer fair execution. On top of that, I had set my risk to $1.5, but when my trade was stopped out, I was charged a $2.3 loss instead. That’s almost 50% more than what I expected. Either they widened the spread at execution, or they’re manipulating trade outcomes in their favor. Either way, it’s shady.

Exposure

FX2256166423

Pakistan

I was trading and everything was going well I was making very good profits all of a sudden the Market hock for some seconds and once it’s back all the profits is gone and my account is gone I contacted the broker the admitted their fault but still my money ain’t refunded this slippage is very frustrating an Annoying it took away all of my money and profits

Exposure

FX3564809082

Sri Lanka

I can’t seems to withdraw my money because the have refused to verify my account for over how many days the said it only takes 24 hours but because i initiated a withdrawal the have refused to verify my accounts even after multiple attempts the don’t want to give out mine for withdrawals or is it because i made a lot of profits the don’t want to give out money

Exposure

FX3902025101

Pakistan

My withdrawal page has disappeared I only keeps showing I don’t have enabled payment options even my KYC is now showing unverified and my wallet is showing 0 balance my money is no where to be found this is one of the most scam brokers bring back my money let me withdraw

Exposure

FX3307550817

Pakistan

I ensured all trades were closed after five minutes, but the broker transferred all my funds from my account to their own, citing vague "system issues." I have tried reaching out to the customer support in different ways but it’s not fruitful at all the are not responding to any of my emails or chats I don’t know what to do again

Exposure

irban321

Pakistan

The Have refused to release my funds, anything i requested for a withdrawal the only send me a mail about Elaborating can’t i withdraw my own money.. what is really happening I have been trying to contact support the are also not responding

Exposure

FX1876184612

Sri Lanka

I can’t withdraw my money from this broker I have been waiting for a long time but I can’t everytime it’s refused to be processed even the customer service are not helping the keep saying it can’t be withdrawn how can’t i withdraw my own money

Exposure

FX3227584169

Sri Lanka

It has been over 1.5 months, and I have not received any updates or my funds. My account now shows a zero balance, and they are completely unresponsive Even after admitting their mistake this is very bad

Exposure

Sarre

United States

Market tools are helpful, but the platform's educational resources could be more comprehensive. More webinars would be great.

Neutral

Mark Carter

New Zealand

Execution transparency and fairness are commendable, but the platform sometimes lags. It sometimes takes a while to load charts.

Neutral

nhuj

Mexico

Every thing is well , but some times the range of spread get increase more than average spread and even today my trade trailing sl got hitted before its really reach that level that was so hurting.

Neutral