Company Summary

| Monex Europe Review Summary | |

| Founded | 1985 |

| Registered Country/Region | Mexico |

| Regulation | FCA (Revoked) |

| Products and Services | Spot FX, Forwards, FX Derivatives, FX Hedging, Global Payments, API Integration, Multi-currency Accounts |

| Demo Account | ❌ |

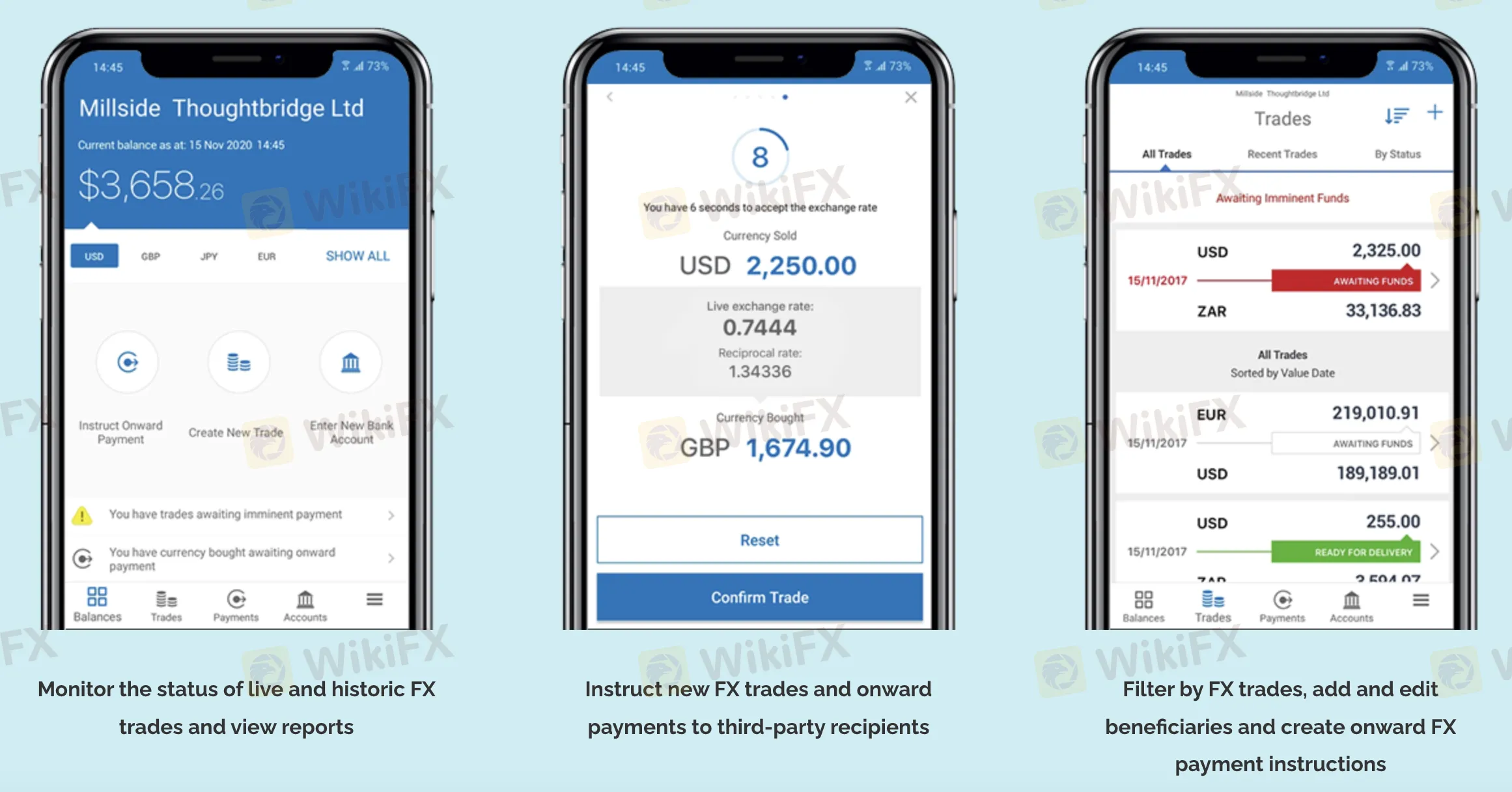

| Trading Platform | Monex Pay Platform (Web, iOS, Android), Monex REST API |

| Customer Support | Tel/WhatsApp: +44 (0) 203 650 6400 |

| Email: support@monexpay.com | |

Monex Europe Information

Monex Europe, formed in 1985 and headquartered in Mexico, was previously regulated by the FCA in the UK but has since had its license revoked. The company provides complete foreign currency and cross-border payment services to corporate clients. Their solution includes the Monex Pay platform and a REST API for integration and automation.

Pros and Cons

| Pros | Cons |

| Offers institutional-level FX and payment solutions | FCA license revoked |

| Supports 60+ currencies and up to 40 multi-currency wallets | No demo accounts available |

| Mobile & API-based trading and payment platforms available | Limited information about fees |

Is Monex Europe Legit?

No, it is not regulated. Monex Europe Limited used to be regulated by the Financial Conduct Authority (FCA) of the UK. The number of their payment license was 463951. However, it is no longer valid because the license state is shows“Revoked”.

Products and Services

Monex Europe offers a lot of different FX products, risk management tools, and global payment services. They offer spot and forward FX, FX derivatives, integrated API solutions, and multi-currency account services. These services support more than 60 currencies and up to 40 currency wallets for businesses that operate around the world.

| Category | Products & Services |

| Commercial FX Products | Spot FX, Deliverable Forwards, Market Orders (Limit & Stop), Margin Credit Facilities |

| FX Derivatives | FX Options, Non-deliverable Forwards (NDFs), Custom Forwards, FX Hedging Strategies, FX Advisory |

| Global Payments | Monex Pay Platform, Multi-Currency Accounts (40+ currencies), Batch/Individual Payments, SWIFT Integration |

| Technology Solutions | Monex REST API, Client & Developer Support, Developer Portal, Customisable Client Portal |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Monex Pay Platform | ✔ | Web, iOS (App Store), Android (Google Play) | Corporate clients managing global payments |

| Monex REST API | ✔ | Server-side/API integration | Businesses & developers needing automation |