Company Summary

| Allianz Review Summary | |

| Founded | 1998 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Financial Services | Institutional Investors, Insurance Asset Management, Retail Funds, Retirement Services. |

| Customer Support | (852) 2238 8888, (852) 2238 8000 |

| hkenquiry@allianzgi.com | |

Allianz Information

Allianz, established in 1998 as a dedicated asset management business in Hong Kong and regulated by the SFC, offers many financial services, including solutions for institutional investors, tailored strategies for insurance asset management, diverse retail funds, and retirement services leveraging their global expertise.

Pros and Cons

| Pros | Cons |

|

|

|

|

Is Allianz Legit?

Allianz has a “Dealing in futures contracts” license regulated by the Securities and Futures Commission (SFC) in Hong Kong with a license number of BFE699.

Products & Services

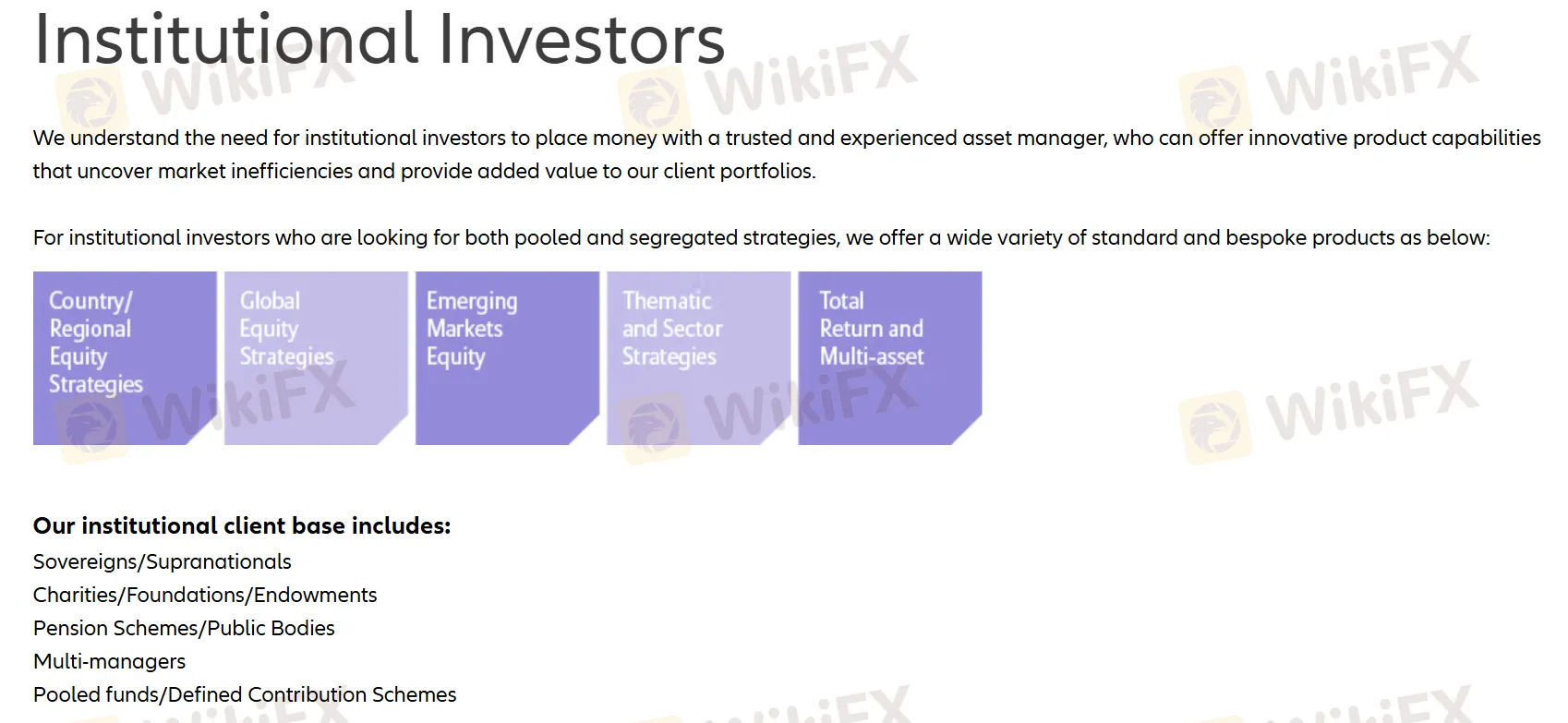

- Institutional Investors: Allianz offers institutional investors both pooled and segregated strategies, including Country/Regional Equity, Global Equity, Emerging Markets Equity, Thematic and Sector Strategies, and Total Return and Multi-asset solutions. Their institutional client base includes sovereigns, pension schemes, charities, and more.

- Insurance Asset Management: Allianz provides tailored investment strategies and solutions for global insurance companies, including life, property & casualty, and health insurers, to navigate regulatory and low-interest rate challenges.

- Retail Funds: Allianz offers retail investors diverse funds across different investment strategies, including equity funds aiming for long-term capital appreciation in global markets, bond funds providing stable income, and multi-asset funds for capital growth and diversification. These funds are accessible through their world-class investment platforms.

- Retirement Services: Allianz provides retirement services, leveraging its global investment and research expertise to flexibly manage wealth through its retirement product offerings. They aim to help individuals plan and secure their financial future.

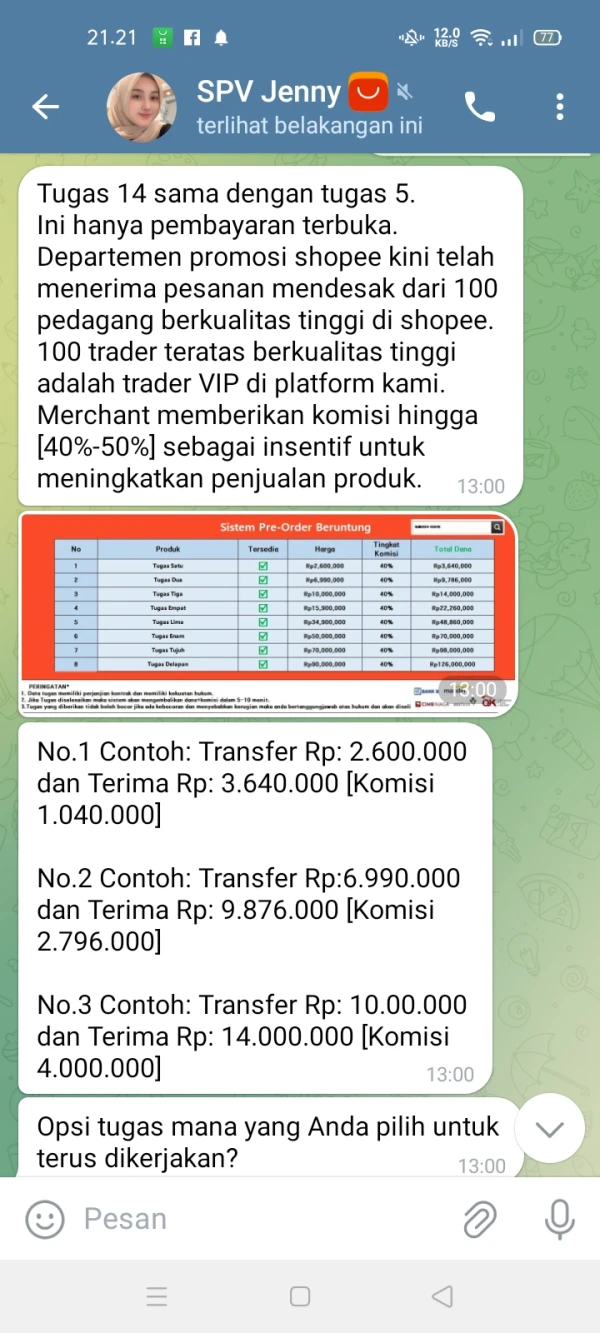

sunshine62137

South Korea

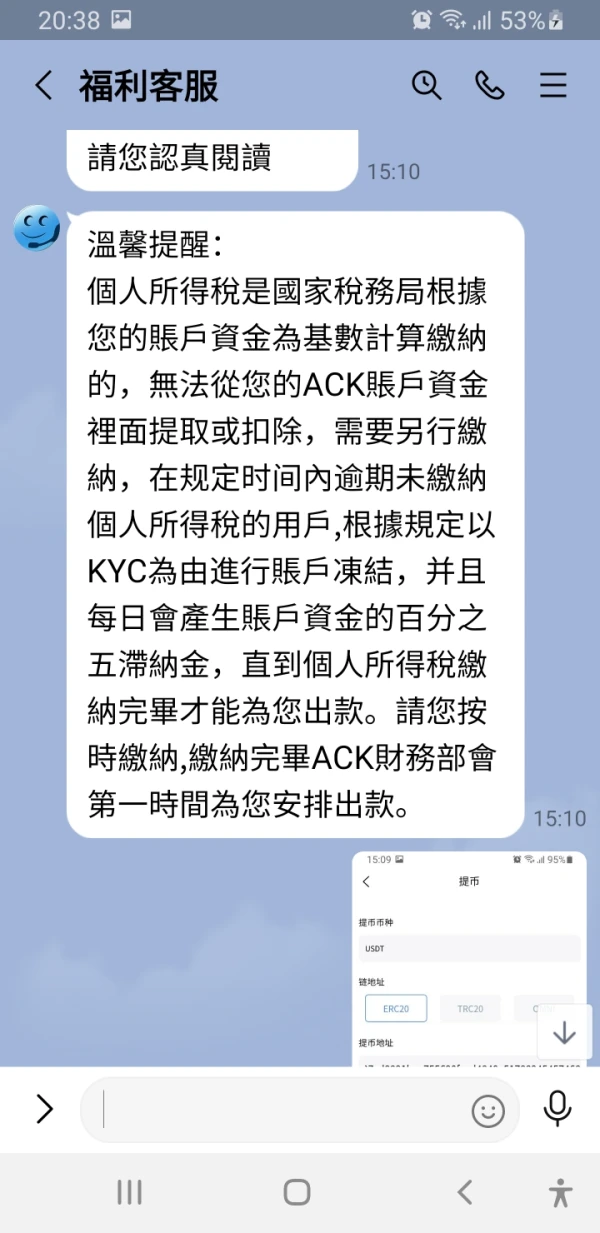

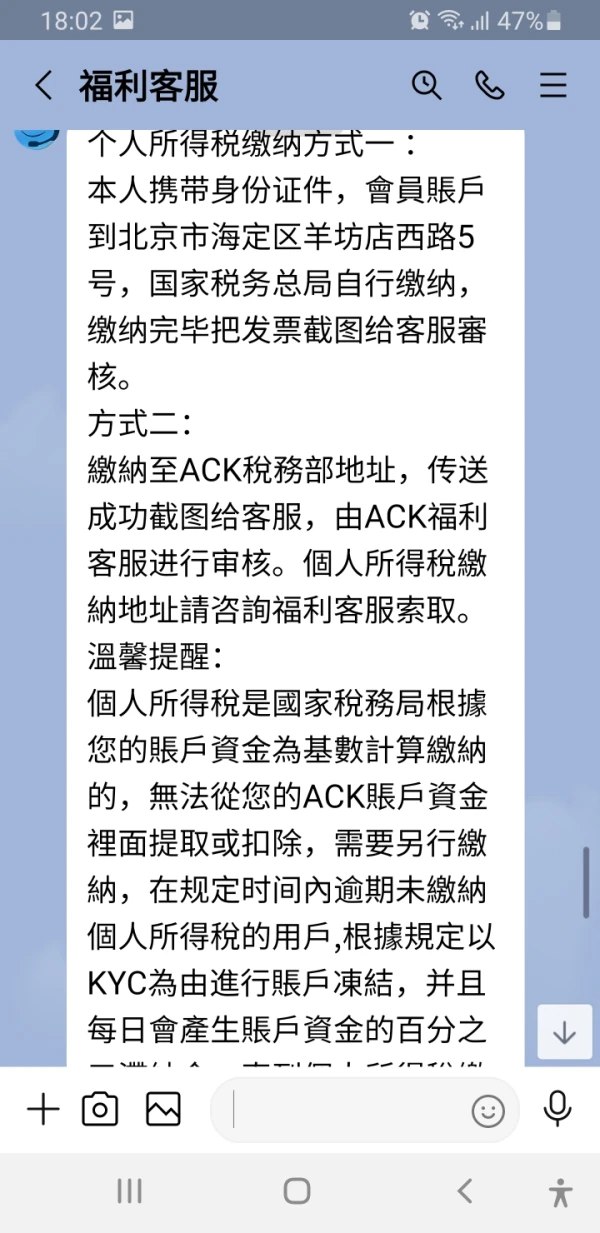

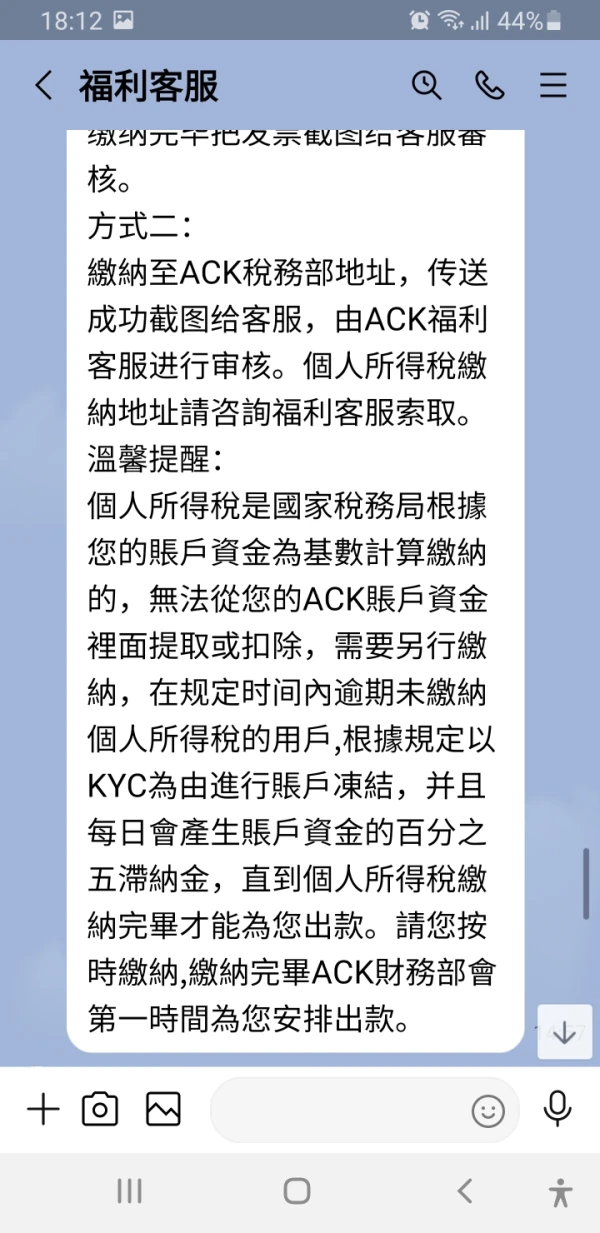

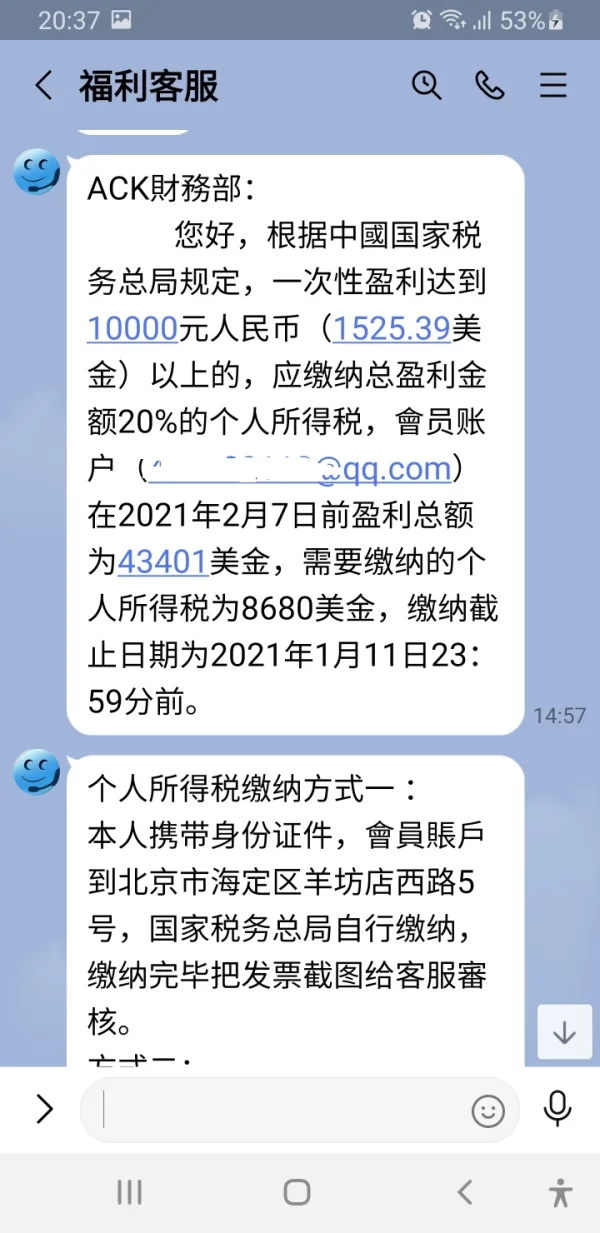

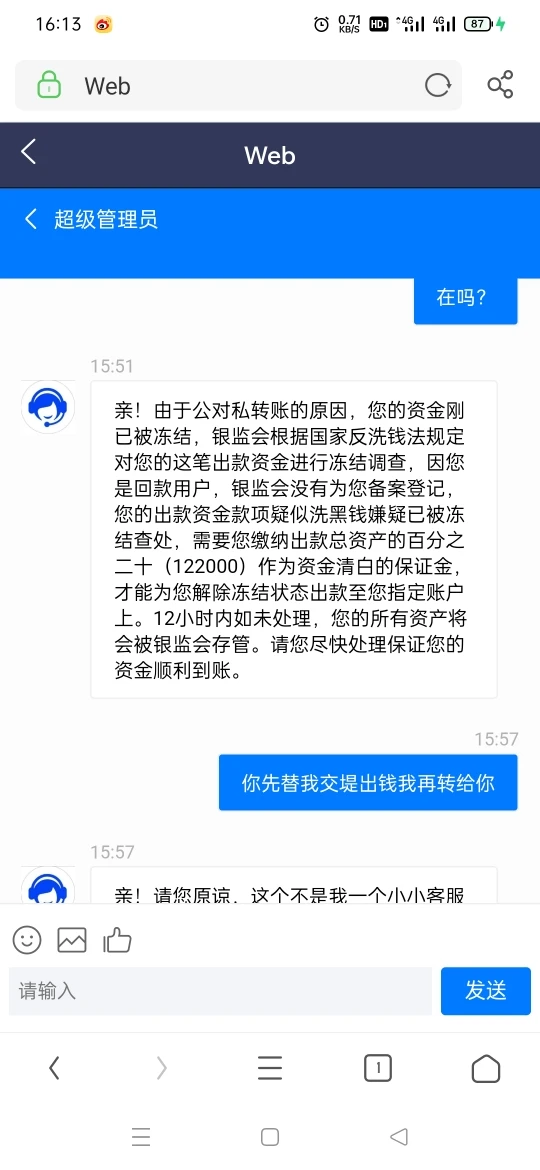

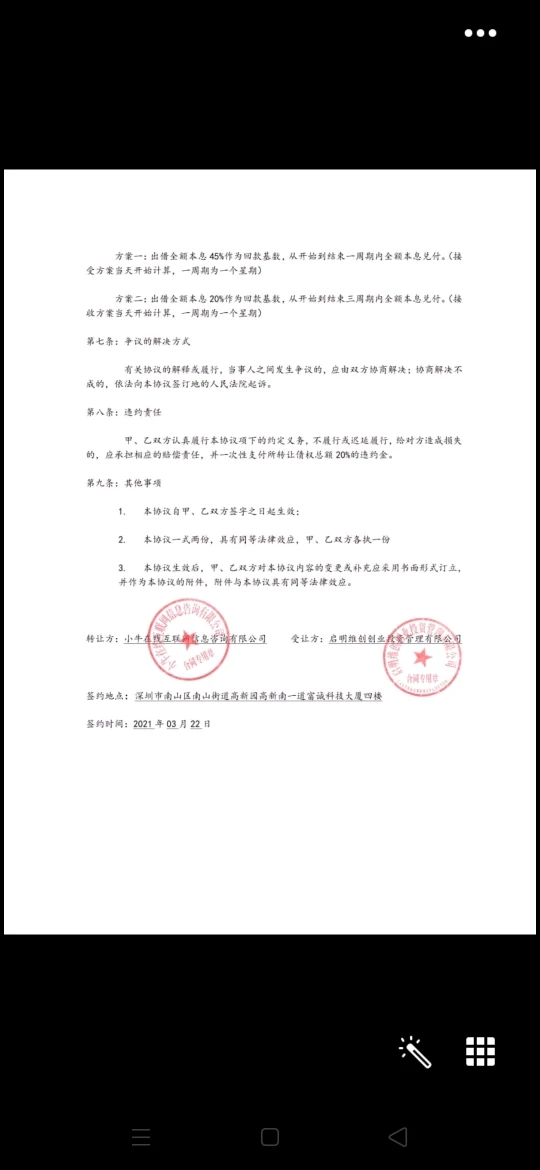

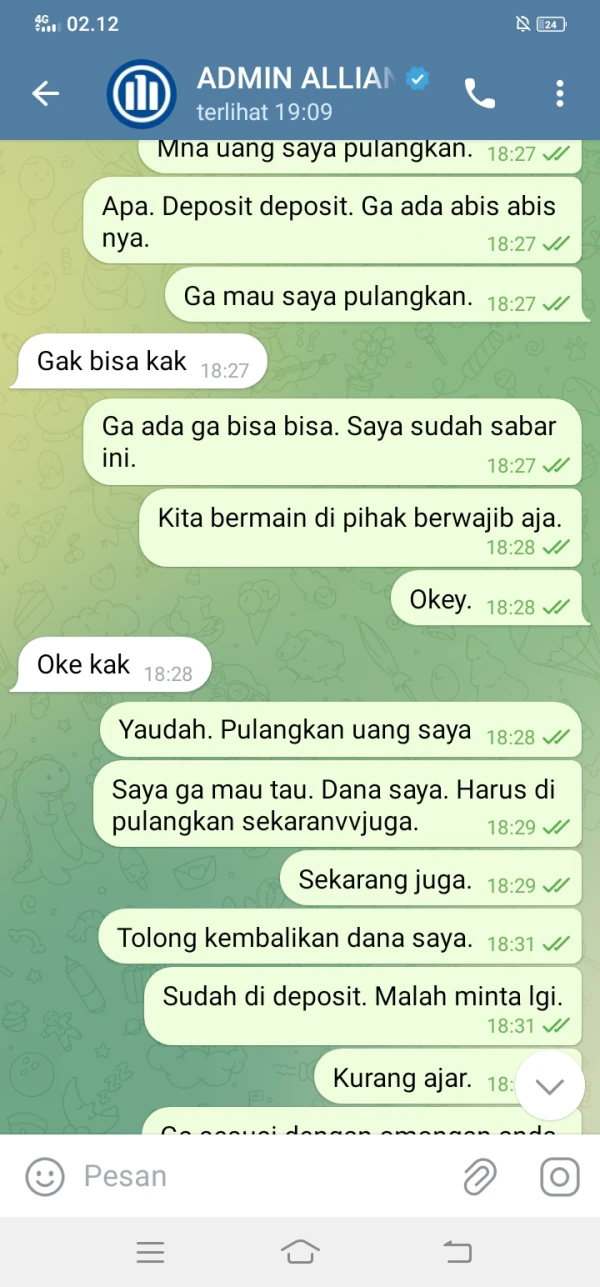

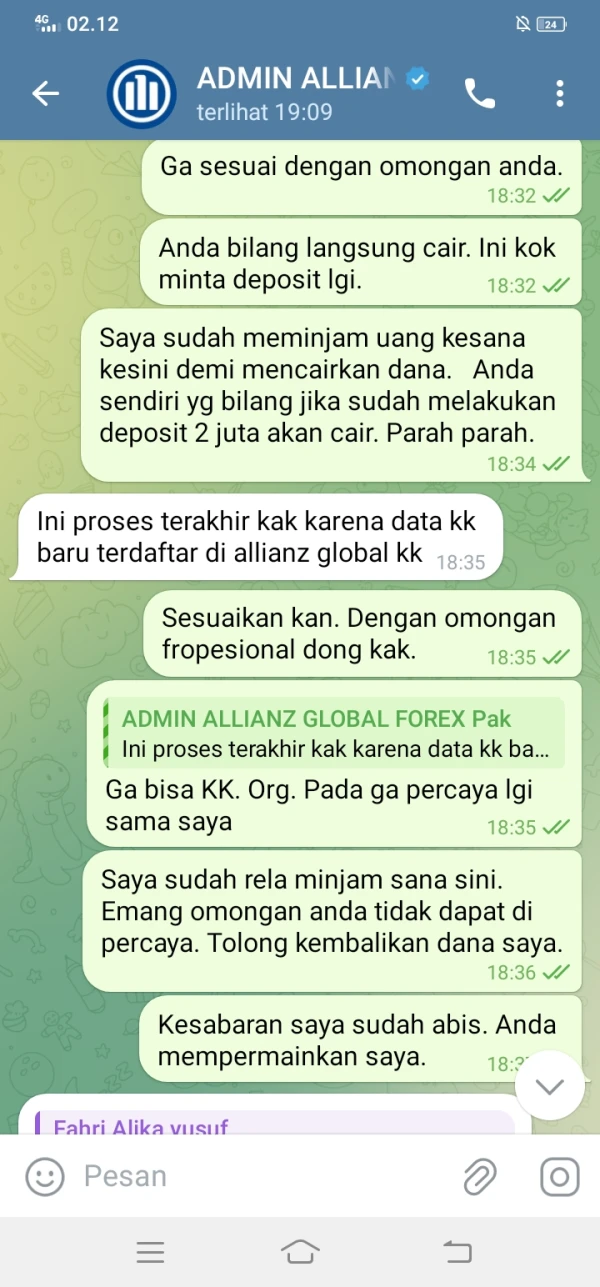

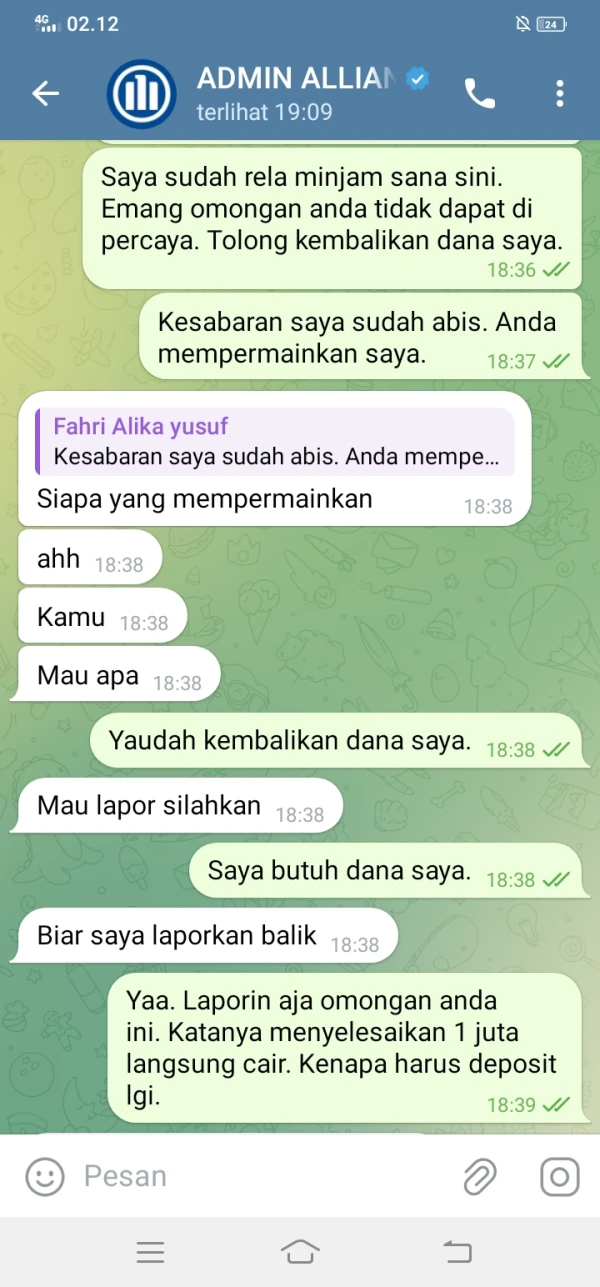

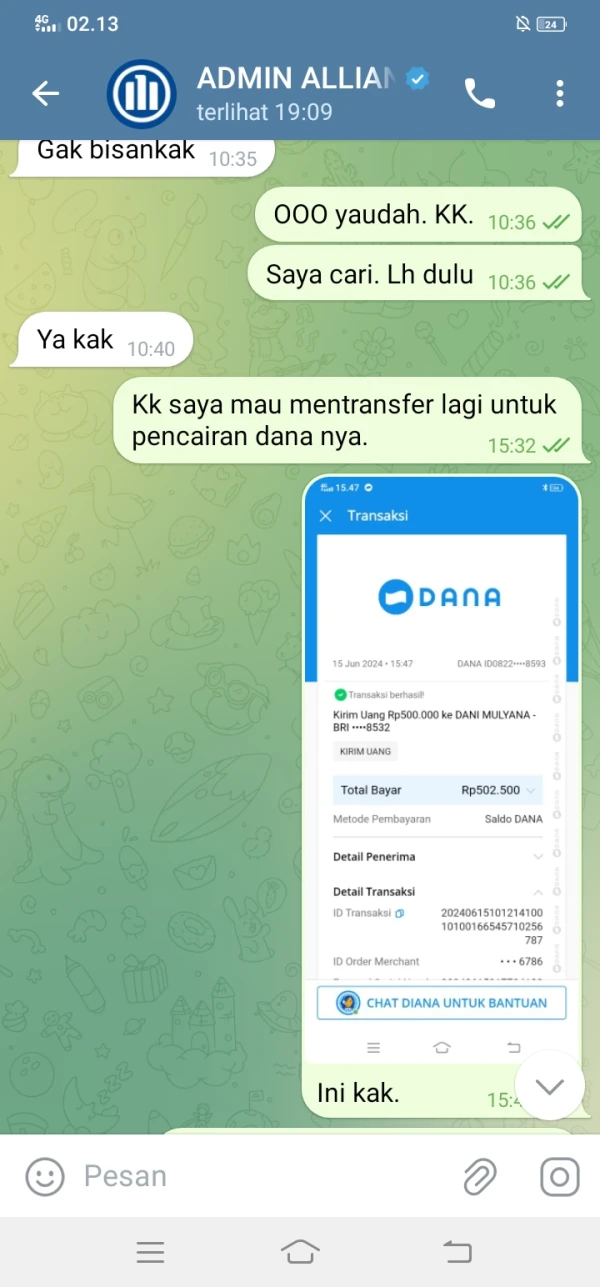

Allianz has been requiring recharge. Either it is to pay taxes, anyway, for various reasons not to allow withdrawal

Exposure

风之语8559

Hong Kong

The liar platform pretends to be a customer service to let you enter this platform and then cheat your deposit step by step

Exposure

mabra1744

Indonesia

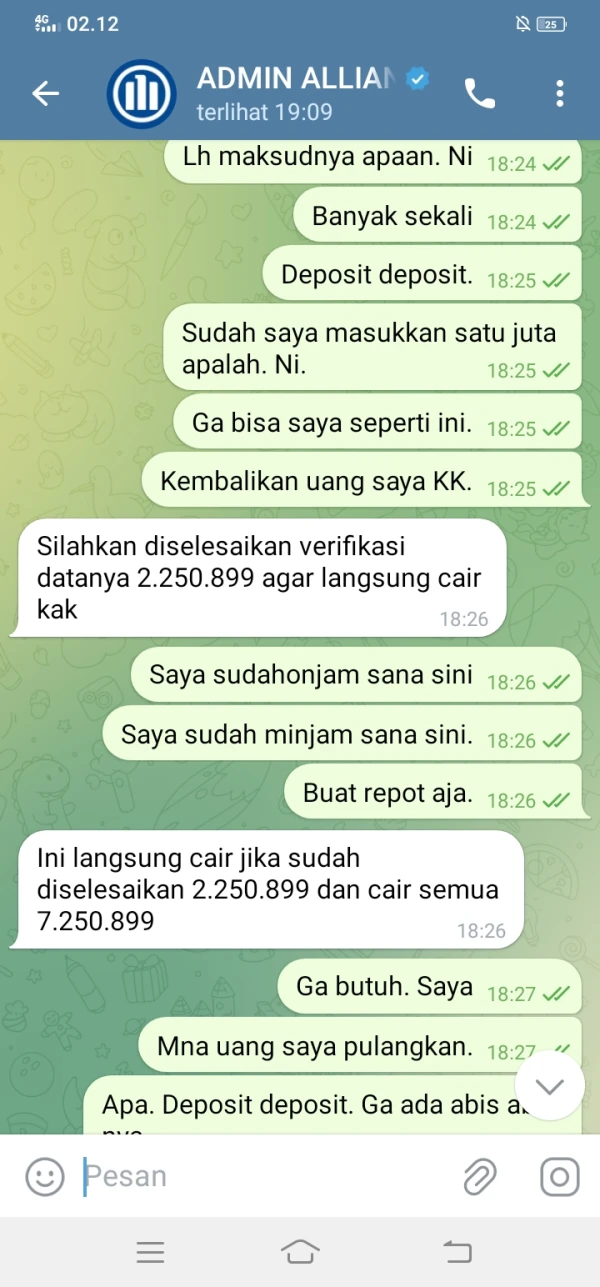

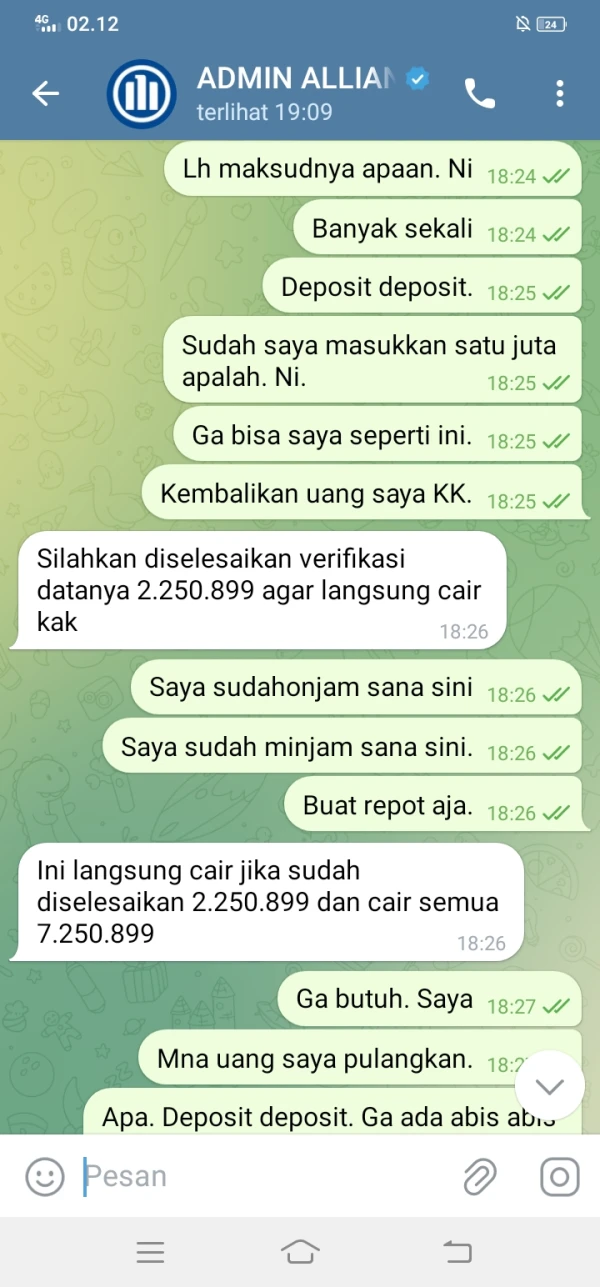

My funds are 1,000,000. Please return them.

Exposure

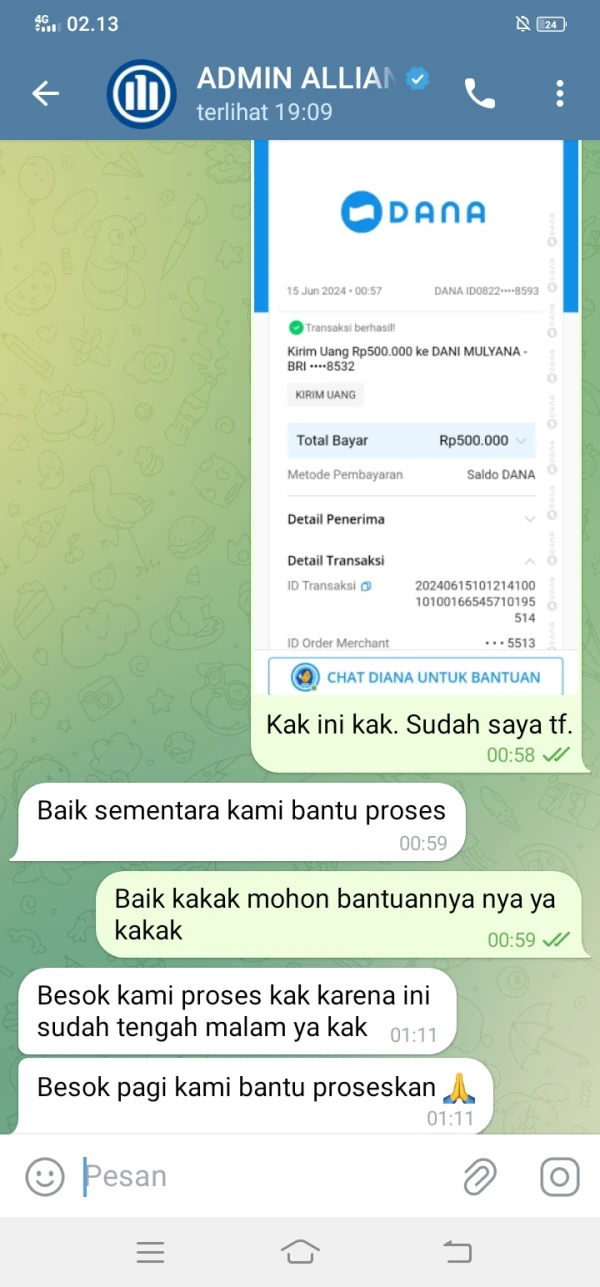

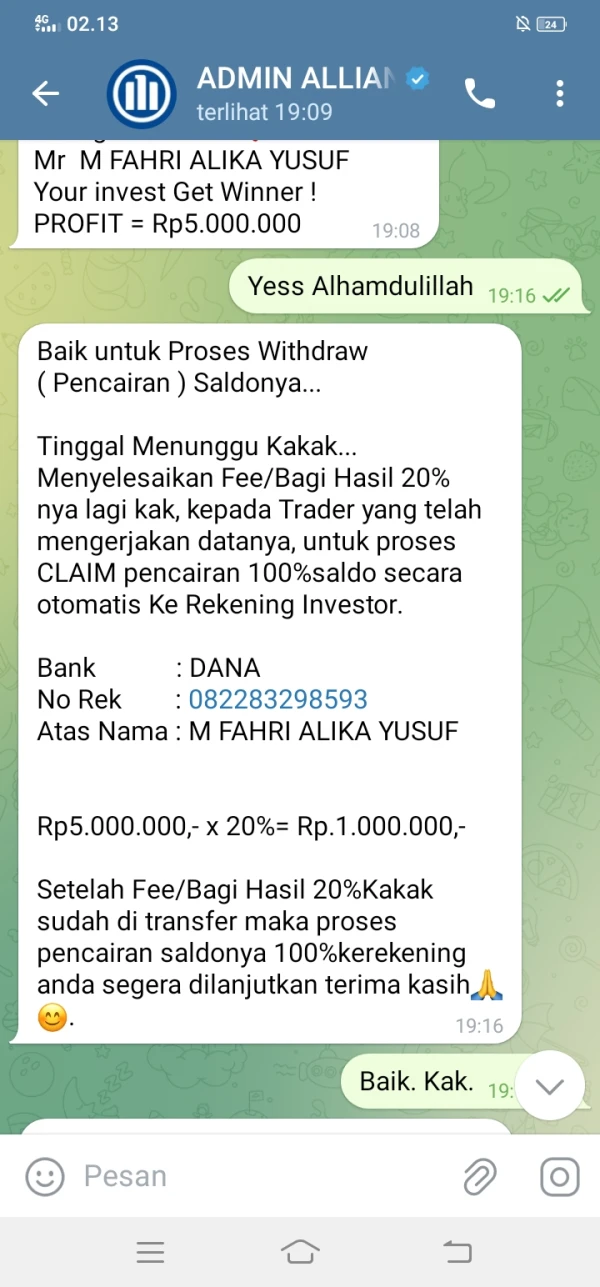

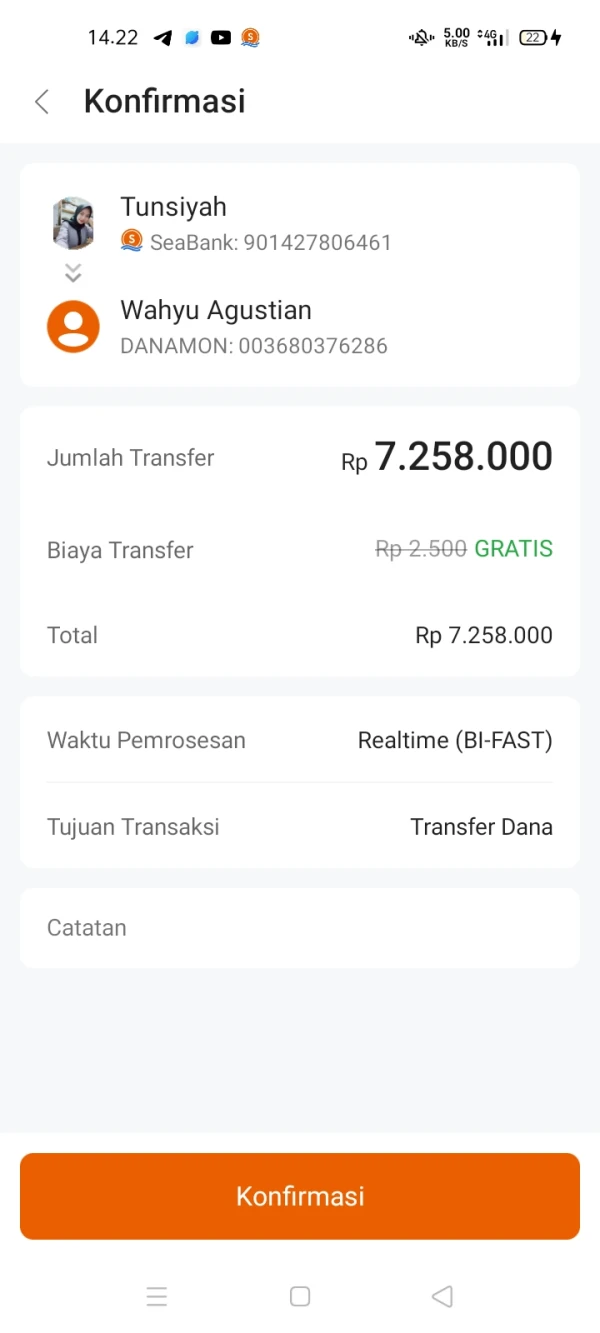

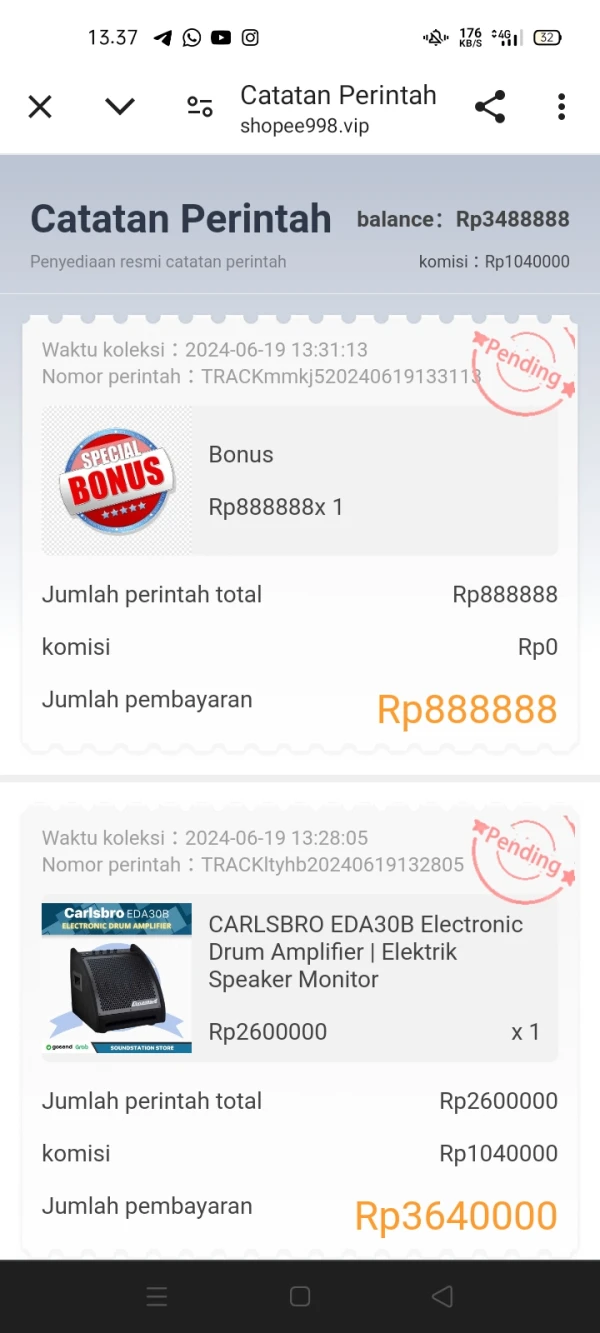

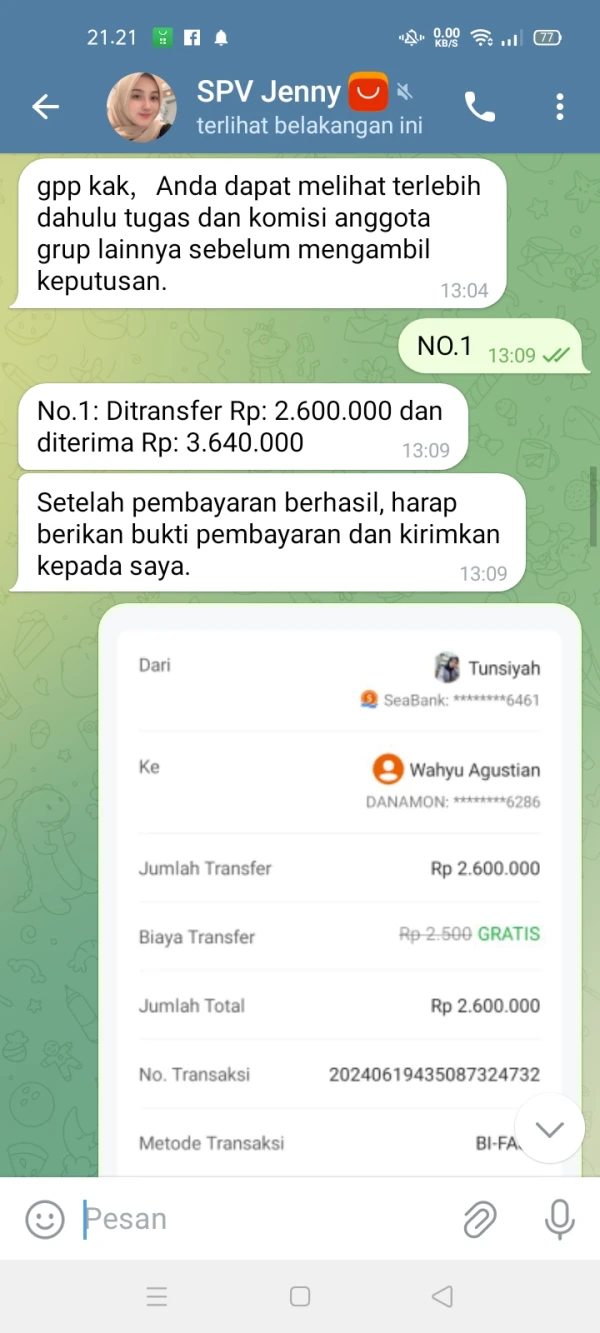

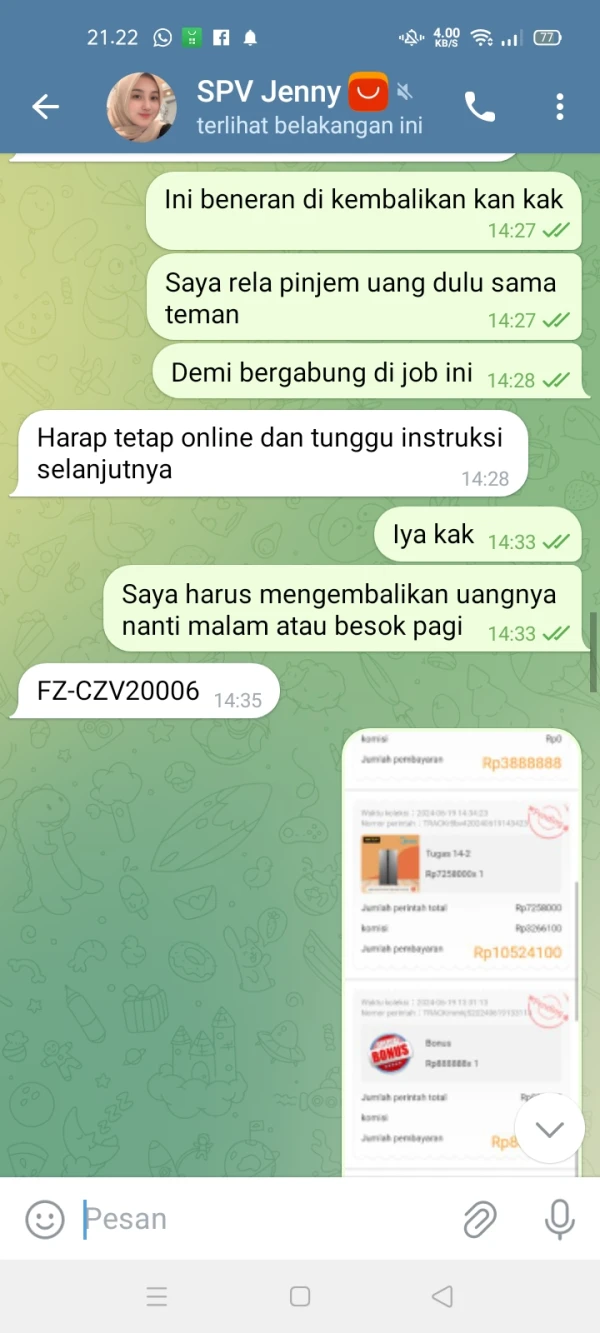

tunsiyah

Indonesia

Please help. I have lost IDR 9,858,000, almost 10 million rupiah. I am a victim of part-time job fraud. Initially I was given the task of making a purchase with a low nominal amount, and my money was returned along with the bonus. Then I was given 3 more tasks to make purchases with the reason that all three tasks had to be completed before the money would be returned along with the commission. I have transferred IDR 2,600,000 for the first assignment and IDR 7,258,000 for the second assignment. When I was given the 3rd assignment, I just realized that I was a victim of fraud. Pleasee help me. The money I used was borrowed. Please return it.😭

Exposure

林婷

United States

I wouldn't feel comfortable trading with Allianz because they don't have any regulatory licenses. It's important for me to know that my investments are protected and overseen by a reputable authority. Without a license, I can't be sure if Allianz is trustworthy or not. So, goodbye for now, allianz!

Positive