Unternehmensprofil

| MasterLink SecuritiesÜberprüfungszusammenfassung | |

| Gegründet | 1989 |

| Registriertes Land/Region | Taiwan |

| Regulierung | Reguliert durch die Taipei Exchange |

| Marktinstrumente | Brokerage, Vermögensverwaltung, Underwriting, Aktienregister & Übertragung, Eigenhandel, Eigenhandel mit Futures, Festverzinsliche Wertpapiere, Derivate, MasterLink Securities Anlageberatung, MasterLink Futures, MasterLink Versicherungsagentur, MasterLink Risikokapital & MasterLink Venture Mana |

| Demokonto | Nicht erwähnt |

| Hebelwirkung | Bis zu 1:600 |

| Spread | Ab 0,5 Pips |

| Handelsplattform | MetaTrader 4 |

| Mindesteinzahlung | $100 |

| Kundensupport | Telefon: +886-2-27313888 |

| E-Mail: sylvia0704@masterlink.com.tw | |

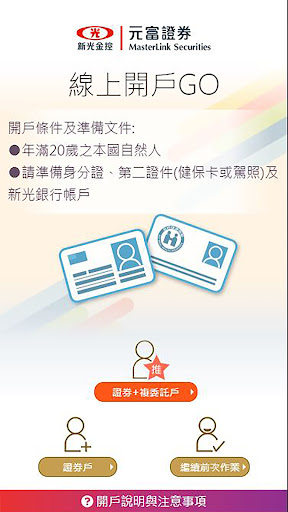

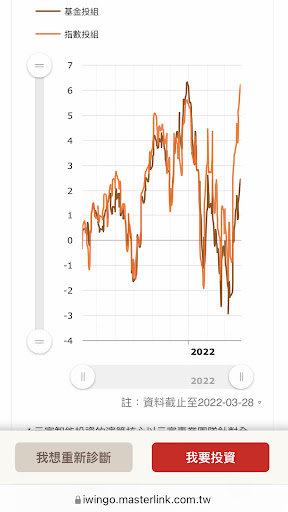

MasterLink Securities Informationen

MasterLink Securities hat seinen Sitz in Taiwan und wurde 1989 gegründet. Dieser Broker bietet Forex, CFDs, Rohstoffe und Indizes an. Er bietet auch eine Hebelwirkung von bis zu 1:600, Spreads von 0,5 Pips bis 1,5 Pips und drei Kontotypen zur Auswahl.

Vor- und Nachteile

| Vorteile | Nachteile |

| Bietet verschiedene Handelsinstrumente | Fehlender Live-Chat-Support |

| Bietet Kontotypen | |

| Reguliert durch die Taipei Exchange | |

| Bietet eine wettbewerbsfähige Hebelwirkung von 1:600 | |

| Bietet die Handelsplattform MetaTrader 4 |

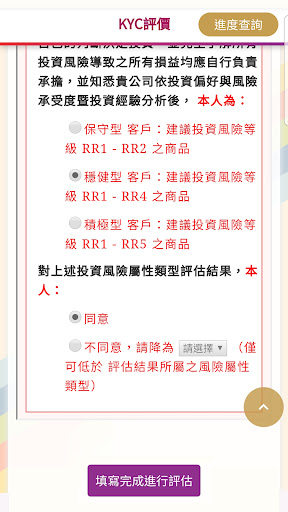

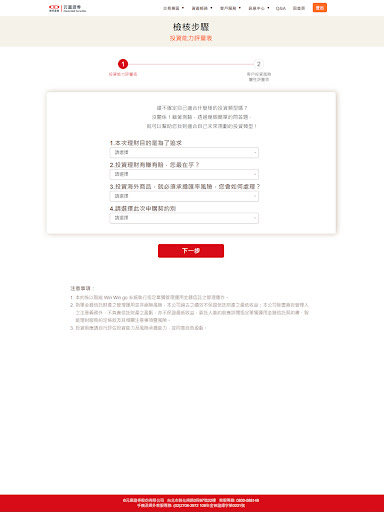

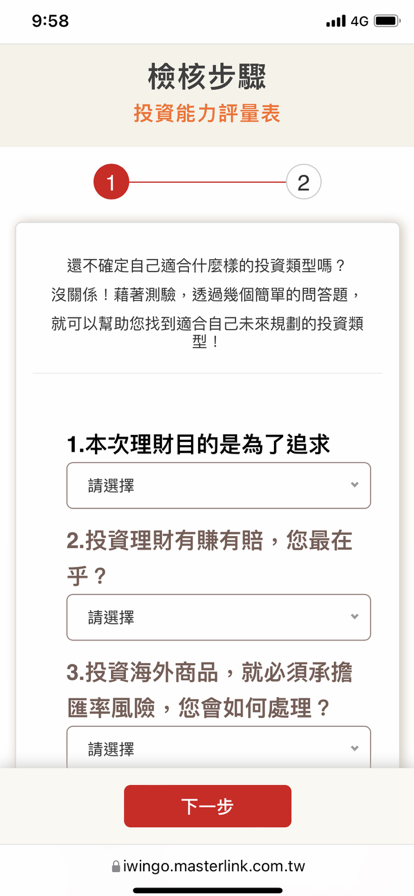

Ist MasterLink Securities seriös?

MasterLink Securities wird reguliert von der Taipei Exchange. Der Lizenztyp ist No Sharing.

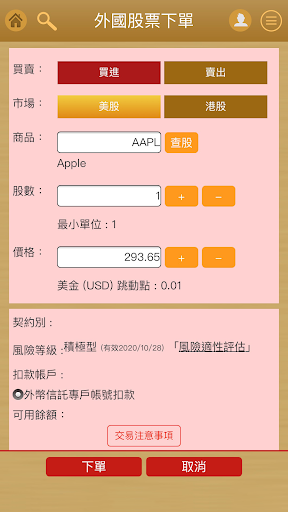

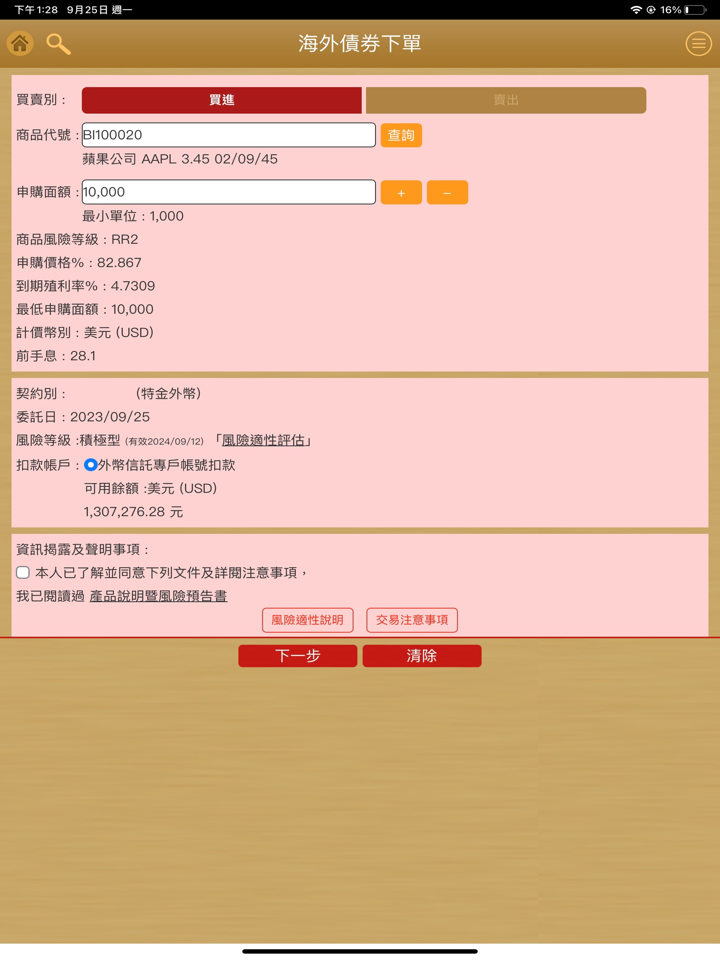

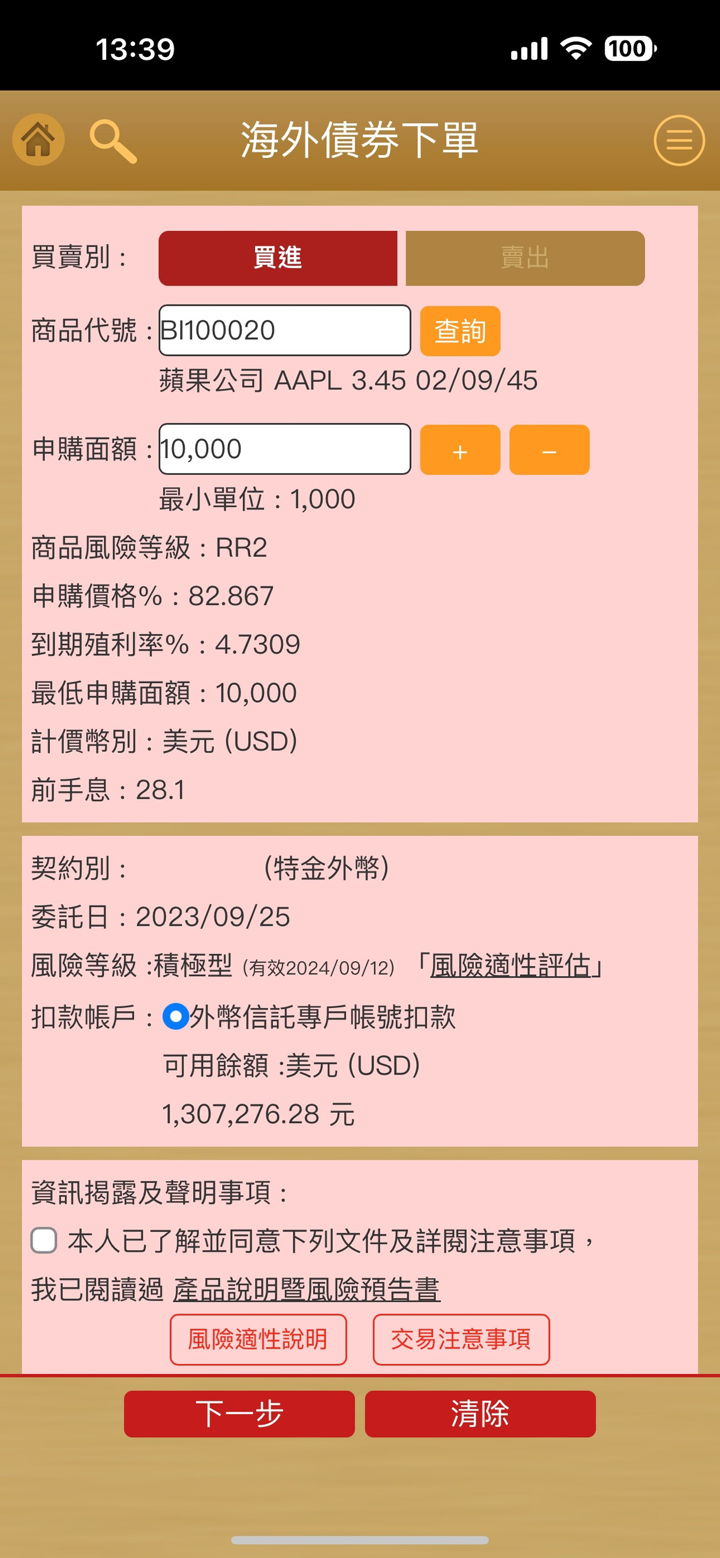

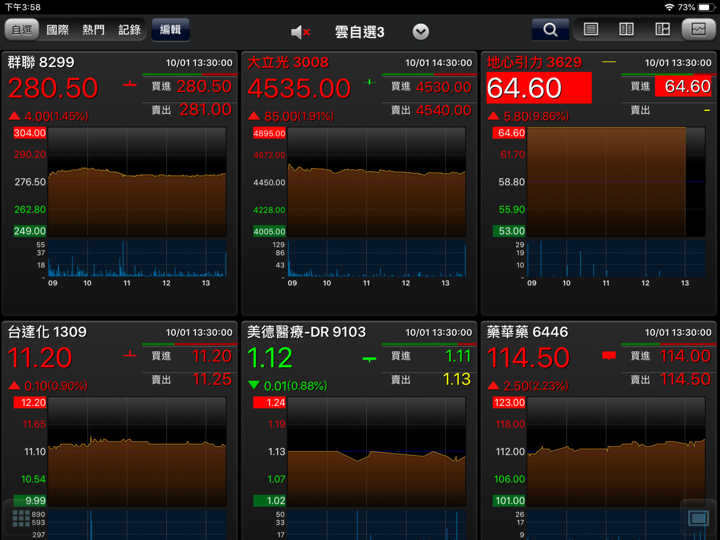

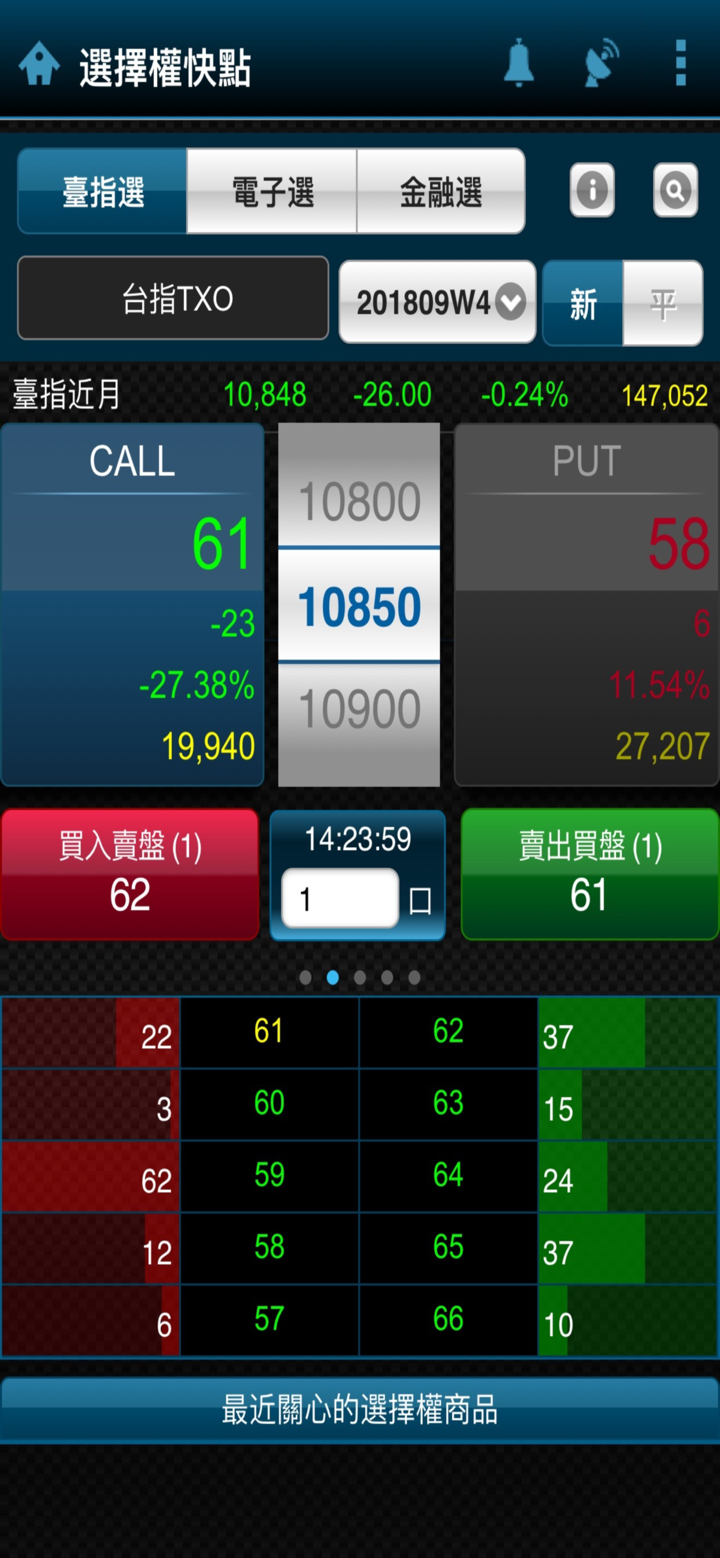

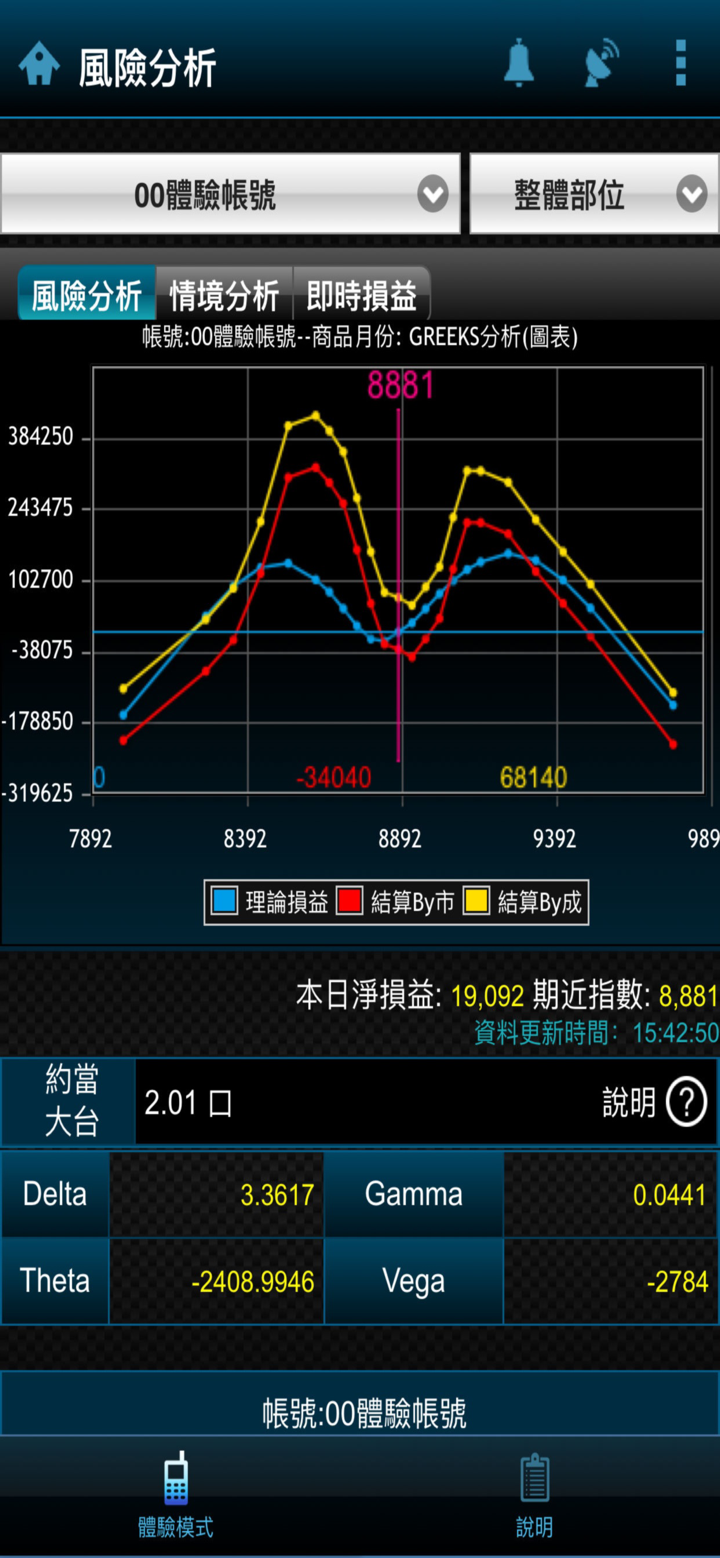

Was kann ich bei MasterLink Securities handeln?

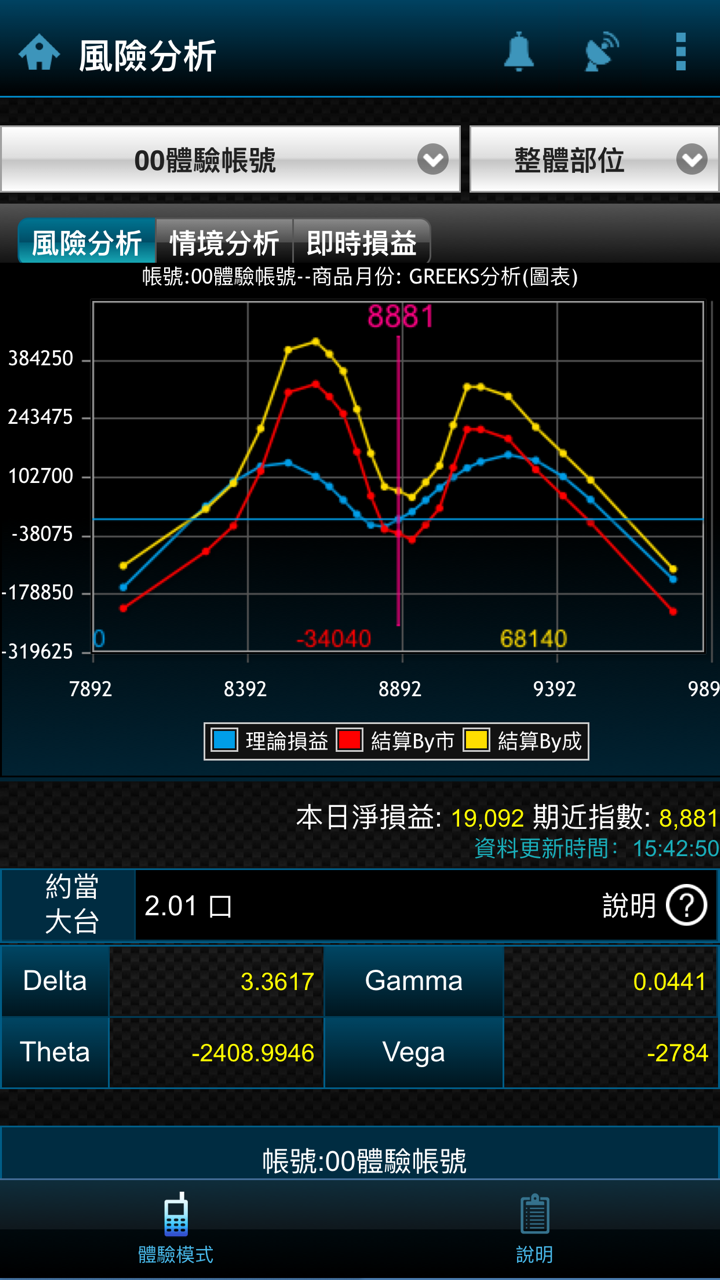

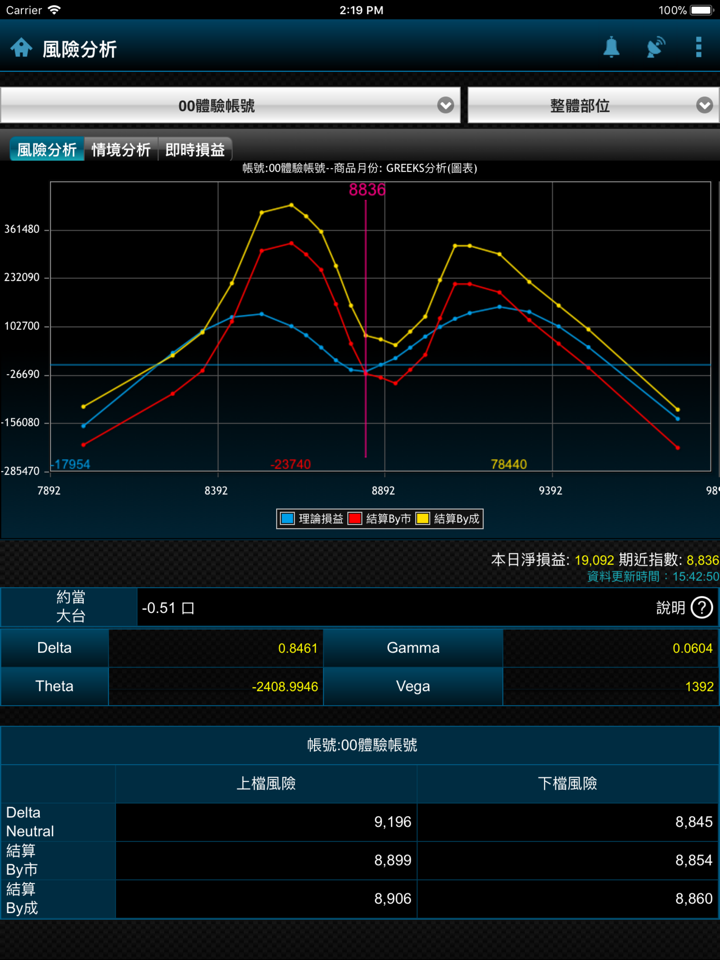

MasterLink Securities bietet Brokerage, Vermögensverwaltung, Underwriting, Aktienregister & Übertragung, Eigenhandel, Eigenhandel mit Futures, Festverzinsliche Wertpapiere, Derivate, MasterLink Securities Anlageberatung, MasterLink Futures, MasterLink Versicherungsagentur, MasterLink Risikokapital & MasterLink Venture Mana, einschließlich Forex, CFDs auf Indizes und Rohstoffe, Rohstoffe und Indexhandel.

| Handelbare Instrumente | Unterstützt |

| Forex | ✔ |

| Rohstoffe | ✔ |

| Krypto | ❌ |

| CFD | ✔ |

| Futures | ✔ |

| Aktien | ✔ |

| Index | ✔ |

| Optionen | ❌ |

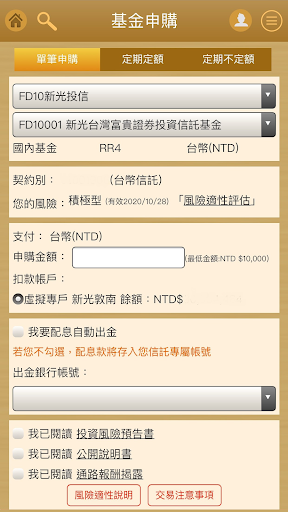

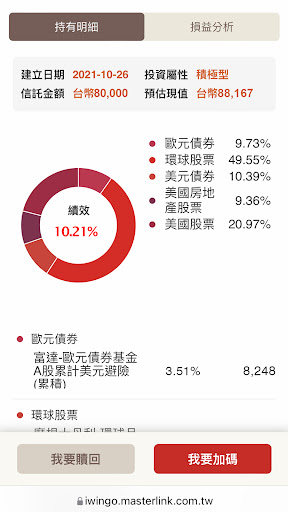

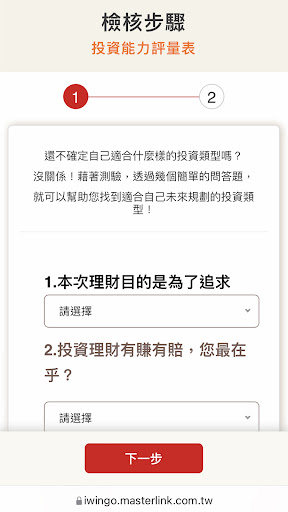

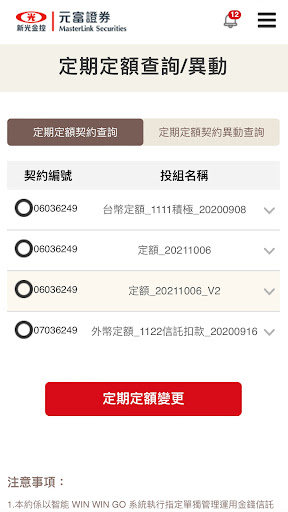

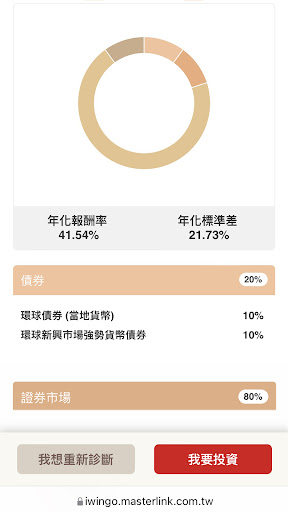

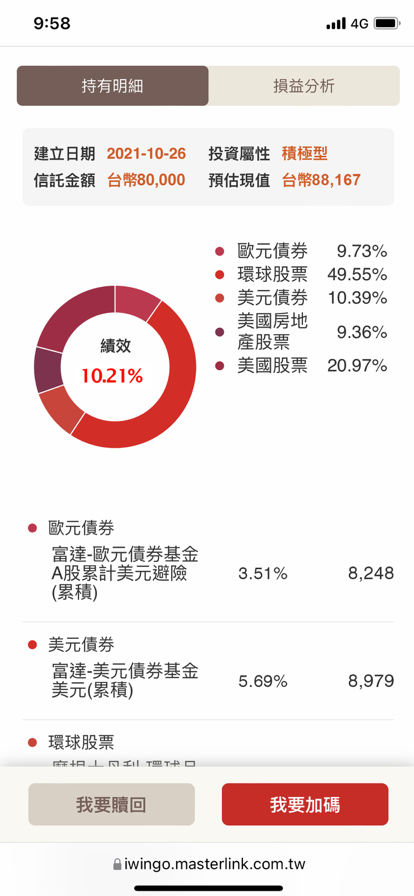

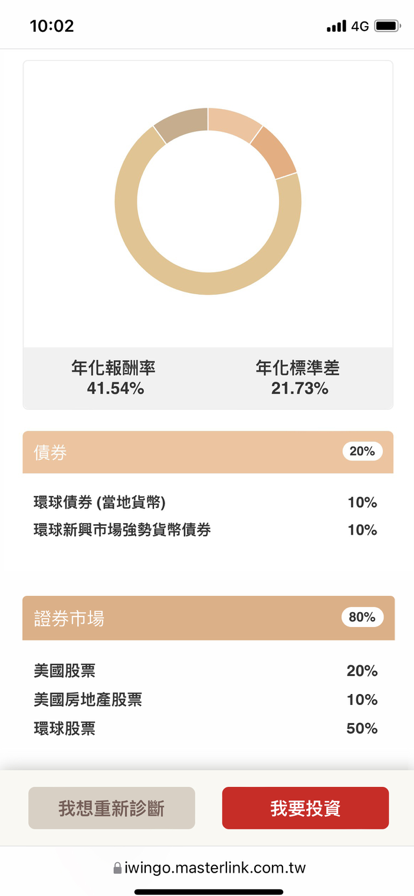

Kontotypen

MasterLink Securities bietet drei Kontotypen an, darunter Standard-, Gold- und Platin-Konten.

Standard-Konto:

Das Standard-Konto erfordert eine Mindesteinzahlung von $100 und bietet Spreads von 1,5 Pips und keine Provisionen. Darüber hinaus bietet es eine Hebelwirkung von bis zu 1:600.

Gold-Konto:

Das Gold-Konto erfordert eine Mindesteinzahlung von $500 und bietet engere Spreads von 1,0 Pips ohne Provisionen. Es bietet auch eine Hebelwirkung von bis zu 1:600.

Platin-Konto:

Das Platin-Konto erfordert eine Mindesteinzahlung von $1.000 und bietet Spreads ab 0,5 Pips. Wie die anderen Kontotypen bietet es eine Hebelwirkung von bis zu 1:600.

| Funktion | Standard | Gold | Platin |

| Hebelwirkung | Bis zu 1:600 | Bis zu 1:600 | Bis zu 1:600 |

| Spreads | Beginnend bei 1,5 Pips | Beginnend bei 1,0 Pips | Beginnend bei 0,5 Pips |

| Provisionen | Keine | Keine | Keine |

| Mindesteinzahlung | $100 | $500 | $1.000 |

| Handelstools | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

Hebelwirkung

Die maximale Hebelwirkung, die von MasterLink Securities angeboten wird, beträgt bis zu 1:600. Dies bedeutet, dass Trader Positionen im Markt bis zu 600-mal des Betrags ihres Handelskapitals kontrollieren können.

MasterLink Securities Gebühren

In einem Standard-Konto können Trader von Spreads bei den wichtigsten Währungspaaren ab 1,5 Punkten profitieren.

In Gold-Konten beginnen die Spreads bei 1,0 Pips.

Im Platin-Konto beginnen die Spreads bei den wichtigsten Währungspaaren bei 0,5 Pips.

Und alle Konten erfordern 0 Provisionen.

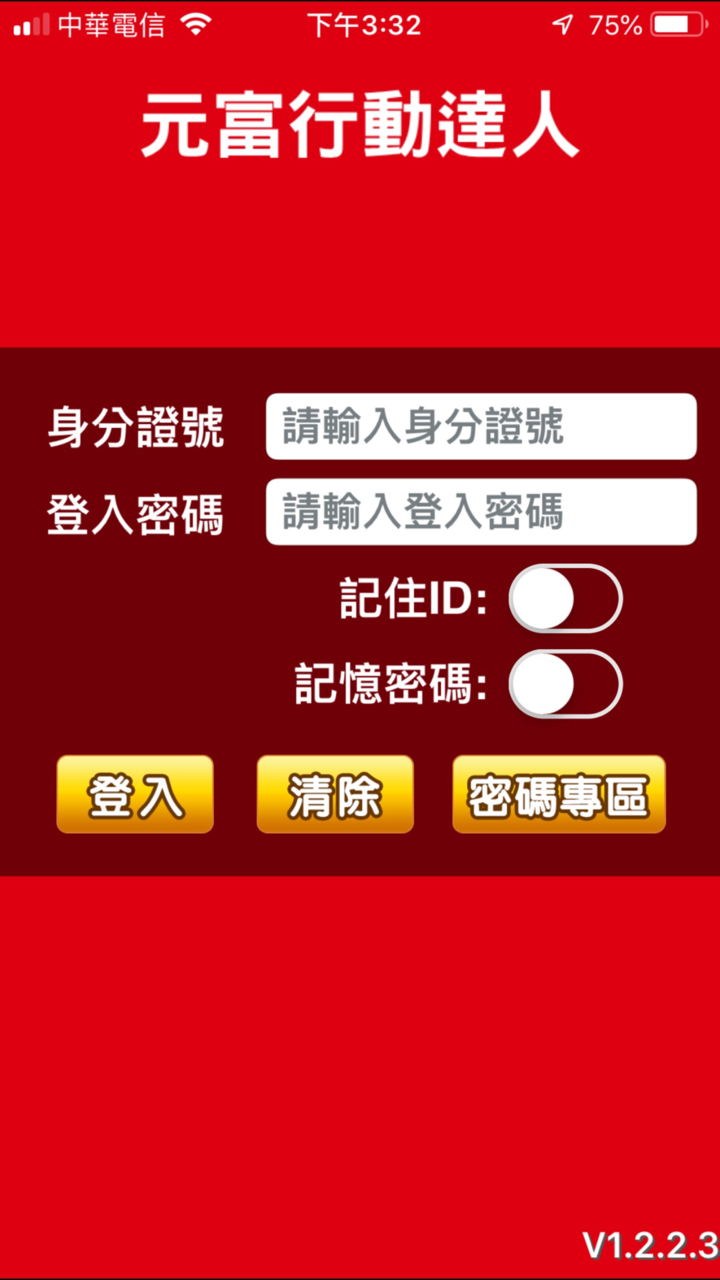

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für welche Investoren |

| MetaTrader 4 | ✔ | Windows, MAC, IOS und Android | Investoren aller Erfahrungsstufen |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

Einzahlung und Auszahlung

Der Mindesteinzahlungsbetrag, um ein Handelskonto bei MasterLink Securities zu eröffnen, beträgt $100 für Standard-Konten, $500 für Gold-Konten und $1.000 für Platin-Konten.