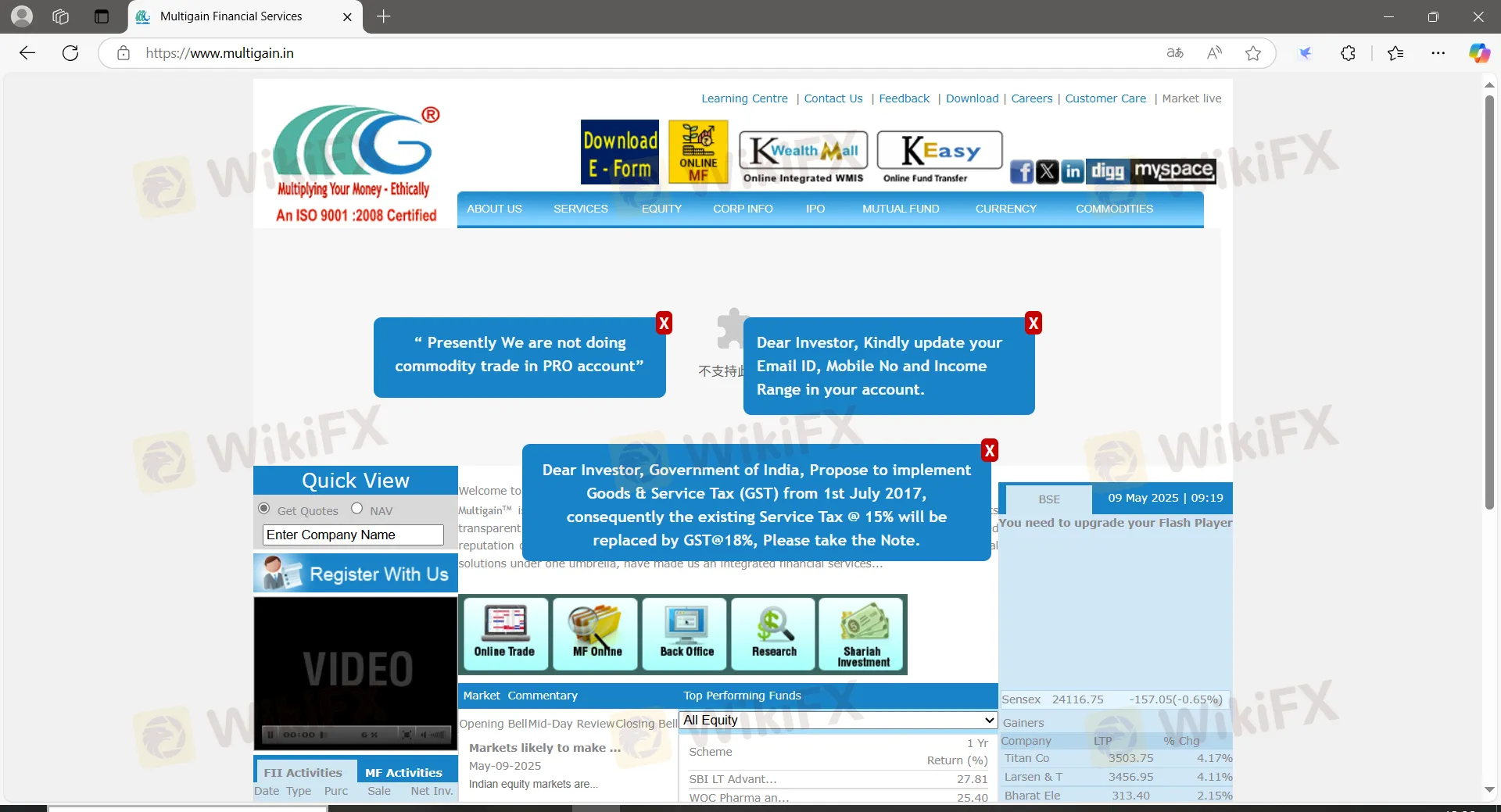

Unternehmensprofil

| Multigain Überprüfungszusammenfassung | |

| Gegründet | 2008 |

| Registriertes Land/Region | Indien |

| Regulierung | Keine Regulierung |

| Marktinstrumente | Währungen, Derivate, Rohstoffe, Investmentfonds, Anleihen, Versicherungen, Immobilien, A.I.F. (Alternative Investmentfonds) |

| Demokonto | / |

| Handelsplattform | Online- und mobile integrierte Plattform |

| Mindesteinzahlung | / |

| Kundensupport | Kontaktformular |

| Tel: 0591-2490200/ 400 / 500 | |

| E-Mail: info@multigain.in | |

| Fax: 0591-2490400 | |

| Adresse: H-50, Lajpat Nagar, Moradabad – 244001 (U.P.) | |

| Soziale Medien: Facebook, X, digg, linkedin, myspace | |

Multigain Informationen

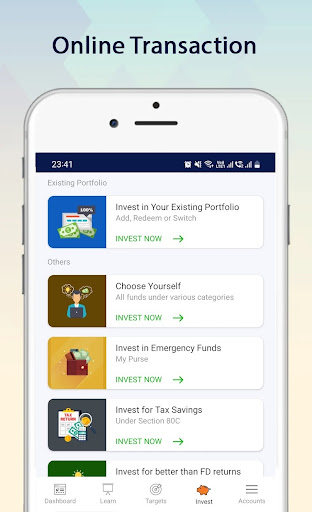

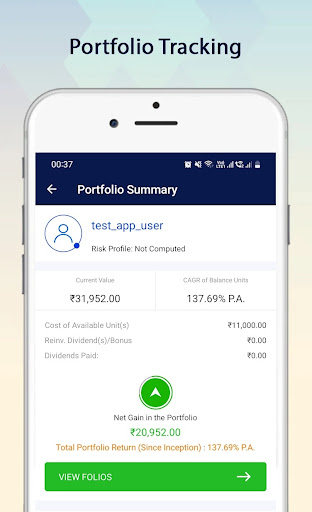

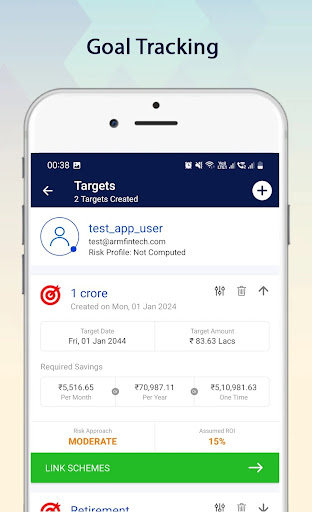

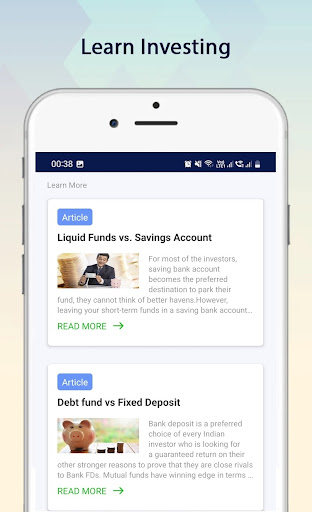

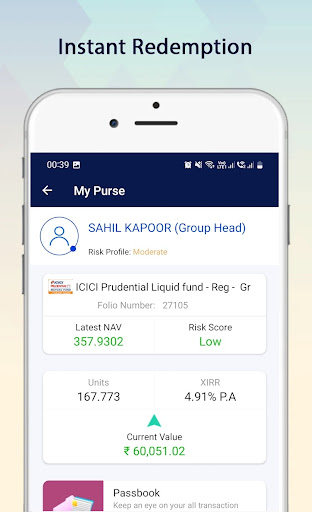

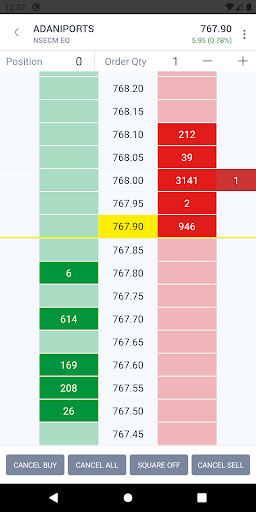

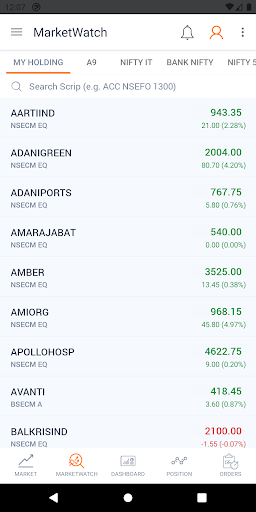

Multigain ist ein unregulierter Dienstleister für erstklassige Makler- und Finanzdienstleistungen an der Börse in Indien. Es bietet Produkte und Dienstleistungen für Sekundärmarktlösungen an: Bargeld & Derivate, Währung, Derivate, Rohstoffe: Spot & Derivate, Depotdienste, Versicherungs-Repository-Dienste, Investmentfonds, Portfolio-Management-Dienste, Anleihen, Versicherungslösung: Leben & Allgemein, Immobiliendienste, Vermögensverwaltungsdienste, A.I.F. (Alternative Investmentfonds), Hypothekendarlehen, IPO, Online-Handel, Mobilhandel und Forschung.

Vor- und Nachteile

| Vorteile | Nachteile |

| Lange Betriebszeiten | Nicht zugängliche Website (teilweise) |

| Verschiedene Kontaktmöglichkeiten | Fehlende Regulierung |

| Verschiedene Handelsprodukte | Keine Demokonten |

| Keine MT4/MT5-Plattform | |

| Fehlende Transparenz | |

| Begrenzte Zahlungsoptionen |

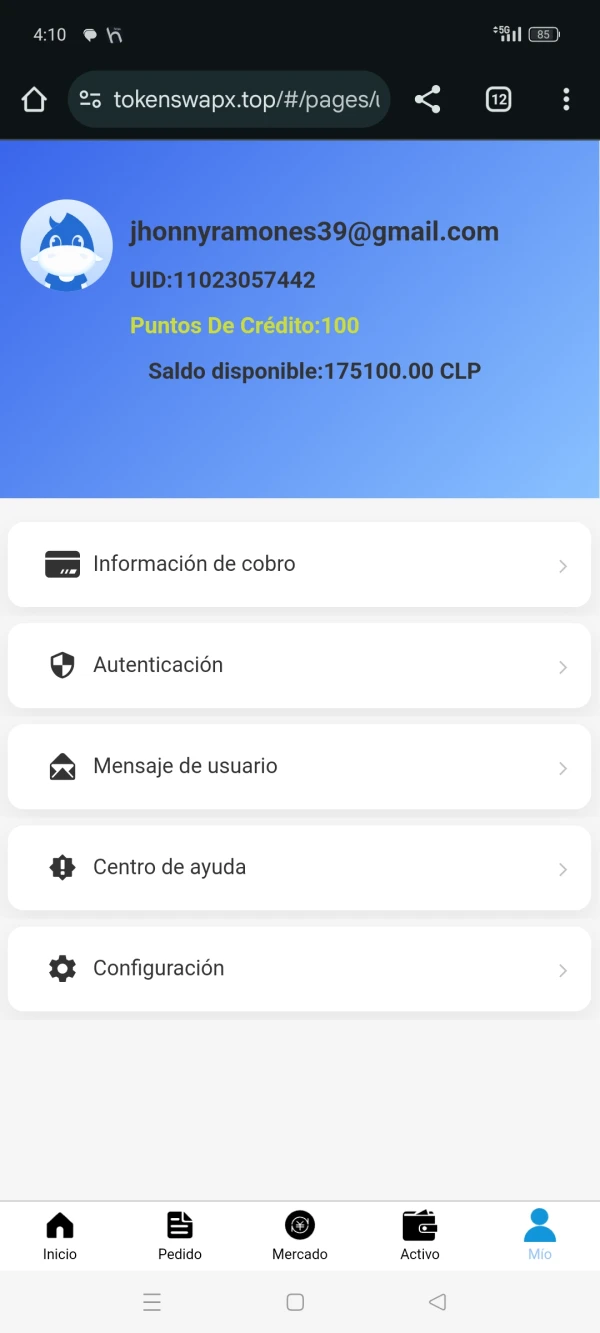

Ist Multigain legitim?

Nr. Multigain hat derzeit keine gültigen Vorschriften. Bitte seien Sie sich des Risikos bewusst!

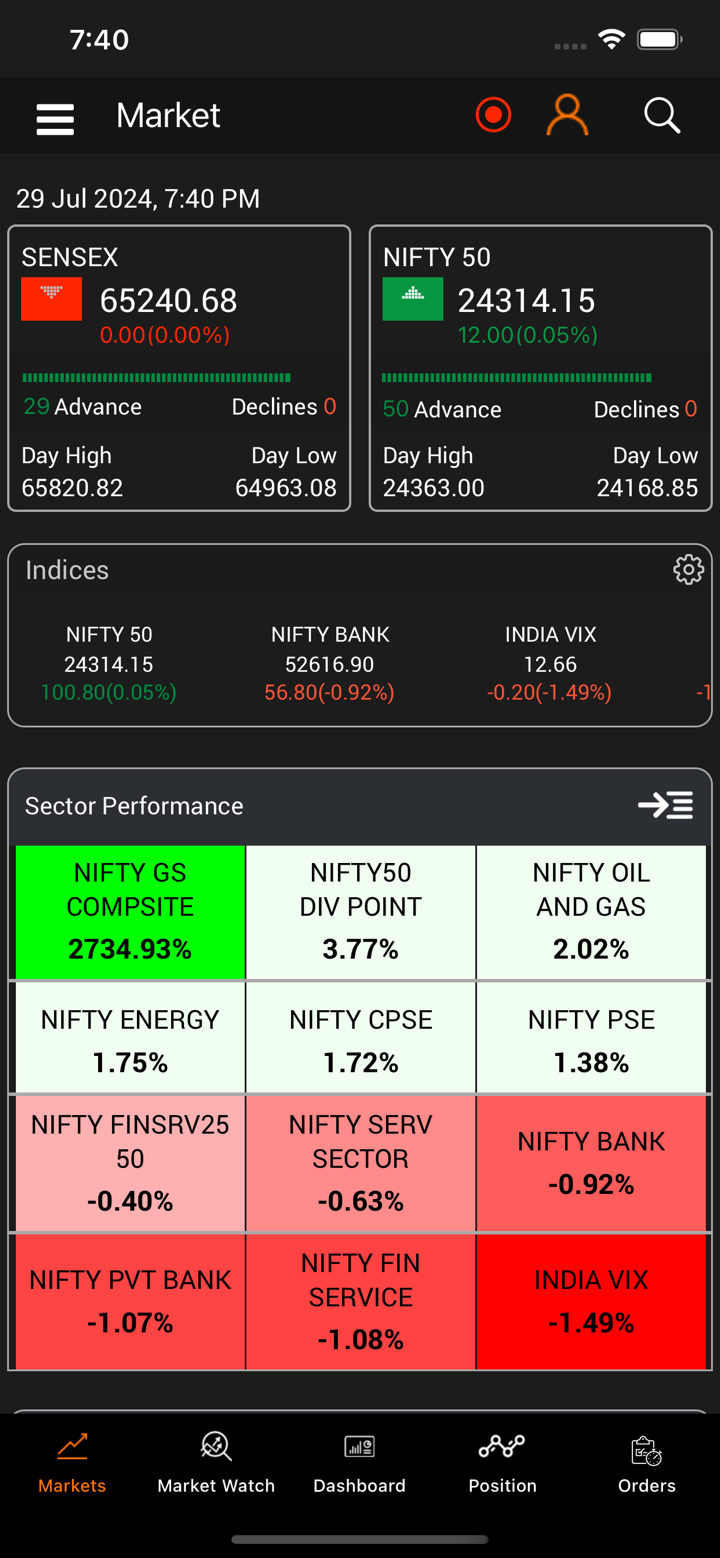

Was kann ich auf Multigain handeln?

| Handelswerte | Unterstützt |

| Währungen | ✔ |

| Derivate | ✔ |

| Waren | ✔ |

| Investmentfonds | ✔ |

| Anleihen | ✔ |

| Versicherungen | ✔ |

| Immobilien | ✔ |

| A.I.F. (Alternative Investmentfonds) | ✔ |

| Indizes | ❌ |

| Aktien | ❌ |

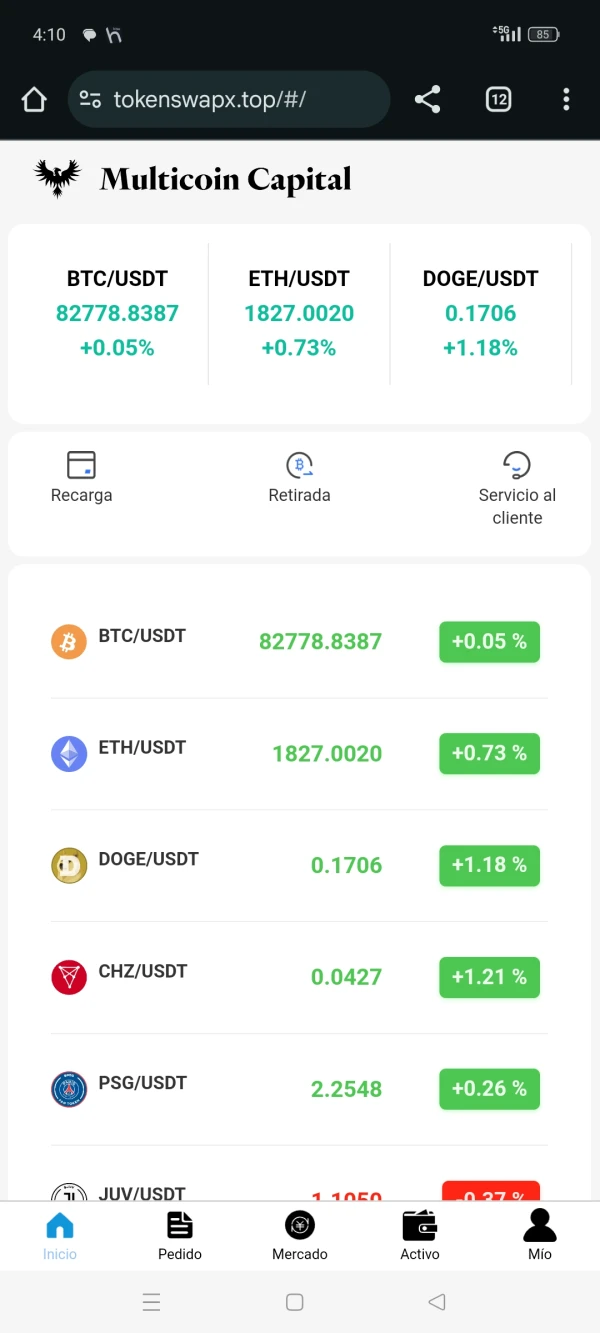

| Kryptowährungen | ❌ |

| Optionen | ❌ |

| ETFs | ❌ |

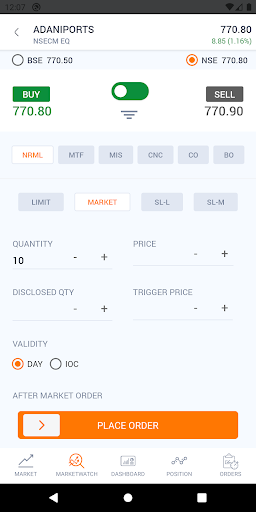

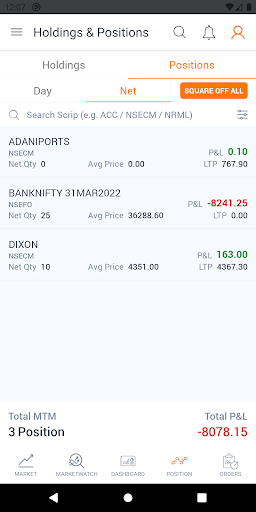

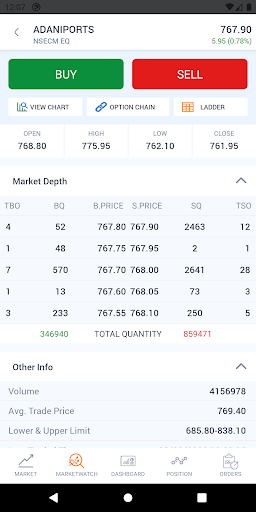

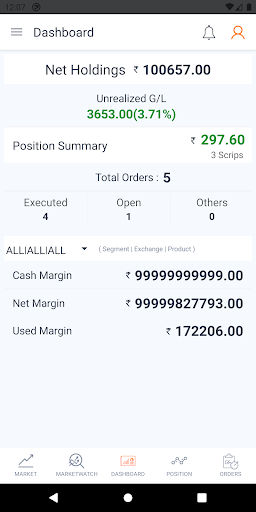

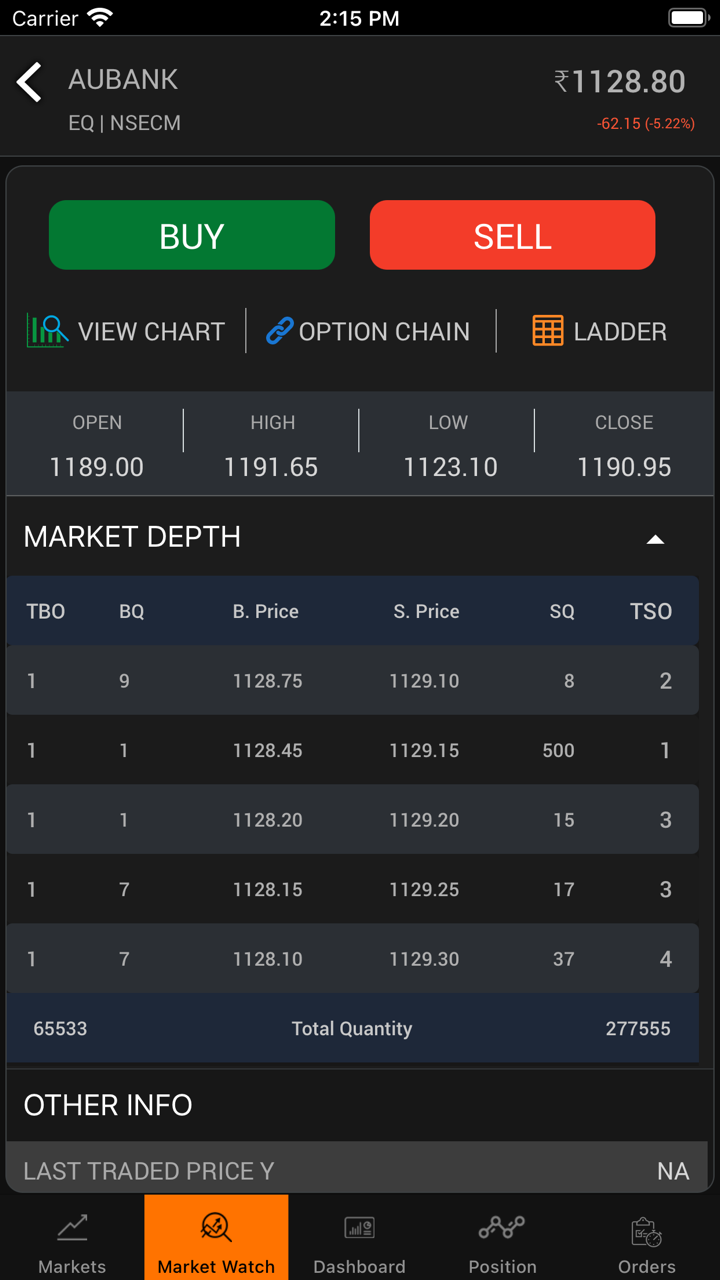

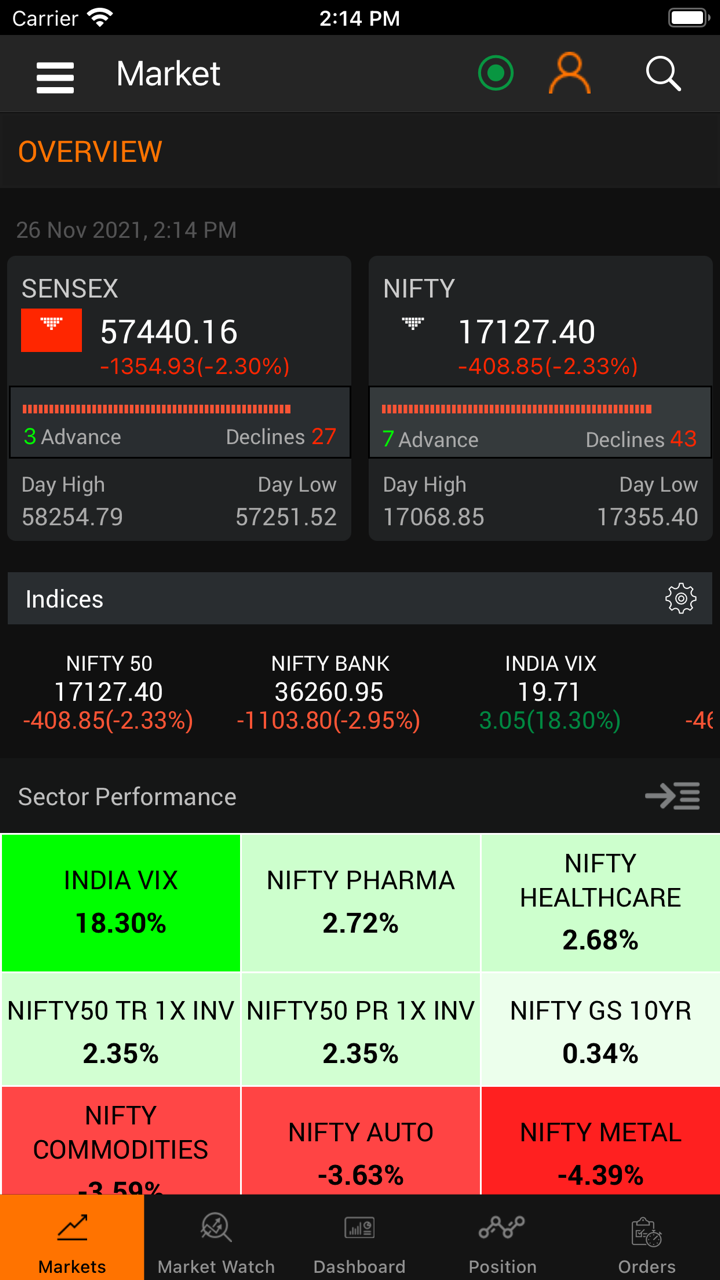

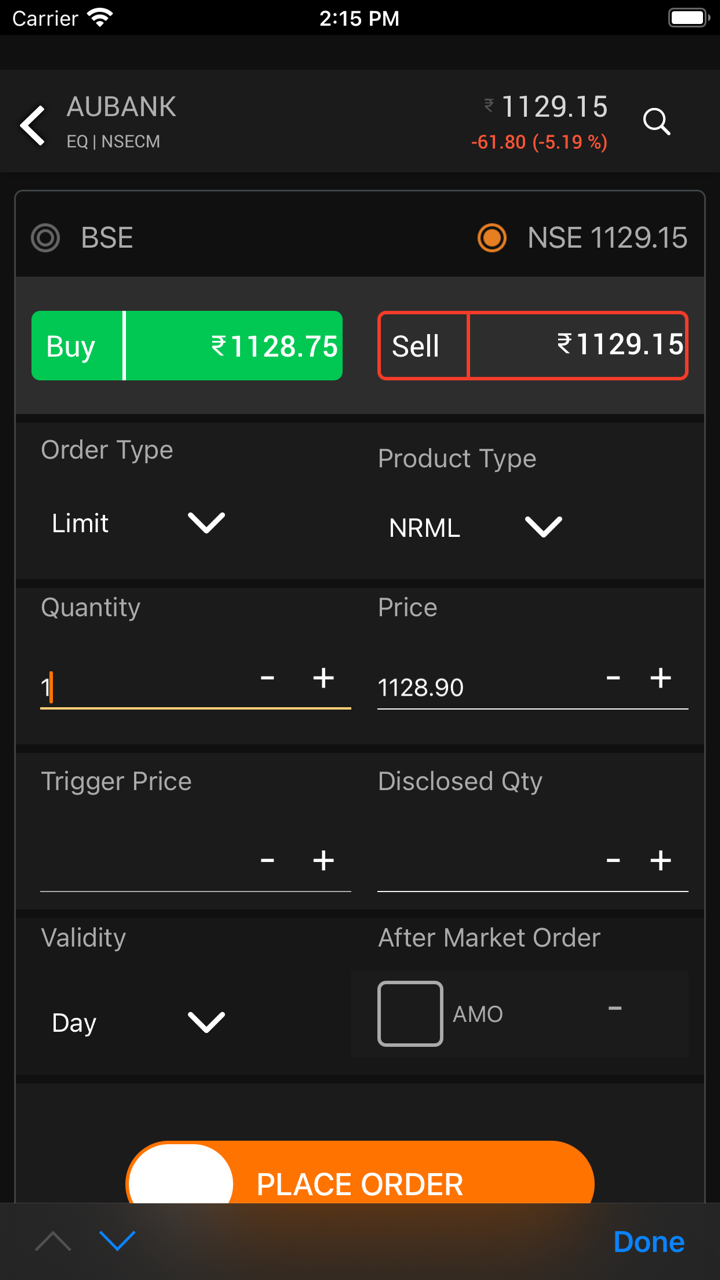

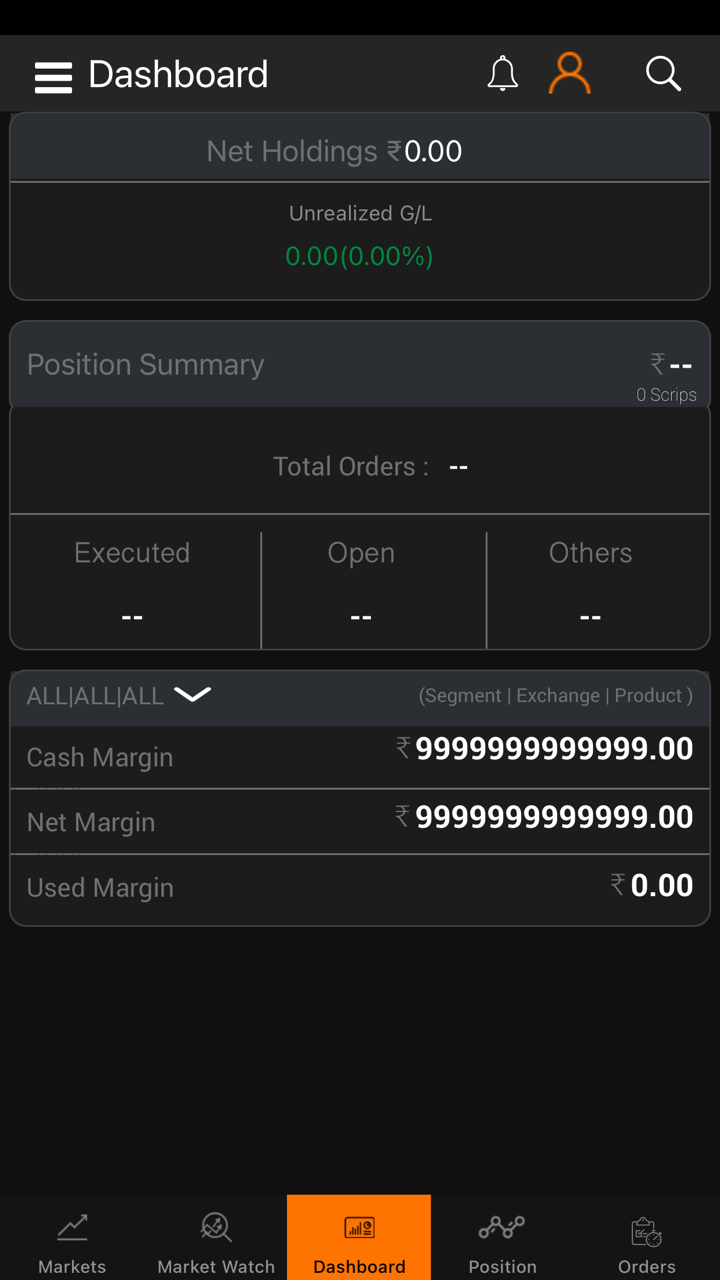

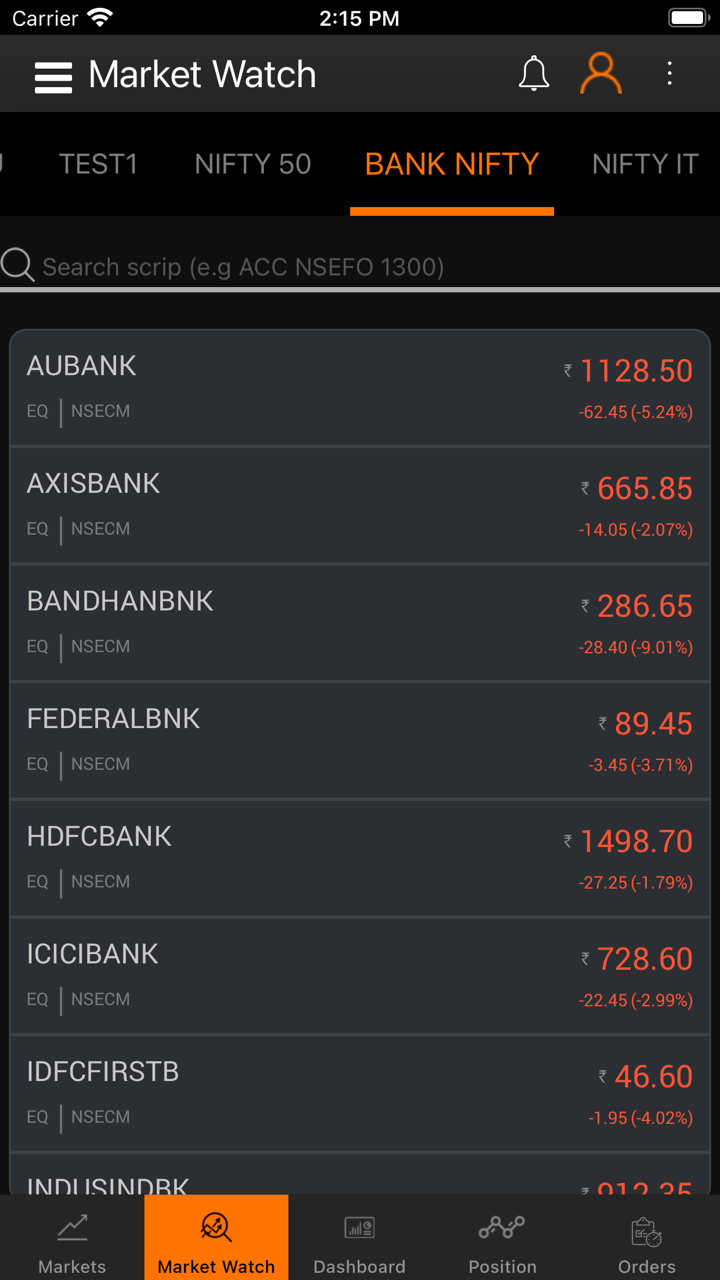

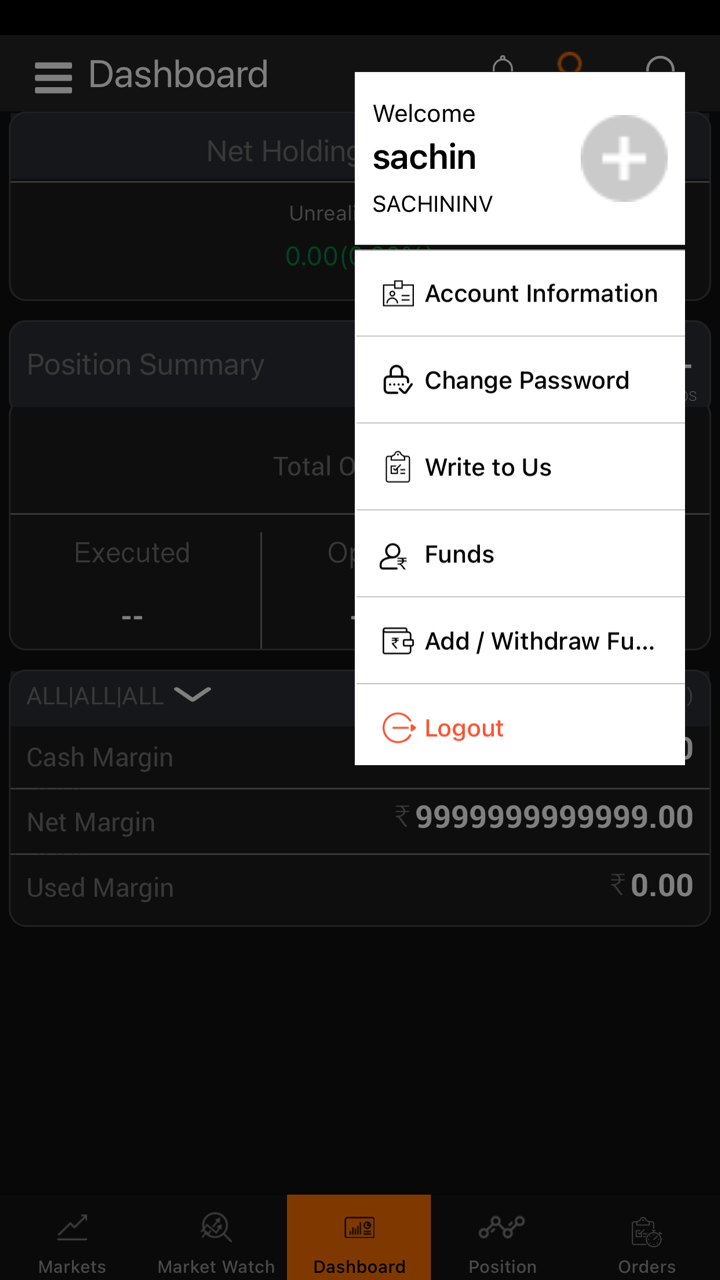

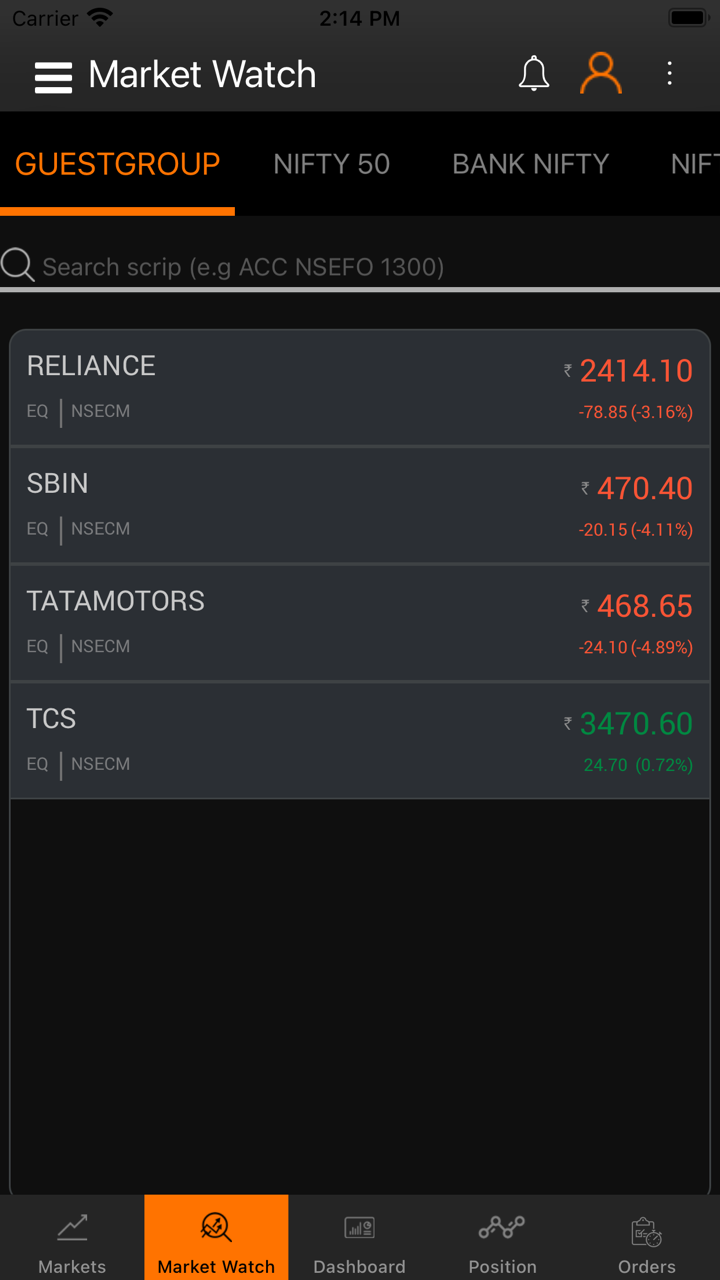

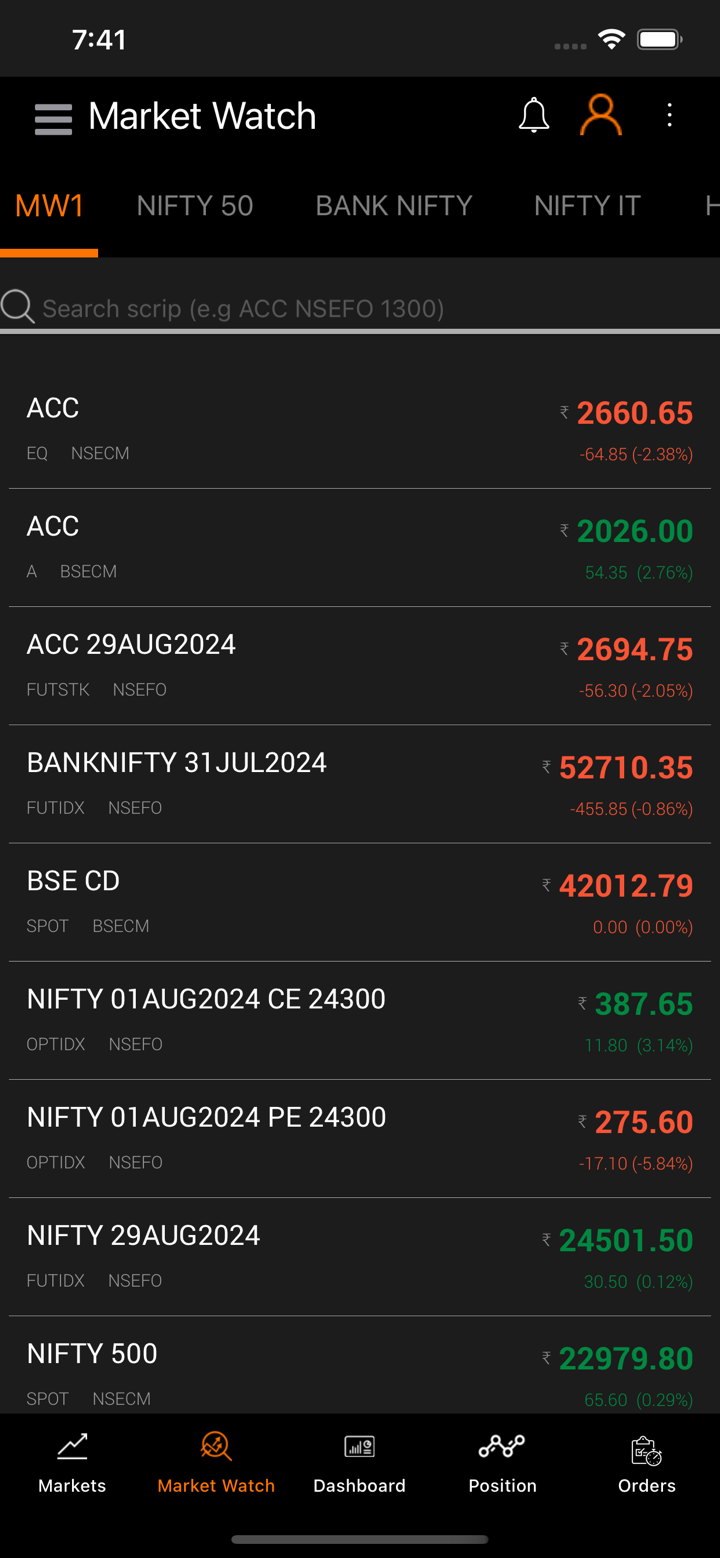

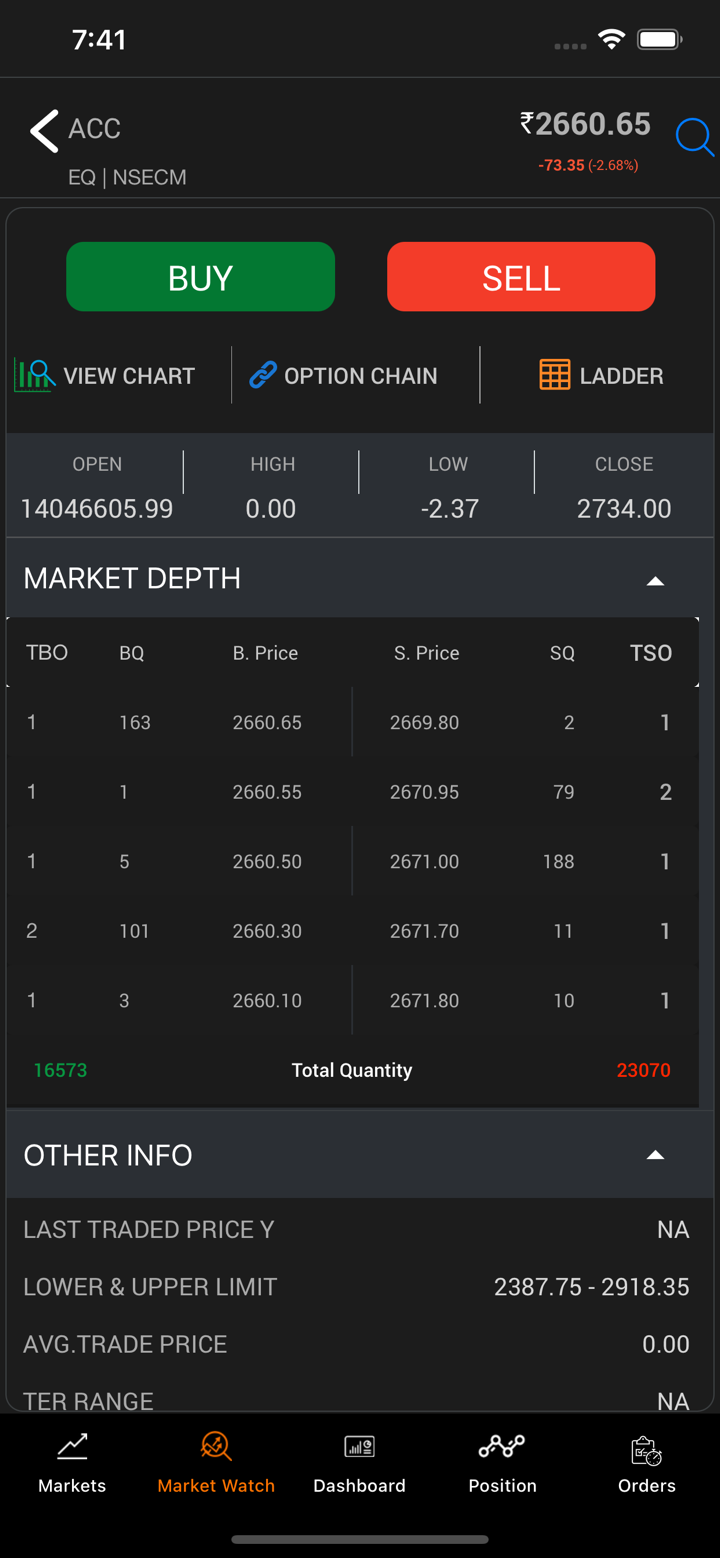

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| Integrierte Online- und mobile Plattform | ✔ | Mobile, Web | / |

| MT4 | ❌ | / | / |

| MT5 | ❌ | / | / |

Ein- und Auszahlung

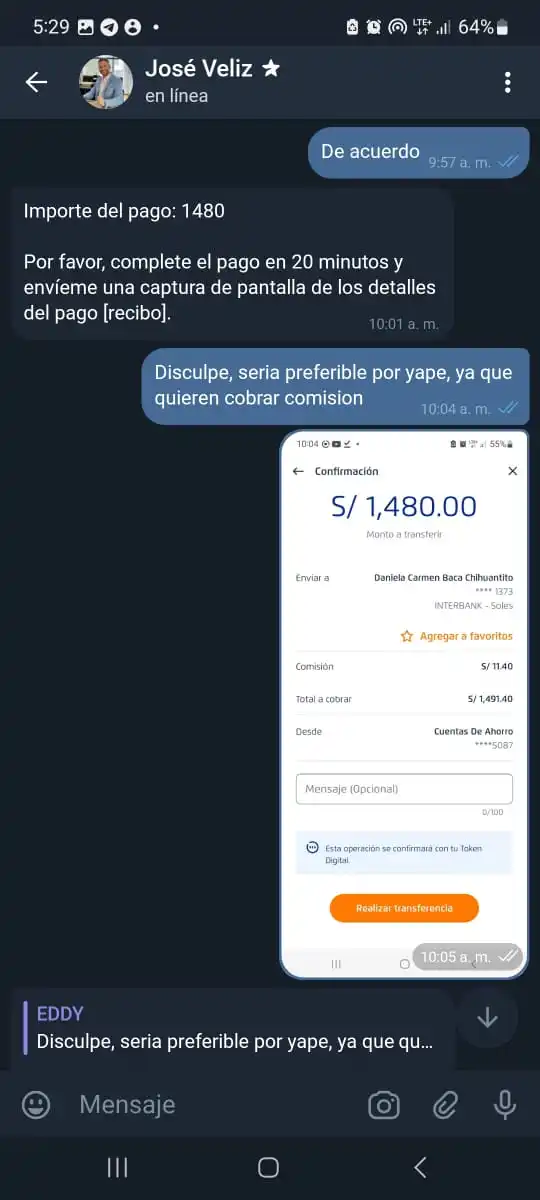

Multigain akzeptiert Zahlungen über Online-/Offline-Banking, Mobile Banking & IVR-Banking.