Unternehmensprofil

| TradeNow Überprüfungszusammenfassung | |

| Gegründet | 2023 |

| Registriertes Land/Region | Vereinigtes Königreich |

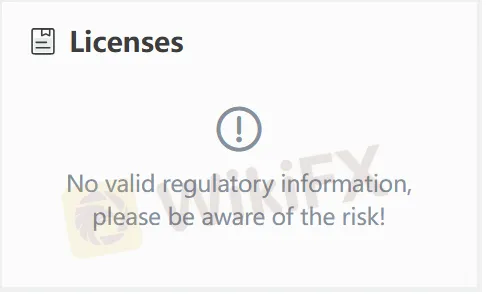

| Regulierung | Keine Regulierung |

| Handelsinstrumente | Aktien, Rohstoffe, Indizes, Kryptowährungen, CFDs |

| Demo-Konto | ✅ |

| Hebel | / |

| Spread | / |

| Handelsplattform | TradeNow |

| Mindesteinzahlung | 0 |

| Kundensupport | 24/7 Support, E-Mail: info@tradenow.pro |

TradeNow Informationen

TradeNow ist ein neu gegründeter Forex-Broker, der im Vereinigten Königreich registriert ist. Die handelbaren Instrumente umfassen Aktien, Rohstoffe, Indizes, Kryptowährungen und CFDs. Es gibt keine Mindesteinzahlungsanforderung. TradeNow ist aufgrund seines unregulierten Status riskant.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene handelbare Instrumente | Keine Regulierung |

| 24/7 Kundensupport | MT4/MT5 nicht verfügbar |

| Demo-Konten verfügbar | Kurze Einrichtungszeit |

| Kostenlose Ein- und Auszahlung | Nur E-Mail-Support |

Ist TradeNow legitim?

TradeNow ist nicht reguliert, was es weniger sicher macht als regulierte Broker. Bitte beachten Sie das Risiko!

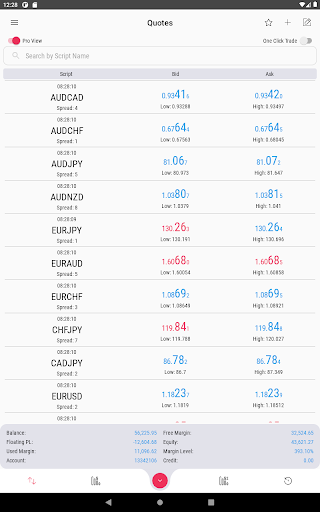

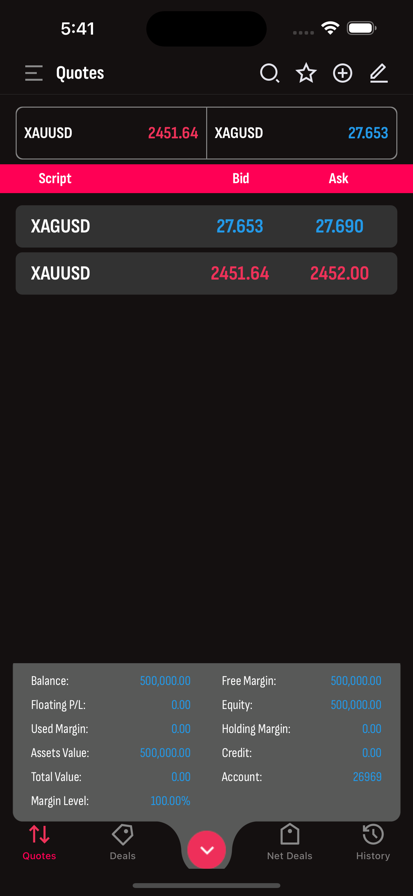

Was kann ich auf TradeNow handeln?

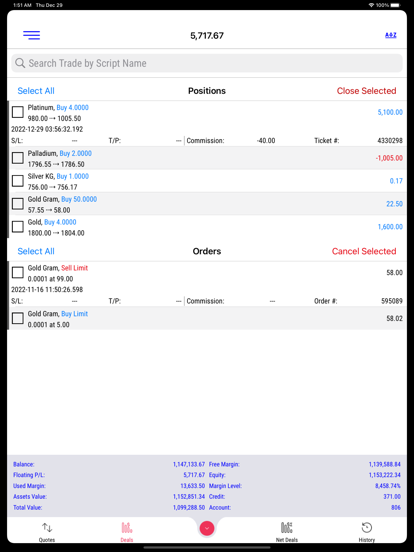

TradeNow bietet eine Vielzahl von Handelsinstrumenten, einschließlich Aktien, Rohstoffe, Indizes, Kryptowährungen und CFDs.

| Handelbare Instrumente | Unterstützt |

| Index | ✔ |

| Rohstoffe | ✔ |

| Aktien | ✔ |

| Kryptowährungen | ✔ |

| CFDs | ✔ |

| ETF | ❌ |

| Anleihe | ❌ |

| Option | ❌ |

| Investmentfonds | ❌ |

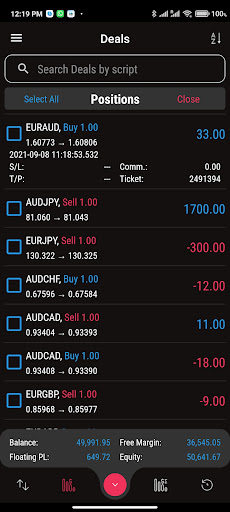

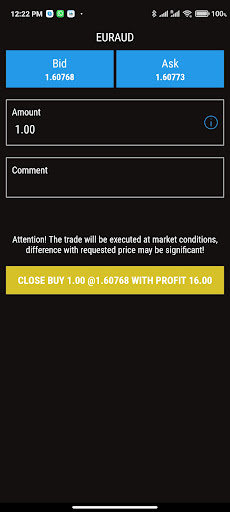

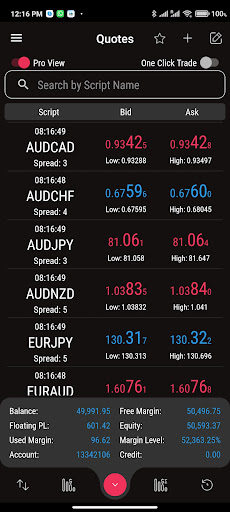

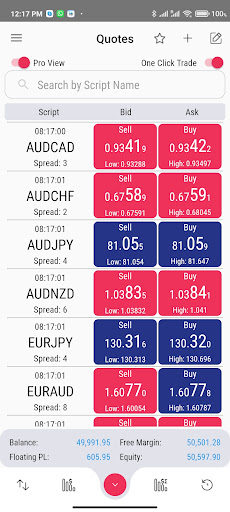

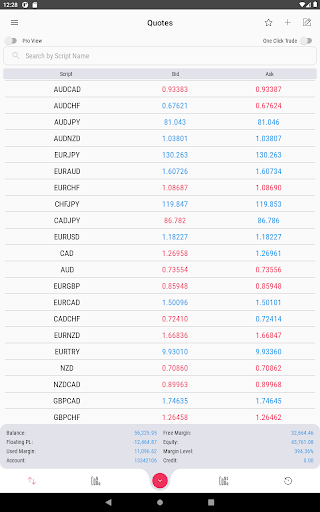

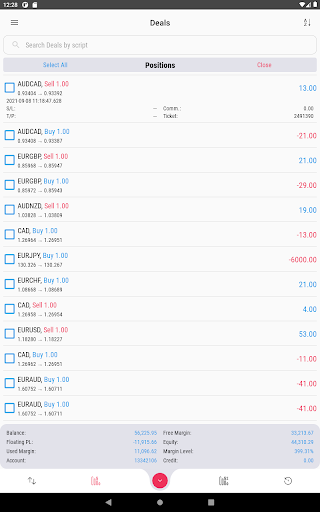

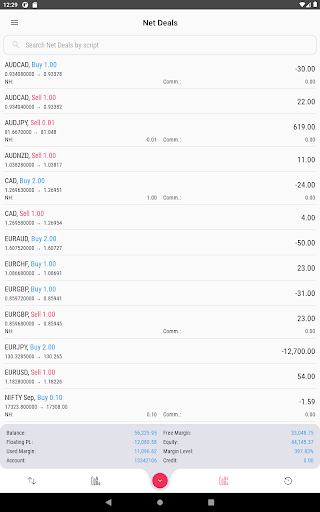

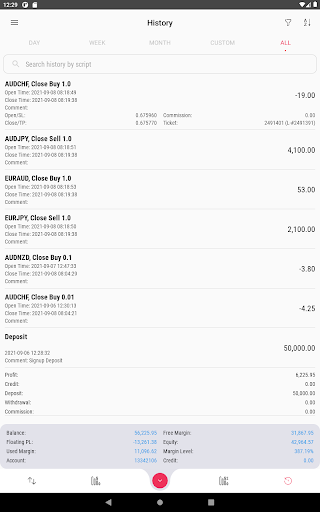

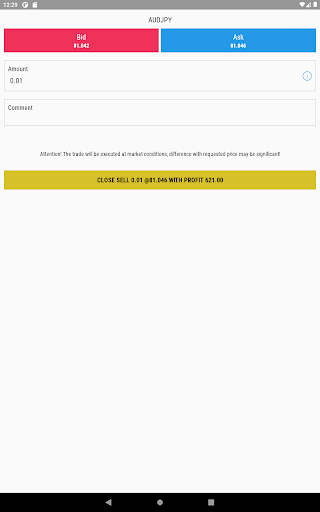

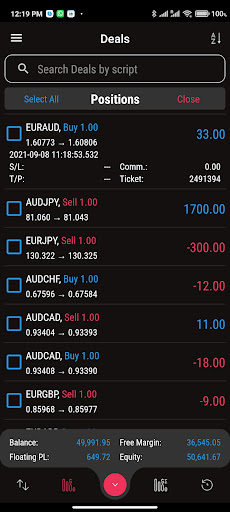

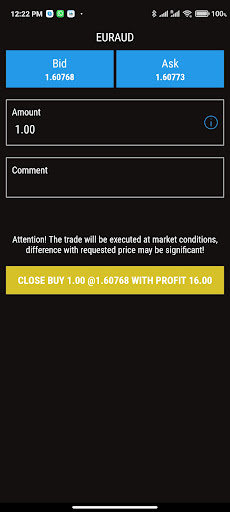

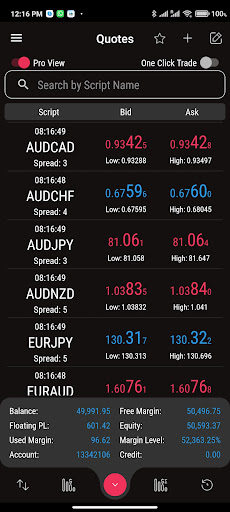

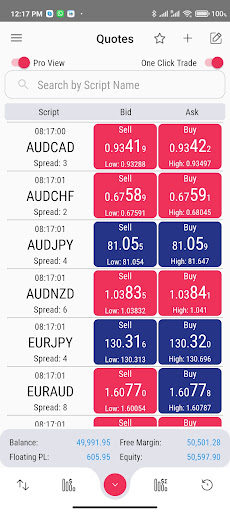

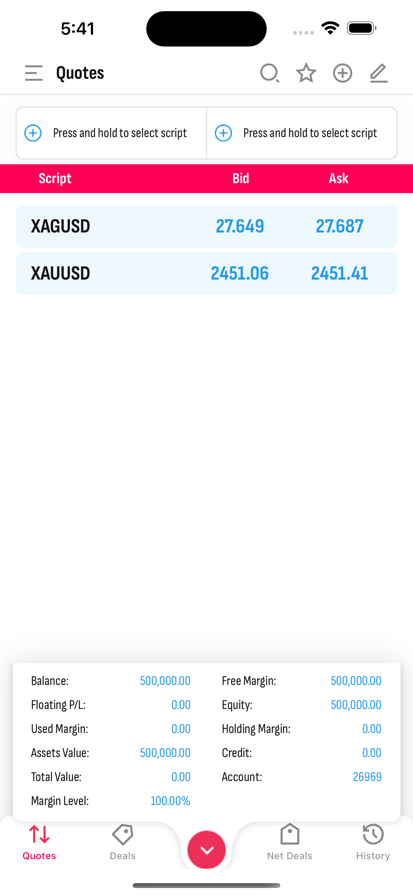

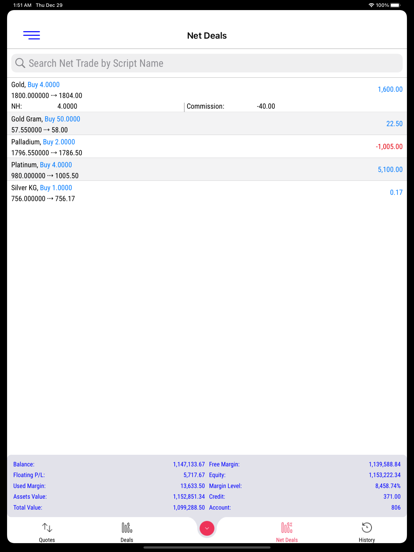

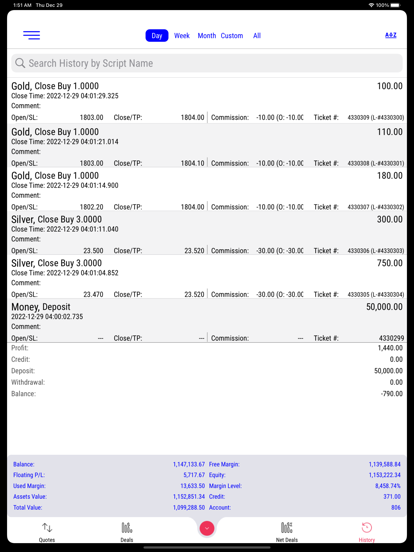

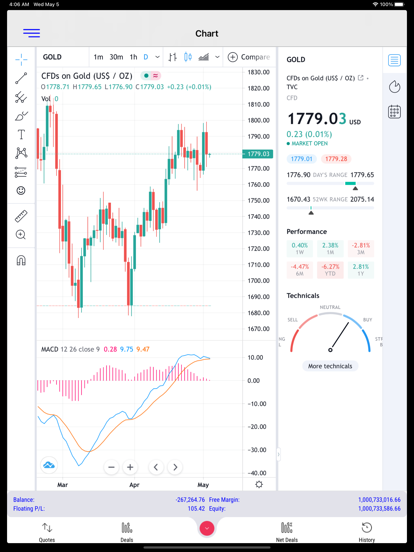

Handelsplattform

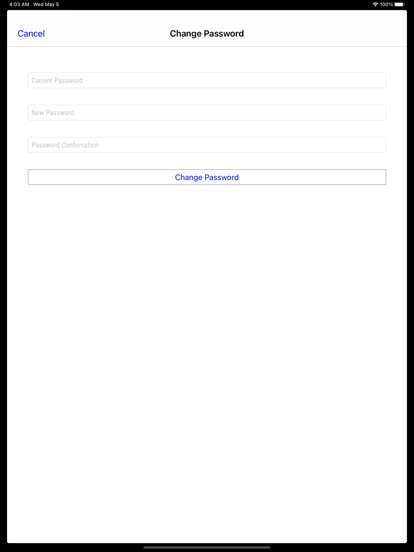

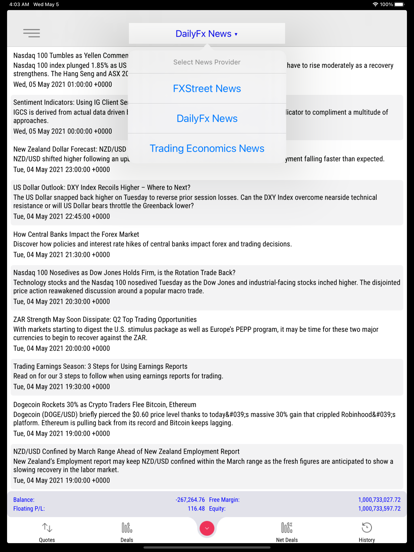

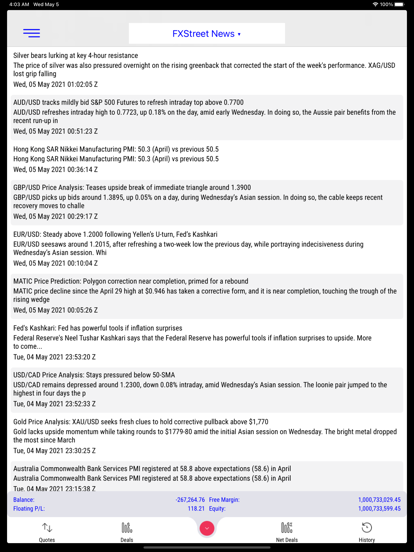

TradeNow bietet eine proprietäre Handelsplattform für iOS und Android zum Handel an, anstelle der autoritativen MT4/MT5 mit ausgereiften Analysetools und EA-Intelligenzsystemen.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| TradeNow | ✔ | iOS, Android | / |

| MT4 | ❌ | / | Anfänger |

| MT5 | ❌ | / | Erfahrene Händler |

Ein- und Auszahlung

TradeNow berechnet keine Gebühren für Ein- und Auszahlungen. Die Zahlungsmethoden, Bearbeitungszeit und anfallenden Gebühren sind jedoch unbekannt.