公司簡介

| CommSec 評論摘要 | |

| 成立年份 | 1995 |

| 註冊國家 | 澳洲 |

| 監管機構 | ASIC |

| 交易產品 | 股票、期權、ETF |

| 模擬帳戶 | ❌ |

| 交易平台 | CommSec 網頁版、CommSec 手機應用程式 |

| 最低存款 | 0 |

| 客戶支援 | 電話:13 15 19(澳洲境內) |

| 電話:+61 2 8397 1206(澳洲境外) | |

CommSec 資訊

Commonwealth Securities Limited 經營 CommSec,自 1995 年成立以來一直是澳洲最佳的線上券商之一。它擁有許多不同的產品,如澳洲和國際股票、ETF、期權、保證金貸款,以及像 CommSec Pocket 這樣的微型投資工具。這使其成為新手和老手投資者的不錯選擇。

優缺點

| 優點 | 缺點 |

| 產品和服務範圍廣泛 | 國際和電話交易成本高昂 |

| 強大的監管支持(ASIC) | 沒有模擬帳戶可用 |

| 用戶友好的網頁和手機平台 |

CommSec 是否合法?

是的,CommSec 受到監管。它在由澳洲證券及投資委員會(ASIC)監管的許可公司 Commonwealth Securities Limited 下運作。ASIC 負責制定規則,牌照類型為市場製造商(MM)。牌照號碼為 000238814。

我可以在 CommSec 交易什麼?

CommSec 提供各種商品和服務,如澳洲和外國股票、ETF、期權等。這使其成為新手和經驗豐富的投資者的不錯選擇。它還提供保證金貸款、SMSF 管理,甚至針對年輕人和小型投資者的投資替代方案。

| 交易工具 | 支援 |

| 股票 | ✓ |

| 期權 | ✓ |

| ETF | ✓ |

| 外匯 | × |

| 大宗商品 | × |

| 指數 | × |

| 加密貨幣 | × |

| 債券 | × |

CommSec 費用

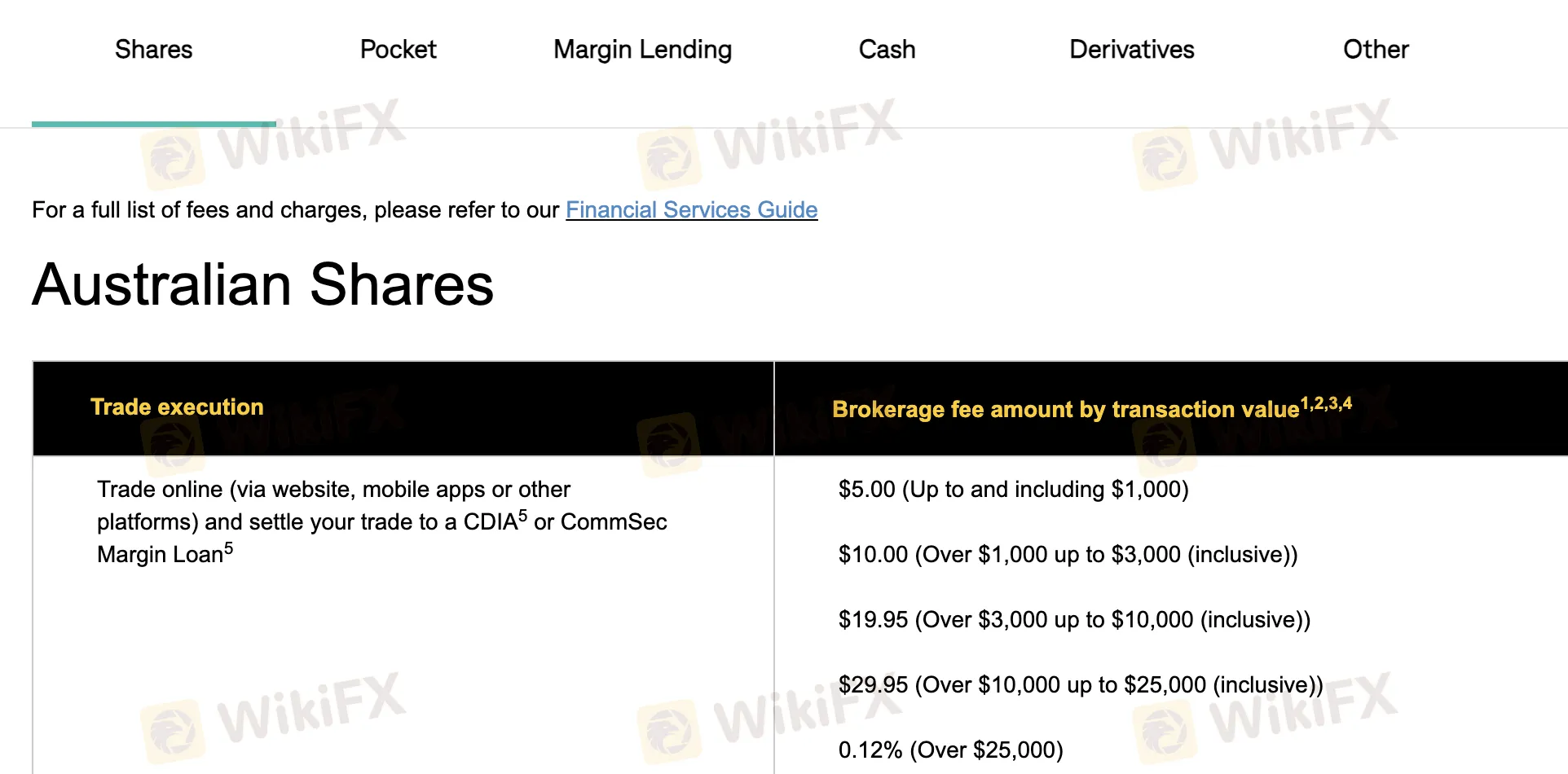

CommSec的價格通常與其他經紀相比是公平合理的,尤其是在澳大利亞境內進行網上交易。然而,海外交易和電話交易可能會更昂貴。對於澳大利亞的小額交易,費用從$5起。對於外匯和期權交易,收取最低美元或百分比費用。

| 類型 | 費用詳情 |

| 澳大利亞股票(通過CDIA網上交易) | $5 (≤$1,000), $10 (>$1,000–$3,000), $19.95 (>$3,000–$10,000), $29.95 (>$10,000–$25,000), 0.12% (>$25,000) |

| 澳大利亞股票(網上,非CDIA結算) | $29.95 (≤$9,999.99), 0.31% (≥$10,000) |

| 電話交易 | $59.95 (≤$10,000), 0.52% (>$10,000–$25,000), 0.49% (>$25,000–$1M), 0.11% (>$1M) |

| CommSec Pocket App | $2 (≤$1,000), 0.20% (>$1,000) |

| 國際股票(基本帳戶) | 美國:$5或0.12%; 加拿大:C$40或0.40%; 歐洲:€12或0.40%; 香港:HK$130或0.40%; 英國:£12或0.40% |

| 外匯轉換費 | 每次貨幣轉換0.55% |

| 保證金貸款利率(浮動) | 約9.15%每年(按月計算),固定利率(1-5年:約7.49-7.69%每年) |

| 交易所交易期權(網上) | $34.95 (≤$10,000), 0.35% (>$10,000) |

| 交易所交易期權(電話) | $54.60 (≤$10,000), 0.54% (>$10,000) |

| ETO合約費用 | 股票期權:每份合約$0.13(開倉/平倉),$0.05(行使); 指數期權:$0.45(開倉/平倉),$0.35(行使) |

非交易費用

| 非交易費用 | 金額 |

| 申請費(個人/公司) | $0 |

| 信託契約調查費 | 最低$200 |

| PPSR登記費(政府費用) | 政府費用(如適用) |

| 帳戶維護費 | $0 |

| 印刷合約備註(郵寄) | $1.95 |

| 拒付費 | $30 |

| 重新預訂費 | $25 |

| 場外轉帳費 | $54 |

| 政府稅金/關稅 | 按成本轉嫁 |

| 帳戶結束費(提前償還貸款) | 視乎貸款金額和利率變動 |

| 存款/提款(CDIA帳戶) | 無限免費電子提款;SMSF CDIA允許每月免費協助提款 |

| 延遲交收費(買入/沽空) | $100 |

| SRN查詢或重新預訂費 | $25 |

| 市場數據(即時快照) | $1美元每月免費,然後每個美國股票報價$0.01,其他股票$0.03 |

| 美國稅表費 | $0 |

| 資金轉帳拒絕費 | $0 |

| 即時購買力 | $0 |

| 美國ACATS轉入/轉出 | $0 |

| 美國DRS轉入 | 每筆已結算交易$25;被拒絕的交易$100 |

| 加拿大DRS轉入 | 每筆已結算交易$30加幣加第三方費用 |

| 美國DRS轉出 | 每筆已結算交易$5 |

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| CommSec 網頁平台 | ✔ | 網頁瀏覽器(桌面,筆記本電腦) | 活躍投資者,投資組合經理 |

| CommSec 手機應用程式 | ✔ | iOS,Android | 在路上的交易者,移動用戶 |