Perfil de la compañía

| CommSec Resumen de la revisión | |

| Establecido | 1995 |

| País registrado | Australia |

| Regulación | ASIC |

| Productos de trading | Acciones, Opciones, ETFs |

| Cuenta demo | ❌ |

| Plataforma de trading | CommSec Plataforma Web, CommSec Aplicación Móvil |

| Depósito mínimo | 0 |

| Soporte al cliente | Teléfono: 13 15 19 (dentro de Australia) |

| Teléfono: +61 2 8397 1206 (fuera de Australia) | |

Información de CommSec

Commonwealth Securities Limited opera CommSec, que ha estado presente desde 1995 y es uno de los mejores corredores en línea de Australia. Ofrece una amplia variedad de productos, como acciones australianas e internacionales, ETFs, opciones, préstamos con margen y herramientas de microinversión como CommSec Pocket. Esto lo convierte en una buena opción tanto para inversores nuevos como experimentados.

Pros y contras

| Pros | Contras |

| Amplia gama de productos y servicios | El comercio internacional y telefónico son costosos |

| Respaldo regulatorio sólido (ASIC) | No hay cuentas demo disponibles |

| Plataformas web y móviles fáciles de usar |

¿Es CommSec legítimo?

Sí, CommSec está regulado. Opera bajo la empresa con licencia Commonwealth Securities Limited, que está supervisada por la Comisión Australiana de Valores e Inversiones (ASIC). ASIC es responsable de las normas, y el tipo de licencia es Market Maker (MM). El número de licencia es 000238814.

¿Qué puedo comerciar en CommSec?

CommSec ofrece una amplia gama de productos y servicios, como acciones australianas y extranjeras, ETFs, opciones y más. Esto lo convierte en una buena opción tanto para inversores nuevos como experimentados. También cuenta con herramientas como préstamos con margen, gestión de SMSF e incluso alternativas de inversión para jóvenes y pequeños inversores.

| Instrumentos de trading | Soportados |

| Acciones | ✓ |

| Opciones | ✓ |

| ETFs | ✓ |

| Forex | × |

| Productos básicos | × |

| Índices | × |

| Criptomonedas | × |

| Bonos | × |

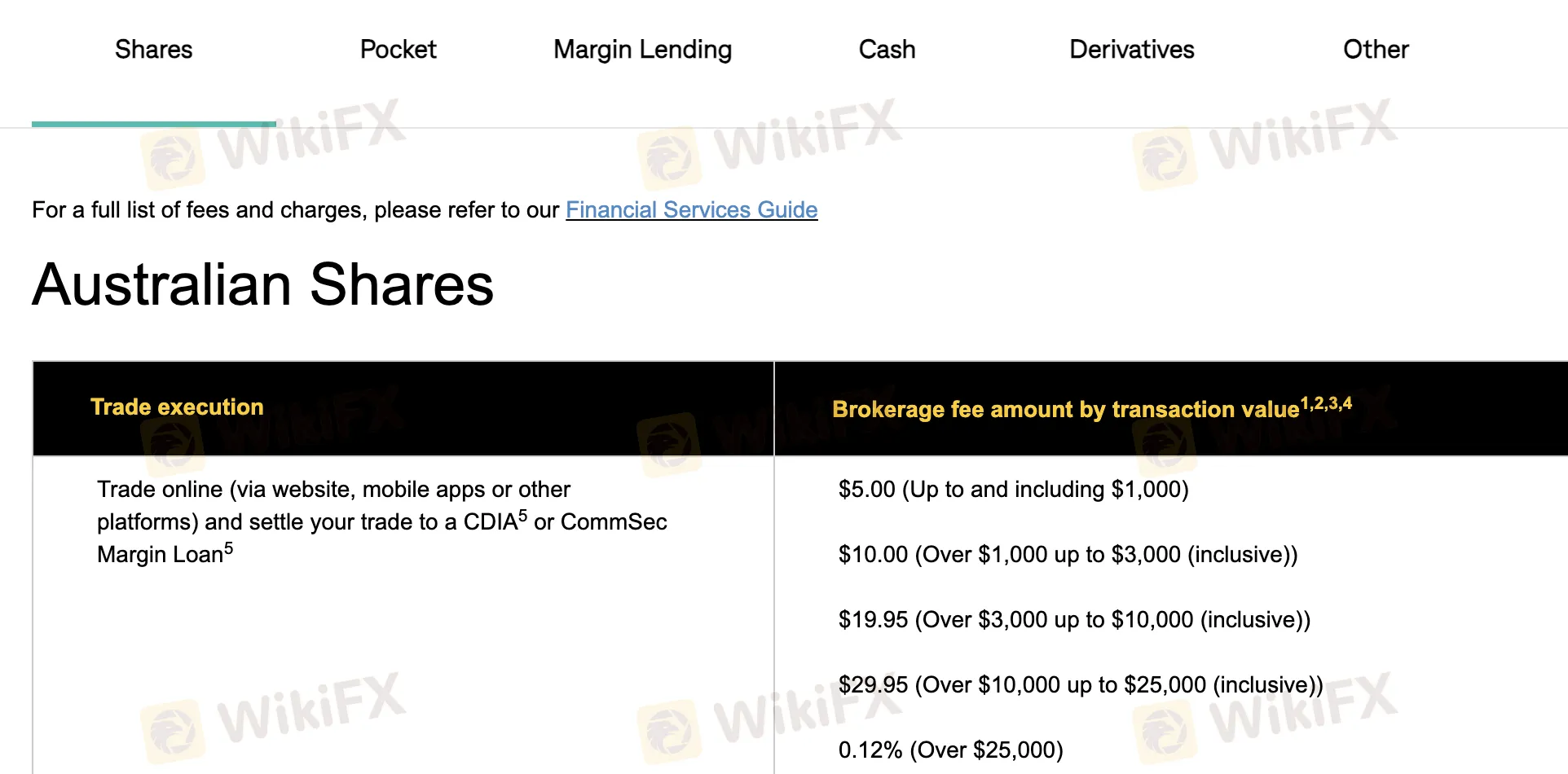

Tarifas de CommSec

Los precios de CommSec suelen ser justos y razonables en comparación con otros corredores, especialmente para el comercio en línea dentro de Australia. Sin embargo, las operaciones en el extranjero y las operaciones telefónicas pueden ser más costosas. Para operaciones modestas en Australia, las tarifas comienzan en $5. Para el comercio de divisas y opciones, existen tarifas mínimas en dólares o en porcentaje.

| Tipo | Detalles de la tarifa |

| Acciones australianas (en línea a través de CDIA) | $5 (≤$1,000), $10 (>$1,000–$3,000), $19.95 (>$3,000–$10,000), $29.95 (>$10,000–$25,000), 0.12% (>$25,000) |

| Acciones australianas (en línea, liquidación no CDIA) | $29.95 (≤$9,999.99), 0.31% (≥$10,000) |

| Operaciones telefónicas | $59.95 (≤$10,000), 0.52% (>$10,000–$25,000), 0.49% (>$25,000–$1M), 0.11% (>$1M) |

| Aplicación CommSec Pocket | $2 (≤$1,000), 0.20% (>$1,000) |

| Acciones internacionales (cuenta básica) | EE. UU.: $5 o 0.12%; Canadá: C$40 o 0.40%; Europa: €12 o 0.40%; Hong Kong: HK$130 o 0.40%; Reino Unido: £12 o 0.40% |

| Tarifa de conversión de divisas extranjeras | 0.55% por conversión de moneda |

| Tasas de préstamos con margen (variables) | ~9.15% anual (mensual), tasas fijas (1–5 años: ~7.49–7.69% anual) |

| Opciones negociadas en bolsa (en línea) | $34.95 (≤$10,000), 0.35% (>$10,000) |

| Opciones negociadas en bolsa (teléfono) | $54.60 (≤$10,000), 0.54% (>$10,000) |

| Comisiones de contratos de ETO | Opciones de acciones: $0.13 por contrato (apertura/cierre), $0.05 (ejercicio); Opciones de índice: $0.45 (apertura/cierre), $0.35 (ejercicio) |

Comisiones no relacionadas con operaciones

| Comisiones no relacionadas con operaciones | Monto |

| Comisión de solicitud (individual/empresa) | $0 |

| Comisión de investigación de escritura de fideicomiso | Mínimo $200 |

| Comisión de registro PPSR (tarifa gubernamental) | Tarifa gubernamental (si corresponde) |

| Comisión de mantenimiento de cuenta | $0 |

| Notas de contrato impresas (por correo) | $1.95 |

| Comisión por falta de pago | $30 |

| Comisión de reprogramación | $25 |

| Comisión de transferencia fuera de mercado | $54 |

| Impuestos/Derechos gubernamentales | Pasados al costo |

| Comisión por cierre de cuenta (pago anticipado de préstamo) | Depende del monto del préstamo y de los movimientos de la tasa de interés |

| Depósito/Retiro (cuentas CDIA) | Retiros electrónicos ilimitados gratuitos; la CDIA de SMSF permite retiros asistidos gratuitos mensuales |

| Comisión por liquidación tardía (Compra/Venta corta) | $100 |

| Consulta SRN o comisión de reprogramación | $25 |

| Datos de mercado (instantáneas en vivo) | $1 USD de cortesía por mes, luego $0.01 por cotización de acciones de EE. UU., $0.03 para otros |

| Comisión por formulario fiscal de EE. UU. | $0 |

| Comisión por rechazo de transferencia de fondos | $0 |

| Poder de compra instantáneo | $0 |

| Transferencias de ACATS de EE. UU. Entrantes/Salientes | $0 |

| Transferencias DRS de EE. UU. Entrantes | $25 por transacción liquidada; transacciones rechazadas $100 |

| Transferencias DRS de Canadá Entrantes | $30 CAD por transacción liquidada más tarifas de terceros |

| Transferencias DRS de EE. UU. Salientes | $5 por transacción liquidada |

Plataforma de Trading

| Plataforma Web CommSec | ✔ | Navegador web (escritorio, portátil) | Inversores activos, gestores de cartera |

| Aplicación Móvil CommSec | ✔ | iOS, Android | Traders en movimiento, usuarios móviles |