公司簡介

| IMC 評論摘要 | |

| 成立年份 | 1989 |

| 註冊國家/地區 | 荷蘭 |

| 監管 | SFC |

| 產品與服務 | 量化研究、交易技術、機構交易、加密解決方案、ETF市場製造 |

| 模擬帳戶 | / |

| 客戶支援 | 紐約:美國紐約市100 Park Ave, Suite 3215, NY 10017 |

| 香港:+852 (3) 658 9888, contact.hongkong@imc.com, 香港中環皇后大道中100號17樓1702室 | |

| 首爾:韓國首爾永登浦區汝矣島路24號FKI大廈40樓,郵遞區號07320 | |

IMC 資訊

IMC 成立於1989年,總部位於荷蘭,是一家歷史悠久、以科技驅動的專有交易和市場製造公司。在紐約、香港和首爾設有主要總部,受香港SFC監管。IMC 強調在超過90個交易所提供量化研究、複雜的交易方法和流動性服務。

優缺點

| 優點 | 缺點 |

| 受香港SFC監管 | 不提供零售交易或模擬帳戶 |

| 超過35年的市場製造和交易經驗 | 沒有像MT4/MT5那樣的公開交易平台 |

| 在90多個交易所和多個資產類別中具有強大的存在 | 有關帳戶功能的信息有限 |

IMC 是否合法?

IMC 是香港證券及期貨事務監察委員會(SFC)許可的金融公司。自2007年3月12日以來,擁有有效的期貨交易許可證(ANR402)。此狀態驗證了IMC在香港的金融監管合規性。

產品與服務

IMC 提供以技術為基礎的金融服務,包括量化分析、複雜的交易方法和新技術。人工智能、機器學習和高性能計算機幫助該組織在全球金融市場競爭。

| 產品 / 服務 | 詳情 |

| 量化研究 | 使用人工智能和機器學習創建和優化交易策略 |

| 技術與工程 | 自動化交易並構建高性能基礎設施 |

| 交易 | 應用具有35年市場專業知識的獨特交易策略 |

流動性服務

經過35年,IMC 是一家值得信賴的流動性提供商,在90多個交易所上穩定定價並深入市場。該公司為股票、加密貨幣和ETF交易對手提供快速、便宜的報價和定制的金融解決方案。IMC 在所有市場中以自動化驅動的定價、地理和產品覆蓋以及產品可靠性脫穎而出。

| Liquidity Service | Details |

| Institutional Sales | Direct, off-screen trading with IMC for buy-side firms across Europe, US, and Asia-Pacific |

| Options Wholesaling | Advanced connectivity to all OCC venues for U.S. listed options trading |

| Crypto Solutions | Global access to crypto products, including spot, perps, futures, and options |

| ETF Market Making | Lead Market Maker in over 150 U.S.-listed ETFs, supporting liquidity and efficiency |

FX6351424842

香港

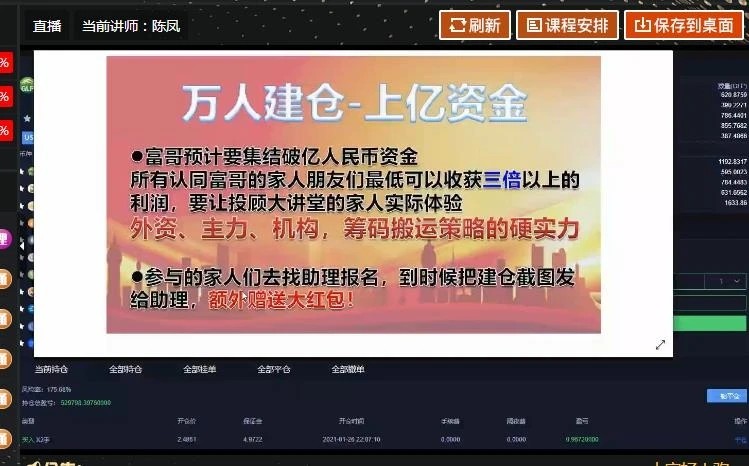

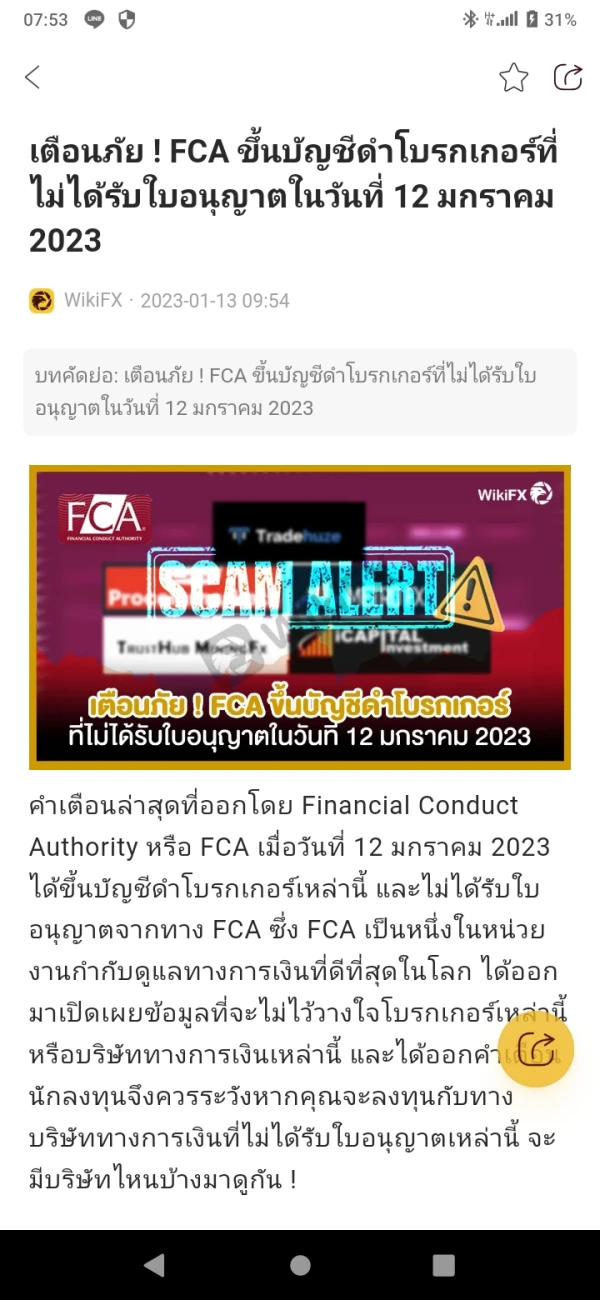

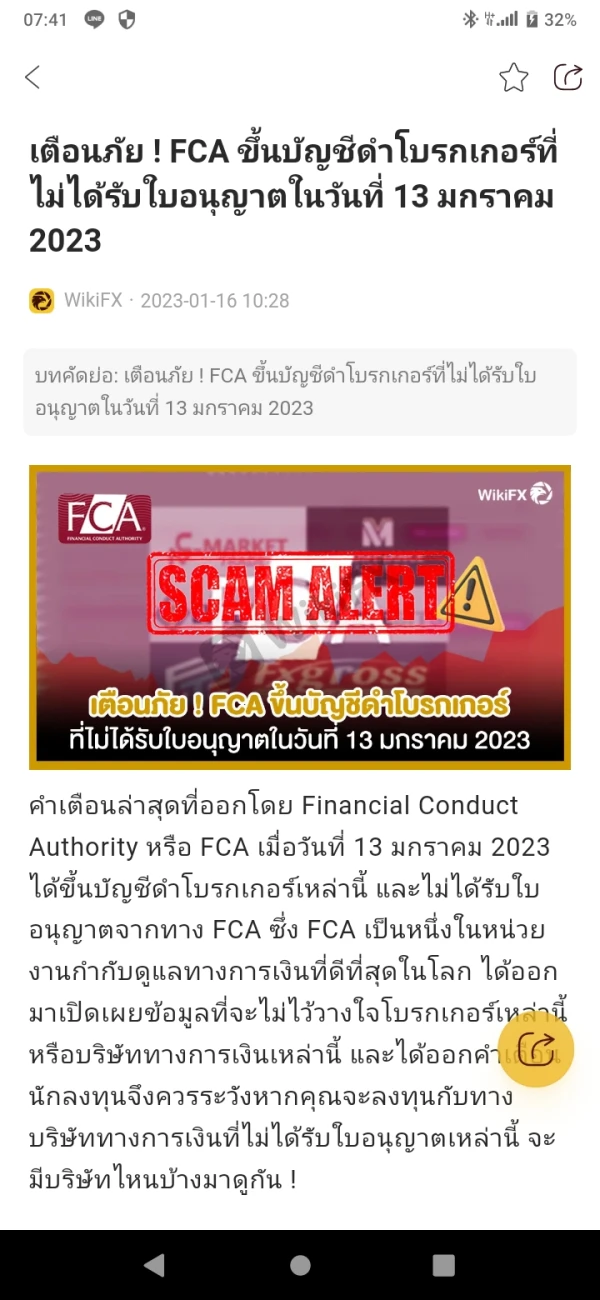

诱导入金!然后平台突然出问题,一直在修复

爆料

FX2287070820

香港

多少人都投资 你平台关闭 想想投资者吗 他们怎么办 就是一个最大的骗子

爆料

jamloveok

泰國

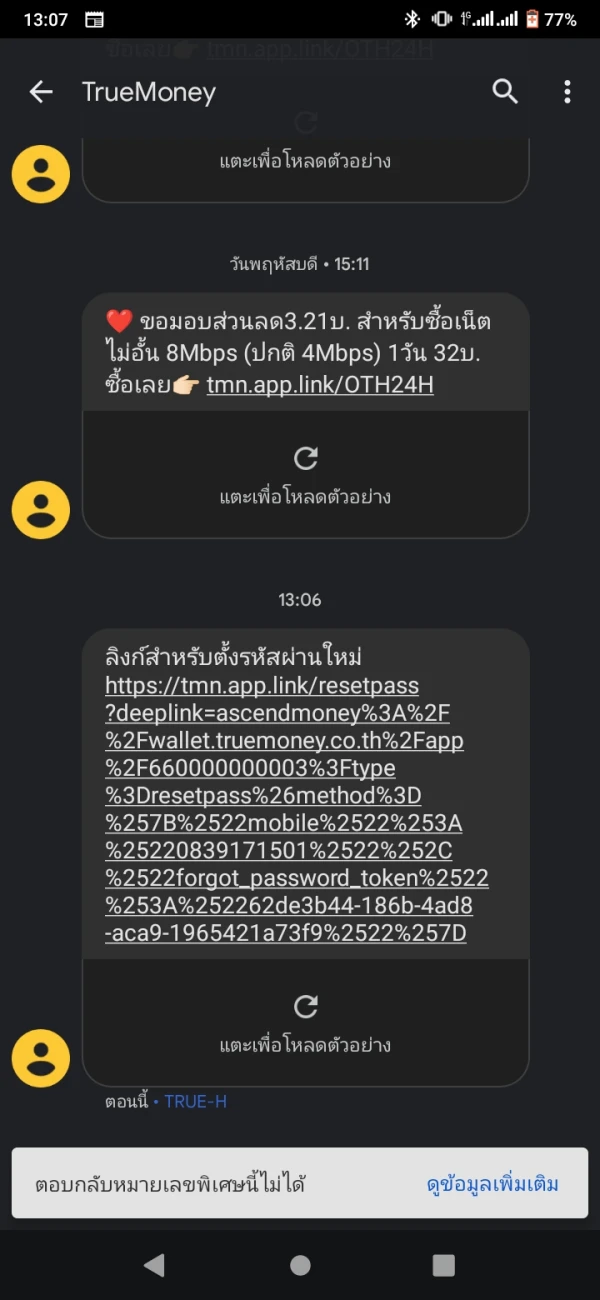

我的網站 truemove 公司告訴你的下屬為什麼然後我會報警他發送了鏈接到我的手機它是如何工作的 truemove 為什麼這種針對 AIS 的作弊行為反對來自 dtac 的快樂不是你看,dtac one-2-call 他們不與 TrueMove h 具有相同的個性,因此其員工的行為優於 TrueMove h。

好評

FX1036488142

厄瓜多爾

到目前為止,我認為這家公司提供的服務令我滿意!它提供多種金融產品,例如期貨。美中不足的是,他們提供的客戶支持並非全天候 24 小時可用,有時我不得不等待數小時甚至一兩天才能得到答复。

好評