Profil perusahaan

| CommSec Ringkasan Ulasan | |

| Dibentuk | 1995 |

| Negara Terdaftar | Australia |

| Regulasi | ASIC |

| Produk Perdagangan | Saham, Opsi, ETF |

| Akun Demo | ❌ |

| Platform Perdagangan | CommSec Platform Web, CommSec Aplikasi Seluler |

| Deposit Minimum | 0 |

| Dukungan Pelanggan | Telepon: 13 15 19 (di dalam Australia) |

| Telepon: +61 2 8397 1206 (di luar Australia) | |

Informasi CommSec

Commonwealth Securities Limited menjalankan CommSec, yang telah ada sejak tahun 1995 dan merupakan salah satu pialang online terbaik di Australia. Ini memiliki berbagai produk, seperti saham Australia dan internasional, ETF, opsi, pinjaman marjin, dan alat investasi mikro seperti CommSec Pocket. Hal ini membuatnya menjadi pilihan yang baik baik untuk investor baru maupun berpengalaman.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berbagai produk dan layanan | Perdagangan internasional dan telepon mahal |

| Dukungan regulasi yang kuat (ASIC) | Tidak ada akun demo yang tersedia |

| Platform web dan seluler yang ramah pengguna |

Apakah CommSec Legal?

Ya, CommSec diatur. Ini beroperasi di bawah perusahaan berlisensi Commonwealth Securities Limited, yang diawasi oleh Australia Securities & Investment Commission (ASIC). ASIC bertanggung jawab atas aturan, dan jenis lisensinya adalah Market Maker (MM). Nomor lisensinya adalah 000238814.

Apa yang Bisa Saya Perdagangkan di CommSec?

CommSec memiliki berbagai barang dan layanan, seperti saham Australia dan asing, ETF, opsi, dan lainnya. Hal ini membuatnya menjadi pilihan yang baik baik untuk investor baru maupun berpengalaman. Ini juga memiliki alat seperti pinjaman marjin, manajemen SMSF, dan bahkan alternatif investasi untuk anak-anak dan investor kecil.

| Instrumen Perdagangan | Didukung |

| Saham | ✓ |

| Opsi | ✓ |

| ETF | ✓ |

| Forex | × |

| Komoditas | × |

| Indeks | × |

| Kripto | × |

| Obligasi | × |

Biaya CommSec

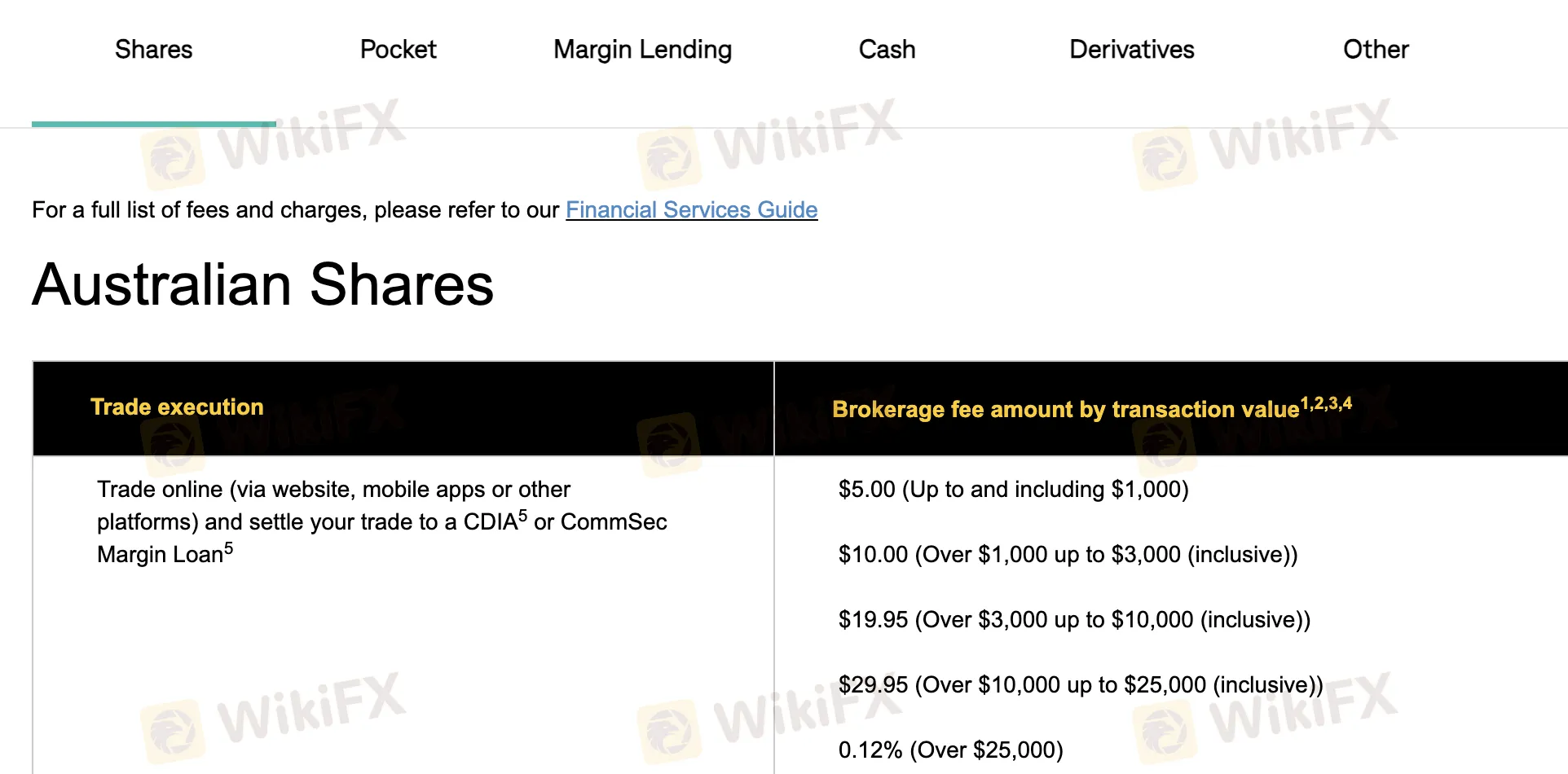

Harga-harga CommSec biasanya adil dan wajar dibandingkan dengan pialang lain, terutama untuk perdagangan online di Australia. Namun, perdagangan luar negeri dan perdagangan telepon bisa lebih mahal. Untuk perdagangan kecil di Australia, biaya dimulai dari $5. Untuk perdagangan asing dan opsi, terdapat biaya minimum dalam dolar atau persentase.

| Jenis | Detail Biaya |

| Saham Australia (online via CDIA) | $5 (≤$1,000), $10 (>$1,000–$3,000), $19.95 (>$3,000–$10,000), $29.95 (>$10,000–$25,000), 0.12% (>$25,000) |

| Saham Australia (online, penyelesaian non-CDIA) | $29.95 (≤$9,999.99), 0.31% (≥$10,000) |

| Perdagangan Telepon | $59.95 (≤$10,000), 0.52% (>$10,000–$25,000), 0.49% (>$25,000–$1M), 0.11% (>$1M) |

| Aplikasi CommSec Pocket | $2 (≤$1,000), 0.20% (>$1,000) |

| Saham Internasional (akun dasar) | AS: $5 atau 0.12%; Kanada: C$40 atau 0.40%; Eropa: €12 atau 0.40%; Hong Kong: HK$130 atau 0.40%; Inggris: £12 atau 0.40% |

| Biaya Konversi Valuta Asing | 0.55% per konversi mata uang |

| Biaya Peminjaman Margin (variabel) | ~9.15% p.a. (bulanan), suku bunga tetap (1–5 tahun: ~7.49–7.69% p.a.) |

| Opsi yang Diperdagangkan di Bursa (online) | $34.95 (≤$10,000), 0.35% (>$10,000) |

| Opsi yang Diperdagangkan di Bursa (telepon) | $54.60 (≤$10,000), 0.54% (>$10,000) |

| Biaya Kontrak ETO | Opsi ekuitas: $0.13 per kontrak (buka/tutup), $0.05 (eksekusi); Opsi indeks: $0.45 (buka/tutup), $0.35 (eksekusi) |

Biaya Non-Trading

| Biaya Non-Trading | Jumlah |

| Biaya Aplikasi (individu/perusahaan) | $0 |

| Biaya Investigasi Trust Deed | Minimum $200 |

| Biaya Pendaftaran PPSR (biaya pemerintah) | Biaya pemerintah (jika berlaku) |

| Biaya Pemeliharaan Akun | $0 |

| Nota Kontrak Cetak (dikirim melalui pos) | $1.95 |

| Biaya Penolakan | $30 |

| Biaya Pemesanan Ulang | $25 |

| Biaya Transfer Off-market | $54 |

| Pajak/Biaya Pemerintah | Diteruskan dengan biaya |

| Biaya Penutupan Akun (pelunasan pinjaman awal) | Tergantung pada jumlah pinjaman dan pergerakan tingkat bunga |

| Penyetoran/Penarikan (akun CDIA) | Penarikan elektronik gratis tanpa batas; SMSF CDIA memungkinkan penarikan dibantu gratis setiap bulan |

| Biaya Penyelesaian Terlambat (Beli/Jual Pendek) | $100 |

| Biaya Kueri SRN atau Pemesanan Ulang | $25 |

| Data Pasar (snapshot langsung) | $1 USD gratis per bulan, kemudian $0.01 per kutipan ekuitas AS, $0.03 untuk yang lain |

| Biaya Formulir Pajak AS | $0 |

| Biaya Penolakan Transfer Dana | $0 |

| Daya Beli Instan | $0 |

| Transfer Masuk/Keluar ACATS AS | $0 |

| Transfer Masuk DRS AS | $25 per transaksi yang diselesaikan; transaksi yang ditolak $100 |

| Transfer Masuk DRS Kanada | $30 CAD per transaksi yang diselesaikan ditambah biaya pihak ketiga |

| Transfer Keluar DRS AS | $5 per transaksi yang diselesaikan |

Platform Perdagangan

| Platform Perdagangan | Dukungan | Perangkat Tersedia | Cocok untuk |

| CommSec Platform Web | ✔ | Browser web (desktop, laptop) | Investor aktif, manajer portofolio |

| CommSec Aplikasi Seluler | ✔ | iOS, Android | Pedagang yang selalu bergerak, pengguna seluler |