Unternehmensprofil

| CommSec Überprüfungszusammenfassung | |

| Gegründet | 1995 |

| Registriertes Land | Australien |

| Regulierung | ASIC |

| Handelsprodukte | Aktien, Optionen, ETFs |

| Demo-Konto | ❌ |

| Handelsplattform | CommSec Web-Plattform, CommSec Mobile App |

| Mindesteinzahlung | 0 |

| Kundensupport | Telefon: 13 15 19 (innerhalb Australiens) |

| Telefon: +61 2 8397 1206 (außerhalb Australiens) | |

CommSec Informationen

Commonwealth Securities Limited betreibt CommSec, das seit 1995 besteht und einer der besten Online-Broker Australiens ist. Es bietet viele verschiedene Produkte wie australische und internationale Aktien, ETFs, Optionen, Margindarlehen und Mikro-Investitionstools wie CommSec Pocket. Dies macht es zu einer guten Wahl für sowohl neue als auch erfahrene Anleger.

Vor- und Nachteile

| Vorteile | Nachteile |

| Breites Angebot an Produkten und Dienstleistungen | Internationale und Telefonhandel sind teuer |

| Starke regulatorische Unterstützung (ASIC) | Keine Demo-Konten verfügbar |

| Benutzerfreundliche Web- und Mobile-Plattformen |

Ist CommSec seriös?

Ja, CommSec ist reguliert. Es arbeitet unter dem lizenzierten Unternehmen Commonwealth Securities Limited, das von der Australian Securities & Investment Commission (ASIC) überwacht wird. ASIC ist für die Regeln zuständig, und der Lizenztyp ist Market Maker (MM). Die Lizenznummer lautet 000238814.

Was kann ich auf CommSec handeln?

CommSec bietet eine Vielzahl von Waren und Dienstleistungen wie australische und ausländische Aktien, ETFs, Optionen und mehr. Dies macht es zu einer guten Wahl für sowohl neue als auch erfahrene Anleger. Es bietet auch Tools wie Margindarlehen, SMSF-Verwaltung und sogar Anlagealternativen für Jugendliche und kleine Anleger.

| Handelsinstrumente | Unterstützt |

| Aktien | ✓ |

| Optionen | ✓ |

| ETFs | ✓ |

| Forex | × |

| Waren | × |

| Indizes | × |

| Kryptowährungen | × |

| Anleihen | × |

CommSec Gebühren

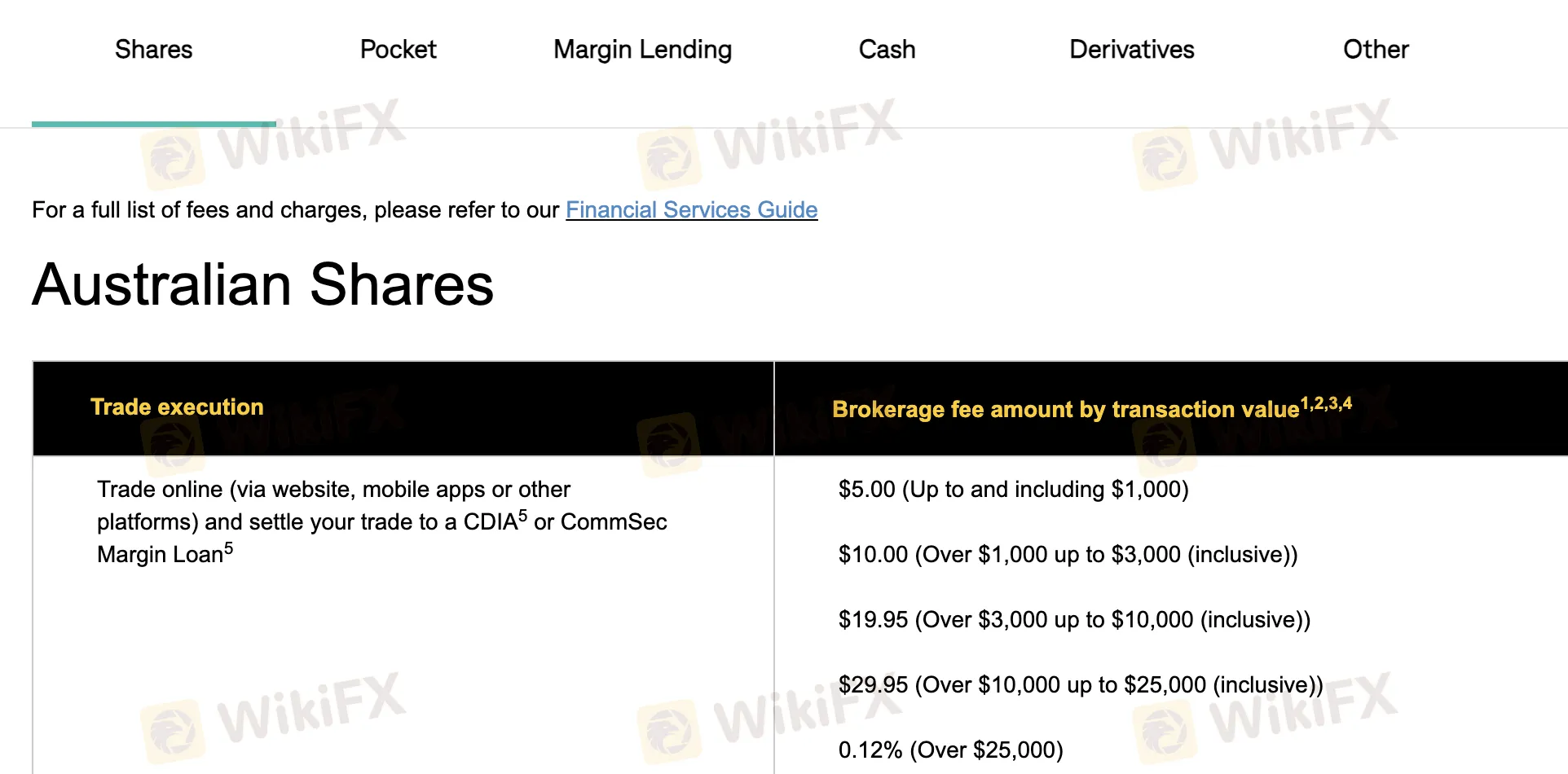

Die Preise von CommSec sind im Vergleich zu anderen Brokern in der Regel fair und angemessen, insbesondere für den Online-Handel innerhalb Australiens. Allerdings können Überseegeschäfte und Telefonhandel teurer sein. Für bescheidene Geschäfte in Australien beginnen die Gebühren bei $5. Für den Devisen- und Optionshandel gelten Mindestgebühren in Dollar oder Prozent.

| Art | Gebührendetails |

| Australische Aktien (online über CDIA) | $5 (≤$1.000), $10 (>$1.000–$3.000), $19,95 (>$3.000–$10.000), $29,95 (>$10.000–$25.000), 0,12% (>$25.000) |

| Australische Aktien (online, nicht CDIA-Abwicklung) | $29,95 (≤$9.999,99), 0,31% (≥$10.000) |

| Telefongeschäfte | $59,95 (≤$10.000), 0,52% (>$10.000–$25.000), 0,49% (>$25.000–$1M), 0,11% (>$1M) |

| CommSec Pocket App | $2 (≤$1.000), 0,20% (>$1.000) |

| Internationale Aktien (Basis-Konto) | US: $5 oder 0,12%; Kanada: C$40 oder 0,40%; Europa: €12 oder 0,40%; Hongkong: HK$130 oder 0,40%; UK: £12 oder 0,40% |

| Devisenumrechnungsgebühr | 0,55% pro Währungsumrechnung |

| Margenlending-Sätze (variabel) | ~9,15% p.a. (monatlich), feste Sätze (1–5 Jahre: ~7,49–7,69% p.a.) |

| Börsengehandelte Optionen (online) | $34,95 (≤$10.000), 0,35% (>$10.000) |

| Börsengehandelte Optionen (Telefon) | $54,60 (≤$10.000), 0,54% (>$10.000) |

| ETO-Vertragsgebühren | Aktienoptionen: $0,13 pro Vertrag (öffnen/schließen), $0,05 (ausüben); Indexoptionen: $0,45 (öffnen/schließen), $0,35 (ausüben) |

Nicht-Handelsgebühren

| Nicht-Handelsgebühren | Betrag | |

| Antragsgebühr (Einzelperson/Firma) | $0 | |

| Trust Deed Untersuchungsgebühr | Mindestens $200 | |

| PPSR Registrierungsgebühr (Regierungsgebühr) | Regierungsgebühr (falls zutreffend) | |

| Kontoführungsgebühr | $0 | |

| Gedruckte Vertragsnotizen (per Post) | $1.95 | |

| Nicht-Einlösegebühr | $30 | |

| Umbuchungsgebühr | $25 | |

| Außerbörsliche Überweisungsgebühr | $54 | |

| Regierungssteuern/Abgaben | Weitergegeben zu Selbstkosten | |

| Kontoschließungsgebühr (frühe Kreditrückzahlung) | Einzahlung/Auszahlung (CDIA-Konten) | Unbegrenzte kostenlose elektronische Abhebungen; SMSF CDIA ermöglicht monatlich kostenlose unterstützte Abhebungen |

| Spätsiedlungsgebühr (Kauf/Leerverkauf) | $100 | |

| SRN-Abfrage- oder Umbuchungsgebühr | $25 | |

| Marktdaten (Live-Snapshots) | $1 USD pro Monat kostenlos, dann $0.01 pro US-Aktienkurs, $0.03 für andere | |

| U.S. Steuerformulargebühr | $0 | |

| Fondsüberweisungsablehnungsgebühr | $0 | |

| Instant Buying Power | $0 | |

| U.S. ACATS-Überweisungen rein/raus | $0 | |

| U.S. DRS-Überweisungen rein | $25 pro abgewickelter Transaktion; abgelehnte Transaktionen $100 | |

| Canada DRS-Überweisungen rein | $30 CAD pro abgewickelter Transaktion plus Gebühren Dritter | |

| U.S. DRS-Überweisungen raus | $5 pro abgewickelter Transaktion |

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| CommSec Web-Plattform | ✔ | Webbrowser (Desktop, Laptop) | Aktive Anleger, Portfoliomanager |

| CommSec Mobile App | ✔ | iOS, Android | Trader unterwegs, mobile Nutzer |