基礎資訊

美國

美國

天眼評分

美國

|

5-10年

|

美國

|

5-10年

| https://www.schwab.com.hk/zh-hk

官方網址

評分指數

影響力

AAA

影響力指數 NO.1

美國 9.97

美國 9.97 監管資訊

監管資訊持牌機構:TD Ameritrade Hong Kong Limited

監管證號:BJO462

美國

美國 schwab.com

schwab.com schwab.com.hk

schwab.com.hk tdameritrade.com

tdameritrade.com tdameritrade.com.sg

tdameritrade.com.sg tdameritrade.com.hk

tdameritrade.com.hk

| 註冊國家/地區 | 香港 |

| 規定 | 證監會 |

| 最低存款 | 2,000 美元(保證金賬戶) |

| 最大槓桿 | 不適用 |

| 最低點差 | 不適用 |

| 交易平台 | 思遊 |

| 模擬賬戶 | 是的 |

| 交易資產 | 股票、ETF、債券 |

| 支付方式 | FPS 轉賬、支票存款、電匯(國際電匯)、ACAT |

| 客戶支持 | 電話、電郵 |

一般信息和法規

TD Ameritrade Hong Kong Ltd.已在證券及期貨委員會(CE 編號 bjo462)註冊,從事證券交易和期貨合約交易的受監管活動,不提供稅務、法律或投資建議或建議。 德美利证券在香港,通過提供尖端交易技術、折扣佣金率、免費教育和出色的客戶服務,散戶投資者可以在美國市場進行交易。 德美利证券 , inc.,成員 finra/sipc,以及 charles schwab corporation 的子公司。 德美利证券是共同擁有的商標 德美利证券知識產權公司和多倫多道明銀行。

最新消息

2022 年 2 月 28 日, 德美利证券香港將關閉,不再保留賬戶。

市場工具

德美利证券客戶可以在網絡平台和移動應用程序上交易各種資產。這包括交易所交易基金 (ETF)、股票、期權、期貨和加密貨幣。

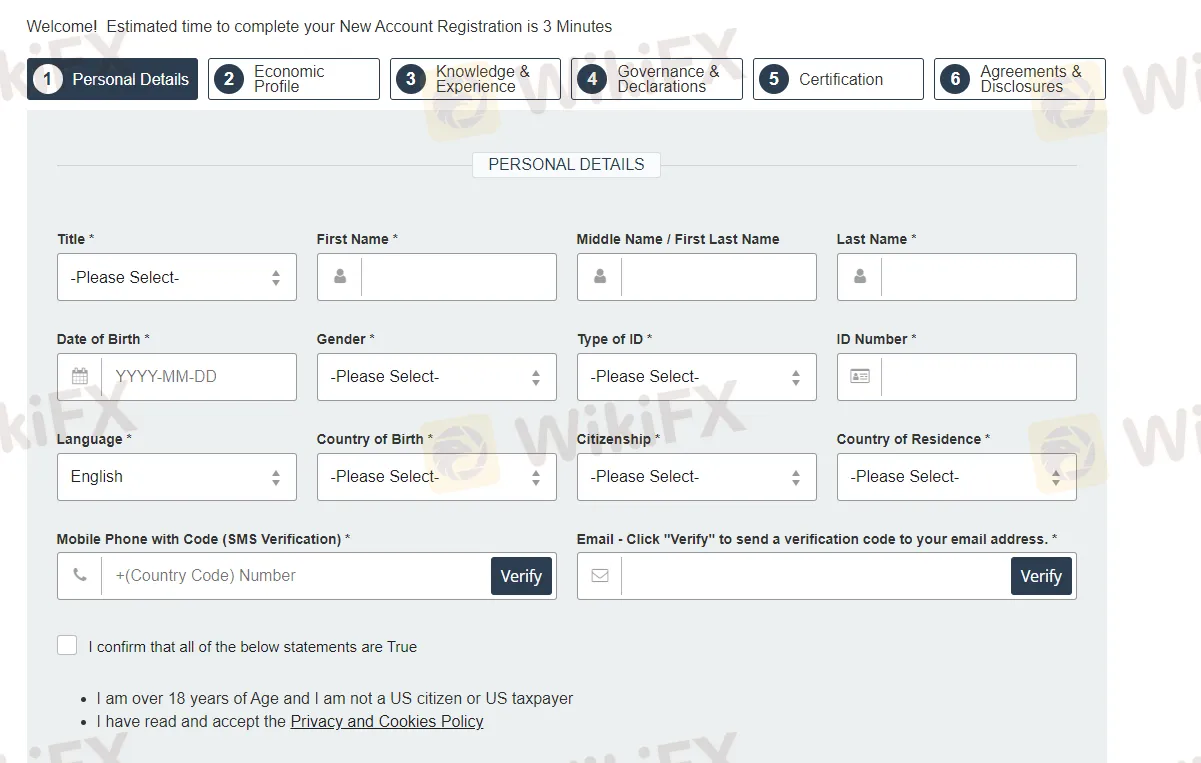

賬戶類型

德美利证券提供兩種經紀賬戶:個人賬戶和聯名賬戶。個人賬戶包括保證金賬戶和現金賬戶。開設保證金賬戶的最低初始存款為 2000 美元,而現金賬戶則沒有最低存款要求。開設個人/聯名賬戶的最低金額為 25,000 美元。

提供模擬賬戶

模擬賬戶可供初學者和專業人士在 100% 無風險的交易環境中測試交易平台的功能和特性。

佣金

股票和交易所買賣基金

以每筆交易 0.00 美元的價格交易無限制股票。注意:0 美元佣金適用於在美國交易所上市的股票和 ETF。 6.95 美元的佣金適用於場外交易 (OTC) 股票的在線交易。

選項

每份合約 0.65 美元,不收取手續費、行使費或轉讓費。當您以 0.05 美元或更少的價格買入平倉任何空頭個人或單腿期權時,可免除期權費。

期貨與期貨期權

每份合約 2.25 美元(加上交易所和監管費用)。

交易所和監管費用

交易所費用因交易所和產品而異。請訪問相應的交易所以獲取相關費用的列表。請注意,美國國家期貨協會 (NFA) 還收取每份合約 0.01 美元的費用。

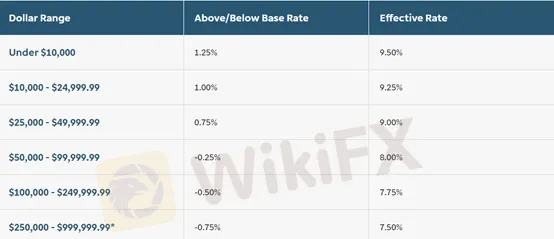

保證金率

德美利证券提供保證金賬戶以幫助為客戶提供槓桿。

交易平台可用

德美利证券為交易者提供 thinkorswim 交易平台,可用於桌面、網絡和移動設備。

資金選擇

德美利证券允許客戶通過 fps 轉賬、支票存款、電匯(國際電匯)或通過其他經紀商 (acat) 的賬戶轉賬為其賬戶注資。所有存款必須以美元支付。

客戶服務

德美利证券提供一般的客戶支持,可以通過電子郵件聯繫他們:help@tdameritrade.com.hk,以及一些社交媒體平台,包括 facebook、instagram 和 youtube。

優點缺點

| 優點 | 缺點 |

| 受 FCA 監管 | 高最低存款要求 |

| 四個交易賬戶可供選擇 | 有限的產品組合 |

| 一流的專有交易平台 | 只有兩個交易平台可用 |

| 交易費用低 | 沒有用於匯款的信用卡/借記卡和電子錢包 |

| 強大的客戶支持 | |

| 提供額外的研究工具 |

經常問的問題

產品和服務是做什麼的 德美利证券有優惠嗎?

德美利证券提供交易所交易基金 (ETF)、股票、期權、期貨和加密貨幣。

交易平台是做什麼的 德美利证券提供?

德美利证券提供名為 thinkorswim 的專有平台。

什麼賬戶類型 德美利证券提供 ?

德美利证券提供兩種類型的交易賬戶:個人賬戶和聯名賬戶。

什麼付款方式 德美利证券提供 ?

德美利证券提供 fps 轉賬、支票存款、電匯(國際電匯),或通過賬戶轉賬供客戶付款。

做 德美利证券提供模擬賬戶?

是的, 德美利证券提供模擬賬戶。

投資者動向指數® (IMXSM) 2 月份跌至 6.79,低於 1 月份的 7.07。IMX 是 TD Ameritrade 專有的、基於行為的指數,它匯總了普通投資者的頭寸和活動,以衡量投資者的行為以及他們在市場中的定位。

德美利證券(TD Ameritrade)香港有限公司已在證券及期貨事務監察委員會註冊(CE編號BJO462),從事證券交易和期貨合約交易的受監管活動,不提供稅務、法律或投資意見或建議。德美利香港公司通過提供先進的交易技術、折扣傭金率、免費教育和出色的客戶服務,使零售投資者能夠在美國市場進行交易。德美利證券是美國金融管理局/SIPC成員,是嘉信理財(The Charles Schwab Corporation)的子公司並且是TD Ameritrade IP Company, Inc.和多倫多國民銀行共同擁有的商標。更多外匯訊息,請上外匯天眼。

As much as I appreciate the services offered by Charles Schwab, there are a few areas where I believe they could improve, especially when it comes to the Charles Schwab leverage options available. Schwab offers leverage of up to 2:1 for equities in margin accounts, meaning I can borrow up to 50% of the value of the securities I am trading. While this is typical for most brokers, some advanced traders, including myself, would appreciate a bit more flexibility, especially when trading higher-risk assets like options or futures. For someone like me who trades actively, this conservative approach can sometimes limit my ability to execute more aggressive strategies. Furthermore, Schwab is primarily focused on the U.S. market, and as such, investors looking for easy access to international markets may find this platform limiting. While Schwab does offer global accounts, their international trading options are somewhat restricted compared to brokers that are more focused on global diversification. Another drawback I encountered is that while Schwab offers great customer service, their thinkorswim® platform, which is geared toward advanced traders, can be quite complex for beginners. I recall feeling slightly overwhelmed by the sheer number of tools and features, which I didn’t initially know how to use effectively. For novice traders, this can be a bit intimidating and could potentially delay the learning curve. However, once I became familiar with it, thinkorswim® provided some of the most powerful trading tools I’ve ever used. In conclusion, while these cons are notable, I still find Schwab to be a great platform due to its overall reliability, excellent educational resources, and transparent fee structure.

In my experience, Charles Schwab is a reliable and secure brokerage, despite its regulatory status with the SFC being revoked. Schwab operates under U.S. financial regulations, and it is a member of SIPC (Securities Investor Protection Corporation), which offers protection for customers' securities, up to $500,000, including $250,000 in cash. This SIPC protection gives me confidence that my assets are secure, and it provides peace of mind in case of unforeseen circumstances. Additionally, Schwab Bank is FDIC-insured, which means that any funds in my Schwab Bank accounts are covered up to $250,000 per depositor, further adding to the safety of my funds. Although the revocation of SFC regulation might seem concerning for non-U.S. investors, the extensive regulatory framework that Schwab adheres to within the United States ensures that I am well-protected as an investor. When I first registered and logged into my Charles Schwab account, I found that Schwab makes security a top priority, which reassured me. While the revoked status from SFC might limit Schwab's activities in some regions, its extensive regulatory background and customer protection mechanisms make it a trustworthy platform for me. Therefore, despite this revocation, I still feel comfortable with Schwab’s overall security and regulatory compliance.

One of the reasons I continue using Charles Schwab is the variety of methods available for depositing funds. Schwab supports electronic funds transfers (EFT), which allow me to quickly transfer money from my bank account to Schwab. I also appreciate that Schwab accepts wire transfers and checks for deposits, giving me flexibility depending on my situation. I’ve personally used EFT for deposits, and it’s always been a smooth and fast process. Additionally, Schwab allows direct deposit, which is a great feature if I want to automate my contributions. Having the ability to easily deposit funds into my Schwab account ensures that I can invest whenever I want without worrying about the logistics of funding my account. Schwab’s deposit methods are reliable and easy to use, which is why I’ve never encountered any issues when adding funds to my account.

One of the things I value about Charles Schwab is their transparency regarding fees. As a regular user of their services, I was relieved to discover that they offer commission-free trading for most online stocks, ETFs, and options. This was particularly appealing to me as an active trader, because avoiding commissions means I can keep more of my investment returns. However, I did notice that for options trades, Schwab charges a $0.65 fee per contract, which is fairly typical across the industry. I also encountered some mutual fund transaction fees, particularly for those outside Schwab's OneSource® program, which can go up to $74.95 per trade. Despite these exceptions, I find Schwab’s overall fee structure to be highly competitive. Additionally, Schwab does not charge account maintenance or inactivity fees, and the Charles Schwab minimum deposit requirement for most accounts is $0, which makes it very accessible. I also appreciate that Schwab provides detailed information on all fees upfront, so there are no surprises. I was able to easily find all the pricing details on their website, which helped me make an informed decision. The absence of hidden fees and the simplicity of their pricing structure makes Schwab an appealing option for me. Overall, I feel that Schwab’s fees are reasonable for the value it provides, and I haven’t encountered any unexpected charges.

請輸入...

王爺爺

台灣

這家投信跟匯豐手法完全一樣,先抽獎給2萬,然後跟你說投資10萬,外資在加碼3天15萬連你本金你就有27萬能夠跟上操作,這3天收益是你自己的,3天後徹資17萬只留你本金與3天操作利潤,然後一開始讓你少少提領,後面漸漸不讓提領,最後跟你結算,叫你拿利潤的一半先匯款,他們才匯本金與利潤還你,以上是這個新詐騙方式,希望不要有人跟我一樣被騙

爆料

kang Rona

印尼

任何人都可以提供有關提取資金的幫助嗎?我擔心存在欺詐方法。而且已經有很多錢進來了。從CE語言開始,這意味著你必須繳納15%的稅退出...

爆料

Gerhard Van Wyk

南非

我5月4日開始交,他們在支付時作假,誘導欺詐。

爆料

Đỗ Văn Ngọc

澳大利亞

TD Ameritrade 的網站看起來很專業,但我搜索了整個網站,沒有找到任何監管牌照的信息。如果一家公司監管嚴格,就應該大聲說出來才能獲得客戶的信任,對吧?

好評

♔

香港

在德美利证券开立账户要两万五千美元……説實話這個門檻對我來説有點高哦!所以暫時我不考慮和它交易了。正好我可以再觀望一下,看看這個公司到底怎麽樣。

中評

墨香

阿根廷

事實上,我喜歡在TD A的交易體驗。我已經交易外匯快兩年了,但不是持續或密集的,因為我不能說我有很多經驗,但TDA的條件和服務一直對我來說很滿意。不明白為什麼這裡wikifx說不受監管,因為我還是可以正常出金的。

好評