公司簡介

| Maven 評論摘要 | |

| 成立年份 | 2010 |

| 註冊國家/地區 | 英國 |

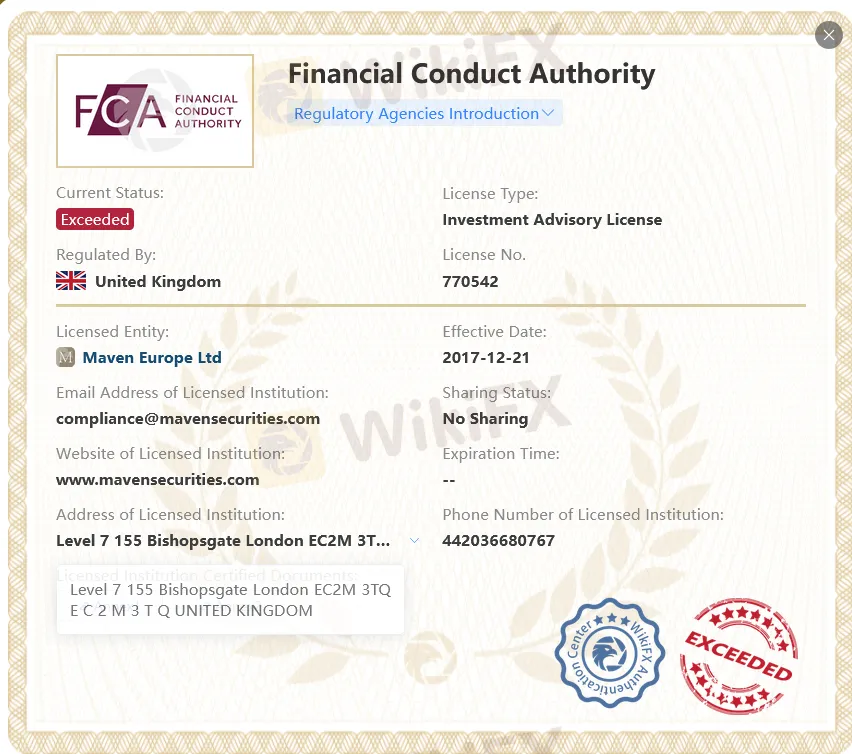

| 監管 | FCA(已超出) |

| 客戶支援 | 電話:+44 203 668 0767 |

| 地址:倫敦,EC2M 3TQ,Bishopsgate 155號7樓 | |

Maven 資訊

Maven 宣稱自2010年成立以來一直是市場領先的專有交易公司,專門從事證券市場。其由英國金融行為監管局(FCA)頒發的牌照已超出。

優缺點

| 優點 | 缺點 |

| 相對悠久的歷史 | 超出 FCA 牌照 |

| 缺乏透明度 |

Maven 是否合法?

否。Maven 目前沒有有效的監管。它只持有超出的 FCA 牌照。請注意風險!

| 監管狀態 | 已超出 |

| 由以下機構監管 | 英國金融行為監管局(FCA) |

| 牌照機構 | Maven 歐洲有限公司 |

| 牌照類型 | 投資諮詢牌照 |

| 牌照號碼 | 770542 |