Tom Nalichowski

1-2年

Based on your own experience, what do you consider the three main benefits of working with C. D. Commodities?

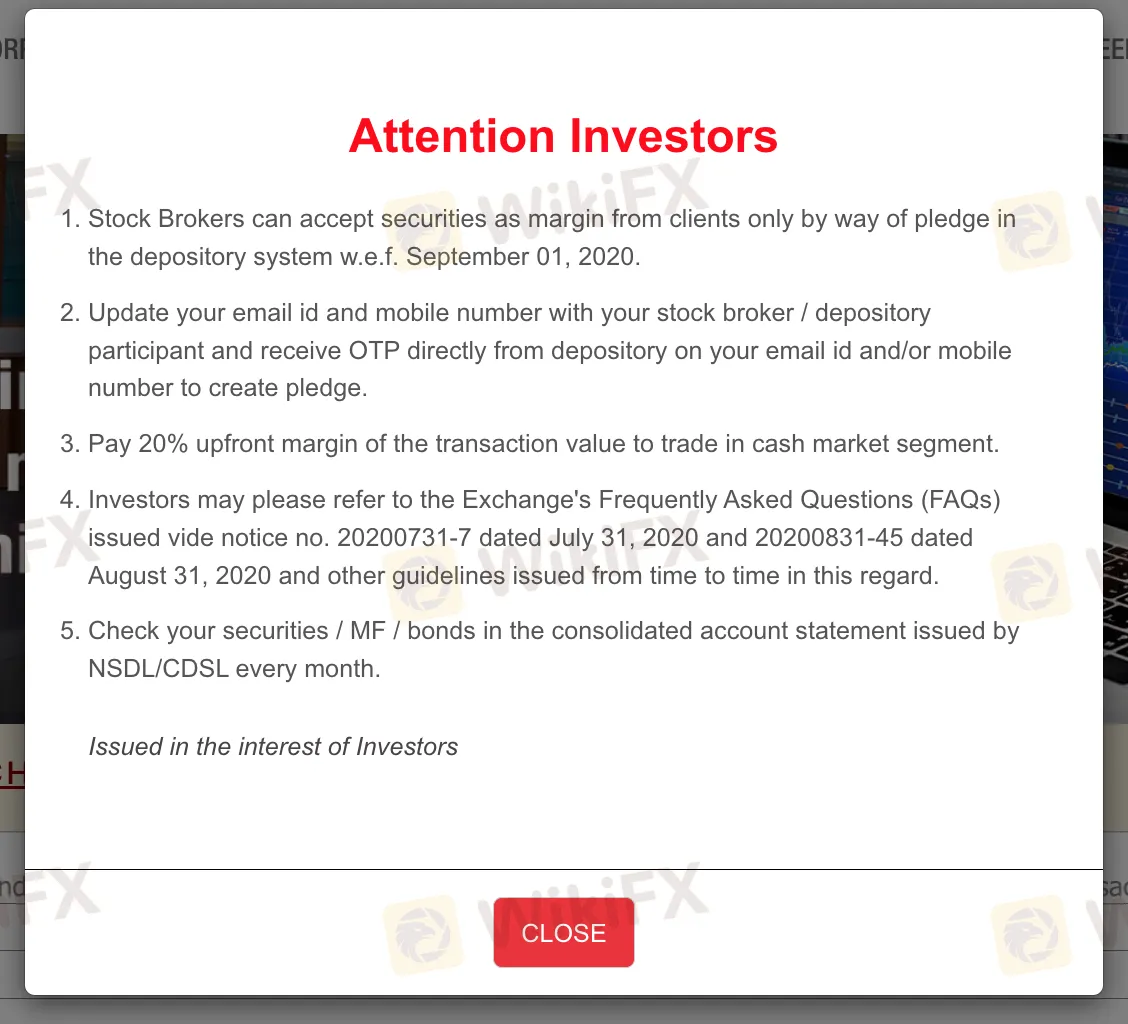

Based on my personal experience as an independent forex trader, I approach C. D. Commodities with considerable caution. When evaluating potential benefits, I must emphasize that any positives are significantly overshadowed by the absence of regulatory oversight. Nonetheless, for me, one relative advantage lies in the range of products available; their offering extends across equities, currencies, commodities, and derivatives, which can be appealing if I'm hoping to diversify beyond just forex. Another practical benefit I’ve noticed is their multiple customer support channels, including several specialized email addresses and phone lines. Quick, clear communication is crucial to me, and having direct contact points for technical, compliance, or trading issues is helpful, especially when urgent matters arise. Lastly, their requirement of a 20% upfront margin in the cash market segment stands out for its transparency in margin policy. While this doesn't necessarily make the broker better than regulated counterparts, I prefer knowing margin commitments in advance to avoid unwelcome surprises.

However, it's essential to highlight that none of these advantages compensate for the very real risks associated with trading through an unregulated entity. I am extremely careful before funding or trading with brokers under such circumstances, prioritizing fund security and clear regulatory protection in all my trading decisions.

Ahmed Harb

1-2年

Could you give a comprehensive overview of the fee structure for C. D. Commodities, covering aspects like commissions and spreads?

As an experienced forex trader, transparency in a broker's fee structure is always at the top of my checklist, especially given how fees directly impact trading costs and long-term profitability. With C. D. Commodities, my research revealed several issues when evaluating their fees. The most specific detail available is that clients are required to pay a 20% upfront margin of the transaction value to trade in the cash market segment. However, beyond this, I found a troubling lack of clarity. There’s no published information outlining their commissions, spreads, or even detailed trading fees for other instruments like derivatives or commodities.

For me, the absence of transparent details about commissions or spreads is a red flag. Without this information, it's impossible to accurately estimate trading costs or compare C. D. Commodities against regulated and more transparent competitors. It's also worth noting that the broker does not provide demo accounts, further limiting my ability to test execution and experience potential fee impacts firsthand. Since trading costs can accumulate rapidly, I would exercise extreme caution before committing real capital. In my opinion, a lack of clear fee disclosure—paired with their unregulated status—means the risks are elevated, and I personally would not be comfortable proceeding without full cost transparency.

Broker Issues

Fees and Spreads

Aman A

1-2年

Does C. D. Commodities impose any charges when depositing or withdrawing funds?

From my own investigation of C. D. Commodities, I’ve found the situation around deposit and withdrawal fees to be quite unclear. The broker does provide contact information and lists a variety of products and services, including equity, currency, and derivatives trading. However, one of my primary concerns is that their official website and public disclosures do not specify details about account types, trading platforms, or crucially, deposit and withdrawal processes or fees.

As someone who strongly values transparency, this omission is a red flag. In my trading experience, reputable brokers are upfront about all potential costs, especially those tied to moving funds in and out. The lack of information means I cannot verify whether C. D. Commodities charges for deposits or withdrawals, or what those costs might be. This uncertainty, combined with their lack of regulatory oversight, increases risk for me as a trader. I would be extremely cautious and hesitant to commit any funds without direct, written clarification from their support on these policies. For me, if fee structures aren’t clear and published, that’s reason enough to look elsewhere for a broker.

Broker Issues

Deposit

Withdrawal

gnsrael

1-2年

How do the different account types provided by C. D. Commodities compare to each other?

From what I’ve gathered about C. D. Commodities, I was unable to find any detailed, transparent information about their account types. In my experience, transparency around account structures—like minimum deposit requirements, leverage, or platform details—is fundamental for proper risk management and informed decision making. Here, the absence of clear account distinctions, alongside the lack of a demo account, stands out as a significant concern for me.

As a trader who relies on testing and comparing broker offerings, I find the inability to access demo accounts or see genuine differences between potential account types quite limiting. It means I can’t evaluate spreads, commissions, or trading conditions in a risk-free setting before committing funds. This is a red flag in the context of prudent trading because it makes the platform’s suitability much harder to assess. Furthermore, the broker’s unregulated status already adds a significant layer of risk. With no oversight, and with essential information about account structures missing, I have to be especially cautious.

For me, the lack of information and transparency is enough to discourage participation. Without concrete account details and with so much uncertainty, I cannot make a well-informed comparison or recommend using this broker for serious trading activities.

Broker Issues

Platform

Account

Instruments

Leverage