基礎資訊

美國

美國

天眼評分

美國

|

5-10年

|

美國

|

5-10年

| https://www.leesegroup.com/

官方網址

評分指數

監管資訊

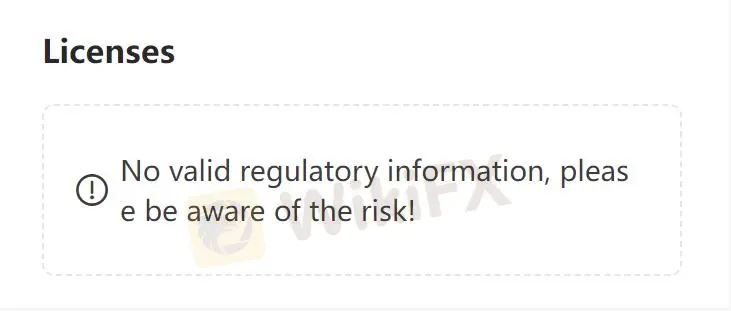

監管資訊暫未查證到有效監管資訊,請注意風險!

美國

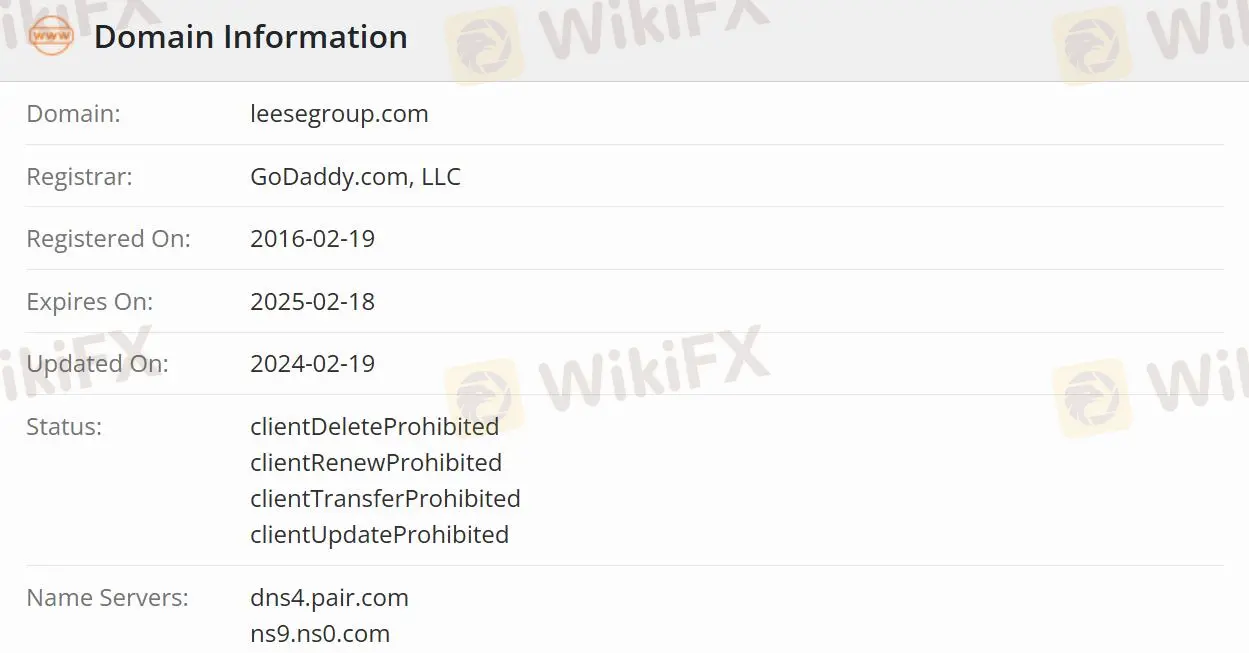

美國 leesegroup.com

leesegroup.com 美國

美國

| Leese Trading Group 綜述 | |

| 成立日期 | 2016-02-19 |

| 註冊國家/地區 | 美國 |

| 監管 | 未受監管 |

| 產品和服務 | 對沖和風險管理/期貨經紀/分析/清算和執行 |

| 客戶支援 | 電子郵件:leesegroup@rcgdirect.com |

| 電話:+1 312-795-7975 | |

Leese Trading Group 致力於為不斷增長的客戶提供一站式的清算、執行、對沖、農業風險管理、農業分析、市場評論、交易技術、數據傳遞和支援服務。該公司接受來自個人、共同所有人、公司、合夥企業、有限責任公司和信託的期貨交易帳戶。

Leese Trading Group 未受監管,相對於受監管的經紀商來說,風險較高。

Leese Trading Group 提供對沖和風險管理、期貨經紀、分析、清算和執行等服務。

對沖和風險管理:為各種農業參與者(從種植者到加工商)提供最佳農業風險管理和監控解決方案,以幫助控制交易風險。

期貨經紀:為了滿足了解並對農產品感興趣的客戶的需求,提供完整的期貨經紀服務。

分析:為客戶提供基本和技術的農業市場評論、即時數據、圖表和分析。提供對對沖、交易和農業風險管理目標至關重要的信息。

清算和執行:Leese Trading Group 的客戶的清算和執行由 Rosenthal Collins Group 負責,該公司是美國和歐洲最大期貨交易所的一個清算會員。

交易者可以通過電子郵件和電話與 Leese Trading Group 聯繫。市場專家每天準備獨家的農業市場研究,通過電子郵件、音頻播客、社交媒體和 LTG Ag Insight 門戶進行分發。

| 聯繫方式 | 詳細資訊 |

| 電子郵件 | leesegroup@rcgdirect.com |

| 電話 | +1 312-795-7975 |

| 支援語言 | 英語 |

| 網站語言 | 英語 |

| 實體地址 | / |

From my experience navigating brokers like RCG, especially those flagged as unregulated and carrying high potential risk, I approach any withdrawal process with heightened caution. Given that RCG lacks valid regulatory credentials and operates under a suspicious license, I know from past dealings with similar entities that documentation requirements can vary widely and may not be clearly outlined upfront. Typically, reliable brokers will ask for standard identification documents before processing withdrawals—such as a government-issued photo ID, proof of address (like a utility bill or bank statement), and sometimes proof of bank account ownership. However, unregulated entities like RCG often have inconsistent or opaque procedures, which for me is a significant red flag. I always ensure that my submitted documents are provided through secure channels, but with RCG’s ambiguous status, I am particularly wary about sharing sensitive information. I would strongly advise confirming directly with their customer support, double-checking their communication is secure, and maintaining records of all correspondences. Ultimately, due to RCG’s lack of regulatory oversight and the warnings of high risk, I personally weigh the safety of my personal data just as much as the funds I am withdrawing. If there is any confusion or reluctance on their part to clarify required documentation, for me, that signals an added reason for caution before proceeding.

In my experience as a forex trader, trust and reliability are non-negotiable qualities in choosing a broker. Looking at RCG—operated by Leese Trading Group—I have significant reservations. Although the firm has been active for over five years and offers specialized services like hedging, futures brokerage, agricultural analysis, and clearing via established partners, its lack of valid regulatory oversight stands out as the most critical red flag for me. Reliable regulation is essential because it enforces standards for client fund protection, ethical business practices, and provides a framework for dispute resolution. RCG carries a "high potential risk" warning and, more specifically, operates without any recognized regulatory license. This absence means there's no third-party supervision ensuring the safety of my funds or the integrity of their business practices. Even though RCG offers tailored agricultural market services and accessible customer support, the risks originating from unregulated status outweigh these offerings for me. After years of seeing traders harmed by brokers lacking proper oversight, I am deeply cautious about placing capital with anyone in this situation. For my own trading, I insist on brokers regulated by reputable bodies in major jurisdictions. Without this fundamental backbone, I cannot confidently call RCG trustworthy or reliable, regardless of their product diversity or client-focused approach. Safety and accountability always come first in my decisions.

From my experience and the details provided about RCG, I have to point out that there is no clear, verifiable information about whether RCG offers fixed or variable spreads. The broker’s WikiFX profile focuses on their futures brokerage, agricultural market analysis, and risk management services, but lacks transparent disclosure on spread types—something I consider a red flag, especially for anyone who actively manages risk around spreads during volatile news events. As a trader, knowing whether a broker uses fixed or variable spreads is fundamental because it directly affects trading costs and risk exposure; variable spreads, for instance, can dramatically widen during high volatility, while fixed spreads may be subject to slippage or execution caveats with unregulated brokers. RCG’s unregulated status and a zero risk management rating further concern me. Without robust regulatory oversight, there’s no guarantee the broker maintains fair pricing or clear execution during periods of market stress. In my practice, I would be extremely cautious about engaging with any broker lacking explicit spread, execution, and regulation details. When managing trades around major news, the integrity and transparency of a broker’s pricing model—and its regulation—give me confidence or tell me when to steer clear. With RCG, these critical answers simply aren’t available, and for me, that’s a risk not worth taking.

From my experience as a forex trader, my first concern with RCG is its clear lack of valid regulation. They operate without oversight from any recognized financial authority, which, for me, significantly increases the risks around the safety of client funds and the recourse available if issues arise. The WikiFX page not only points out that RCG is unregulated, but also flags a "suspicious regulatory license" and "suspicious scope of business"—both serious red flags that would make me approach with extreme caution. In the forex industry, regulation is crucial because it mandates certain standards regarding transparency, client fund protection, and dispute resolution. When a broker lacks this, there are fewer formal avenues for support if something goes wrong. RCG is based in the United States and has been operating for five to ten years. While their longevity might seem reassuring, the absence of regulatory information overrides this benefit for me. They advertise services like futures brokerage, agricultural risk management, analysis, and clearing—but none of these offerings are subject to third-party supervision, so I have to weigh any potential opportunity against the substantial risk of loss or account issues. Ultimately, with the risk management score at zero and repeated warnings about potential risk, I would be extremely hesitant to trust this broker with any significant trading capital. For me, personal financial safety and the ability to access fair, transparent processes in case of disputes are simply too important to compromise, no matter what products or research are offered.

請輸入...