Unternehmensprofil

| Leese Trading Group Überprüfungszusammenfassung | |

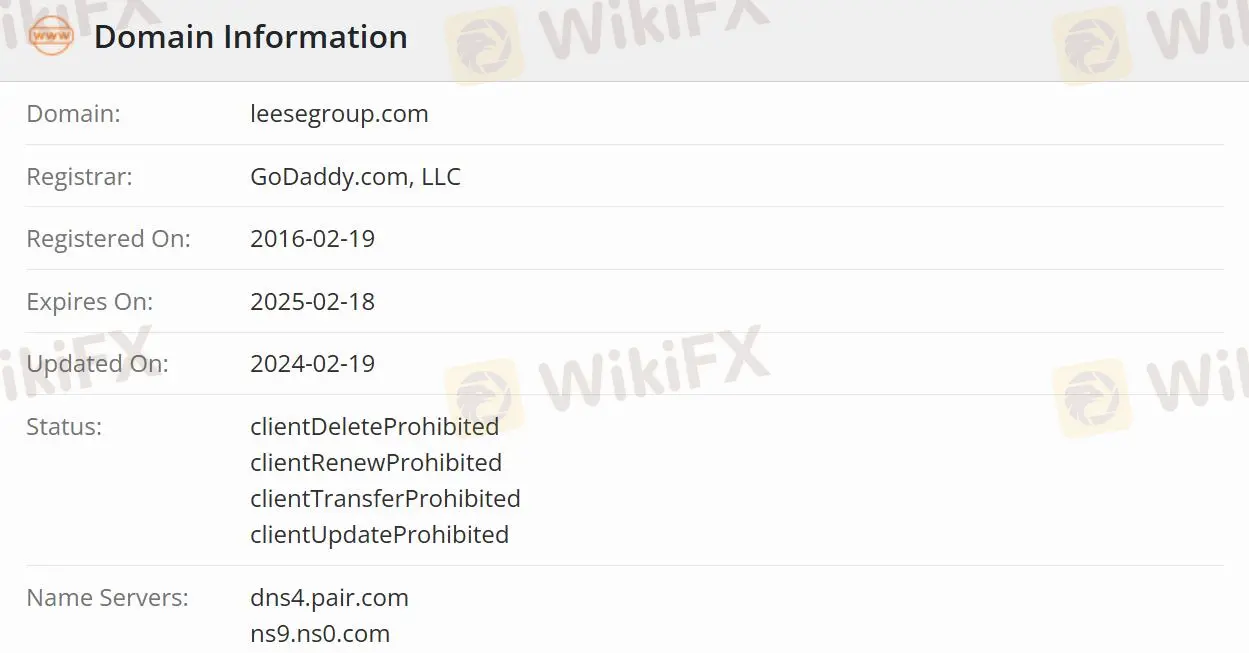

| Gegründet | 2016-02-19 |

| Registriertes Land/Region | Vereinigte Staaten |

| Regulierung | Unreguliert |

| Produkte und Dienstleistungen | Absicherung & Risikomanagement/Futures-Brokerage/Analyse/Klärung & Ausführung |

| Kundensupport | E-Mail: leesegroup@rcgdirect.com |

| Telefon: +1 312-795-7975 | |

Leese Trading Group Informationen

Leese Trading Group widmet sich der Betreuung einer wachsenden Liste von Kunden als einziger Ansprechpartner für Clearing, Ausführung, Absicherung, Risikomanagement in der Landwirtschaft, landwirtschaftliche Analyse, Marktberichterstattung, Handelstechnologie, Datenlieferung und Support. Das Unternehmen akzeptiert Futures-Handelskonten von Einzelpersonen, gemeinsamen Eigentümern, Unternehmen, Partnerschaften, Gesellschaften mit beschränkter Haftung und Trusts.

Ist Leese Trading Group seriös?

Leese Trading Group ist nicht reguliert, was es weniger sicher macht als regulierte Broker.

Welche Produkte und Dienstleistungen bietet Leese Trading Group an?

Leese Trading Group bietet Zugang zu Absicherung & Risikomanagement, Futures-Brokerage, Analyse, Klärung & Ausführung und so weiter.

Absicherung & Risikomanagement: Bietet optimale Lösungen für das Risikomanagement und die Überwachung in der Landwirtschaft, um das Handelsrisiko für verschiedene landwirtschaftliche Teilnehmer von Erzeugern bis hin zu Verarbeitern zu kontrollieren.

Futures-Brokerage: Bietet umfassende Futures-Brokerage-Dienstleistungen, die auf die Bedürfnisse von Kunden zugeschnitten sind, die sich mit landwirtschaftlichen Produkten auskennen und daran interessiert sind.

Analyse: Bietet Kunden sowohl fundamentale als auch technische Marktberichterstattung, aktuelle Daten, Charts und Analysen. Liefert Informationen, die für Absicherung, Handel und das Risikomanagement in der Landwirtschaft von entscheidender Bedeutung sind.

Klärung & Ausführung: Die Klärung und Ausführung für Leese Trading Group-Kunden erfolgt über Rosenthal Collins Group, ein Clearing-Mitglied an einigen der größten Futures-Börsen in den Vereinigten Staaten und Europa.

Kundensupport-Optionen

Trader können über E-Mail und Telefon mit Leese Trading Group Kontakt aufnehmen. Die Marktspezialisten erstellen exklusive landwirtschaftliche Marktforschung, die täglich per E-Mail, Audio-Podcasts, sozialen Medien und über das LTG Ag Insight-Portal verbreitet wird.

| Kontaktmöglichkeiten | Details |

| leesegroup@rcgdirect.com | |

| Telefon | +1 312-795-7975 |

| Unterstützte Sprache | Englisch |

| Websprache | Englisch |

| Physische Adresse | / |