公司简介

| Leese Trading Group 评论摘要 | |

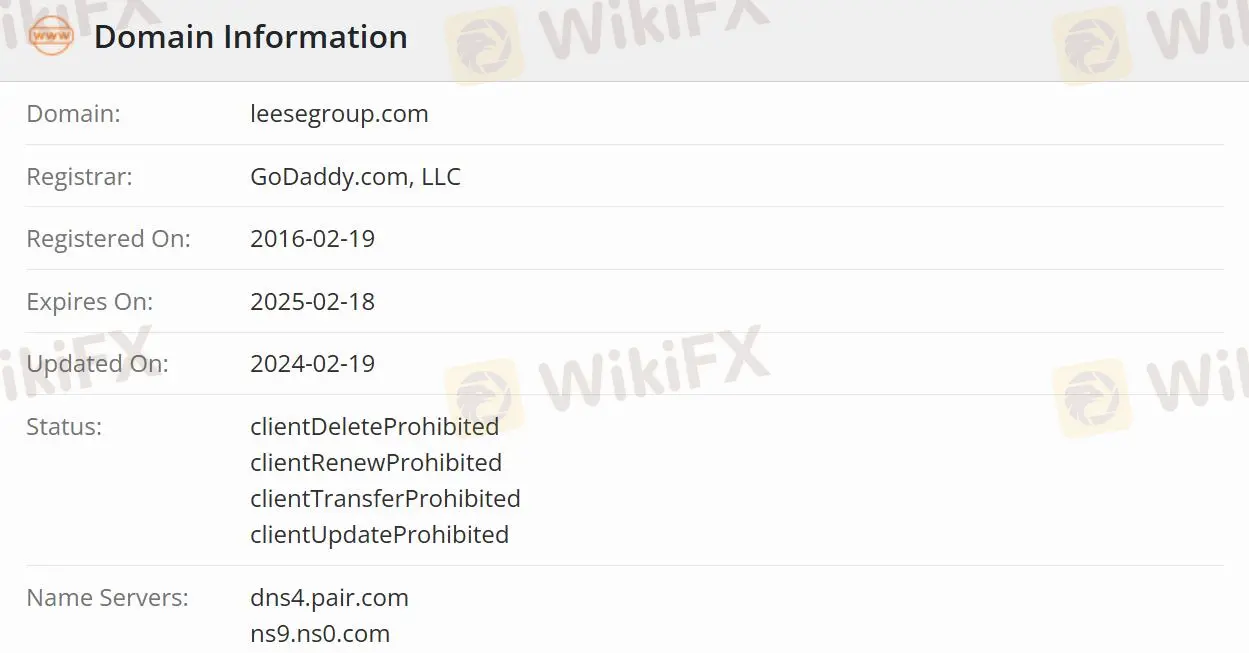

| 成立日期 | 2016-02-19 |

| 注册国家/地区 | 美国 |

| 监管 | 未受监管 |

| 产品和服务 | 对冲和风险管理/期货经纪/分析/结算和执行 |

| 客户支持 | 电子邮件:leesegroup@rcgdirect.com |

| 电话:+1 312-795-7975 | |

Leese Trading Group 信息

Leese Trading Group 致力于为越来越多的客户提供清算、执行、对冲、农业风险管理、农业分析、市场评论、交易技术、数据传递和支持等服务。该公司接受来自个人、联合所有者、公司、合伙企业、有限责任公司和信托的期货交易账户。

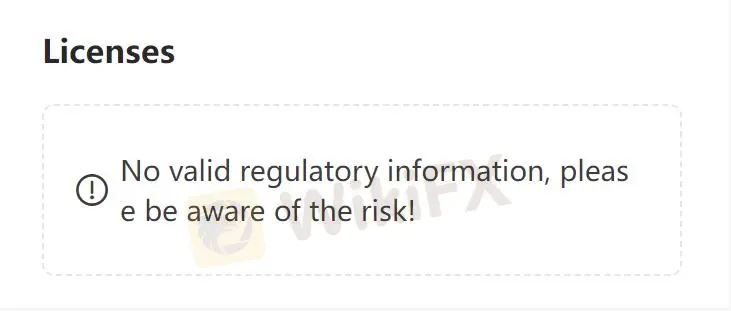

Leese Trading Group 是否合法?

Leese Trading Group 没有受到监管,比受监管的经纪商更不安全。

Leese Trading Group 提供哪些产品和服务?

Leese Trading Group 提供对冲和风险管理、期货经纪、分析、结算和执行等服务。

对冲和风险管理:为各种农业参与者从种植者到加工商提供最佳农业风险管理和监控解决方案,帮助控制交易风险。

期货经纪:为了满足了解和对农产品感兴趣的客户的需求,提供完整的期货经纪服务。

分析:为客户提供基本和技术农业市场评论、突发数据、图表和分析。提供对对冲、交易和农业风险管理目标至关重要的信息。

结算和执行:Leese Trading Group 的结算和执行由 Rosenthal Collins Group 完成,该公司是美国和欧洲一些最大期货交易所的结算会员。

客户支持选项

交易者可以通过电子邮件和电话与 Leese Trading Group 联系。市场专家每天准备独家农业市场研究,并通过电子邮件、音频播客、社交媒体和 LTG Ag Insight 门户进行分发。

| 联系方式 | 详细信息 |

| 电子邮件 | leesegroup@rcgdirect.com |

| 电话 | +1 312-795-7975 |

| 支持语言 | 英语 |

| 网站语言 | 英语 |

| 实际地址 | / |