Unternehmensprofil

| C. D. CommoditiesBerichtszusammenfassung | |

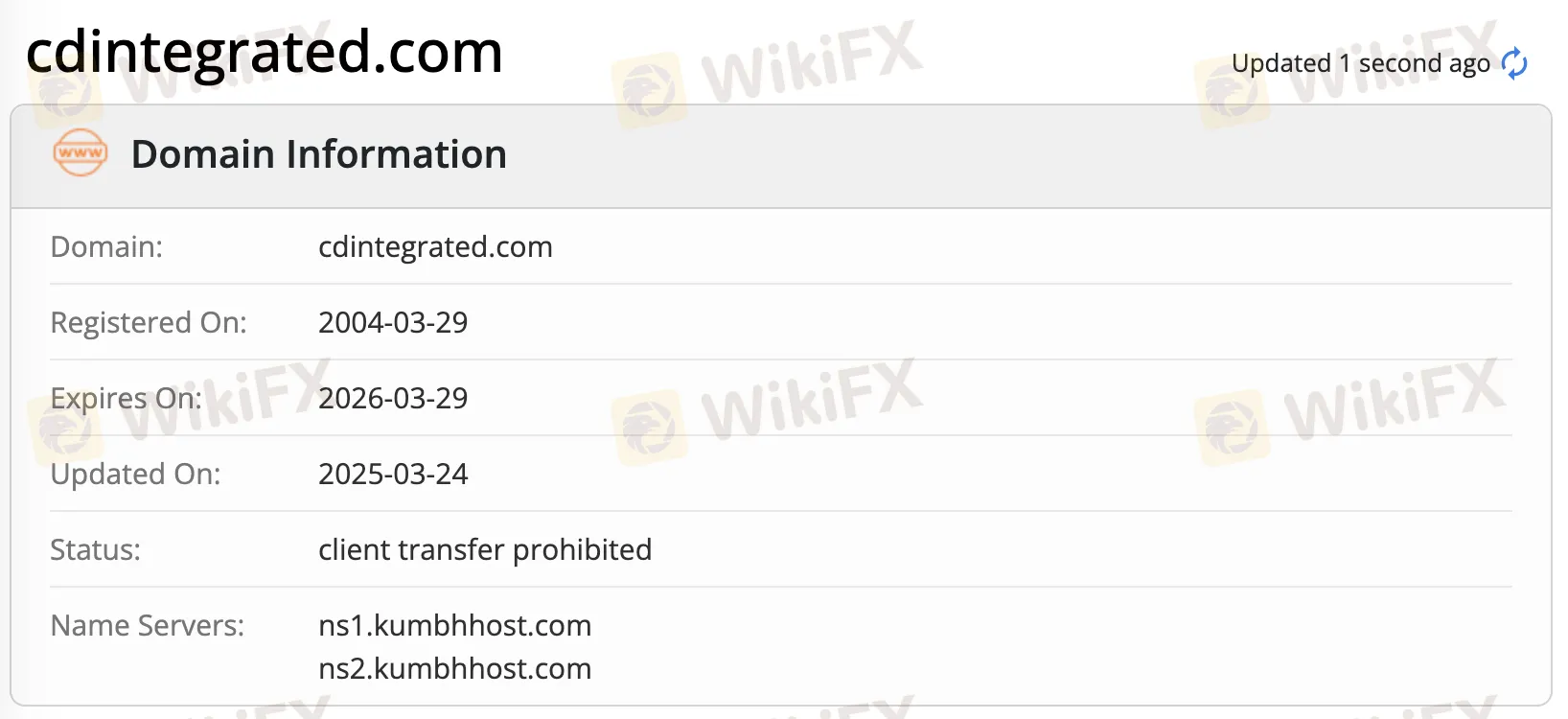

| Gegründet | 2004 |

| Registriertes Land/Region | Indien |

| Regulierung | Keine Regulierung |

| Produkte & Dienstleistungen | Aktien, Währungen und Derivate, Rohstoffe, Haus-Training |

| Demo-Konto | ❌ |

| Kundensupport | Tel: Demat: 079 - 35026099 Trading: 079 - 35026100-102 Karriere: 079 - 35026119 Compliance: 079 - 35026111 |

| E-Mail: Technisch: tech@cdintegrated.co.in Neuer Kunde: trading@cdintegrated.co.in Demat: dphelp@cdintegrated.co.in Management: parashar@cdintegrated.co.in parthiv@cdintegrated.co.in Karriere: career@cdintegrated.co.in Webseite: www.cdintegrated.com Investorbeschwerde: compliance@cdintegrated.co.in | |

C. D. Commodities Informationen

C. D. Commodities ist ein unregulierter Broker, der Produkte und Dienstleistungen zu Aktien, Währungen und Derivaten, Rohstoffen und Haus-Training anbietet.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Kontaktmöglichkeiten | Keine Demokonten |

| Verschiedene Produkte & Dienstleistungen |

Ist C. D. Commodities legitim?

Nein. C. D. Commodities hat derzeit keine gültigen Vorschriften. Bitte beachten Sie das Risiko!

Produkte & Dienstleistungen

C. D. Commodities bietet Produkte und Dienstleistungen zu Aktien, Währungen und Derivaten, Rohstoffen und Haus-Training an.

| Produkte & Dienstleistungen |

| Aktien, Währungen und Derivate |

| Rohstoffe |

| Haus-Training |

C. D. Commodities Gebühren

Handelsgebühren

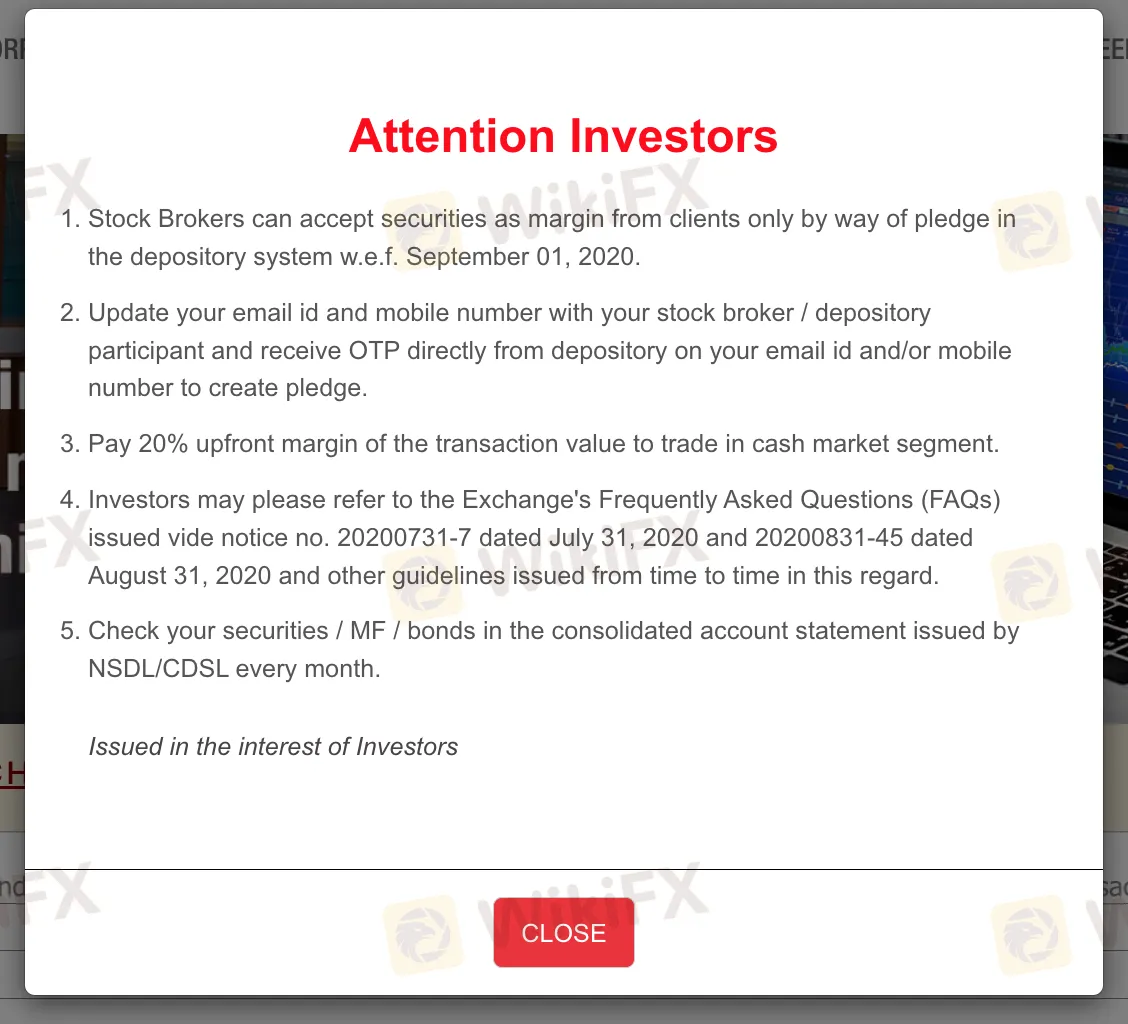

Kunden müssen einen 20%igen Vorschuss des Transaktionswerts zahlen, um im Bargeldmarktsegment zu handeln.

Weitere Informationen

Die Website des Brokers hat keine klaren Informationen über Handelsplattform, Kontotyp oder Einzahlungs-/Abhebungsbetrag bereitgestellt.