Perfil de la compañía

| C. D. CommoditiesResumen de la reseña | |

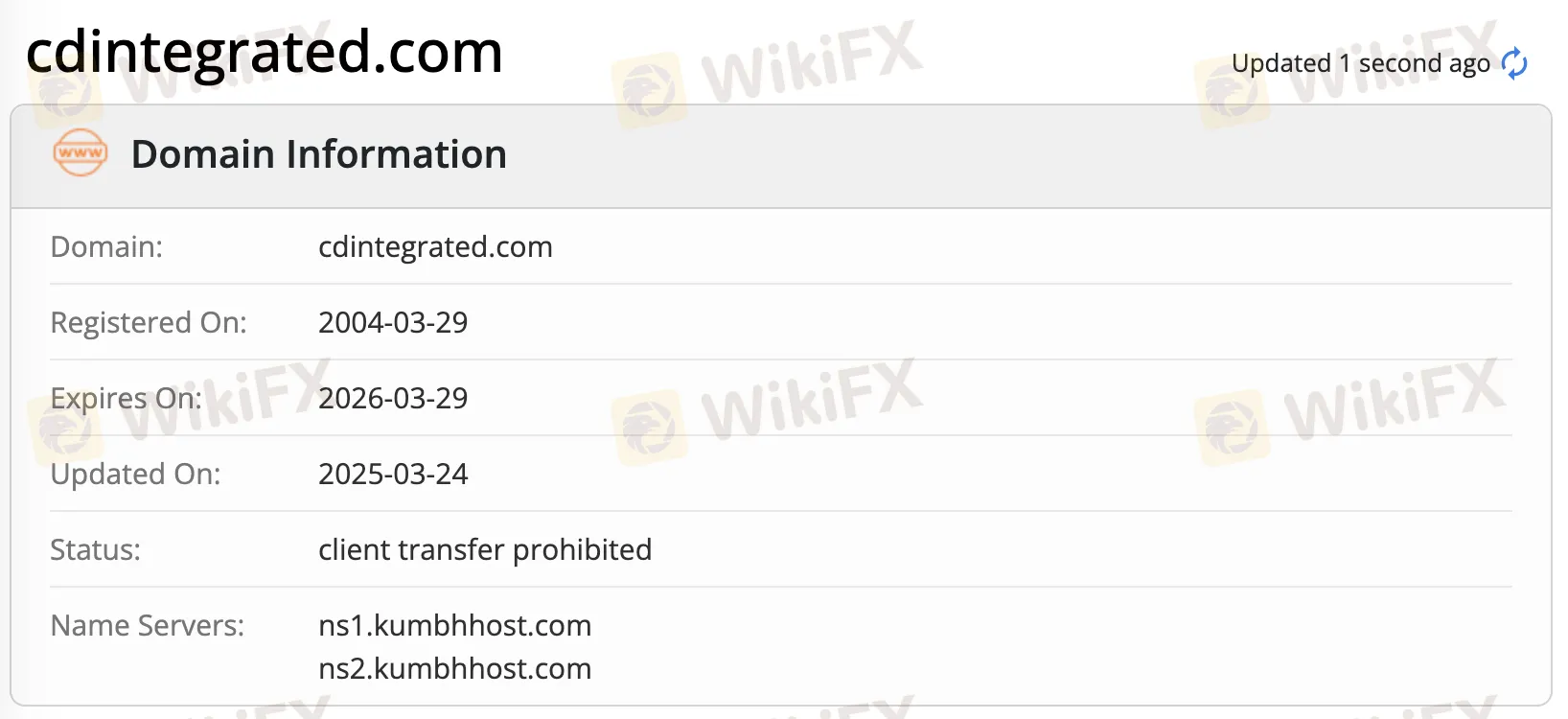

| Establecido | 2004 |

| País/Región registrado | India |

| Regulación | Sin regulación |

| Productos y Servicios | Acciones, divisas y derivados, materias primas, formación en casa |

| Cuenta de demostración | ❌ |

| Soporte al cliente | Tel: Demat: 079 - 35026099 Trading: 079 - 35026100-102 Carrera: 079 - 35026119 Cumplimiento: 079 - 35026111 |

| Correo electrónico: Técnico: tech@cdintegrated.co.in Nuevo cliente: trading@cdintegrated.co.in Demat: dphelp@cdintegrated.co.in Gestión: parashar@cdintegrated.co.in parthiv@cdintegrated.co.in Carrera: career@cdintegrated.co.in Sitio web: www.cdintegrated.com Quejas de inversores: compliance@cdintegrated.co.in | |

Información de C. D. Commodities

C. D. Commodities es un corredor no regulado que ofrece productos y servicios en acciones, divisas y derivados, materias primas y formación en casa.

Pros y contras

| Pros | Contras |

| Varios canales de contacto | Sin cuentas de demostración |

| Varios productos y servicios |

¿Es C. D. Commodities legítimo?

No. C. D. Commodities actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo!

Productos y Servicios

C. D. Commodities ofrece productos y servicios en acciones, divisas y derivados, materias primas y formación en casa.

| Productos y Servicios |

| Acciones, divisas y derivados |

| Materias primas |

| Formación en casa |

Tarifas de C. D. Commodities

Comisiones de negociación

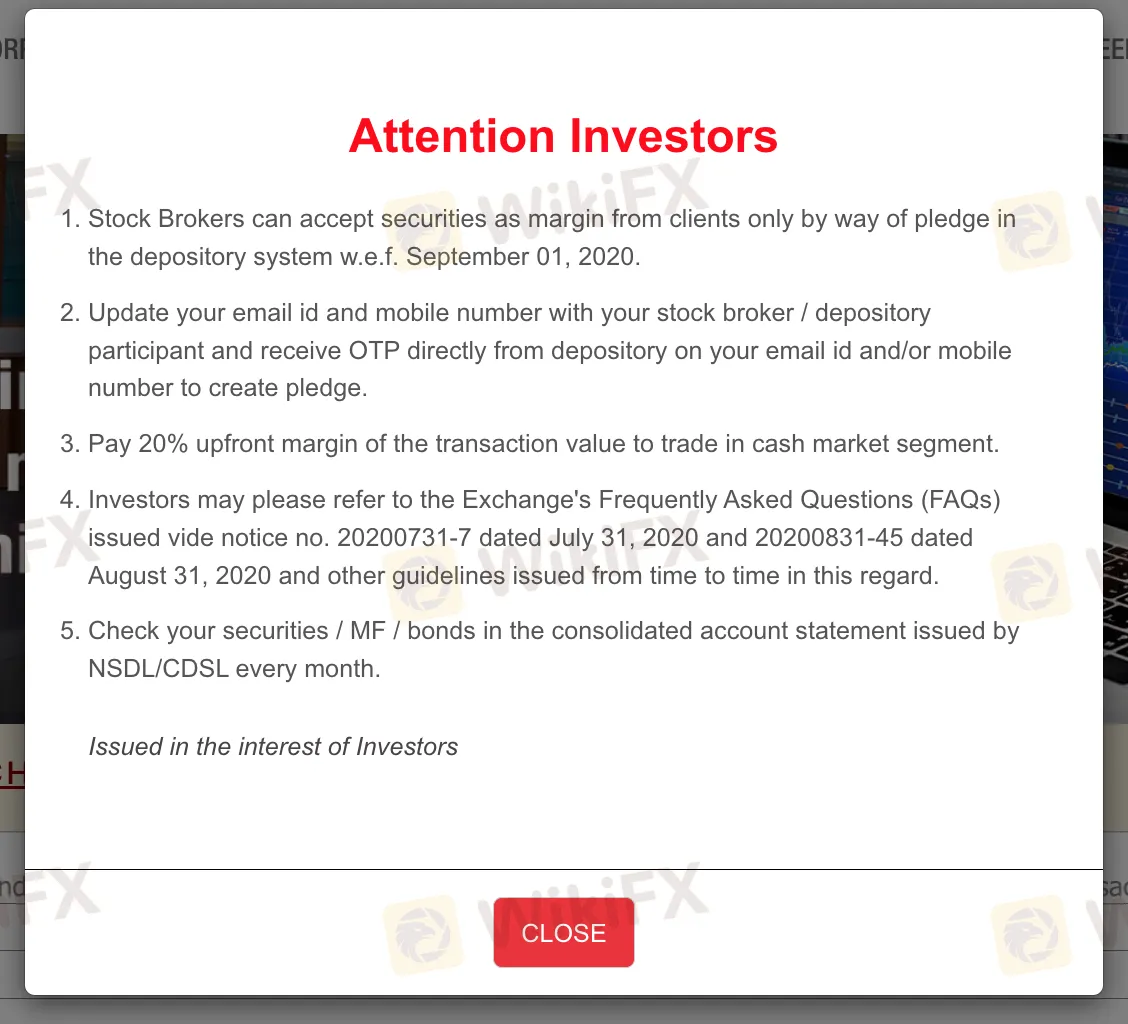

Los clientes deben pagar un margen inicial del 20% del valor de la transacción para operar en el segmento del mercado de efectivo.

Otra información

El sitio web del corredor no ha proporcionado claramente información sobre la plataforma de negociación, tipo de cuenta o cantidad de depósito/retiro.