Giới thiệu doanh nghiệp

| C. D. CommoditiesTóm tắt Đánh giá | |

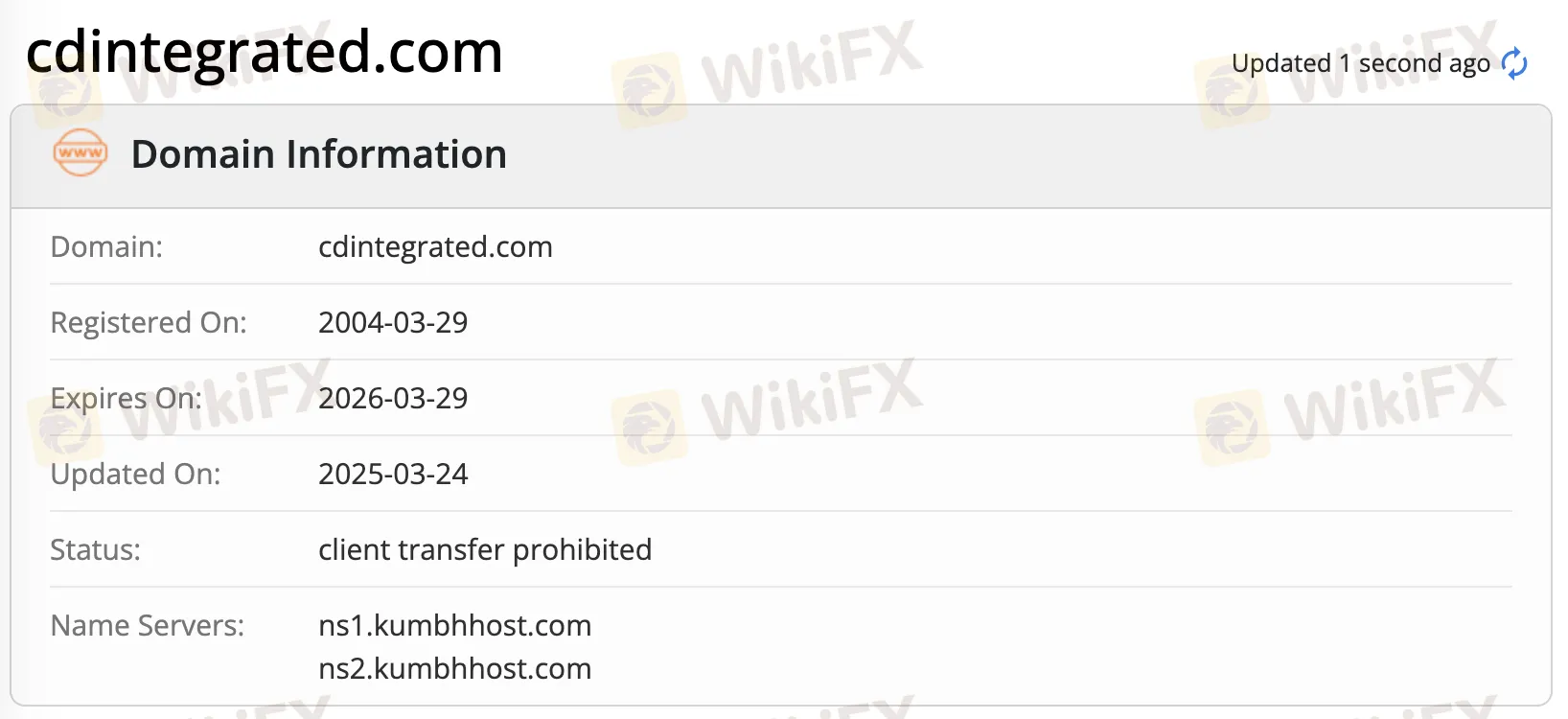

| Thành lập | 2004 |

| Quốc gia/Vùng đăng ký | Ấn Độ |

| Quy định | Không có quy định |

| Sản phẩm & Dịch vụ | Cổ phiếu, tiền tệ và dẫn xuất, hàng hóa, đào tạo nhà |

| Tài khoản Demo | ❌ |

| Hỗ trợ Khách hàng | Điện thoại: Demat : 079 - 35026099Trading : 079 - 35026100-102Nghề nghiệp : 079 - 35026119Tuân thủ : 079 - 35026111 |

| Email: Kỹ thuật: tech@cdintegrated.co.inKhách hàng mới: trading@cdintegrated.co.inDemat: dphelp@cdintegrated.co.inQuản lý: parashar@cdintegrated.co.inparthiv@cdintegrated.co.inNghề nghiệp: career@cdintegrated.co.inTrang web: www.cdintegrated.comKhiếu nại của Nhà đầu tư: compliance@cdintegrated.co.in | |

Thông tin về C. D. Commodities

C. D. Commodities là một nhà môi giới không được quy định, cung cấp sản phẩm và dịch vụ về cổ phiếu, tiền tệ và dẫn xuất, hàng hóa và đào tạo nhà.

Ưu điểm và Nhược điểm

| Ưu điểm | Nhược điểm |

| Nhiều kênh liên hệ | Không có tài khoản demo |

| Nhiều sản phẩm & dịch vụ |

Có phải C. D. Commodities là hợp lệ?

Không. Hiện tại, C. D. Commodities không có quy định hợp lệ. Vui lòng chú ý đến rủi ro!

Sản phẩm & Dịch vụ

C. D. Commodities cung cấp sản phẩm và dịch vụ về cổ phiếu, tiền tệ và dẫn xuất, hàng hóa và đào tạo nhà.

| Sản phẩm & Dịch vụ |

| Cổ phiếu, tiền tệ và dẫn xuất |

| Hàng hóa |

| Đào tạo nhà |

Phí của C. D. Commodities

Phí Giao dịch

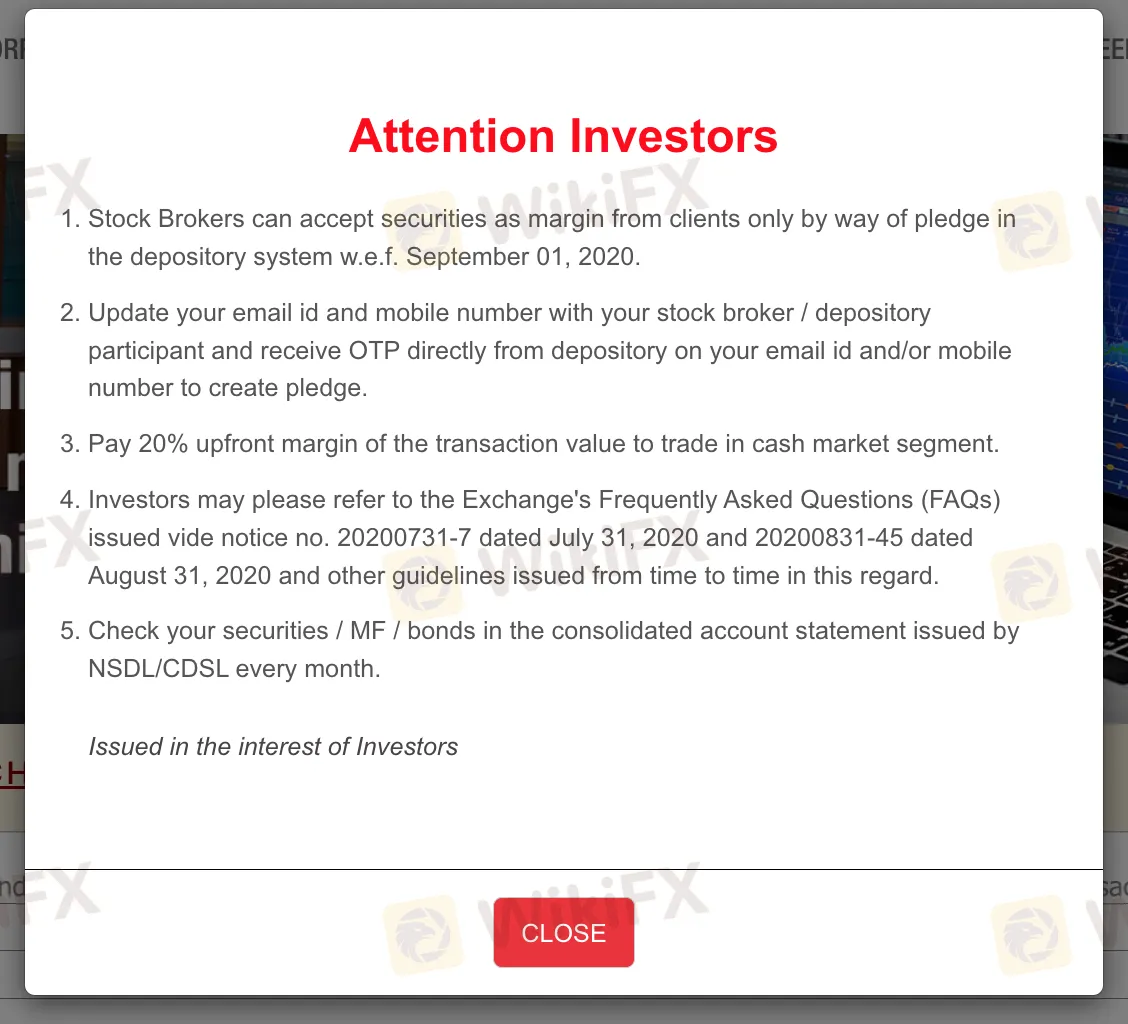

Khách hàng cần thanh toán 20% tiền đặt cọc trước trên giá trị giao dịch để giao dịch trong phân khúc thị trường tiền mặt.

Thông tin khác

Trang web của nhà môi giới chưa cung cấp rõ ràng thông tin về nền tảng giao dịch, loại tài khoản hoặc số tiền gửi/rút.