Company Summary

| C. D. CommoditiesReview Summary | |

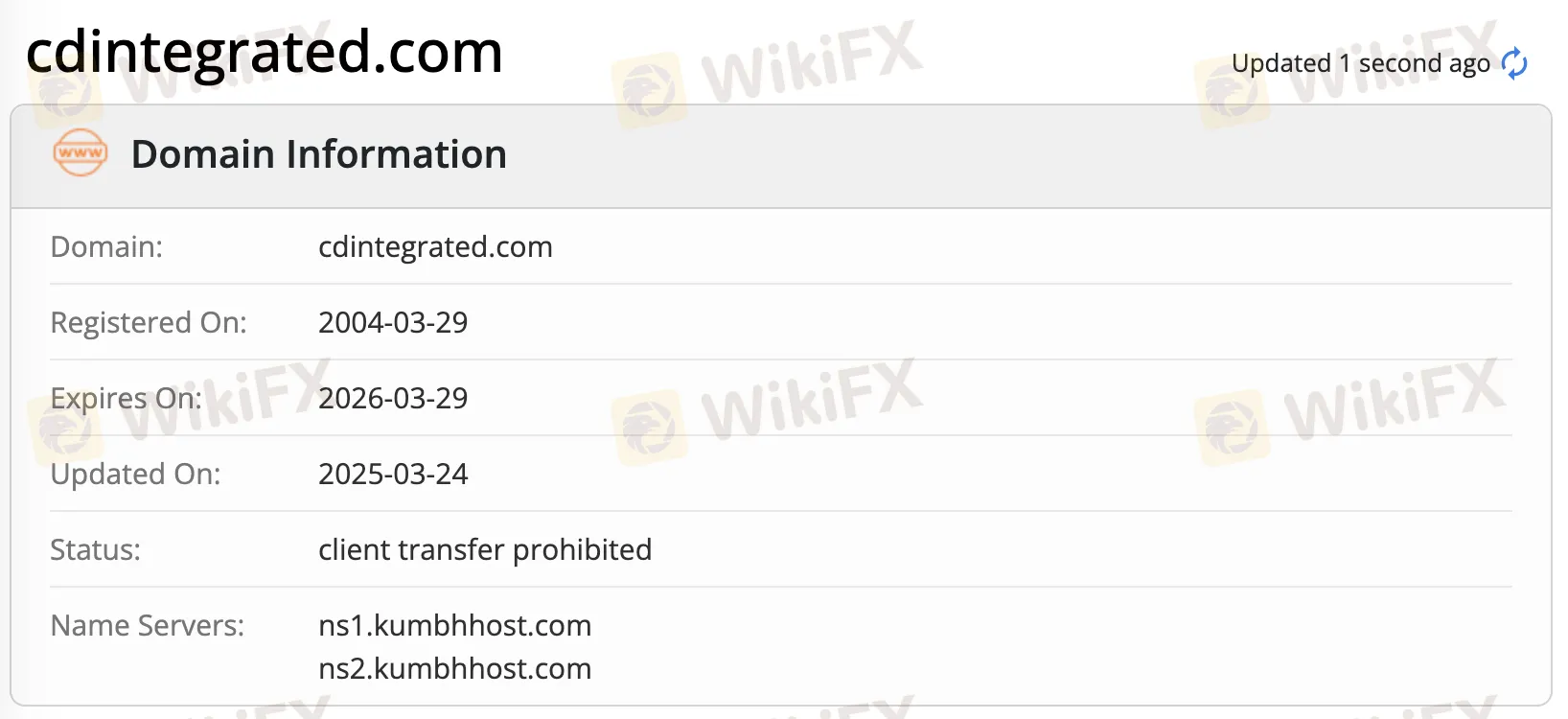

| Founded | 2004 |

| Registered Country/Region | India |

| Regulation | No regulation |

| Products & Services | Equity, currency and derivatives, commodities, house-traning |

| Demo Account | ❌ |

| Customer Support | Tel:Demat : 079 - 35026099Trading : 079 - 35026100-102Career : 079 - 35026119Compliance : 079 - 35026111 |

| Email:Technical: tech@cdintegrated.co.inNew Client:trading@cdintegrated.co.inDemat: dphelp@cdintegrated.co.inManagement: parashar@cdintegrated.co.inparthiv@cdintegrated.co.inCareer: career@cdintegrated.co.inWebsite: www.cdintegrated.comInvestor Complaint: compliance@cdintegrated.co.in | |

C. D. Commodities Information

C. D. Commodities is an unregulated broker, offering products and services on equity, currency and derivatives, commodities and house-traning.

Pros and Cons

| Pros | Cons |

| Various contact channels | No demo accounts |

| Various products & services |

Is C. D. Commodities Legit?

No. C. D. Commodities currently has no valid regulations. Please be aware of the risk!

Products & Services

C. D. Commodities offers products and services on equity, currency and derivatives, commodities and house-training.

| Products & Services |

| Equity, currency and derivatives |

| Commodities |

| House-training |

C. D. Commodities Fees

Trading Fees

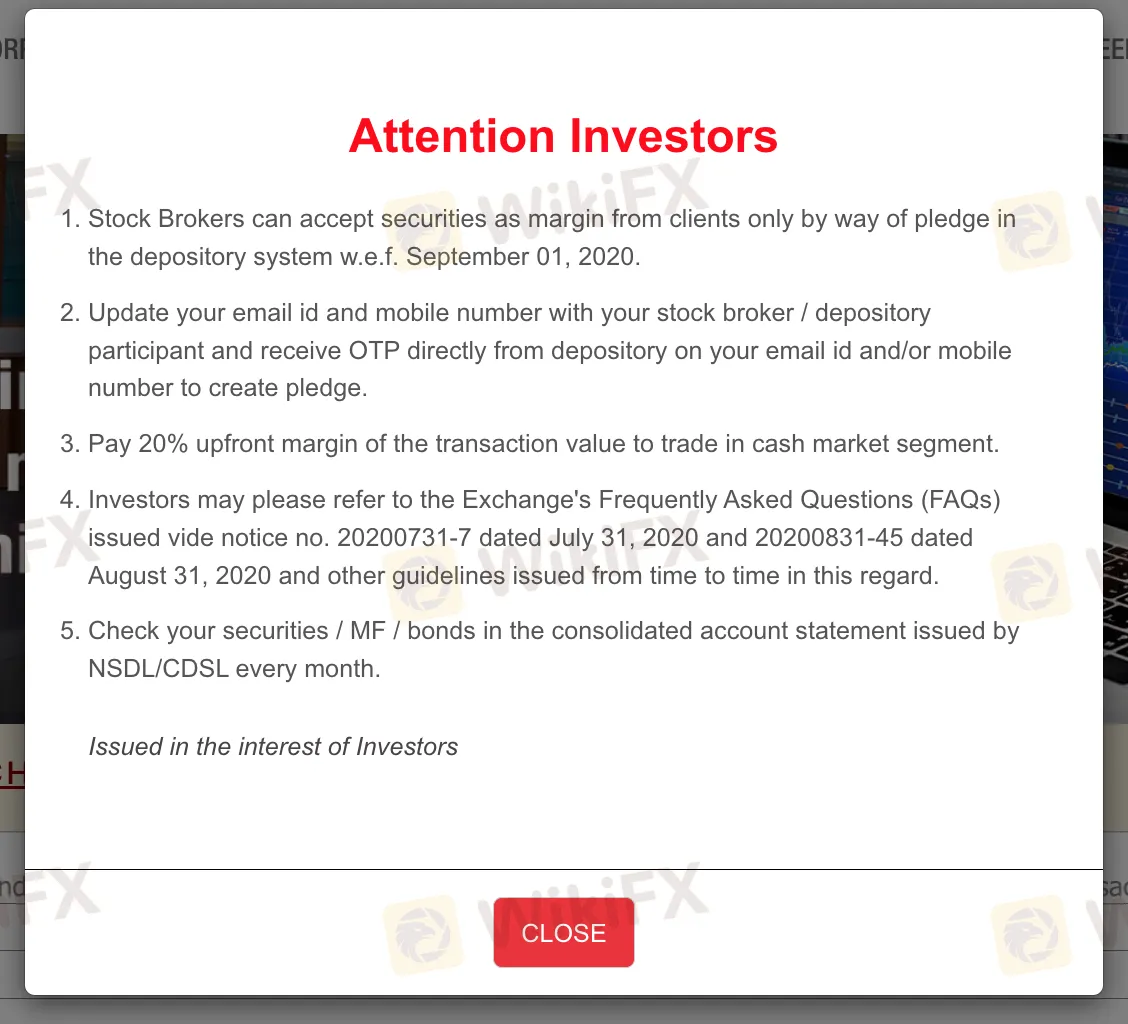

Clients should pay a 20% upfront margin of the transaction value to trade in the cash market segment.

Other Information

The broker's website has not clearly provided information about trading platform, account type or deposit/withdrawal amount.