Şirket özeti

| Monex Europe İnceleme Özeti | |

| Kuruluş Yılı | 1985 |

| Kayıtlı Ülke/Bölge | Meksika |

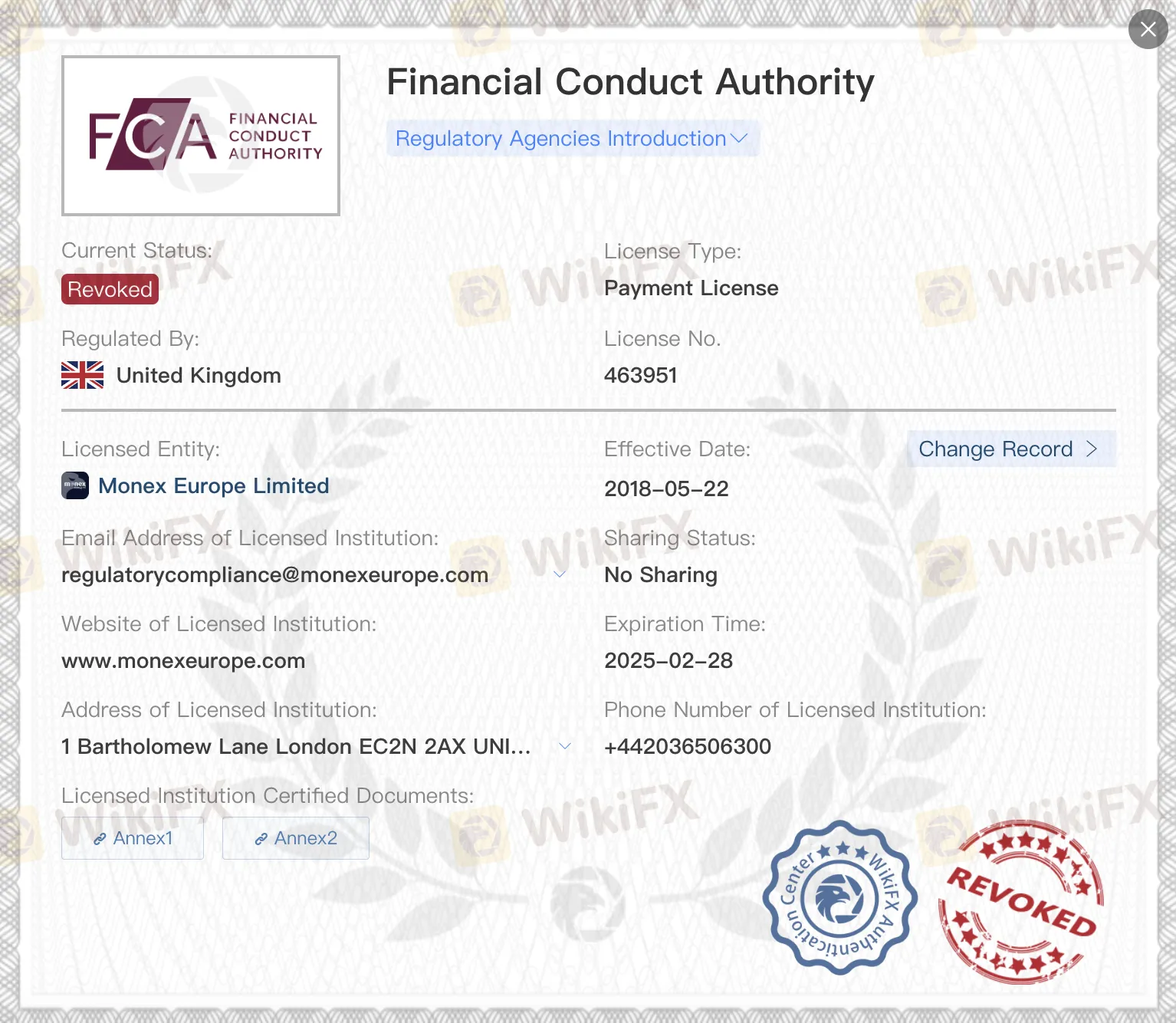

| Düzenleme | FCA (İptal Edildi) |

| Ürünler ve Hizmetler | Spot FX, Forward İşlemleri, FX Türevleri, FX Hedge, Küresel Ödemeler, API Entegrasyonu, Çoklu Para Birimi Hesapları |

| Deneme Hesabı | ❌ |

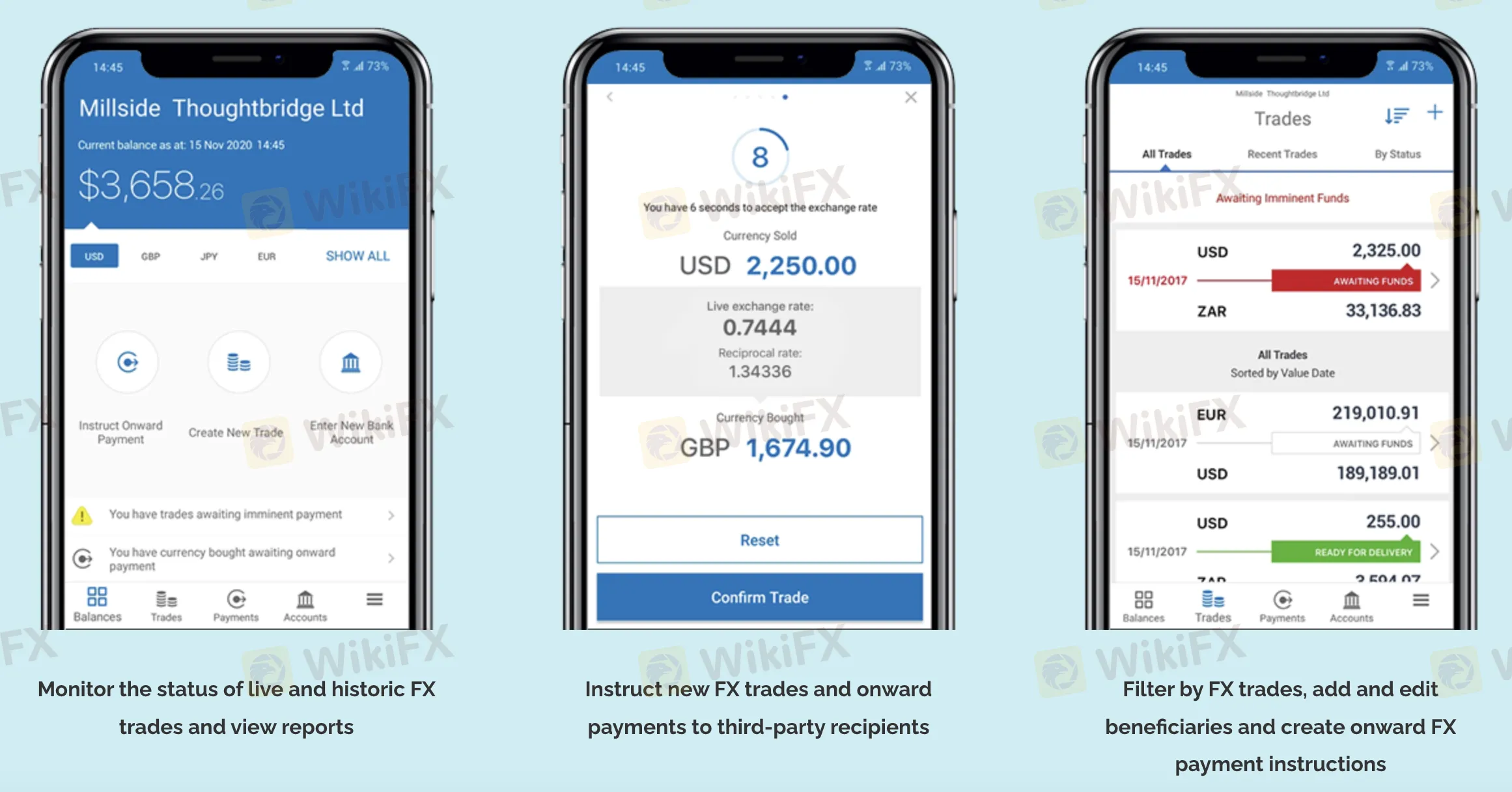

| İşlem Platformu | Monex Pay Platformu (Web, iOS, Android), Monex REST API |

| Müşteri Desteği | Tel/WhatsApp: +44 (0) 203 650 6400 |

| E-posta: support@monexpay.com | |

Monex Europe Bilgileri

Monex Europe, 1985 yılında kurulmuş ve merkezi Meksika'da bulunan, daha önce Birleşik Krallık'ta FCA tarafından düzenlenen ancak lisansı daha sonra iptal edilen bir kuruluştur. Şirket, kurumsal müşterilere tamamen yabancı para ve sınır ötesi ödeme hizmetleri sunmaktadır. Çözümleri, Monex Pay platformunu ve entegrasyon ile otomasyon için bir REST API'yı içerir.

Artıları ve Eksileri

| Artıları | Eksileri |

| Kurumsal düzeyde FX ve ödeme çözümleri sunar | FCA lisansı iptal edildi |

| 60'tan fazla para birimini ve 40'a kadar çoklu para birimi cüzdanını destekler | Deneme hesapları mevcut değil |

| Mobil ve API tabanlı işlem ve ödeme platformları mevcuttur | Ücretlerle ilgili sınırlı bilgi |

Monex Europe Güvenilir mi?

Hayır, düzenlenmemiştir. Monex Europe Limited, Birleşik Krallık Finansal Davranış Otoritesi (FCA) tarafından düzenlenirdi. Ödeme lisans numaraları 463951 idi. Ancak lisansları artık geçerli değil çünkü lisans durumu "İptal Edildi" olarak gösteriliyor.

Ürünler ve Hizmetler

Monex Europe çok çeşitli FX ürünleri, risk yönetimi araçları ve küresel ödeme hizmetleri sunmaktadır. Spot ve vadeli FX, FX türevleri, entegre API çözümleri ve çoklu para hesabı hizmetleri sunmaktadırlar. Bu hizmetler dünya çapında faaliyet gösteren işletmeler için 60'tan fazla para birimini ve 40'a kadar para cüzdanını desteklemektedir.

| Kategori | Ürünler & Hizmetler |

| Ticari FX Ürünleri | Spot FX, Teslim Edilebilir Vadeli İşlemler, Piyasa Emirleri (Limit & Stop), Marj Kredi Olanakları |

| FX Türevleri | FX Opsiyonları, Teslim Edilemeyen Vadeli İşlemler (NDF'ler), Özel Vadeli İşlemler, FX Hedge Stratejileri, FX Danışmanlık |

| Küresel Ödemeler | Monex Pay Platformu, Çoklu Para Hesapları (40+ para birimi), Toplu/Bireysel Ödemeler, SWIFT Entegrasyonu |

| Teknoloji Çözümleri | Monex REST API, Müşteri & Geliştirici Desteği, Geliştirici Portalı, Özelleştirilebilir Müşteri Portalı |

İşlem Platformu

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar | Uygun |

| Monex Pay Platformu | ✔ | Web, iOS (App Store), Android (Google Play) | Küresel ödemeleri yöneten kurumsal müşteriler |

| Monex REST API | ✔ | Sunucu-tabanlı/API entegrasyonu | Otomasyon gerektiren işletmeler ve geliştiriciler |