Profil perusahaan

| Monex Europe Ringkasan Ulasan | |

| Dibentuk | 1985 |

| Negara/Daerah Terdaftar | Meksiko |

| Regulasi | FCA (Ditarik) |

| Produk dan Layanan | Spot FX, Forwards, Derivatif FX, Lindung Nilai FX, Pembayaran Global, Integrasi API, Akun Multi-mata uang |

| Akun Demo | ❌ |

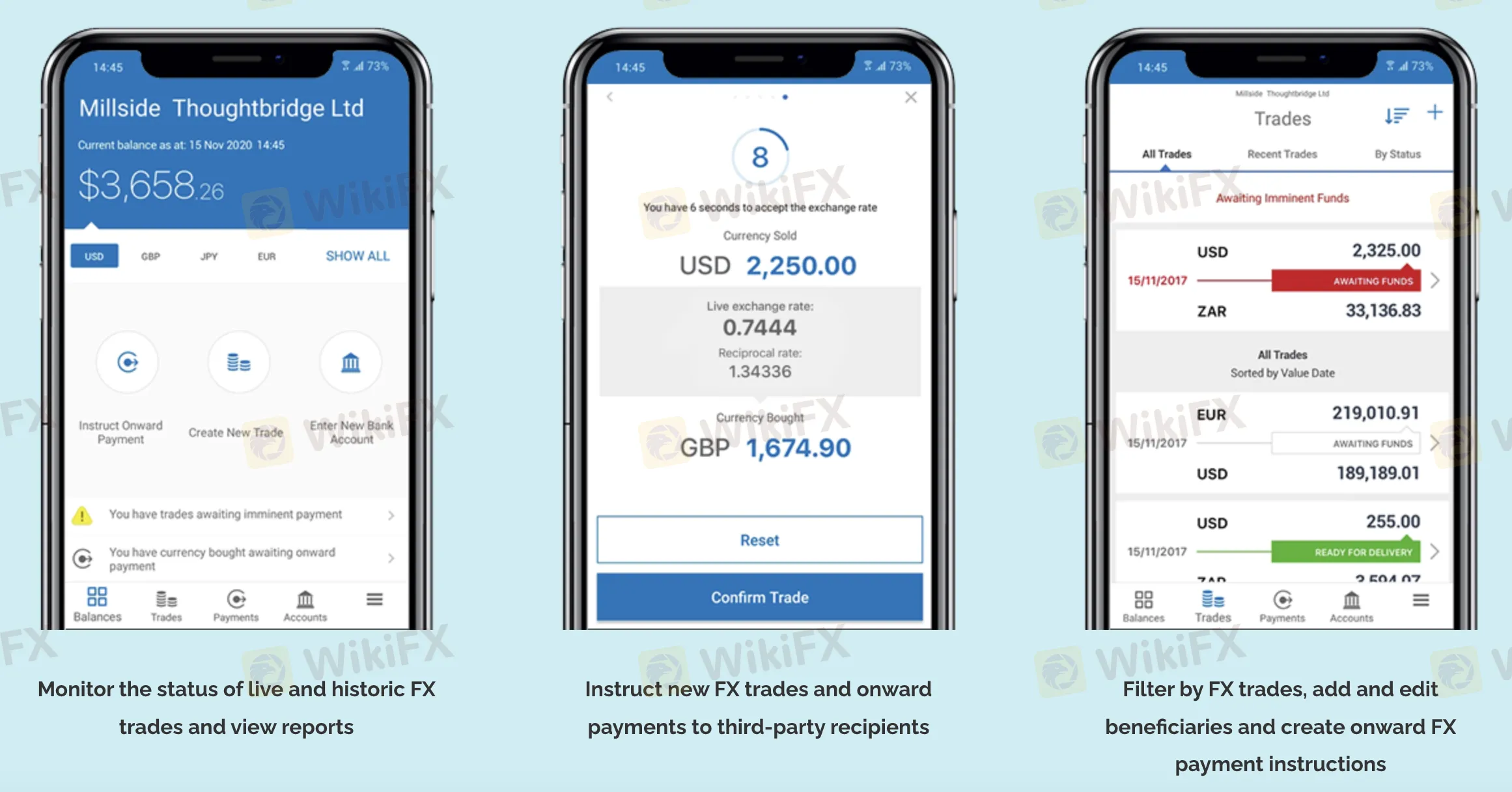

| Platform Perdagangan | Platform Monex Pay (Web, iOS, Android), Monex REST API |

| Dukungan Pelanggan | Tel/WhatsApp: +44 (0) 203 650 6400 |

| Email: support@monexpay.com | |

Informasi Monex Europe

Monex Europe, dibentuk pada tahun 1985 dan bermarkas di Meksiko, sebelumnya diatur oleh FCA di Inggris tetapi lisensinya telah dicabut. Perusahaan ini menyediakan layanan valuta asing dan pembayaran lintas batas lengkap kepada klien korporat. Solusi mereka mencakup platform Monex Pay dan REST API untuk integrasi dan otomatisasi.

Pro dan Kontra

| Pro | Kontra |

| Menawarkan solusi FX dan pembayaran tingkat institusi | Lisensi FCA dicabut |

| Mendukung 60+ mata uang dan hingga 40 dompet multi-mata uang | Tidak ada akun demo tersedia |

| Platform perdagangan dan pembayaran berbasis seluler & API tersedia | Informasi terbatas tentang biaya |

Apakah Monex Europe Legal?

Tidak, tidak diatur. Monex Europe Limited sebelumnya diatur oleh Otoritas Perilaku Keuangan (FCA) Inggris. Nomor lisensi pembayaran mereka adalah 463951. Namun, tidak lagi valid karena status lisensinya menunjukkan “Ditarik”.

Produk dan Layanan

Monex Europe menawarkan berbagai produk FX yang berbeda, alat manajemen risiko, dan layanan pembayaran global. Mereka menawarkan spot dan forward FX, derivatif FX, solusi API terintegrasi, dan layanan akun multi-mata uang. Layanan ini mendukung lebih dari 60 mata uang dan hingga 40 dompet mata uang untuk bisnis yang beroperasi di seluruh dunia.

| Kategori | Produk & Layanan |

| Produk FX Komersial | Spot FX, Forward yang Dapat Dikirim, Pesanan Pasar (Batas & Stop), Fasilitas Kredit Margin |

| Derivatif FX | Opsi FX, Forward yang Tidak Dapat Dikirim (NDFs), Forward Kustom, Strategi Lindung Nilai FX, Penasihat FX |

| Pembayaran Global | Platform Monex Pay, Akun Multi-Mata Uang (40+ mata uang), Pembayaran Batch/Individu, Integrasi SWIFT |

| Solusi Teknologi | Monex REST API, Dukungan Klien & Pengembang, Portal Pengembang, Portal Klien yang Dapat Disesuaikan |

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Platform Monex Pay | ✔ | Web, iOS (App Store), Android (Google Play) | Klien korporat yang mengelola pembayaran global |

| Monex REST API | ✔ | Integrasi Sisi Server/API | Perusahaan & pengembang yang membutuhkan otomatisasi |