Resumo da empresa

| Monex Europe Resumo da Revisão | |

| Fundação | 1985 |

| País/Região Registrada | México |

| Regulação | FCA (Revogada) |

| Produtos e Serviços | Spot FX, Forwards, Derivativos de FX, Hedge de FX, Pagamentos Globais, Integração de API, Contas Multimoedas |

| Conta Demonstrativa | ❌ |

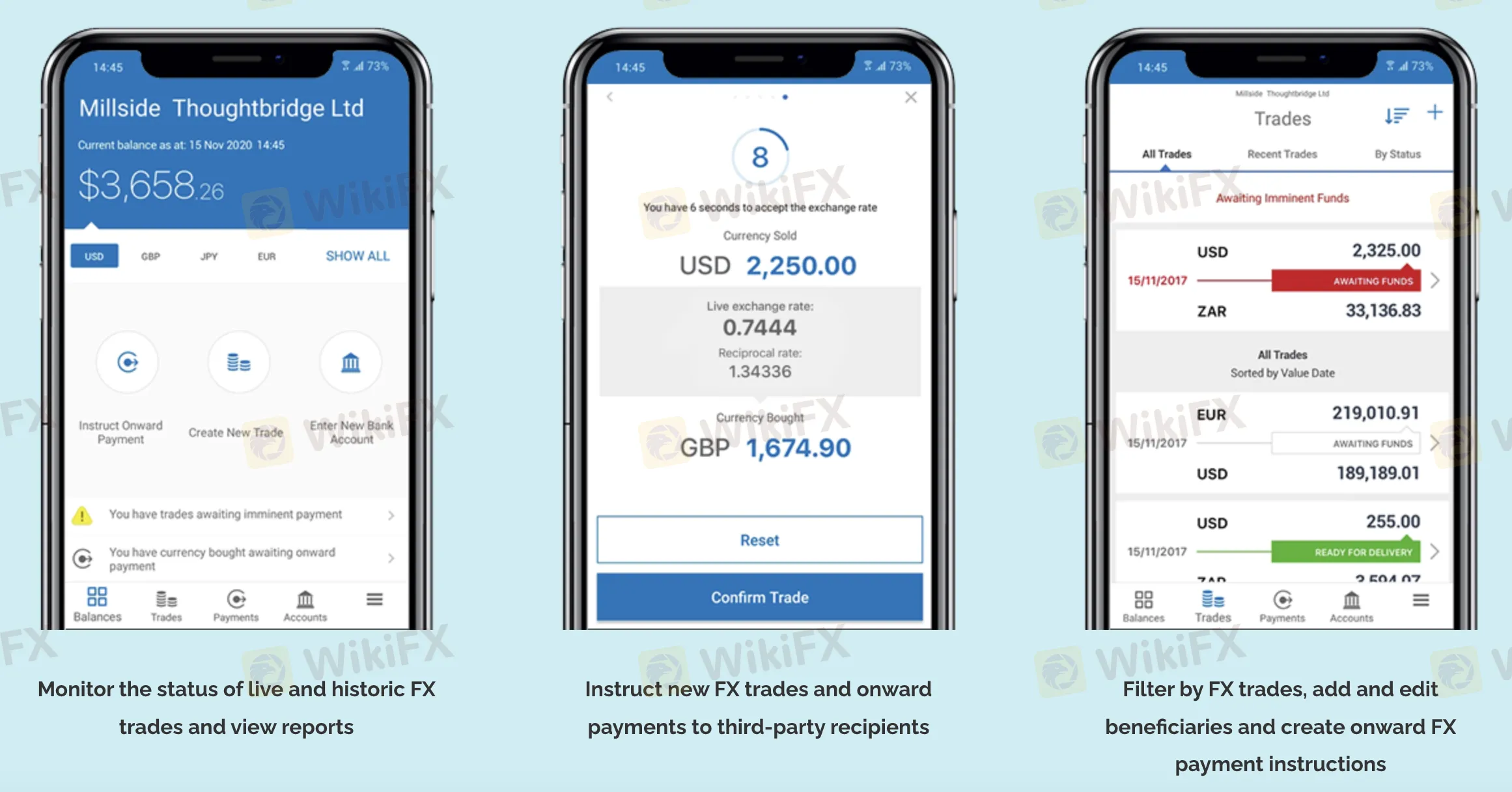

| Plataforma de Negociação | Plataforma Monex Pay (Web, iOS, Android), API REST Monex |

| Suporte ao Cliente | Tel/WhatsApp: +44 (0) 203 650 6400 |

| Email: support@monexpay.com | |

Informações sobre Monex Europe

Monex Europe, fundada em 1985 e sediada no México, era anteriormente regulamentada pela FCA no Reino Unido, mas teve sua licença revogada. A empresa fornece serviços completos de câmbio e pagamentos transfronteiriços para clientes corporativos. Sua solução inclui a plataforma Monex Pay e uma API REST para integração e automação.

Prós e Contras

| Prós | Contras |

| Oferece soluções de câmbio e pagamento de nível institucional | Licença FCA revogada |

| Suporta 60+ moedas e até 40 carteiras multimoedas | Não há contas de demonstração disponíveis |

| Plataformas de negociação e pagamento móveis e baseadas em API disponíveis | Informações limitadas sobre taxas |

Monex Europe é Legítimo?

Não, não é regulamentado. A Monex Europe Limited costumava ser regulamentada pela Financial Conduct Authority (FCA) do Reino Unido. O número de sua licença de pagamento era 463951. No entanto, não é mais válida porque o estado da licença mostra "Revogada".

Produtos e Serviços

Monex Europe oferece uma variedade de produtos FX, ferramentas de gestão de risco e serviços de pagamento globais. Eles oferecem FX à vista e a prazo, derivativos de FX, soluções de API integradas e serviços de contas multi-moeda. Esses serviços suportam mais de 60 moedas e até 40 carteiras de moeda para empresas que operam em todo o mundo.

| Categoria | Produtos e Serviços |

| Produtos FX Comerciais | FX à Vista, A prazo, Ordens de Mercado (Limite e Stop), Facilidades de Crédito de Margem |

| Derivativos de FX | Opções de FX, A prazo não entregáveis (NDFs), A prazo personalizados, Estratégias de Hedge de FX, Consultoria de FX |

| Pagamentos Globais | Plataforma Monex Pay, Contas Multi-Moeda (40+ moedas), Pagamentos em Lote/Individuais, Integração SWIFT |

| Soluções Tecnológicas | API REST Monex, Suporte ao Cliente e Desenvolvedor, Portal do Desenvolvedor, Portal do Cliente Personalizável |

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Plataforma Monex Pay | ✔ | Web, iOS (App Store), Android (Google Play) | Clientes corporativos que gerenciam pagamentos globais |

| API REST Monex | ✔ | Integração do lado do servidor/API | Empresas e desenvolvedores que precisam de automação |