회사 소개

| Monex Europe 리뷰 요약 | |

| 설립 연도 | 1985 |

| 등록 국가/지역 | 멕시코 |

| 규제 | FCA (취소됨) |

| 제품 및 서비스 | 스폿 FX, 포워드, FX 파생상품, FX 헷지, 글로벌 결제, API 통합, 다중 통화 계정 |

| 데모 계정 | ❌ |

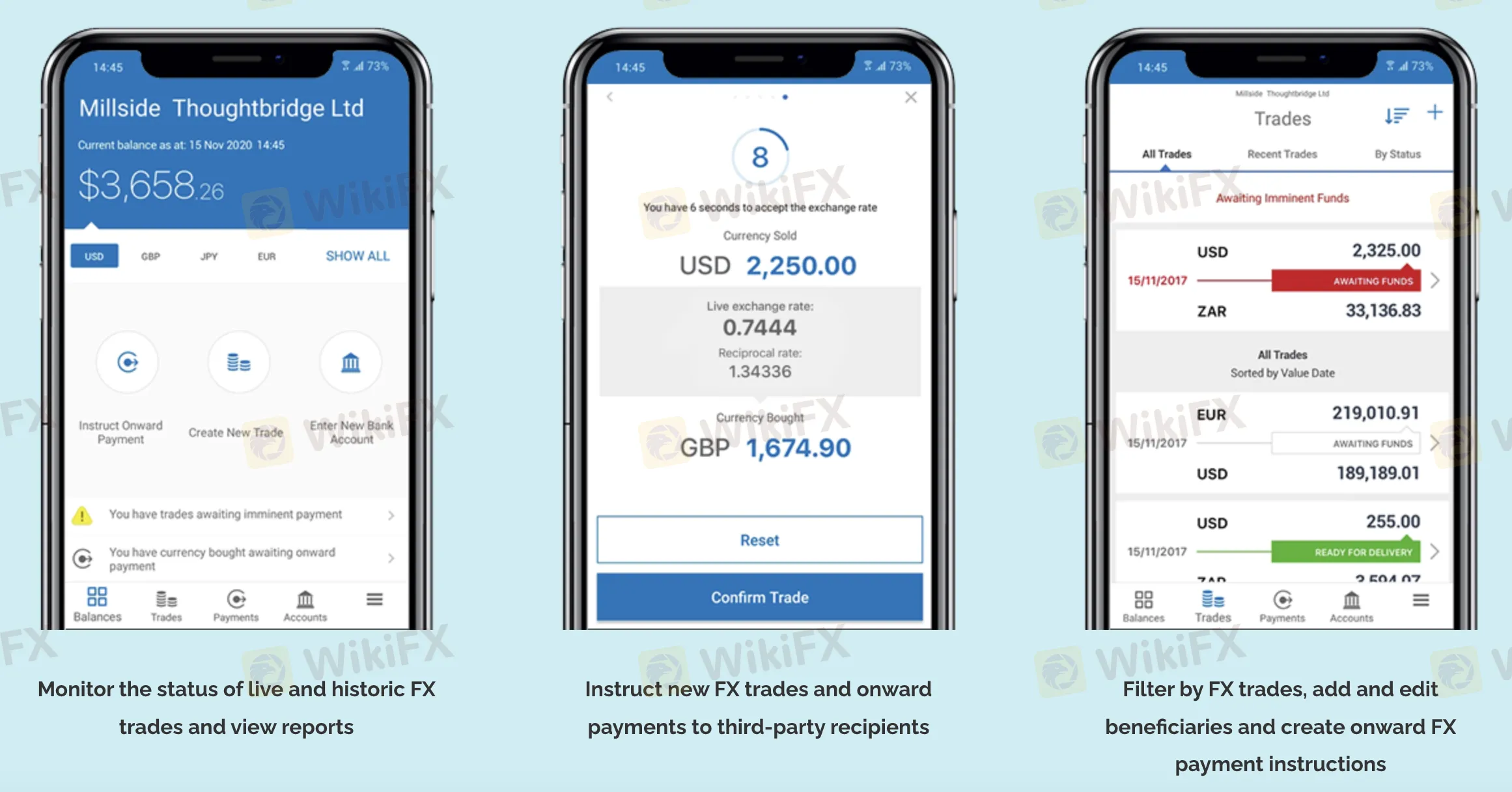

| 거래 플랫폼 | Monex Pay 플랫폼 (웹, iOS, 안드로이드), Monex REST API |

| 고객 지원 | 전화/WhatsApp: +44 (0) 203 650 6400 |

| 이메일: support@monexpay.com | |

Monex Europe 정보

Monex Europe은 1985년에 설립되어 멕시코에 본사를 두고 있으며, 영국의 FCA에서 이전에 규제를 받았지만 현재 라이선스가 취소되었습니다. 이 회사는 기업 고객을 대상으로 완전한 외환 및 국제 송금 서비스를 제공합니다. 그들의 솔루션에는 Monex Pay 플랫폼과 통합 및 자동화를 위한 REST API가 포함되어 있습니다.

장단점

| 장점 | 단점 |

| 기관급 FX 및 결제 솔루션 제공 | FCA 라이선스 취소 |

| 60가지 이상의 통화 및 최대 40개의 다중 통화 지갑 지원 | 데모 계정 미제공 |

| 모바일 및 API 기반 거래 및 결제 플랫폼 제공 | 수수료에 대한 제한된 정보 |

Monex Europe이 신뢰할 만한가요?

아니요, 규제를 받지 않았습니다. Monex Europe 리미티드는 영국의 금융행정청 (FCA)에 의해 규제를 받았습니다. 그들의 결제 라이선스 번호는 463951이었습니다. 그러나 현재 해당 라이선스는 "취소됨" 상태임으로 더 이상 유효하지 않습니다.

제품 및 서비스

Monex Europe은(는) 다양한 외환 상품, 리스크 관리 도구 및 글로벌 결제 서비스를 제공합니다. 그들은 현물 및 선물 외환, 외환 파생상품, 통합 API 솔루션 및 다양한 통화 계정 서비스를 제공합니다. 이 서비스들은 전 세계에서 활동하는 기업을 위해 60가지 이상의 통화와 최대 40개의 통화 지갑을 지원합니다.

| 카테고리 | 제품 및 서비스 |

| 상업용 외환 상품 | 현물 외환, 인도 선물, 시장 주문 (한도 및 중지), 마진 신용 시설 |

| 외환 파생상품 | 외환 옵션, 비인도 선물 (NDFs), 맞춤형 선물, 외환 헷지 전략, 외환 자문 |

| 글로벌 결제 | Monex Pay 플랫폼, 다중 통화 계정 (40여 가지 통화), 일괄/개별 결제, SWIFT 통합 |

| 기술 솔루션 | Monex REST API, 클라이언트 및 개발자 지원, 개발자 포털, 사용자 정의 가능한 클라이언트 포털 |

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| Monex Pay 플랫폼 | ✔ | 웹, iOS (App Store), 안드로이드 (Google Play) | 글로벌 결제를 관리하는 기업 고객 |

| Monex REST API | ✔ | 서버 측/API 통합 | 자동화가 필요한 기업 및 개발자 |