Resumo da empresa

| NORDEAResumo da Revisão | |

| Fundação | 2000 |

| País/Região Registrada | Dinamarca |

| Regulação | Sem Regulação |

| Serviços | Empréstimos e créditos, poupança e investimentos, seguros, private banking, serviços digitais, financiamento, comércio exterior, banco corporativo, gestão de caixa, banco de investimento, negócios internacionais |

| Suporte ao Cliente | Telefone: +45 7033 3333; +45 7033 4444 |

| Redes Sociais: LinkedIn, Facebook, Threads, YouTube | |

| Endereço: Dinamarca, Finlândia, Noruega, Suécia | |

NORDEA Informação

Fundada em 2000 e registrada na Dinamarca, NORDEA oferece serviços financeiros diversificados para indivíduos, empresas e grandes instituições, incluindo serviços bancários diários, serviços digitais, banco de investimento e produtos de mercado de capitais. Embora a empresa tenha vários canais de atendimento ao cliente, como telefone e redes sociais, não é regulamentada e carece de informações detalhadas sobre processos de depósito e saque e estruturas de taxas. Os clientes precisam ter cautela ao usar seus fundos.

Prós e Contras

| Prós | Contras |

| Múltiplos serviços bancários | Sem regulação |

| Vários canais de suporte ao cliente | Estrutura de taxas pouco clara |

| Histórico operacional longo |

NORDEA é Legítimo?

NORDEA não é regulamentado, e os clientes devem ter cautela ao negociar.

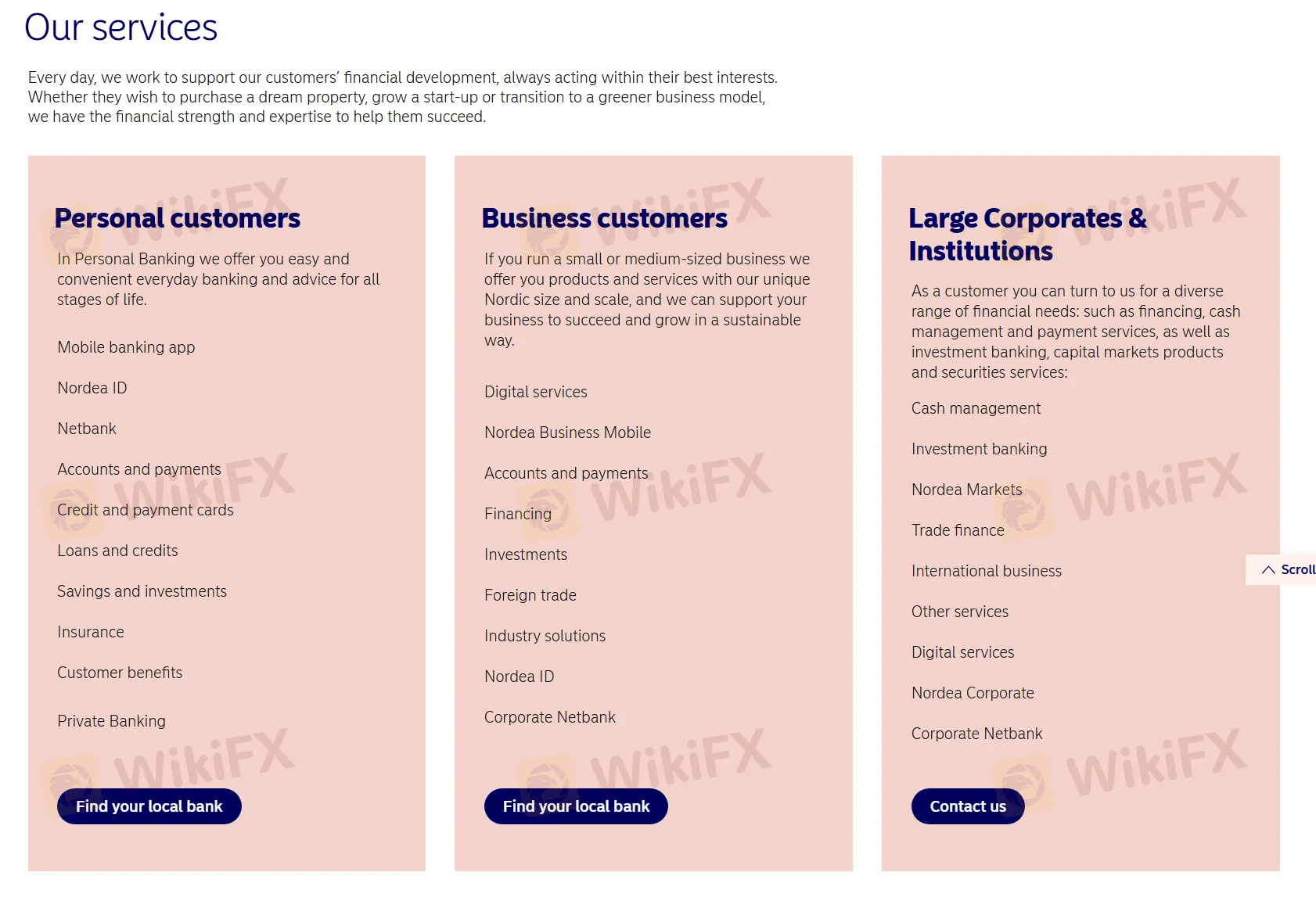

Serviços

NORDEA oferece serviços para clientes pessoais, empresariais e grandes corporações e instituições, incluindo:

Clientes Pessoais: Para clientes individuais, oferece serviços bancários diários e financeiros convenientes, incluindo aplicativos de banco móvel, gestão de contas, serviços de pagamento, cartões de crédito, empréstimos, poupança e investimento, seguros, benefícios ao cliente e serviços de private banking.

Clientes Empresariais: Para pequenas e médias empresas, oferece serviços digitais, banco móvel, gestão de contas, financiamento, investimento, comércio internacional, soluções industriais e outros serviços para apoiar o desenvolvimento sustentável dos negócios.

Grandes Empresas e Instituições: Para grandes empresas e instituições, oferece serviços financeiros abrangentes, incluindo gestão de caixa, banca de investimento, produtos de mercado de capitais, serviços de valores mobiliários, comércio internacional, outros serviços e serviços digitais.

| Tipo de Cliente | Serviços Oferecidos |

| Clientes Pessoais | Aplicativo de banco móvel |

| Nordea ID | |

| Netbank | |

| Contas e pagamentos | |

| Cartões de crédito e débito | |

| Empréstimos e créditos | |

| Poupanças e investimentos | |

| Seguros | |

| Benefícios ao cliente | |

| Private Banking | |

| Clientes Empresariais | Serviços digitais |

| Nordea Business Mobile | |

| Contas e pagamentos | |

| Financiamento | |

| Nordea Business Mobile | |

| Comércio exterior | |

| Soluções industriais | |

| Nordea ID | |

| Corporate Netbank | |

| Grandes Empresas e Instituições | Gestão de caixa |

| Banca de investimento | |

| Mercados Nordea | |

| Financiamento comercial | |

| Negócios internacionais | |

| Outros serviços | |

| Serviços digitais | |

| Nordea Corporate | |

| Corporate Netbank |