Grundlegende Informationen

Dänemark

Dänemark

Bewertung

Dänemark

|

5-10 Jahre

|

Dänemark

|

5-10 Jahre

| https://www.nordea.com/en/

Website

Bewertungsindex

Einfluss

AAA

Einflussindex NO.1

Finnland 9.44

Finnland 9.44 Lizenzen

LizenzenKeine gültigen Verordnungsinformationen gefunden, bitte beachten Sie das Risiko!

Dänemark

Dänemark nordea.com

nordea.com Finnland

Finnland

| NORDEAÜberprüfungszusammenfassung | |

| Gegründet | 2000 |

| Registriertes Land/Region | Dänemark |

| Regulierung | Keine Regulierung |

| Dienstleistungen | Darlehen und Kredite, Ersparnisse und Investitionen, Versicherungen, Private Banking, digitale Dienstleistungen, Finanzierung, Außenhandel, Firmenkundengeschäft, Liquiditätsmanagement, Investmentbanking, internationales Geschäft |

| Kundenbetreuung | Telefon: +45 7033 3333; +45 7033 4444 |

| Soziale Medien: LinkedIn, Facebook, Threads, YouTube | |

| Adresse: Dänemark, Finnland, Norwegen, Schweden | |

Im Jahr 2000 gegründet und in Dänemark registriert, bietet NORDEA vielfältige Finanzdienstleistungen für Einzelpersonen, Unternehmen und große Institutionen, einschließlich täglicher Bankgeschäfte, digitaler Dienstleistungen, Investmentbanking und Kapitalmarktprodukten. Obwohl das Unternehmen mehrere Kundendienstkanäle wie Telefon und soziale Medien hat, ist es nicht reguliert und es fehlen detaillierte Informationen zu Einzahlungs- und Auszahlungsprozessen sowie Gebührenstrukturen. Kunden sollten Vorsicht walten lassen, wenn sie ihre Gelder verwenden.

| Vorteile | Nachteile |

| Vielfältige Bankdienstleistungen | Keine Regulierung |

| Verschiedene Kundensupport-Kanäle | Unklare Gebührenstruktur |

| Langjährige Betriebshistorie |

NORDEA ist nicht reguliert, und Kunden sollten beim Handel Vorsicht walten lassen.

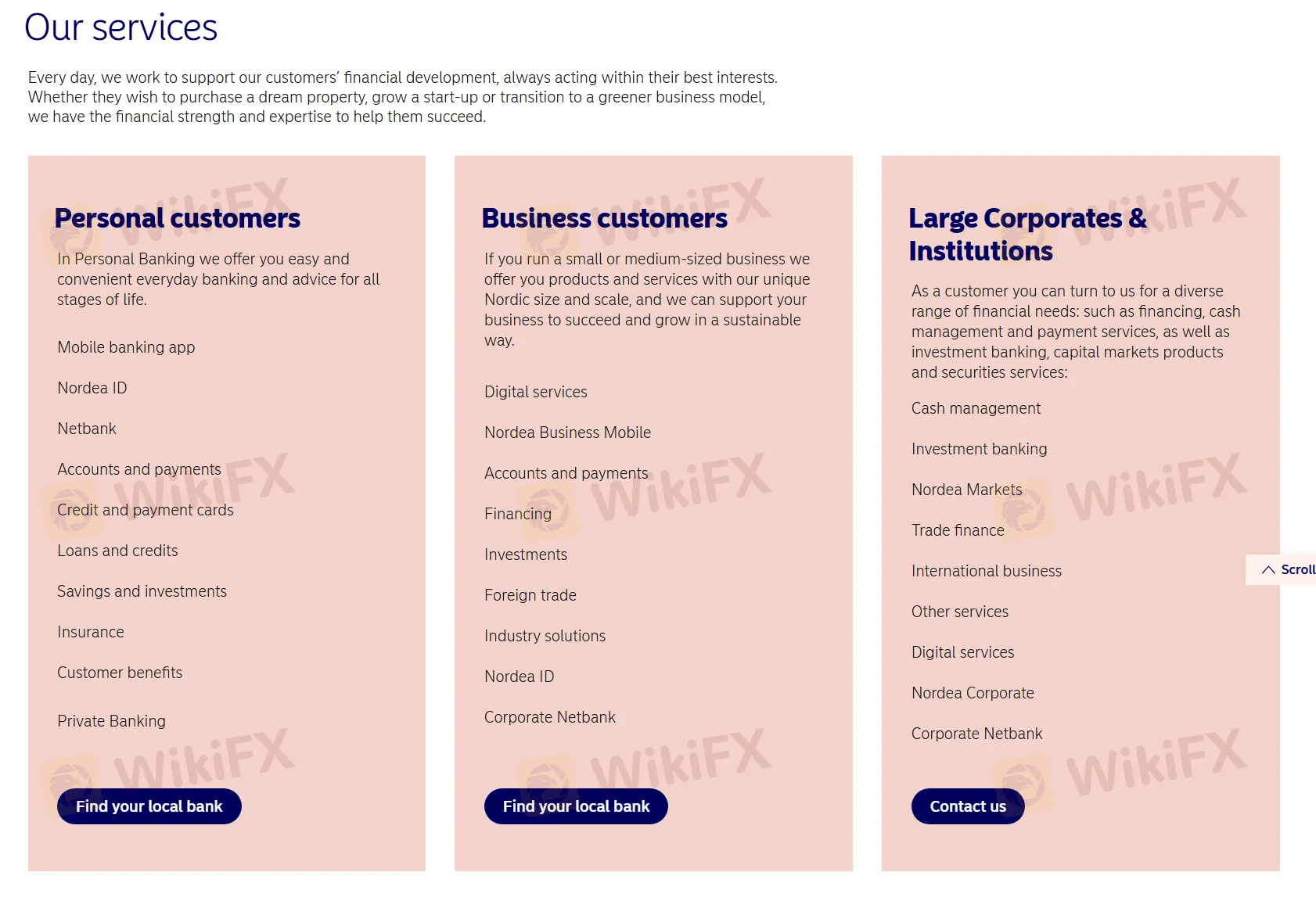

NORDEA bietet Dienstleistungen für Privatkunden, Geschäftskunden sowie große Unternehmen und Institutionen, einschließlich:

Privatkunden: Für Einzelpersonen bietet es bequeme tägliche Bankgeschäfte und Finanzdienstleistungen, einschließlich mobiler Banking-Apps, Kontoverwaltung, Zahlungsdienste, Kreditkarten, Darlehen, Ersparnisse und Investitionen, Versicherungen, Kundenleistungen und Private Banking-Dienstleistungen.

Geschäftskunden: Für kleine und mittlere Unternehmen bietet es digitale Dienstleistungen, mobiles Banking, Kontoverwaltung, Finanzierung, Investitionen, internationalen Handel, Branchenlösungen und andere Dienstleistungen zur Unterstützung nachhaltiger Geschäftsentwicklung.

Großunternehmen & Institutionen: Für Großunternehmen und Institutionen bietet es umfassende Finanzdienstleistungen, einschließlich Cash-Management, Investmentbanking, Kapitalmarktprodukte, Wertpapierdienstleistungen, internationalen Handel, andere Dienstleistungen und digitale Dienstleistungen.

| Kundentyp | Angebotene Dienstleistungen |

| Privatkunden | Mobile Banking-App |

| Nordea ID | |

| Netbank | |

| Konten und Zahlungen | |

| Kredit- und Zahlungskarten | |

| Kredite und Darlehen | |

| Sparen und Investitionen | |

| Versicherung | |

| Kundenleistungen | |

| Private Banking | |

| Geschäftskunden | Digitale Dienstleistungen |

| Nordea Business Mobile | |

| Konten und Zahlungen | |

| Finanzierung | |

| Nordea Business Mobile | |

| Außenhandel | |

| Branchenlösungen | |

| Nordea ID | |

| Corporate Netbank | |

| Großunternehmen & Institutionen | Cash-Management |

| Investmentbanking | |

| Nordea Markets | |

| Handelsfinanzierung | |

| Internationales Geschäft | |

| Andere Dienstleistungen | |

| Digitale Dienstleistungen | |

| Nordea Corporate | |

| Corporate Netbank |

As someone who approaches every broker with an emphasis on regulatory clarity and safety, my review of NORDEA is necessarily conservative, especially regarding deposit and withdrawal options. Based on my examination, NORDEA is a diversified financial provider registered in Denmark with a history going back to 2000, and offers a full suite of banking services for individuals and businesses—including accounts, digital banking, and payments. However, I found no specific, public information outlining which deposit or withdrawal methods are accepted for their trading services or investment accounts. For me, this absence of transparency is a major concern, as knowing if they support popular options like credit cards, PayPal, Skrill, or even cryptocurrencies is essential for making informed decisions and safeguarding one’s funds. Furthermore, NORDEA operates without regulatory oversight, which means there is no external authority ensuring standardized handling of clients’ deposits and withdrawals. As a trader, that heightens my caution considerably, since recourse options and fund protection mechanisms are unclear. This lack of detail could make it difficult to verify transaction times, potential fees, or the security of financial transfers. In conclusion, unless NORDEA provides full disclosure of their accepted payment methods, as well as clearer guidance on withdrawal processes and associated costs, I would personally refrain from depositing funds or considering them as my broker of choice.

Based on my thorough investigation of NORDEA, I want to stress that there is no clear information regarding the availability of widely-used trading platforms such as MT4, MT5, or cTrader. In my experience, the absence of detailed disclosures about supported platforms is a red flag, especially since these platforms are considered industry standards for forex traders due to their reliability, advanced charting tools, and vast support community. NORDEA is primarily described as offering a broad range of banking and financial services—including investment banking and capital markets—but without explicit mention of specific trading platforms or detailed trading conditions. This lack of transparency, combined with the fact that NORDEA is not currently regulated, makes it impossible for me to confidently determine if they provide access to any forex-centric platforms at all. As a trader, this is especially concerning because access to reputable, robust platforms is fundamental to trade execution, analysis, and security. Without verified platform information, I would approach this broker with caution and would not proceed with live trading until such critical details are clarified and supported by a trustworthy regulatory framework. For my own trading, I always prioritize brokers who clearly state which platforms they support, and who are upfront about trading infrastructure and client protection.

Speaking purely from my experience as a trader who values transparency and regulatory safety above all, I have significant reservations about NORDEA as a platform for forex or trading activities. While the group presents a long operational history and offers a broad array of financial services, my primary concern is the absence of any valid regulatory oversight. This is underscored by their own documentation, which explicitly warns that NORDEA is not regulated and has a low risk management score. For me, the lack of clear regulatory supervision means that there is no assured external framework to protect trader funds or mediate disputes, which is fundamental in the forex world where risks are already high. Additionally, I found the lack of transparency regarding their deposit and withdrawal processes, as well as unclear fee structures, problematic. Knowing exactly how costs are incurred and how accessible my capital is has always been a non-negotiable aspect of any broker relationship. In the absence of these details, I cannot confidently gauge the fairness or competitiveness of their trading conditions. Ultimately, no matter how diverse their product offering might be, I would personally avoid committing significant capital to any broker that lacks proper licensing, as it simply does not align with prudent risk practices.

Bitte eingeben...

TOP

TOP

Chrome

Chrome Plug-In

Aufsichtsrechtliche Anfrage zu globalen Forex-Brokern

Es durchsucht die Forex-Broker-Websites und identifiziert die legitimen und betrügerischen Broker genau

Jetzt installieren